Which account to use for own shares/shares

By virtue of the Chart of Accounts for accounting the financial and economic activities of organizations and the Instructions for its application (approved by order of the Ministry of Finance of Russia dated October 31, 2000 No. 94n), account 81, entitled “Own shares (shares)”, is intended for accounting for own shares (redemption/cancellation). "

Note that accounting for own shares (shares) is active. That is, it can only be on the debit of account 81.

This account reflects information about the availability and movement of its shares, purchased by the joint-stock company from shareholders for their subsequent resale or cancellation.

Other business companies (LLC, etc.) and partnerships use it to account for the share of a participant acquired by the company/partnership itself for transfer to other participants or third parties.

Also see: When You Don't Have to Pay Tax on the Sale of Stocks.

Accounting and audit of shares purchased from shareholders

Introduction

A security is a monetary document that certifies the property right of the owner of the document or his relationship to the person who issued such a document. Any enterprise, joint stock company, credit institution and the state can issue securities. Securities include stocks, bonds, bills, certificates of deposit and other securities.

A share is a security that confirms that its owner has contributed a certain amount to the authorized capital of the joint-stock company. It gives the right to participate in the management of the joint-stock company and distribute its income. Depending on the scope of rights, shares are divided into:

simple - give the right to participate in the management of the joint-stock company, receive dividends in the amount determined by the meeting of shareholders if there is profit.

privileged - give the right to receive dividends in a fixed amount regardless of the enterprise's profit, but do not give the right to participate in management.

Depending on the method of designating the owner, shares are divided into registered (containing the owner’s surname) and bearer shares.

For joint-stock companies, a fairly pressing issue is the reflection of transactions to repurchase their own shares from shareholders. The grounds for repurchasing shares may lie on a legal (reorganization of a company or completion of a major transaction) and purely financial planes.

The paper discusses the procedure for accounting and auditing of own shares purchased from shareholders.

The essence and reasons for the repurchase of own shares

For shareholders of companies, a fairly pressing issue is the reflection of transactions to repurchase their own shares from shareholders. The grounds for repurchasing shares may lie on legal and financial levels.

The legal reasons for the need to repurchase shares include the legally established right of a shareholder to demand the Joint Stock Company (JSC) to repurchase shares. Based on paragraph 1 of Art. 75 of the Law “On Joint-Stock Companies” such a repurchase is possible in the following cases:

when reorganizing a company or making a major transaction, the decision on approval of which is made by the general meeting of shareholders, if they voted against the decision on its reorganization or approval of the said one or did not take part in voting on these issues;

when making changes and additions to the company's charter or approving a new version of the company's charter, limiting the rights of shareholders if they voted against the adoption of the relevant decision or did not take part in the voting.

According to paragraph 6 of Art. 76 of the Law “On JSC”, shares purchased by the company in the event of its reorganization are subject to mandatory redemption upon their redemption. In addition, Art. 72 of the Law regulates the possibility of repurchasing shares in order to reduce their total number by decision of the meeting of shareholders. Based on clause 3 of Art. 72 of the Law, shares acquired by the company on the basis of a decision adopted by the general meeting of shareholders to reduce the authorized capital of the company by acquiring shares in order to reduce their total number are canceled upon their acquisition.

When repurchasing shares on such grounds (requiring redemption of repurchased shares), it is necessary to take into account that as a result of a decrease in the authorized capital, it may be below the minimum permissible size, which will lead to the liquidation of the company. Art. 73 of the Law establishes a number of other restrictions on the company’s ability to repurchase its own shares

The company may decide to repurchase its own shares for purely financial reasons. The reasons for making such a decision may be: the desire to resist a hostile takeover or purchase of shares by a competitor; the desire to redistribute outstanding shares from a large number of small shareholders to a smaller number of large ones (the costs of maintaining a register and holding shareholder meetings are reduced); the ability to conduct profitable financial transactions with own shares.

In accordance with Art. 34 of the Law: “shares, the ownership of which has been transferred to the company, do not provide voting rights, are not taken into account when counting votes, and dividends are not accrued on them. Such shares must be sold by the company at a price not lower than their nominal value no later than one year after their acquisition by the company, otherwise the company is obliged to make a decision to reduce its authorized capital.” International practice allows that if a share was issued at par value or above and is fully paid and then acquired by the issuer, then this share can be issued again at a price less than par value.

Issues related to the price of repurchase of own shares are also subject to legislative regulation in a number of cases, in particular clause 3 of Art. 75 of the Law “On JSC” states: “The repurchase of shares by the company is carried out at a price determined by the board of directors of the company, but not lower than the market value, which must be determined by an independent appraiser without taking into account its changes as a result of the actions of the company that gave rise to the right to demand valuation and repurchase of shares " That is, the redemption price of shares is determined at the moment preceding the occurrence of such a situation. This rule aims to protect the interests of shareholders demanding the redemption of their shares, because in practice, the creation of the provisions provided for in Art. 75 of the Law of Conditions can be specifically initiated by persons seeking to take advantage of the upcoming sale of repurchased shares of the company and buy them at a reduced price.

Thus, the price at which the shares are repurchased has nothing to do with their par value, and in practice, situations are possible in which the repurchase price will be either higher or lower than the par value, and this is precisely what causes the difficulties of reflecting repurchase transactions in accounting own shares.

