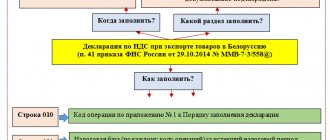

Entering information to generate information from documents confirming the validity of applying a zero VAT rate begins with adding a declaration that reflects exports. By clicking on the name of the declaration, you need to fill out general information about it.

In the "Reporting period"

The quarter and year are selected in accordance with the period for which the declaration was drawn up.

In the “Type of declaration”

selectable:

- “primary” – if no changes were made to the declaration;

- “updated” – if additions or adjustments were made to the primary declaration.

In the "Adjustment number"

it reflects which updated declaration is submitted to the tax authority (for example, “1”, “2”, etc.).

In the field “Taxpayer (exporter) attribute”

within the framework of the ongoing activities of the organization (or individual entrepreneur), one of the proposed options is selected. So, if the exporter (organization or individual entrepreneur) himself produces goods sold for export, then the attribute “manufacturer of export goods” is selected; if he sells previously purchased goods for export, then he is a “reseller”, etc.

In the subsection “Type of activity of the taxpayer (exporter)”

those types for which VAT is declared for deduction in this declaration are selected, and the tax base and the amount declared for deduction are indicated separately for each type.

Activity code «01»

indicated by taxpayers who sell goods in export mode.

Amount of VAT to be deducted

=

(line 030 + line 040 – page 050)

section 4 –

page 080

section 5 VAT tax

Activity code «04»

indicated by taxpayers who sell goods under the free customs zone regime.

Amount of VAT to be deducted

=

(line 030 + line 040 – page 050)

section 4 –

page 080

section 5 VAT tax

Activity code «05»

indicated by taxpayers who perform work and provide services directly related to the export of goods and the sale of goods in the free customs zone regime.

Attention! Tax base by code «05»

must correspond to the amount of tax bases reflected on

lines 020

of section 4 of the VAT tax return, attributable to the implementation of work (services) directly related to the export of goods.

Attention! Amount declared for deduction by code «05»

must correspond to the value of VAT on transactions for the sale of work (services) directly related to the export of goods, calculated using the formula:

Amount of VAT to be deducted

=

(line 030 + line 040 – page 050)

section 4 –

page 080

section 5 VAT tax

Activity code «06»

indicated by taxpayers selling goods to EAEU member countries (Armenia, Belarus, Kazakhstan, Kyrgyzstan).

Amount of VAT to be deducted

=

(line 030 + line 040 – page 050)

section 4 –

page 080

section 5 VAT tax

Contract details

The section is filled out by exporters for all international contracts within the framework of which goods were sold for export during the reporting period and reflected in the VAT return.

To fill out contract information, you must add a contract. Then, by clicking on it, the following data is indicated:

- date and number of the international export contract concluded by the exporter with the foreign buyer;

- code of the type of activity of the exporter to which the contract relates;

- details of the foreign buyer (recipient) according to information from the contract: name, tax identification number (if available), address;

- transaction passport number (if available), which is issued in the bank where the exporter’s account is opened, to which the buyer should receive proceeds for goods under the contract;

- contract amount - the total amount of the transaction in the contract currency. If the value of exported goods is determined in several currencies, then it is converted into the prevailing currency;

- delivery amount - the cost of a specific delivery in the contract currency, subject to its stage-by-stage execution and stage-by-stage reimbursement of VAT amounts to the exporter. If the value of exported goods is determined in several currencies, it is recalculated into the prevailing currency;

- delivery terms according to INCOTERMS standards;

- form of settlements with the taxpayer: cash, non-cash, etc. When specifying the cash form of settlements, the total amount of revenue for all receipts is also reflected;

- details of the bank from whose account the export proceeds were received (subject to non-cash payment): name, BIC and bank account number;

- details of the exporter's bank (commission agent), into whose account the proceeds from the foreign buyer were received: BIC and bank account number;

- information about cash receipt orders (subject to cash payment) - the number and date of each PCO;

- details of the application for the import of goods and payment of indirect taxes: number and date of registration of the application with the tax authority.

