The Labor Code requires the employer to pay the wages employees deserve at least twice a month. The first such payment is called an advance payment, since it is accrued before the month worked has expired.

- What proportion of the total salary should the advance be?

- When exactly does it need to be paid?

- What are the consequences for an employer of ignoring advance payments?

All questions regarding the advance are discussed below.

Question: Organizations are required to pay wages for the first half of the month, taking into account the time worked by the employee. Some companies apply a coefficient of 0.87 to the calculated advance payment. Does the employer underestimate the salary for the first half of the month in such a situation? View answer

What documents regulate the advance?

In no way, since the official term “advance” does not exist in labor legislation. This is a colloquial, established name for the first part of the salary, which must be paid at least twice a month (Article 136 of the Labor Code of the Russian Federation).

REFERENCE! The second part is traditionally called “pay” or “salary” itself, although in fact the salary is both payments together.

Question: Until recently, salaries in our organization were paid twice a month. Currently, they offered to write a statement refusing the advance payment and stated that the salary would be calculated once a month. Is this legal? View answer

Therefore, instead of the term “advance”, the legislation uses the expression “procedure for payment of wages”. And this procedure already has a strict documentary justification in the internal acts of the organization:

- collective agreement;

- internal rules of the company;

- individual employment contracts;

- Regulations on the enterprise.

Question: What type of income code should be indicated in the payment order when paying an advance (that is, from wage income for the first half of the month), if the employer withholds 70% of the salary from the salary once a month according to writs of execution, so that according to new writs the bank Didn't make the deduction yourself? View answer

According to the Labor Code

The Labor Code of the Russian Federation does not clearly state what part the manager is obliged to pay for half a month of work. But, in Art. 136 of the Labor Code of the Russian Federation states that he is obliged to pay the work of his colleagues at least every half month.

The nuances of payments are discussed in the Letter of Rostrud dated September 26, 2016 No. TZ/5802-6-1.

This document states that payments must be made in the following order:

| In the second half of the month, from the 16th to the 30th (31st) | Advance is given for half a month |

| In the first half of next month, from 01 to 15 | salary is issued for the period already worked |

The manager must determine the exact dates in his internal documents. For example, a salary is from the 5th to the 8th of each month, and an advance payment is from the 20th to the 23rd.

Issue period

Since the Labor Code of the Russian Federation does not specify exactly when payments should be made, the Ministry of Labor took up the consideration of this issue. The Ministry provides more detailed explanations on these issues in its letters.

The department decided that the date and amount of the advance should be determined by the employer himself, enshrining these provisions in his internal documents.

But, the payment of wages must be made no later than 15 calendar days after the end of the month for which it was accrued. That is, wages for March must be paid no later than April 15. Then there will be no violations of the Labor Code of the Russian Federation.

And since payments must be made every 15 days, the terms are limited:

| The advance is issued in the second half of the month | from 16 to 30 (31) numbers |

| And the salary in the first half of the month | until the 15th |

Calculation methods

As already mentioned, the employer must independently determine what percentage of the salary is the advance. This figure must be written down in local documents.

These documents include:

- Internal labor regulations.

- Collective agreement.

- Employment contract.

For example, the documents indicate that it is 30% of a person’s salary.

Therefore, it can be determined that the advance part of the salary can be calculated using one of the methods:

| The salary specified in the contract is divided by the standard working days in the current month | The resulting value is multiplied by the number of days that the given worker actually worked from the first day to the date of payment |

| If the company uses piecework wages | That is, by multiplying the number of units of products manufactured during this period by the piece rate |

| Multiplying the tariff rate by 0.5 | Do not forget that for the calculation it is necessary to take into account all allowances and surcharges |

| Dividing the tariff amount by the standard working hours | Then, the resulting number must be multiplied by the standard time that was worked in the current month. Don't forget about all the allowances and surcharges. |

Maximum size

Not a single regulatory act stipulates what percentage of the salary the advance should be.

Ideally, the amount for the first half of the month worked should be 50% of the total payment.

This is easy to calculate if the employee has a fixed salary, no bonuses or additional payments, no deductions, etc.

But, as you know, all additional payments and all deductions are made at the end of the month, when the final payment is made.

Therefore, for a simpler calculation of the advance, it is usually 20 - 30% of the salary of a particular worker.

Let's give examples

For example, an advance is 25% of wages. Worker N. worked completely for a month. His monthly salary is 80,000 rubles.

Then in the second half of the month he should receive:

| 80,000 * 13% = 10,400 rubles | amount of income tax payable to the budget |

| 80,000 – 10,400 = 69,600 rubles | This is the amount of your salary after tax. |

| 69,600 * 25% = 17,400 rubles | this is the amount to be paid |

He will receive this amount if the advance payment is set exactly half a month in advance. But, if it is paid, for example, not for 15 days, but for 10, then you need to calculate it a little differently.

