Sign of payment in a cash receipt - what are they?

The format of a modern cash receipt is very different from what it was just a few years ago. Today, every document must include the following information:

- Store information.

- The total amount of the transaction.

- Serial number of the order.

- Tax contributions.

- The exact time and date of receipt generation.

- Fiscal data.

- Actually a sign of calculation.

At the request of the owner of the outlet, many other data can be printed, however, the ones listed above are mandatory.

Business Solutions

- shops clothing, shoes, groceries, toys, cosmetics, appliances Read more

- warehouses

material, in-production, sales and transport organizations Read more

- marking

tobacco, shoes, consumer goods, medicines Read more

- production

meat, procurement, machining, assembly and installation Read more

- rfid

radio frequency identification of inventory items More details

- egais

automation of accounting operations with alcoholic beverages Read more

What are the signs of settlement in a check of any type and format?

This term describes one of the mandatory initial data indicated on the cash receipt. It must be present on the document, regardless of whether it is presented to the buyer in paper or electronic form. Possible options for details are established by federal legislation. Among them:

- Receipt is a standard sale of goods, records the moment when the purchaser hands over money to the seller and receives purchases in return.

- Receipt return – printed when a reverse operation occurs, that is, the purchased item is returned to the store, and the buyer’s money is returned to the buyer in cash or to the card.

- Expense – registration of the issuance of material funds to the client from the cash register for things received from him. Used in scrap metal collection points, pawn shops and other similar institutions.

- Refunding is the reverse operation. It is used extremely rarely, but is nevertheless possible.

It should be noted that the procedure requires printing a new check, since all information received by the cash register is immediately transferred to the tax department. At first glance, this creates some difficulties, but in fact it also brings convenience, not only to the buyer, but also to the seller. Thanks to this introduction, there is no need to additionally create an act, which saves time.

What is a cash receipt and when does it need to be punched at an online cash register?

According to paragraph 2 of Art.

1.2 of the Law “On the Use of Cash Register Equipment” dated May 22, 2003 No. 54-FZ, when selling goods (services), the enterprise and individual entrepreneurs must issue the buyer a cash receipt or a strict reporting form (SSR) replacing it. A cash receipt is a primary form that is generated using cash registers at the time of mutual settlements between the client and the business entity in electronic form or on paper.

A cash receipt contains a number of required elements, one of which is a sign of mutual settlement with the client:

- receipt - revenue or other receipts of funds from clients;

- return of receipt - payment of a sum of money received earlier to the client;

- expense - issuing cash to the client, for example, for accepting scrap metal;

- return of expense - return transfer of a sum of money from the client that was paid to him by the business entity earlier, for example, if the counterparty takes the scrap metal previously given and returns the cash.

Read more about the required check details here.

When to return goods via online checkouts

There are different situations possible in which, in principle, one has to resort to the procedure, but basically this happens for two objective reasons. The first is related to the client's refusal to purchase. What caused such a desire, inadequate quality or one’s own preferences, is completely unimportant. When everything complies with the law, the seller is obliged to return the goods to the buyer via the online checkout.

The second reason for canceling a purchase is a typo during the initial checkout. The problem may be an incorrectly entered amount, unit of product or its name. In this case, it is impossible to do without correction, since this will lead to the transfer of incorrect information to the tax service, and at the same time to other troubles. As a result of the procedure, the buyer receives a new receipt, and the seller has to prepare other documents, which we will talk about later.

How to issue a partial refund at the online checkout?

If the client wants to exchange or return not all purchased items to the seller, then the employee is obliged to issue a partial refund through the online checkout, just as he does when receiving the entire purchase back. Only in the fiscal document the employee does not indicate the entire amount previously paid, but only the cost of the products that are returned to the store.

If defects are discovered in the purchased product, the consumer has the right to ask for a reduction in its price (the norm is posted at the link). In this case, perform the following steps:

- create a return receipt for the entire purchase price;

- they generate and issue to the individual a document with the new price of the items being sold and the overpaid amount.

Technical support of equipment. We will solve any problems!

Leave a request and receive a consultation within 5 minutes.

How to make a refund for goods at the online checkout: step-by-step instructions

The actions of the store employee are subject to the situation that led to the registration of the procedure. The period during which funds must be returned to the consumer’s hands also depends on this. If we talk about the most general algorithm of actions, it will look like this:

- The customer notifies of his desire to cancel the purchase by means of a statement.

