Composition and structure of the report

The document is divided into 3 parts, each of which has a tabular form. Despite the fact that there are established sample forms for reporting, an enterprise can independently edit the document until it obtains the desired form. Nevertheless, it must consistently contain information by section:

- I – “Movement of capital”.

- II – “Adjustments due to changes in accounting policies and corrections of errors.”

- III – “Net assets”.

The contents of the statement of changes in capital fully reflect events occurring with the enterprise's own sources. The first section is devoted to the capital structure and transactions carried out with it. The second consists of at least three, and if it is necessary to reflect changes in other items of capital, then more parts. The third section contains information on the values at the end and beginning of the period of net assets. The statement of changes in capital (Form 3) must be drawn up on the basis of data for 3 years: the reporting year and the two preceding it.

What does the form consist of?

The content of the reporting includes 3 sections:

- Flow of funds - reflects the structure of resources in the enterprise and the operations that took place during the reporting period.

- Adjustments due to changes in accounting policies and corrections of errors.

- Net assets - indicates the position at the beginning and end of the year.

All final information about the financial and economic activities of the organization is distributed according to the following main parameters:

- types of funds (capital), ways of changing it;

- reporting periods (years).

Often, when preparing reports, a period of 3 years is taken (the reporting year and the two previous ones). Completing the 2021 statement of changes in equity involves using data for 2017-2019.

Requirements for the content of the report

The report on changes in capital (Form 3) must be prepared in accordance with the requirements of the Ministry of Finance of the Russian Federation. The contents indicate:

- net profit and loss values;

- each item of profit/loss, income/expenses in monetary terms and their amount;

- the effect of the accumulation of changes in accounting policies and the adjustment of errors considered in accordance with IFRS;

- capital transactions;

- changes in additional and reserve capital, as well as the condition and value of the company’s shares.

The data must be presented in the report itself or in an appendix to it. If you comply with the rules for maintaining accounting and financial records, it is not difficult to fill out Form 3 “Report on changes in capital”, a sample form of which can be found in the recommendations of the Ministry of Finance of the Russian Federation for the preparation of mandatory financial statements.

Features of report preparation

The OKUD form 0710004 is formed strictly in accordance with the requirements established by the Ministry of Finance of the Russian Federation. The instructions on how to fill out the statement of changes in capital for 2021 consist of several steps.

First of all, you need to fill out the title part of the document. To do this, information about the name of the enterprise, form of ownership, INN, KPP, codes according to all-Russian classifiers, type of activity and unit of measurement used in the register are entered in the appropriate lines.

Next, fill out the sections of the tabular part of Form No. 3. The procedure for filling out the items of the statement of changes in capital in relation to net assets is provided for by Order of the Ministry of Finance No. 84n dated August 28, 2014. Here are the instructions:

- Section 1 contains data on net profit and losses, movements (increase or decrease) of funds, items of profit and loss, income and expense values in monetary terms, etc.

- Section 2 is intended to reflect adjustments and amendments to accounting policies. Here, corrections are made to previously made errors in calculations (it is necessary to note the indicators before and after the amendments). The adjustment is made in accordance with International Financial Reporting Standards (IFRS).

- In the 3rd section - “Net assets” - it is necessary to determine the real value of the enterprise’s capital property (the difference between assets and resulting liabilities), their current value and condition as of the reporting date.

This is what an example of filling out a statement of changes in capital for 2021 looks like:

Characteristics of the first part of the report

Section I of the third form contains information on all changes in the elements of the enterprise’s equity capital for the period under review. It includes: authorized, additional, reserve capital, as well as data on retained earnings (uncovered losses), shares purchased from the owners of the enterprise.

In each part, relevant indicators are indicated that can be compared with data from previous years. If the company has not changed its accounting policies, then the values will coincide with those included in the reports for the past 2 years. In case of changes, it is necessary to make adjustments to the data and indicate the reasons for the discrepancy in the explanatory note to the report.

Authorized capital: rules for filling out the column

The authorized capital of an enterprise is created upon formation of a legal entity through contributions from the founders. During the financial activities of the company, the volume of assets may change, which must be documented.