What percentage of the salary is an advance for state employees? As much as will be specified in the collective agreement.

Documenting

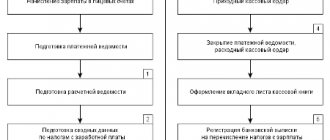

Money can be transferred either to the employee’s bank card or given to him from the cash register.

To carry out the procedure through a bank, you must issue a payment order. When conducting transactions through bank accounts from legal entities and individual entrepreneurs, it is necessary to correctly fill out the payment order. In particular, you must always indicate the purpose of the payment.

But, since in the Labor Code of the Russian Federation there is no such thing as “advance on wages,” it would be more appropriate to indicate “salary for the first half .... according to statement No.... dated hh.mm.yy.”

If the manager transfers directly through his bank account, then he may not indicate his full name, but indicate the same purpose of payment as indicated above.

An accounting statement for the payment of salary must also be prepared. This is the primary accounting document that the enterprise must have.

If the advance is issued directly from the cash register, then it is necessary to issue a cash receipt order and a payroll slip.

Are taxes calculated?

Any income of citizens is subject to income tax. Its interest rate depends on the type of income and the recipient. As a general rule, citizens of the Russian Federation pay 13% of their income to the budget, and non-residents – 30%.

Salary is a citizen’s main income, so personal income tax must be paid on it. And this is the responsibility of the employer, since he acts as a tax agent.

Since the advance is part of the salary, it is subject to taxation. But not when paying!

Tax is imposed on all wages, and the tax is calculated, withheld and paid to the budget on the entire salary amount.

The payment occurs after the manager calculates the salary amount for the month. Of course, the calculation can be approximate, since in the second half of the month the employee may get sick or take a vacation at his own expense.

In any case, income tax is not deducted separately from the advance amount. In other words, not subject to taxation.

When is the advance paid?

The date separating the payment terms is chosen by the enterprise arbitrarily. The law does not give strict instructions in this regard, however, there are recommendations from Rostrud, the Ministry of Social Development of the Russian Federation and the Federal Service for Labor and Employment, based on the logic of things.

When is the advance payment and the second part of the salary paid ?

Since remuneration for labor must be paid for the time actually worked and occurs twice a month, it is quite logical to divide the month approximately in half and choose the 15th-16th as the payment date.

FOR YOUR INFORMATION! With this choice of payment dates, it is recommended to divide the salary into approximately equal parts.

However, in the absence of strict legal requirements, the entrepreneur has some freedom in choosing dates for salary payments. You just need to take into account some nuances:

- it is allowed to divide payments not necessarily into 2 parts, you can split the salary into smaller shares, paying it three or four times a month, then the logic for setting dates will be different;

- if the gap between the advance and pay is more than 15 days, then according to the law, the employee theoretically has the right to complain about the delay in wages, suspend work and even go to court;

- the selected time periods must be recorded in the internal documents of the organization.

NOTE! The time for paying the advance must be a specific date, not a period. It is impossible to schedule advance payments, for example, from the 5th to the 10th, and paydays from the 25th to the 30th. Thus, the requirement to comply with the frequency of payments is violated.

If the appointed date coincides with a weekend or holiday, the employee will receive the required advance payment the day before.

Question: Is it necessary to calculate and transfer personal income tax to the budget from an advance payment of wages (clause 2 of Article 223, clause 6 of Article 226 of the Tax Code of the Russian Federation)? View answer

Payment of taxes

By law, the employer is required to withhold tax from the employee's salary and transfer it to the state treasury. According to Art. 223 of the Tax Code of the Russian Federation, the date of receipt of funds, and accordingly, the calculation of tax is the last day of the billing month. This means that it is impossible to deduct the amount of personal income tax due from the advance payment.

There are two solutions to this situation:

- Pay the first part of your salary without withholding any taxes. And at the end of the month, calculate the balance and subtract the entire tax amount from it.

- Immediately withhold personal income tax from the advance payment, but do not transfer it to the budget. At the end of the billing period, deduct personal income tax from your salary and pay the tax in the total amount.

The indicated options for how to calculate an advance salary and withhold the required tax allow you to take into account the interests of controlling organizations and the employer’s enterprise.

Advance share of salary

What amount or share will the first payment of part of the salary be? The law does not answer clearly here either. Of the documents, this issue is indirectly addressed only by the somewhat outdated, but not yet repealed, Resolution of the USSR Council of Ministers No. 566, which states that the amount is established by the organization and should not be lower than the tariff rate.

