Criteria for selecting companies for inspection.

Depending on the subject of the camera room, applicants for it may be companies whose VAT returns include:

1) errors and contradictions were found in the information from the documents available at the Federal Tax Service (declarations are subject to automated verification using control ratios - Letter of the Federal Tax Service of Russia dated July 16, 2013 No. AS-4-2/12705);

2) tax benefits are declared (clause 6 of article 88 of the Tax Code of the Russian Federation). One of the most frequent requests from tax authorities during a desk tax audit is the request for documents on preferential transactions reflected in the VAT return in section 7 “Transactions not subject to taxation.” (Recall that the right to request documents within the framework of the “camera chamber” regarding preferential transactions can be exercised by the tax authorities in a situation where the applied benefit is intended only for a certain category of persons - clause 14 of the Resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated May 30, 2014 No. 33, resolution AS UO dated 02.24.2015 No. F09-579/15 in case No. A71-6132/2014, dated 02.17.2015 No. F09-10024/14 in case No. A60-21098/2014, dated 05.23.2014 No. F09-5197/12 in case No. A60-32962/2011);

3) the amount of VAT for reimbursement has been presented (clause 8 of Article 88 of the Tax Code of the Russian Federation, Letter of the Federal Tax Service of Russia dated September 16, 2015 No. SD-4-15/16337);

4) contradictions and inconsistencies have been identified that indicate an understatement of the amount of VAT to be paid or an overstatement of the amount of VAT to be reimbursed;

5) mandatory documents that must be submitted simultaneously with the declaration are not attached (clause 7 of Article 88 of the Tax Code of the Russian Federation).

Having received an electronic request or notification from the tax office, the accountant must send a confirmation in response. Otherwise, the inspectors have a legal basis to block the bank account (clauses 1 and 11 of Article 76 of the Tax Code of the Russian Federation).

Tax authorities have the right to send a request for a desk audit within three months from the date of submission of the declaration (calculation), except for cases where the request is sent as part of additional tax control measures (in this case, tax authorities can send it outside the three-month period). The company has the right not to comply with tax authorities’ demands sent outside the three-month period of a desk audit (clause 11, clause 1, article 21, clause 2, article 88, clause 1, article 93 of the Tax Code of the Russian Federation).

However, companies should keep in mind that failure to provide explanations does not prevent the continuation of the tax audit (clause 5 of Article 88 of the Tax Code of the Russian Federation). If the tax authority detects tax violations, a tax audit report is drawn up (Clause 1, Article 100 of the Tax Code of the Russian Federation).

The company must submit clarifications or make corrections to the submitted declaration within five working days after the date of receipt of the request (clause 3 of Article 88 of the Tax Code of the Russian Federation). And the company is given ten working days to submit documents after receiving a request for them from the Federal Tax Service.

In the case of a desk audit of the VAT return, explanations must be submitted in electronic form according to the format approved by the Federal Tax Service (clause 3 of Article 88 of the Tax Code of the Russian Federation, Letter of the Federal Tax Service of Russia dated January 11, 2018 No. AS-4-15 / [email protected] ). If you do not draw up an explanation or submit it at the wrong time, the company may be fined 5,000 rubles, and if the violation is repeated within a year, 20,000 rubles. (Article 129.1 of the Tax Code of the Russian Federation).

Here are the most popular requirements of tax authorities regarding requests for documents and explanations on declared VAT deductions.

Transfer of deductions.

Fearing in-depth “camera chambers”, many companies transfer VAT deductions to future periods in order to comply with the standard, despite the fact that it is not mandatory for taxpayers.

The possibility of transferring deductions is provided for in clause 1.1 of Art. 172 of the Tax Code of the Russian Federation. In this case, you can only transfer deductions that are listed in clause 2 of Art. 171 of the Tax Code of the Russian Federation (paragraph 1, clause 1.1, article 172 of the Tax Code of the Russian Federation). In these cases, the company has the right to apply a VAT deduction within three years after the goods (work, services) are accepted for accounting. The last date of the quarter in which the deadline falls is the deadline for deducting VAT (Definition of the Constitutional Court of the Russian Federation dated March 24, 2015 No. 540-O).

