There are many contradictory aspects in the taxation of EAEU citizens in Russia. This is due to the fact that the positions of international and Russian law are defined in different terminology and therefore do not create a formal disagreement, but in practice they lead to ambiguity in the rules for applying the tax rate when calculating personal income tax. In the article, 1C experts explain the intricacies and consequences of choosing an algorithm for calculating personal income tax for citizens of the EAEU and talk about the procedure for reflecting the tax status of employees from the EAEU, applying the personal income tax rate and calculating tax in “1C: Salaries and Personnel Management 8” edition 3.

The norms of international law link the citizenship of an individual and the rate for calculating personal income tax. In the Tax Code of the Russian Federation, the personal income tax rate and benefits depend on the status of a tax resident. Tax resident status automatically determines both the tax rate of 13% and the right to benefits. The opposite is not true: the 13 percent personal income tax rate does not provide resident status and the right to tax deductions.

Contrasting the rights of citizens of the EAEU with the rights of citizens of the Russian Federation seems incorrect, because the Russian Federation is part of the EAEU. Adding to the complexity is the use in the Treaty on the Eurasian Economic Union, signed in Astana on May 29, 2014 (as amended on March 15, 2018), of the concept of “employment,” which is not defined either by Russian legislation or international law.

Knowing about the contradictions in applying the personal income tax rate to the income of employees from the EAEU countries, the employer has the opportunity to make an informed decision when calculating tax and applying deductions.

Russian residency status

How is the residence status of the Russian Federation determined?

Paragraph 2 of Article 207 of the Tax Code of the Russian Federation determines the procedure for determining whether or not a taxpayer has the status of a resident of the Russian Federation. A resident of the Russian Federation becomes a person who is actually in Russia for at least 183 calendar days over the next 12 consecutive months.

Note

About the tax status of an individual, about the calculation of personal income tax for non-residents and accounting in the 1C: Salaries and Personnel Management 8 program, edition 3, read the article “Personal Income Tax for Non-Residents: Accounting in 1C: ZUP 8”.

Consequently, a foreigner can become a tax resident of the Russian Federation only six months after entering Russia, and a Russian can lose the status of a resident of the Russian Federation by leaving the country for six months.

Letters of the Ministry of Finance of Russia dated 06.06.2014 No. 03-04-05/27351, dated 22.11.2012 No. 03-04-06/6-331, dated 21.03.2011 No. 03-04-05/6-157, Federal Tax Service of Russia dated 05.03 .2013 No. ED-3-3/ [email protected] and others explain the specifics of calculating 183 days of stay on the territory of the Russian Federation.

To determine the status of an individual, all calendar days in which the individual was actually in the Russian Federation for the next 12 consecutive months are summed up. These 12 months may begin in one tax period and end in another. During these 12 months, all calendar days of the taxpayer’s presence in the Russian Federation should be added up. The legislation does not contain period continuity requirements. In addition to direct stay on the territory of the Russian Federation, the calculation of 183 days includes the following days (in accordance with Article 207 of the Tax Code of the Russian Federation):

- treatment or study abroad, if the period does not exceed six months;

- work on offshore hydrocarbon fields abroad;

- arrival in the Russian Federation and days of departure from the Russian Federation.

For some categories of citizens (for example, Russian military personnel and government employees sent abroad), tax residency is determined regardless of the time spent in the Russian Federation.

What does Russian residency status provide?

Article 224 of the Tax Code of the Russian Federation establishes a personal income tax rate of 13% for most types of income of residents of the Russian Federation, and 30% for non-residents of the Russian Federation.

In accordance with paragraph 3 of Article 210 of the Tax Code of the Russian Federation, tax deductions for personal income tax are applied to the income of only residents of the Russian Federation.

When and why to review the status of residence of the Russian Federation

A review of the tax status is necessary to clarify the legality of applying the personal income tax rate and tax deductions.

The Ministry of Finance of Russia and the Federal Tax Service of Russia insist on the need to clarify the final status of an individual based on the results of the calendar year and recalculate the tax at a different rate when acquiring the status of a tax resident and when losing this status (see letters of the Ministry of Finance of Russia dated April 22, 2016 No. 03-04-06/23366 , dated 19.03.2013 No. 03-04-06/8402, dated 28.03.2012 No. 03-04-06/6-81, dated 28.10.2011 No. 03-04-06/6-293, Federal Tax Service of Russia dated 22.10.2012 No. AS-3-3/ [email protected] , dated 08/14/2012 No. ED-3-3/ [email protected] ). At the same time, the Tax Code of the Russian Federation does not contain norms that require determining the tax status of an individual at the end of the year and recalculating the previously calculated personal income tax in this regard.