Is it necessary to withhold alimony from advance wages ?

In modern entrepreneurship, various methods of calculating the advance interest are used, all of them are legal, the choice is up to the employer.

- Payment for actual working hours. The advance is paid on a set date in an amount corresponding to remuneration for the number of days or hours worked. However, it may vary monthly. This method is recommended in the letter of the Ministry of Labor No. 14-1/10/B-660; it must be mentioned in internal documents.

- Fixed percentage of the salary amount. It is more convenient for calculations, since it will be the same at constant wages. It is attractive for employees because they always know how much they can count on by a certain date. If the monthly payments are divided in half, it is convenient to pay half of the due remuneration. A level of 40% is also acceptable; a smaller share is not accepted.

- Fixed amount. An entrepreneur has the right to pay not a share of the salary, but a part of it in the form of the same amount, and recalculate the rest in accordance with the time worked. With this method, the advance payment will remain unchanged, and subsequent payments may differ under different remuneration systems (they will be the same for a fixed salary, but may change for hourly or piecework wages).

Calculation process

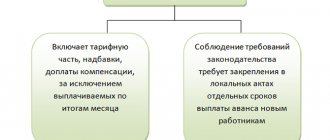

Not all workers know what percentage of their salary the advance is. When calculating the amount, the following factors must be taken into account:

- Set salary.

- Additional payments received by an employee when replacing one of his absent colleagues.

- Compensatory allowances due to deterioration or non-standard working conditions.

- Payment for hours worked in excess of the established norm.

- Part-time work in the same organization (i.e. an employee combines several positions at once).

- Availability of student trainees.

- Etc.

The calculation of salary advances is not affected by payments such as:

- Social benefits, since the employee does not receive them based on the results of his work.

- Financial assistance that an employee is entitled to annually.

- Bonus payments, since their amount can only be determined at the end of the month.

The Labor Code of the Russian Federation does not clearly define what percentage of the salary should be paid as an advance. The first part of the salary is calculated for the working hours actually worked by the employee. Let's say funds are issued on the 14th. If there are 31 days in a month, then the advance is 45% of the total salary. When receiving an advance, each employee has the right to know what part of the salary was paid to him.

The remaining amount will be transferred to the employee at the end of the month. Can the advance be more than the salary? Yes maybe. If, after receiving the first part of the income, the employee goes on sick leave or takes time off, the second part will be reduced.

How to calculate the advance amount

The salary mass includes not only the tariff rate, but also compensation, social charges, allowances, bonuses, etc. They are taken into account when dividing the payment amount.

For an advance payment, you need to take into account part of the tariff rate (salary), bonuses for experience and qualifications, compensation charges, and social subsidies.

The bonus share, if it is due, may well not be included in the advance payment, since in most cases the bonus is accrued or not accrued depending on the results of the month, which has not yet expired at the time of payment of the advance payment.

Profit tax is required to be withheld from wages. How does it affect the amount of the advance? 13% of personal income tax is deducted at the end of the month, so the first payment occurs without this deduction. The same applies to contributions to social funds. They are deducted from the salary, and the advance is only part of it.

How to charge

How much the worker receives depends on the method of calculation. The advance for the first half of the month can be calculated as:

- A fixed amount equal to a percentage of the established salary.

- An amount that varies depending on the actual hours worked at the time of accrual.

What is the difference between these methods? For the second option, funds can be issued either with or without holidays and weekends. The formula for calculating the advance in both cases is as follows:

- The established salary is combined with bonuses. Then this amount should be divided by the required working days per month. The resulting result must be multiplied by the number of days actually worked. This option is suitable for cases where only actual working days are taken into account.

- Sum up the employee’s existing salary with the bonuses he is entitled to. Then multiply the result by 50%. The resulting amount is the size of the advance, regardless of holidays and weekends.

Please note: bonuses are not classified as allowances.

If the amount of the salary advance is fixed, holidays and weekends that fall in the first half of the month do not affect the resulting amount.

The employer does not pay an advance

If an employer neglects his obligation to pay remuneration for work at least twice a month, this is a direct violation of the law. Such an administrative offense is subject to punishment, according to Article 5.27 of the Code of Administrative Offenses of the Russian Federation:

- officials who established an unlawful procedure for calculating salaries will have to pay a fine in the amount of 1-5 thousand rubles, and in the event of a relapse of such a violation - 10-20 thousand rubles, and possibly receive disqualification for 1-3 years;

- Individual entrepreneurs are required to provide at least two-time payments, otherwise they face a fine of 1-5 thousand or 10-20 thousand in case of repetition;

- a legal entity is liable to its employees for a fine of 30-50 thousand rubles, and repeated involvement is fraught with amounts of 50-70 thousand rubles.