As a result of a discrepancy between the invoices in the company's purchase book, reflected in the IR ASK VAT-2 database, and the counterparty's invoices, reflected in the sales book, the tax authorities send requests for explanations.

When transferring company deductions, you need to keep in mind that you cannot transfer:

- deduction from the advance (“spent” advance, return of the advance);

- “travel” deductions;

- deductions of the buyer acting as a tax agent;

- deduction for property received as a contribution to the authorized capital (letter of the Federal Tax Service of Russia dated 01/09/2017 No. SD-4-3 / [email protected] , Ministry of Finance of Russia dated November 17, 2016 No. 03-07-08/67622, dated 10/09/2015 No. 03-07-11/57833, dated 07/21/2015 No. 03-07-11/41908, dated 04/09/2015 No. 03-07-11/20290).

What is the share of VAT deductions?

The activities of any organization are constantly monitored by the authorities of the Federal Tax Service of Russia. The tax inspectorate pays special attention to compliance with the limit values of many indicators (and there are about forty of them), since they are often the ones that indicate gross violations in accounting.

However, the greatest attention is still paid to the criteria related to the calculation and payment of VAT, in particular to the amount deducted from the tax base for the final calculation of the tax. The specified deduction should not exceed predetermined limits, which are set as a percentage of the amount of this tax. This limitation is called the specific weight of the VAT deduction.

What is a safe share of VAT deductions?

The VAT safe harbor is the amount by which a company can reduce its taxes. It is calculated like this. The amount of the deduction divided by the amount of accrued VAT, multiplied by 100%. Where deduction is the amount of tax indicated by suppliers in invoices. The received amount must be compared with the control value and a decision must be made: leave the current data or transfer part of the deduction to the next quarter if the amount is unsafe.

You must understand that as such the term “safe share of VAT deduction” does not exist in the Tax Code. But at the same time, everyone knows that the amount of deductions for four quarters should not exceed on average 89% of the tax accrued for the same quarters. Moreover, the Federal Tax Service regularly updates data on the safe percentage of deductions. This data is published in the form of a table, which shows the average percentage of deductions by region, but without reference to the company’s field of activity.

At the same time, deduction thresholds vary quite significantly across the country. For example, in the data for the 2nd quarter of 2021, 193% was recognized as a safe value in the Murmansk region, and only 72% in the Astrakhan and Orenburg regions.

The Federal Tax Service publishes such statistics by region four times a year: in early February, early May, early August and early November. Accordingly, in order to calculate the share of the deduction for the 1st quarter, you need to focus on data from February 1, for the second - from May 1, and so on. You can find the data on any trusted accounting resource on the Internet.

VAT discrepancies

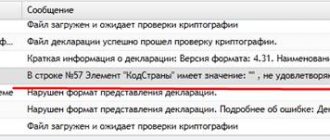

In 2021, tax authorities have more reasons to submit VAT reporting requirements. Previously, there were only four defect codes in the declaration. Now the number has almost doubled. There are currently nine codes for markings in the VAT return.

| Code | Explanation |

| 0000000001 | Discrepancy with counterparty reporting |

| 0000000002 | Inconsistency of information in sections 8 (purchase book) and section 9 (sales book). |

| 0000000003 | Discrepancies between invoices issued and received in sections 10 and 11 |

| 0000000004 | Error in a specific column of the report (the number of the erroneous declaration line is indicated in brackets) |

| 0000000005 | The invoice date in sections 8-12 is incorrect |

| 0000000006 | The date of the application for deduction exceeds the allowable period of three years |

| 0000000007 | The date of the invoice claimed for VAT deduction does not correspond to the period of activity |

| 0000000008 | The transaction code is incorrectly indicated in sections 8-12 of the declaration (the codifier is given in the Federal Tax Service order dated March 14, 2016 No. ММВ-7-3 / [email protected] ) |

| 0000000009 | Canceling entries are incorrectly reflected in section 9 of the declaration |

Details in the article: Error codes in the VAT return.

How is VAT deduction applied?

