What is included in the calculation of vacation pay?

The amount of vacation pay that an employee will receive is influenced by 2 indicators:

- Special coefficient.

- The number of periods worked by the employee.

The first indicator changes annually, but it is the same for everyone and depends on the number of holidays occurring in the current year.

The second figure is individual in nature and depends on the amount of time worked by a certain employee and the average salary.

Peculiarities of calculating vacation pay taking into account vacation payments

In the first case, an employee combining study and work has the right to leave of up to 40 days in the first and second year, and up to 50 days in each subsequent year (such leaves are provided only if the employee receives higher education for the first time).

- If the employee is a minor.

- If the employee has in his care an adopted child less than three months old (or several adopted children).

- Persons working part-time (in this case, they are granted leave simultaneously with leave from another, main job).

- Employees (or employees) whose spouse is a military personnel.

- Persons who have become blood donors or have the status of “Honorary Donor”.

What is not included in the calculation of vacation pay?

It was mentioned above that the amount of vacation payments depends half on the total amount of money earned by the employee for a certain period of time.

However, for the calculations to be carried out correctly, some payments must be subtracted from the final figure (if they took place in a certain period of time), these include:

- Vacation pay amount.

- Various types of financial assistance.

- Payment of sick leave.

- Additional incentive bonuses.

Thus, the basis for calculating vacation pay is exclusively the employee’s salary.

Are vacation pay included in the calculation of average earnings?

- The salary that is accrued to an employee at the tariff rate, according to the official salary for the time that he worked

- Salary that is transferred to an employee for work done at a piece rate

- Salary, which is accrued to an employee in the form of a percentage of sales, proceeds, and also in the form of commission incentives

- Salary, which is issued not in the form of money, but, for example, in the form of food and goods

- Bonuses and allowances to the general rates that are paid to employees for length of service, for length of service, for rank, for keeping state secrets, and so on

- Bonuses and monetary rewards given to an employee by an employer in accordance with the generally accepted remuneration system

Please note => Income tax benefit when purchasing a share of an apartment

Average earnings is the average salary of an employee for a particular period of time. This figure is needed in calculations related to vacation payments, cash benefits for disabled employees and when calculating the amount of pension savings.

Right to annual leave

Every person, even those who are especially sensitive to their work responsibilities, needs rest, since strength needs to be restored, and personal issues also need to be resolved, all of which naturally takes time.

For these purposes and tasks, the legislator provides for annual paid leave. The key word in this phrase is “annual”, especially this time period is important for those who got a job not so long ago, as it will be when they can take a break from routine everyday life.

According to the current legislation in our country, the minimum period after which an employee can go on another vacation is 6 months. But what should you do if a person has not worked for a new employer for six months, and you need a vacation now?

Meanwhile, official documents also take into account this scenario, because there is a clarification that leave can be issued earlier with the agreement of the parties, that is, the employee and the employer.

Regardless of what time period has passed since the conclusion of the employment contract, if necessary, you should try to negotiate a vacation with management, but you need to take into account one important aspect: if the cherished 6 months have not yet expired, then the vacation can only be administrative, that is, unpaid.

The procedure for calculating vacation pay in 2021

It was mentioned above that vacation directly depends on the special coefficient in force in the current year and on the average salary of the individually considered employee for a certain period of time. In order to consider the calculations in more detail, let’s consider them using a separate example.

In 2021, when calculating vacation pay, accountants use a new scheme adopted this year. The main reason for this innovation is a different number of holidays (weekends), of which there are much more during the twelve months under consideration.

The special coefficient that accountants use this year when calculating vacation pay is 29.3. It is this figure that is equivalent to the average days worked by workers.

The next figure that directly affects the amount of vacation pay is the average salary of an individual employee.

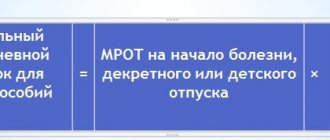

Thus, today, in order to calculate vacation pay, you first need to calculate the wages that were paid to the employee over the last year; in order to find out this unknown number, you need to use the following formula:

- Average salary/12/29.3;

After the required has been calculated, you need to multiply this number by the number of vacation days, as a rule, in most Russian organizations it is 28. The result of these simple arithmetic problems will be equal to the vacation pay that the employee will receive.

Let’s assume that an employee must go on vacation in August of this year, 2016. In March, from the 10th to the 17th, the employee in question was on sick leave.

The salary that the employee received during the period of time under consideration is equal to 350,000 rubles:

- OD=30-8=22

- KNM=29.3/30*22=21.48 days.

- SDZ=350000/(11*29.3+21.48)=

- TOTAL vacation pay = 28 * 1018.093 = 28.506 rubles.

Thus, the vacation pay that this employee will receive will be equal to the amount: 28,506 rubles.

