Labor guarantees for seasonal workers

Labor relations between an employer and a seasonal worker are regulated by the provisions of the Labor Code of the Russian Federation. An employer engages a citizen in seasonal work by concluding a fixed-term employment contract with him. The period of validity of the agreement is determined in accordance with weather and climatic conditions affecting the execution of work.

A sample employment contract with a seasonal worker can be downloaded here ⇒ Employment contract with a seasonal worker.

The Labor Code of the Russian Federation provides seasonal workers with the following labor guarantees:

- paid days of rest according to Art. 295 Labor Code of the Russian Federation;

- payment for the period of absence from work due to temporary incapacity for work on the basis of sick leave;

- payment of severance pay upon dismissal due to reduction.

When engaging an employee in seasonal work, the employer sets a work schedule and fixes it in local regulations and an employment contract. The period of work of a seasonal worker during the reporting period should not exceed the standards established by the production calendar.

If the period of work of a seasonal employee exceeds the established norms, the employer will calculate and pay an additional payment for overtime:

- in the amount of 150% of the hourly tariff rate for each hour of overtime (the first 2 hours);

- in the amount of 200% of the hourly tariff rate for each hour of overtime (subsequent hours).

Additional payment is also provided for attracting a seasonal employee to work on weekends, holidays, and night hours (from 23:00 to 06:00).

Seasonal workers have all labor rights according to the Labor Code of the Russian Federation

For many employers operating in the fishing industry, the spring-summer period is the period for attracting additional workers to perform temporary work. These works are seasonal in nature, and, as a rule, in the territory of a certain region, workers are also attracted from other regions to perform them. At the end of the fishing season, various authorities receive numerous appeals from seasonal workers about violations of their labor rights by employers. Meanwhile, the legal regulation of labor relations with persons employed in seasonal work has a number of features. Seasonal, in accordance with Part 1 of Article 293 of the Labor Code of the Russian Federation (hereinafter referred to as the Labor Code of the Russian Federation), are recognized as works that, due to climatic and other natural conditions, are performed during a certain period (season), not exceeding, as a rule, 6 months. Article 295 of the Labor Code of the Russian Federation establishes a special procedure for granting leave to seasonal workers: “Employees engaged in seasonal work are provided with paid leave at the rate of two working days for each month of work.” In addition, seasonal workers, on the basis of Article 127 of the Labor Code of the Russian Federation, can use vacation with subsequent dismissal (except for cases of dismissal for guilty actions). In this case, the day of dismissal is considered the last day of vacation, even if it extends beyond the term of the employment contract. If a seasonal employee does not use his vacation, he must be paid monetary compensation upon dismissal. Seasonal workers are generally entitled to temporary disability benefits. In addition, for seasonal workers, in cases provided for by law, work for a full season is counted towards their length of service, which entitles them to a pension for a full year of work.

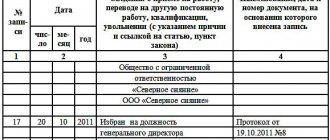

Contracts with seasonal workers are a type of fixed-term employment contracts. Article 59 of the Labor Code of the Russian Federation directly provides for them the basis for concluding an agreement: “for the performance of seasonal work, when, due to natural conditions, the work can only be carried out during a certain period (season).” The general provisions of labor legislation on fixed-term employment contracts apply to employment contracts with seasonal workers, with some features established by Chapter 46 of the Labor Code of the Russian Federation. The condition regarding the seasonal nature of work, according to Article 294 of the Labor Code of the Russian Federation, must be specified in the employment contract with a seasonal worker. Documentation of labor relations with a seasonal worker is carried out on the general basis provided for by labor legislation for employment. An employment contract with seasonal workers is concluded in writing, on its basis an order (instruction) of the employer is issued on hiring and entries are made in the employee’s work book and other personnel documents. The probationary period for seasonal workers cannot exceed 3 months. The provision for testing an employee in order to verify his suitability for the assigned work must be specified in the employment contract. The absence of a probationary clause in the employment contract means that the employee was hired without a trial. As a general rule, a fixed-term employment contract is terminated upon expiration of its validity period, of which the employee must be notified in writing at least 3 calendar days before dismissal. If the employee, after the expiration of the fixed-term employment contract, actually continues to work and the employer has not demanded termination of the employment contract due to the expiration of its term, then the employment contract is considered to be concluded for an indefinite period. An employee engaged in seasonal work may, on his own initiative, terminate his employment contract with the employer early. The employee must notify the employer in writing about the early termination of the contract 3 calendar days in advance. On the last day of work of a seasonal worker, he must be paid wages and compensation for unused vacation. Thus, in order to avoid negative consequences, before going to work in hard-to-reach areas, citizens must request an employment contract from the employer, one copy of which must remain with the employee, read it carefully, paying special attention to the clauses of the contract regulating the procedure, terms , place of payment of wages and its amount.

