Step-by-step instruction

On March 12, the Organization paid the supplier:

- drinking water in the amount of 10 pcs. for the amount of 120 rubles. (including VAT 20%);

- reusable deposit container - 19 liter water bottle in the amount of 1 pc. for the amount of 250 rubles. (without VAT).

On the same day, the supplier delivered 1 bottle of water.

According to the terms of the agreement, the bottle is a returnable collateral container.

The accounting policy stipulates that the program keeps records of collateral and other people's property in off-balance sheet accounts.

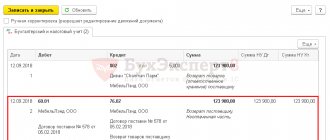

| date | Debit | Credit | Accounting amount | Amount NU | the name of the operation | Documents (reports) in 1C | |

| Dt | CT | ||||||

| Transfer of advance payment to the supplier | |||||||

| March 12 | 60.02 | 51 | 1 200 | 1 200 | Transfer of advance payment to the supplier | Debiting from the current account - Payment to the supplier | |

| 76.05 | 51 | 250 | 250 | Transfer of deposit to supplier | |||

| Accounting for the amount of collateral on the balance sheet | |||||||

| March 12 | 009.01 | — | 250 | Accounting for the amount of collateral in an off-balance sheet account | Manual entry - Operation | ||

| Purchasing water | |||||||

| March 12 | 60.01 | 60.02 | 120 | 120 | 120 | Advance offset | Receipt (act, invoice, UPD) - Goods |

| 10.01 | 60.01 | 100 | 100 | 100 | Acceptance of materials for accounting | ||

| 19.03 | 60.01 | 20 | 20 | Acceptance for VAT accounting | |||

| Registration of SF supplier | |||||||

| March 12 | — | — | 120 | Registration of SF supplier | Invoice received for receipt | ||

| 68.02 | 19.03 | 20 | Acceptance of VAT for deduction | ||||

| — | — | 20 | Reflection of VAT deduction in the Purchase Book | Purchase Book report | |||

| Receipt of returnable reusable packaging | |||||||

| March 12 | 002 | — | 250 | Accounting for containers on an off-balance sheet account | Manual entry - Operation | ||

| Write-off of water for general household needs | |||||||

| March 12 | 26 | 10.01 | 100 | 100 | 100 | Write-off of materials | Requirement - invoice |

BASIC: returnable packaging

Do not take into account the cost of returnable packaging when calculating income tax. Moreover, if the price of returnable packaging is included in the total cost of materials (goods), it must be highlighted. The container must be valued at the value that can be obtained from its possible use or sale. For example, from handing over empty boxes to waste paper, from selling empty plastic containers to the public, etc.

This procedure for accounting for containers is prescribed in paragraph 3 of Article 254 of the Tax Code of the Russian Federation.

The amount of the deposit transferred to the supplier for returnable packaging should not be taken into account as expenses when calculating income tax (Clause 32, Article 270 of the Tax Code of the Russian Federation).

An example of how the receipt of returnable packaging is reflected in accounting and taxation. To ensure the return of the packaging, the organization transferred a deposit to the supplier. The organization applies a general taxation system

In May, Alpha LLC purchased a batch of kefir. The cost of the purchased batch of kefir is 11,000 rubles. (including VAT - 1000 rubles).

Boxes of kefir are packed in 10 plastic pallets. According to the contract, the organization must return them to the supplier.

The deposit price of one pallet is 300 rubles. In May, Alpha transferred a deposit in the amount of 3,000 rubles to the supplier’s bank account. (300 rub. × 10 pcs.). In June, the organization paid for the goods and returned the container.

Alpha's accountant made the following entries in the accounting records.

May:

Debit 10-1 Credit 60 – 10,000 rub. – the actual cost of kefir is reflected;

Debit 19 Credit 60 – 1000 rub. – VAT on purchased kefir is taken into account;

Debit 10-4 Credit 76 – 3000 rub. – reflects the collateral value of returnable packaging received from the supplier;

Debit 76 Credit 51 – 3000 rub. – the amount of the deposit has been transferred to secure the obligation to return the packaging;

Debit 009 – 3000 rub. – reflects the amount of the deposit for returnable packaging.

