RKO: in Excel

You can also use RKO in excel. It contains the same columns as in the word document - choose the one that is convenient for you.

Get the form for free!

Register in the online document printing service MoySklad, where you can: completely free of charge:

- Download the form you are interested in in Excel or Word format

- Fill out and print the document online (this is very convenient)

RKO is issued in one copy. It is issued by the employee who issues the money, but the recipient also enters some information. How to fill out RKO - read on.

The cash disbursement order is filled in when you withdraw cash from the cash register:

- to the bank for crediting to the current account,

- on account - upon a written application from the recipient, in which he must indicate the amount and period for which he is taking cash,

- for personal use by an employee, for example, for travel expenses or as financial assistance,

- for the needs of the enterprise - in this case, you must indicate a specific purpose for issuing money, for example, for business expenses.

Procedure for processing transactions

| Cash issuance report |

|

| Delivery of cash proceeds to the bank |

|

| Issuing cash for salaries |

|

| Other issues |

|

All operations for issuing cash from the cash register are formalized using a debit order using a unified, optional for use from 01/01/2013, in accordance with Federal Law No. 402-FZ “On Accounting”, form No. KO-2. An expenditure order is issued with an entry made in the book on the day of the actual issuance of money.

An example of filling out a cash receipt order

Example of filling out RKO

RKO can be issued on paper or electronically. It's easy to fill out the form. Download a sample of filling out a cash flow order that is current in 2021 - you can simply replace the data with your own.

RKO

Get a RKO sample for free!

Register in the online document printing service MoySklad, where you can: completely free of charge:

- Download the form or sample you are interested in

- Fill out and print the document online (this is very convenient)

The amount you enter in the KO-2 form should not exceed 100 thousand rubles. Anything that exceeds this limit must be carried out by bank transfer.

Maintaining in electronic form

Reporting in most organizations operating in the Russian Federation is carried out in the form of specialized programs. One of the capabilities of such programs is maintaining documentation, in particular, cash registers, in electronic form.

Registration of the standard form RKO KO-2 is possible in programs such as 1C: Accounting, 1C: Enterprise, Bukhsoft online and their analogues.

Filling out cash registers electronically has many advantages, including:

- no errors in specifying the debit order number - the system automatically assigns the current serial number following the number of the last created document for the disbursement of funds;

- the ability to automatically create all invoices - the program sets them automatically according to the specified basis for the issuance of funds;

- the ability to adjust the specified data (grounds, amounts, full name of the recipient of funds). In this case, the document is simply corrected and printed;

- If paper media is lost, it is always possible to restore data;

Filling in 1C: Enterprise - the ability to automatically generate financial statements based on a database of posted receipts and expenses at the cash desk;

- If you omit any of the fields that must be filled in or if you indicate data that is erroneous (in accordance with the procedure for preparing accounting documentation), the system automatically does not allow the document to be processed.

This method of limitation allows you to avoid a large number of errors made when filling out the KO-2 form manually.

After the electronic form of the document is filled out, it is printed on paper and authorized employees sign. If there is a seal of the organization, they also affix it.

Registration of RKO

An expense cash order can be issued by:

- Chief Accountant,

- an accountant or employee (for example, a cashier) appointed by the manager,

- director (in the absence of a chief accountant and accountant).

RKO is always drawn up on the day the money is issued.

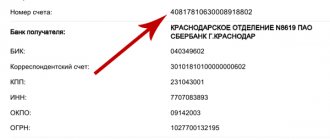

Start filling out the RKO by filling out:

- the full name of the company indicating the organizational and legal form,

- OKPO code,

- form numbers in accordance with internal document flow,

- dates of completion,

- code of the structural unit that issues money. If it is not there, put a dash,

- number of the subaccount in which cash is accounted for,

- analytical accounting code (if required),

- loan (i.e. account number that reflects the disbursement of funds),

- amounts in rubles (in numbers).

Next, the procedure for filling out the RKO is as follows:

- you need to enter the full name of the person you are giving the money to,

- indicate the basis for issuance, for example: salary, financial assistance, business trip expenses, etc.,

- indicate the amount in words,

- enter the name, date and number of the attached document on the basis of which you are issuing money. This could be a payroll, receipt, order, contract, etc.

The cash receipt order must contain the signatures of the director or authorized employee, as well as the accountant. They definitely need to be decrypted.

The next part is filled out by the employee who receives the money. He points out:

- The amount issued is in words, and kopecks are in numbers. The remaining blank part of the line must be filled with a dash.

- Date of receipt of money.

- Passport details.

Signatures are placed by the cashier who issued the money and the employee who received it. Without filling out this part, the RKO will be invalid. In this case, the money will be considered appropriated by the employee who issued it.

The cashier can draw up one cash register at the end of the working day for the entire amount issued during the day, but provided that there are fiscal documents of the online cash register - checks or BSO.

Corrections in the cash receipt order are not allowed.

To avoid mistakes, use the MySklad service - you can fill out online and print a cash receipt order in a few clicks.

