To account for production costs, account 20 “Main production” is used. As a rule, an account in 1C 8.3 Accounting 3.0 is closed automatically. If this does not happen, consider 4 reasons for this situation and how to eliminate them.

Production costs can be direct, that is, those that relate to the production of products, and indirect, which cannot be linked to the production of certain products.

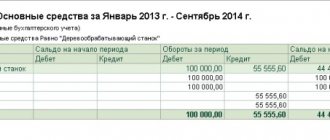

In the debit of account 20, where production costs fall, records are kept of material costs, depreciation of production equipment, labor costs and the accrual of contributions for it.

At the end of each month in the 1C 8.3 Accounting 20 program, the account is closed automatically to accounts 90, 43, 40.

To close the month you need:

- Correctly set up accounting policies for the production of products and the performance of production work and services;

- adjust the payroll of employees who participate in the production of products;

- correct maintenance of production documents - correctly indicate nomenclature groups and divisions;

- take into account the balance of work in progress.

Let's consider the necessary steps to close account 20 in the 1C 8.3 Accounting program.

Enter the site

RSS Print

Category : Accounting Replies : 33

You can add a topic to your favorites list and subscribe to email notifications.

« First ← Prev. 3 Next → Last (4) »

| Mika [email protected] Belarus, Orsha Wrote 135 messages Write a private message Reputation: | #21[336449] May 27, 2011, 10:40 |

Notification is being sent...

You need to have fun, because your future is covered in darkness - maybe it will be a thousand times worse than your present, which seems bad to you...| Mara [email hidden] Belarus, Brest Wrote 566 messages Write a private message Reputation: | #22[336524] May 27, 2011, 11:15 |

Notification is being sent...

| Mika [email protected] Belarus, Orsha Wrote 135 messages Write a private message Reputation: | #23[336610] May 27, 2011, 12:09 |

Expenses associated with downtime are taken into account when taxing profits Based on clause 2 of Article 2 of the Law of the Republic of Belarus dated December 22, 1991 No. 1330-XII “On taxes on income and profit” (hereinafter referred to as Law No. 1330-XII), losses from downtime for intra-production reasons are included in non-operating expenses taken into account when taxing profits. Therefore, in case of downtime through no fault of the employees, the employees’ wages in the amount of 2/3 of the tariff rate (salary) established for the employee are included in the expenses from non-operating operations taken into account when determining taxable profit. In accounting, this payment is included in the cost price on the basis of subclause 2.3.3 of the Basic provisions on the composition of costs included in the cost price of products (works, services), and is reflected in the entry: D-t 20, 23, 25, 44 (analytical accounts “Costs , taken into account for taxation as part of non-operating expenses"), etc. - K-t 70. In this regard, for tax accounting purposes, it is necessary to adjust the accounting data and reflect payment for downtime as part of non-operating expenses. If an employee is transferred to another job during downtime, then the amount of wages accrued to him for the work performed is included in the cost of production (work, . Such wages are also included in production and sales costs taken into account when taxing profits in accordance with clause 3 of Art. .3 of Law No. 1330-XII Amounts of additional payments up to average earnings in the event of a transfer of an employee to a lower-paid job during downtime (additional payment is made if the employee meets production standards) are also included in labor costs in accordance with subclause 3.12 clause 3 Article 3 of Law No. 1330-XII. For accounting purposes, the specified wages and additional payments are taken into account as part of the cost of products (works, services). In accounting, accrued wages and additional payments are reflected in the entries: D-t 20, 23, 25, 26, 29, 44 (analytical accounts “Costs taken into account when taxing profits”) - Kt 70. Costs of production and sales taken into account when taxing profits include costs for social needs. Costs for social needs include mandatory contributions according to the norms established by law to the Federal Social Security Fund (clause 4-1, article 3 of Law No. 1330-XII). Other costs taken into account when taxing profits include insurance premiums for types of compulsory insurance (subclause 4-2.43, clause 4-2, article 3 of Law No. 1330-XII). Therefore, contributions to the Social Security Fund and contributions for compulsory insurance against industrial accidents and occupational diseases, calculated on the amounts of payments accrued to employees during the downtime period, are included in the cost price and in the costs taken into account when taxing profits. Accrued contributions to the Social Security Fund and mandatory insurance contributions are reflected in accounting records: D-t 20, 23, 25, 26, 29, 44 (analytical accounts “Costs taken into account when taxing profits”) - K-t 69 - for the amount of deductions in FSZN accrued on the amount of payment for downtime; Dt 20, 23, 25, 26, 29, 44 (analytical accounts “Costs taken into account when taxing profits”) - Kt 76 - for the amount of contributions for compulsory insurance against industrial accidents and occupational diseases accrued in the amount payment for downtime.

