Kontur.Accounting - 14 days free!

Automated calculation of vacation pay in a few clicks.

Save your time. Try for free

Employees are provided with annual leave while maintaining their place of work (position) and average earnings. (Article 114 of the Labor Code of the Russian Federation). Moreover, some categories of workers are entitled to additional vacations in addition to the main vacation.

The average salary retained by an employee during vacation is determined by the formula:

Average daily earnings = Amount of accrued salary for the billing period / (Number of full months × Average monthly number of calendar days (29.3))

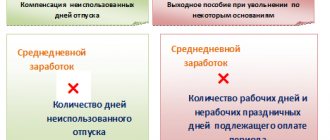

Amount of vacation pay = Average daily earnings × Number of vacation days

The amount of vacation pay will also depend on whether the tariff rates (salaries) were increased during the billing period or after.

Number of vacation days to calculate

Most often, vacations are granted in calendar days. Standard paid basic leave is 28 calendar days. Moreover, the employee can take time off not immediately, but in parts. The main thing is that at least 2 weeks of vacation should be taken off continuously.

Some categories of workers are entitled to extended basic leave (Article 115 of the Labor Code of the Russian Federation). For example, workers under 18 years of age must rest 31 calendar days, and disabled people - 30 (Article 267 of the Labor Code of the Russian Federation, Article 23 of the Federal Law of November 24, 1995 No. 181-FZ)

Labor legislation also provides for additional leaves for employees (Article 116 of the Labor Code of the Russian Federation).

For the calculation, it is important to exclude all non-working holidays from vacation days. That is, all all-Russian holidays established by Art. 112 of the Labor Code of the Russian Federation, and holidays established in a specific region by the law of the subject of the Russian Federation (part 1 of article 72 of the Constitution of the Russian Federation, article 22, 120 of the Labor Code of the Russian Federation, article 4 of the Federal Law of September 26, 1997 No. 125-FZ, clause. 2 letters of Rostrud dated September 12, 2013 No. 697-6-1). However, weekends are still included in the calculation.

Important! Non-working days to which holiday weekends are postponed are included in the calculation. If the day off coincides with a holiday, then the Government of the Russian Federation issues a resolution setting the date to which the day off and holiday is transferred. For example, in 2021, February 23 fell on a Saturday, and the day off from that day was moved to May 10. If an employee is on vacation on May 10, this day must also be paid.

Determining the billing period

Calculate vacation pay in a few clicks in the Kontur.Accounting web service! Get free access for 14 days

As a general rule, the billing period for calculating average daily earnings is defined as 12 calendar months preceding the month in which the first day of vacation falls (Article 139 of the Labor Code of the Russian Federation, clause 4 of the Regulations, approved by Decree of the Government of the Russian Federation of December 24, 2007 No. 922 , hereinafter referred to as the Regulations).

It is necessary to exclude from the billing period all the time when the employee (clause 5 of the Regulations):

- Received payment in the form of average earnings (with the exception of breaks for feeding the child in accordance with the law). For example, the time of a business trip or other paid leave;

- Was on sick leave or maternity leave;

- Didn’t work due to downtime through no fault of his own;

- Did not participate in the strike, but due to it could not work;

- Used additional paid days off to care for disabled children and people with disabilities since childhood;

- In other cases, he was released from work with full or partial retention of wages or without pay. For example, vacation time at your own expense or parental leave.

It may turn out that in the 12 months preceding the vacation there was no time at all when the employee was paid wages for the days actually worked, or this entire period consisted of time excluded from the calculation period. In this case, as the calculation period you need to take the 12 months preceding the first mentioned 12 months (clause 6 of the Regulations).

If the employee did not have actual accrued wages or actually worked days during the billing period and before it began, then the days of the month in which the employee goes on vacation are taken as the billing period (clause 7 of the Regulations).

A collective agreement or local regulatory act may provide for other billing periods for calculating average wages, if this does not worsen the situation of workers (Article 139 of the Labor Code of the Russian Federation).

How to calculate the average earnings for an employment center if there was a vacation

Determining the amount of money to be credited to the employee for the period that has passed since the end of the previous vacation is the basis for calculating vacation pay. This value takes into account the income that the employee received for the specified period in the form of an average value.