| 1C:ITS In the “Legislative Consultations” section, see more about whether personal income tax needs to be recalculated if the status of an individual changes during the calendar year: from resident to non-resident; from non-resident to resident - follow the link. |

Insurance premiums

Let us say right away that the procedure for taxing the income of foreign citizens temporarily residing in Russia with insurance premiums is no different from the rules provided for ordinary Russian citizens. The fact is that foreign workers temporarily residing in the territory of the Russian Federation and working under employment contracts are subject to compulsory insurance on an equal basis with citizens of the Russian Federation (Article 2 of the Federal Law of December 29, 2006 No. 255-FZ “On compulsory social insurance in case of temporary disability and in connection with maternity" (hereinafter referred to as Law No. 255-FZ), paragraph 1 of Article 7 of Federal Law dated December 15, 2001 No. 167-FZ "On compulsory pension insurance in the Russian Federation" (hereinafter referred to as Law No. 167-FZ) and Article 10 of the Federal Law of November 29, 2010 No. 326-FZ “On Compulsory Health Insurance in the Russian Federation” (hereinafter referred to as Law No. 326-FZ)).

Difficulties arise when assessing insurance premiums for compulsory social and pension insurance on the income of foreign citizens temporarily staying in the Russian Federation. Please note: foreign citizens temporarily staying in Russia, on the basis of Art. 10 of Law No. 326-FZ are not subject to compulsory health insurance.

EAEU citizen status

Article 73 “Taxation of personal income” of the Treaty on the EAEU provides a special rule, according to which in the EAEU member countries (Belarus, Kazakhstan, Armenia, Kyrgyzstan and the Russian Federation), income from the first day of work is taxed at the same rate as for citizens a state in which citizens of other EAEU states are employed.

Thus, when working in Russia, EAEU citizens pay personal income tax, like Russians - tax residents, at a rate of 13% and have a privilege compared to foreigners from other countries - non-residents, whose income is taxed at a rate of 30%.

Hiring Kyrgyz citizens in 2021 step-by-step instructions

Important

Certificate of medical examination, specifying the absence of AIDS, drug addiction and other serious diseases, including infectious ones. 4. Voluntary medical insurance policy (VHI policy can be concluded with any Russian insurance organization or obtained from the relevant medical organization).

5. Certificate of fluency in the Russian language, knowledge of the history of our state and its legislative framework. 6. Certificate of registration at the place of residence of a citizen of another state in Russia.

A foreign citizen must apply to this migration service to obtain a patent within thirty days of his stay in Russia. Otherwise, that is, as a result of a late application to the FMS, the foreign citizen will be forced to pay a fine.

When should the norms of the Treaty on the EAEU, and not the Tax Code of the Russian Federation, be applied?

Part 4 of Article 15 of the Constitution of the Russian Federation establishes the unconditional priority of international norms over the norms of the national legislation of our country. This applies to both tax legal relations and social insurance. For example, if the international norm of Article 73 of the Treaty on the EAEU contradicts the internal law of the Russian Federation - Article 207 of the Tax Code of the Russian Federation, then it is the international rules that should be applied. The personal income tax rate of 13% should be applied to the income of EAEU residents received from the first day of employment in the Russian Federation. Work under employment and civil law contracts can be classified as employment work in accordance with Article 96 of the Treaty on the EAEU and Article 13.3 of the Federal Law of July 25, 2002 No. 115-FZ “On the legal status of foreign citizens in the Russian Federation.”

The concept of “income in connection with employment” includes any income provided for in an employment or civil law contract. Moreover, the activities are carried out directly on the territory of the Russian Federation. This is a mandatory condition for applying the personal income tax rate of 13% (see letters from the Ministry of Finance of Russia dated June 10, 2016 No. 03-04-06/34256, dated July 17, 2015 No. 03-08-05/41341). In a letter dated 06/10/2015 No. OA-3-17/ [email protected] the Federal Tax Service of Russia clarifies that the fact that an employee is located and working in Russia is confirmed by copies of passport pages with marks from border control authorities about crossing the border, information from the work time sheet, data migration cards, registration documents at the place of residence (stay).

Please note that this taxation procedure does not apply to EAEU residents working under an agreement with a Russian employer in another state (for example, remotely in Belarus). In this case, the general rules apply: the employer must not withhold personal income tax from the remuneration of a non-resident employee of the Russian Federation received outside the Russian Federation (clause 6, clause 3, article 208, clause 2, article 209 of the Tax Code of the Russian Federation).