How many days of vacation for a seasonal worker?

According to Art. 293 of the Labor Code of the Russian Federation, the employer is obliged to provide a seasonal employee with paid leave at the rate of 2 working days for each month of work . This means that, after working a full calendar month, a seasonal employee can go on vacation for 2 days; after working for 2 months, he can take a vacation for 4 days, etc.

In general, the minimum period of continuous work at the enterprise for taking leave is 6 calendar months. However, this requirement does not apply to persons hired to work under a fixed-term employment contract.

A seasonal employee can take a vacation for 2 days after continuous work for the 1st calendar month. In exceptional cases, by prior agreement with the employer, leave may be granted earlier - after 2 weeks of work. In this case, the rest period will be 1 day.

We emphasize that seasonal workers are subject to the general provisions of labor legislation, in accordance with which an employee can take leave without pay, regardless of the period worked at the enterprise.

Let's look at an example . 07/01/2021 Dubkov S.D. got a job at Sadovod LLC. Dubkov’s employment contract was drawn up taking into account the following provisions:

- the contract period is from 07/01/2021 to 10/01/2021 (3 months);

- Dubkov is involved in the work of harvesting apples.

On August 1, 2021, Dubkov took a 2-day vacation (from August 7 to August 8).

On August 15, 2021, Dubkov again turned to the management of Sadovod LLC to arrange a vacation for 2 days - from August 20 to 22, 2021. Since Dubkov used 2 days of vacation accrued for July earlier, and for the first 2 weeks of August Dubkov was accrued 1 vacation day, rest days from August 20 to 22 are issued to Dubov in the following order:

- 08.2021 – 1 day of annual paid leave;

- 08.2021 – 1 day of vacation at your own expense.

Leave for seasonal workers

Despite the fact that seasonal work involves concluding an employment contract for a certain period of time, the so-called fixed-term employment contract, seasonal workers, like permanent employees, have the right to apply for paid leave. We will talk about the features of providing leave to seasonal workers in this article.

Section is devoted to the peculiarities of labor regulation of certain categories of workers. XII Labor Code of the Russian Federation (hereinafter referred to as the Labor Code of the Russian Federation), Ch. 46 of which the specifics of labor regulation for workers engaged in seasonal work are established.

Seasonal work is work that is performed during a certain period (season) due to climatic and other natural conditions. The duration of the season, as a rule, does not exceed six months (Article 293 of the Labor Code of the Russian Federation). Meanwhile, sometimes the duration of seasonal work can exceed six months. Lists of seasonal work, including individual seasonal work, which can be carried out over a period (season) exceeding six months, and the maximum duration of these individual seasonal works are determined by industry (inter-industry) agreements concluded at the federal level of social partnership.

Examples of Industry Agreements include:

- Industry agreement on the timber industry complex of the Russian Federation for 2015 - 2021, approved by the All-Russian industry association of employers “Union of Timber Industrialists and Timber Exporters of Russia, Trade Union of Forestry Workers of the Russian Federation on December 26, 2014;

- Industry agreement on organizations of the timber industry complex of the Russian Federation for 2015 - 2021, approved by the Trade Union of Forestry Workers of the Russian Federation, the All-Russian Industry Association of Employers of the Pulp and Paper Industry, the All-Russian Industry Association of Employers of the Furniture and Woodworking Industry on December 19, 2014;

- Federal industry agreement on automobile and urban ground passenger transport for 2014 - 2021, approved by the All-Russian Trade Union of Automobile Transport and Road Workers, the Non-Profit Organization Russian Motor Transport Union on October 24, 2013;

- Industry tariff agreement in the housing and communal services of the Russian Federation for 2014 - 2021, approved by the Ministry of Regional Development of Russia, the All-Russian industry association of employers “Union of Utility Enterprises”, the All-Russian Trade Union of Essential Workers on September 9, 2013.