June:

Debit 60 Credit 51 – 11,000 rub. – payment for sold kefir is transferred;

Debit 76 Credit 10-4 – 3000 rub. – the container is returned to the supplier;

Debit 51 Credit 76 – 3000 rub. – the deposit amount has been returned;

Credit 009 – 3000 rub. – the amount of the deposit for returnable packaging has been written off.

When calculating income tax, the organization did not take into account the cost of returnable packaging (3,000 rubles) and the amount of the deposit (3,000 rubles).

If, in violation of the contract, the organization does not return the container, then it will not receive the deposit back. In this case, the amount of the deposit should be considered a payment for the purchase of the container. The organization transfers ownership of it, that is, the container is sold (Article 218 of the Civil Code of the Russian Federation, paragraph 1 of Article 39 of the Tax Code of the Russian Federation). In this case, the supplier will charge VAT and issue you an invoice (subclause 1, clause 1, article 146 of the Tax Code of the Russian Federation).

For more information, see:

- How to record transactions with containers when selling purchased goods;

- How to record transactions with containers when selling your own products.

Transfer of advance payment and deposit amount to the supplier

Complete the transfer of funds to the water supplier by debiting from the current account transaction type Payment to the supplier (Bank and cash desk - Bank statements).

Break the payment into 2 lines:

- reflect the advance payment for water in the usual manner;

- on the line with the amount of the deposit for the packaging, indicate: Expense item - item with the type Other payments for current operations ;

- Debt repayment - Do not repay ;

- Settlement account - 76.05 “Settlements with other suppliers and contractors.”

Postings

After returning the container to the supplier and receiving the deposit amount from him, issue a Receipt to the bank account :

- Type of operation - Other receipt ;

- Settlement account — 76.05;

- Income item with the type Other receipts from current operations .

Formation from AWS: “Purchases” - “Returns” - “Returns of goods to suppliers”

We go to the automated workplace and, by clicking “Create”, select the type of operation (here – “Return to supplier”, and “Return to the principal” should be sorted out in the “Commission sales” block).

Fig.15 Formation from automated workstation

A cap:

- The date is filled in with the current value automatically;

- Organization – the user specifies “by hand” from the list of all organizations;

- Supplier – selected by the user from the list of all contractors, or from the last (highlighted) suppliers with whom the user worked;

- Counterparty – can be entered automatically, but if the supplier has several counterparties in the database, the system will suggest the one that is most often used; if necessary, you can select the desired counterparty from the list of supplier’s counterparties;

Fig. 16 Filling out the document header

- Agreement – should be selected from the list of existing agreements with the supplier, subject to their use with a specific partner. If conventions are not used, the field is left blank. If the system settings do not provide for the use of agreements, then this column will not be displayed in the document;

- Agreement – you must select an agreement from the list of those in force with this counterparty. The type of agreement will be visible by the type of transaction. Accordingly, when you select the “Return to supplier” operation, contracts with the supplier will be highlighted in the list of contracts. When you select the “Return to principal” operation, contracts with the principal will be highlighted in the list of contracts;

- Warehouse – from which the shipment will be made, select from the directory. The availability of goods in a certain warehouse is visible in the “List of goods in warehouses” report;

- Compensation* – you can apply for one of two options: Return the funds/Keep as an advance.

*The selection of compensation according to the document will be active after filling out the tabular section.

When you select the “Return DS” option, the return document will become an independent settlement object, for which the supplier’s liability will appear. On its basis, you can generate DS receipt documents with a return operation.

“Keep as advance” here means that the refund amount becomes a “free” advance paid, which will be available when the payment offset is recorded in the purchasing documents.

Important! When creating a return for a purchase document, the “Compensation” field becomes unavailable for switching.

Fig. 17 Leave as an advance

To select the desired compensation option, you need to click on the hyperlink “Debt to supplier reduced” and in the window that appears, remove the settlement object (click delete, then OK).

Fig. 18 Debt to supplier reduced

After this, you will be able to switch the compensation option. When deleting a settlement object, the debt will be equal to 0.

Tabular part: Products can be filled in manually by selecting item, quantity, price. But it’s easier and more convenient to fill out using the “Fill” - “Add goods from receipts” button (see the filling scheme above).

Delivery: The “Delivery” section is filled in independently, the desired delivery method is selected, and the delivery details are filled in depending on the method (in the same way as in the “Order to Supplier” document).

Additionally: Here the data from the base document is automatically entered. If necessary, the fields can be filled in manually.

