Failure to fulfill government orders.

In accordance with paragraph 6 of Art. 69.2 of the Budget Code of the Russian Federation, a state (municipal) task is unfulfilled in the event of failure to achieve (exceeding the permissible (possible) deviation) indicators characterizing the volume and quality of state (municipal) services provided (work performed).

Paragraph 46 of Regulation No. 640[1] provides for the following procedure for the return of subsidies in the event of failure to fulfill a state task:

- If, based on the report on the implementation of the state task, the volume indicators indicated in the report are less than the indicators established in the state task (taking into account permissible (possible) deviations), then the subsidy funds are subject to transfer to the budget in the amount corresponding to the unachieved indicators and are taken into account in the manner determined to account for the amount of receivables returned.

- Calculation of the volume of the subsidy to be returned to the budget is carried out using standard costs for the provision of public services (performance of work) in the form provided for in the agreement on the provision of the subsidy. An approximate format for this calculation is given in Appendix 2 to the Standard form of an agreement on the provision of a subsidy to a federal budgetary or autonomous institution for financial support for the implementation of a state task for the provision of public services (performance of work), approved by Order of the Ministry of Finance of the Russian Federation dated October 31, 2016 No. 198n.

- Federal budgetary or autonomous institutions ensure the return of subsidies to the federal budget in the amount of unachieved indicators no later than May 1 of the current financial year.

When calculating the amount of subsidy to be returned, the following must be taken into account:

- formulas for calculating the volume of subsidy balances formed due to failure to achieve state target indicators and subject to return to the budget are given in Letter of the Ministry of Finance of the Russian Federation dated 02/05/2016 No. 02‑01‑09/5870;

- the volume of the subsidy for the state task, subject to return to the budget, is determined on the basis of the values of the standard costs for the provision of public services (performance of work) and the unfulfilled volume of the state task for each state service (work). In addition, when calculating, one should take into account possible deviations in indicators within which the state task is considered completed (Letter of the Ministry of Finance of the Russian Federation dated April 11, 2016 No. 02-01-09/20628);

- if the actual volume of individual services provided (work performed) is higher than that provided for in the state assignment, then the excess amount is not taken into account when calculating the amount of the remaining subsidy to be returned to the budget (Letter of the Ministry of Finance of the Russian Federation dated April 12, 2016 No. 02‑01‑09/20629) .

In accounting, the return of subsidy balances is reflected in the following accounting entries (clauses 150, 158, 133 of Instruction No. 174[2], clauses 178, 180, 161 of Instruction No. 183n[3]):

| Contents of operation | Debit | Credit |

| Budgetary (autonomous) institutions have accrued debt to return to budget revenue the balances of subsidies for the state task, formed in connection with the failure to achieve the indicators established by the state task characterizing the volume of state (municipal) services (works), based on the report on the implementation of the state task | 4 401 40 131 | 4 303 05 731 |

| The debt to return the remaining subsidy has been repaid | 4 303 05 831 | 4 201 11 610 |

8

According to the state task approved for the State Budgetary Institution “Physical Culture and Recreation Complex”, the number of people involved should be 1,100 people (an indicator characterizing the volume of state work “Organization and conduct of sports and recreational work for the development of physical culture and sports among various groups of the population”) with taking into account a possible deviation of 10%. The approved amount of standard costs for performing such work is 337,700 rubles. (RUB 307 – cost per unit of work per person involved). The actual volume of work, according to the report on the implementation of the state task, amounted to 900 people.

For other public services (works) included in the state assignment, indicators characterizing the volume and quality of services (works) have been fully achieved. The return of funds to the budget is carried out at the expense of the total balance of the subsidy for the state task that arose at the end of the year and amounts to 50,000 rubles.

We will calculate the amount of the subsidy to be returned due to failure to achieve the indicators established in the state task.

To begin with, we will determine the possible deviation of the indicator for the work performed, within which the state task is considered completed. It is 110 people. (1,100 people x 10%). Taking into account possible deviations, the outstanding volume of government work is 90 people. (1 100 - 110 - 900).