To determine the categories of work classified as seasonal, you can be guided by the List of seasonal work, approved by Decree of the People's Commissariat of Labor of the USSR dated October 11, 1932 N 185. According to this List, seasonal work includes, in particular, icebreaking work, snow and ice removal work , logging, rafting and related work, peat work. In addition to this List, employers may be guided by:

- A list of seasonal industries in which work in organizations during a full season when calculating the insurance period is taken into account so that its duration in the corresponding calendar year is a full year, approved by Decree of the Government of the Russian Federation of July 4, 2002 N 498;

- A list of seasonal work and seasonal industries, work in enterprises and organizations of which, regardless of their departmental affiliation, for a full season is counted towards the length of service for a pension for a year of work, approved by Resolution of the Council of Ministers of the RSFSR dated July 4, 1991 N 381;

- The list of seasonal industries and types of activities used when granting a deferment or installment plan for tax payment, approved by Decree of the Government of the Russian Federation of April 6, 1999 N 382.

Since seasonal work implies the establishment of an employment relationship only for a certain period, a fixed-term employment contract is concluded with employees hired to perform it, as follows from Art. 59 Labor Code of the Russian Federation.

Please note that the general provisions of labor legislation on fixed-term employment contracts apply to employment contracts with seasonal workers, with some features established by Chapter. 46 Labor Code of the Russian Federation.

So, according to Art. 294 of the Labor Code of the Russian Federation, when concluding such an employment contract, it must necessarily provide for a condition regarding the seasonal nature of the work. If the contract does not contain a provision regarding the seasonal nature of the work, then it is considered concluded for an indefinite period. This means that the specifics of labor for temporary workers in this case do not apply even when the work can be objectively classified as seasonal.

The validity period of an employment contract for seasonal work is determined by agreement of the parties, but, as a rule, does not exceed 6 months.

In general, a fixed-term employment contract is terminated upon expiration of its validity period. An employment contract concluded to perform seasonal work during a certain period (season) is terminated at the end of this period (season). The employee must be notified in writing of the termination of the employment contract at least three calendar days before dismissal (Article 79 of the Labor Code of the Russian Federation).

It should be recalled that during the entire term of the employment contract, this contract can be terminated at any time by agreement of the parties. This rule is provided for in Art. 78 of the Labor Code of the Russian Federation and applies to all types of employment contracts - both fixed-term and concluded for an indefinite period.

If the initiator of early termination of the employment contract is an employee, then this employee is obliged to notify the employer about this in writing three calendar days before dismissal (Article 296 of the Labor Code of the Russian Federation).

If an employment contract concluded with a seasonal worker is terminated by the employee due to the liquidation of the organization, reduction of its number or staff, then the employer is obliged to notify the employee of the upcoming dismissal in writing, against signature, at least seven calendar days in advance.

Note! A fixed-term employment contract with a pregnant woman cannot be terminated. Article 261 of the Labor Code of the Russian Federation establishes that in the event of expiration of a fixed-term employment contract during a woman’s pregnancy, the employer is obliged, upon her written application and upon presentation of a medical certificate confirming the state of pregnancy, to extend the term of the employment contract until the end of pregnancy, and if she is granted leave in the prescribed manner for pregnancy and childbirth - until the end of such leave.

Taking into account the provisions of Part 2 of Art. 261 of the Labor Code of the Russian Federation, a fixed-term employment contract cannot be terminated until the end of pregnancy. The pregnancy status is confirmed by a medical certificate provided by the woman at the request of the employer, but not more than once every three months.

A fixed-term employment contract is extended until the end of a woman’s pregnancy, regardless of the reason for the end of the pregnancy (birth of a child, spontaneous miscarriage, abortion for medical reasons, etc.), as stated in paragraph 27 of the Resolution of the Plenum of the Supreme Court of the Russian Federation dated January 28, 2014 No. 1 “On the application of legislation regulating the labor of women, persons with family responsibilities and minors.”