Reflection of share repurchase in accounting

In Russian accounting, the procedure for recording transactions for the repurchase of own shares has undergone changes during the transition to the Chart of Accounts dated October 31, 2000 No. 94n. According to the previously existing Chart of Accounts, own shares purchased from shareholders were reflected in a special sub-account to account 56 “Cash documents”. Currently, a separate account 81 “Own shares” is intended for accounting for own shares. The changes that have occurred are not just in the nature of allocating a separate account for accounting for own shares - the approach to the procedure for reflecting such shares has changed. On account 56 they were reflected at par, and on account 81 own shares are reflected according to the amount of costs for their redemption: “When a joint stock company or other company (partnership) buys from a shareholder (participant) shares (shares) owned by him in accounting for the amount of actual costs An entry is made in the debit of account 81 “Own shares.”

The current scheme for reflecting transactions for the acquisition of own shares in accounting and reporting seems to be more correct compared to the previous one. Own shares purchased from shareholders are reflected at the cost of acquisition in the Asset of the balance sheet on a specially allocated line of the same name as a type of short-term financial investment.

A number of authors propose to regard the accounting of own shares as a counter-passive and reflect it in the liability side of the balance sheet with a minus. In particular, T.V. Kuzmina in her work “Organization of Accounting in JSC” writes: “Despite the fact that own shares in the portfolio can be issued into circulation, nevertheless this should not make own shares in the portfolio an asset on the balance sheet. When a joint-stock company buys back a certain amount of its own, issued and circulating shares, it reduces its capitalization, rather than acquiring an asset (fund). Essentially, treasury shares in a portfolio are the same as unissued share capital and there is no reason to classify it as an asset on the balance sheet. If treasury shares in a portfolio are accounted for and shown on the balance sheet at cost, they must be deducted from the paid-up share capital, i.e. from paid-up share capital at par and share premium or retained earnings.”

The amount of the authorized capital shows how much money the company received from shareholders to carry out its activities. The authorized capital is not a fund, but funds contributed by shareholders; they are not personalized. In the process of economic activity, the company is free to invest available funds in various income-generating instruments, which may include its own shares.

Funds aimed at repurchasing one’s own shares are, of course, funds diverted from circulation, but they are precisely funds that are potentially capable of generating income (if resold at a higher price). Or means by which the shareholder structure can be optimized (cutting off a large number of small shareholders), which also leads to financial benefits through reducing the costs of maintaining the register and holding shareholder meetings.

Thus, until the moment when the company decides to cancel the repurchased shares from shareholders, there is no reason to reduce the amount of the authorized capital either in accounting or reporting.

When analyzing financial statements by external users, it is proposed to supplement the balance sheet line “own shares purchased from shareholders” with the following explanation: “incl. at nominal value."

Accounting for repurchased shares on account 81 in the amount of actual costs simplifies the procedure for reflecting transactions to repurchase own shares in the accounting accounts. The actual costs of repurchasing shares, in addition to the repurchase price itself, may include: the amount of the broker's remuneration, interest on the loan.

The repurchase of shares on our own (without the involvement of brokers) is accompanied by the accounting entry: Dt 81 Kt of cash accounts.

When repurchasing shares through a broker, the accounting entries are as follows:

Dt 76 “Settlements with various debtors and creditors” (you can open a separate sub-account for settlements with a broker for the repurchase of your own shares)

Kt 51 “Current account” - for the amount intended for the repurchase of shares and payment of brokerage fees.

If a bank loan was received for the purpose of purchasing shares, then the interest on such a loan is reflected by the entry:

Dt 76 Kt 66 “Settlements on short-term bank loans.”

With this scheme for organizing accounting records, account 76 acts as a calculation account. The amounts collected on it related to the repurchase of shares and forming the actual costs of acquisition are written off upon receipt of shares from the broker by posting:

Dt 81 “Own shares” Kt 76 “Settlements with various debtors and creditors.”

It is also necessary, at the time of repurchase of shares, to make internal entries to account 80 “Authorized capital”: Dt “Announced capital” Ct “Withdrawn capital”.

The need for this entry is due to the fact that, according to current legislation, repurchased shares do not provide voting rights, are not taken into account when counting votes, and dividends are not accrued on them.

Shares purchased from shareholders are subject to either mandatory redemption or sale at market value no later than one year from the date of their redemption (Clause 6, Article 76 of the Law “On JSC”). When redeeming repurchased shares, there are three options:

shares redeemed at a price corresponding to their par value are redeemed, which is documented by posting: Dt 80 “Authorized capital” Kt 81;

shares purchased at a price exceeding their par value are redeemed - the difference is written off by posting: Dt 91 “Other expenses” Kt 81;

shares purchased at a price below par are redeemed - when the costs of purchasing shares were below par, the difference is written off by posting: Dt 81 “Own shares” Kt 91 “Other income”.

Since in ch. 25 of the Tax Code of the Russian Federation does not establish a procedure for writing off canceled shares without increasing/decreasing financial results for tax purposes if their nominal value exceeds the actual purchase price (or vice versa), this gives grounds for increasing/decreasing the tax base for tax purposes.

In this regard, a different procedure has been established for writing off canceled shares purchased at a price higher than their par value, if during their initial placement they were sold to generate share premium. That. write-off of the excess of the redemption price over the par value at the expense of the amounts of share premium is drawn up: Dt 80 Kt 81 - for the par value of the canceled shares and

Dt account “Share premium” Kt 81 – for the difference between the redemption price and the par value.

This approach complicates the accounting of repurchased own shares, however, it is the most logical - receipt of income on shares during their initial placement is not recognized as income of the issuer in accordance with Art. 251 of the Tax Code of the Russian Federation, at the same time, repurchase at a market price that exceeds the face value should also not be recognized as an expense, because To cover such a difference, there is a previously created source - share premium. When making a decision on the sale of repurchased shares, the following entries must be made in the accounting records of the enterprise:

Dt accounts receivable account (62, 73, 76) Kt 91-1 “Other income” - for an amount equal to the sales price;

Dt 91-2 “Other expenses” Kt 81 “Own shares” - for the amount of actual costs of repurchasing shares.

