Source:

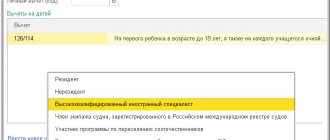

1. The company paid the employee on the day of dismissal 2. The company paid the employee the day before the dismissal 3. The company withheld vacation pay upon dismissal 4. The company paid wages to the dismissed employee late 5. The company issued wages and benefits on the day of dismissal 6. The company upon dismissal paid severance pay 7. The company paid the dismissed employee on the last day of the reporting period 8. Several employees quit in the first quarter 9. The employee went on vacation with subsequent dismissal 10. The employee went on a business trip before dismissal

The company paid the employee on the day of dismissal

The company paid the employee on the day of dismissal - gave him a salary and compensation for unused vacation.

Upon dismissal, the employee receives income in the form of salary on the last working day (Clause 2 of Article 223 of the Tax Code of the Russian Federation).

Compensation for unused vacation days is not a salary. The date of receipt of income is the day of payment. Since the company paid the employee on the last working day, the dates in line 100 match. Tax on both payments must be withheld on the same day.

Compensation for unused vacation is not vacation pay. The deadline for transferring personal income tax on this amount is the day following the payment, as for salary. All three dates in lines 100–120 match. This means that compensation and salary should be reflected in one block of lines 100–140.

For example.

The employee resigned on June 16. On this day, the company gave him a salary for June - 28,000 rubles, and withheld personal income tax from it - 3,640 rubles. (RUB 28,000 × 13%). The company also transferred vacation compensation - 18,000 rubles, and withheld personal income tax - 2,340 rubles. (RUB 18,000 × 13%). The date of receipt of salary income is the last working day. That is June 16th. For vacation compensation - the day of payment. Also June 16th. The deadline for transfer is June 17. The dates on lines 100–120 are the same, so the company reported them together. The amount of income is 46,000 rubles. (28,000 + 18,000), personal income tax - 5980 rubles. (3640 + 2340). The company filled out Section 2 as in sample 84.

Sample 84. How to fill in the payment calculation on the day of dismissal:

Top

basic information

All income of individuals must be reflected in the personal income tax form. The employer pays taxes for the employee. This also applies to the moment of dismissal of an employee. Not all income is subject to taxation. For example, severance pay is paid only if the minimum three-month average salary is exceeded. Basic income, including salary and compensation for vacations, is required to be reflected.

Important! Deductions from amounts paid must be withheld on the day of payment. For example, if an employee quits and receives a salary for the period worked, then the full amount of tax must be withheld from it at the time of calculation. This point is mandatory.

It is also worth paying attention to the payment date. If the calculation was made the next day after dismissal, then this date is written in column 110. The day of dismissal in this case will be different. It is written in column 100.

It is worth considering that various situations do not provide for the option of not reflecting wage payments in 6 personal income taxes. All data must be entered correctly. This applies to both calculations and dating. If, during an audit, the tax authority discovers a discrepancy, then penalties may be applied to the organization.

Important! Reporting for any type of personal income tax is handled by the employer or chief accountant. They must have relevant experience and skills. This is due to the fact that there should not be errors in such documents. This also applies to spelling. All norms and rules for filling out reports are observed on legal grounds.

The rules for filling out reports in Form 6 of personal income tax are regulated by the Tax Code. There are several important nuances here. The main thing is that the two forms of personal income tax are not interchangeable, that is, reporting must be submitted depending on the deadlines for 2 personal income tax and 6 personal income tax. 2 Personal income tax is submitted to the tax authority no later than 1.04 of the year following the reporting period, and 6 Personal income tax must be provided quarterly with a maximum date no later than the end of the month that followed the quarter. These deadlines are not related to the transfer of contributions, which after dismissal have their own established deadlines.

Read on topic: Compensation for unused vacation upon dismissal in 6 personal income tax

Read on the topic: Dates for receiving income in 6 personal income tax upon dismissal. Transfer deadlines

The company paid the employee the day before dismissal

The company issued wages and compensation for unused vacation days the day before dismissal. On the same day, the company withheld and transferred personal income tax from these payments.

The Code establishes a special date for receiving income in the form of wages in the event that an employee resigns. Personal income tax must be calculated on the last working day (clause 2 of Article 223 of the Tax Code of the Russian Federation). If the company issued the money earlier, then it withheld tax until the date the income was received.