In the event of the birth of a child, the dismissal of a woman due to the end of a fixed-term employment contract is carried out on the day the maternity leave ends. In other cases, a woman may be fired within a week from the day the employer learned or should have learned about the end of the pregnancy.

According to Art. 114 of the Labor Code of the Russian Federation, every employee has the right to annual paid leave, the minimum duration of which is according to the general rule established by Art. 115 of the Labor Code of the Russian Federation is 28 calendar days.

However, this rule does not apply to workers engaged in seasonal work, since for them labor legislation, namely Art. 295 of the Labor Code of the Russian Federation, there is a special procedure for calculating the duration of vacation and vacation is provided to such employees in working days, and not in calendar days, as in the general case.

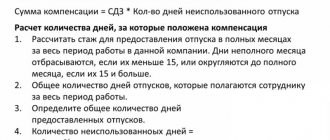

So, on the basis of Art. 295 of the Labor Code of the Russian Federation, employees engaged in seasonal work are provided with paid leave at the rate of two working days for each month of work. Therefore, if an employee has worked under a contract, for example, for four full months, then he should be given paid leave of eight working days. If an employee has worked under a contract, for example, for four months and twelve days, then he should be given a vacation of eight working days, since when determining the number of vacation days, surpluses amounting to less than half a month are excluded from the calculation. Surplus amounts of half a month or more are rounded up to the nearest full month. It is precisely this rule that is enshrined in paragraph 35 of the Rules on regular and additional leaves, approved by the People's Commissariat of Labor of the USSR on April 30, 1930 N 169, currently in force in the part that does not contradict the Labor Code of the Russian Federation.

Please note that the organization has the right in its local regulations to establish a different procedure for rounding days worked to calculate the number of vacation days for seasonal employees, but not worsening the general rights of employees.

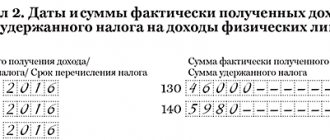

The amount of vacation pay is calculated based on the employee’s average daily earnings, as established by Art. 139 of the Labor Code of the Russian Federation, as well as the Regulations on the specifics of the procedure for calculating average wages, approved by Decree of the Government of the Russian Federation of December 24, 2007 N 922 “On the specifics of the procedure for calculating average wages” (hereinafter referred to as Regulation No. 922).

The average daily earnings of an employee are calculated by dividing the amount of actually accrued wages for the period of the employment contract by the number of working days according to the calendar of a 6-day working week, as indicated in paragraph. 5 tbsp. 139 Labor Code of the Russian Federation, clause 11 of Regulation No. 922.

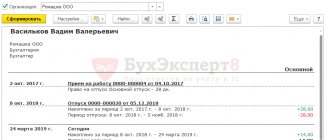

× Example. The organization entered into an employment contract with a seasonal worker, according to which the employee was hired from June 1, 2015 to September 30, 2015. In accordance with the terms of the contract, the organization pays him a monetary remuneration in the amount of 60,000 rubles.

The number of working days in terms of a 6-day working week for this period is 104 days (in June - 25 days, in July - 27 days, in August - 26 days, in September - 26 days).

Since the employee worked 4 full calendar months, he was granted 8 working days of leave.

Let's determine the average daily earnings of an employee:

60,000 rub. / 104 days = 576.92 rubles.

Let's calculate the amount of vacation pay:

RUB 576.92 x 8 days = 4615.36 rub.

× Example. The organization entered into an employment contract with a seasonal employee, according to which the employee was hired from June 1, 2015 to August 31, 2015. After some time, the employee wrote an application for early termination of the employment contract, on the basis of which he resigned for family reasons from July 10 2015

For the period worked, the employee was accrued remuneration in the amount of 16,000 rubles.

The number of working days in terms of a 6-day working week for this period is 34 days (in June - 25 days, in July - 9 days).

The organization’s accounting policy establishes that the rounding of days worked by seasonal workers to calculate the number of vacation days is carried out as follows: surpluses amounting to less than half a month are excluded from the calculation. Surplus amounts of half a month or more are rounded up to the nearest full month.