Attention! Details of the application for the import of goods are filled in only when selecting an activity code «06»

.

In the "Advanced"

information about the receipt of revenue, as well as about contracts with other persons, is indicated.

Subsection “Information on bank statements on receipt of revenue”

is intended to reflect information about the receipt of revenue from export supplies of goods based on bank statements.

Attention! This subsection is required to be filled out if in the field “Form of settlements with the taxpayer”

cash or non-cash form selected.

In the subsection “Information on bank statements on receipt of proceeds”

are indicated:

- the date of actual crediting (in accordance with the bank statement) of export proceeds to the taxpayer’s account from a foreign buyer;

- the amount of export proceeds received by a Russian bank in rubles and foreign currency.

This is interesting: Apartment tax in the Moscow region 2021 2021

Subsection “Information about other documents (IPD)”

is intended to reflect data on the termination of the right of mutual claims between the exporter and the foreign buyer on the basis of other receipt documents (except for bank statements and PKO).

Attention! This subsection is required to be filled out if in the field “Form of settlements with the taxpayer”

a form other than cash or non-cash is chosen.

In the subsection “Information about other documents (IPD)”

are indicated:

- the name of the document submitted by the exporter to the tax authority (including an order agreement for payment for goods concluded between a foreign person and the organization (person) that made the payment);

- number and date of the document submitted to the tax authority.

Subsection “Agreements with other persons”

filled in if the exporter (commission agent) concludes an agreement with another person, incl. and with the carrier.

This subsection specifies:

- number and date of conclusion of an agreement by the exporter (commission agent) with another person;

- the subject of the contract, which is selected from the proposed list;

- name (full name) of the other person, his tax identification number and checkpoint (if available);

- the cost of goods (work, services) including VAT under an agreement with another person and separately VAT.

Attention! When choosing an activity code «04»

Additionally, the subsection

“Certificate of registration of a person as a SEZ resident”

in, which indicates the number and date of the certificate, as well as the name of the federal executive body authorized to carry out the functions of managing the SEZ, which issued the registration certificate.

Section “Information about the commission agent”

is filled in subject to the conclusion of a commission agreement (order, agency agreement) for the commissioner (attorney, agent) to carry out a foreign trade transaction in the interests of the exporter.

Attention! Section “Information about the commission agent”

not filled in when selecting an activity code

«05»

.

This section reflects the following data:

- name (full name) of the commission agent (attorney, agent), his tax identification number and checkpoint (if any);

- date of conclusion and number of the agreement between the exporter and the commission agent (attorney, agent), type of agreement;

- BIC of the Russian bank of the exporter, to whose account the commission agent (attorney, agent) transferred export proceeds when implementing an international contract through the commission agent.

In the "Supplier Information"

information about Russian (including Eurasian) suppliers of goods used for the production or resale of export goods is indicated.

Attention! Section "Information about suppliers"

not filled in if the supplier is a resident of another state (except for EAEU member countries). In this case, information about imported customs declarations is filled in.

This section contains the following information:

- number and date of conclusion by the exporter (commission agent) of the agreement with the supplier of inventory items (inventory);

- sign of a supplier selling goods and materials to an exporter (manufacturer, reseller, etc.);

- name (full name) of the supplier, his tax identification number and checkpoint (if available), address;

- bank details (BIC and account number) that received payment from the exporter (commission agent) for goods and materials purchased from the supplier (in the case of non-cash payments);

- information about goods in the contract with the supplier: name of goods and materials, form of payment between the exporter (commission agent) and the supplier, quantity and value of goods and materials recorded on invoices, cost of goods and materials according to invoices issued by the supplier and the amount of VAT.

