Determining the composition of the RSV

The calculation form and the procedure for working with it are introduced by Order of the Federal Tax Service dated September 18, 2019 No. ММВ-7-11/ [email protected]

The number of calculation sheets to fill out depends on certain circumstances:

| Composition of the RSV | Payer category | Base |

Required sections:

| Payers making payments and other remuneration to individuals. If there were no payments to employees during the reporting period, a zero calculation is submitted. The Ministry of Finance in Letter No. 03-15-05/77364 dated 10/09/2019 reports that for a zero DAM, it is enough to fill out the title page, Section 1 without appendices and Section 3 | Clause 2.2 of the filling procedure (Appendix No. 2 to Order No. ММВ-7-11/ [email protected] ) |

In addition to the required sections:

| Heads of peasant farms | Clause 2.3 of the filling procedure (Appendix No. 2 to Order No. ММВ-7-11/ [email protected] ) |

In addition to the required sections:

| Payers applying additional or reduced contribution rates | Clause 2.4 of the filling procedure (Appendix No. 2 to Order No. ММВ-7-11/ [email protected] ) |

In addition to the required sections:

| Payers who paid VNIM benefits from their own funds. In fact, with the participation of all regions of the Russian Federation in the pilot project “Direct Payments” in the second half of 2021, Annexes 3 and 4 of the DAM are losing relevance | Clause 2.5 of the Filling Out Procedure (Appendix No. 2 to Order No. ММВ-7-11/ [email protected] ) |

Why do we need Section 3 of insurance premium calculations?

The calculation of insurance premiums is regulated by Order of the Federal Tax Service of the Russian Federation dated October 10, 2016 No. ММВ-7-11/ [email protected] It includes, in addition to other sections, Section 3, intended to reflect information on personalized accounting for all insured persons.

The calculation of insurance premiums is submitted for each quarter; accordingly, in Section 3 it is necessary to reflect information on individuals with whom civil or employment contracts have been concluded for this period. In this case, the fact of payment of remuneration for work activity does not play any role: whether funds were issued or not, people still need to be included in Section 3.

We take into account the general requirements for filling out the DAM

The basic requirements for report preparation are established in clauses 2.8-2.19 of Appendix No. 2 to Order No. MMV-7-11/ [email protected] :

- continuous page numbering;

- text fields are filled in capital block letters from left to right;

- When writing a report manually, black, blue or purple ink is used;

- corrections are not allowed;

- Double-sided printing of calculations is not permitted;

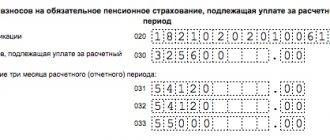

- total indicators are indicated in rubles and kopecks;

- in the absence of quantitative or cost indicators, zeros are entered in the cells; in other cases, the cells are crossed out;

- When using programs to prepare calculations, it is allowed that there are no dashes when printing the document.