Based on the standard costs for one person involved, the sports institution must return 27,630 rubles to the budget. (90 people x 307 rub./person).

| Contents of operation | Debit | Credit | Amount, rub. |

| Debt was accrued for the return of subsidies for government tasks due to failure to achieve established indicators | 4 401 40 131 | 4 303 05 731 | 27 630 |

| The debt was repaid using the total balance of the subsidy for the government task | 4 303 05 831 | 4 201 11 610 Off-balance sheet account 18 (Article 610 KOSGU*) | 27 630 |

* The article is applied in accordance with clause 14.1 of Order No. 209n[4].

The difference between the total unused balance of the subsidy for the state task and the balance formed in connection with the failure to achieve the state task indicators in the amount of 22,370 rubles. (50,000 - 27,630) the institution has the right to use in the next year in accordance with the financial and economic activity plan.

Gvmp

1.1.8 letters of the Ministry of Finance of Russia and the Federal Treasury dated 02/02/2017 NN 02-07-07/5669, 07-04-05/02-120).

Account 210 02 is intended for accounting by an institution performing the functions of an administrator of budget revenues of transactions on receipt of payments administered by it to the budget.

“Settlements with the financial authority for budget revenues”

(P.

227 of the Instruction approved by Order of the Ministry of Finance of Russia dated December 1, 2010 N 157n). The receipt of funds to the personal account of the income administrator is reflected in budget accounting in accordance with paragraph 15 of clause 86 of Instruction No. 162n. Based on the above, the situation under consideration is reflected in budget accounting with the following entries: 1.

Debit KDB 1,209 30,560 Credit KRB 1,206 23,660 - reflects the amount of financial claims for compensation of state costs in the amount of receivables accumulated by the local government as of the beginning of the current financial year as part of payments for electricity; 2.

What entries should be made in the accounting of a government institution to reflect an interbudgetary transfer.

Calculations for the return of the balance of the interbudgetary transfer received last year (based on the notification (f.

0504817), accounting certificate (f. 0504833)): Debit KDB.1.205.51.560 Credit KDB.1.205.51.660 2. The balance of the transfer to the budget that previously provided it was transferred (based on an extract from the personal account of the budget revenue administrator): Debit KDB .1.205.51.560 Credit KDB.1.210.02.151. Rationale How to take into account interbudgetary transfers How to reflect the receipt of a transfer In the accounting of the income administrator, reflect interbudgetary transfers on the basis of primary documents (clause.

7 Instructions No. 157n). For example, accrue subsidies and subventions on the basis of the notification received for settlements between budgets (f. 0504817) (clause 78 of Instruction No. 162n, Guidelines for notification (f. 0504817), approved by Order of the Ministry of Finance dated March 30, 2015 No. 52n).

The revenue administrator reflects the cash receipts of the transfer based on an extract from the personal account of the budget revenue administrator (f.

0531761)

Early termination of government assignments.

According to clause 41 of Regulation No. 640, in the event of early termination of the execution of a state task, the unused balances of the subsidy in the amount corresponding to the indicators characterizing the volume of unprovided public services (uncompleted work) are subject to transfer in the prescribed manner by budgetary or autonomous institutions to the budget and are taken into account in the manner prescribed for accounting for receivables returns.

The grounds for early termination of the execution of a state task are reflected in the state task itself (Clause 1, Article 69.2 of the Budget Code of the Russian Federation). These include:

- liquidation of the institution;

- adoption, in accordance with the established procedure, of a decision on the reorganization of an institution, as a result of which the institution ceases to operate as a legal entity;

- redistribution of powers, resulting in the exclusion from the competence of the institution of the authority to provide public services (carry out public work);

- changes in current regulatory legal acts, as a result of which the further implementation of the state task will contradict these acts;

- the occurrence (detection) during the implementation of a state task of circumstances that do not allow it to be completed for reasons beyond the control of the institution;

- poor quality performance of a government task or violation of the terms of such task;

- other cases provided for by the legislation of the Russian Federation.

In our opinion, in accounting, operations to return unused subsidy funds to the budget are reflected in the same way as the return of a subsidy in case of failure to fulfill a government task.