Section "Product Information"

is intended to reflect information about the goods specified in the international export contract. This section also contains information about export and import customs declarations, as well as shipping documents (TCD).

In the "Product Details"

the name and volume of supply of the exported goods are indicated in accordance with the contract and the Commodity Nomenclature of Foreign Economic Activity.

Information about export customs declarations includes: customs declaration number; total invoice value of goods and currency code; data on the marks of the customs authority through which the goods were exported outside the customs territory of the Russian Federation.

Attention! Information about export customs declarations is not filled in when selecting an activity code «06»

.

Information on import customs declarations reflects: the customs declaration number and the amount of VAT claimed by the taxpayer for deduction under the import declaration.

The information on shipping documents (TSD) contains the following data:

- type, number and date of registration of transport, shipping and (or) other document;

- data on the marks of the customs authority through which the goods were exported outside the customs territory of the Russian Federation;

- carrier details: name (full name), tax identification number and checkpoint (if available).

Attention! After entering information on the contract, all necessary sections will be generated automatically.

General information about the declaration

Entering information to generate information from documents confirming the validity of applying a zero VAT rate begins with adding a declaration that reflects exports. By clicking on the name of the declaration, you need to fill out general information about it.

In the "Reporting period"

The quarter and year are selected in accordance with the period for which the declaration was drawn up.

In the “Type of declaration”

selectable:

- “primary” – if no changes were made to the declaration;

- “updated” – if additions or adjustments were made to the primary declaration.

In the "Adjustment number"

it reflects which updated declaration is submitted to the tax authority (for example, “1”, “2”, etc.).

In the field “Taxpayer (exporter) attribute”

within the framework of the ongoing activities of the organization (or individual entrepreneur), one of the proposed options is selected. So, if the exporter (organization or individual entrepreneur) himself produces goods sold for export, then the attribute “manufacturer of export goods” is selected; if he sells previously purchased goods for export, then he is a “reseller”, etc.

In the subsection “Type of activity of the taxpayer (exporter)”

those types for which VAT is declared for deduction in this declaration are selected, and the tax base and the amount declared for deduction are indicated separately for each type.

Activity code «01»

indicated by taxpayers who sell goods in export mode.

Attention! Tax base according to code “01”

lines 020

of section 4 of the VAT tax return for transaction codes 1011410, 1011412, 1010410, 1010456, 1010457, 1010458, 1010459 and 1010460 (in terms of sales of goods for export).

Attention! «01»

must correspond to the VAT value for transaction codes 1011410, 1011412, 1010410, 1010456, 1010457, 1010458, 1010459 and 1010460 (in terms of sales of goods for export), calculated using the formula:

Amount of VAT to be deducted

= section 4 –

page 080

section 5 ND on VAT

Activity code «04»

indicated by taxpayers who sell goods under the free customs zone regime.

Attention! Tax base by code «04»

must correspond to the amount of tax bases reflected on

lines 020

of section 4 of the VAT tax return under transaction codes 1011411, 1011413, 1010410, 1010456, 1010457, 1010458, 1010459 and 1010460 (regarding the sale of goods in the free customs zone regime).

Attention! Amount declared for deduction by code «04»

must correspond to the VAT value for transaction codes 1011411, 1011413, 1010410, 1010456, 1010457, 1010458, 1010459 and 1010460 (regarding the sale of goods in the free customs zone regime), calculated using the formula:

Amount of VAT to be deducted

=

(line 030 + line 040 – page 050)

section 4 –

page 080

section 5 VAT tax

Activity code «05»

indicated by taxpayers who perform work and provide services directly related to the export of goods and the sale of goods in the free customs zone regime.

Attention! Tax base by code «05»

must correspond to the amount of tax bases reflected on

lines 020

of section 4 of the VAT tax return, attributable to the implementation of work (services) directly related to the export of goods.

