The need for accounting and accounting policies

The basic provisions on the rules of accounting are contained in the Federal Law of December 6, 2011 No. 402-FZ “On Accounting” (as amended on December 28, 2013, as amended and supplemented). According to this 402-FZ, any economic entity is required to maintain accounting, unless otherwise established by this law.

According to the Federal Law “On the Development of Small and Medium Enterprises in the Russian Federation” and other regulations, an individual entrepreneur can use simplified methods of accounting , including simplified accounting (financial) reporting.

When choosing which simplified methods to use for accounting, an individual entrepreneur must proceed from the requirement of Part 1 of Article 13 of the Federal Law “On Accounting” - accounting statements must provide a reliable representation of the financial position and cash flows.

Accounting policies must provide for rational accounting.

An individual entrepreneur, when forming an accounting policy, may provide for maintaining accounting using a simple system (without using double entry, without a chart of accounts), adopt a simplified system of registers (simplified form) of accounting, or decide to conduct accounting without using accounting registers (according to PBU 1/2008 “Accounting Policy organization”, approved by order of the Ministry of Finance of Russia dated October 6, 2008 No. 106n).

A simple form of accounting (without registers) means recording business transactions only in the Book (journal) of recording facts of economic activity. Maintaining this book allows, if necessary, to determine the availability of property and funds from an individual entrepreneur on a certain date and to draw up financial statements, i.e. solve accounting problems.

may not maintain accounting (according to the Federal Law “On Accounting”, Article 6, Part 2).

Thus, individual entrepreneurs using the simplified tax system may not conduct accounting or submit financial statements.

Let's turn to the law

General standards and principles of accounting are regulated by the Federal Law “On Accounting” dated December 6, 2011 No. 402-FZ, which came into force on January 1, 2013 and is relevant in 2019.

According to it, all economic entities are required to maintain accounting (clause 1, article 6). However, it is also stated there (clause 2 of Article 6) that this requirement does not apply to:

- Individual entrepreneurs - if, in accordance with the legislation on taxes and fees, they keep records of their income and expenses or other indicators characterizing the type of their activity.

- Branches or representative offices of foreign organizations that maintain tax records in accordance with the law.

We are more interested in the first point. After all, it states that an individual entrepreneur should not carry out accounting if he maintains tax records. Does this rule apply to all individual entrepreneurs, regardless of tax regime? Let's clarify the situation.

IP on the simplified tax system

When working on a simplified system, an individual entrepreneur is required to maintain and provide, upon request of the tax inspectorate, an Income and Expense Accounting Book (KUDiR). Moreover, this applies to both the simplified tax system 6% and the simplified tax system 15%. Therefore, when working on a simplified basis, an entrepreneur, according to Law No. 402-FZ, may not keep accounting records.

Individual entrepreneur on Unified Agricultural Tax

The situation is similar with payers of the single agricultural tax - when calculating tax payments, they must take into account both income and expenses. Therefore, the exception applies to them as well.

IP on UTII

As soon as the new law was adopted, a controversial situation arose regarding whether an individual entrepreneur should keep accounts if he works under the UTII regime. Fortunately, there is an official document that removes all doubts on this issue.

The letter of the Ministry of Finance of Russia dated August 13, 2012 No. 03-11-11/239 explains that entrepreneurs who are payers of the single tax on imputed income are subject to clause 2 of Article 6 of Law No. 402-FZ and have every right not to keep accounting records. accounting

I will not dwell on this Letter in detail, since you can easily find its text on the Internet.

IP on OSNO

Those who work on the general taxation system must calculate and charge personal income tax, which directly depends on the income that must be taken into account. Consequently, the obligation to maintain accounting records for individual entrepreneurs working for OSNO is removed.

Read about what taxes you need to pay when using the general regime HERE.

IP on PSN

Working under a patent, the individual entrepreneur is also not obliged to keep accounting, since he maintains KUDiR (which takes into account only income). You can read more about the patent regime HERE.