3

In the event of early termination of the execution of a state task in connection with the reorganization of a budgetary or autonomous institution, the unused balances of the subsidy are subject to transfer to the relevant budgetary and autonomous institutions that are legal successors (clause 41 of Regulation No. 640).

Examples of basic postings in a government institution

At the same time, reduce the off-balance sheet account 02. In accounting, reflect the costs of purchasing intangible assets under article KOSGU 320, and non-produced assets - under article KOSGU 310.

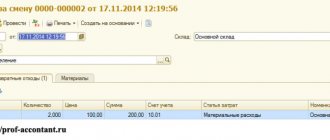

To reflect the debt for supplies, use the following entries: Dt 1 106 32 320 Dt 1 302 32 73Х - intangible assets; Dt 1,106 13,330 Kt 1,302 33 73Х - non-produced assets. Payments to suppliers from a personal account in the Federal Treasury, show by posting: Dt 1 302 32 83Х Kt 1 304 05 320 – for intangible assets; Dt 1 302 33 83Х Kt 1 304 05 330 – for non-produced assets I will show you with an example how to capitalize inventories on the balance sheet, how to put them into operation and write them off.

Example. A government agency purchased stationery worth 50,000 rubles. The accountant made the accounting entries.

DT 1 106 34 346 Kt 1 302 34 734 - 50 thousand rubles, edging goods arrived; Dt 1 105 36 346 Kt 1 106 34 346 - 50 thousand rubles, stationery accepted for accounting; Dt 1 302 34 834 Kt 1 304 05 346 - 50 thousand.

Necessary entries when returning subsidies from previous years to the regional budget

In this situation, it is most correct to identify the guilty person responsible for the intended use of budget funds (manager, chief accountant) and accrue debt on account 209 30.

and give the details of the local budget revenue administrator where to transfer the debt. You can check with the founder whether he will allocate additional funds to transfer the amount of misuse of budget funds.

In such a situation, the postings will be a reflection of other expenses of the government institution.

Justification How can the financial authority reflect in budget accounting and the Report (f. 0503324) the collection of interbudgetary transfers from the regional (local) budget into the federal budget. The auditors identified the misuse of transfers. The financial authority, as the revenue administrator, records transactions as a return of transfer balances.

The financial authority includes the amount of recovery in the Report on the use of interbudgetary transfers from the federal budget (f.

0503324). The territorial body of the Treasury of Russia collects the provided interbudgetary transfers if the financial authority, State Budgetary Service of the corresponding budget or the recipient of the funds: spent the money for other purposes; the balance was not returned on time; violated other conditions for spending transfers. The Treasury collects money from the account unconditionally.

To do this, a TOFK employee fills out a Refund Application (f.

0531803). Grounds: an order from the Russian Ministry of Finance or other regulatory agencies for collection, a notification of a decision to apply budget coercive measures. This is stated in paragraph 5 of Article 242, paragraph 3 of Article 306.4, Article 306.8 of the Budget Code of the Russian Federation, paragraphs 5, 6 of Appendix No. 1, paragraph 4 of Appendix No. 2 to Order of the Ministry of Finance of Russia dated June 11, 2009 No. 51n, paragraphs 3, 7 of the Procedure , approved by order of the Ministry of Finance of Russia dated August 11, 2014 No. 74n.

After you receive the documents on the collection of funds from the account, make the following entries in your accounting: No. Contents of the transaction Account debit Account credit 1. The amounts of the unused balance of the interbudgetary transfer of previous years restored in the current year have been accepted (based on a copy of the order of the Ministry of Finance of Russia on collection, notice of collection ) KDB.1.401.10.151 KDB.1.205.51.660 2. Calculations for the return to the federal budget of the balance of the interbudgetary transfer received last year are reflected (based on an accounting certificate (f.

0504833)) KDB.1.205.51.560 KDB.1.205.51.660 3.

The balance of the transfer to the federal budget was collected (based on an extract from the personal account of the budget revenue administrator) KDB.1.205.51.560 KDB.1.210.02.151 Such rules are established in paragraphs 78, 120 of Instruction No. 162n and confirmed in letters of the Ministry of Finance of Russia dated February 22, 2021 No. 02 -06-10/18528, No. 02-06-10/10520.