Attention! Amount declared for deduction by code «05»

must correspond to the value of VAT on transactions for the sale of work (services) directly related to the export of goods, calculated using the formula:

Amount of VAT to be deducted

=

(line 030 + line 040 – page 050)

section 4 –

page 080

section 5 VAT tax

Activity code «06»

indicated by taxpayers selling goods to EAEU member countries (Armenia, Belarus, Kazakhstan, Kyrgyzstan).

Attention! Tax base by code «06»

must correspond to the amount of tax bases reflected on

lines 020

of section 4 of the VAT tax return under transaction codes 1010421, 1010422, 1010461, 1010462, 1010463, 1010464, 1010465 and 1010466.

Attention! Amount declared for deduction by code «06»

must correspond to the VAT value for transaction codes 1010421, 1010422, 1010461, 1010462, 1010463, 1010464, 1010465 and 1010466, calculated using the formula:

Amount of VAT to be deducted

=

(line 030 + line 040 – page 050)

section 4 –

page 080

section 5 VAT tax

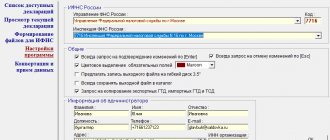

PIK "VAT"

The software and information complex “VAT” (PIK “VAT”) is intended to form a unified database that reflects detailed information about the export operations of taxpayers, as well as about the control measures carried out by the INFS in relation to the exporter. For example, the PIK “VAT” contains information about the exporter himself, about the contract concluded with a foreign partner, whether tax audits were carried out against the exporter and what their results were, whether the exporter was previously reimbursed for VAT from the budget, etc.

VAT refund procedure

The Tax Service conducts audits of all declarations filed by an organization for a certain tax period. If no inconsistencies or violations were found, the tax office to which the declarations were submitted makes a decision on VAT refund within 7 working days. If any violations are discovered, the tax office will draw up a report, which is reviewed by the head of the tax service. Based on the results of the review, a decision is made whether any sanctions will be taken due to the violations committed.

In addition, the tax office may consider the amount of the taxpayer’s recoverable amount. In some cases, a decision may be made to partially refund VAT. So, if there are previously unpaid fees, state duties and other obligatory payments, their amount will be deducted from the amount of the restored VAT.

To reflect information on export transactions of taxpayers and tax audits carried out in relation to them, a software and information complex PIK VAT has been developed. This module reflects information about what contracts the company has concluded with foreign counterparties, whether control measures were carried out in relation to it, and whether it was previously reimbursed for taxes from the budget. Entering information into a common database is the right of a legal entity, not its obligation.

Russian companies have the right to download the VAT PIK for free on the website of the Federal Tax Service or the State Scientific Research Center of the Federal Tax Service. If you use the module autonomously, the accountant will be forced to enter information about export-import transactions twice: the first time this must be done in the enterprise’s accounting program. To avoid unnecessary work, you can integrate the module with 1C or other systems.

It is not difficult to understand which version of the program is currently the latest. This information is posted on the Federal Tax Service portal. There is also information about which systems the module is compatible with, what modifications were made to it compared to previous versions.

The exporter can help the inspectors

To optimize the process of conducting a desk audit of a VAT return, exporters can provide information of interest to tax authorities in a special electronic form. To do this, you need to download the “VAT Refund: Taxpayer” software package. After all, as the Federal Tax Service said back in 2006, submitting information through the “VAT Refund: Taxpayer” PC facilitates a more efficient desk audit of the VAT return and speeds up the process of deciding on the legality of applying the zero VAT rate and on the refund of input tax from the budget ( question 7 Letters of the Federal Tax Service of the Russian Federation dated 08/09/2006 No. ШТ-6-03/ [email protected] ). The whole point is that inspectors will not have to waste time manually entering data on the export operation into the VAT PIK, and they will quickly transfer the information they need from the VAT Refund: Taxpayer PC.

What is VAT refund

VAT refund involves a procedure related to the return of this tax.