Direct determination of the amounts to be credited is carried out by the accounting department of the enterprise. The procedure and rules for calculation are established by the Labor Code of the Russian Federation. Earnings are determined based on the total amount of all payments that the employee has received since returning to work after the previous rest.

Consequently, the indicated amount includes his direct salary, various bonuses, financial assistance and similar incentives. At the same time, labor legislation contains such a concept as the inadmissibility of double payment.

That is, accrual of funds for the same period is unacceptable.

Please note Due to this principle, the amount of previous payments cannot be included in the payment for a new annual vacation.

The fact is that the basis for calculations is income per day, and during the specified period the employee did not actually work. And his previous transfers included payments for the previous period of work.

Thus, the inclusion of these transfers in the new ones will become double payment for the time worked. The calculation formula does not include benefits from the Job Center.

According to government decree, employment center authorities take into account only those amounts that are received directly for the performance of their work duties.

No other means matter. This applies not only to the calculation of money for vacations, but also to sick leave payments and similar transfers that were made in connection with direct work.

Therefore, the employer, when issuing a certificate of income for the employment center, will not take into account these transfers. Calculation of funds for an employee is carried out using the following simple mathematical operations.

- The result will be the value for one day actually worked.

- Then you should take the number of days of future vacation and multiply them by the value of the average vacation. The result will be the amount of funds that the employee will receive when going on vacation.

- It is necessary to deduct from the total amount the money paid for sick leave and daily wages for absenteeism, as well as for days of absence from work for any other reasons.

- This will give the net income received for the time worked.

- The specified value must be divided by the number of days worked for the period since the last vacation.

- You should take payment for all the time that has passed since the end of your last vacation. In this case, it is necessary to take into account all accruals received by the employee. This will give the total amount of money credited for the work.

This formula can be visualized as follows: Then, the duration of the vacation is multiplied by this value.

This results in a specific amount that will be given to the employee.

How to calculate average earnings for 3 months

→ → Current as of: December 19, 2021

The task of determining average earnings for the last three months faces those employers who have laid-off workers who have decided to register with the employment service and have requested a certificate of average earnings (,).

It is needed to assign unemployment benefits.

For these purposes, average earnings are calculated for the 3 months preceding the month of dismissal (). That is, if, for example, an employee was fired on November 14, 2021, then the average earnings will need to be calculated for the period from August 1 to October 31, 2021. In this case, these 3 months exclude periods during which ():

- the employee retained his average earnings (business trips, paid vacations, etc.);

- the employee was paid temporary disability benefits;

- the employee was released from work with preservation of average earnings for any reason.

Accordingly, payments received by the employee for the listed periods are not taken into account in the calculation.

If it so happens that the indicated 3 months consist entirely of excluded periods, then the average earnings must be calculated from the other next 3 calendar months in which the employee had days worked ().

Next, to answer the question of how to calculate the average earnings for 3 months, we will look at the amounts based on which the calculation is made.

When determining the amount of average earnings, all payments included in the remuneration system are taken into account: wages, allowances, additional payments, bonuses, other remunerations ().

And at the same time, payments that are not wages, including social payments, are not taken into account.

In general, average earnings for the purpose of determining unemployment benefits are calculated using the formula: Example. Amount of payments by manager Nikolaev O.S.

for 3 months amounted to 63,500 rubles. The billing period is from August 1, 2016 to October 31, 2021. The employee worked 61 days. The number of working days according to the organization’s schedule is 66.

Then the average earnings will be: 22901.64 rubles. (63,500 rub. / 61 days x 66 days.

/ 3). Also read:

Accountant forum:

Subscribe to our channel at

Calculation of average earnings for an employment center

Copyright: Lori's photo bank Calculation of average earnings for unemployment benefits is carried out according to the rules of Resolution of the Ministry of Labor of the Russian Federation dated August 12, 2003 No. 62.

The following payments must be taken into account:

- earnings calculated in favor of the employee based on the tariff rate and actual time worked;

- The calculation of average earnings for an employment center necessarily includes bonus payments, which are provided for by the wage and bonus system at the enterprise.

