How is the cash limit regulated?

The state, represented by the Central Bank of Russia, has set a limit on cash payments. The regulatory act on the basis of which the law determines the procedure for settlements is Directive of the Central Bank of the Russian Federation dated October 7, 2013 No. 3073-U. This document replaced the previous Instruction No. 1843-U dated June 20, 2007, with some significant changes made to it.

But the maximum limit for settlements using cash has not changed - within the framework of one agreement between the parties to the settlement it is 100,000 rubles. (or the corresponding amount of currency, according to the current Central Bank exchange rate).

NOTE! The prohibition on exceeding this figure applies regardless of whether you pay or receive money. But if violations are detected, the party receiving the excess cash is considered responsible.

The size of the limit and when it is valid

The maximum amount for cash payments is RUB 100,000. This restriction applies to payments under one agreement. This means that if you conclude several contracts with the same counterparty, then the amount of all cash settlements with him may exceed the limit. The main thing is to comply with the restriction for each individual agreement. This is confirmed by arbitration practice (see, for example, the resolution of the Tenth Arbitration Court of Appeal dated September 7, 2015 No. A41-27520/15).

The limit is valid without time restrictions. That is, no matter how much time has passed since the contract was concluded, take into account the limit on it when making cash payments.

The limit is set for payments between:

- organizations;

- organization and individual entrepreneur;

- individual entrepreneurs.

Restrictions do not affect settlements with citizens.

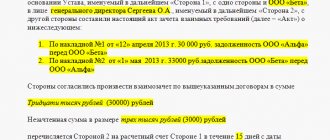

From all this it follows that an organization or entrepreneur cannot pay in cash the entire amount under an agreement (including a long-term one) if the price specified in it exceeds 100,000 rubles. The frequency of payments does not matter. That is, if, say, the contract price is 200,000 rubles, then you can pay in cash only in the amount of 100,000 rubles. And if you made the first payment to the counterparty’s cash desk under such an agreement in the amount of 55,000 rubles, then the amount of the next cash payment under the same agreement will be a maximum of 45,000 rubles. The excess balance under the contract will have to be transferred by bank transfer to the account of the counterparty.

All this follows from paragraphs 5 and 6 of the Bank of Russia instruction dated October 7, 2013 No. 3073-U.

The maximum amount of cash payments applies to all obligations stipulated by the agreement. That is, not only for the price of the contract, but also for fines, penalties and any other prescribed sanctions, as well as compensation for losses. Moreover, even when they are fulfilled even after the end of the agreement. This follows from paragraph 2 of paragraph 6 of the Bank of Russia Directive No. 3073-U dated October 7, 2013.

For example, an organization did not pay on time under a contract whose price was 80,000 rubles. Now she is obliged to pay an additional 30 thousand fine. In this case, the debt can be repaid in cash only within 100 thousand. The remaining 10 thousand will need to be paid only by bank transfer.

Limited settlement participants

Who does this restriction on accepting and transferring cash apply to? You cannot transfer amounts exceeding the one hundred thousand limit between:

- legal entities;

- organizations and private entrepreneurs;

- individual entrepreneurs (IP).

Individuals can exchange cash without restrictions. The settlement of enterprises with individuals without business registration is also not limited.

LET'S SUMMARY : the table shows couples in whose employment relationships a cash limit is or is not mandatory.

| There is a limit on cash payments | Unlimited settlement participants |

| legal person + legal entity face | physical face + physical face |

| legal person + individual entrepreneur | legal face + physical person (not registered as individual entrepreneur) |

| IP + IP | physical person + individual entrepreneur |

Nearest forecast

In order to make transparent control over expensive purchases of ordinary citizens (real estate, cars, jewelry), the Russian Ministry of Finance took the initiative to set a maximum amount for cash payments between individuals. The amount for cash payments under one agreement between individuals is planned to be 300,000 rubles. The changes that are going to be made to Article 861 of the Civil Code of the Russian Federation also provide for punishment in the form of a fine in the amount of the exceeded limit. It was planned that the changes would come into force from the beginning of 2016, however, this project has not yet been considered by the State Duma.