We post the document by clicking on the corresponding icon.

Purchasing water

Costs for ensuring normal working conditions (including the purchase of drinking water) can be taken into account when calculating income tax (clause 7, clause 1, article 264 of the Tax Code of the Russian Federation, Letter of the Ministry of Finance of the Russian Federation 03/23/2020 N 03-03-07/22134) .

VAT on such expenses is accepted for deduction in the usual manner (clause 1 of Article 172 of the Tax Code of the Russian Federation).

Reflect the receipt of water with the document Receipt (act, invoice, UPD) document type Goods (invoice, UPD) (Purchases - Receipt (acts, invoice, UPD)).

Filling out a document is no different from the usual receipt of materials.

Postings

According to FSBU 5/2019, drinking water does not belong to reserves, therefore, to reduce the number of operations in the program, you can take it into account at the time of receipt in expenses, bypassing account 10:

- create a directory element Nomenclature for water with the Type of nomenclature Services ;

- create a document Receipt (act, invoice, UPD) document type Services (act, UPD) .

Then you will not need to fill out a demand invoice.

To register an incoming invoice, indicate its number and date at the bottom of the document form Receipts (acts, invoices, UPD) - Goods (invoice, UPD) and click the Register .

The document is filled in automatically.

If the document has the Reflect VAT deduction in the purchase book by date of receipt checkbox , then when it is posted, entries will be made to accept VAT for deduction.

Postings

Receipt of returnable reusable packaging

Returnable packaging does not meet the definition of inventory (clauses 3, 5 of FSBU 5/2019). Ownership of it does not pass to the buyer, therefore it is recorded on the balance sheet in account 002 “Inventory assets accepted for safekeeping” at the cost indicated in the acceptance documents.

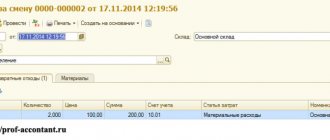

Reflect the security deposit behind the balance sheet using the document Transaction entered manually (Transactions - Transactions entered manually).

Fill in the information about the supplier, the quantity and cost of the deposit containers according to the invoice.

Reflect the return of the deposit container to the supplier with a return entry.

Additions for working with reusable returnable containers in UT 11

The improvements were carried out for an organization engaged in the wholesale sale of beer and beverages; in this case, the containers are kegs, bottling equipment, branded refrigerators, etc. everything that is transferred to buyers for reporting.

Of the standard reports for accounting for packaging, UT 11 contains only a statement of returned returnable packaging. The containers are handed over to customers for a certain period of time, the date of return of the containers is indicated in the document for the sale of goods that are delivered in containers, so there was a need for a report that would show not only the total balances of containers from buyers, but also in terms of return periods: expired and not yet expired, the so-called debitor for the transferred containers

The standard statement for the transferred containers is in the context of the container transfer documents, but does not show what document was used to return the containers, only the movement that the return was made, so this report also had to be modified: display the return document.

Then a document sheet was required that would display all movements according to documents in chronological order, something like a container reconciliation report, because one return document often returns containers from several deliveries (according to several delivery documents) and in the standard sheet one return was divided into a few lines.

Also in the standard UT 11 there is no tool for adjusting the debt on transferred containers, an analogue from the accounting of the cash debitor Debt Adjustment, but still, using standard means you can adjust the debt, the document Adjustment of Registers, this is a universal document; in general, any register can be corrected, so it must be used with maximum caution. The need for such adjustments does not arise often, for example, internal movement between points of one client, transferred to one point, picked up from another, etc.

A little about accounting for bottling and refrigeration equipment: it is very convenient to account for equipment as reusable containers, you can always see what equipment was transferred to which of the clients and when, the transfer of equipment as a lot of reusable containers does not lead to a change in the client’s debt for money, only for containers. Equipment, like containers, may not be the organization’s own equipment, but received from the supplier, that is, full accounting can be carried out both to suppliers and to clients. Refrigeration equipment can be taken into account in terms of characteristics, each of the characteristics will be the serial number of the refrigerator, the only thing you will need to control is the uniqueness of each characteristic.

Write-off of water for general household needs

On the same day, fill out the Requirement-invoice document (Warehouse - Requirements-invoices).

It is better to create it based on the receipt document, then the document header and the Materials will be filled in automatically.

Attribute the cost of water to other expenses in BU and NU.

Postings

To access the section, log in to the site.