- the calculation of the average salary for an employment center should include payments at piece rates and in the form of a percentage of revenue;

- bonuses and additional payments accrued in the estimated time interval that could be assigned to a dismissed employee for class, skill, length of service, qualifications, possession of an academic degree, access to classified documents, for combining two professions;

- employee income in non-cash form;

- payment for night hours, overtime, for working shifts on weekends and holidays;

- the amount of increased payment for involving an employee in performing heavy work, for performing a labor function in workplaces with dangerous or harmful conditions;

- when the average salary for an employment center is determined, the calculation must also take into account such payments as regional coefficients and bonuses;

The calculation base is formed from the employee’s income accruals for three full calendar months preceding the month of termination of the employment contract. The calculation of average monthly earnings for an employment center cannot contain in the database days and payments for the following periods:

- days of release from work duties without pay.

- downtime caused by a strike of other workers;

- days of illness confirmed by sick leave;

- the time of actual absence from the workplace, provided that the person retains his average income;

- childcare periods;

How to calculate the average earnings for an employment center if there are no wage accruals in the period taken as the base?

To calculate the average income for 1 day, you need to sum up the earnings in the billing period and divide the resulting figure by the days that, according to the timesheet, were working days for the employee in this date range.

Annual leave is included in the calculation of average earnings for the employment center

Despite the lack of an approved certificate form for calculating average earnings for an employment center, the Letter of the Ministry of Labor of the Russian Federation numbered 16-5b 421 dated August 15, 2016 proposed a certificate form for use to determine the amount of unemployment benefits.

In the billing period (three calendar months before the month of dismissal from the first to the first) the following are not counted:

- days of annual leave, leave without pay, study leave;

- days on which the employee was released from work, but at the same time he was paid the average salary in full or in part;

- days of rest that were provided to the employee for previously worked time;

- days of a strike, if the employee did not participate in it, but was not able to start work because of this event.

- days of rest for disabled people since childhood and disabled children;

- days of temporary disability, days of maternity leave, days of leave to care for children under one and a half and three years old;

A temporarily unemployed citizen can register at the employment center not only to find a new job, but also to receive cash benefits. To obtain unemployed status and apply for benefits, you will need a number of documents, of which the main one, which determines the amount of monthly payments, is a certificate calculating the average earnings for the employment center.

Compensation for unused vacation upon dismissal is not included in the calculation.

Since compensation is paid at the time of dismissal, and average earnings for the purpose of filling out a certificate are calculated for the last three calendar months preceding the month of dismissal.

Earnings are determined based on the total amount of all payments that the employee has received since returning to work after the previous rest.

Consequently, the indicated amount includes his direct salary, various bonuses, financial assistance and similar incentives.

Determination of earnings for the billing period

Calculate vacation pay in a few clicks in the Kontur.Accounting web service! Get free access for 14 days

All payments accrued to the employee, which are provided for by the employer’s payment system, are taken into account, regardless of the sources of these payments (Article 139 of the Labor Code of the Russian Federation). In paragraph 2 of the Regulations, approved. By Decree of the Government of the Russian Federation of December 24, 2007 No. 922, there is an open list of such payments.

The following cannot be included in the calculation of average earnings:

- All payments accrued to the employee for the time excluded from the payroll period. They are listed in clause 5 of the Regulations. For example, average earnings for days of business trips and in other similar cases, social benefits, payments for downtime;

- All social benefits and other payments not related to wages. For example, financial assistance, payment of the cost of food, travel, training, utilities, recreation, gifts for children (clause 3 of the Regulations);

- Bonuses and remunerations not provided for by the remuneration system (clause “n”, clause 2 of the Regulations).

Bonuses (other remunerations) provided for by the remuneration system are taken into account taking into account certain features established by clause 15 of the Regulations.

Which payments are included in the calculation base and which are not?

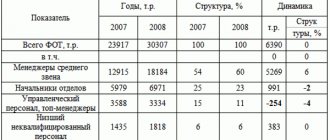

Certain provisions of the labor code clearly indicate which days and payments are used when calculating vacation pay and which are not. In this regard, we will create a small table:

- employee salary;

- percentage of revenue;

- payment in kind;

- monetary allowances for employees of government agencies and municipalities;

- fees from media and cultural organizations;

- allowances and surcharges.

| Payments that are excluded from the base | Amounts to be taken into account |

|

Sometimes employees are paid bonuses that are permanent and secured by internal regulations. These payments are also subject to accounting when calculating vacation benefits.