The balance of other income and expenses is written off later to account 99 “Profits and losses”.

Audit of own repurchased shares

In the process of economic and financial activities, enterprises can divert funds in the form of financial investments in order to obtain additional income. The main purpose of an audit of financial investments is to obtain confirmation of the legality of the activities of an economic entity for the audited period. The auditor must document an audit program, which is a list of auditor actions for detailed audits.

The following tasks arise from the analysis of the audit: confirm the correctness of accounting for repurchased shares; confirm the correctness of the documentation; establish the correctness and timeliness of the repurchase and redemption of shares; confirm the accuracy of financial statements; check the correctness of the securities accounting book.

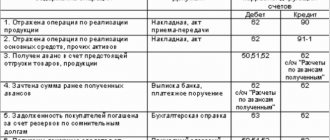

An approximate program for conducting an audit of shares purchased from shareholders is presented in the following table:

Audit program for shares purchased from shareholders

Contents of the procedure Sources of information Methods for obtaining audit data Regulatory and legislative acts

Check the correctness of the formation of the initial cost of share premium for shares

Study the composition of costs reflected in account 81 and its subaccounts. Primary accounting documents: documents for the acceptance and transfer of shares, cash receipts and expenditures. Checking documents Regulations on accounting and financial reporting; Order of the Ministry of Finance of the Russian Federation No. 2 of January 15, 1997 “On the procedure for reflecting transactions with securities in accounting”

Check the correctness of analytical accounting for account 81 Analytical accounting registers Checking registers

Check at what cost the repurchased shares are accounted for. Minutes of founders’ meetings

Find out when it is planned to repurchase shares Extracts from the minutes

Conclusion

The work examined issues related to accounting for the movement of a joint stock company's own shares in the process of its operation. Based on the results of the study, the following conclusions can be drawn.

In the process of functioning, a joint stock company faces a large number of problems associated with the circulation of its own shares. The company must study specific legislation related to the activities of joint-stock companies, primarily the Law “On Joint-Stock Companies”. It is necessary to take into account the reporting requirements and legislation of the state body that exercises control over activities in the securities market - the Federal Securities Commission.

In its activities on the securities market, a joint-stock company is faced with the need to repurchase its own shares. Such a need may be caused both by legal requirements and by one’s own financial interests. The work examines the problematic issues regarding the procedure for reflecting transactions to repurchase own shares in accounting. The repurchased shares can be either sold or redeemed by the company. Redemption of shares at a price above par value, if during their initial placement they were sold with the formation of share premium, is carried out by writing off the difference between the purchase price and par value to the share premium account.

Bibliography

1. About auditing activities. Federal Law of the Russian Federation dated August 7, 2001 No. 119-FZ (as amended on December 30, 2001).

2. About joint stock companies. Federal Law of the Russian Federation dated December 26, 1995 No. 208-FZ (as amended on February 27, 2003).

3. About accounting. Federal Law of the Russian Federation dated November 21, 1996 No. 129-FZ (as amended on March 28, 2002).

4. Tax Code of the Russian Federation: Part 1 of July 16, 1998, No. 146-FZ; Part 2 of 08/05/2000 No. 118-FZ: As amended. and additional as of 04/15/2003. - M.: Prospekt, 2003. - 518 p.

5. Chart of accounts for the financial and economic activities of the organization and Instructions for its use. Order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n.

6. Krasnova L.P., Shalashova N.T. Accounting: Textbook. - M.: LAWYER, 2002. - 528 p.

7. Labyntsev N.T., Kovaleva O.V. Audit: theory and practice: Proc. allowance. – M.: PRIOR, 2000. – 278 p.

8. Kuzmina T.V. Organization of accounting in joint-stock companies // Accounting. – 2003. – No. 6. – pp. 12-18.

9. Tkachuk N.V. Accounting for own shares // Accounting. – 2003. – No. 19. – P. 15-17.

Basic entries for the repurchase of shares (shares)

The accountant makes an entry when own shares are repurchased from shareholders or when there is an entry for the repurchase of a share.

| Redemption by a joint stock company or other company/partnership from a shareholder/participant of shares/shares owned by him/her | In accounting, an entry is made for the amount of actual costs under Dt 81 and a credit to cash accounting accounts - 50, 51, 52 |

| Cancellation of own shares purchased by the joint-stock company (i.e., the authorized capital will be re-registered in a new – smaller amount) | They are carried out according to Kt 81 and Dt 80 “Authorized capital” after this company has completed all the procedures provided for by law. The difference arising in account 81 between the actual costs of repurchasing shares (shares) and their nominal value is charged to account 91 “Other income and expenses”. |

It is possible that the cost of purchasing shares does not correspond to their nominal value.

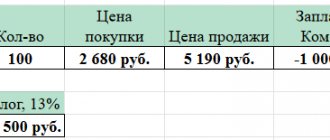

EXAMPLE

The nominal value of the shares of Balance CJSC is 3,000 rubles, and the redemption price is 3,500 rubles. The resulting difference between the nominal value and the acquisition cost in the amount of 500 rubles (3,500 rubles - 3,000 rubles) is included in the financial results of the company as other expenses.

