Carrying out operations with damaged inventory items is not difficult for an experienced accountant, however, those who draw up the Write-Off Certificate for Worn-Out Assets for the first time may experience difficulties due to the lack of a single approved form.

Inventory and materials are understood as property of an organization that is used in business activities, has a material value and a monetary value; for accounting purposes they are divided:

- Raw materials and materials.

- Unfinished production.

- Finished products.

When carrying out business activities, there is a need to get rid of property that has become unsuitable for use due to its loss of consumer properties due to damage, expiration, or detected defects. If repairs are impractical and impossible to use, there is no point in keeping them on the balance sheet.

The commission is created on the basis of an order from the director; usually one of the deputy heads of the enterprise is appointed as chairman; the composition includes the person who is responsible for the inventory and materials, an accounting employee, and heads of structural divisions.

The objectives of the created body are:

- Inspection of tangible assets that are expected to be written off.

- Identification of the circumstances of the breakdown.

- Determining the circle of persons guilty of damage and making proposals for bringing to justice.

- Determining the feasibility of using individual parts.

- Preparation of inspection and write-off reports.

If there are no objections, the act is signed in two copies and submitted for approval.

The procedure and rules for registering a write-off act at an enterprise

Deregistration is a strictly regulated process, which is prescribed by law.

First of all, it is worth noting that a special commission is being assembled for this purpose. It necessarily includes financially responsible persons, usually from different structural divisions of the organization. Their responsibilities will include finding and inspecting any faults, damage or defects found.

The object being studied can be furniture, tools, equipment, inventory, inventory, household equipment, fixed assets, equipment, goods and everything that is on the balance sheet of the enterprise.

It is necessary not only to record the presence of violations on the form, but to fill out the act completely and indicate the reason for the marriage. You cannot make a write-off without good reason. In addition, the reason itself must be supported by a certain evidence base. There are instructions where the algorithm is clearly stated; you just need to follow them. For example, if materials are written off, additional supporting documents may be used.

What is suitable as a base:

- MOL reports that valuables were used;

- reporting on volumes of products produced (names, other data);

- written documentation that confirms the consumption of materials in quantities exceeding established standards (in addition, there must be justification for this fact);

- calculation, in which it becomes clear how much material costs are spent on one unit of product;

- other accounting or financial papers.

How to properly prepare and execute a simple act of write-off of materials

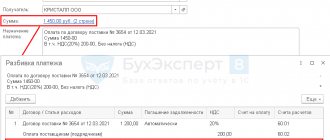

This is a paper that must necessarily include information about the company and members of the commission. It is necessary to register:

- position and full name of each employee;

- names, quantity, price per piece and the entire volume regarding the items that will be written off.

Who will be included in the commission is approved by order of the director of the organization or production. The chairman who will be responsible for and manage the entire process must also be indicated there.

When all the data is entered into the act, everyone who certified the defectiveness of the product must sign. This confirms the accuracy of all recorded points.

At the end of the event, the chairman is the last to sign. He checks the correctness and correctness of the filling, and checks again, if necessary, the names of the values, their amounts and costs.

The last person to certify the document is the head of the organization. Without his attention, the paper will have no weight.

If everything is indicated and calculated correctly, then this is documentation with legal status. Let's figure out what this is about the write-off act.

Based on this entry, accounting reflects the book value of written-off materials or other inventory items. After this, the enterprise declines due to loss. All this must be reflected in a timely manner in the tax accounting of any legal entity so that there are no difficulties in balancing the balance.

This document does not have a unified template, so it is compiled taking into account simple recommendations and mandatory details. Otherwise, the shape and order of the fields can be any. The main thing is that it corresponds to a template that will be officially adopted in accordance with the nuances and characteristics of the company’s activities.

Let's look at what points are required and what this paper usually looks like.

Instructions for filling out the document

As already mentioned, each enterprise creates individual forms in accordance with the characteristics of the production process.

The document is prepared in two copies.

- One of them is transferred to the accounting department for storage.

- The other should be received by an employee recognized as financially responsible.

The write-off itself is carried out by members of a special commission. What kind of employees does it include?

- Holding the position of chief accountant.

- A person with financial responsibility for goods.

- Specialists in a specific profile, when decommissioning special equipment.

The composition of the commission is approved by the management of the enterprise.

After the commission has been carried out, the accountant is engaged in indicating the extent of damage with the book value of the valuables that were written off.

Entries are made only according to a report previously drawn up by employees. Separate calculations are made for compensation if guilty parties are involved in the procedure.

Where can it be in excel format?

A sample act on the write-off of materials in production can be downloaded here. Download an example document in excel format from this link.

What should be present in the document has already been written above.

Experts believe that tabular design of the main part is the optimal solution. Or use a list, then the information will be more convenient to read and understand.