It follows that for the time worked, a seasonal worker should be granted leave of 2 working days.

Let's determine the average daily earnings of an employee:

16,000 rub. / 34 days = 470.59 rub.

Let's calculate the amount of vacation pay:

RUB 470.59 x 2 days = 941.18 rub.

It should be noted that it will most likely not be possible for a seasonal employee to exercise the right to leave while working under an employment contract. Therefore, leave is granted, as a rule, after the expiration of the contract and is formalized as leave with subsequent dismissal. Moreover, on the day of dismissal in this case, in accordance with paragraph. 3 tbsp. 127 of the Labor Code of the Russian Federation is considered the last day of vacation.

Vacation pay is paid based on the employee’s application no later than three days before it begins. This is indicated by Art. 136 Labor Code of the Russian Federation.

Please note that instead of vacation leave upon dismissal, a seasonal employee has the right to receive monetary compensation, which is calculated in the same manner as vacation pay, that is, based on the employee’s average daily earnings (Article 139 of the Labor Code of the Russian Federation, clause 11 of Regulation No. 922), and also based on the number of days of unused vacation upon dismissal (Article 295 of the Labor Code of the Russian Federation).

Compensation for unused vacation is paid to a seasonal employee on the day of his dismissal, that is, on the day of termination of the employment contract, as established by Art. Art. 84.1, 140 Labor Code of the Russian Federation. If the employee did not work on that day, then this amount must be paid no later than the next day after the dismissed employee submits a request for payment.

If a seasonal employee has the right to additional paid leave on the basis of Art. 116 of the Labor Code of the Russian Federation (for example, for work with harmful and dangerous working conditions, irregular working hours), then this leave should be calculated according to the general rules.

Applying for leave for a seasonal worker: step-by-step instructions

Registration of leave for a seasonal employee is carried out in the general manner - based on the employee’s application to the employer.

Below are instructions that describe the features of registering vacation and calculating vacation pay for a seasonal employee.

Step 1. Preparing an application

At the first stage, an employee involved in seasonal work draws up an application for leave and submits it to the employer.

The application is drawn up in the general manner and does not have any special features compared to the application drawn up when applying for leave under a standard employment contract.

The application form is not approved by law; the document is drawn up in free form, indicating the following information:

- name of company;

- Full name, position of the manager in whose name the application is being submitted;

- Full name, position of seasonal worker;

- vacation period (from _____ to _____), number of days (___days);

- basis for granting leave (Article 295 of the Labor Code of the Russian Federation);

- date of application.

A sample application form can be downloaded here ⇒ Application for leave for a seasonal worker.

Once completed, the employee signs the document and submits it to the manager for approval.

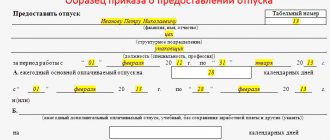

Step #2. Issuance of an order

Based on the application, the employer issues an order to grant the employee leave.

The order must be drawn up and signed by the manager no later than the day the vacation begins.

After drawing up the document and signing it by the manager, one copy of the order is given to the seasonal worker for review (“Acquainted”, employee’s full name, signature, date).

A sample order can be downloaded here ⇒ Leave order for a seasonal worker.

Step #3. Calculation of average earnings for vacation pay

An employer providing annual leave to a seasonal employee is obliged to pay for days of rest in accordance with the norms of the Labor Code, namely to pay vacation pay in the amount of average daily earnings for each day of rest:

VacationSeason = WedDearSeason*PeriodOpt,

where Vacation season is the total amount of vacation pay accrued during the vacation period; Average daily earnings for the billing period; PeriodOtp – vacation period in calendar days.

When calculating the average earnings of a seasonal worker, the employer takes into account the entire amount of income paid to the employee within the pay period, which generally does not exceed the term of the employment contract, namely:

- salary calculated according to the tariff rate;

- additional payment for overtime, work on weekends, holidays, night shifts;

- awards.

If during the validity of a fixed-term employment contract a seasonal employee was on vacation at his own expense or was absent due to illness, then such periods are excluded from the calculation period. Payment of benefits for the period of incapacity for work accrued on the basis of sick leave is not included in the calculation of the average earnings of a seasonal worker.