It should be noted that a company or individual entrepreneur has the right to refund VAT in one of 2 ways proposed in the Tax Code of the Russian Federation:

- in general order;

- application procedure.

In this case, despite the chosen method of compensation, the refund itself is carried out by:

- transferring the refund amount to the taxpayer’s bank account;

- directing the amount to pay taxes for future periods.

However, these options for using money from VAT refunds are possible only if the conditions discussed in the article “What is the procedure for VAT refunds from the budget?” are met.

Next, we will consider the most important elements for each of the VAT refund methods.

Accountant's Directory

Accounting articles and background information

Peak VAT program

VAT Taxpayer is a program created by the Federal Tax Service of Russia in order to simplify the filling out of tax reports for private entrepreneurs and accountants at enterprises. The software will relieve you of the need to work with ordinary text editors and search for filling samples on the Internet. There are ready-made forms for different types of documents. After selecting the required form, the user only needs to enter the required data in the fields, after which the VAT Taxpayer will automatically create a ready-made report.

Purpose

The program will be especially useful to individuals and legal entities faced with the need to maintain records for individual entrepreneurs, individual entrepreneurs and legal entities. It also makes it possible to draw up the documents necessary to justify VAT refunds on exports and all related acts. It is important to note that when creating a list of export transactions, it is possible to indicate transaction amounts in any currencies around the world. In addition, when drawing up a justification for reimbursement, you can work with directories of goods and invoices. In general, the form provides quite a few selectors for specifying information provided for in current legislative acts. VAT The taxpayer constantly receives updates with new filling rules.

This is interesting: Patent reporting for individual entrepreneurs without employees 2021

It will create a finished report, which can be saved to a computer disk or sent to print.

Key Features

- automates the completion of tax reporting for VAT refunds on exports;

- contains ready-made forms for different types of documents;

- allows you to save and print the finished document;

- has a very pragmatic interface;

- is an official decision from the Federal Tax Service of the Russian Federation.

When a taxpayer applies the general VAT refund procedure

The general procedure for VAT refund is regulated by Art. 176 of the Tax Code of the Russian Federation. The mechanism of this procedure starts from the day of filing a VAT return with the amount of tax to be reimbursed to the tax authority. Having received the report, the tax authority begins a desk tax audit of the validity of the VAT refund. The period for conducting a desk audit of a declaration is two months, but if during the inspection the inspectors suspect that the payer has committed a tax offense, the period can be extended to three months (Clause 2 of Article 88 of the Tax Code of the Russian Federation). However, it is possible to reduce this period.

Read more in the material “Desk tax audit on VAT: deadlines and changes in 2021.”

Based on the results of the audit, a decision is made in favor of the taxpayer or a refusal.

For more information about the content of the procedure, the time allocated for verification, execution of the decision and transfer of the amount, read the material “How is VAT refunded: return (refund) scheme?” .

Particular attention should be paid to what determines the emergence of the right to VAT refund in a company. It could be:

- making shipments for export (due to the application of a 0% rate);

How confirmation of VAT refunds on export transactions is carried out is discussed in detail in the articles:

- “What is the procedure for accounting and refunding VAT when exporting?”;

- “What is the procedure for refunding VAT at a rate of 0% (receiving confirmation)?”;

- “What is the procedure for returning (reimbursing) VAT when exporting to Kazakhstan?”.

- the excess of the amount of deductions over the amount of VAT on sales.

VAT refund in such a situation is carried out using the following list of justifications:

- contract;

- primary documents;

- invoices.

Other documents are discussed in the article “What documents are needed for VAT refund?” .

In addition, companies can recover VAT on the basis of an updated declaration.

How the tax authority carries out a refund in this situation is described in the article “What is the procedure and features of the refund of “input” VAT?” .

Where to download and how to work with the PIK VAT program?

PIK VAT is the name of the program that allows you to summarize and generate information on desk audits carried out on VAT claimed for refund. Using this information complex, the processed data is subsequently transported from the local tax level to higher ones - regional and federal.