The statement of changes in capital begins with the first part “Authorized capital” of Section I. The data required to fill out is located on account 80, which is opened to account for the funds of the authorized capital. The column indicates:

- balance of initial capital as of December 31. reporting year and two previous years;

- the amounts by which capital was reduced or increased in one year.

Credit turnover on account 80 is indicated in the corresponding line of the report - increase in capital. If there are debit turnovers on the authorized capital account, fill out a column explaining the reason for its decrease. A change in the size of the authorized capital usually results from an increase or decrease in the number of shares and their par value, as well as the reorganization of the enterprise.

What does the statement of changes in equity show?

This report discloses information on the movement of authorized, reserve and additional capital , and also reflects data on changes in the amount of retained earnings (uncovered loss), and the share of own shares.

The report is submitted by all organizations, except budgetary, credit and small insurance organizations.

The indicators are entered as of December 31 of the reporting year, the completed reports are submitted along with the balance sheet and financial results statement.

Download samples of filling out financial statements for 2020:

- balance;

- income statement;

- cash flow statement.

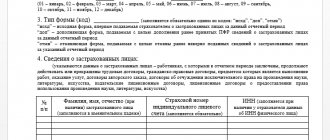

Who should take it?

The statement of changes in equity is included in the organization's regular (full) financial statements. It is rented out by absolutely all legal entities that are not small, budget, insurance or credit.

Form 3 is regulated by Appendix 2 to Order of the Ministry of Finance of the Russian Federation No. 66n dated July 2, 2010. The report must be drawn up using the generally required template OKUD 0710004.

.

The simplified financial statements of an organization include only three documents - a balance sheet (OKUD 0710001), a statement of financial results (OKUD 0710002), as well as on the intended use of funds, which is generated according to the OKUD 0710003 template. The report in question is not included in the simplified financial statements regulated by Appendix 5 to Order of the Ministry of Finance of the Russian Federation No. 66n dated July 2, 2010.

If an organization has the right to report to the Federal Tax Service in a simplified format, it may legally not fill out information about changes in capital. In addition, an enterprise that prepares simplified financial statements may not submit a cash flow statement to the Federal Tax Service. This means that non-profit organizations and legal entities that are small businesses have the right not to submit a report, since they can generate and present financial statements according to a simplified scheme (this is stipulated by the Law “On Accounting”, Article 6).

Accordingly, organizations that do not have the right to use simplified accounting statements must annually generate this report and send it to the Federal Tax Service within the established time frame.

Structural divisions of foreign legal entities that are located within the borders of the Russian Federation, as well as individual entrepreneurs (based on Article 6 of the Law “On Accounting”) are legally exempt from accounting and presentation of financial statements. These subjects do not take the OIC.

Due date in 2021

Russian legislation establishes that a statement of changes in capital (OIC) and other forms of annual financial statements of an enterprise must be submitted to the Federal Tax Service within 3 (three) months immediately following the corresponding reporting year.

Reports for 2021 must be sent to the tax service by March 31, 2021 . The specified deadline for submission also applies to other forms of company financial statements.

Format for filing with the Federal Tax Service

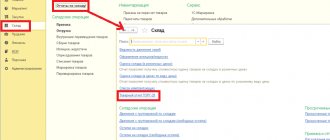

In 2021, all legal entities report to the Federal Tax Service for 2021. At the same time, the report on changes in capital, like other documentation related to the annual financial statements of enterprises, is presented only in electronic format.

Paper media are no longer used for registration. Electronic documentation is sent through an official operator with proper authority. Financial reporting is received by the Federal Tax Service via special telecommunication channels.

The remote reporting procedure will be in effect from 2021 for all legal entities – without exceptions.

Own shares and shares purchased from shareholders

The data for this report item is in the balance sheet (Section III). The numerical value of own shares and shares purchased from shareholders is included in the capital and subtracted from it. Because of this, it is recommended to indicate the amount on Forms 1 and 3 using parentheses.

Shares purchased for further resale in value terms are reflected on the account. 81. The amount is the actual acquisition costs. When shares are withdrawn from circulation, the size of the authorized capital is reduced by the amount of their value. The difference between the selling price and the nominal value is included in other income/expenses of the enterprise.