The financial authority reflects the collected amount in section 1 of the Report on the use of interbudgetary transfers (f.

0503324): in column 9 – the restored amount of the balance of the interbudgetary transfer of previous years; in column 10 – the amount of funds returned to the federal budget.

This is stated in letters of the Ministry of Finance of Russia dated February 22, 2021 No. 02-06-10/18528, No. 02-06-10/10520.

We recommend reading: Is it possible to get a foreign passport in less than a month in St. Petersburg

The need for balances has not been confirmed.

By virtue of clause 9 of Procedure No. 59[5], the balances of the targeted subsidy provided to budgetary (autonomous) institutions of the Ministry of Sports that are not used in the current financial year are subject to transfer to the federal budget in accordance with Procedure No. 82n[6]. At the same time, such balances can be spent by the institution in the next financial year for the same purposes when the Ministry of Sports makes a decision on the need for the remainder of the targeted subsidy, agreed with the Ministry of Finance.

According to Procedure No. 82n, unused balances of targeted subsidies, in respect of which the bodies exercising the functions and powers of the founder have not decided on the need to direct them for the same purposes in the current financial year, are subject to collection.

In order to confirm the need for the balances of the targeted subsidy, the budgetary (autonomous) institution, no later than May 20 of the current financial year, submits to the territorial body of the Federal Treasury (OFC), in which it has opened a separate personal account for accounting for transactions with targeted subsidies, information approved by the founder on transactions with targeted subsidies for 20__ (f. 0501016) indicating the balance of targeted funds allowed for use.

If the institution does not provide the above information before the specified date, the territorial OFK, no later than the tenth working day after June 1 of the current financial year, collects the balance of targeted subsidies by transferring them to an account opened on balance sheet account 40101 “Income distributed by Federal Treasury bodies between budgets of the budget system of the Russian Federation”, for subsequent transfer of balances to the federal budget revenue.

Taking into account the above procedure for collecting the balances of targeted subsidies to an institution that has not confirmed the need for them, it is advisable to transfer such balances to the budget and not wait for the funds to be written off forcibly.

Let's look at the procedure for reflecting the return of a targeted subsidy using an example.

9

The Olympic Reserve School (budgetary institution), on the basis of an agreement concluded with the founder, has been provided with a targeted subsidy from the budget this year for the payment of scholarships in the amount of 500,000 rubles. Based on the report, the amount of confirmed expenses due to the targeted subsidy amounted to 483,000 rubles. Unused balance of the subsidy in the amount of RUB 17,000. the institution returned:

- at the end of the current year;

- early next year.

In accounting, these transactions are reflected as follows:

| Contents of operation | Debit | Credit | Amount, rub. |

| Income accrued in the form of a targeted subsidy based on the concluded agreement | 5 205 52 561 | 5 401 40 152 | 500 000 |

| A targeted subsidy has been received to a separate personal account | 5 201 11 510 | 5 205 52 661 | 500 000 |

| Off-balance sheet account 17 (subarticle 152 of KOSGU) | |||

| Accrued expenses for payment of scholarships | 5 401 20 296 | 5 302 96 737 | 483 000 |

| Scholarships have been transferred to bank cards of college students | 5 302 96 837 | 5 201 11 610 | 483 000 |

| Off-balance sheet account 18 (subarticle 296 of KOSGU) | |||

| The income of the current financial year for the provided subsidy has been accrued in accordance with the report on the expenditure of targeted funds | 5 401 40 152 | 5 401 10 152 | 483 000 |

| Return of the subsidy to the budget at the end of the current year | |||

| Debt has been accrued to return the balance of unspent subsidy funds to budget revenues | 5 401 40 152 | 5 205 52 661 | 17 000 |

| Unused balances of the targeted subsidy were returned | 5 205 52 561 | 5 201 11 610 Off-balance sheet account 17 (subarticle 152 of KOSGU) | 17 000 |

| Return of the subsidy to the budget early next year | |||

| Debt has been accrued to return the balance of unspent subsidy funds to budget revenues | 5 401 40 152 | 5 303 05 731 | 17 000 |

| Unused balances of the targeted subsidy were returned | 5 303 05 831 | 5 201 11 610 Off-balance sheet account 18 (Article 610 KOSGU) | 17 000 |