Transition of individual entrepreneurs to a simplified taxation system

The individual entrepreneur makes such a transition on a voluntary basis. However, there are conditions under which you cannot switch to the simplified tax system . According to clause 3 of Article 346.12 of the Tax Code of the Russian Federation, individual entrepreneurs cannot switch to and apply the simplified tax system:

- engaged in the production of excisable goods;

- engaged in the extraction and sale of non-common minerals;

- switched to paying the unified agricultural tax (USAT);

- whose average number of employees exceeds 100 people;

- who failed to notify the tax authority of the transition to the simplified tax system within the prescribed period.

Read more about the application of the simplified tax system in the article - Simplified taxation system, as well as in Chapter 26.2 of the Tax Code of the Russian Federation.

How can an individual entrepreneur switch to the simplified tax system?

In order for an individual entrepreneur to use the simplified tax system, you need to submit a notification to the tax authority in the form “26.2-1” :

notifications about the transition to a simplified taxation system.

If the individual entrepreneur has just been registered (newly), then the notification of the transition to the simplified tax system is submitted no later than 30 calendar days from the date of registration of the individual entrepreneur for tax registration. In this case, it is considered that the individual entrepreneur has switched to the simplified tax system from the date of tax registration (this day often coincides with the day of state registration of the individual entrepreneur).

If the individual entrepreneur is already operating and uses other taxation systems, then a notification of the transition to the simplified tax system from the beginning of the next year must be submitted to the tax authority no later than December 31 of the current year . That is, such an individual entrepreneur will not be able to switch to the simplified tax system before next year.

With one exception.

An individual entrepreneur who has ceased to be a payer of the single imputed tax (UTI) has the right to switch to the simplified tax system from the month in which his obligation to pay UTII ceased. To do this, he must submit a notification about the transition to the simplified tax system no later than 30 days after the termination of his obligation to pay UTII.

An individual entrepreneur who pays UTII for certain types of activities simultaneously apply the simplified tax system, but in relation to other types of activities.

In the notification, the individual entrepreneur must indicate his chosen option for the object of taxation on the simplified tax system - “income” or “income reduced by the amount of expenses.”

An individual entrepreneur who has switched to the simplified tax system does not have the right to switch to a different taxation regime until the end of the year (as well as to change the variant of the object of taxation of the simplified tax system), but has the right to simultaneously apply the patent taxation system and, as noted above, UTII.

If an individual entrepreneur has ceased the type of activity in respect of which he applied the simplified tax system, he is obliged to notify the tax authority of the date of such termination no later than 15 days.

Read more about the transition to the simplified tax system in the article - Notification of the transition to the simplified tax system.

Well, how long can you demand from an individual entrepreneur financial statements in forms No. 1 and No. 2 with a tax mark?

But should an individual entrepreneur keep accounting records?

An individual entrepreneur approached us with the question of how he could obtain financial statements with a mark from the tax office.

An entrepreneur is planning a supply to a large company and brought us a request for documents that were required from him to conclude an agreement.

Have you looked? That’s right, and I’m talking about the same thing, how can you demand financial statements from an individual entrepreneur, and even under the heading “required” and with a mark from the tax authority?

You can, of course, laugh at this. Perhaps the controller-analysts on the other side adhere to the tradition of the ancient Roman accountants that all valuables, including the personal belongings of the owner and his family members, should be included in the system of accounting records?

But seriously, should an individual entrepreneur keep accounting records and submit financial statements?

In general, no. The rule is this: all economic entities are required to maintain accounting records. Individual entrepreneurs are also economic entities, but a special exception has been made for them (clause 1, part 2, article 6 of the Federal Law of December 6, 2011 No. 402-FZ).

Individual entrepreneurs have the right not to keep accounting records if, in accordance with the legislation of the Russian Federation on taxes and fees, they keep records of income or income and expenses and (or) other objects of taxation or physical indicators characterizing a certain type of business activity.