The transactions for repurchase and cancellation of shares will be as follows:

Dt 81 – Kt 50, 51, 52 – 3500

Dt 80 – Kt 81 – 3000Dt 91 “Other income and expenses” – Kt 81 – 500

If, instead of canceling shares (shares), the organization resells these shares or shares, transactions are also carried out through account 91:

Dt 51/52, etc. – Kt 91 Dt 91 – Kt 81

Theoretical basis of accounting for own shares

Reflection in accounting and reporting of transactions with own shares purchased from shareholders may raise several questions:

- account for own shares (shares) as an asset, liability or capital;

- reflection in the financial statements of transactions with own shares (shares) purchased from shareholders;

- the procedure for accounting for transactions with own shares;

- procedure for tax accounting of transactions with own shares purchased from shareholders.

It is very important for organizations in which the authorized capital is divided into contributions (shares) by the authorized capital to keep correct records at all stages of operation:

- at the time of creation - to account for settlements with the founders and in determining the share of each;

- during the period of economic activity - for the correct distribution of income in the form of dividends;

- during the period of reorganization or liquidation - to calculate the share of retiring participants (founders) and to determine financial responsibility in the event of a loss or bankruptcy.

Finished works on a similar topic

- Course work Accounting for own shares (shares) purchased by the company 440 rubles.

- Abstract Accounting for own shares (shares) purchased by the company RUB 220.

- Test work Accounting for own shares (shares) purchased by the company 200 rubles.

Receive completed work or advice from a specialist on your educational project Find out the cost

Transactions with your own shares (shares) are carried out in accordance with:

- with the first part of the Civil Code of the Russian Federation,

- Federal Law of December 26, 1995 N 208-FZ “On Joint-Stock Companies”,

- Federal Law of 02/08/1998 N 14-FZ “On Limited Liability Companies”,

- Federal Law of November 21, 1996 N 129-FZ “On Accounting”,

- Accounting provisions PBU 4/99, PBU 9/99, PBU 10/99.

A joint stock company may reduce the size of the authorized capital stated in the constituent documents in accordance with the law of the Russian Federation. Based on Law N 208-FZ, the authorized capital of a joint-stock company is reduced in the following ways:

- by reducing the par value of shares,

- by reducing the total number of shares, in particular by purchasing shares and their further redemption.

When reducing the amount of the authorized capital, its value should not affect the value of the company's net assets. It should be noted that the reduction of the authorized capital to the amount of the net assets of the joint-stock company can only be carried out by reducing the par value of the shares. Reducing the amount of the authorized capital by redeeming previously acquired shares is not possible, since this in itself ensures a further decrease in the value of net assets.

Looking for ideas for study work on this subject? Ask a question to the teacher and get an answer in 15 minutes! Ask a Question

Requirements and restrictions for transactions for the repurchase and acquisition by a joint-stock company of its own shares are established by Federal Law No. 208. In accordance with it, shares that were acquired on the basis of a decision adopted by the general meeting of shareholders to reduce the authorized capital of the company by purchasing shares in order to reduce their total number are redeemed when purchasing them. In other situations, shares acquired by the company by decision of the board of directors do not provide voting rights and are not taken into account when counting votes, and dividends are not accrued on them. These shares are sold no later than one year after their acquisition. If this does not happen, then the general meeting of shareholders makes a decision to reduce the authorized capital by redeeming these shares. The second option is possible - increasing the par value of the remaining shares by redeeming the acquired shares while maintaining the size of the authorized capital. Preferred shares are purchased at the price specified in the charter of the joint-stock company or at their market value. The shares that the company bought back are at its disposal.

A joint stock company may buy back its own shares from shareholders at the request of the shareholders themselves. The repurchase is carried out at market value.

Correspondence for postings

When accounting for the repurchase/cancellation of own shares, as well as the repurchase of shares, correspondence is possible with the following accounts:

| By debit | By loan |

| 50 Cashier 51 Current accounts 52 Currency accounts 55 Special bank accounts 91 Other income and expenses | 73 Settlements with personnel for other operations 80 Authorized capital 91 Other income and expenses |

Read also

17.09.2019

Reflection of share repurchase in accounting

In Russian accounting, the procedure for recording transactions for the repurchase of own shares has undergone changes during the transition to the Chart of Accounts dated October 31, 2000 No. 94n. According to the previously existing Chart of Accounts, own shares purchased from shareholders were reflected in a special sub-account to account 56 “Cash documents”. Currently, a separate account 81 “Own shares” is intended for accounting for own shares. The changes that have occurred are not just in the nature of allocating a separate account for accounting for own shares - the approach to the procedure for reflecting such shares has changed. On account 56 they were reflected at par, and on account 81 own shares are reflected according to the amount of costs for their redemption: “When a joint stock company or other company (partnership) buys from a shareholder (participant) shares (shares) owned by him in accounting for the amount of actual costs An entry is made in the debit of account 81 “Own shares.”

The current scheme for reflecting transactions for the acquisition of own shares in accounting and reporting seems to be more correct compared to the previous one. Own shares purchased from shareholders are reflected at the cost of acquisition in the Asset of the balance sheet on a specially allocated line of the same name as a type of short-term financial investment.

A number of authors propose to regard the accounting of own shares as a counter-passive and reflect it in the liability side of the balance sheet with a minus. In particular, T.V. Kuzmina in her work “Organization of Accounting in JSC” writes: “Despite the fact that own shares in the portfolio can be issued into circulation, nevertheless this should not make own shares in the portfolio an asset on the balance sheet. When a joint-stock company buys back a certain amount of its own, issued and circulating shares, it reduces its capitalization, rather than acquiring an asset (fund). Essentially, treasury shares in a portfolio are the same as unissued share capital and there is no reason to classify it as an asset on the balance sheet. If treasury shares in a portfolio are accounted for and shown on the balance sheet at cost, they must be deducted from the paid-up share capital, i.e. from paid-up share capital at par and share premium or retained earnings.”