Personal income tax from non-residents in 2018

Also, Russian employers hiring and future employees from Kyrgyzstan should know that income in this case will be subject to a thirteen percent tax from the first working day in our state. After a Kyrgyz citizen is hired, his employer, according to Russian laws, is obliged to report this fact to the local branch of the Federal Migration Service of our country.

Since such hiring is documented either when concluding an employment contract, or in the case of signing a civil law contract by both parties - the Russian employer and the foreign employee. This responsibility is assigned to Russians who employ all citizens of Kyrgyzstan, regardless of their status.

When should the Tax Code of the Russian Federation be applied, and not the norms of the Treaty on the EAEU

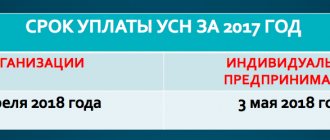

The regulatory authorities of the Russian Federation believe that the personal income tax rate for employees from the EAEU countries at the end of the year still depends on their status, which does not contradict the letter of the Treaty on the EAEU. The Ministry of Finance of Russia, in letter No. 03-04-06/3032 dated January 22, 2019, reminds that the procedure for determining tax status applies to individuals regardless of citizenship. For the case when, by the end of the year, a citizen of the EAEU acquires the status of a tax resident of the Russian Federation, a revision of the tax status makes it possible to apply tax deductions and recalculate personal income tax in connection with this. Obviously, if a citizen of the EAEU does not have time to obtain tax resident status during the tax period, then, in accordance with the requirements of the Ministry of Finance, at the end of the year, personal income tax is recalculated at a rate of 30%. If possible, the tax should be withheld, and if there is no corresponding income, the impossibility of withholding should be reported in the report on Form 2-NDFL.

For citizens who arrived in the Russian Federation after 07/02/2019 (183rd day of the year), it will no longer be possible to become a tax resident in the current tax period, since there are less than 183 days left in the year. From the first day of work, a 30% rate cannot be applied to their income - this will violate the requirements of an international treaty, and at the end of the tax period, a 13% rate will contradict the requirements of the Ministry of Finance. In addition, the inability to foresee the future must be taken into account: the employer does not know whether the employee will be working for him at the end of the tax period and whose responsibility it will be to determine the tax status at the end of the tax period.

At the same time as explaining the need to recalculate personal income tax at the end of the tax period in accordance with the tax status, the Ministry of Finance of Russia in its letter dated January 22, 2019 No. 03-04-06/3032 reports that the specified letter does not contain legal norms, does not specify regulatory requirements and is not regulatory legal act, has an informational and explanatory nature and does not prevent taxpayers, tax authorities and tax agents from being guided by the norms of the legislation of the Russian Federation on taxes and fees in an understanding that differs from the interpretation set out in the letter.

The letter of the Federal Tax Service of Russia dated November 28, 2016 No. BS-4-11/ [email protected] reflects the opposite position that there is no need to recalculate the tax.

Neither the opinion of the Russian Ministry of Finance nor the Federal Tax Service of Russia can be considered more or less beneficial for EAEU citizens. A revision of the tax status will lead to an increase in the personal income tax rate on non-resident income, and the absence of a revision will entail the non-application of deductions due to residents.

| 1C:ITS For recommendations on choosing the option for calculating personal income tax of EAEU citizens for tax agents who are cautious and ready to defend their position, see the “Legislative Consultations” section. |

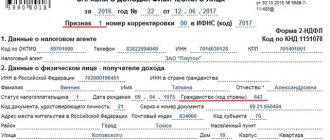

Regardless of the choice of calculation option, at the end of the tax period, the reporting should reflect the actual data - the personal income tax rate, citizenship and tax status of the individual.

Thus, in the case when a non-resident citizen of the EAEU is taxed at a rate of 13%, the 2-NDFL certificate should indicate the citizenship of the non-resident of the Russian Federation and the taxpayer status code “2”.

What is the difference between resident and non-resident

Since both concepts relate more to tax and financial legislation, the difference is expressed precisely in money.

- A tax non-resident is required to contribute 30% of income to the state treasury. The resident pays the usual 13% (clauses 1, 3 of Article 224 of the Tax Code of the Russian Federation).

- Financial residents have every right to open deposits in foreign currency on the territory of the Russian Federation and carry out other banking operations. Non-residents are subject to significant restrictions.

In what cases does a person receive resident status?

There are not so few grounds operating in 2021. In addition to the residence permit, other factors also influence the presence of resident status.

- All citizens of the Russian Federation are considered such, except for Russians living abroad for more than a year with a residence permit, on the basis of employment or for training purposes.

- Foreigners who stay in the Russian Federation for more than 183 days during the year also become residents and pay 13% personal income tax.