Value added tax is paid by organizations and entrepreneurs operating on the special purpose tax system, as well as other categories of taxpayers in accordance with the requirements of Chapter 21 of the Tax Code of the Russian Federation.

Tax payable is calculated on sales transactions and similar ones.

The taxpayer has the right to reduce the amount of the calculated tax by a tax deduction.

It represents the amount of tax presented to the taxpayer by suppliers of goods (works, services) and indicated in the invoice.

To apply the deductible amount, the following conditions must be met:

- The purchased goods (works, services) are registered.

- Purchased goods (works, services) must be used in transactions subject to VAT.

- The supplier submitted a correctly executed invoice.

- No more than three years have passed since the goods (works, services) were registered.

Important information about deadlines and fines

Having received a request from the Federal Tax Service, the company must hurry - it only has 5 working days, let alone prepare a response. If the taxpayer does not provide an explanation within the prescribed period, he will be fined. The amounts of punishment are significant:

- 5,000 rubles - if clarifications are submitted late or not submitted at all;

- 20,000 rubles - if the deadline for submitting clarifications is repeatedly missed during the calendar year.

Tax authorities often send requests to companies to provide explanations if the purchase book reflects a “spent” advance with a three-year statute of limitations.

For example, in the tax return for the second quarter of 2021, a “spent” advance for the first quarter of 2015 is declared. Despite the fact that representatives of the Ministry of Finance do not see any obstacles to the declared deductions from the “old” prepayment (Letter dated 05/07/2018 No. 03-07-11/30585), tax authorities ask companies for clarification if there is a gap between prepayment and shipment of goods (works). , services) more than three years have passed.

Is there a “safe” VAT deduction amount?

How to assess whether an organization pays enough value added tax? After all, absolute numbers in this regard are completely uninformative. The amount of tax depends on a combination of factors, including the type of activity, profitability, markup, seasonality and many others, including the general economic situation in the country. Therefore, the wording of the question “ how much VAT should I pay so that the tax authorities do not want to come with an audit?” "is itself incorrect.

It is much more correct to ask the question about the share of deductions in the total amount of accrued VAT, because it is this indicator that tax authorities pay attention to. Officially, it is called the share of VAT deductions in the calculated amount of VAT on taxable items.

For the Russian Federation, the threshold value of this indicator is

87,39%

The size of this indicator for Russia was previously 86.93%

For information on the safe share of deductions by region, see below - these are the figures that the local tax office focuses on when checking.

For Moscow, the threshold value of the indicator is

88,76%

The size of this indicator for Moscow was previously 88.08%

Calculation of the share of VAT deductions

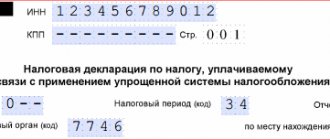

What does this indicator mean and how is it calculated? This is nothing more than a percentage of VAT deductions in the amount of accrued tax. To calculate it, you need only two values, which can be found in section 3 of the VAT return. This is line 190 (VAT deductible) and line 118 (VAT accrued).

The indicator is calculated using the following formula:

VAT deductible / VAT accrued * 100%

In order to see the dynamics of this indicator, it is better to take the relevant data from the last four declarations.

The result of the calculation will be a percentage value corresponding to the share of VAT deductions in the total amount of accrued tax. In other words, this value shows what percentage of the accrued VAT the company claims to deduct. It is this that the tax authorities will compare with the threshold indicator in order to draw a conclusion about the degree of tax risks of the company for VAT. If the proportion of VAT deductions according to the taxpayer’s declaration is greater, then this immediately attracts the attention of tax inspectors.

Formula for calculating safe VAT

If you do not know how to calculate the safe share of VAT deductions, you should understand the issue in more detail and give an example of this operation. It should be taken into account that Federal Tax Service employees have a significant number of tools and indicators for checking and analyzing financial data for each specific organization and if there are any suspicions, a detailed assessment of economic activities and tax documentation confirming the volume of payments to the federal budget will be carried out.