Form and content

The KO-2 order form was approved by the State Statistics Committee of the Russian Federation in Resolution No. 88 of August 18, 1998. A detailed explanation of how to fill out a unified form significantly reduces the risk of errors. The regulation does not prohibit the use of electronic methods. The issuance of money from the cash register can be issued using a digital cash register, subject to the use of an electronic digital signature. There is no prohibition on drawing up orders manually.

The following are recognized as mandatory details:

- date, number;

- Name;

- information about the entrepreneur;

- basis for issuing money;

- amount, including in words;

- list of applications;

- signatures of the cashier, chief accountant, entrepreneur, as well as the person who received the cash.

The “Base” column must reflect the essence of the business transaction. The attachment will include orders for the issuance of funds, instructions, requirements, applications, endorsed by the head. Since the entrepreneur does not have any structural divisions, a dash is placed in the corresponding line. The positions “Debit” and “Credit” can be ignored, because individual entrepreneurs do not keep accounting records. When making transactions, the write-off account will be “Cashier” (50).

You should also remember the urgent nature of the document. It is necessary to issue money via cash settlement services within 24 hours. Correcting dates or extending orders is prohibited.

RKO: fill out online

You just need to enter the amount and basis of payment, select the expense item and recipient, and the system will automatically generate and number the document.

Fill out RKO online

Fill out the RKO online!

Register in the MoySklad online service - you will be able to: completely free of charge:

- Fill out and print the document online (this is very convenient)

- Download the required form in Excel or Word

In MyWarehouse you can also download a complete list of expenditure orders for all time. This is convenient for reporting - the total amount of funds issued is immediately visible.

More than 1,000,000 companies already print invoices, invoices and other documents in the MyWarehouse service Start using

Rules for filling out the document

Form KO-2 can be filled out either by hand or using special programs that help automate the entry of information into the designated fields of the document. The title must indicate the name (full or short), according to the statutory documents. If there are no structural units, then a dash is placed in the corresponding field.

We enter the following information in the appropriate columns:

- Document Number. The numbering is done “end-to-end”, according to the serial numbers from the accounting journal and is maintained in this way until the end of the year.

- OKPO code. It is taken from the document issued by the statistical authorities during the registration of the enterprise.

- Date of. The current date of issue of funds in an eight-digit format, where the first two digits of the number come first, then the serial number of the month in two digits, then four digits of the year.

- Debit/Credit. Accounting invoices are entered. Legal entities do not fill out the simplified taxation system.

- Amount rub., kopecks We write legibly in numbers, separating pennies with a comma.

- Issue. The column is filled in in the dative case (to whom?) indicating the full name of the recipient (Ivanov Ivan Ivanovich).

- Target code. Required to be filled out if the organization uses coding of expense/receipt transactions.

- Base. The type of expense transactions is indicated.

- Sum. We indicate the value in words (letters) in rubles, and kopecks in numbers.

- Application. Data is entered if there is primary documentation confirming the basis for the issuance. The document numbers and dates of their preparation must be entered.

- Received. This field in the document must be filled out by the recipient of funds independently. Information about funds is entered in words, kopecks are indicated in numbers. The recipient's signature, current date and location are indicated. It is allowed to fill in the data by the cashier.

- Issued by the cashier. The information is entered by the cashier himself after cash is issued. There must be a surname with initials, as well as a confirming signature.

How to fill out RKO: difficult cases

Although filling out the RKO is not difficult, in special cases problems arise. We've sorted out the most common ones.

Payment to the supplier through the cash register: how to issue cash settlement

Be sure to request a power of attorney from the supplier’s representative to receive from your company a specific amount under a specific agreement, delivery note, etc. It must be attached to the RKO. Note that:

- When filling out an expense cash order, in addition to the details of the power of attorney, you must indicate the full name of the representative and his passport details.

A power of attorney to receive money without it being signed by a RKO representative does not prove that he received it.

- In the “Bases” line, you must enter the details of the contract, invoice, etc., as well as the names of the goods.

- If payment is made under several contracts at once, it is better to draw up a separate order for payment for each of them. It will be clearly visible how much was paid for each delivery.

- When recording this order in the cash book, you need to indicate the full name of the representative, details of the power of attorney and the name of the supplier.

How to fill out cash settlements for the issuance of accountable amounts: sample

Since August 19, 2021, the Bank of Russia has issued instructions according to which money can be issued on account by order of the director. An application from an accountable is no longer required. The main thing is to indicate the chosen issuance procedure (by application or by order) in the company’s accounting policy.

Why do you need an expense cash order?

An expense cash order refers to documents for the primary accounting of cash transactions.

It is used to issue cash from the cash register. A cash order is a settlement register; it is formed in one copy by an accounting employee and signed by the head of the budget organization, the chief accountant, the cashier and the person receiving the funds. The seal in this case is not mandatory and is used only if available in the organization. The expense cash order must not contain corrections, otherwise it is invalidated. If an error is made, the cash order must be made again in the correct version.

The obligation to use form KO-2 is determined by Bank of Russia Instructions No. 3210-U dated March 11, 2014. For public sector organizations, this requirement is enshrined in Order of the Ministry of Finance dated March 30, 2015 No. 52n. Doing business also involves creating a cash order for mutual settlement between the accountable person and the company cashier.