Calculation of vacation pay: examples of calculation in 2021 and calculator

The previous leave was in December. This year I am asking for it in June. But they only give me and pay for 14 days. Referring to the fact that I need to work for 11-12 months. But this is not my first leave after getting a job at this enterprise. Is it legal? . And how to deal with it. Tell me, please... on April 1, I (our entire department) was transferred to another legal entity, but they left the old vacation schedule according to which I went on another 14-day vacation on April 28. The wages are piecework, in 28 days I earned a little more than 30,000 rubles, but our new accountant calculated me vacation pay of 2,200 rubles for 14 days, citing the fact that before the 28th I only received an advance of 5,000 based on it and calculated it. I’m actually at a loss as to how you can calculate vacation based on an advance payment?? Why didn’t you request the data, didn’t close the salary based on 28 days worked. Tell me how to do it correctly and where to contact the accountant regarding the recalculation, it seems the accountant will not recalculate it, because I was expecting at least the rest of the vacation pay in the salary calculation for April, but I didn’t see it.

22 Dec 2021 marketur 187

Share this post

- Related Posts

- How to write a report on students who did not come to class

- Job description for cleaner of office and industrial premises, etc.

- Criteria for granting tax benefits

- Why a Guarantor When You Buy an Apartment Using Maternal Capital

Features of bonus calculation

As an additional incentive for employees to achieve greater success at work, employers very often use, in addition to paying monthly wages, bonuses, which can be:

- monthly;

- quarterly;

- annual;

Incentives are local in nature, that is, they are paid individually in each individual enterprise, and therefore the terms of their payments are stipulated in a separate clause in the agreement concluded between the employee and the employer.

In most cases, the criterion for paying a bonus is the achievement of certain results by the employee in his professional activities.

Monthly

If the employee fulfills the condition of working the entire pay period preceding the vacation, when calculating the amount of vacation pay, the accountant must also take into account the amount of bonuses paid.

So, if an employee received 13 monthly bonuses during the reporting period, then when determining the amount of vacation pay, the accounting employee has the right to take into account only 12 of them, since according to the current financial documents, it is allowed to take into account no more than 1 bonus per month that were paid during the billing period in question.

Quarterly

If an employee going on vacation has fully worked the pay period, then bonuses paid during this period of time should also be fully included in the calculation of vacation pay. The key point here is that the premiums must be paid within this billing period.

If bonuses were paid for the period of time in question, but their payment was made outside the billing period in question, then in this case they should not be included in the calculation of vacation pay.

Annual

When calculating the employee's vacation pay, the annual bonuses he receives are also taken into account, but only in the following cases:

- Such a measure of material incentives is provided in the organization.

- If it was assigned to the employee for his labor success.

The bonus paid once a year is taken into account when calculating vacation pay (if any), regardless of the month in which the employee goes on vacation.

That is, if an employee received an annual bonus in the past 2015, then regardless of whether the employee goes on vacation in February or August 2016, the previously received bonus must in any case be taken into account.

General procedure for calculating vacation pay

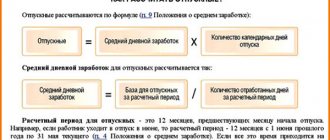

The first important step is to accurately determine the period that will be considered calculated. Labor legislation defines it as standard - before taking leave it is at least 12 months according to the calendar. Next, calculate the amount of payments accrued during this time. Accounting is carried out for any concepts, according to the current system introduced by employers. It doesn't matter where the money comes from.

Additional factors are taken into account along with the main part:

- Regional coefficients.

- Combined positions.

- Night work.

- Overtime work.

- Additional payment for going on site on holidays and weekends.

And so on. The final figure is divided by 12, then by 29.4. The result is the average reward throughout the day. The amount of vacation pay is determined after multiplying the previous number by the days according to the calendar that make up the vacation.

For example, a break from work for an employee will be 14 calendar days. Start – 05.04. For each of the 12 months preceding the vacation, the amount of accrued salary is 30 thousand rubles.

The benefit amount is calculated as follows: multiply 30 thousand by 12, then divide by 12, divide by 29.4, multiply by 14 days. The result is 14 thousand rubles.

The calculation is associated with certain difficulties in case of one or several months with incomplete work. The same applies to situations where a citizen was absent from work for some time.

Difficulties arise when at least one condition is met in the billing period:

- Exemption from work in various situations, with or without pay.

- Lack of work due to downtime caused by the employer. Or when the reasons do not depend on either party.

- Vacation or business trip.

- Caring for disabled people since childhood, disabled children, requiring additional paid days off.

- Strikes without the participation of citizens, preventing them from fulfilling their duties.

- Benefits for temporary disability, pregnancy and childbirth.

Calculations do not include the periods indicated above. The same applies to payments accrued for such time.

To walk or not? Can an employee not go on vacation?

Going on vacation is a guaranteed human right, but not an obligation. From which it follows that, in principle, he can avoid taking long weekends. However, for the second participant in the employer’s labor relations, such a scheme is not so harmless.

Since the law establishes a fine for an employee’s failure to go on vacation for 2 years. That is why, towards the end of the year, enterprises begin internal accounting of employees who have not left their jobs for the cherished 28 days during the year.