Who has the right to ask for a tax refund?

To receive a social tax deduction for treatment and a personal income tax refund, the following conditions must be met:

- the citizen worked for a Russian employer in the past year and received income from which personal income tax was withheld;

- the citizen paid for medications prescribed by a doctor and (or) services from medical institutions included in the list according to government decree No. 201, provided to him and his family members (spouse, children, parents);

- The medical organization is registered in the Russian Federation and has a license to provide medical activities.

If such expenses are documented (you have an agreement with the medical institution, checks and receipts for payment for treatment and medications), an application for a deduction for treatment is attached to the 3-NDFL declaration.

Application for personal income tax refund for treatment

This can be done in two ways: Make a personal visit to the inspectorate; this method is the fastest and most reliable, because the tax officer will immediately check the correctness of filling out and, if there are errors or omissions, will tell you how to correct them. Using postal services is a longer method, because by time , which will be spent by the tax inspectorate on checking your documents, you should add the time for receiving and processing incoming correspondence, as well as the time spent in transit of a registered letter. All documents should be sent with a description of the attachment. Please note that this method should be used if you are confident that the documentation has been completed correctly.

- The amount of compensation cannot exceed 13% of the total amount spent on treatment, insurance or the purchase of medicines.

- The maximum payment amount cannot exceed 15 thousand 600 rubles, which is 13% of 120 thousand rubles. — the maximum amount established by Decree of the Government of the Russian Federation No. 201.

- The previous restriction does not apply to cases where the treatment was considered expensive - such services are reimbursed in full.

- The amount of income tax subject to refund cannot exceed the actual amount of personal income tax paid in total for the past year.

- If the amount of tax that is subject to reimbursement is greater than the total personal income tax paid for the year, then the balance cannot be carried forward to the next year.

- All documents are submitted to the tax service in the first quarter of the year following the reporting year.

When returning income tax for 2021, the completed lines will look like this: If you submit the application in person, in the last block of the title page “Accuracy and completeness of the information specified ... indicate “3”, your phone number, the current date and put a “living signature”. If the declaration is submitted for you by a representative under a power of attorney, enter the number “2”, his full name and the details of the power of attorney certified by a notary (series and number).

- Payment for treatment, medications and insurance is taken into account not only for yourself, but also for your family members: children under 18 years of age, spouses, parents.

- The medical services provided to you and the medications purchased must be included in the special Lists of medical services and medications for which tax deductions can be applied (Resolution of the Government of the Russian Federation of March 19, 2001 No. 201), and the hospital, clinic or other medical institution must have a valid license for medical activities.

- The VHI agreement under which premiums were paid cannot include services other than payment for treatment, and the insurance company that entered into the agreement must have the appropriate license.

- The deduction will be denied if your medical services were fully or partially paid for by your employer or other person. In particular, payment from financial assistance for treatment provided by the employer to the employee will not be accepted (clause 3, clause 1, article 219 of the Tax Code of the Russian Federation). Payment can only be made by the taxpayer himself in full.

- declaration 3-NDFL for each individual tax period;

- 2-NDFL certificate from each place of work, if you have several;

- original and certified photocopy of the passport of a citizen of the Russian Federation;

- TIN certificate (original and copy);

- an agreement with a medical institution (indicating the license) for the provision of treatment and rehabilitation services;

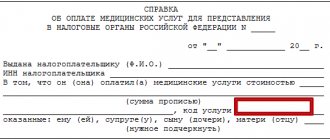

- certificate of payment for medical services provided in a special form approved by Order of the Ministry of Health and the Ministry of Taxes of the Russian Federation No. 289/BG-3–04/256 dated July 25, 2001;

- prescriptions from the attending physician, written out in form 107-U;

- checks and receipts confirming payment for medical services;

- checks for payment and corresponding receipts, sales receipts from pharmacy points confirming the purchase of medications prescribed in Form 107-U.