Let's consider an example of a calculation for Moscow with an indicator for the region at 88.1%. Also, to carry out calculations, we will need accurate data from the declaration. Payer. In particular, you need line 190 – VAT deductible and line 118 – VAT accrued. The following scheme applies:

Amount to be deducted / amount of accrued tax * 100%

Moving on to a specific example with numbers, let’s consider a company in its declaration, which indicates the total amount of VAT in the amount of 900,000 rubles, while the tax deduction for this time amounted to 850,000 rubles. In an example it would look like this:

850 000 / 900 000 * 100% = 94,4%

Thus, the result exceeds the safe value of 88.1%. As a result, questions and claims will arise against the legal entity. However, if necessary, you can also calculate the safe share for subsequent payment. For this, the following scheme is used:

Accrued amount*(100% - Safe amount)/100%

As a result, using the numbers from the example, we obtain the following data:

900 000 * (100% — 88,1%) / 100 = 107 100

The amount received is the threshold value that, or its greater equivalent, must be paid by the company in order to exclude any checks and claims from regulatory services.

The amount of safe deduction under this scheme can be determined for any amount of VAT, which is especially important given the increase in 2019. We recommend that you check and double-check your calculations before filing your final return and paying the amounts listed therein. This will reduce the associated risks and remain in good standing with the state supervisory service.

An example of calculating the safe amount of VAT deduction

Let’s assume that during the reporting period, a taxpayer from Moscow paid VAT in the amount of 100,000 rubles.

It is impossible to say whether this is a lot or a little for this organization. But the picture becomes clearer if we calculate the share of VAT deductions:

According to the company’s declaration data, for the specified period, the amount of calculated VAT, taking into account the restored amounts, 1,500,000 rubles. The tax deduction for the same period amounted to 1,400,000 rubles. Substituting these figures into the above formula, we find that the share of VAT deductions in the amount of accrued tax in the period under consideration period amounted to 1,400,000 / 1,500,000 = 93.33% . This is more than the threshold value of 88.76% for Moscow (as of November 1, 2021), which means that the tax authorities have a reason to take the taxpayer into custody.

What should be the amount of VAT in the considered example for Moscow, so as not to attract increased attention from tax authorities?

It can be calculated using the reverse formula: accrued VAT * (100 – safe VAT) / 100 = = 1,500,000 * (100 - 88.76) / 100 = 168,600 rubles.

Based on the criteria used by the Federal Tax Service, the company in our example needs to pay at least 168,600 rubles in VAT in order not to leave the “safe” zone.

Example #1 of calculating the tax burden

Let's look at an example of how input VAT affects the tax burden of an enterprise.

- purchased goods with a value of RUB 3,923,500 in the 1st quarter of 2021. (Including VAT RUB 598,500)

- Sold for 4,618,200 rubles. (including VAT RUB 704,471.18)

- Add. Expenses (delivery, consulting services, etc.) – RUB 397,300. (including confirmed VAT of 60,605.08 rubles).

- VAT payable RUB 45,365.10. (704,471.18 – 598,500 – 60,605.08).

- Profit before tax: 3,913,728.82 – 3,325,000 – 336,694.92– 45,365.10 = 206,668.8 rubles.

- Income tax RUB 41,333.76. (206,668.8 × 20%).

- Net profit amounted to 165,335.04 (206,668.8–41,333.76)

Let's look at typical wiring

| Debit | Credit | Sum | Calculation | Content |

| 41 | 60 | 3 325 000 | Goods received from supplier | |

| 19 | 60 | 598 500 | Input VAT | |

| 60 | 51 | 3 923 500 | Inventory and materials paid to the supplier | |

| 68.2 | 19 | 598 500 | VAT is deductible | |

| 62 | 90 | 4 618 200 | Sale of goods and materials | |

| 90.3 | 68.2 | 704 471,18 | Output VAT | |

| 51 | 62 | 4 618 200 | Inventory and materials paid by the buyer | |

| 44 | 76 | 336 694,92 | Add. Expenses | |

| 19 | 76 | 60 605,08 | Input VAT at additional cost. Expenses | |

| 76 | 51 | 397 300 | Add. services paid to the counterparty | |

| 68.2 | 19 | 60 605,08 | VAT deductible | |

| 44 | 68.4 | 41 333,76 | 206 668,8 × 20 % | Profit |

| 68.4 | 51 | 41 333,76 | Income tax paid | |

| 90 | 99 | 165 335,04 | 206 668,8 – 41 333,76 | Net profit |

Let's calculate the share of VAT to be reimbursed:

659,105.08 (598,500 + 60,605.08) (Hb) ÷ 3,913,728.82 × 100 = 16.84

Let's calculate the tax burden on the company:

45,365.10 (VAT) ÷ 3,913,728.82 (Bn) × 100 = 1.16

Example #2 of calculating the tax burden

If you purchased goods and materials without VAT, but at a lower price. The cost of goods and materials is 3,000,000 rubles. without VAT. Sold for 4,618,200 rubles. (including VAT RUB 704,471.18) Additional. Expenses (delivery, consulting services, etc.) – RUB 397,300. (including confirmed VAT of RUB 60,605.08). VAT payable RUB 643,866.10. (704,471.18 – 60,605.08). Profit before tax: 3,913,728.82 – 3,000,000 – 336,694.92 – 643,866.10 = – 66,832.2 rubles.

That is, the organization suffered losses in the amount of 66,833.2 rubles.

| Debit | Credit | Sum | Calculation | Content |

| 41 | 60 | 3000 000 | Goods received from supplier | |

| 60 | 51 | 3 000 000 | Inventory and materials paid to the supplier | |

| 62 | 90 | 4 618 200 | Sales of goods and materials | |

| 90.3 | 68.2 | 704 471,18 | Output VAT included | |

| 51 | 62 | 4 618 200 | Inventory and materials paid by the buyer | |

| 44 | 76 | 336 694,92 | Add. Expenses | |

| 19 | 76 | 60 605,08 | Input VAT has been taken into account at additional cost. Expenses | |

| 76 | 51 | 397 300 | Add. services paid to the counterparty | |

| 68.2 | 19 | 60 605,08 | VAT deductible | |

| 99 | 90 | 66 833,2 | Enterprise losses |

Share of VAT deductible

60,605.08 (Hb) ÷ 3,913,728.82× 100 = 1.55

The tax burden for VAT in this case will be:

643,866.10 (VAT) ÷ 3,913,728.82 (Bn) × 100 = 16.45

Comparing the 2 options, we can conclude that the purchase of goods and materials from a VAT evader is fraught with a decrease in net profit (and in this case led to losses) due to an increase in expenses.

What are the consequences of exceeding the share of VAT deductions for organizations and individual entrepreneurs?

With a high proportion of the VAT deduction, the amount of this tax approaches zero, which is regarded by the tax authorities as a violation of the established criterion. In this regard, the tax inspector may demand clarification or call the head of the organization or entrepreneur personally to the territorial body of the Federal Tax Service. Representatives of the tax service may also come with an inspection.

Important ! Exceeding the percentage ratio of the deduction to VAT is one of the indicators that the Federal Tax Service pays attention to when compiling a list of candidates for an on-site inspection. However, violation of this restriction is significant only if other indicators are also violated.

It should be noted that not only exceeding the established values may be of interest to tax authorities. They may also consider the percentage of the deduction to be too low to be suspicious. Therefore, organizations and entrepreneurs who want to reduce the attention of tax authorities in this way risk, on the contrary, attracting unnecessary interest.

What to do if the specific gravity of the deduction is exceeded?

First of all, in order to know whether the deduction amount is higher than necessary and to prepare for the application of measures to your organization by the tax authorities, you need to calculate its specific weight. For the calculation, you can use the VAT return, namely its third section. It contains the following lines:

- VAT deductible – line 190;

- VAT accrued – line 118.

So, the specific gravity value is found using the following formula:

VAT deductible: VAT accrued * 100%.

To trace the trend, it is advisable to calculate the share for the last several periods.

When indicating a deduction for value added tax above the average value, it is necessary to prepare for the fact that the tax office will require explanations by sending a corresponding request or by calling the taxpayer to give explanations in person. Therefore, you should prepare in advance, namely:

- Collect documents confirming the right to a deduction and its amount;

- Prepare documents for the representative of the organization on his powers.