- The employee draws up an invoice for that part of the purchased items that should be returned to the warehouse.

- The entire debt amount is calculated.

- A cash transaction is being completed.

Next, we will consider in more detail different situations and ways to overcome them.

Registration of a refund for goods on the same day of purchase at the online checkout due to a seller’s error

This option is the simplest, including for the buyer himself. He does not need to submit any documents or write an application. It is enough to reprint the order with the correct price, name and quantity of the product. The client receives it directly at the cash register. If necessary, he is also compensated for the monetary difference.

Documentation of returning goods and money from the online cash register

What documents should I use to complete the return procedure at the online checkout?

A refund to the buyer is a consequence of his returning the purchased goods to the seller. The product may be of either low quality or high quality (clause 1 of article 18, clause 2 of article 25 of the Law “On the Protection of Consumer Rights” dated 02/07/1992 No. 2300-1), and the day of its return will not necessarily coincide with the day of sale . When accepting goods from the buyer, the following is issued:

- return application drawn up in any form or on a form developed by the seller;

- return invoice in the form used by the seller for this primary accounting document.

The application may be accompanied by a paper version of the cash receipt issued to the buyer upon sale in any of the possible forms (paper or electronic), or a duplicate of it, printed by the seller from the database stored in the fiscal drive.

But as a document for the return of money via the online cash register (both cash and non-cash returned to a bank card), a regular cash receipt (or BSO) will be issued with all its mandatory details, but with the calculation sign “return of receipt” (letter Ministry of Finance dated May 24, 2017 No. 03-01-15/31944). At the same time, the seller does not have the obligation to draw up, for example, an act of returning money to the buyer, since the law of May 22, 2003 No. 54-FZ (clause 1, article 1) limits the application of cash register systems to the provisions of its own text and regulations adopted in accordance with him.

To find out whether the cashier-operator’s obligation to keep a logbook remains with an online cash register, read the article “Cashier-operator logbook for an online cash register.”

Business Solutions

- the shops

clothes, shoes, products, toys, cosmetics, appliances Read more

- warehouses

material, in-production, sales and transport organizations Read more

- marking

tobacco, shoes, consumer goods, medicines Read more

- production

meat, procurement, machining, assembly and installation Read more

- rfid

radio frequency identification of inventory items More details

- egais

automation of accounting operations with alcoholic beverages Read more

For the cashier, this is not the end of the procedure. He must draw up a memo indicating the mistake made and also confirming the printing of new documents. The “wrong” check is retained by the employee and attached to the note as evidence.

It should be noted that these instructions only apply to situations where the problem was identified directly on the day of sale, and, if possible, at the very moment of purchasing the product. However, it is impossible to return it and get your money back in full. This requires a procedure using a different algorithm, which we will discuss below.

How to make, process and process a refund for a product to the buyer through an online checkout when the product is returned

No one can take away the right to completely cancel a transaction from a client, so if there are legal grounds for this: for example, the item turned out to be of inadequate quality, the wrong size, or the buyer simply changed his mind, the procedure is also carried out without delay, but is somewhat more complicated.

First, he will have to write a statement addressed to the store director, which indicates exactly what was purchased and for what amount, as well as the reason for the refusal. The form can be found on the Internet or requested directly at the point of sale. Additionally, you will have to attach a previously issued check and show your passport.

If the receipt was lost, the seller will be able to find it on the fiscal registrar, so there will be no problems for the buyer in any case. Unless more time is spent on registration. Next, the seller will have to take a few more steps:

- Issue an invoice.

- Print a check.

- Give a new receipt and money to the client.

If the purchase was made using a bank card, the funds will be credited back to it.

How to make a return at the online checkout not on the day of purchase

This situation, according to the rules of the event, completely coincides with the previous one. The consumer will need a completed application and a receipt (if available), and the store employee will need an invoice and a printout of new documents. Upon completion of the transfer of funds back to the acquirer, the transaction is considered cancelled.

In addition, we note only one point. Returning an item several days after purchasing it requires special attention. Different groups of products have different periods during which such a procedure can be carried out. In addition, there are certain groups of items that cannot be replaced or returned to the store.

How to issue a partial refund at the online checkout

One receipt often indicates several product items, but the buyer's claims may relate to only one or some of them. In this case, you have to resort to a completely different version of the procedure. In general, it is similar to the situation when the client wants to completely abandon what he purchased, which means an application, delivery note and other documents are drawn up. But all this describes only specific items that must be returned to the store.