Even for entrepreneurs on UTII or PSN there is a place for tax accounting, and they are also not required to keep accounting records.

Entrepreneurs are exempt from maintaining accounting records and submitting financial statements to the Federal Tax Service (Letters of the Ministry of Finance dated 03/20/2018 N 03-11-11/17116, dated 02/07/2018 N 03-11-12/7268, dated 03/02/2015 N 03-11- 11/10791).

And by the way, if you, as an individual entrepreneur, are asked by the tax office for accounting registers (oh, how they love to do this), turnover and cards for 60 and 62 accounts, etc., then you don’t have to give them, since you are required to keep accounting records you do not have.

Although, on the other hand, if someone falls victim to ritualism, they can try to submit tax accounting reports... independently act, so to speak, as a participant in a single pilot project. The main thing is not to get too carried away, otherwise you can put your favorite dog (cat) on balance, like an animal in fattening, and then one more step - and hello, little green men!

There is an exception when accounting interferes with the lives of entrepreneurs. If an individual entrepreneur applies a simplified taxation system, then he must monitor the residual value of fixed assets, calculated according to accounting rules, calculate depreciation, that is, in fact, maintain such accounting “mini-accounting” of the fixed assets.

After all, an individual entrepreneur loses the right to simplification if the residual value of fixed assets in the reporting (tax) period exceeds 150 million rubles (Letter of the Ministry of Finance of Russia dated January 30, 2019 N 03-11-11/5277).

This limit does not include personal property, but only property directly used in business activities.

Andrey Zhiltsov , head of the Multi-Accountant service

When an individual entrepreneur loses the right to use a simplification

If during the reporting (tax) period the income of an individual entrepreneur exceeded 150 million rubles and (or) the individual entrepreneur did not comply with the above conditions for applying the simplified tax system (established in paragraph 3, paragraph 4 of Article 346.12 and paragraph 4 of Article 346.13 of the Tax Code of the Russian Federation), then such an individual entrepreneur is considered to have lost the right to the simplified tax system from the quarter in which the violations were committed.

The individual entrepreneur must report such loss to the tax authority no later than 15 days.

An individual entrepreneur can switch to the simplified tax system again, but not earlier than a year after losing the right to the simplified tax system.

If, at the end of the year, the conditions for applying the simplified tax system were not violated, the individual entrepreneur has the right to apply the simplified tax system next year.

Methods of accounting for an individual entrepreneur

How to conduct accounting for an individual entrepreneur - various options, and when they are acceptable:

- Preservation of primary documents - contracts, salary slips, etc. - is mandatory for all types of taxation.

- Keeping a ledger for accounting income and expenses (KUDiR) in paper or electronic form is mandatory for those who are taxed according to the simple simplified tax system. For individual entrepreneurs working under UTII or a patent, this is not necessary, but it is desirable.

- Maintaining full-fledged accounting is mandatory for enterprises using OSNO or the simplified tax system with the risk of switching to OSNO.

Note ! The individual entrepreneur chooses which form to prefer. Also, the individual entrepreneur has the choice of whether to do the accounting themselves, use outsourcing services, or have a full-time accountant.

What does switching to the simplified tax system give to individual entrepreneurs?

First of all, the use of the simplified tax system replaces three with one tax. In accordance with paragraph 3 of Art. 346.11 of the Tax Code of the Russian Federation, individual entrepreneurs are exempt from the obligation to pay:

- personal income tax (on income from activities as an individual entrepreneur, but excluding dividends);

- tax on property of individuals (but except for property not used by individual entrepreneurs for business activities, as well as except for property, the tax base for which is determined from the cadastral value);

- value added tax (VAT) (but excluding VAT on import transactions).

Should an individual entrepreneur keep accounting records?

Not every individual entrepreneur has the knowledge necessary to maintain accounting records. Therefore, for some individual entrepreneurs, the process of reflecting all financial and business transactions is quite complicated. Such entrepreneurs often resort to the help of professional accountants or outsourcing companies.