- the taxpayer received a certificate from a medical institution, which clearly states that without purchasing expensive medications (consumables), treatment was impossible;

- a certificate of payment for medical services provided to the tax service is indicated by code “2”;

- there is confirmation that the medical institution does not have the above medications (expensive), but their purchase at the expense of the patient or the person paying for the treatment is provided for in the contract;

- medications and consumables used during the treatment of a patient are included in the List of medications (services), reimbursement for which is provided for by law;

- the costs of treatment (purchase of drugs and consumables) were paid directly by the taxpayer himself, and the treatment was carried out in a medical institution licensed by the Russian Federation to provide such services.

Sample application for a refund of money for treatment to the tax office

How much will they return?

IMPORTANT!

It should be taken into account that not the entire amount of expenses is claimed for refund, but only 13% of this amount. This 13% does not exceed the amount of personal income tax withheld from the employee’s income and paid to the budget. The maximum amount for deduction in 2021 is RUB 120,000.

For example, income for the year amounted to 540,000 rubles. The amount of calculated and withheld personal income tax is RUB 70,200. Treatment expenses for the year amounted to 100,000 rubles. RUR 13,000 is due for refund. (100,000*13%). This amount is indicated in the application for a tax deduction for treatment, which is submitted to the tax office simultaneously with the 3-NDFL declaration or within 3 months after its submission.

3 months is the period established for a desk audit. If you apply for a refund for medical services during this period, the decision on the return or refusal of personal income tax refund is made within 10 days after the end of the inspection.

If expenses were 130,000 rubles, then reimbursement would be 15,600 rubles. (120,000*13%).

ConsultantPlus experts have discussed how to take advantage of the social tax deduction for treatment. Use these instructions for free.

Application for personal income tax refund for treatment - form, sample filling

Application for a personal income tax refund for treatment - form, sample filling... How to correctly fill out an application for a personal income tax refund for treatment? Which citizens can claim a personal income tax refund? And much more in our article…….

We all know and have all encountered the possibilities of treatment and the acquisition of medicines, and we also know how much it costs. The state gives us the opportunity to compensate, at least not the entire amount of money spent on treatment, but part of it. Having completed an application and submitted the necessary documents to the Federal Tax Service, it gives us the right to receive 13% of the amount spent on treatment.

You can also take advantage of a personal income tax refund for training and receive a property deduction for the purchase of housing. In this case, when you fill out the appropriate application and provide the necessary documents, you will receive 13% of the amount spent back.

Filling out the 3NDFL declaration program for treatment, instructions, step-by-step example - more details

What treatment expenses are eligible for reimbursement?

Any taxpayer has the right to write an application for a personal income tax refund for the following treatment costs:

- Dental treatment and prosthetics;

- Expenses for purchasing medicines. As for medicines, returns are subject only to those on the list approved by the government of the Russian Federation;

- Diagnostic and advisory activities;

- Sanatorium-resort treatment, with the exception of food and accommodation.

Approved by Decree of the Government of the Russian Federation No. 201 of March 19, 2001. a list of types of medical services and the purchase of medicines for treatment, etc., can be found here

The taxpayer has the right to fill out an application and 3NDFL declaration for his own funds spent on the treatment of his relatives:

- For services and medications for your own treatment;

- For services and medications for the treatment of a spouse, children under 18 years of age and parents;

You might be interested in:

2021 application form for refund of property tax deduction Free download

Download the 2021 declaration program, detailed instructions for filling out

Detailed filling out of the program declaration of income from the sold apartment - in detail

Download the new 3NDFL declaration form - free

Rules for filling out an application

When compiling, follow the following rules:

- If you are applying for a tax refund for the first time this year, enter the number 1 in the “Application Number” field.

- In the “Payer status” line, “1” is indicated.

- KBK for personal income tax 182 1 0100 110.

- The OKTMO code is taken from the 2-NDFL income certificate.

- The tax period is a year, so in the “Tax period code” field you should indicate “YY.00.2020” if you are returning tax for 2020.

