What is included in travel expenses in 2021 and who sets the standards for reimbursement of travel expenses, we discuss in this article. We will also consider the reflection of travel expenses in accounting. And learn how to calculate travel expenses.

Also see:

- What is the daily allowance for a business trip abroad in 2020?

- Do I need a travel permit?

What is included in the list of travel expenses

The following employee expenses are subject to reimbursement of expenses related to business trips:

- daily expenses (you can read more about daily allowances in the article “The amount of daily allowances for business trips and their calculation”);

- fare;

- housing expenses;

- payment for a visa and fee for obtaining a foreign passport;

- consular fees;

- exit/entry fees;

- toll road fees;

- registration of compulsory insurance;

- mandatory fees and payments;

- other expenses incurred by an employee on a business trip with the consent of management.

This list was compiled taking into account the norms of labor legislation (Labor Code of the Russian Federation) and the Regulations on business trips approved by the Government of the Russian Federation.

Calculating and processing travel expenses abroad has its own characteristics, which you can familiarize yourself with in the article “How to calculate daily allowances when traveling abroad.”

Business trip under a contract for the provision of paid services

I have a 2-week business trip coming up about the Russian Federation, of course, I don’t want to go at my own expense. As far as I understand, I am not entitled to daily allowance. The employer seems to pay for hotels and flights - what about other expenses? The agreement is already in force.

Persons working in a company on the basis of civil contracts are not subject to labor legislation and other acts containing labor law standards. This provision is established by Article 11 of the Labor Code of the Russian Federation. In addition, from the concept of a business trip contained in Article 166 of the Labor Code of the Russian Federation, it follows that a business trip of a person not associated with the organization by the norms of the employment contract cannot be considered as a business trip. A similar opinion was expressed by the Ministry of Finance of the Russian Federation in Letter dated December 19, 2021 N 03-03-04/1/844. Consequently, an organization sending a person working in a company on a business trip on the basis of a civil contract does not have the obligation to reimburse him for travel expenses. At the same time, there is the possibility of paying compensation amounts to the executor of the order. We have already noted that a third-party specialist can carry out an order for a company during a trip on the basis of a contract, paid services, or on the basis of an agency agreement. Relations between the parties under: - a contract are regulated by the norms of Chapter 37 “Contracting” of the Civil Code of the Russian Federation; - in case of a contract for the provision of paid services - by the norms of Chapter 39 “Paid provision of services” of the Civil Code of the Russian Federation; — in the case of a contract, orders are built on the basis of the provisions of Chapter 49 “Assignments” of the Civil Code of the Russian Federation.

We recommend reading: Labor Veteran Working Pensioner What Leave Is Entitled

Payment of travel expenses

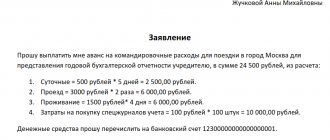

In order for an employee to travel to perform a job assignment, he must be paid an advance for travel expenses.

The deadline for paying travel expenses is before the start of the trip. It can be established in the organizational and administrative document of the company.

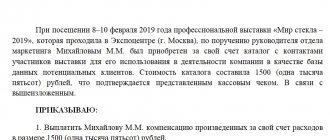

To receive an advance, an order is made for a business trip (you can read more about this topic in the material “How to properly arrange a business trip”).

Also, the employer can establish in the internal regulations the need to submit a preliminary calculation, memo, application for travel expenses or the development of an estimate of travel expenses, samples of which should preferably be fixed in a local act.

You can learn how to calculate travel allowances in the article “How to calculate travel allowances (expenses).”

In addition to daily allowance and payment of other travel expenses, the employee retains an average salary.

There are certain nuances when it comes to paying for business trip days that fall on weekends or holidays. You can find them in the article “Payment for business trips on weekends and holidays: features.”

Each company sets its own travel expense standards, taking into account its financial capabilities. At the same time, the daily allowance should cover the cost of food and household expenses during a business trip.

In what cases personal income tax is withheld from the amount of travel expenses, you can find out in the article “How to reflect daily allowances in tax accounting.”

Reimbursable Expenses for Business Travel Under the Agreement for the Provision of Legal Services

The sizes of regional standards for the normative area of residential premises used to calculate subsidies, the cost of housing and communal services and the maximum permissible share of citizens' expenses for paying for residential premises and utilities in the total family income are established by the constituent entity of the Russian Federation.

