How to draw up a power of attorney to submit reports to the tax office?

The tax office has not approved a unified form for the transfer of powers. This means that organizations and individual entrepreneurs have the right to issue a power of attorney in any form. The main thing is that the document indicates the date and place of preparation; information about whose interests the authorized person represents; information about himself and his rights, a list of transactions that are entrusted to him. You also need to specify the validity period of the power of attorney. If this is not done, it will be valid for one year from the date of preparation. The finished paper must be certified by the director of the organization or individual entrepreneur.

How to correctly draw up and execute an M-2 power of attorney

Already from the name of the power of attorney it is clear that it has a standard form, therefore its execution is strictly regulated by law.

All cells must be filled out without making any mistakes or adjustments - if there are any, it is better not to make corrections to the form, but to create a new document.

When filling out the intersectoral form M-2, you should use the data from the passport of the authorized person or other document proving his identity. The signature of the principal must also be present on the form and must be certified by the head of the enterprise or a person authorized to act on his behalf.

One power of attorney can be issued to receive goods from one supplier using several accompanying documents at once - in the M-2 form you just need to indicate all their details. But if the suppliers are different, then in each case you will need to create an individual document.

The power of attorney is drawn up in a single original copy.

It consists of two parts:

- one, after filling out, is torn off and remains with the accountant,

- the second, the main one, is transferred to a trusted person. He, in turn, gives it to the supplier, who adds it to his package of shipping documents.

All powers of attorney issued to employees of the organization, after losing their relevance, must be stored in the archive for the period established by the legislation of the Russian Federation or internal regulations of the enterprise, after which they can be disposed of.

Can a representative revoke a power of attorney issued in his name?

According to the civil code, only the person who issued it can revoke a power of attorney. At the same time, your relationship with the client is based on a contractual basis. Accordingly, as soon as the contract terminates, you can require the client to revoke the power of attorney. In addition, you can inform the inspectorate that it is time to revoke the power of attorney, since you are no longer serving the client.

Send two letters: to the client and to the inspectorate. Tell the client that you have stopped working with him and require him to revoke the power of attorney. Inspections - that you no longer represent the client's interests. For the inspection, this will be sufficient grounds to revoke the power of attorney in the information resource.

General information

The drawing up and certification of powers of attorney is regulated by Art. 185.1-189 Civil Code of the Russian Federation. They establish such points as certification of a power of attorney, its revocation, reassignment, expiration dates, and more.

The most common question in this case is: is it necessary to notarize a power of attorney? It is not required for legal entities; only the signature and seal (if used) of the general director is sufficient, if the power of attorney is not irrevocable. Otherwise, in accordance with paragraph 2 of Art. 188.1 of the Civil Code of the Russian Federation, an irrevocable document must be certified.

Also, notarization requires a power of attorney from the individual entrepreneur, since he is still an individual. In this situation, a power of attorney will be drawn up by a notary when the entrepreneur contacts him.

The duration of the power of attorney can be any - there are no restrictions. It is indicated in the text of the document itself. But if the validity period is not specified, then by default it will be valid for 1 year.

Important! When contacting the Federal Tax Service, it is better for the authorized person to have a copy of the power of attorney with him, since tax authorities often keep the document for themselves.

Is it possible not to indicate the passport details of the representative in the power of attorney for the right to submit reports?

The inspector can only take passport data from a power of attorney or a message about representation. But he is obliged to enter data into the system only on the basis of a power of attorney. He can take them from the message about representation only of his own free will. So the only way to correctly document the data of an authorized person is to register them in a power of attorney.

There is no need to be afraid of compromising your passport data. The Inspectorate is the same operator for processing personal data as any other supervisory authority. The risk is, rather, that the power of attorney remains at the disposal of your client, whose interests you represent. If this is a concern, the contract should stipulate what responsibility the parties bear in the event of disclosure of personal data.

Report through Extern for your company or clients if you have an accounting firm. Convenient tables help keep all reports, payments and budget calculations under control. 3 months free.

Start using

Validity period of the document

When drawing up various trust documents, questions often arise related to their validity periods. If we are talking about a trust form for receiving goods and materials, then it should immediately be noted that the period of this document should not exceed more than 3 years. Basically, such deadlines are indicated on the power of attorney form itself when issued, however, there are cases when there is no entry in the corresponding field. In such cases, the power of attorney will retain its legal force for 12 months, that is, one year. After this period, all such trust documents are automatically invalidated.