The name and date are written at the very beginning. Then you need to indicate on what fact the commission operates. Be sure to include the order number along with the date it was compiled.

Placing an affirmative stamp is only allowed on page number one, at the top right, in the corner. Any institution must obey this rule.

Why is a preamble to a contract needed? Read about what it is in the article at the link.

It doesn’t matter what types of material assets it uses. In the final part of the act, each member of the commission puts his signature. The write-off act will not be considered valid if at least one of the points is missing.

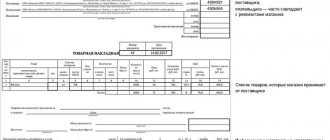

Sample act for write-off of materials.

What details must be provided?

Some points are mandatory for every official company document. Let's figure out what you can't do without.

What to indicate:

- date of creation and name;

- name of company;

- content of the operation, quantities;

- persons responsible for implementation with full names and positions.

This form must be approved by the company management in advance. How to correctly make an act of writing off materials due to unsuitability - look in the primary documentation. If it does not yet exist, then compose it according to the model above and formalize it with a separate order from the manager.

Point at which expenses can be recognized

Materials that should have gone into production are written off as costs when they are released from the warehouse. That is, the right day to write them off is the one when the rest of the raw materials will be transferred into operation according to documents.

If you need to determine when items were actually used, you can use additional, non-core reporting forms. For example, a materials usage report would be suitable for this purpose. With this step, you can reduce the costs of the period by the cost of these raw materials, which were not processed, but must be written off.

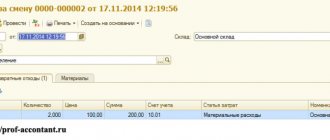

For tax purposes, it is also important when exactly the products were actually consumed. In accounting you can reflect everything with the following entries:

Dt 20/23/25/26/29/44/97 Kt 10 or 16 – write-off.

Moreover, you can transfer materials even without indicating the purpose for their use. This happens if at the minute of vacation the name of the order or product, for the production of the batch or the name of the costs are not known.

Then everything can be written off as expenses based on a document that will be drawn up after the actual consumption of raw materials. Until the papers are signed, these materials remain with the recipient.

The very fact of vacation is reflected as an internal movement - within subaccounts 10.

Synonyms for the word "fallen into disrepair"

69 synonyms found. You can find more synonyms by clicking on the words.