The amount of the authorized capital shows how much money the company received from shareholders to carry out its activities. The authorized capital is not a fund, but funds contributed by shareholders; they are not personalized. In the process of economic activity, the company is free to invest available funds in various income-generating instruments, which may include its own shares.

Funds aimed at repurchasing one’s own shares are, of course, funds diverted from circulation, but they are precisely funds that are potentially capable of generating income (if resold at a higher price). Or means by which the shareholder structure can be optimized (cutting off a large number of small shareholders), which also leads to financial benefits through reducing the costs of maintaining the register and holding shareholder meetings.

Thus, until the moment when the company decides to cancel the repurchased shares from shareholders, there is no reason to reduce the amount of the authorized capital either in accounting or reporting.

When analyzing financial statements by external users, it is proposed to supplement the balance sheet line “own shares purchased from shareholders” with the following explanation: “incl. at nominal value."

Accounting for repurchased shares on account 81 in the amount of actual costs simplifies the procedure for reflecting transactions to repurchase own shares in the accounting accounts. The actual costs of repurchasing shares, in addition to the repurchase price itself, may include: the amount of the broker's remuneration, interest on the loan.

The repurchase of shares on our own (without the involvement of brokers) is accompanied by the accounting entry: Dt 81 Kt of cash accounts.

When repurchasing shares through a broker, the accounting entries are as follows:

Dt 76 “Settlements with various debtors and creditors” (you can open a separate sub-account for settlements with a broker for the repurchase of your own shares)

Kt 51 “Current account” - for the amount intended for the repurchase of shares and payment of brokerage fees.

If a bank loan was received for the purpose of purchasing shares, then the interest on such a loan is reflected by the entry:

Dt 76 Kt 66 “Settlements on short-term bank loans.”

With this scheme for organizing accounting records, account 76 acts as a calculation account. The amounts collected on it related to the repurchase of shares and forming the actual costs of acquisition are written off upon receipt of shares from the broker by posting:

Dt 81 “Own shares” Kt 76 “Settlements with various debtors and creditors.”

It is also necessary, at the time of repurchase of shares, to make internal entries to account 80 “Authorized capital”: Dt “Announced capital” Ct “Withdrawn capital”.

The need for this entry is due to the fact that, according to current legislation, repurchased shares do not provide voting rights, are not taken into account when counting votes, and dividends are not accrued on them.

Shares purchased from shareholders are subject to either mandatory redemption or sale at market value no later than one year from the date of their redemption (Clause 6, Article 76 of the Law “On JSC”). When redeeming repurchased shares, there are three options:

shares redeemed at a price corresponding to their par value are redeemed, which is documented by posting: Dt 80 “Authorized capital” Kt 81;

shares purchased at a price exceeding their par value are redeemed - the difference is written off by posting: Dt 91 “Other expenses” Kt 81;

shares purchased at a price below par are redeemed - when the costs of purchasing shares were below par, the difference is written off by posting: Dt 81 “Own shares” Kt 91 “Other income”.

Since in ch. 25 of the Tax Code of the Russian Federation does not establish a procedure for writing off canceled shares without increasing/decreasing financial results for tax purposes if their nominal value exceeds the actual purchase price (or vice versa), this gives grounds for increasing/decreasing the tax base for tax purposes.

In this regard, a different procedure has been established for writing off canceled shares purchased at a price higher than their par value, if during their initial placement they were sold to generate share premium. That. write-off of the excess of the redemption price over the par value at the expense of the amounts of share premium is drawn up: Dt 80 Kt 81 - for the par value of the canceled shares and

Dt account “Share premium” Kt 81 – for the difference between the redemption price and the par value.

This approach complicates the accounting of repurchased own shares, however, it is the most logical - receipt of income on shares during their initial placement is not recognized as income of the issuer in accordance with Art. 251 of the Tax Code of the Russian Federation, at the same time, repurchase at a market price that exceeds the face value should also not be recognized as an expense, because To cover such a difference, there is a previously created source - share premium. When making a decision on the sale of repurchased shares, the following entries must be made in the accounting records of the enterprise:

Dt accounts receivable account (62, 73, 76) Kt 91-1 “Other income” - for an amount equal to the sales price;

Dt 91-2 “Other expenses” Kt 81 “Own shares” - for the amount of actual costs of repurchasing shares.

The balance of other income and expenses is written off later to account 99 “Profits and losses”.

Posting of the day! Accounting for the purchase of own shares

The accountant of an enterprise must include in the accounting records information about the acquisition of its own shares for subsequent resale or cancellation. How is this data carried out depending on the type of company?

To account for such transactions, line 1320 “Own shares purchased from shareholders” is filled in, the data is entered in parentheses. Joint-stock companies reflect their own shares purchased from shareholders both at their request and by decision of the board of directors. Limited liability companies - reflect the value of shares in the authorized capital purchased from the participants (founders) of the company.

Example: purchase

Own shares (shares) purchased by the company are taken into account in the amount of actual costs of their acquisition, regardless of their nominal value. These costs are reflected in the debit of account 81 “Own shares (shares)”.

On December 5 of the reporting year, OJSC Invest acquired 10 of its own shares at a price of 900 rubles. per share. The nominal value of each share is 1000 rubles.

Invest's accountant made the following entry:

DEBIT 81 CREDIT 51

– 9000 rub. (900 rub. × 10 pcs.) – shares are capitalized.