In this case, in line 100, enter the date of receipt of income according to the code - the last working day. And in line 110 - the day of payment. The date on line 110 will be earlier than the date on line 100. But the program will skip this calculation.

There should be no problems with personal income tax. Inspectors allow tax to be withheld from wages issued before the date of receipt of income.

Compensation for unused vacation days is not a salary. The employee receives such income on the day of payment (subclause 1, clause 1, article 223 of the Tax Code of the Russian Federation). This means that the dates in line 100 for salary and compensation will not match. Complete them in different blocks of lines 100–140.

For example

The employee resigns on June 16th. On June 15, the company gave the employee a salary and compensation for unused vacation. Compensation - 9000 rubles, personal income tax - 1170 rubles. (RUR 9,000 × 13%). Salary - 26,000 rubles, personal income tax - 3,380 rubles. (RUB 26,000 × 13%). The date of receipt of income for salary is 06.16.2016, for compensation - 06.15.2016. Therefore, the company completed two blocks of lines 100–140, as in sample 85.

Sample 85. How to fill in the payment calculation the day before dismissal:

Top

The company withheld vacation pay upon dismissal

In the first quarter, the employee took his vacation in advance, and in the second quarter he quits. On the day of dismissal, the company withheld vacation pay from the salary for rest days that the employee did not work.

An employee can take vacation time in advance. But upon dismissal, the company has the right to withhold vacation pay for unworked rest days (Article 137 of the Labor Code of the Russian Federation). The company withholds personal income tax from vacation pay at the time of payment. Therefore, if an employee returns vacation pay, the tax must be recalculated.

In this case, personal income tax is not excessively withheld, because the company correctly calculated it on the date of issue of money. In addition, the employee will return only the amount he received, that is, minus personal income tax. This means that the company will not refund the tax to the employee.

The company will be overpaid for personal income tax. To get it back, some tax officials suggest applying for a refund. Others allow the next payment to the budget to be reduced by the recalculated tax. Do as your inspector recommends.

There is no error in the period when the company issued vacation pay. Therefore, do not specify the calculation for the previous quarter. In the current quarter, adjust section 1 - reduce income in line 020 for vacation pay. Reflect the calculated and withheld personal income tax minus the tax on excess vacation pay (letter of the Federal Tax Service of Russia dated May 24, 2016 No. BS-4-11/9248).

As for the salary upon dismissal in Section 2, the procedure for filling out depends on whether the employee returns vacation pay or the company withholds it itself from the last salary. If the employee returned the money to the cashier, show the salary in the amount in which it was accrued. If the company reduces wages for vacation pay, show the income minus the amount withheld. From the same amount, calculate and transfer personal income tax.

For example

The employee quits on April 15. On this day, the company gave him his salary for April. Accrued salary - 18,000 rubles. From this amount, the company withheld vacation pay - 3,000 rubles. (amount to be charged).

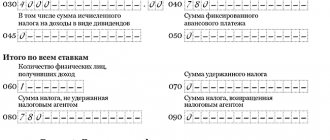

Section 1.

In line 020 for the first quarter, the company recorded the employee’s income including vacation pay - 160,000 rubles. Personal income tax in lines 040 and 070 - 20,800 rubles. (RUB 160,000 × 13%). In the second quarter, the company increased income in line 020 by salaries for April and decreased by withheld vacation pay - 175,000 rubles. (160,000 + 18,000 – 3000). Personal income tax - 22,750 rubles. (RUB 175,000 × 13%).

Section 2.

In fact, the company reduced the accrued salary for vacation pay. Therefore, she showed 15,000 rubles in the calculation. (18,000 - 3000). In line 140 I wrote down personal income tax on this amount - 1950 rubles. (RUB 15,000 × 13%). The date of receipt of income is 04/15/2016. The company filled out the calculation as in sample 86.

Sample 86. How to reflect the salary from which the company withheld vacation pay:

Top

How to reflect the dismissal of an employee in 6-NDFL if the vacation was taken in advance

Let's consider a particular situation when an employee has been given leave in advance and has not worked it out on the day of dismissal. In this case, the employee is deducted for unworked vacation days. In this case, the employee’s personal income tax base is reduced by the amount of deduction. Therefore, in the reporting form it is necessary to show the amounts of the final payment minus the deduction for unworked vacation.