Accordingly, the new fiscal document will also contain information only on certain items. The funds are returned according to the same. The original receipt, which contains proof of other purchases, is not taken from the purchaser. A copy is simply made from it, which remains at the point of sale. Thus, the person receives a new warrant covering the items that were returned and keeps the old one to confirm ownership of all the others.

Results

Standard operations carried out at the online checkout also include returning money to the buyer for returned goods.

Such an operation is formalized with a cash receipt (or BSO), which has the usual set of details for this document, but with a special calculation feature designated as “receipt return.” At the same time, the seller must issue a receipt for the returned goods. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

How to return a receipt using an online cash register legally: documentation

Despite the fact that for the buyer the algorithm of actions is quite simple and requires practically no effort, the seller has to additionally prepare a lot of paperwork so that there are no problems with the tax service in the future. Among them may be:

- Fiscal documents, that is, created directly on the cash register. These include all cash receipts, including those made for the purpose of correcting information.

- Exculpatory – confirming the legality of the procedure. They can be an application from the buyer, an act of delivery of a previously purchased product, or a letter of guarantee.

- Cash registers, which are created to record all transactions carried out at a retail outlet. These include receipts and expenditures, and a cash book.

With the introduction of innovations in the laws on trading activities, it has become easier to generate such reports, so this should be done without fail, and, if necessary, submitted to the tax service.

How to make a refund if there is no money in the cash register

One of the most controversial issues when accepting goods back is the payment period. If at the time of the return the store does not have a sufficient amount of funds, then it can exercise its right to return the payment within 10 days from submitting the corresponding application . This is stated in the existing Law on the Protection of Consumer Rights, namely in Article 22. It also states that after this period, if the store does not return the required amount, the buyer has the right to impose a penalty . Their amount is determined in Article 23 of the same Law, namely 1% of the total cost of the product for each day of delay.

In addition, to protect its interests, the buyer can send an appeal to Rospotrebnadzor or draw up a corresponding statement of claim in court.

Writing an application

We have already talked about what is being included in this document, but let’s put another emphasis on its content. The buyer has the right to write an appeal to the director, but it must contain the following:

- Passport details.

- Why does the consumer refuse the purchased item?

- The price of the purchased product, the date and time of the transaction.

- Date, signature.

The store employee will have to ensure that it is filled out correctly, since this paper will remain here. The easiest way is to take care of timely printing of forms, which clients can fill out if necessary. As for the cash receipt, if possible, a copy should be made of it. If the receipt is lost, the cashier will have to find confirmation in the Federal Register, and reflect in the documents that the order itself was lost.

How to issue a refund on a card from an online cash register

Today, purchases with non-cash payments using credit cards are made much more often than with cash. In general, the measures for returning assortment do not differ, regardless of the payment method. Unless the card details are additionally entered into the application written by the buyer. In this case, funds can take up to ten days to arrive, and the client’s attention should be drawn to this so that he does not doubt the correctness of the seller’s actions.

Features of returns via online cash register for non-cash payments

The buyer may request reimbursement of costs for goods to a bank card. For example, if they were paid with “plastic”. Legislators have not established a special refund methodology for such situations. Therefore, the buyer is recommended to indicate the need for cashless payment in the application. You will also need to indicate the card details in it.

The salesperson gives the return receipt to the consumer. It states that the money is transferred to a plastic card. Generating the document will eliminate the shortage in the cash register when creating a report before the end of the shift.

If the purchase was made for cash, and they want to receive a refund via non-cash payment

To begin with, the client will have to clarify this desire in the application along with the details for transferring funds. Otherwise there are no differences from the general procedure.

The only point that should be further clarified is that such a change in the form of payment is possible only if cash was initially used. If the purchase was initially made using a bank card, it is impossible to exchange it for real money; the funds will be transferred to the credit card from which they were debited.

How to complete the procedure via POS terminal

Steps may vary slightly. It depends on the hardware you're using, but they usually look like this:

- The store employee selects the “Financial” section.

- Next, you need to stop at returning the goods and insert a customer card into the device.

- After this, the amount is entered, and the consumer confirms it and enters the PIN code.

- The completed check is printed and given to the purchaser.

The money must be returned within five working days.