When the need for the remaining subsidy is confirmed, the transferred funds are transferred to the institution’s account or the debt to the budget is written off (if the funds were not transferred to the budget). In accounting, these transactions will be reflected in the following entries:

| Contents of operation | Debit | Credit |

| Subsidy funds were returned to the budget until a decision was made to confirm the need for their use | ||

| Unused subsidy funds were credited to the institution’s personal account | 5 201 11 510 Off-balance sheet account 17 (Article 510 KOSGU) | 5 205 52 661 5 205 62 661 |

| Subsidy funds were not transferred to the budget until a decision was made to confirm the need for their use | ||

| The debt to return the remainder of the subsidy to the budget has been written off | 5 303 05 831 | 5 205 52 661 5 205 62 661 |

Login for clients

For example, in the standard form of agreement established by Decree of the Government of the Moscow Region dated October 18, 2016 No. 758/38[1], there is no reference to the fact that in the agreement with a subordinate institution it is necessary to indicate a specific date for the return of balances. But in the standard form approved for federal AUs and BUs by Order of the Ministry of Finance of the Russian Federation dated October 31, 2016 No. 198n[2], there is an indication of the need to indicate the date, month and year following the year of provision of the subsidy as the return period. However, the founding bodies, as a rule, cannot arbitrarily choose the date before which the subordinate institutions must make the return. The founders are guided by the deadlines established in “superior” acts adopted at the federal, regional or municipal level.

In particular, a specific period can be determined in the budget law, a legal act containing measures to implement the law

The procedure for accounting in the GRBS operations for the accrual, receipt and transfer to budget revenue of amounts of receivables from the previous year

This procedure is established by paragraphs 80, 111, 102 of Instruction No. 162n, Instruction to the Unified Chart of Accounts No. 157n (accounts 205.00, 206.00, 302.00, 304.05, 401.20).

Accounting for the return of unused balances of targeted subsidies depends on the year in which the institution returns them - the current or the next. If unused balances were received in the current year, make an accounting entry: Debit KRB.1.304.05.241 Credit KRB.1.206.41.660 – reflects the return of targeted subsidies provided in the current year (as a restoration of cash expenses). If unused balances are received next year, make the following entries in accounting: Debit KDB.1.205.81.560 Credit KRB.1.206.41.660 – transformation of the unused balance of the targeted subsidy from previous years (based on the annual report on its use and the founder’s decision to return the balance); Debit KDB.1.210.02.180 Credit KDB.1.205.81.660 – reflects the return of the targeted subsidy to budget revenue.

Violations in the use of subsidies have been identified.

Violations are identified based on the results of subsequent state (municipal) financial control. The main violation, as a rule, is the misuse of subsidies.

Targeted subsidies must be used in strict accordance with the purposes of their provision outlined in the relevant agreements. Control over the use of targeted subsidies can be exercised by the founders, as well as by state (municipal) financial control bodies, which include:

- The Accounts Chamber of the Russian Federation, control and accounting bodies of the constituent entities of the Russian Federation and municipalities - bodies of external state (municipal) financial control;

- The Federal Treasury, bodies of state (municipal) financial control, which are respectively bodies (officials) of the executive power of constituent entities of the Russian Federation, local administrations, are bodies of internal state (municipal) financial control.

In addition, for the misuse of subsidy funds (that is, the direction of funds received from the budget of the budgetary system of the Russian Federation for purposes that do not correspond to the goals defined by the agreement), a budgetary (autonomous) institution may be brought to administrative liability under Art. 15.14 Code of Administrative Offenses of the Russian Federation (Letter of the Federal Treasury dated August 10, 2017 No. 07‑04‑05/09-665).