If the validity period is not a mandatory item to fill out, then the date of issue of the trust form must be strictly displayed. Otherwise, such a document will also be declared invalid.

Based on the above text, it can be noted that the best option would be to issue such a power of attorney for a maximum period, that is, three years, so as not to get into an unexpected situation in the future when the document is cancelled. But it is not always possible to do this, since everything depends on the product being supplied. Let’s say that a certain product is accepted centrally, and the list of products is always different from the previous one. Under such circumstances, it is not always possible to generalize such products.

How to correctly draw up and execute an M-2 power of attorney

The unified forms M-2 and M-2a are strictly regulated by the legislation of the Russian Federation, so it is necessary to fill them out correctly so that the relevant services do not cause unnecessary problems with them.

Firstly, it should be noted that each cell in this form is required to be filled out, and you need to make sure that the text of this power of attorney does not contain any errors or strikethroughs. Otherwise, this trust document may not even be considered. Therefore, if there are any corrections, it is recommended to fill out the document from scratch.

Secondly, when drawing up such powers of attorney, it is necessary to ensure that the filled-in information from the attorney’s passport is correct. At the same time, the power of attorney must also contain the personal signature of the principal and a special mark from the head of the organization, which confirms the certification of this document.

By the way, one trust form for receiving goods from one supplier is allowed to be issued using several accompanying papers, and all their details must be displayed in the form. In the case where such suppliers are always different, it is necessary to draw up a document for each one separately.

It is necessary to take into account the fact that the power of attorney to receive goods and materials is drawn up in only one copy, and all copies created are not considered valid. Such a document is divided into two parts - the first is filled out and remains with the company’s accountant, and the second is given to the attorney.

Each trust document issued to employees of a certain institution, after the end of its validity period, is stored in the appropriate archive for the time established in the legislation of the Russian Federation. After this, all such papers are disposed of.

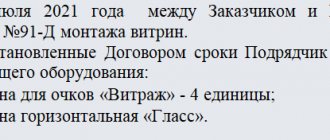

So, let's move on directly to filling out the special M-2 form. At the very beginning of the form, you need to fill out a table containing the following entries:

- form number, date of issue and validity period;

- information about the authorized person (position, full name and personal signature).

Then you need to enter the name of the supplier to whom you need to present this document.

After this, you must enter all the information about the number and date of the order, including a document confirming the completion of all actions that the principal entrusts to the attorney. This part of the form is torn off and remains with the accountant.

Second part

This part of the form is the most basic in the unified M-2 form. First, you need to enter the name of the trustee company here. Also write down the number of the trust document, the date of its issue and the period of validity.

Then you need to enter all the necessary information about the consumer institution (meaning the enterprise that draws up this document), its name and legal address, including all bank details.

After this, you need to indicate the position held, the name of the person who will subsequently perform certain operations using this trust document. In addition to everything, you should enter his passport details into the form, namely: series and number, date of issue and the authority that issued it.

Below you must enter the name of the supplier company, including a link to the document with the help of which the corresponding material assets are issued.

The third part

The current section of the form contains a special table in which you must enter all relevant products that the attorney must subsequently accept. Therefore, the table must include the serial number of each product, its name, unit of measurement and quantity. However, there is no field for the cost of a specific product.

How to inform the tax office about a power of attorney?

The power of attorney must be provided on paper. Additionally, you can transfer it via the Internet in the form of a scan, signing it with the electronic signature of an authorized representative. But the scan only notifies inspectors that the original has been sent and needs to be found. The inspection has the right not to accept the scan until there is a power of attorney on paper.

If the paper power of attorney is lost, you can contact the tax office - directly to the inspector, if you have an established relationship with him, or with an official letter. And if you report through Kontur.Extern, you can contact us: we will help the inspection find a power of attorney and enter data on it.

How much time do I need to allow for sending a power of attorney to the inspectorate?

Tax officers are required to enter the data of the new power of attorney into the system within 3 business days. But technical or legal difficulties can never be ruled out. In order not to take risks, it is better to transfer the power of attorney at least 10 days before submitting the reports.

When a power of attorney is replaced by an old one, it must be transferred no later than 15 days before the expiration of the previous document. This will allow you to avoid blocking accounts if during the period “between powers of attorney” the Federal Tax Service sends a request to the client.