Let's return to our example: let the employee not receive compensation, but a deduction for unworked vacation in the amount of 5,000 rubles.

What should you do if the accrued final payment turns out to be less than the deduction for unworked vacation? It is impossible to reflect the amounts of accruals and taxes in the report with a minus. In this case, you will have to submit an updated 6-NDFL report for the period in which vacation pay was paid. In this report you will have to reduce the amount of accrued vacation pay.

- recommendations and assistance in resolving issues

- regulations

- forms and examples of filling them out

The company paid the dismissed employee's salary late

The employee quit. The company gave him his salary only a few days after his dismissal.

Upon dismissal, the date of receipt of income in the form of salary is the last working day (clause 2 of Article 223 of the Tax Code of the Russian Federation). As of this date, the company calculates personal income tax. It doesn't matter when the company issues the money. In line 020 of section 1 of the calculation, include income in the period in which it was accrued. But the company will be able to withhold personal income tax only upon payment.

If the company did not withhold personal income tax in the reporting period. Reflect the income in line 020, and the calculated tax in line 040. Do not show the withheld tax in line 070, as well as in section 2 of the half-year calculation (letter of the Federal Tax Service of Russia dated May 16, 2016 No. BS-4-11/8609).

If the company withheld personal income tax in the reporting period. Reflect the income in line 020, the calculated personal income tax in line 040, and the withheld income in line 070. Reflect the payments in section 2. In line 100, write down the day the employee was dismissed. In line 110 - the date of payment, in line 120 - the next business day.

For example.

The employee resigned on May 16. On this day, the company calculated his salary for May - 34,000 rubles, and calculated personal income tax - 4,420 rubles. (RUB 34,000 × 13%). The company transferred the money only on June 1. On this day I withheld and transferred personal income tax. The date of receipt of income is 05/16/2016, personal income tax withholding is 06/01/2016. The company filled out the calculation as in sample 87

Sample 87. How to fill out a calculation if the company delayed wages upon dismissal:

Top

The company issued wages and benefits on the day of dismissal

The employee brought in sick leave, and a few days later he quit. The company provided the employee with salary and sick pay on the same day.

Upon dismissal, the employee receives income in the form of salary on the last working day (Clause 2 of Article 223 of the Tax Code of the Russian Federation). For benefits, the date of receipt of income is the day of payment (subclause 1, clause 1, article 223 of the Tax Code of the Russian Federation). Since the company issued benefits and wages on the day of dismissal, the dates in lines 100 match. The company withholds tax on the day of payment. But personal income tax from wages must be transferred no later than the next day. And from benefits - no later than the last day of the month in which the company issued the money (clause 6 of Article 226 of the Tax Code of the Russian Federation). The dates in lines 120 do not match. This means that payments should be filled out in two different blocks of lines 100–140.

For example

The employee resigned on May 24. On this day, the company gave the employee a salary for May - 29,000 rubles, personal income tax - 3,770 rubles. (29,000 rubles × 13%) and sickness benefits - 9,000 rubles, personal income tax - 1,170 rubles. (RUR 9,000 × 13%). The date of receipt of income and withholding of personal income tax for both payments is 05/24/2016. The deadline for transferring taxes from wages is 05.25.2016, from benefits - 05.31.2016. The company filled out payments in different blocks of lines 100–140, as in Sample 88.

Sample 88. How to reflect benefits and wages issued on the day of dismissal:

Top

How to reflect the payment of dividends in 6-NDFL

Another difficult point that we will talk about is how dividends paid are reflected in the report. They must be reflected separately in section 1. The rate for residents is set at 13%, therefore dividends paid to them are reflected in the same block with accruals to employees. But they are highlighted in line 025 of section 1.

The rate for non-residents is set at 15%. If the founder is a non-resident, then Section 1 must also be completed for dividends.

The procedure for withholding income tax for dividends has no special features: it must be withheld on the day of payment, and transferred no later than the next business day.

Using the conditions of the first example, let’s supplement it: on July 25, dividends were paid to the resident founder in the amount of 100,000 rubles.