In the accounting of a budgetary (autonomous) institution, operations to return targeted subsidy funds to the budget in the event of violations being detected based on the results of control activities will be reflected in the following accounting entries (clauses 152, 93 of Instruction No. 174n, clauses 180, 96 of Instruction No. 183n):

| Contents of operation | Debit | Credit |

| The institution's debt has been accrued to return to budget revenue the balances of unused subsidies for other purposes in the event that, based on the results of subsequent state (municipal) financial control, violations of the procedure for using these subsidies are identified | 5 401 10 152 (162) 5 401 10 152 (162) | 5 303 05 731 |

| The debt to return the remaining subsidy has been repaid | 5 303 05 831 | 5 201 11 610 |

Return of remaining subsidies from previous years

Depending on the purpose of spending the funds, the return of funds to the budget or another source is reflected in different ways:

| By capital expenditure |

|

| For current expenses |

|

Reflection in accounting of subsidies from the local budget for LLCs on the simplified tax system (income)

Hello, dear forum users!

At the end of 2011, our organization received subsidies for partial compensation of expenses under the target program “Development of SMEs” from the local budget. LLC on the simplified tax system (income). We maintain accounting records and submit accounting reports to the tax office, because in 2 sq. 2011 was a type of activity falling under UTII. Documents confirming the costs incurred are provided to the commission before concluding subsidy agreements. Subsidy agreements were concluded in November 2011: 1 Agreement - subsidy for partial compensation of expenses for renting premises in 2011 - RUB 10,000.00. 2 Agreement - subsidy for partial compensation of expenses for participation in exhibitions in 2011 - 40,000.00 rubles.

According to the subsidy agreement, the subsidy recipient must fulfill the following conditions in 2011: 1. Create 2 new jobs. 2. Average salary is not less than XXXXXXX rub. 3. Revenue—RUB XXXXXXX. In case of failure to comply with these conditions, the Subsidy must be returned without dispute upon the written request of the district administration in May 2012.

Subsidies were received on account in December 2011.

1. How to reflect subsidies in accounting? How to reflect subsidies in financial statements (balance sheet, profit and loss statements, for 2011?

Reflection of subsidies to compensate for expenses that have already been incurred by the time the subsidy is received (recognized as expenses in accounting):

D 76 K 91.01 - 10,000.00 1 Agreement D 76 K 91.01 - 40,000.00 2 Agreement The subsidy was accrued in November 2011.

D 51 K 76 - 10,000.00 1 Agreement D 51 K 76 - 40,000.00 2 Agreement Subsidy received in December 2011

2. Questions were deleted by the moderator. Please ask these questions EVERYONE in a NEW topic.

Thanks in advance for your answers.

Quote (Katerino4ka): 2. In the event of a return due to non-fulfillment of the terms of the contract, what postings should be made?

I can’t figure out whether the subsidy is subject to the simplified tax system of 6% and if it is, then what to do with the moment of returning the subsidy if the terms of the contract are not fulfilled. I apologize to the moderators, because... I understand that this question relates more to the taxation section, but it has an investigative connection with this task.

Good afternoon. According to the forum rules, one question is asked per topic. Each new question must be asked in a new topic. Therefore, the first question remains in this topic, and the rest (I have highlighted them in blue) please ask EVERYONE in a NEW topic.

Good afternoon The subsidy always has a specific purpose. It follows that the postings should “spin” around account 86 “Targeted financing”: Dt 51 - Kt 76 Dt 76 - Kt 86 Dt 86 - Kt 98

These postings immediately after receiving the subsidy.

Moreover, Dt 76 - Kt 86 may be earlier, the first posting - on the date of the decision on the subsidy (conclusion of subsidy agreements, i.e. November 2011). Accounting in account 86 is carried out regarding the types of financing. Therefore, you may need to create two sub-accounts - for each contract. Further postings completely depend on the date of expenses due to the subsidy: - on the date of payment of rent: Dt 60 - Kt 51

- 10000

Dt 91 - Kt 60

- 10000

Dt 86 - Kt 91

- 10000 - exactly the same postings on the date of expenses for the exhibition , only the amounts will be different - actually paid for the exhibition.

If expenses were incurred before the date of receipt of the subsidy, then the transactions are divided by date: - by date of expenditure: Dt 60 - Kt 51 Dt 91 - Kt 60

- by date of receipt of the subsidy:

Dt 86 - Kt 91

If part of the expenses was incurred before receiving the subsidy, and some later, then the postings Dt 86 - Kt 91

there will be several: - at the time of receiving the subsidy - for the amount of expenses already incurred - later - for each date and amount of expenses incurred.

