Only citizens of the Russian Federation who pay personal income tax (NDFL) at a rate of 13% can claim a tax deduction. To receive a deduction, you need to submit a declaration in form 3-NDFL. This can be done in several ways.

1. In your Personal Account on the tax website.

2. Through the “Declaration” program. You need to download and install it on your computer. Instructions for installing the program are also available on the tax website, and instructions for filling out are even available in video format.

3. On paper. The form with the declaration form can be downloaded from the tax website and filled out by hand in capital block letters. Examples of filling out are also available on the website. The completed declaration must be brought to the Federal Tax Service office at your place of residence or stay or to the MFC. But keep in mind that from March 30 to April 30, 2021, all branches of the Federal Tax Service will be closed.

We will analyze in detail the first method: filing a declaration through your Personal Account on the Federal Tax Service website.

Read on topic: Instructions: what is a tax deduction and how to get it

Practice

In reality the situation is different. The deadline for paying a tax deduction after filing an application is legally equal to 1 month. But in reality, tax authorities usually extend this period. How exactly?

By organizing document verification. It is called cameral. The government agency has only 3 months to carry it out. And nothing more.

Accordingly, after the end of such a period, the taxpayer must either be refused a refund or have it transferred to the specified details. The exception is cases where a desk audit was carried out without a written application for a deduction. In this case, you will not be able to claim a refund.

What will be the deadline for paying the tax deduction after submitting an application for this operation along with documents and a declaration? When organizing a desk audit, funds must be reimbursed no later than the end of the audit or before the moment when this operation should have been completed.

It follows that the deadline for paying tax deductions is increased by 2 months. In case of a desk audit, funds are reimbursed within 3 months.

To receive a deduction, it is not necessary to fill out a declaration and submit supporting documents.

Currently, in order to receive a deduction for the costs of purchasing housing and repaying mortgage interest, you must submit a declaration in Form 3-NDFL and supporting documents to the tax office.

Naturally, this process is difficult and time-consuming.

It takes a long time to fill out a declaration, especially for those taxpayers who are far from following the rules for completing it. This forces many citizens to turn to specialists who prepare the necessary documents for a monetary reward of 500 rubles or more.

In addition, not everyone likes to visit the tax office and waste their time on bureaucratic procedures.

With the adoption of the law, the procedure for obtaining a tax deduction will be significantly simplified.

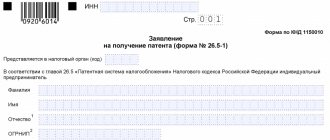

There is no need to fill out a declaration in Form 3-NDFL and submit supporting documents to the tax office. It will be enough to send an application for a tax deduction through the taxpayer’s personal account, and the tax office itself will collect the necessary information and transfer the amount of overpaid taxes in connection with the provision of the deduction to the account specified in the application.

At the same time, the simplified procedure does not deprive the taxpayer of the right to receive a deduction in the general manner. That is, everyone decides for themselves whether to use the simplified procedure or fill out a declaration and contact the tax office in person.

Is it necessary to submit a 3-NDFL declaration and at the same time an application for a refund?

The taxpayer does not have to submit an application for a tax refund along with the 3-NDFL declaration. This can be done later. After all, the declaration will still be cameralized first. And this takes up to 3 months. You can submit your application within these 3 months or upon completion of the review.

See “The Ministry of Finance explained how long to wait for a tax refund under 3-NDFL” .

The application must be accompanied by documents on the right to deduction, on a change of residence and other supporting documents.

What documents are needed for a tax deduction for an apartment?

To receive a tax deduction for the purchase of an apartment, you need to provide the following to the local branch of the Federal Tax Service:

- applicant's passport;

- income certificate 2-NDFL;

- equity participation agreement or purchase and sale agreement;

- completed declaration in form 3-NDFL;

- copies of payment documents (for example, bank statements, receipts, receipts);

- a copy of an extract from the Unified State Register or a transfer acceptance certificate, if the housing was purchased under an equity participation agreement;

- application for a tax deduction indicating the details of the bank account to which the money will be transferred.

If the apartment was purchased with a mortgage , along with the main list of documents you need to provide:

- bank agreement on the issuance of a mortgage loan;

- certificate of interest paid for the year.

If the apartment was purchased as joint property by spouses :

- a copy of the marriage certificate;

- statement on distribution of shares.

To receive a tax deduction for children, in addition to the main list, a copy of the birth certificate is submitted.

Without application

The deadline for paying the tax deduction after submitting an application with documents and a declaration is already clear. It is 1 month. And nothing more. But this does not mean at all that the citizen will quickly transfer the money due to the specified details. Russian legislation in this area has many peculiarities.

For example, it is worth paying attention to the fact that the Federal Tax Service will begin counting down the due month only from the moment it receives a written application from the taxpayer. While this paper is not available, there is no need to wait the allotted time for a refund. The tax authorities can delay this moment indefinitely.

You can put it this way: no application - no money. The deadline for paying the tax deduction after filing a return without an application has not been established. They simply don't have a place.

Procedure for returning a tax deduction

Let us remind you that in order to return 13% of the purchased property, you need to collect documents, fill out 3-NDFL and submit the finished package to the tax authority.