- The amount to be refunded is equal to the value on page 050 of section 1 and page 160 of section 2 of the declaration.

- On page 2, where bank details are indicated, in the “Account type (code)” field, the value “02” is indicated if the funds are credited to a card, or a “Demand” account, or “07” if the funds are credited to a bank account.

- The account number is taken from the details for crediting salaries, which you will find in your online banking account. If you do not use such an application, contact the bank branch in person. Do not enter your bank card number in this field.

Instructions for filling out with example pages

The application consists of three pages , let's look at how to fill out each one correctly.

1 page

- You must provide your TIN .

Here you will see a line with checkpoint data. There is no need to fill it out, as it is intended for organizations. How to find out your TIN? If you do not have the appropriate paper on hand, you can do this on the website of the Federal Tax Service. In the request form you need to enter your data, including your passport number, date and place of issue, and if you have a tax identification number, it will appear in the result window. Example TIN: 459852236745. It must consist of 12 Arabic numerals. - Application number . You put the number “1” if this is your first application this year. If you have to submit a revised document, it should be numbered "2". If you are generating a deduction for several years, then the application is required for each year, and accordingly the numbering will be “3”, etc.

- Code of the tax office that will consider your case.

You can find it on the Federal Tax Service website; to do this you will need to enter your address. When filling out a document in the tax office, this data is determined automatically. - Full Name. Enter the data legibly: last name on the first line, first name on the second, middle name on the third. When completing a handwritten document, use block letters.

- Article of the Tax Code of the Russian Federation . In your case, this is Article 78 “Credit or refund of amounts of overpaid tax.”

- Next, you must indicate the reason for the overpayment . We put the code “1” because you paid more taxes than necessary.

- We indicate the payment code . For taxes it is "1".

- Here it is necessary indicate the amount of deduction, which you are applying for. The number should be oriented to the right. What amount should I indicate?

Example of deduction calculation:You spent 30 thousand rubles on treatment. You are entitled to a refund in the amount of 30*13%=30*0.13= 3.9 tr.

To find out if you can claim the full amount, you need to make the following calculations:

salary*12 months*13%.

This is how we will get the amount of personal income tax paid by you. If the salary is 20 tr. 20*12*0.13= 31.2.

Thus, you can claim 3.9 tr. fully.

- Taxable period.

- If you fill out the form in the tax office, simply select the year.

- If you have a printed form, enter the year this way: GD.00.2017 (if you want to receive a refund for 2021). "GD" in this code means that the period is measured in a year.

- OKTMO . It is issued automatically in the taxpayer's account. When entering manually, determine the code of your region on the Federal Tax Service website and enter it.

- Budget classification code. How to recognize him? This is the name of the tax. You need personal income tax. Enter "182 1 01 02010 01 1000 110".

- We set the number of pages of the document , the number of documents of which you are attaching copies.

- Next, confirm the accuracy of the data and provide your phone number. Put the date and signature.

2 page

- It is necessary to repeat the TIN , enter the last name and initials.

- Provide bank details. When you entered into a service agreement, you received this information. If they are lost, the safest way to get them is in your personal account at your bank. Or contact the department in person with your passport.

You need to specify:- full name of the bank;

correspondent account;

- BIC;

- taxpayer account number;

- recipient (full name);

- identity document details. And the code for a passport is “21”. For a military ID you need to indicate “07”, for a passport of a foreign citizen you need to indicate “10”.

Reference! When filling out the TIN and KPP on the Federal Tax Service website, it is not necessary to indicate.

Example:

North-West Bank OJSC "Sberbank of Russia" St. Petersburg account 30101810500000000653 BIC 044030653 r/account 40817810755031838030 Semenov Petr Mikhailovich Document code "21" 4503 123586, date of issue 07/23/2 000, Department of Internal Affairs of the Nevsky district of St. Petersburg.

You cannot indicate the details of your spouse or other relative . The account must be opened in your name.