How to issue a return

- The buyer fills out an application for the return of goods indicating passport data, name of the goods, reason for return and receipt number.

- You accept the application and at the checkout generate a check with the calculation sign “return of receipt”.

If you are returning a marked item, scan the marking code. If it is not saved, you don’t have to scan it (Government Decree No. 174 of April 20, 2021).

- Give money for the goods.

If the buyer paid by card, return it to the card. If the card is not valid, you can transfer it to another, but do not give out cash (clause 2 of Bank of Russia instructions No. 3073-U dated October 7, 2013).

If the buyer paid in cash, return the money from the cash register or transfer it to the buyer’s client’s card. If there is not enough cash in the cash drawer, deposit it in the cash register and then give it to the customer.

- Fill out the return invoice if you do accounting. You can develop the invoice form yourself.

Partial return

For example, you bought three goods, but decided to return one from this receipt. In this case, at the checkout, you need to generate a check with the calculation sign “return of receipt” for the one product that the buyer wants to return.

If the service is paid in full, but partially provided, issue a check with the calculation sign “return of receipts”, and in the amount of this check indicate the amount to be returned.

Partial replacement

Generate a check with the calculation attribute “return of receipt” for the product that needs to be exchanged. In the payment method, select "counter provision". After this, generate a check with the payment attribute “receipt”, indicate in it the name of the product being replaced and also indicate “counter provision” in the payment method.

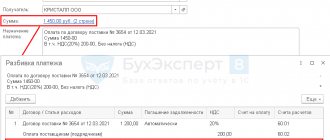

We made an advance payment and then decided to return the goods

If you generated two checks to sell a product: the first for an advance payment, and the second for the offset of this advance payment, you will need one check for the return. The indication of the payment method depends on the moment of return of this product.

If the buyer returns the goods after full payment, indicate “full payment” in the method of calculating the return receipt, and the cost of the goods in the payment amount.

If the buyer returns a product purchased on credit with an initial payment (with partial payment), indicate “partial payment and credit” in the method of calculating the return check, in the calculation amount - the full cost of the goods, and in the payment amount - the advance payment that was made paid by the buyer, in the amount on credit - the balance of payment that the buyer did not have time to pay.

The goods were paid for in full with a certificate and decided to return

In this case, indicate “full payment” in the method for calculating the return receipt, and indicate the cost of the goods in the payment amount. The form of payment - cash or non-cash - indicate the method by which the money was returned to the buyer.

We paid for the goods with delivery, but decided to return them

If shipping costs are not refundable. In the receipt for receipt, goods and delivery must be separate items. In the return receipt, indicate only the item being returned and its cost.

Why do you need a correction check?

The need for this document arises if the seller discovered his own mistake some time after the transaction was completed, when the buyer had already left the outlet. It is impossible to leave the situation as it is, since at the end of the day the profit at the cash desk will not correspond to the report. The printing of such a receipt is always accompanied by the preparation of a report indicating the error that occurred.

However, the preparation of an adjusted order is required only when excess funds are detected. If there is a shortage, there is no need to punch additional checks. The procedure must be completed before the end of the work shift and the preparation of the Z-report.

How to cancel a check:

Cancellation

- with an open check, before the last press of the IT , press: MODE → IT → IT → IT

How to close a shift (evening Z report)?

- press the MODE until the indicator shows: FN REPORTS

- click IT → enter administrator password (default 22) → IT

- the screen will display CLOSE SHIFT

- press IT

Before or immediately after closing a shift, you can additionally generate a SHIFT REPORT , in which the total amount of revenue for the shift will be printed:

- MODE key several times until NONFISCAL REPORTS appears on the indicator

- then click: IT → enter administrator password (default 22) → IT

Issuing a correction check

- in cash register mode, with a closed receipt, press VZ

- + and - keys to select CORRECTION and press IT

- + and - keys to select INCOME or EXPENDITURE and press IT

- deposit amount → PI → IT

What products can be returned through online checkouts?

The consumer has the right to refuse any purchase, regardless of its quality, within a specified period. For products with properties that meet the requirements, it is 14 days, for defective items - a warranty period or 2 years, if one was not declared.

But there are exceptions included in a special list. These include things that provide personal hygiene, cosmetics and perfumes, underwear, medicines, household chemicals, plants, technically complex goods, animals and some other groups. They are not returnable under any circumstances.