Is it possible for a taxpayer to download the VAT PIK?

When was the latest version of the program released?

Purpose of PIK VAT

Should a taxpayer use the VAT PIK?

Confirmation of a zero tax rate using PIK VAT

Tax rates

According to the current law, VAT has different rates from 0 to 18%. A reduced rate of 10% applies to:

- Book products and educational periodicals.

- Children's goods.

- Medical products.

Government authorities approve and update the list of products and services for which a zero value added tax rate is applied. The 2021 VAT return with a 0% rate is submitted in respect of such goods and work as:

- products transported through customs, free customs zone;

- international transportation services;

- export of electricity;

- work performed in sea and river ports for storing goods for transportation across the Russian border;

- transport and forwarding services;

- services for transporting passengers and luggage outside the territory of the Russian Federation;

- products for space activities;

- precious metals;

- built vessels subject to registration;

- goods for official use by international and diplomatic organizations.

Is it possible for a taxpayer to download the VAT PIK?

Despite the fact that the PIK VAT program

It is declared as an official tool for tax authorities; even a simple taxpayer can download it. Moreover, the Federal Tax Service provides such an opportunity not only on its official website, but also on the resource of the Federal Tax Service State Research Center. Modern versions of the information complex are constantly present in the relevant sections. The program is called “VAT Refund: Taxpayer”.

In addition to the program itself, a large number of special services are offered. They allow you to transfer data from already used accounting databases to the described complex. This saves the accountant’s working time - he just needs to send the information stored in electronic accounting to the complex and send it to the tax office. No unnecessary copying or printing on paper.

When was the latest version of the program released?

All information about which version of the “VAT Refund: Taxpayer” program is relevant right now can be found on the sites mentioned above.

When searching for information, pay attention to the following subtlety. The text editor contains a file called Readme. It contains information about what services are included in the software package. This is where information is located about the version number of the program available for download, and about what adjustments have been made to the previous version of the complex.

Purpose of PIK VAT

Primary user of PIK VAT

- This is the Federal Tax Service. Using this program, tax officials analyze all information received from taxpayers to determine whether VAT is calculated and paid correctly. This is done by comparing the declaration data with information taken from the primary documents and from the responses received from the counterparties of the company being audited. Everything is done within the framework of tax control.

Features the program has,

are such that the complex is almost instantly able to compare all information coming from different sources and information available in the database. This is done automatically and avoids

errors caused by human factor.

Should a taxpayer use the VAT PIK?

Not a single legislative norm contains any indication that the taxpayer is obliged to create the PIK VAT

. However, the Federal Tax Service, represented by its local authorities, constantly asks you to fill out the columns of this program. What should a taxpayer do: ignore the requests of tax officials or not spoil his authority and provide the requested data?

It seems to us that it is right to meet the inspection halfway and create the required data block. The tax authorities' arguments in favor of this decision are as follows:

PIK VAT

you can download without any problems.

This program is easy to use.

The data entered into it will allow tax authorities to reduce the time required for desk audits and to better examine the information provided. As a result, it is possible to avoid refusals of VAT refunds due to technical inaccuracies and lack of data.

However, a greater role here is played by the issue of diplomacy and reluctance to receive a “black mark” from the Federal Tax Service. Accountants believe that the use of PIK VAT in an organization leads to double control by the tax service.

Blog about taxes by Vladimir Turov

Good afternoon, dear taxpayers.

If you are refunding VAT from the budget, then today's information is for you.

Letter of the Federal Tax Service of Russia dated October 6, 2020 No. ED-20-15/129 “On conducting desk audits of VAT tax returns.”

From this letter you will learn what requirements need to be met so that VAT refunds from the budget go without a hitch. And what needs to be done so that tax authorities reimburse VAT from the budget almost automatically. The letter is a playbook that you and your accountant should use to proactively review and prepare for a quick and hassle-free VAT refund.

