When is it possible and when is it mandatory to send documents to the tax office electronically?

The flow of documents between tax authorities and taxpayers is enormous.

This is not only the submission of regular tax reports, but also various types of responses to requests, notifications, submission of documents, requirements, etc. Gradually becoming a thing of the past, the days when the taxpayer had to run to the inspector with each piece of paper or bring him boxes with confirming documents on a truck documents. Although the legislation does not contain a ban on paper document flow. Controllers will still accept most documents in paper form. Mandatory sending of documents to the tax office in electronic form is provided only in certain cases. For example, filing VAT returns and documents related to this tax (books of purchases and sales, journal of invoices), as well as sending explanations on VAT reporting to tax authorities is possible only in electronic form (with rare exceptions) .

Find out more about this on our website:

- “Rules for writing and submitting explanations to the VAT return”;

- “The journal for recording issued and received invoices - a new format.”

What is the procedure for submitting documents required by the tax authority? Find out the answer to this question in ConsultantPlus. If you do not have access to the K+ system, get a trial online access for free.

Tax authorities accept other types of tax reporting both in electronic and paper form. It all depends on the number of employees of the taxpayer who sends the report (clause 3 of Article 80 of the Tax Code of the Russian Federation). At the same time, ordinary citizens can communicate with controllers and submit any documents to them in a wide variety of ways:

- through the taxpayer’s personal account;

- by coming directly to the inspection;

- by sending documents by post.

It is important to remember the basic rule: if you submitted your return electronically, then further interaction with controllers regarding this tax report should occur electronically. This rule follows from the order of the Federal Tax Service dated April 15, 2015 No. ММВ-7-2/ [email protected] Let’s look at this document in more detail.

ConsultantPlus experts explain in detail how to submit requested electronic documents to the Federal Tax Service that are not compiled in established formats. Get trial access to the system and go to the Tax Guide for free.

Actions after making changes

After the inspection makes changes about an individual entrepreneur in the Unified State Register of Entrepreneurs, sometimes additional actions may be necessary. For example, these:

Change the seal

You need to order a new seal if any of the details indicated on it have changed. Usually this is your full name or address. Do not delay changing the seal, because many clients and potential partners check information about individual entrepreneurs in the Unified State Register of Entrepreneurs, and its discrepancy with the seal details can cause mistrust.

Re-register the cash register

If your full name or registration address has changed (and along with it the address where the cash register will be installed), the cash register must be re-registered using the new data. To do this, you can contact any inspection. The online cash register will be linked to the business address that you indicate in your registration address.

Notify the bank

If you change your last name, first name or patronymic, you must notify the bank that maintains your account. Otherwise, problems may arise when conducting transactions for which you present documents. You also need to report a change in your registration address, even if your actual address of residence does not change: in some cases, notifications are sent exactly to the registration address.

What is important to remember about deadlines when transferring electronic documents

Typically, taxpayers transfer documents to the tax office electronically at the end of each reporting or tax period. According to the TKS, a significant part of them submit tax and accounting reports to the inspectorate.

But there are other reasons why you need to submit documents to the tax office electronically: tax officials may request documents during an audit (desk, on-site, counter) or offer to clarify the declaration data or make corrections to them. What should you consider when submitting documents electronically to the inspectorate?

First of all, remember the deadlines:

- 10 working days are given to the taxpayer to prepare and submit documents requested during tax audits;

- 5 working days are given to submit clarifications and correct the declaration (clause 3 of article 88, clause 5 of article 93.1 of the Tax Code of the Russian Federation);

The deadlines must be counted from the date of receipt of the requirement from the inspection. Violation of deadlines is fraught: for each document not submitted, a fine of 200 rubles is provided. (Article 126 of the Tax Code of the Russian Federation).

There are other deadlines to keep in mind. For example, to file objections to a tax audit report under the TKS, the taxpayer has 1 month (clause 6 of Article 100 of the Tax Code of the Russian Federation).

If you have not sent a receipt for the electronic request of the Federal Tax Service for the submission of documents, use the advice of ConsultantPlus experts and find out whether it is possible to avoid liability. Get trial access to the system and study the material for free.

Receive documents on changes

Within 5 days after receiving the application, the Federal Tax Service must consider your application. Based on the results of the review, either changes are made to the Unified State Register of Individual Entrepreneurs (and then you receive a Unified State Register of Individual Entrepreneurs with new data), or the inspectorate issues you a written reasoned refusal to state registration of changes.

According to the law, regardless of the method of submitting documents, the result of consideration of your application must be sent to the email specified in application P24001. In practice, this does not always happen, so it is better to immediately submit a request to receive original documents on amendments.

Fill out all the necessary documents automatically and for free

There is no need to look for sample applications and requests; our service will select and fill them out for you automatically. Enter your details in a simple form and receive ready-made documents in 15 minutes.