We invite you to familiarize yourself with the features of obtaining a tax deduction for the treatment of a relative - a spouse and a child over 18 years of age.

3 page

- Write down your last name, first name, patronymic.

- Code of the document that proves your identity.

- Passport or other (for example, military identification) data.

- Address of residence (place of stay) indicating postal code and region code.

Sample

A sample application for a tax refund for treatment in the prescribed form is as follows:

Page 2:

Page 3:

What documents to attach to the application

Attached are copies:

- Agreements with medical institutions.

- Documents confirming payment for medications and medical services (receipts, cash register checks).

- Marriage (birth) certificates, if you paid for the treatment of your spouse or relatives.

Originals:

- Certificates of payment for medical services for submission to the Federal Tax Service, issued by the medical institution in the form approved. by joint order of the Ministry of Health and the Federal Tax Service No. 289/BG-3-04/256 dated July 25, 2001.

- Prescription forms with the stamp “For tax authorities” issued by the medical institution.

The procedure for obtaining a tax deduction through an employer

Let's consider in order all the steps to obtain a tax deduction through an employer:

1. Prepare a package of documents confirming the right to deduct.

The list of documents is for the most part similar to the list of documents for obtaining a deduction through the tax office. The full list is here: List of documents for tax deduction for treatment.

At the same time, it is worth highlighting several differences: - you do not need to fill out the 3-NDFL declaration; — no need to take a 2-NDFL certificate; — there will be a different application format. This will be an application for the issuance of a notice (with all the details of your employer).

2. Submit the prepared package of documents to the tax authority.

When the package of documents for the deduction has been collected, you can submit it to the tax office at the place of your permanent registration (in person, by mail or through your Personal Account on the Federal Tax Service website) to confirm the right to deduct. The tax authority, within 30 days after submitting the documents, must issue a Notification confirming the right to a tax deduction (paragraph 2, paragraph 2, article 219 of the Tax Code of the Russian Federation).

3. Provide documents to the employer.

As soon as you receive a Notification from the tax office confirming your right to a deduction, you need to write an application to your employer and, together with the Notification, submit it to your employer’s accounting department.

After this, all further calculations necessary for the deduction will be made by your employer. Starting from the month of submitting the notice to the employer, no income tax will be withheld from your salary, and you will receive a salary amount that is 13% more than usual. This will happen until you have completely exhausted the deduction amount.

Example: Sizov E.Sh. officially works and his salary is 30,000 rubles. Personal income tax is withheld monthly in the amount of 3,900 rubles. He receives 26,100 rubles in his hands.

Sizov E.Sh. paid 60,000 rubles for a paid operation in March 2021. He contacted the tax office at the place of registration with a full set of documents necessary to receive the deduction: - an application for the issuance of a notice confirming the right to the deduction; — supporting documents (agreement with a medical institution, a certificate of payment for treatment for the tax authority).

In May 2021, the tax inspectorate issued E.Sh. to Sizov. Notice confirming the right to deduction. He immediately handed over the Notification along with a written application for a deduction in the amount of 60,000 rubles to his employer.

In May and June 2021 Sizov E.Sh. received wages without deduction of 13% personal income tax. That is, he received 30,000 rubles in his hands, and not 26,100 rubles, as before. Since July 2020 Sizov E.Sh. again began to receive wages minus 13%, since he exhausted the deduction in the amount of 60 thousand rubles in 2 months.

Application method

The document is submitted in one of the following ways:

- Personally, by contacting the Federal Tax Service. In this case, the application is drawn up in two copies, one of which, with a mark from the tax authority, is returned to the taxpayer.

- By Russian Post in a valuable letter with a description of the contents. Keep your postal receipt.

- Online. To do this, you must wait for approval of the amount to be deducted stated in the declaration. When this amount appears in the taxpayer’s personal account on the Federal Tax Service website (section “My Taxes”), you should select the “Manage overpayment” item and fill out a form indicating bank details.