Maintaining accounting involves performing the following operations:

- compliance with cash discipline;

- generation of primary documents;

- calculation of wages to employees;

- formation of a balance sheet;

- accounting of fixed assets;

- other operations.

When choosing the form of ownership of a future enterprise, every entrepreneur has a question: is it necessary to keep accounting? Or is it possible not to do this? As for such a form of ownership as an LLC, accounting is a prerequisite for it, regardless of the taxation regime.

Regarding individual entrepreneurship, everything is not so clear.

Starting from January 1, 2013 and to this day, the basic rules of accounting are regulated by Federal Law No. 402 of December 6, 2011 “On Accounting.”

Based on the first paragraph of the sixth article of this document, all economic entities must maintain accounting. However, the second paragraph of the same article defines exceptions to the general rule. According to them, the obligation to keep accounting records does not apply to:

- Individual entrepreneurs, provided that in the process of carrying out their activities they take into account their expenses and income (and other economic indicators in accordance with the nature of their activities) according to the norms of tax legislation.

- Branches of foreign companies, as well as their representative offices, provided that their tax accounting does not contradict current legislation.

Thus, an individual entrepreneur is not required to keep accounting only if he keeps tax records. Does the tax system chosen by the entrepreneur affect this rule? Let's look into this issue.

Expenses that may reduce income

Under the simplified tax system, not all costs of an individual entrepreneur associated with generating income can be classified as expenses that reduce income. But only those defined by Art. 346.16 of the Tax Code of the Russian Federation. This is a fairly extensive list, but it is better not to interpret it yourself.

You only need to count as expenses what is on this list.

Expenses include:

- for the purchase of raw materials;

- for the acquisition of fixed assets;

- to pay for goods purchased for subsequent sale;

- for remuneration of employees;

- to pay taxes, insurance premiums, fees and other costs.

The most important rule when accounting for expenses on the simplified tax system: expenses are recognized as expenses only after actual payment and in the presence of supporting documents.

Losses

A loss is the excess of expenses over income.

Choosing an individual entrepreneur as an object of taxation under the simplified tax system “income reduced by the amount of expenses” allows you to reduce the tax base of the current year by the amount of losses from previous years. Moreover, losses can be carried forward to the next year for 10 years following the year in which losses were incurred.

Also, the individual entrepreneur has the right to add to the loss or include in the expenses of the following years the difference between the calculated tax and the minimum tax paid.

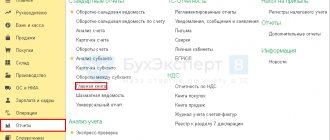

Book of income and expenses

An individual entrepreneur must take into account his income and expenses and reflect them in a special “ Book of accounting for income and expenses of organizations and individual entrepreneurs using a simplified taxation system .” This is necessary to determine the taxable base and calculate tax.

Order of the Ministry of Finance of the Russian Federation dated October 22, 2012 No. 135n (as amended on December 7, 2016 No. 227n) approved the form of the book and the procedure for filling it out.

organizations and individual entrepreneurs using a simplified taxation system.

Do individual entrepreneurs keep accounting records on OSNO?

This situation is similar to the previous one (letter of the Ministry of Finance of Russia dated July 26, 2012 No. 03-11-11/221).

According to paragraph 2 of Art. 54 of the Tax Code of the Russian Federation, entrepreneurs working for OSNO take into account income and expenses for their commercial activities in the book of income and expenses and business operations of individual entrepreneurs, approved by order of the Ministry of Finance of Russia No. 86n dated August 13, 2002 and the Ministry of Taxes of Russia No. BG-3-04/430.

Read about the tax burden of individual entrepreneurs on the OSN here.

Thus, the condition for accounting for income and expenses (clause 2 of Article 6 of Law No. 402-FZ) is also met here. Consequently, individual entrepreneurs on OSNO, like simplifiers, are free to refuse accounting.