To receive a deduction for an apartment, prepare the following documents:

- certificate from work 2-NDFL;

- agreement for purchase or participation in shared construction;

- deed of transfer;

- certificate or extract of ownership;

- payment documents;

- loan agreement if there is a mortgage;

- application with bank details and personal account.

Based on the documents, the 3-NDFL declaration is filled out. You can compile it in two ways: on tax office forms or in a special Declaration program. With documents and a completed declaration, the taxpayer goes to the Federal Tax Service for registration and hands over the package.

According to the law, you will have to wait three months for a desk audit. If the declaration is drawn up correctly, there will be a receipt in the fourth month. But it happens that after a full four months the money is not transferred.

When and where to apply for an income tax refund

A taxpayer writes an application for an income tax refund if during the tax period he has the right to a deduction - property or social, and he wants to receive a deduction through the inspectorate.

For information on how to return personal income tax for treatment and education, read the materials “Procedure for the return of personal income tax (personal income tax) for treatment” and “Procedure for the return of personal income tax (personal income tax) for education” .

An application is also submitted if the taxpayer’s residence status has changed (he was a non-resident - he became a resident) and there is a need to recalculate personal income tax.

In addition, there are cases when a tax agent unnecessarily withholds and transfers the taxpayer’s personal income tax to the budget, and then ceases to exist. The error is identified, but it is no longer possible to return the tax through an agent. In this case, the taxpayer also needs to write an application for a personal income tax refund.

See “You cannot send an employee to the inspectorate for a personal income tax refund .

A taxpayer should apply for a refund of income tax to the tax authority at his place of residence. When changing the residence status, an individual must contact the tax office with which he was registered at the place of his residence or stay (clause 1.1 of Article 231 of the Tax Code of the Russian Federation).

In all other cases, personal income tax must be returned through the employer. ConsultantPlus experts explained step by step how to do this. Get free access to the system and see what steps you need to take to get your tax refund at work.

How long should I wait for a tax deduction?

The main amount of time that a citizen is forced to wait for a decision from the tax authority regarding the registration of benefits is spent on:

- verification and review of documents by the tax service;

- decision of a special commission to provide a refund or refuse to issue funds.

If the decision is positive, a certain amount of time will be spent on transferring funds to the taxpayer’s personal account. Some time may be spent sending documents if necessary.

For purchasing an apartment

When figuring out how long to wait for a refund of a tax deduction for the purchase of an apartment, a person should know that the tax authorities take approximately 2 to 4 months to consider the application. The exact timing depends on the individual nuances of the current situation.

With a mortgage

If a citizen is interested in how long to wait for a tax deduction when using mortgage lending funds, he should know that in this case he can qualify to receive money from the interest overpaid on the loan. The period for providing benefits will be standard.

After submitting documents

After 3 months from the day the citizen submitted the documents, a desk audit must take place at the tax service, after which the person will be officially notified of the decision made on his issue.

If the tax service delays the inspection and decision-making for a longer period, the citizen has the right to file a complaint with the appropriate authorities.

After desk check

Within a month after the inspection, funds must be transferred to the account whose details were indicated by the citizen in the application, if the answer is positive. Otherwise it is considered a violation.

Procedure and deadlines for refunding personal income tax

Currently, an increasing number of citizens are incurring expenses related to the purchase of housing, treatment, and education. These persons have the right to apply tax deductions for personal income tax (hereinafter - personal income tax). After submitting a tax return in Form 3-NDFL, the question arises: within what period will the tax amount on expenses incurred be returned? The establishment of the fact of excessive payment of personal income tax by a taxpayer is carried out by the tax authority during a desk tax audit of the personal income tax return, the period of which is three months from the date the taxpayer submits the tax return in Form 3-NDFL.

Information on the progress of the desk audit of the submitted tax return, including the date of its completion, is available on the website of the Federal Tax Service of Russia or the Federal Tax Service of Russia for the Tomsk Region in the electronic service “Taxpayer Personal Account for an Individual” in the “3-NDFL” tab.

The amount of overpaid tax is subject to refund (if the result of the desk audit is positive) upon a written application from the taxpayer within one month from the date the tax authority receives such an application.

Please note that the personal income tax refund period begins to be calculated from the day the refund application is submitted, but not earlier than from the completion of the desk tax audit.

The taxpayer submits an application for a refund of the overpayment after confirming the fact of overpayment of personal income tax, i.e. after completion of the desk tax audit.

The electronic service “Taxpayer’s Personal Account for an Individual” allows you to generate an application for a personal income tax refund if the tax authority makes a decision to provide a tax deduction. The application generated in the service is submitted by the taxpayer to the inspectorate in person or sent by registered mail.

The date of receipt of funds to the account specified by the taxpayer in the refund application can also be tracked in the specified service. When the processing status of the personal income tax refund decision is set to “Executed” and the “Execution Date” and “Execution Amount” columns are filled in, the tax refund will be issued.

If an individual is not a user of the electronic service “Taxpayer’s Personal Account for Individuals”, the application form for a refund of overpaid tax can be found on the website of the Federal Tax Service of Russia for the Tomsk Region in the section Individuals – Personal Income Tax – Tax Deductions.

Department of the Federal Tax Service of Russia for the Tomsk Region