Reflection of additional and reserve capital in the report

Cash as part of additional capital is accounted for in account 83. The main feature of filling out the column “Additional capital” is the reflection of indicators that affect its overall value. Moreover, the inter-reporting period from December 31 of the previous year to January 1 of the reporting year is taken as the period under consideration. This procedure is established due to the rules for revaluation of fixed assets: data received as of January 1 of the new year must be indicated as of December 31. previous year. For example, when revaluing as of 01/01/16. the date for the report will be 12/31/15.

The indicator is determined based on loan turnover data when interacting with accounts:

- accounting for cash and settlements when creating a positive exchange rate difference;

- accounting for financial results (account 91) when a negative exchange rate difference is formed;

- 75 on the amounts of the founders’ contribution to the property of the enterprise.

Accounting for reserves is kept on the account. 82. The document indicates data on the amount of deductions in the reporting and two previous periods. Reserve capital is formed from retained earnings in order to pay off expenses in cases where it is impossible to pay them from net income.

Retained earnings and uncovered losses

To reflect data on the amount of retained earnings (loss), a period is used that influences the overall value of the value. As with the additional capital indicator, the period under consideration is the period from December 31 of the year preceding the reporting year to January 1. reporting year.

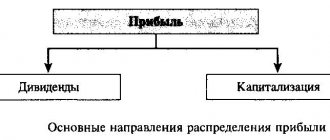

The indicators that form profit (loss) include:

- cash net profit (loss);

- OS revaluation process;

- expenses and income affecting changes in the amount of capital;

- amount of dividends;

- process of reorganization of a legal entity.

Characteristics of the values of some report lines

Income and expenses that are directly related to an increase (decrease) in capital are not included in the financial result of the enterprise. Their value is attributed in the case of income to line 3213 (3313), and in the case of expenses - to line 3223 (3323) of the statement of changes in capital.

The values of the capital reduction lines are indicated in parentheses, since the values change the capital downwards. Line 3227 (3327) contains information about the amount of profit that was distributed among the founders.

After the data in the first section has been successfully entered into the document, it is necessary to calculate the sum of all values. It is worth considering that the value in brackets must be subtracted from the result. The total values must coincide with the data indicated in the balance sheet (Section III).

How to fill out form No. 3 correctly

Completing the above sections of Form 3 of the balance sheet is sometimes difficult. Let us examine in detail how to reflect the necessary information in it.

Section 1 reflects equity capital in motion, not only for the reporting period, but also for 2 years before it. First, we show the balance as of December 31 of the year that preceded the previous one. Then we enter data for the year before the reporting year and calculate the balance as of December 31 of that year. After this, we formalize the movement, as well as the balance at the end of the reporting year. Each indicator has its own column and line in the report.

In Section 2 we indicate the changes that occurred after the approval of the statements for previous periods. Such changes may occur as a result of identifying errors or making any amendments to the constituent documents of the organization, for example, to accounting policies.

Attention! Section 2 is best completed first, as its data will be used when filling out other sections.

Section 3 contains information on the value of net assets for all three years under consideration. This indicator is calculated on the basis of information reflected in accounting as the difference between the value of assets accepted for calculation and liabilities also accepted for calculation.

Similar articles

- Statement of changes in capital - sample filling

- Rules for filling out form No. 1 Balance sheet

- Balance sheet for 2021 form

- How to fill out form No. 5 Appendix to the balance sheet?

- Financial condition of the organization according to form P-3

Completing Section I of the report on changes in capital

Each of the section articles to be filled out has its own code. Let's look at an example of filling out the first section without indicating the amounts, considering the reporting year to be 2015. First, the data is grouped into subsections:

- code 3100 “Capital amount as of 12/31/13”;

- code 3200 “Capital amount as of 12/31/14”;

- code 3300 “Capital amount as of 12/31/15.”