Can the share of VAT deductions exceed the safe share of VAT deductions legally?

The mere statement of a high percentage reduction in value added tax is not an absolute reason for including an organization in the plan of desk or on-site inspections.

The company's activities are considered comprehensively. A thorough pre-check analysis is carried out in its regard.

Note that sometimes in practice tax authorities ask the taxpayer to explain the reasons for the high share of VAT tax deductions.

At this point, it is important to clearly and reasonably explain why the company has declared a high percentage of reduction in value added tax.

If such reasons are objective in nature, then there is a possibility that the provision of appropriate explanations can reduce the risk of including the taxpayer in the plan of on-site tax audits.

The question often arises: can the share of VAT deductions legally exceed the safe share of VAT deductions?

The answer is, of course it can. There is no ban on this.

Moreover, if, after a desk audit, the declared amount of tax to be refunded is found to be correct, the Federal Tax Service is obliged to return the excess amount to the taxpayer.

This situation may arise, for example, if:

- the company purchased a large volume of goods, sales of which will occur only in the next quarter;

- the manufacturing enterprise purchased expensive equipment;

- the customer refused to purchase a large batch of products, and the purchase of components for its production had already been made;

- in other reasonable circumstances.

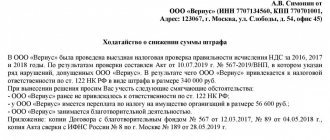

How to correctly draw up explanations when the amount of VAT deductions has been exceeded?

On the Internet you can easily find an answer to the tax authority’s demand for an explanation of the high share of VAT deductions. However, the time spent searching for a template can be saved, since such a response does not require strict adherence to the form: it can be compiled in free form. As part of this article, we will provide an approximate plan for writing a response, which will give an idea of how to give an explanation to the Federal Tax Service in connection with the excess of the specific weight of the tax deduction.

So, in a written response to a request for clarification, you must indicate which specific requirement you are responding to. Next, you must inform that you analyzed the documents confirming the size of the tax base and deductions. If any inaccuracies are identified, write about them. If there were none, report that no such were identified. Next, write about whether you consider it necessary to submit an updated VAT return to the Federal Tax Service:

- Errors are identified - there are reasons, support them with an adjusted declaration;

- No shortcomings were identified - no reason.

Next, describe the situation that served to increase this indicator with references to supporting documents and legislative acts.

At the end, you say that you consider yourself a law-abiding taxpayer.

Reason 1. The company has just recently been registered

Organizations whose business is just starting do not have a sufficient market, but a “young” company has plenty of expenses. For example, invoices for office and warehouse rent, advance payment for electricity, Internet connection, telephone connection, purchase of goods to a warehouse for subsequent resale, etc. In this situation, the organization has a lot of expenses, but sales have not yet been established and do not generate enough income to cover expenses. In the explanations for the inspector, we indicate the reason for the increase in the indicator: “Due to the start of business activities, the company’s costs exceed its income. To organize the work of the office and warehouse, the necessary equipment and furniture were purchased, and the services of companies providing communication services were paid for. Advance payments have been made to connect the company to electricity and heating. Products have been delivered to the warehouse, the sale of which is planned for the next quarter.” As an appendix, we provide constituent documentation confirming the date of registration of the company, as well as all primary documents confirming the listed costs: invoices, accounting cards, contracts, invoices, acts for the provision of services, etc.

Reason 2. Replenishment of goods for subsequent resale

For example, the head of an organization issued an order to stock the warehouse with products that will become more expensive in the next quarter, so buying goods in advance means acquiring additional profit from the difference in price. As a result, the warehouse will be replenished with goods, and a high proportion of deductions will be reflected in tax accounting. In the explanations we indicate: “replenishment of the warehouse with goods for subsequent sale in a future period.” We attach documents confirming the accuracy of the information provided: accounting cards confirming the receipt and balance of goods in the warehouse, a copy of the agreement for the purchase of products, invoices.