For a comparison of popular tax regimes for small businesses, read the article “What is the difference between the simplified tax system and the OSNO? What is more profitable?

Calculation and payment of tax simplified tax system

The tax amount is equal to the product of the taxable base for a certain period and the tax rate.

But before you count, individual entrepreneurs need to check the simplified tax system tax rate with their tax office. The fact is that a specific rate of the simplified tax system is established by a subject of the Federation, which is given the right by federal legislation to reduce the rate (and even set it to zero) for a certain period or for certain categories of tax payers.

“The tax levied on taxpayers who have chosen income as an object of taxation” (as it is called in the table of budget classification codes - KBK) is equal to the product of the tax base (amount of income, revenue) and the tax rate equal to 6%.

The amount of the simplified tax system can be reduced to 50% if you deduct the amount of insurance contributions paid for a specific reporting period for compulsory and voluntary pension, compulsory medical, compulsory social insurance in case of temporary disability and in connection with maternity, compulsory social insurance against accidents for production and occupational diseases, as well as the amount of the trade tax (if applicable).

“The tax levied on taxpayers who have chosen income reduced by the amount of expenses as an object of taxation” is equal to the product of the taxable base (i.e., the difference between the amount of income and the amount of expenses (determined in accordance with Article 346.16 of the Tax Code of the Russian Federation) and the tax rate, equal to 15%.

Next, you need to compare the resulting tax amount with the amount of the so-called minimum tax (it is equal to 1% of revenue).

If the calculated tax amount is less than the minimum, then the minimum tax must be paid. That is, when comparing two amounts, we choose to pay the larger one.

The simplified tax system must be calculated and paid for the tax period (year). But in the middle of the year, three advance payments must be calculated and paid quarterly, which are then taken into account when calculating the tax for the year.

The calculation of advances is the same as the tax in general, but the amounts of income and expenses are taken on an accrual basis for a specific reporting period - first for the first quarter, then for six months, then for 9 months.

Advance payments of the simplified tax system must be paid by the 25th day of the month following the reporting period (quarter, half-year, 9 months):

- for the first quarter of the year (from January to March) – until April 25;

- for six months (from January to June) – until July 25;

- for 9 months (from January to September) – until October 25.

Tax for the year is paid by individual entrepreneurs no later than April 30 of the following year.

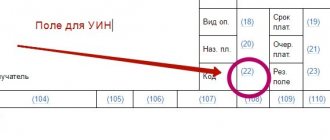

The following BCCs must be indicated in payment orders (receipts):

income - 18210501011011000110

income minus expenses - 18210501021011000110

Money Manager

Money Manager application

Money Manager is one of the most functional applications with which you can not only keep your spending under control, but also receive statistics for any period of time. Here you can manage credit and debit cards, get statistics and track the status of your assets on charts. In addition, the application has the following features:

- double entry system;

- creating a budget for selected categories;

- PC access;

- password access protection;

- transfer of funds between assets;

- tracking expenses and income by assets;

- built-in calculator;

- search by category.

Available on Google Play.

Monefy

Monefy application

Monefy is an application with a simple, clear and user-friendly interface. Allows you to record expenses by individual categories, assigning them individual icons. All expenses are displayed in the form of a chart. The report can be generated for a period from 1 day to a year. The application is synchronized with multiple devices via Dropbox; backup copies are also stored here, with which you can restore data in the event of a technical failure or loss of your smartphone.

Main functions and features:

- presentation of data on the expenditure of funds in the form of an informative graph and display of detailed information in a list format;

- support for all currencies;

- management of individual categories;

- built-in calculator;

- password protection of data;

- data backup;

- no advertising.

Debit card #CandoEVERYTHING from Rosbank - up to 8% on balance

Apply now

Available on Google Play and App Store.

Moneon

Moneon app

Moneon is a comprehensive tool for keeping track of finances, both personal and family. In addition to the usual functions, the application supports voice input of transactions, as well as independent creation of categories.