Upon termination of an employment contract, the employee must receive from the employer all payments due to him on the day of his dismissal (Article 140 of the Labor Code of the Russian Federation). And at the end of the quarter, the employer reflects payments to this employee in the calculation of 6-NDFL.

The company paid severance pay upon dismissal

The employee resigned by agreement of the parties. Upon dismissal, the company provided severance pay.

Three average earnings upon dismissal are exempt from personal income tax (clause 3 of article 217 of the Tax Code of the Russian Federation). If the company issued compensation within these amounts, it has the right not to reflect them in 6-NDFL.

If the company issued more, reflect in the calculation only the amount that exceeds three average earnings. Write it down in line 020 of the calculation and line 130. The date of receipt of income and withholding of personal income tax is the day of payment. Reflect this date in lines 100 and 110. And in line 120 put the next day.

For example

The company fired the employee by agreement of the parties. On May 20, she paid him severance pay - 90,000 rubles. This is 20,000 rubles. higher than three times average earnings. The company withheld personal income tax from the difference - 2,600 rubles. (RUB 20,000 × 13%). The date of receipt of income is 05/20/2016. The next day, May 21, falls on a weekend, so the company reflected the nearest working day in line 120—05/23/2016. She filled out section 2 as in sample 89.

Sample 89. How to reflect severance pay upon dismissal in the calculation:

Top

How to fill out 6-NDFL upon dismissal

Since full payment to the employee is made on the last day of work, this is the date of actual receipt of income. Only payments subject to personal income tax are reflected in 6-NDFL:

- salary;

- compensation for unused vacation.

Severance pay paid in the event of staff reduction, liquidation of an organization and in other cases established by law is not subject to personal income tax. Therefore, there is no need to enable it. The severance pay paid upon dismissal by agreement of the parties is taxed in excess of three months' average earnings. This excess and the tax on it are included in the report.

The company paid the dismissed employee on the last day of the reporting period

The employee resigned on the last day of the quarter—June 30. On this day, the company issued a calculation and withheld personal income tax.

The date of receipt of income in the form of salary is the day of dismissal (clause 2 of Article 223 of the Tax Code of the Russian Federation). And the deadline for tax transfer is the next working day (clause 6 of Article 226 of the Tax Code of the Russian Federation). The employee resigned on the last day of the quarter—June 30. This means that the deadline for transferring personal income tax fell on the next reporting period - July 1.

In section 2 of the 6-NDFL calculation, the payment must be reflected in the period in which the operation is completed. The Federal Tax Service clarified that the operation was completed in the period in which the deadline for personal income tax payment falls (letter of the Federal Tax Service of Russia dated October 24, 2016 No. BS-4-11 / [email protected] ). This means that section 2 should be completed in the reporting for nine months. In this case, reflect the salary in section 1 of the calculation for the six months.

For example

The company fired the employee on June 30. On this day, I paid out a salary - 76,000 rubles, calculated and withheld personal income tax - 9,880 rubles. (RUB 76,000 × 13%). The date of receipt of income and withholding of personal income tax is 06/30/2016. The deadline for tax payment is 07/01/2016. The company withheld tax in the second quarter, so it reflected the payment in section 2 of the calculation for nine months as in sample 90.

Sample 90. How to fill out section 2 if the personal income tax payment deadline falls in the next quarter:

Top

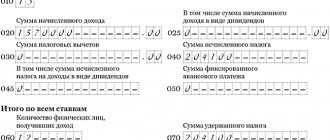

Filling out 6-NDFL when dismissing an employee: example

If you reflect the dismissal of an employee in the middle of the month in 6-NDFL, then everything is simple. We reflect the accrued amounts and personal income tax in section 1, and in the second - payments to the employee, withheld and transferred tax in one block.

Let's show it with a hypothetical example. On October 12, 2019, an employee quits. He was credited with:

- salary for October - 10,000 rubles;

- compensation for vacation - 5000 rubles.

The tax withheld was:

Dismissal in 6-NDFL: example of filling out 2019

Several times, the Federal Tax Service explained the procedure for filling out a report if the day of completion of work fell on the last working day of the quarter (for example, Letter dated November 2, 2016 No. BS-4-11 / [email protected] ). In this case, the last date for transferring personal income tax moves to the next quarter. In this case, the accrued final payment and the tax on it must be reflected in section 1. But in the second section there is no need to reflect these amounts in the dismissal quarter. They should be included in this section in the next quarter in which the tax payment date falls.