On line 1320 of the balance sheet for the reporting year, indicate the cost of own shares in the amount of 9,000 rubles.

Example: resale or cancellation

On December 5 of the reporting year, OJSC Invest acquired 10 of its own shares at a price of 900 rubles. per share. The nominal value of each share is 1000 rubles. On December 10 of the reporting year, the company sold 6 repurchased shares at a price of 1,100 rubles. a piece.

The Invest accountant made the following entries:

DEBIT 81 CREDIT 51

– 9000 rub. (900 rub. × 10 pcs.) – shares are capitalized.

DEBIT 51 CREDIT 91-1

– 6600 rub. (RUB 1,100 × 6 pcs.) – shares sold;

DEBIT 91-2 CREDIT 81

– 5400 rub. (900 rubles × 6 pcs.) – the book value of the shares is written off;

DEBIT 91-9 CREDIT 99

– 1200 rub. (6600 – 5400) – the financial result has been determined.

In this situation, line 1320 of the annual balance sheet indicates the cost of own shares in the amount of 3,600 rubles. (9000 – 5400).

Example: Cancellation of previously repurchased treasury shares

On January 5 of the reporting year, OJSC Invest bought back 10 of its own shares at a price of 900 rubles. per share. The nominal value of each share is 1000 rubles.

Invest's accountant made the following entry:

DEBIT 81 CREDIT 51

– 9000 rub. (900 rub. × 10 pcs.) – shares are capitalized.

On February 20, the general meeting of Invest shareholders decided to reduce the authorized capital by canceling 4 repurchased shares. Changes were made to the constituent documents. The Invest accountant made the following entries:

DEBIT 80 CREDIT 81

– 4000 rub. (1000 rubles × 4 pcs.) – the authorized capital has been reduced;

DEBIT 81 CREDIT 91-1

– 400 rub. (RUB 1,000 × 4 pcs. – RUB 900 × 4 pcs.) – reflects the difference between the par value of the shares and the actual costs of their acquisition;

DEBIT 91-9 CREDIT 99

– 400 rub. – financial result determined

In this situation, line 1320 of the annual balance sheet indicates the value of own shares in the amount of 5,000 rubles. (9000 – 4000).

Date of publication: October 26, 2012, 14:30

— + 0

Tweet

Share accounting: Russian practice and international standards

Investments of funds by organizations in the form of investments in securities in accordance with clause 3 of the “Procedure for reflecting transactions with securities in the accounting records”, approved by Order of the Ministry of Finance of Russia dated January 15, 1997 No. 2, are reflected in the accounting records as financial investments. Thus, financial investments in the authorized capital (shares) represent the amount of assets invested in the property of another organization to ensure its authorized activities. Currently, Russia is experiencing economic growth, which is partly of an investment nature. A necessary condition for continued economic recovery is the ability of the Russian financial market to provide Russian enterprises with access to internal and external sources of financing. At the same time, the rapid development of the corporate securities market, which provides access to various sources of capital through the portfolio investment mechanism, should play a key role in creating investment potential. In the context of the new investment structure in Russia, in which three quarters of capital investments fall on the share of enterprises and organizations of the non-state sector, it is important that joint-stock enterprises learn to attract capital and master market mechanisms for its use. In this regard, the question of the correct balance of financial investments in stock.

General characteristics of the promotion

According to the Federal Law of April 22, 1996 No. 39-FZ “On the Securities Market” No. 39 FZ, a share is an issue-grade security that secures the owner’s rights to receive part of the profit of the joint-stock company in the form of dividends, to participate in the management of the joint-stock company and to part of the property remaining after its liquidation. It is perpetual, i.e. it circulates on the market as long as the joint stock company (JSC) that issued it exists. The joint stock company is not obliged to buy it back.

Shares can be registered or bearer. The issue of bearer shares is permitted in a certain ratio to the amount of the paid-up authorized capital of the issuer in accordance with the standards established by the Federal Securities Commission. 1 There are two categories of shares: ordinary (sometimes called ordinary) and preferred. Ordinary shares differ from preferred shares in the following ways:

- after full payment of their cost, ordinary shares provide the owner with the right to participate in voting at a meeting of shareholders; a similar right appears to owners of preferred shares if the meeting of shareholders decides not to pay dividends on preferred shares or discusses issues relating to the property interests of the owners of these shares, including issues of reorganization and liquidation of the company;

- payment of dividends and liquidation value on ordinary shares can be carried out only after the distribution of the corresponding funds among the owners of preferred shares;

- For ordinary shares, dividends may not be paid, while for preferred shares, the amount of dividend for which is determined in the charter, complete non-payment of dividends is impossible. According to Russian legislation, preferred shares can be issued, the amount of the dividend for which is either determined or not determined. In the latter case, the amount of the dividend on them cannot be less than the dividend on ordinary shares.

A joint stock company may issue preferred shares, which provide for different priorities in the payment of dividends and liquidation value. In world practice, preferred shares that have advantages in the order of dividend payments on them compared to other preferred shares are called preferential preferred shares.

Preferred shares may be convertible or cumulative. A convertible preferred share is a share that can be exchanged for other shares - common or other types of preferred. Cumulative preferred shares are shares for which dividends are accumulated in the event of non-payment. The issuer determines the period of time during which dividends can accumulate. If dividends are not paid to the owners after this period, then they acquire the right to vote at the shareholders' meeting until the dividends are paid.

There are placed and announced shares. Issued shares are shares sold. They determine the amount of the authorized capital of the joint-stock company. Authorized shares are shares that the joint-stock company has the right to place in addition to those placed. The number of authorized shares is determined in the charter. The presence of authorized shares simplifies the process of increasing the authorized capital of a joint-stock company. If shareholders grant this right to the Board of Directors, then it can make decisions to increase the authorized capital in an amount not exceeding the value of authorized shares, without convening a meeting of shareholders.