Main functions and features:

- creating a budget for individual categories or for the entire wallet;

- unlimited number of wallets;

- support for all the most popular currencies;

- Data protection with password and Touch ID.

Connecting to a premium package opens up additional features:

- adding photos;

- accounting of income and debt obligations;

- generation of reports;

- recognition of SMS messages;

- scheduling regular payments;

- synchronization of wallets between family members or partners.

Available on the App Store (iOS devices only).

Bills Monitor

Bills Monitor

Bills Monitor is a full-featured billing and personal finance management tool. Here you can not only record your expenses, but also create reminders about upcoming bill payment deadlines.

Main functions and features:

- display of unpaid invoices;

- 20 preset categories and the ability to add your own;

- generation of a report in the form of a diagram;

- Convenient search for the required account by name, category;

- data backup with recovery option.

Multicard from VTB Bank - cashback for purchases

Apply now

Available on the App Store

Coin Keeper

Coin Keeper application

Coin Keeper is a functional financial accounting service that allows you to monitor expenses and income, compare indicators for different periods of time and analyze expenses by different categories.

Main functions and features:

- accounting for receipts and expenditures of funds;

- financial management on a smartphone and personal computer;

- managing the budget of a family or a small group of partners;

- viewing statistics;

- setting reminders for regular payments;

- budget planning by period;

- support for all currencies;

- data protection;

- export data to CSV;

- import of banking transactions from more than 150 Internet banks in Russia (for the “Platinum” version).

Available on the App Store and GooglePlay. The free period for the Premium package is 7 days.

Money Flow

Moneflow application

A convenient and functional application for tracking personal income and expenses, as well as assessing your overall financial condition.

Main functions and features:

- customizing the interface - choosing icons and colors for accounts and categories, choosing the main background;

- built-in currency converter with support for more than 170 currencies;

- calculator;

- use of double entry;

- tags and geotags with the ability to record the place of purchase;

- creating an interactive report;

- attaching images to operations;

- convenient and simple search for transactions;

- automatic data backup;

- data protection (Face ID, Touch ID).

The application has a thoughtful, intuitive interface and nice design.

Debit card All inclusive from Fora-Bank - 3.5% on the card balance

Apply now

Available on the App Store.

Money OK

Money OK app

Money OK is a simple and understandable financial management program available to both iPhone owners and Android smartphone users.

Main functions and features:

- accounting of income and expenses;

- adding comments to operations;

- budget planning;

- Touch ID protection;

- built-in calculator;

- support for different currencies;

- synchronization of multiple devices and maintaining joint records;

- choice of design and personalization;

- setting reminders;

- scanning receipts with a QR code.

The application has a built-in editor for working with subarticles, which allows you to group categories by simply moving the icons.

Available on the App Store and GooglePlay.

Goodbudget: Budget & Finance

Goodbudget App

A functional app for planning your home budget and tracking expenses.

Main functions and features:

- automatic synchronization with multiple devices via iPhone, Android or web;

- adding accounts;

- payment planning;

- search for transactions;

- balance check;

- budget editing;

- analysis of spending of funds and preparation of reports by category;

- uploading transactions in CSV format;

- generating a bank account statement.

Debit card #CandoEVERYTHING from Rosbank - up to 8% on balance

Apply now

Available on the App Store and GooglePlay.

Wallet – accounting of expenses budget

Wallet application

Wallet is a smart application for monitoring finances with rich functionality.

Main functions and features:

- maintaining a family and personal budget;

- instantly adding new entries;

- analysis of the structure of expenses and income by different categories;

- display of the current overall balance and for individual accounts;

- saving transaction history;

- the ability to group records by events or accounts;

- transfers between lists, including those with different currencies;

- creating descriptions for operations;

- built-in calculator and support for more than 150 currencies;

- synchronization via Dropbox;

- backup and data protection (password or Touch ID).

The free version of the program is a trial version and has some functional limitations.

Available on the App Store.