Reason 3. Seasonality of business

Sales volumes of some types of goods depend on seasonality, for example, products for winter fishing or lawn mowers. Sales of such goods practically cease outside the season for which they are intended for use. However, costs, for example, for storage and warehouse maintenance, remain. Therefore, the deductions are high. In the explanations we indicate: “seasonality of the product.” We attach documents confirming the availability of expenses and balances in the warehouse.

Reason 4. Late receipt of invoices from counterparties

An invoice can be accepted for deduction only upon receipt of it from the counterparty. Upon receipt of the original invoice, the organization records its receipt by mail in a special journal. But, unfortunately, the post office is not always impeccable in the quality of the services provided, and correspondence is “delayed” and sometimes completely lost. It is not surprising that invoices are received by the accounting departments of organizations with a delay. As a result, we accept some invoices for deduction in the tax period following their issue. The law provides for the possibility of submitting an invoice at a later date; it is enough to attach an explanation justifying such actions on your part. In the explanations we indicate: “acceptance for deduction of invoices issued in the previous tax period due to a delay in the receipt of the specified documentation by the organization.” We attach documents confirming the accuracy of the information provided: an extract from the invoice register, a copy of the invoice itself, an extract from the purchase book about the absence of the specified invoices in the previous tax period.

Reason 5. Small trade margin (during resale) or small added value (during production)

The market sets the price level above which the organization cannot set the price of the goods it sells. Therefore, in order to maintain their position in the market, some companies set minimum markups and surcharges on products. During production, a situation may additionally arise when raw materials for production are purchased at a VAT rate of 10%, and sales at 18%. In the explanations we indicate: “a small trade margin in order to maintain the competitiveness of the organization.” We attach documentation confirming the accuracy of the information provided: copies of contracts for the purchase of goods or raw materials, invoices for the purchase and shipment of products. Of course, these are just some of the reasons that will be accepted by the inspector as an explanation to the tax office about the high share of VAT deductions (sample: reason 1).

Deduction of VAT from prepayment if its amount is greater than stated in the contract

The Federal Tax Service and the Ministry of Finance insist that it is possible to deduct VAT from an advance payment only if the conditions for transferring the advance payment are contained in the contract. Implies a familiar agreement in the form of a separate document. If there is no such agreement or there is no provision for prepayment, then the tax authorities will refuse the deduction.

Arbitrators have different opinions on this matter - there are decisions in which the existence of an agreement in the form of an independent document is recognized as optional. After all, if the company made an advance payment, it means that it confirmed the conclusion of the contract.

We invite you to familiarize yourself with the Tax deduction for a disabled child in 2019, how to apply

However, the tax authorities did not refuse the contract requirement in this case. True, now they consider it acceptable to provide them with a copy rather than the original document.

Thus, if VAT is claimed on an advance payment, the Federal Tax Service may request an agreement (copy), which must contain a condition for prepayment. Otherwise, deductions may not be recognized.

It happens that the contract specifies one advance payment amount, but in fact the buyer transfers more. The Ministry of Finance admitted that in this case, VAT can be deducted from the entire prepayment amount actually transferred. But the tax authorities nevertheless request clarification in such a situation.

You can answer something like this:

Response to request No. ___________ dated __________ for a deduction from the advance payment transferred to the supplier

Cactus LLC, in response to request for clarification No. ____________ dated _______, explains the following.

In line 150 of section 3, the deduction amount was 36,000 rubles.

In accordance with paragraph 9 of Article 172 of the Tax Code of the Russian Federation, VAT can be deducted from an advance payment if the following conditions are met:

These conditions are met in relation to the operation in question.

Our company transferred an advance payment in a larger amount than provided for in the contract, so we claimed a large amount of VAT as a deduction. In accordance with the explanations of the Ministry of Finance given in letter No. 03‑07‑11/8323 dated 02.12.2020, this deduction procedure does not contradict the requirements of the law. The legality of the deduction is also confirmed by arbitration practice (Resolution of the Arbitration Court No. F04-2547/2020 of June 21, 2020 in case No. A45-18969/2020).

We also inform you that the counterparty calculated VAT on the amount of the advance payment actually transferred by us and reflected it in the sales book and tax return.