To make sure that the data on the power of attorney has been entered, we recommend that you make an ION request before submitting the reports. If you receive a receipt in response, everything is in order - you can report.

Universal form

Is there a “special” form of power of attorney - a special form that would give the right to carry out any actions on behalf of the represented person? No, there is no single form of power of attorney, just as there is no special form.

But there is an exception to the rule. Resolution of the State Statistics Committee of Russia dated October 30, 1997 No. 71a approved two standard inter-industry forms of powers of attorney for obtaining goods and materials: No. M-2 and No. M-2a. The forms themselves are the same, the only difference is the presence of a spine in form No. M-2. Instruction of the USSR Ministry of Finance dated January 14, 1967 No. 17 “On the procedure for issuing powers of attorney to receive inventory items and releasing them by proxy” is still in effect, but it is applied only to the extent that does not contradict current legislation (in particular, the Civil Code of the Russian Federation ).

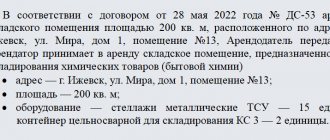

These forms are used to formalize the right to act as a trustee of an organization when receiving material assets issued by a supplier under a work order, invoice, contract, order, agreement.

All other powers of attorney are drawn up in any form; they list all the actions for which the given person is authorized.

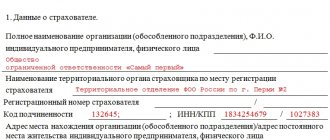

A power of attorney issued by a legal entity must contain the following details:

- organization data (name, legal address, TIN);

- Full name, passport details, place of residence of the representative;

- signature of the manager or other person authorized to do so by the constituent documents;

- seal of a legal entity;

- date of submission of the power of attorney;

- signature of the chief accountant, if the power of attorney is issued on behalf of a legal entity based on state or municipal property, to receive or issue money and other property assets.

A power of attorney issued by an individual must contain the following mandatory information:

- Full name, passport details, place of residence of the principal;

- Full name, passport details, place of residence of the representative;

- signature of the principal;

- date of submission of the power of attorney.

One of the mandatory details that must be present in a power of attorney of any type is the date that determines the beginning and end of its validity (if the validity period is not expressly established). At the same time, when indicating the validity period of the power of attorney, you must remember that it cannot be more than three years. The basis is Article 186 of the Civil Code. Failure to indicate the validity period does not make the power of attorney invalid - it remains valid for a year from the date of issue (as established in the same Article 186 of the Civil Code of the Russian Federation). And a completely different matter is a power of attorney that does not reflect the date of its issue; such a document is considered void.

The procedure for drawing up a power of attorney issued by a legal entity differs from the procedure for drawing up a power of attorney issued by an individual.

As an example, let’s look at what a power of attorney to receive a salary is.

An individual has the right to authorize another individual to receive a salary. At the same time, the organization in which the principal works can also certify a power of attorney to receive wages (clause 4 of Article 185 of the Civil Code of the Russian Federation). It is necessary that the principal draw up a power of attorney in the presence of a person authorized by the company to certify such documents. The possibility of issuing wages by power of attorney is provided for in paragraph 16 of the Procedure for conducting cash transactions in the Russian Federation, approved by Decision of the Board of Directors of the Bank of Russia No. 40 dated September 22, 1993. It states that if the issuance of money is made by power of attorney, executed in the prescribed manner, then in the text of the expense order, after the surname, first name and patronymic of the recipient, the cashier indicates the surname, first name and patronymic of the person entrusted with receiving the salary.

A power of attorney to obtain a work record book is issued in a similar manner. At the same time, the last name, first name and patronymic of the person entrusted with receiving the work book for the employee are indicated in the journal for recording the movement of work books.

And the last thing you need to know about the power of attorney form is that the signature must be genuine.

The law does not allow the use of a facsimile signature on a power of attorney. In other words, this document cannot be signed using mechanical or other copying means, using an electronic digital signature or another analogue of a handwritten signature.

Otherwise, a power of attorney not signed personally may be invalidated. This was at one time indicated by the Russian Ministry of Taxation (see letter of the Russian Ministry of Taxation dated April 1, 2004 No. 18-0-09/ [email protected] ) and arbitration practice (see Resolutions of the FAS of the East Siberian District dated July 6, 2006 No. A19-40221/05-31-F02-3281/06-S2, FAS Volga District dated June 21, 2007 No. A57-4833/06-33, etc.).