“The Federal Tax Service, in order to increase business activity and provide comfortable conditions for tax administration to conscientious taxpayers, reports the following.

1 . In relation to tax returns for value added tax (hereinafter referred to as VAT), in which the right to reimbursement of tax amounts from the budget is declared, provided for in Article 176 of the Tax Code of the Russian Federation (hereinafter referred to as the Code), a desk tax audit can be completed after one month from the day of submission of the VAT return.

<�…>

No later than 10 calendar days from the date of submission of the VAT tax return, an assessment is carried out for compliance with the conditions:

a) an application for application of the application procedure for VAT refund has not been submitted;

the taxpayer, in accordance with the data of the software “VAT Control”, belongs to a low, medium or uncertain (for individual entrepreneurs) level of risk;

VAT reimbursement from the budget of the Russian Federation was declared in the period preceding the tax period for which the VAT tax return was submitted and according to the decision on reimbursement (in whole or in part), confirmation of the amount of VAT to be reimbursed amounted to more than 70% of the tax amount claimed for reimbursement;

more than 80% of VAT deductions from the total amount of deductions declared by the taxpayer in the audited VAT tax return falls on counterparties of low, medium or uncertain (individual entrepreneurs) risk levels, and at least 50% of the amount of VAT tax deductions falls on counterparties specified in the tax return for the previous tax period.”

I advise you to study this letter yourself. I have come to the conclusion that this letter from the Federal Tax Service of Russia (knowing their rules and criteria) can be used to increase your chances of getting a VAT refund from the budget. This is very good.

And given that, in accordance with the new guidelines, in connection with the launch of the new version of the ASK VAT-2, all chains, declarations and relationships are now being checked more carefully if you work on the OSN. This is called connection trees, where beneficiaries and beneficiaries are determined, a dossier is collected on the beneficiary... This letter gives us an understanding of how not to fall under the distribution and what criteria must be met. It will help not only to reimburse VAT from the budget, but also to avoid running into an on-site tax audit. Therefore, I declare this letter useful. We thank Egorov for this good document.

And to you, dear taxpayers, I wish you a cloudless VAT refund from the budget, taking into account all the recommendations given in this letter,

Thank you and good luck in your business.

Link to document:

Letter of the Federal Tax Service of Russia dated October 6, 2020 No. ED-20-15/129

SIGN UP FOR A TAX SEMINAR

(Visited 1,803 times, 1 visits today)

Vladimir Turov

Head of legal practice, practicing and leading specialist in tax planning, building individual tax schemes and holdings, optimizing financial flows.

Program “VAT Refund: Taxpayer”

According to tax authorities, when using this program, VAT

during export operations it is easier to register, that is, with the help of

PIK VAT

it is successfully possible to confirm the zero rate for exports.

However, in order to confirm your right to this rate, you must submit the following documents to the tax office:

customs declaration (or list of declarations) with appropriate customs marks;

shipping documents for export operations.

All these documents can be sent electronically, if the copy format allows tax authorities to identify them.

Organizations and individual entrepreneurs are given the right to determine for themselves whether they need the PIK VAT

and whether information should be included in it. Nevertheless, for tactical reasons it should still be used. Using this program, you can reduce the time for a tax audit, but most importantly, the taxpayer will improve his position in the ranking of tax authorities.

* * *

Organizations and individual entrepreneurs are given the right to determine for themselves whether they need the PIK VAT

and whether information should be included in it. Nevertheless, for tactical reasons it should still be used. Using this program, you can reduce the time for a tax audit, but most importantly, the taxpayer will improve his position in the ranking of tax authorities.

Similar articles

- Electronic submission of reports to the tax office

- How and in what cases is VAT refunded - refund procedure?

- How to correctly fill out an invoice without VAT?

- How to find out the size of the safe share of VAT deductions?

- Filling out a VAT return form - example