Limitation of cash payments

Any business entity must adhere to the restrictions established by Directive of the Central Bank of the Russian Federation No. 5348-U dated December 9, 2019. This applies to both individual entrepreneurs and legal entities.

Settlements between individual entrepreneurs and legal entities are also subject to restrictions. The maximum amount that one entity can pay to another is 100,000 rubles.

If there are several contracts and each one is for an amount of up to one hundred thousand rubles, payments can also be made in cash.

These restrictions apply to the following types of monetary transactions:

- transfer of funds for goods in accordance with the purchase and sale or delivery agreement;

- payment for services related to the activities of a person;

- repayment of debt under an agreement (credit, loan), as well as repayment of debt associated with other obligations;

- other types of operations.

There are only some restrictions, but they are expressly provided for by current legislation.

When can you not think about the limit?

The established limits on the amount of cash do not apply:

- when paying wages;

- for social charges, insurance payments;

- when issuing accountable funds;

- for personal expenses of the business owner, money for which is taken from the cash register.

The Central Bank Directive also provides additional types of settlements where you don’t have to worry about the cash limit:

- operations with the help of the Bank of Russia;

- customs payments, taxes and fees;

- loan payments.

IMPORTANT INFORMATION! The new edition of the Central Bank Directive contains an innovation that plays into the hands of banks, but is not entirely pleasant for entrepreneurs. You cannot take cash from the cash register for purposes not mentioned in the special list: you first need to deposit the proceeds in the bank, and then take the required amount from there. In this case, the bank will receive interest for both operations, the state will receive additional control over the movement of funds, and the entrepreneur will receive another complication. However, “Dura lex sed lex” (“The law is harsh, but it is the law”).

If the cash desk of an enterprise or individual entrepreneur received amounts not from their current account, but from other sources (revenue, loans, return of unused accountable funds, etc.), then take cash from this money for settlements not included in the list of the Central Bank, not allowed.

Should an individual entrepreneur comply with a limit when withdrawing cash for purposes not related to business?

The outdated rules contained situations in which the cash payment limit did not apply. The list included withdrawal of money: on account; for personal purposes of the individual entrepreneur; for payments to employees from the wage fund and social payments.

The new rules do not contain such a list. Is it possible to conclude that the listed operations are allowed to be carried out only taking into account the 100 thousandth limit?

No you can not. The explanation is the same as for the case of settlements between a businessman and an individual. The rules clearly state that the limit applies when making payments between two organizations, two individual entrepreneurs, or an organization and an individual entrepreneur. And the withdrawal of cash by an entrepreneur for consumer purposes does not belong to any of these operations. Therefore, there is no question of any limitation here. The same applies to the issuance of accountable funds and cashing out money for salaries.

Calculate your salary taking into account the increase in the minimum wage from 2021

REFERENCE. In 2007, there was also a limit on cash payments of 100 thousand rubles under one agreement. But it was established by another document - instructions of the Central Bank of the Russian Federation dated June 20, 2007 No. 1843-U. And in this document, as in the commented rules, there was no clause regarding the withdrawal of money for salaries. However, Central Bank specialists in letter dated December 4, 2007 No. 190 explained: when issuing wages and scholarships, the limit does not apply. There is reason to believe that today the official position remains the same.

Scope of one agreement

An important clarification regarding the cash limit is that it cannot be exceeded within the framework of one contract.

A contract is a document of agreement between persons (legal and/or natural) about certain actions intended to establish, terminate or change certain rights and obligations of the parties.

The amount of transactions for each such document cannot exceed 100,000 rubles, and the specifics of its conclusion are not taken into account.

- Type of contract . It doesn’t matter what the agreement is about - a loan, supply of goods, payment for services - the declared value for payment in cash cannot be more than the limited value.

- Terms of the contract . Even if the contract involves a long settlement, the specified amount cannot be exceeded.

- Frequency of payments . Installment plans or other cash payments, divided according to the agreement into several parts, each of which is less than the limit, will not be legal if their amount exceeds 100,000 rubles.