- download

- Synonyms for string

- Hide phrases

| № | Synonym | Qty | Initial form |

| 1 | hors de combat | 20 | |

| 2 | broken | 7 | break down |

| 3 | break down | 7 | break down |

| 4 | runaway | 10 | go haywire |

| 5 | go haywire | 10 | go haywire |

| 6 | shabby | 24 | get jabbering |

| 7 | get jabbering | 24 | get jabbering |

| 8 | broken | 30 | break |

| 9 | break | 29 | break |

| 10 | worn out | 49 | wear out |

| 11 | wear out | 48 | wear out |

| 12 | worn out | 8 | travel around |

| 13 | travel around | 8 | travel around |

| 14 | disabled | 2 | disabled |

| 15 | spoiled | 241 | go bad |

| 16 | spoil | 251 | spoil |

| 17 | go bad | 141 | |

| 18 | spoiled | 138 | spoil |

| 19 | threadbare | 35 | get worn out |

| 20 | get worn out | 35 | get worn out |

| 21 | kicked | 14 | |

| 22 | refused | 24 | refuse |

| 23 | refuse | 24 | |

| 24 | damaged | 55 | get damaged |

| 25 | get damaged | 55 | get damaged |

| 26 | moonlighting | 3 | earn extra money |

| 27 | earn extra money | 3 | earn extra money |

| 28 | worn out | 6 | wear out |

| 29 | wear out | 6 | wear out |

| 30 | flying | 110 | fly |

| 31 | fly | 68 | fly |

| 32 | broken | 29 | break down |

| 33 | break down | 29 | break down |

| 34 | spoiled | 34 | spoil |

| 35 | spoil | 20 | spoil |

| 36 | spoiled | 11 | spoiled |

| 37 | fallen into disrepair | 5 | |

| 38 | fallen into disrepair | 10 | |

| 39 | crashed | 49 | crash |

| 40 | broken | 112 | broken, break |

| 41 | smash | 165 | broken, break |

| 42 | crash | 49 | crash |

| 43 | collapsed | 71 | collapse |

| 44 | collapse | 70 | collapse |

| 45 | gone away | 25 | leave |

| 46 | leave | 25 | leave |

| 47 | disheveled | 28 | get disheveled |

| 48 | get disheveled | 27 | get disheveled |

| 49 | unraveled | 2 | unravel |

| 50 | unravel | 2 | unravel |

| 51 | burnt | 45 | burn out |

| 52 | burn out | 44 | burn out |

| 53 | passed | 46 | pass |

| 54 | pass | 50 | pass |

| 55 | screwed up | 78 | get screwed |

| 56 | get screwed | 39 | get screwed |

| 57 | broken | 57 | break down |

| 58 | break down | 66 | |

| 59 | demolished | 45 | communicate |

| 60 | communicate | 46 | communicate |

| 61 | worked together | 12 | work together |

| 62 | worked out | 14 | work |

| 63 | work | 18 | work |

| 64 | work together | 12 | work together |

| 65 | fallen into disrepair | 8 | |

| 66 | become faulty | 5 | |

| 67 | become unfit | 8 | become unfit |

| 68 | become faulty | 5 | become faulty |

| 69 | stunned | 3 |

How to reflect deteriorated materials and inventory items in a write-off act sample

If there are differences in the papers, then the tax service will have questions regarding the unjustifiedness of deregistration and reduction of expenses.

When there are several types or brands of a similar product in stock at once, misgrading becomes possible. Then, during the recalculation, it will be difficult to determine the culprits, and writing off another brand is quite problematic, especially if their values differ. And the identified surpluses will then have to be included in income.

Tax authorities usually compare the volumes written off with the number of inventories in accounting documents. For example, they can compare data on deregistered inventories. If they find discrepancies here, the inspector may refuse to recognize tax expenses and will remove the corresponding number of VAT deductions.

Dilapidated synonyms

fallen into disrepair from use - adj., number of synonyms: 3 • worn out (43) • worn out (5) • frayed... Dictionary of synonyms

fallen into a bad state - adj., number of synonyms: 10 • shabby (24) • withered (32) • read... Dictionary of synonyms

having fallen into disrepair - adj., number of synonyms: 5 • deteriorated (143) • spoiled (134) • damaged... Synonym dictionary

frayed - adj., number of synonyms: 35 • frayed (10) • bedraggled (29) • carried away... Dictionary of synonyms

damaged - adj., number of synonyms: 54 • hurt (7) • worn out (27) • mutilated (14) ... Dictionary of synonyms

collapsed - adj., number of synonyms: 71 • exploded (36) • weathered (18) • crumbled... Dictionary of synonyms

Worn - I adj. 1. Has become unusable due to prolonged wear; dilapidated, old (about clothes and shoes). 2. Deteriorated from prolonged use (about mechanisms, machines). 3. transfer decomposition A well-known; hackneyed (about views, thoughts, etc.).... ... Modern explanatory dictionary of the Russian language by Efremova

worn out - adj., number of synonyms: 48 • worn out (25) • worn out (10) • worn out... Dictionary of synonyms

OLD - OLD, primordial, pre-window, ancient, ancient, long-standing, old, ancient. The Old Testament, all biblical books written before the birth of Christ, are equally recognized by Jews and Christians. Ancient Denmi, Eternal, God. Old man, ... ... Dahl's Explanatory Dictionary

spoiled - adj., number of synonyms: 143 • bricked (1) • trampled (5) • frayed ... Dictionary of synonyms

Source of the article: https://dic.academic.ru/dic.nsf/dic_synonims/139191/%D0%BF%D1%80%D0%B8%D1%88%D0%B5%D0%B4%D1%88% D0%B8%D0%B9

Who approves the papers

After we have figured out how to write an act for writing off damaged materials, it is worth figuring out who should sign it for it to become an official document.

In the “released” and “received” columns, the positions and full names of the responsible persons should be indicated. These people can actually confirm that the raw materials have gone into the activity and are used to generate income.

It is also advisable to add a line with the signature of the person who was responsible for this leave and allowed it. Usually this is the manager. warehouse or head of the supply department. This way, internal control over the vacation will be carried out and unauthorized spending will be avoided.

How can you write off production materials in accounting?

There are 3 options on how to do this:

- at cost;

- average cost;

- FIFO method.

When one of them is selected, it should be documented in the accounting policy. It will then need to be applied consistently in each period. It can be changed only if the chosen method is canceled at the legislative level.

If it is difficult for you to control these moments, then you should use special software in which keeping records will be easy even for a non-accounting specialist. To purchase this software, you should contact Cleverence. Our specialists will help you choose the right programs, install them and show you how to use them in order to spend a minimum of time taking into account all these details.

How to spell correctly, emphasis on the word “worthlessness”

Making the Word Map better together

Hello! My name is Lampobot, I am a computer program that helps you make Word Maps. I can count perfectly, but I still don’t understand very well how your world works. Help me figure it out! Thank you!

I will definitely learn to distinguish widely used words from highly specialized ones.