High share of tax deductions for VAT. Response to the tax office

After submitting your VAT return, did the tax office receive a request to provide an explanation for the high share of VAT deductions? An example of an explanation is easy to find in open sources, but it is not worth wasting time because explanatory documentation can be provided in any form. It is recommended to indicate that:

- the indicators indicated in the declaration are correct, re-checked and approved in the previous values;

- the organization did not make errors or incompletely reflect information, and clarification is not required;

- The organization has taken measures to increase these indicators in the next reporting period and reduce the share of VAT tax deductions.

It is recommended to decipher and attach to the explanatory note the calculation of the disputed values of the indicators and documentation confirming the information provided in the documentation. To explain why an organization has a high share of VAT tax deductions, an explanation (it is difficult to find a suitable example, because the reasons for each organization are individual) should be provided with the requested documentation attached within five banking days. Without providing written explanations on the issues requested by the inspectors, the entrepreneur is not liable before the law. But a timely response to the tax authorities’ demands on a voluntary basis will save the organization from problems with unreasonable penalties, which inspectors, at their discretion, will impose on the enterprise on controversial issues. Unfortunately, in such situations, controversial issues are resolved not in favor of the organization. Of course, the tax inspectorate evaluates the tax risks of companies based on more than one indicator, so just exceeding the values established on the basis of statistical information will not be the reason for an audit, but it will certainly be the basis for additional demands from inspectors. It is fair to note that, working within the specified indicator, an entrepreneur is not immune from tax audits. So, before submitting the declaration, the leaders of the organization should check such an indicator as the share of tax deductions for VAT, because exceeding the threshold value will provoke a keen interest in the company on the part of the inspection authorities. Although, if the company’s business is legitimate and legal in nature, and the transactions are not related to “fly-by-night companies,” then both the accountant and the director have nothing to fear and have something to provide tax officers with as an objection to the claims. For example, to indicate the objective reasons for the high share of tax deductions for VAT, we will consider a sample explanation.

An example of an explanation for a requirement

If, after reading the above recommendations, you do not have an understanding of the structure of the letter, we hasten to please you - we will then provide several examples of responses to such a requirement.

So, example one. The company was recently registered: sales are still weak, but expenses are quite high.

Sample response to a request:

In response to requirement N 0000 to conduct an analysis of VAT tax reporting for the period: 0 - 0 quarters of 0000, we inform you that we carried out an audit, the results of which revealed that the data in the VAT return for the specified period was entered correctly: the tax base was formed correctly. The reason for the high share is the excess of the organization's expenses over its income. This is due to the start of entrepreneurial activity. To organize the work of the company, it was necessary to pay office rent, purchase computer and other office equipment, as well as pay for communication services and delivery of goods to the warehouse. The product has not yet been sold, its sale is planned for the next quarter. In response to the request, we provide the supporting documents specified in the application.

Example two. The company's activities are related to the sale of seasonal goods.

In your response to the request, you indicate everything the same as in the first example, but as the reason you indicate the seasonality of the products sold. Write here about when you plan to implement it. This letter is also supported by supporting documents.

VAT deduction if there is an unscrupulous counterparty in the chain.

Most of the requests concern situations where the supplier of the first or subsequent level counterparty does not submit reports.

Let us remind you that as of August 19, 2017, a refusal to deduct is possible if the company has abused its right (Article 54.1 of the Tax Code of the Russian Federation). Tax authorities have the right to withdraw a deduction if:

- the company deliberately distorted facts in accounting and reporting;

- the concluded transaction has no business purpose, its only purpose is to reduce taxes;

- The executor of the transaction is fictitious.

However, if the tax authorities do not provide evidence of the coordination of the actions of the applicant and the disputed counterparties aimed at completing a transaction for the purpose of non-payment (incomplete payment), there is no evidence of the control of the counterparties, other facts of imitation of economic ties and (or) evidence of affiliation of the parties to the transaction, claims of the tax authorities easy to challenge in court (Resolution of the AS UO dated March 30, 2018 No. F09-795/18 in case No. A76-8310/2017).

We invite you to familiarize yourself with the Order on bringing to disciplinary liability sample