I want to draw the moderator's attention to this message because:Notification is being sent...

You need to have fun, because your future is covered in darkness - maybe it will be a thousand times worse than your present, which seems bad to you...| Zoya [email hidden] Belarus, Gomel Wrote 125 messages Write a private message Reputation: | #24[336684] May 27, 2011, 12:36 |

Notification is being sent...

| oks_li [email hidden] Belarus, Minsk Wrote 2513 messages Write a private message Reputation: 374 | #25[337113] May 27, 2011, 16:34 |

Notification is being sent...

| LO-LA [email protected] Belarus Gomel Wrote 1243 messages Write a private message Reputation: 140 | #26[338244] May 31, 2011, 9:02 |

oks_li wrote:

Zoya wrote:

conditionally permanent, accounted for 26.25 accounts are written off regardless of revenue. Tell me where I can read this, in what document?

Instructions for using the Standard Chart of Accounts No. 89

LO-LA wrote:

DTM wrote:

White and Fluffy wrote:

All this should be spelled out in the accounting policy...

everything is correct! You must determine your own option. just keep in mind that expenses incurred at the beginning of the year, and not written off from account 97 at the end of the year, are not transferred to the new year, but are written off as losses. But what if there was no activity in 2010, but there were expenses, so you still have to deduct the loss? it’s still a loss. Why can’t it be written off at 97. and then written off for 2011? If possible, please provide a link to the document. The tax office said that only on 97.

I want to draw the moderator's attention to this message because:Notification is being sent...

| Erika [email protected] Belarus, Brest Wrote 611 messages Write a private message Reputation: | #27[338533] May 31, 2011, 11:46 |

Notification is being sent...

| oks_li [email hidden] Belarus, Minsk Wrote 2513 messages Write a private message Reputation: 374 | #28[338961] May 31, 2011, 15:19 |

LO-LA wrote:

oks_li wrote:

Zoya wrote:

conditionally permanent, accounted for 26.25 accounts are written off regardless of revenue. Tell me where I can read this, in what document?

Instructions for using the Standard Chart of Accounts No. 89

LO-LA wrote:

DTM wrote:

White and Fluffy wrote:

All this should be spelled out in the accounting policy...

everything is correct! You must determine your own option. just keep in mind that expenses incurred at the beginning of the year, and not written off from account 97 at the end of the year, are not transferred to the new year, but are written off as losses. But what if there was no activity in 2010, but there were expenses, so you still have to deduct the loss? it’s still a loss. Why can’t it be written off at 97. and then written off for 2011? If possible, please provide a link to the document. The tax office said that only at 97. Because only expenses BEFORE the start of an activity are taken into account at 97 or, for example, you are mastering a new type of activity.

Erika wrote:

please, tell me... is it possible, having non-operating income, to write off account 97... if the activity has not yet started!!!! Thank you

Quote:

no earlier than from the date of commencement of the organization’s activities, operation of production facilities, workshops and units;

Where does non-operating income come from? Can we say that you started this activity?

I want to draw the moderator's attention to this message because:Notification is being sent...

| Katyusha [email hidden] Belarus, Minsk Wrote 98 messages Write a private message Reputation: | #29[338979] May 31, 2011, 15:30 |

Notification is being sent...

| oks_li [email hidden] Belarus, Minsk Wrote 2513 messages Write a private message Reputation: 374 | #30[338999] May 31, 2011, 15:42 |

Notification is being sent...

« First ← Prev. 3 Next → Last (4) »

In order to reply to this topic, you must log in or register.