Each of them (except 3100) contains the following information:

1. Code 3210, 3310 “Increase in capital, total”, including:

- 3211, 3311 “Net profit”;

- 3212, 3312 “Revaluation of fixed assets and intangible assets”;

- 3213, 3313 “Income that is directly attributable to an increase in capital”;

- 3214, 3314 “Additional issue of shares”;

- 3215, 3315 “Increase in par value of shares”;

- 3216, 3316 “Reorganization of legal entities. faces."

2. Code 3220, 3320 “Reduction of capital”, including:

- 3221, 3321 “Loss”;

- 3222, 3322 “Revaluation of fixed assets and intangible assets”;

- 3223, 3323 “Expenses directly related to the reduction of capital”;

- 3224, 3324 “Reduction in par value of shares”;

- 3225, 3325 “Reduction in the number of shares”;

- 3226, 3326 “Reorganization of legal entities. faces";

- 3227, 3327 "Dividends".

3. Code 3230, 3330 “Additional capital”.

4. Code 3240, 3340 “Reserve capital”.

The table contains information without a column about the title of the article: only the code is used.

When preparing reports, you must fill out all 8 columns. Section I “Changes in capital”

| Code | Authorized capital | Own shares purchased from owners | Extra capital | Reserve capital | Retained earnings (loss) | Total |

| 3100 | () | |||||

| 3200 | () | |||||

| 3210 | ||||||

| 3211 | — | — | — | — | About (Kt) account. 84 with account 99 | |

| 3212 | — | — | Sk (Kt) count. 83 | — | ||

| 3213 | — | — | About (Kt) account. 83 | — | ||

| 3214 | About (Kt) account. 80 from account 75 | About (Kt) account. 81 in correspondence with account. 75, 91 | About (Kt) account. 83 in correspondence with account. 19, 75 | — | — | |

| 3215 | About (Kt) account. 80 from account 75 | About (Kt) account. 83 in correspondence with account. 19, 75 | — | — | ||

| 3216 | ||||||

| 3220 | () | () | () | () | () | |

| 3221 | — | — | — | — | About (Dt) count. 84 with account 99. Meaning in "()" | () |

| 3222 | — | — | () | — | () | () |

| 3223 | — | — | () | — | () | () |

| 3224 | About (Dt) count. 80 from account 75. Meaning in "()" | About (Dt) count. 83 with account 75, value in "()". Or Ob (Kt) account. 83 in correspondence with account. 80 | — | () | ||

| 3225 | About (Dt) count. 80 from account 81, value in "()" | Total turnover by account. 81 (if the amount Ob (Dt) › the amount Ob (Kt), then the value is in “()”) | — | () | ||

| 3226 | () | |||||

| 3227 | — | — | — | — | About (Dt) according to count. 84 with account 75, 70, value in "()" | () |

| 3230 | — | — | About (Dt) count. 83 in correspondence with account. 84 | About (Kt) account. 82 with account 83 | About (Kt) account. 84 with account 83 | — |

| 3240 | — | — | — | — |

In brackets are the values that are subtracted during the calculation, and a dash means an empty column. The table shows an example of filling out the first section of the statement of changes in equity without indicating the amounts of data.

The lines of subgroup 3300 are filled in similarly to 3200. After filling in for each column, the final value is displayed, which is indicated in the lines of subgroups 3210 and 3220, and then in the general characteristics of capital for the year (line 3100, 3200). In order to determine the value of the “Total” column, you need to add all the data in each column in the row.

Statement of changes in capital (Form No. 3)

Form No. 3 was approved by Order of the Ministry of Finance dated July 22, 2003 No. 67n. It reflects data on the movement of the company's equity capital. This includes, for example:

– authorized (share) capital;

- Extra capital;

- Reserve capital;

– retained earnings (uncovered loss).

The Statement of Changes in Capital must also indicate the amount of reserves formed or spent by the company in 2001–2003.

Section I "Changes in Capital"

Column 3 “Authorized capital”

In the line “Balance as of December 31 of the year preceding the previous one,” you need to reflect the amount of the company’s authorized capital as of December 31, 2001.

The line “Balance as of January 1 of the previous year” indicates the amount of authorized capital as of January 1, 2002.

These amounts are equal to the credit balance of account 80 “Authorized capital” as of the corresponding dates.