Personal Finance

Personal Finance application

A convenient application for successful financial planning and budget control. Allows you to estimate real income and expenses and correctly draw up a financial plan.

Main functions and features:

- quick addition of new entries – you only need to fill in the amount;

- accounting of income and expenses, including joint ones;

- setting reminders and financial planning;

- reporting and financial analysis;

- password protection;

- export data in CSV format;

- secure synchronization of multiple devices via Dropbox account;

- data backup, loss protection.

Multicard from VTB Bank - cashback for purchases

Apply now

Available on the App Store and Google Play.

Budget, finance, cost accounting

Budget application - Budget, finance, expense accounting

A convenient application with a wide range of functions for managing personal and family finances and accounting for current and planned expenses.

Main functions and features:

- control over budget spending;

- drawing up a financial plan;

- analysis of data on expenses and income;

- forecast of financial position for any date;

- reminders about upcoming payments;

- calculation of early loan repayment;

- support for all world currencies, including cryptocurrencies;

- built-in converter;

- Data protection with a PIN code, using Face ID or Touch ID.

Available on the App Store.

Money Wallet

Money Wallet application

Money Wallet is a convenient application for controlling finances with the ability to synchronize between several devices (in the paid version).

Main functions and features:

- setting up and editing the list of categories;

- payment planning;

- creating a budget for a week, month or year;

- support for all world currencies;

- the ability to select icons for different types of accounts;

- data backup with recovery option.

Available on Google Play.

Tax return simplified tax system

Before April 30, an individual entrepreneur must submit to the tax office at his place of residence (registration of an individual entrepreneur) a tax return on the tax paid in connection with the application of the simplified taxation system for the past tax period (year). This deadline coincides with the deadline for paying the simplified tax system.

There is no point in waiting until the last minute to give up. And it makes more sense to submit your declaration first, and only then pay the tax.

tax return for tax paid in connection with the application of the simplified taxation system.

You can fill out the declaration using numerous software tools or on-line services.

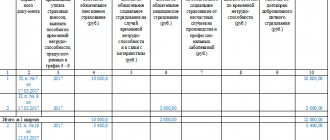

Insurance premiums for individual entrepreneurs

For himself, without employees, the individual entrepreneur must pay contributions to mandatory pension and health insurance.

The annual amount of these payments is fixed and is paid regardless of whether the individual entrepreneur has income or not.

Fixed amount of contributions for compulsory pension insurance:

- with income for 2021 of less than 300 thousand rubles. = 36,238 rub.;

- with income for 2021 of more than 300 thousand rubles. = 36,238 rub. + 1% from amounts over 300 thousand.

Fixed amount of contributions for compulsory health insurance = 6,884 rubles.

1 percent of the amount exceeding 300 thousand rubles must be paid before July 1, 2021, and the remaining contributions must be paid before December 31, 2019.

The amounts of insurance contributions for compulsory pension and compulsory health insurance are calculated and paid separately.

KBC fixed contributions:

OPS – 18210202140061110160

Compulsory medical insurance – 18210202103081013160

If an individual entrepreneur is registered in the current year, his fixed contribution amount is proportional to the number of months starting from the beginning of his activities. For an incomplete month, the amount of contributions is proportional to the number of calendar days of that month.

If an individual entrepreneur ceases his business activities in the current year, the fixed amount of insurance premiums is determined in proportion to the number of calendar months up to the month in which state registration as an individual entrepreneur expired.

For an incomplete month of activity, the fixed amount of insurance premiums is determined in proportion to the number of calendar days of this month up to and including the date of state registration of termination of activity as an individual entrepreneur.

In case of termination of the activities of an individual entrepreneur, payment of insurance premiums is carried out no later than 15 calendar days from the date of deregistration with the tax authority.

For detailed information on individual entrepreneur insurance premiums for yourself, see the article - Individual entrepreneur insurance premiums, for employees - Taxes and contributions for individual entrepreneur employees