This is important to know: Do you need an order to approve the vacation schedule in 2021?

Calculation of average daily earnings

Calculate vacation pay in a few clicks in the Kontur.Accounting web service! Get free access for 14 days

Knowing the billing period and the total amount of earnings for this period, you should determine the employee’s average daily earnings:

Average daily earnings = Earnings for the billing period / (Number of full months in the period × 29.3)

29.3 in the formula corresponds to the average monthly number of calendar days. Moreover, the billing period is considered to be fully worked if in each month of this period there are no days excluded from the billing period (days of temporary disability, business trips, vacations, downtime, etc.).

If the billing period is not fully worked out, the formula is applied:

Average daily earnings = Earnings for the billing period / (29.3 × Number of fully worked months in the billing period + Number of calendar days in incompletely worked months of the billing period)

Moreover, for each month that is not fully worked, you need to apply the formula:

The number of calendar days in an incompletely worked month = 29.3 / The number of calendar days of the month × The number of calendar days falling within the time worked in a given month.

Example

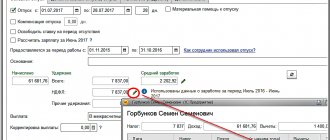

The employee has been working for the organization since August 1, 2021. On July 15, 2019, he goes on vacation for 14 calendar days. In this case, the billing period is 11 months - from August 1 to June 30. During the billing period, the amount of earnings for calculating vacation pay amounted to 600,000 rubles. There were no salary increases in the organization during this time.

In March, the employee was on a business trip for 21 calendar days. The remaining days of March are 10 (31 − 21). Accordingly, March is an incomplete month of the billing period, from which only 9.5 days are taken to calculate vacation pay (29.3 × 10 / 31).

In October, the employee was sick for 11 calendar days. The remaining days of October are 20 (31 − 11). Accordingly, October is also an incomplete month, from which only 18.9 days are taken to calculate vacation pay (29.3 × 20 / 31).

There are 9 fully worked months left in the billing period (11 − 2). Accordingly, the average daily earnings of an employee will be:

600,000 rub. / (29.3 days × 9 months + 9.5 days + 18.9 days) = 2,054.09 rubles.

The employee must be paid the amount of vacation pay of RUB 28,757.26. (RUB 2,054.09 × 14 days).

For employees who receive vacation in working days, the average daily earnings are calculated based on the number of working days according to the calendar of a 6-day working week:

Average daily earnings = Salary accrued for the entire period of work / Number of working days according to the calendar of a six-day working week, which falls on the time worked by the employee

If the billing period has not been worked out at all and there was no salary immediately before the vacation (for example, the employee returned from maternity leave or the employee was on a long business trip and immediately goes on vacation), then the formula is applied (clause 8 of the Regulations):

Average daily earnings = Salary (tariff rate) / 29.3

The procedure for calculating vacation pay in 2019

If the calendar year has been worked in full, the calculation of the average daily earnings for calculating vacation pay is carried out according to the standard formula. The total amount of wages and income included in it for the previous 12 months is divided by 12 and 29.4. The last figure is calculated annually and is included in the Labor Code of the Russian Federation as an amendment.

This is important to know: How holidays are paid on vacation according to the Labor Code

Since in practice it is rarely possible to fully work out a calendar year, it is necessary to adjust the annual income taking into account available sick leave, financial assistance and bonuses. Additional payments can significantly increase average daily earnings (ADW), and the availability of sick leave benefits can slightly reduce it - this depends on the duration of the certificate of incapacity for work.

The calculation of SDZ for an incompletely worked working month is calculated as the accrued amount of wages without sick leave , divided by days worked according to the calendar and adjusted by a factor of 29.4.

So, the average earnings, subject to the condition that the year has been worked in full, will be:

20000 x 12: (12 x 29.4) = 682.7 rub.

Taking into account sick leave:

From this example it follows that the time spent and the amount of sick leave are not included in the calculation of vacation pay and do not significantly affect the calculation of SDZ.

If during the 12 months of the accounting year there were some months when the employee was absent for some reason or income that was not subject to inclusion in the payroll was deducted, the SDZ calculation is calculated by dividing the total amount of accrued wages for the previous accounting period by the average monthly value of calendar days (29.4), multiplied by the number of full months and calendar days in partially worked months.