Get an applicationRead more

Get an applicationRead more

In application P24001, you can choose which way is more convenient for you to receive the original documents on amendments. To do this, you need to select the appropriate code in paragraph 1 of sheet G:

- “1” - Issue to the applicant. If you choose this option, you will only be able to receive documents in person, at the place where you submitted the application (at the inspectorate, the MFC or a notary). When filing electronically, you will also need to contact the registration inspectorate. To obtain documents you will need an original passport and an inspection receipt confirming acceptance of the application.

- “2” - Issue to the applicant or person acting on the basis of a power of attorney. The procedure for obtaining is the same as when choosing code “1”, but your representative can also receive documents. He needs to have with him the original passport, a notarized power of attorney from you and an inspection receipt

- “3” - Send by mail. Please note that documents are sent to the individual entrepreneur’s registration address, and not to the actual address (if they do not match). You can receive documents by mail with your passport or your representative with a passport and power of attorney. An inspection receipt is not required.

You can track the progress of your application until you receive the result in a special section of the Federal Tax Service website.

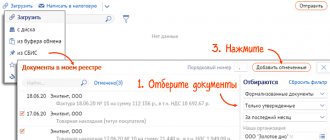

How to submit electronic documents

Another important issue that must be addressed when submitting electronic documents to the tax office is the method of presentation. Documents in electronic form can be sent to the TCS inspection through an EDI operator or through personal accounts of taxpayers (clause 2 of Article 93 of the Tax Code of the Russian Federation).

Is it possible to submit paper primary documents in electronic form? Yes, this allows clause 2 of Art. 93 of the Tax Code of the Russian Federation - in the form of electronic images created by scanning with the preservation of their details in established formats. The same article of the code stipulates that if the requested electronic documents are transmitted via TCS, then they must be certified by the enhanced CEP of the person being inspected or his representative.

By order of January 18, 2017 No. ММВ-7-6/ [email protected] the Federal Tax Service approved the format of the list of documents that accompanies the electronic document flow between tax authorities and taxpayers (it came into force on January 15, 2018, clause 1.1 of the Federal Tax Service order dated December 27, 2017 No. MMB-7-6/ [email protected] ).

Individuals not related to business activities can also submit documents electronically. For example, a citizen can attach scanned images of supporting documents to the electronic 3-NDFL declaration when applying for a property or social deduction. The scans signed with an electronic signature along with the declaration will be sent to the inspectorate in electronic form.

In any case, tax officials reserve the right to familiarize themselves with the original documents.

Prepare your documents

Application on form P24001

Important!

From November 25, 2020, the application form P24001 for state registration of changes in information about individual entrepreneurs in the Unified State Register of Individual Entrepreneurs and the requirements for filling out this form have changed. If you prepare an application using the old form, the tax office will not accept it. Our free service will help you prepare documents according to the new sample.

An application for changes to information about an individual entrepreneur in form P24001 must be submitted to the inspectorate, regardless of the nature of the changes. Prepare one copy of the completed application and sign it in the presence of a competent employee (inspectorate, MFC, notary office). Do not staple or stitch the application.

Application on form P24001

Application on form P24001 - Create an application

- Generate an application automatically Enter your data in the form, download the already completed documents and instructions for submission Generate an application

- XLS, 260 KB

Request for issuance of documents on amendments

If you need original documents on making adjustments to the Unified State Register of Individual Entrepreneurs, you can submit a request for them along with form P24001. The request is made in free form, you can sign it in advance.

Copies of documents

Depending on the nature of the changes, the following copies of documents must be attached to the application:

- When changing passport data

: Copies of all completed pages of the passport - A copy of the document confirming the changes (marriage certificate, etc.)

: a copy of passport pages 2,3 and all completed pages with registrations

: a copy of the document confirming the new citizenship

: a copy of the new document

Original documents

When submitting your application, you will need the following original documents:

- Your passport

- Passport and notarized power of attorney of the representative (if someone else is submitting documents for you)

- Extract from the Unified State Register of Individual Entrepreneurs (or Certificate of Registration of Individual Entrepreneurs, if you were registered before 2021)

- Notification of registration with the tax authorities

What free electronic services are there for interacting with tax authorities?

Among the services for sending electronic documents to the tax office are:

Tax officials provide many other free services to taxpayers. They do not allow you to interact with tax authorities on the exchange of electronic documents, but they help solve other important practical tasks (for example, “Check yourself and your counterparty,” “Online appointment for an inspection,” “Find out about a complaint” and others).

Results

Electronic submission of documents to the tax office is carried out by taxpayers regularly in the form of tax and accounting reports. When sending electronic documents to the inspectorate, it is necessary to certify them with an electronic signature and comply with legally established deadlines (when submitting documents at the request of inspectors). A special free tax service allows you to remotely submit documents for registering companies and individual entrepreneurs.

Sources: Tax Code of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.