- Additional obligations . If the contract has an additional agreement or obligations arising from it, for example, penalties, fines, penalties, compensation, they cannot be paid in cash if payment has already been made under this agreement for a limited amount.

- Decor . One document or exchange of papers between the parties does not matter, the total obligations cannot exceed one hundred thousand in cash.

- Method of calculation . Will an authorized person bring the money, will it be issued at the cash desk - more than 100,000 rubles. “in one hand” is not issued.

Cash payment limit in 2021

Home / Cash discipline

| Table of contents: 1. Limit size 2. Participants of limited settlements 3. Cash payments without restrictions | 4. Payments within one agreement 5. Penalties |

The cash payment limit is a legal limitation on the maximum amount within which organizations (IPs) are allowed to make and accept cash payments under one agreement.

Limit size

The procedure for cash payments is standardized by the Directive of the Central Bank of the Russian Federation dated October 7, 2013 No. 3073-U (hereinafter referred to as the Directive).

This act sets a limit of 100,000 rubles. for cash payments between the parties to the transaction.

If cash payments are made in foreign currency, the threshold is equal to the amount corresponding to 100 thousand rubles. at the rate established by the Central Bank of the Russian Federation on the day the money is received at the cash desk of the business entity.

Participants of limited settlements

Limitation of settlements applies to legal entities. individuals and individual entrepreneurs, but does not apply to individuals.

Below, in the table, possible variations of transactions using cash between parties falling under the scope of the Directive, as well as those free from compliance with the limit, are considered.

List of abbreviations used:

- LE – organization (legal entity);

- FL – a citizen who is not registered as an individual entrepreneur (individual);

- Individual entrepreneur - individual entrepreneur.

| Transactions subject to the limit | Unlimited deals |

| YUL + YUL | LE + FL |

| Legal entity + individual entrepreneur | IP + FL |

| IP + IP | FL + FL |

Cash payments without restrictions

Cash can be spent without restrictions on:

- payment of wages and other payments included in the wage fund;

- insurance payments and social payments (maternity pay, vacation pay, sick leave, etc.);

- issuing money to employees on account (including for travel expenses);

- payment of money by an individual entrepreneur to himself for personal expenses, if such funds are not used to conduct commercial activities.

It is prohibited to issue money from the cash register of an organization (IP) for purposes not specified in the Directive.

For example: a business entity plans to issue a loan to an employee. In this case, the cash proceeds should be handed over to a financial institution (bank), and then the funds should be received by check and handed over to the employee.

In this case, the subject will pay the bank commission twice: for depositing funds into the account and for withdrawing cash by check.

An individual entrepreneur has the right to withdraw any amount from the cash register; to do this, it is necessary to issue an expenditure order, indicating the following wording as the basis: “For personal needs.”

Compliance with the limit is also not required for the following types of calculations:

- Operations carried out through the Bank of Russia;

- Customs payments, as well as payments for taxes and duties;

- Banking operations that are carried out in accordance with the legislation of the Russian Federation.

Payments within one agreement

Cash within the current limit can be spent on:

- acquisition of products (except for securities), services, works;

- refund of funds for a previously purchased transaction item, provided that it was paid for in cash.

The settlement threshold cannot be exceeded within a single agreement. In this case, the specifics of concluding the contract do not matter.

| Type of contract | The limit applies to payments under the contract, regardless of the subject of the transaction. |

| Duration of the agreement | The period for which the contract is concluded does not matter; exceeding the settlement limit is prohibited. |

| Frequency of payments | The total volume of cash payments, divided into several parts, cannot exceed the threshold of 100,000 rubles. |

| Additional agreements and obligations | Fines, penalties, penalties and other compensation payments, as well as additional payments within the framework of additional payments. agreements to the main contract cannot be made in cash if the main payment for the allowable amount has already been made. |

| Calculation method | Transferring money belonging to an organization (IP) through an authorized person in an amount exceeding the permissible threshold is not legal. |

If the total price of the agreement is more than 100,000 rubles, you can pay part of the amount within the limit in cash, and the remaining funds should be transferred by bank transfer.