The main characteristics of shares are nominal and market values, their profitability and risk.

Accounting for financial investments in shares

According to clause 43 of the Regulations on accounting and financial reporting in the Russian Federation, approved by Order of the Ministry of Finance of Russia dated July 29, 1998 No. 34n, financial investments represent investments of an organization in government securities, bonds and other securities of other organizations, as well as loans provided to other organizations. The current accounting methodology considers financial investments as an independent accounting object. This approach is based on the concept of separating costs associated with current activities (production and distribution costs) and investments in assets in order to generate income.

Based on the above definition of financial investments, investments in shares as a type of financial investment represent the amount of assets invested in the property of another organization to ensure its statutory activities, which can be made in the form of:

- making contributions by participants to the authorized capital when creating and expanding a joint-stock company;

- acquisition of shares (shares) of organizations on the secondary market;

- acquisition of shares of privatized organizations from state property management bodies.

The type of financial investment under consideration is taken into account by the investor in the amount of actual costs. According to Order of the Ministry of Finance of Russia dated January 15, 1997 No. 2 “On the procedure for reflecting transactions with securities in the accounting records,” in the case of the acquisition of shares, such costs are:

- amounts paid in accordance with the agreement to the seller (issuer or investment bank) 3 ;

- amounts paid by organizations to individuals for information and consulting services related to the acquisition of shares;

- intermediary fees;

- expenses associated with the accrual (payment) of interest on borrowed funds used to purchase shares before they are accepted for accounting;

- other expenses directly related to the acquisition of shares.

Both cash (rubles, foreign currency) and non-monetary assets (fixed assets, property rights, securities, etc.) can act as investment resources. However, with any form of payment, the value of shares is expressed in rubles. Purchased shares are accounted for in active account 58 “Financial investments”, subaccount 1 “Units and shares”. An important condition for the possibility of reflecting shares on account 58 is their full payment by the investor. In case of partial payment, incurred costs are taken into account as financial assets only when the investor receives all the necessary rights to the investment object (the right to receive income, the right to participate in the management of the organization, etc.). In this case, the unpaid cost of the objects is reflected in accounts payable. In this case, this operation is reflected by the following posting:

Debit 58 “Units and shares”

Credit 76 “Settlements with various debtors and creditors” sub-account “Settlements for purchased shares” - for the unpaid part

Credit 51 “Currency accounts”, 52 “Currency accounts” for the paid part.

At the same time, in the balance sheet, acquired shares are also reflected at actual costs, and the unpaid part is reflected under accounts payable.

If the investor does not receive all the necessary rights to the investment object, then the amounts contributed against the shares to be acquired are read from the debit of account 76 to the subaccount “Settlements for acquired shares” in correspondence with the credit of account 51 or 52. In this case, the indicated amounts are reflected in the balance sheet under the accounts receivable item.

Non-monetary contributions are made to the authorized capital only after the founders (participants) have carried out their monetary valuation. Moreover, according to Article 34 of the Federal Law of December 26, 1995 No. 208 Federal Law “On Joint-Stock Companies”, if the par value of the shares acquired in this way is more than 200 minimum wage, then such an assessment must be made by an independent appraiser (auditor). The methodology for accounting for non-monetary contributions to the authorized capital (shares) involves the following entries in accounts 4:

- when adding non-monetary assets to the authorized capital - Debit 58 “Financial investments”, subaccount 1 “Shares and shares” Credit 91 “Other income and expenses” subaccount 1 “Other income”;

- when writing off depreciation related to contributed depreciable assets - Debit 02 “Depreciation of fixed assets” 05 “Depreciation of intangible assets”, Credit 01 “Fixed assets”, 04 “Intangible assets”

- when writing off the balance sheet (residual) value of contributed property - Debit 91 1 “Other expenses” Credit 01,04,58, etc.;

- when reflecting other operating expenses associated with financial investments - Debit 91 2 “Other expenses” Credit 51 “Settlement accounts”, 60 “Settlements with suppliers and contractors”, etc.;

- when reflecting the financial result - Debit 91 9 “Balance of other income and expenses”, Credit 99 “Profits and losses” of operating profit Debit 99 “Profits and losses” Credit 91 9 “Balance of other income and expenses” loss.

Investment of funds into the formed authorized capital occurs, as a rule, in two stages during the process of state registration of the organization and during a certain period of its activity. The size of the down payment and the deadline for making the remaining amount depend on the organizational and legal form of the legal entity being created. The Federal Law “On Joint Stock Companies” determines the minimum amount of the authorized capital at 1000 minimum wages for OJSCs, 100 minimum wages for CJSCs and prescribes payment of at least 50% by the time of registration and payment of the remaining part of the authorized capital within a year from the date of registration of the company. Securities received as a contribution to the authorized capital at the cost specified in the constituent documents are credited to account 58 “Financial investments”, subaccount 1 “Shares and shares” from the credit of account 75 “Settlements with founders”.

The process of investing non-monetary assets in the authorized capital (shares) determines the formation of operating income and expenses for the investor, the accounting of which is organized in account 91 “Other income and expenses”. According to clause 3 of Article 39 of the Tax Code of the Russian Federation, non-monetary investments in the authorized capital and shares of other organizations are not recognized as sales and are therefore exempt from VAT. Professional private traders in the securities market, when purchasing securities in order to receive income from their sale, have the right to evaluate financial investments at the purchase price. In this case, the remaining expenses caused by the acquisition process are taken into account as current expenses and are reflected in account 26 “General business expenses”.