- Financial residents - foreigners are only persons with a valid residence permit.

- If we go beyond individuals, then all legal entities (companies) registered within the framework of Russian legislative requirements on the territory of the Russian Federation, as well as their foreign branches and other divisions, will be recognized as residents.

- Diplomatic bodies of the Russian Federation around the world have a similar status.

For residents and non-residents in Russia, there are different conditions for opening and servicing bank accounts, carrying out currency transactions, receiving/sending money transfers, many other banking operations and more.

Non-resident rights

There are practically no barriers imposed on persons with this status. The only thing is that they will be limited in their ability to carry out currency transactions with Russian banks. Mortgage lending is closed to such persons. However, non-residents with a residence permit can also enjoy all the benefits of the status, including the right to social grants, medical care and education for children.

Tax status of an employee and personal income tax in “1C: Salary and Personnel Management 8” (rev. 3)

The 1C: Salary and Personnel Management 8 program, edition 3, provides the ability to calculate personal income tax in accordance with the Treaty on the EAEU. The ability to manage the tax status of an employee in the program allows you to recalculate personal income tax.

Example 1

| Employee A.M. Klubnik, a citizen of Belarus (part of the EAEU), came to the Russian Federation and has been working in Russia since July 10, 2018 under an employment contract. |

When applying for a job in the 1C: Salaries and Personnel Management 8 program, edition 3, in the employee’s card, click on the Personal data link in the Country Citizenship field, select BELARUS. There are less than 183 days left until the end of the year, and A.M. Strawberries will not receive resident status in the 2021 tax period and, therefore, will not receive standard personal income tax deductions. From the first day of work, a rate of 13% is applied to calculate personal income tax in accordance with Article 73 of the Treaty on the EAEU. For correct calculation in the employee’s card, using the Income Tax link, in the Status field, you should select Citizen of a country that is a party to the Treaty on the EAEU (Fig. 1).

Rice. 1. Filling out the data in the employee card

Calculation and withholding of personal income tax from Kyrgyz citizens working in the Russian Federation

Attention

It should be recalled that for citizens of the Eurasian Economic Community countries, including Kyrgyzstan, such restrictions are not relevant. Hiring Kyrgyz citizens: step-by-step instructions Attention However, activity in some sectors of the economy, mainly related to state security, remains prohibited for migrants.

Info

In recent years, a huge flow of foreigners from neighboring countries has poured into Russia; there are also citizens of more developed countries, in particular European ones. Due to the increase in members of the Eurasian Economic Union, many employers are thinking about how to employ a citizen of Kyrgyzstan.

Usually, in order to work legally in Russia, it is necessary to obtain special permitting documents, for example, a labor patent or a work permit. However, residents of some countries, including Kyrgyzstan, are luckier, since they do not require such documents.

From August 12, the procedure for paying contributions and personal income tax from the salaries of Russians and workers from Kyrgyzstan is the same

From August 12, the income of workers - citizens of Kyrgyzstan - is subject to personal income tax at a rate of 13 percent, regardless of the length of their stay in Russia. This applies to earnings accrued to them for the period from August 12 to August 31. Salaries for days from August 1 to August 11 are taxed according to previously applicable rules.

The Eurasian Economic Commission reported that on August 12, the Treaty on the Accession of the Kyrgyz Republic to the Treaty on the Eurasian Economic Union came into force. The EAEU member states have completed all internal procedures necessary for the entry into force of the Treaty. And from this date, Kyrgyzstan became a full member of the EAEU along with Armenia, Belarus, Kazakhstan and Russia.

Judicial review of this procedure for constitutionality and compliance with the norms of the EAEU

This issue was considered by the Constitutional Court of the Russian Federation, and determined that this procedure does not contradict the Constitution of Russia and international treaties of Russia.

This conclusion is contained in the Resolution of the Constitutional Court of the Russian Federation dated June 25, 2015 No. 16-P “In the case of verifying the constitutionality of paragraph 2 of Article 207 and Article 216 of the Tax Code of the Russian Federation in connection with the complaint of a citizen of the Republic of Belarus S.P. Lyarsky.”

Thus, the taxation of the income of citizens of the EAEU countries on the territory of Russia with personal income tax is no different from the imposition of this tax on the income of Russian citizens. There is only one difference - citizens of the EAEU countries do not have the right to tax deductions. I wrote about what they are and how you can get them in previous publications:

“Part of the payment for your education, including driving school, courses and trainings, can be returned through personal income tax”

“Refund through personal income tax of tuition fees for children under 24 years of age, incl. distance learning, for university, kindergarten, clubs