When concluding several agreements with one counterparty, even signed at the same time, the total value of cash obligations can be anything. But the amount of cash payments for each contract separately should not exceed the permissible limit.

If several agreements with a similar subject of transaction have been concluded between the parties and the terms of the agreements have not undergone significant changes, the court qualifies such contracts as “one agreement” with all the ensuing consequences.

Penalty for exceeding the cash payment limit

For non-compliance with the procedure for handling cash, fines are provided, according to Art. 15.1 Code of Administrative Offenses of the Russian Federation:

- from 40 to 50 thousand rubles. for legal entities persons (organizations);

- from 4 to 5 thousand rubles. for officials and individual entrepreneurs.

Cases related to non-compliance with the Directives of the Central Bank of the Russian Federation are within the competence of the tax authorities (Article 23.5 of the Code of Administrative Offenses of the Russian Federation).

The period during which inspectors can impose a fine for failure to comply with the cash payment threshold is no more than 2 months from the date of such violation. It does not matter when the violation was actually discovered.

Administrative liability for non-compliance with legislative norms applies to both the recipient of funds and the payer (Article 15.1 of the Code of Administrative Offenses of the Russian Federation). Judicial practice universally supports this position with decisions in favor of the budget.

Read in more detail: Cash payment limit between legal entities

Did you like the article? Share on social media networks:

- Related Posts

- Cash accounting book (form KO-5)

- Payroll (form T-53)

- Order establishing a cash limit in 2021

- Application for the release of money for reporting

- Cash book (form KO-4)

- Receipt cash order (form KO-1)

- Cash discipline in 2021

- Cash withdrawal from the cash register

Leave a comment Cancel reply

Options for allowed combinations

It follows from the text of the Central Bank Directive that the “cache” restriction concerns actions specifically under a single agreement without a limit on time and number of transactions. Let's consider cases when cash payments in excess of the established limit between legal entities and/or individual entrepreneurs are allowed:

- several concluded contracts, even on the same day, can together amount to any amount of cash (but each individually must not exceed the limit);

- an agreement for an amount greater than the established one allows you to pay in cash up to 100,000 rubles, and the rest must be paid by bank transfer;

- An individual entrepreneur can take money from the cash register for his own needs in as much as he deems necessary (this does not need to be formalized in a separate agreement, but only in a cash receipt order).

Responsibility for exceeding the maximum cash settlements for delivery

If cash payments are made under the supply agreement for an amount exceeding the limit of 100,000 rubles, then the violators will be held accountable in accordance with Art. 15.1 of the Code of the Russian Federation on Administrative Offences. Part 1 of this article provides for liability in the form of a fine of the following amount:

- 4,000–5,000 rub. - for officials;

- 40,000–50,000 rub. - for organizations.

IMPORTANT! Dividing one contract, which involves delivery in an amount exceeding 100,000 rubles, into separate supply agreements, the amount of cash settlements for each of which does not exceed 100,000 rubles, will not relieve liability if the regulatory authorities establish that the real will of the counterparties was aimed at single delivery (resolution of the Federal Antimonopoly Service dated December 3, 2008 in case No. A72-3587/2008).

So, this article presents a sample supply agreement that provides for a cash payment method.

When concluding an agreement, it is important to remember that the amount of money transferred under the agreement should not exceed 100,000 rubles. The same rule applies for settlements in foreign currency, taking into account the exchange rate of the Central Bank of the Russian Federation. Exceeding the established limit entails administrative liability. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

The violator will pay more

The Civil Code of the Russian Federation in paragraph 1 of Article 15 defines exceeding the cash payment limit as an administrative offense. If it is revealed by an appropriate check, the party who accepted excess cash will be fined. The sanctions will affect not only the company itself, but also the manager who neglected or abused:

- fine to a legal entity - up to 40-50 thousand rubles;

- fine to the manager - up to 4-5 thousand rubles.

FOR YOUR INFORMATION! The period during which you can fear liability for this offense is 2 months from the date of signing the relevant agreement.

You should be very careful when signing contracts, study all the items under which funds will flow before deciding on cash payments.