How clear is the meaning of the word craving

(noun):

Synonyms for the word "unsuitability"

Sentences containing the word "unfitness"

- – The apartment and office belong to the institute, personal belongings are completely unusable

, the professor’s bank account is empty, and his car has also disappeared - a flyer of a rather old model.

Quotes from Russian classics with the word “worthlessness”

- But Peter understood the needs and true situation of the people, realized the unsuitability

of the previous system and decisively set out on a new road.

Associations to the word "unsuitable"

What kind of “badness” happens?

The meaning of the word "unfitness"

UNUSABILITY, -i, f.

Property and state by value

adj. waste.

Make a thing unusable.

(Small Academic Dictionary, MAS)

Submit Comment

Additionally

The meaning of the word "unfitness"

UNUSABILITY, -i, f.

Property and state by value

adj. waste.

Make a thing unusable.

Sentences containing the word "unfitness"

– The apartment and office belong to the institute, personal belongings are in complete disrepair

, the professor's bank account is empty, and his car has also disappeared - a flyer of a rather old model.

- It may happen, but only for a long time. Now everything is in disrepair

it has arrived.

Previously, for patchwork sewing they used old scraps from worn- out

clothes.

Synonyms for the word "unsuitability"

Associations to the word "unsuitable"

What kind of “badness” happens?

Morphology

Map of words and expressions of the Russian language

An online thesaurus with the ability to search for associations, synonyms, contextual connections and example sentences for words and expressions in the Russian language.

Reference information on the declension of nouns and adjectives, verb conjugation, as well as the morphemic structure of words.

The site is equipped with a powerful search system with support for Russian morphology.

Source of the article: https://kartaslov.ru/%D0%BA%D0%B0%D0%BA-%D0%BF%D1%80%D0%B0%D0%B2%D0%B8%D0%BB%D1 %8C%D0%BD%D0%BE-%D0%BF%D0%B8%D1%88%D0%B5%D1%82%D1%81%D1%8F-%D1%81%D0%BB%D0 %BE%D0%B2%D0%BE/%D0%BD%D0%B5%D0%B3%D0%BE%D0%B4%D0%BD%D0%BE%D1%81%D1%82%D1% 8C

Nuances that arise when writing off materials in different industries

All the types mentioned above are the same for all areas of the company’s activities. But there are still small specifics for individual companies. Let's look into this.

Construction niche

The main difference here is that there is a wide variety of materials, and at the same time, the primary documentation is filled out with insufficient quality.

Here, in order to write off raw materials, you need to prepare a whole set of papers:

- monthly reports on consumption of inventories;

- estimates;

- production standards for expenses, which are approved by the general director;

- journals for recording work already completed.

Any construction organization conducts a monthly recalculation and assessment of consumed raw materials in open storage. During the month, their expenses are not taken into account, so they are inventoried 12 times a year. Based on the results of this event, the MPZ is written off.

Agricultural enterprises

Here, operations require specific primary documents:

- act of consumption of seeds and other prepared planting material;

- a statement according to which feed is accounted for in accordance with the plan;

- a document that is drawn up in the event of death or forced slaughter of animals and poultry.

But simply filling out these papers is not enough. It is important to provide a professional rationale for the event. For example, upon departure there must be a medical report indicating the diagnosis and cause of death. If an animal dies due to the fault of an employee, then the full price will be collected from the responsible employee.

Valuation at which materials will be written off

Usually written off within the limits of natural loss, which goes to the account of production costs. And everything that turns out to be in excess of these norms will be used for other expenses or will be recovered from the guilty persons.

If we talk about low-value goods or raw materials that wear out quickly, the accountant can write them off at the cost at which they were recorded at the time of transfer to production. Or you can simply mark them evenly, little by little. This is acceptable if the estimated service life is more than 12 months. Depending on which method was chosen, it should be enshrined in the accounting policy.

Do you want to implement “Store 15”? Get all the necessary information from a specialist.

Thank you!

Thank you, your application has been accepted.

Types of workwear

Overalls can be used individually or collectively.

Personal clothing is issued for use by one person and the rules for writing off such clothing are established depending on how long it has been in use.

Collective CO is provided for a specific workplace or team. Such workwear is usually used much less often and the period of its use is usually longer. It is usually written off when it is no longer possible to use it due to wear and tear.

Postings depending on the basis

It is important to understand that write-off is a set of operations that must be documented. Account 10 is credited. The one on which these components could be stored is debited. We have listed their main types in the table.

| Dt | CT | Explanation |

| 20 | 10 | If written off to OP |

| 23 | If it is sent for the needs of auxiliary production | |

| 94 | Applies to cases of theft, end of life or obsolescence | |

| 99 | Write off everything that was damaged and lost as a result of a natural disaster or emergency |

These points are described in detail in special programs. Possible corresponding accounts are reflected there and cases when this can be used are described.