According to the Accounting Regulations “Income of the Organization” (PBU 9/99), approved by Order of the Ministry of Finance of Russia dated May 6, 1999 No. 32n, receipts (income, dividends) associated with a share in equity capital are recognized as operating income. Such income is reflected in the credit of account 91 “Other income and expenses”, subaccount 1 “Other income”, including the tax withheld at the source of payment, which is accompanied by the following entries:

- when accruing income (dividends) from equity participation in other organizations - Debit 76 3 “Calculations for due dividends and other income”, Credit 91 1 “Other income”;

- when income (dividends) are credited to the current account – Debit 51 Credit 76 3.

When transactions receive dividends in foreign currency, exchange rate differences may arise due to the difference in the ruble valuation of dividend amounts at the rate on the date of registration in account 76 “Settlements with various debtors and creditors” subaccount 3 “Settlements on due dividends and other income” and on the date of actual crediting dividends to the organization's foreign currency account. In this case, positive exchange rate differences are written off to the credit of account 91 1 “Other income”, and negative ones - to the debit of account 91 2 “Other expenses”.

Shares and deposits may subsequently be the subject of purchase and sale transactions, for the accounting of which the organization also uses account 91 “Other income and expenses”.

The sale of shares and securities is reflected at the time of their transfer to the buyers. Based on clause 2 of Article 149 of the Tax Code of the Russian Federation, it is not subject to VAT. Operating expenses associated with the circulation of financial investment objects are debited to account 91 2, taking into account VAT amounts. The transactions under consideration are reflected as follows 5:

- when transferring deposits (shares) to the buyer (at the sale price) Debit 62 “Settlements with buyers and customers” Credit 91 1 “Other income”;

- when writing off the book value of sold financial assets - Debit 91 2 “Other expenses” Credit 58 1 “Units and shares”;

- when reflecting operating expenses associated with the sale - Debit 91 2 “Other expenses”, Credit 60.51;

- when reflecting the financial result from the sale - profit: Debit 91 9 Credit 99; loss: Debit 99 Credit 91 9.

Accounting for own shares

A joint stock company may purchase shares from shareholders for the purpose of their subsequent resale, cancellation or distribution among its employees. Shares purchased by the joint stock company are reflected in active account 81 “Own shares (shares)”. The cost of repurchased shares is reflected in the debit of this account and the credit of cash accounting accounts. In accordance with the Methodological Recommendations on the procedure for generating indicators of an organization's financial statements, approved by Order of the Ministry of Finance of Russia dated June 28, 2000 No. 60n, own shares purchased from shareholders must be read at the amount of actual costs. Previously, they were accepted for accounting at face value.

Repurchased shares do not provide voting rights at shareholder meetings, and dividends are not accrued or paid on them. They can be reflected on the organization’s balance sheet for up to 1 year after the redemption. During the specified period, they must either be sold or the authorized capital must be reduced by their value.

Thus, shares placed among shareholders come to the disposal of the issuer in the following three cases:

- In case of non-payment of shares or their incomplete payment by holders on time.

- When repurchasing shares at the request of shareholders.

The return of unpaid shares from the buyer is reflected by the following posting:

Debit 81 “Own shares (shares)” Credit 75 “Settlements with founders” subaccount 1 “Settlements on contributions to the authorized (share) capital”.

In case of incomplete payment by the buyer of the shares, they also become available to the issuer. In this case, the funds and property contributed as payment are not returned to the shareholder and are reflected in the joint-stock company as part of non-operating income as an unrepaid debt to the founder. This business transaction is accompanied by the following transactions:

Debit 75-1 “Settlements on contributions to the authorized (share) capital” Credit 91-1 “Other income”

According to Article 75 of the Federal Law “On Joint-Stock Companies,” shareholders holding voting shares have the right to demand that the company repurchase all or part of their shares in cases where the latter voted “against” when the general meeting of shareholders made decisions:

- on the reorganization of the company;

- making a major transaction;

- introducing amendments and additions to the company’s charter or approving the company’s charter in a new edition, limiting the rights of shareholders who voted “against”.

In this case, the repurchase of shares is carried out at their market value, determined without taking into account its change as a result of the actions of the company, which resulted in the emergence of the right to repurchase shares.

The repurchase of shares is accompanied by the following transactions:

- when reflecting the par value of the shares you purchased - Debit 81 “Own shares (shares)” Credit 76 “Settlements on shares being redeemed”;

- when reflecting the difference between the market and nominal value of shares –

a) if the market value exceeds the par value of the shares: Debit 83 “Additional capital” subaccount “Share premium” Credit 76 subaccount “Settlements on redeemable shares”;

b) if the market value is less than the par value of the shares: Debit 76 subaccount “Calculations for redeemable shares” Credit 83 subaccount “Share premium”;

- when paying shareholders the market value of shares - Debit 76 subaccount “Settlements on redeemable shares” Credit 50.51.

- When purchasing shares by an element for the purpose of subsequent redemption or resale.

When resale of shares, they are written off from the credit of account 81 “Own shares (shares)” to the debit of cash accounting accounts. Canceled shares are written off to reduce the authorized capital [Debit 80 “Authorized capital”, Credit 81 “Own shares (shares)”]. In this case, the difference in the value of the sold and canceled shares is written off to account 91 “Other income and expenses”: for expenses – Debit 91 2 “Other expenses” Credit 81 “Own shares (shares)”; for income - Debit 81 “Own shares (shares)” Credit 91 1 “Other income”.