IMPORTANT! The amount of fines is paid to the budget. Additionally, an employee who has suffered from late payment of salary has the right to demand compensation for its delay (Article 235 of the Labor Code of the Russian Federation).

Also read: where to go if you don’t get paid

Deductions from advance payment

Everyone knows that personal income tax is withheld from wages. In addition, individuals may have other deductions, such as alimony. Do I need to deduct them from the advance amount?

Formally, these deductions cannot be made from the advance payment. After all, they depend on the size of wages, and it is still unknown. In other words, the basis for calculating these deductions has not yet been formed.

It turns out that the advance must be paid in full. But in the second half of the month anything can happen. For example, an employee may quit or go on unpaid leave. In this case, there may be no salary at all for the remainder of the month, or it will be so small that it will not cover the amount of deductions due. A situation will arise in which the employee will have a debt to the employer, and the employer will have a debt to the budget.

However, this can be avoided on completely legal grounds. To do this, reserve deductions are made from the advance payment for the amount of deductions due in the form of taxes, alimony, and so on. Let's explain with an example.

According to internal documents of Romashka LLC, the advance payment must correspond to the actual time worked for the first half of the month. There are only 21 working days in the current month, and in the period from 1 to 15 there were 10.

An employee of the organization is paid a salary in the amount of 20,000 rubles, of which 25% is subject to withholding in the form of alimony. In the first half of the month he worked all 10 days. The advance payment will be calculated as follows:

- The employee’s earnings for the first half of the month were: 20,000 / 21 * 10 = 9,523.8 rubles.

- Reserve withholding of personal income tax from the specified amount: 9523.8 / 100 * 13 = 1238.09 rubles.

- Reserve withholding of alimony: 9523.8 / 100 * 25 = 2380.95 rubles.

- On hand, in the form of an advance, the employee will receive: 9523.8 - (1238.09 + 2380.95) = 5904.76 rubles.

In the second half of the month, the employee took leave at his own expense. Accordingly, no salary was accrued to him for this period; there is no basis for deduction. At the end of the month, the employer paid personal income tax for the employee in the amount of 1238.09 rubles and alimony in the amount of 2380.95 rubles. If backup deductions had not been made, the employee would have received the entire advance in the amount of 9523.8 rubles, but the employer would have nothing to transfer personal income tax and alimony from.

Accounting entries for advance payment

Accounting arrangements depend on the method of payment of the advance. Most often, it is transferred, like the rest of the salary, to a bank card . In this case, you must correctly indicate the purpose of the payment, mentioning the month of calculation, for example, “salary for half of August 2021.” Two entries are required: for the transfer of advance funds - debit 70, credit 50, and for the bank commission - debit 91-2, credit 51.

The law allows advance payment in other ways:

- in cash: you need to fill out a statement of the T-53 form provided for this or a KO-2 cash order;

- in non-monetary equivalent: part of the salary can be in kind, Art. 131 of the Labor Code of the Russian Federation allows this, regulating that its share should not exceed 20%; Thus, according to accounting, “transfer of finished products to payroll” occurs, and postings take place in 5 stages: revenue from finished products (debit 70, credit 50-1), writing off the cost of production (debit 90-2, credit 43), accrual VAT (debit 90-3, credit 68), profit or loss from transfer to salary account (debit 90-9 or 99, credit 99 or 90-9, respectively).

Nuances

Sometimes an employee has an urgent need for money long before he receives his salary. In this case, a document such as an application for an advance on wages is provided.

The worker should contact his immediate management with the paper. If the decision is positive, a corresponding order is drawn up.

Money may be needed due to the birth of a child, the death of a loved one, or another difficult situation. Then it would be more correct to replace the application for an advance with a request for financial assistance. The paper should be in writing.

Advance and taxation

According to Russian legislation, income tax is paid by the employer.

He transfers money to the tax service from the citizen’s income after the payment of wages. The payment day is the next after the salary is transferred. Personal income tax is sent once a month.

Based on this, we can conclude that no contribution is paid on the advance payment. And this is true, but accounting when calculating tax uses the total amount of funds provided to the employee, that is, wages plus advance payment.

Thus, since the advance payment is the income of citizens, tax is calculated on it, but this is done not at the time of disbursement of funds, but when transferring the basic salary based on the month worked.

It is important to know! Early sending of tax contributions is unacceptable, since this must be done from the citizen’s income, and not from the company’s funds. Premature payments may not be taken into account, which could result in a fine being imposed on the company.

Article 226 of the Tax Code of the Russian Federation “Features of tax calculation by tax agents. Procedure and deadlines for tax payment by tax agents"

Read also: Rules for filling out a work book