Several employees left in the first quarter

In March, several employees quit, whose income the company reflected in the calculation of 6-personal income tax for the first quarter.

The company fills out section 1 of the calculation with a cumulative total (clause 3.1 of the Procedure, approved by order of the Federal Tax Service of Russia dated October 14, 2015 No. ММВ-7-11 / [email protected] ). Including line 060, which counts the number of “physicists” who received income in the reporting period. Therefore, even if employees quit last quarter and no longer received income, they need to be counted in line 060 of the half-year calculation.

For example

In the calculations for the first quarter, the company reflected the income of 15 “physicists”. In line 020 I wrote down 600,000 rubles, in lines 040 and 070 the calculated and withheld personal income tax from this amount is 78,000 rubles. (RUB 600,000 × 13%). At the end of the first quarter, 5 employees left and were no longer receiving income from the company. For April, May and June, the company paid income to the 10 remaining employees - 450,000 rubles, calculated and withheld personal income tax - 58,500 rubles. (RUB 450,000 × 13%).

The company reflected income and personal income tax on an accrual basis. In line 020 - 1,050,000 rubles. (600,000 + 450,000), in lines 040 and 070 - 136,500 rubles. (78,000 + 58,500). In line 060, the company counted all the “physicists” to whom it accrued and paid income during the six months. In the first quarter, 15 employees received income, in the second, 10 employees out of the same 15 people. The second time, the company did not take into account the “physicists”, but included those laid off in the calculation. The company filled out Section 1 of the calculation as in sample 91.

Sample 91. How to reflect dismissed employees in the calculation:

Top

The employee went on vacation and was subsequently fired

The employee went on vacation and was subsequently fired. The company gave him a paycheck and vacation pay.

Upon dismissal, the employee receives salary income on the last working day for which the company accrued money (Clause 2 of Article 223 of the Tax Code of the Russian Federation). If an employee goes on vacation with subsequent dismissal, the date of termination of the contract is considered the last day of vacation (Part 2 of Article 127 of the Labor Code of the Russian Federation). But the company pays off and issues a work book before the vacation (Part 4 of Article 84.1 of the Labor Code of the Russian Federation). The last day for which the company calculates wages is the last working day before vacation. This means that this is the date of receipt of income.

No later than three calendar days before the start of the vacation, the company transfers vacation pay. On this day the employee receives income. The deadline for transferring tax on this payment is the last day of the month in which the company issued the money (letter of the Federal Tax Service of Russia dated May 11, 2016 No. BS-3-11 / [email protected] ). This day should be written on line 120.

For example

The employee went on vacation and was subsequently fired. The last working day before vacation is May 20. And the date of termination of the employment contract is June 10.

Vacation pay. On May 16, the company issued vacation pay - 32,000 rubles, personal income tax - 4,160 rubles. (RUB 32,000 × 13%). The deadline for transferring personal income tax from vacation pay is 05/31/2016.

Salary. The company paid the employee on the last working day before the vacation - May 20. I gave him a salary - 58,000 rubles, personal income tax - 7,540 rubles. (RUB 58,000 × 13%). The deadline for transferring personal income tax is May 21, which happened to be a weekend. Therefore, in line 120 the company wrote 05/23/2016.

In section 2, the company filled out payments as in sample 92.

Sample 92. How to fill out a calculation if an employee goes on vacation with subsequent dismissal:

Top

6-NDFL upon dismissal: sample filling when paying wages for the months preceding dismissal

If, before the day of termination of the employment contract, the employee has not yet received wages for the period preceding the month of completion of work, then it is paid on the last day of work. For wages, paragraph 2 of Article 223 of the Tax Code of the Russian Federation establishes that the actual date of receipt of income is the last day of the month for which it is accrued.

Accordingly, the tax agent fills out two blocks in section 2.

Let’s supplement the example with the condition that on October 12, 2019, the employee was paid not only a salary for October, but also for September in the amount of 20,000 rubles.

In this case, the organization will fill out two blocks in section 2:

- the first block reflects the salary for June;

- in the second - the final payment.