If some of the expenses (or all) were made before 09/30/11, then I advise you to first collect them in account 97 “Future expenses”. Then the second wiring ( Dt 91 - Kt 60

) will be divided into two: -

Dt 97 - Kt 60

- according to the date of expenses -

Dt 91 - Kt 97

- according to the date of receipt of the subsidy.

These are accounting entries.

As for accounting for subsidies in income for tax purposes (STS “income”), I advise you, in accordance with the forum rules, to open a new topic. However, before doing this, I strongly recommend searching the forum - we have discussed this topic more than once.

Accountant's Directory

No. 150n (recognized as not requiring state registration by letter of the Ministry of Justice of the Russian Federation dated January 26, 2010 No. 01/844-AF); compliance of the content of the transaction for payment of monetary obligations for the supply of goods, performance of work, provision of services, rent, based on the basis document, with the KOSGU code and the content of the text of the purpose of payment specified in the Application for cash expenses; not exceeding the amount specified in the Application over the amount of the remaining expenses for the corresponding KOSGU code and the corresponding subsidy code recorded on the personal account for other subsidies; compliance of the information specified in the Application with the Information.

Despite the fact that payment documents undergo the above control, sometimes situations arise when, after making a cash payment, it is necessary to clarify the code of the payment made. The reasons for these clarifications may be not only errors in specifying the payment code, but also internal orders and regulations of the institution, when, for example, when accepting a commission for accounting, a non-financial asset may be recognized as a fixed asset, and not as an inventory.

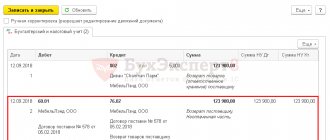

Return of accounts receivable: features of accounting (Zernova I.)

Accounts receivable are the property claims of an institution against other persons who are its debtors.

In this article, we will look at how debt amounts should be reflected in the accounting records of institutions in connection with their repayment by the debtor. General provisions In the activities of institutions, situations may arise related to the failure to fulfill contractual obligations for the supply of non-financial assets by suppliers against a previously paid advance, the debt of accountable persons for amounts of money issued to them that were not returned on time, overpaid amounts of taxes, fees and penalties, etc.

In other words, in this case, accounts receivable appear in the institution’s accounting. With a change in the property status of debtors, they have the opportunity to repay their debts.

In addition, when debtors are declared bankrupt, the amount of debt can be transferred by the bankruptcy trustee to the accounts of institutions or to the budget.

What transactions should be used to record the return of funds to the Social Insurance Fund?

Reflect the return of the current year as a restoration of expenses for the corresponding CVR (letter of the Ministry of Finance of Russia dated December 23, 2021 No. 02-07-10/77985). The postings are as follows: D. 0.201.11.510 – K.

0.303.02.730, increase in off-balance sheet account 17 (analytics code - KVR, KOSGU code - 213) reimbursement was received from the Social Insurance Fund for the current year (as a restoration of cash expenses). D. 0.201.11.510 - K. 0.303.02.730, increase in off-balance sheet account 17 (analytics code - KVR, KOSGU code - 510) reimbursement was received from the Social Insurance Fund last year.

The current year's return is reflected in f.

0503737 section “Expenses” and f. 0503723 in the “Disposals” section with a minus sign, as a restoration of cash expense. Rationale 1.

Accounting and postings for the return of accounts receivable from previous years in a budgetary institution

Accounts receivable can also be formed through mutual settlements with the Social Insurance Fund.

Return of last year in the report f. 0503737 is reflected in lines 591 and 950 with detail by CWR in the corresponding columns of the report f. 0503737. In the report on f. 0503723 reflect the receipt from the Social Insurance Fund in the same way, that is, in section 3 on lines 421 and 501.

This situation can arise only in those regions of the Russian Federation that are not included in the number of participants in the pilot project. To reflect such an overpayment, use account 303 02 “Calculations for insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity.”

If there is a receivable on the balance sheet, check whether it is uncollectible or doubtful.

Its further accounting depends on this.