According to paragraph 1 of Article 782 of the Civil Code of the Russian Federation, the customer has the right to terminate the contract unilaterally and refuse services only if he pays the contractor the costs. Unfortunately, the customer will not be able to take them into account in the tax base under the simplified tax system - there is no corresponding type of expense in the closed list of paragraph 1 of Article 346.16 of the Tax Code of the Russian Federation.

Accounting for travel expenses

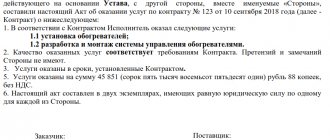

Let's consider the reflection of travel expenses in accounting. To reflect them, account 71 “Settlements with accountables” is provided:

- by debit – take into account all funds issued for travel and entertainment expenses;

- on credit - reflect transactions when travel expenses are written off.

An advance for business trip expenses can be issued from the company's cash desk, transferred from a current account to an employee's bank card, or it can be transferred to a special corporate card.

Here are examples of wiring:

- Dt 71 – Kt 50: issued for travel expenses. If before this money was received at the cash desk for travel expenses, then the posting is as follows: Dt 50 - Kt 51 ;

- Dt 71 – Kt 51 : an advance was transferred against the report from the company’s current account;

- Dt 55 – Kt 51: transfer to a special account was made.

Subsequently - when the employee pays by card (for example, for a hotel) - the accountant will reflect the following transaction: Dt 71 - Kt 55 .

If an employee withdraws money from a corporate card (for example, for food), the posting is as follows: Dt 71 – Kt 55.

In accounting, travel expenses are charged to expense accounts (in most cases).

At the end of the business trip, the employee must submit to the accounting department a correctly completed advance report for travel expenses. In this case, the accountant will reflect the following entries in accounting: Dt 26 – Kt 71 (travel expenses written off).

You can read how to correctly draw up an advance report and report for an advance on travel expenses in the article “What should a business trip report be?”

Accounting for reimbursement of expenses to a subcontractor

The contracting organization has no right to accept for deduction the amounts of VAT allocated in the supporting documents, paid by the subcontractor as part of travel and accommodation expenses. After all, the subcontractor’s trip is not a business trip, i.e. the right to a tax deduction provided for in paragraph 7 of Art. 171 of the Tax Code of the Russian Federation does not arise for the organization.

Additionally, on the issue of compensation to performers and contractors - individuals for expenses in the form of travel and accommodation costs incurred by them in the performance of their obligations under the contract, see the Encyclopedia of disputes regarding personal income tax and insurance premiums.

Other expenses of an employee on a business trip with the consent of management

An employee has the right to claim compensation for additional travel expenses if they are provided for in company regulations or labor legislation.

Additionally, in addition to daily allowance and accommodation, an employee may have expenses for a taxi on a business trip.

How to arrange this payment of travel expenses can be found in detail in the article “Payment for a taxi on a business trip: taxes and supporting documents.”

The company may also include other expenses in travel expenses. So, if an employee goes on a long trip, then packing luggage may be included in travel expenses.

Service fees and fines for returning/exchanging tickets (if the traveler is not at fault) are also included in travel expenses.

Payment of travel expenses on a business trip may take into account the standards established for categories of employees. For example, in a local act, an employer can stipulate that the company’s management, including deputy directors, have the right to travel in first class in a railway carriage and fly in business class. For all other employees - reserved seat and economy class, respectively. And this will not be a violation of paying expenses for business trips.

When auditing travel expenses, it is necessary to check first of all the existence of an internal regulation on business trips, which should specify all the norms for additional reimbursement. expenses.

Reimbursement of travel expenses under a service agreement

Specific boundaries of the Service Provision Zone on the territory of the Russian Federation 2.7.9.2. Is it possible to recover from the Federal Tax Service the travel expenses and daily allowance of a representative? Reimbursement for travel under a concluded GPC agreement. Compensation to the Client for expenses when independently purchasing economy air tickets. The FSS of Russia cannot refuse to reimburse expenses for insurance payments on September 13, 2021. The procedure for organizing vocational training by reimbursing the employer for expenses associated with paying for educational services for vocational training for workers of pre-retirement age through the provision of subsidies. Payment for services does not include reimbursement of the performer’s expenses necessary and incurred to participate in the court hearing (transportation costs for travel to the place of consideration of the case and back, living expenses) (clause 3.2 of the agreement).

Under the contract for the provision of paid services, the Contractor undertakes, on the instructions of the Customer, to provide the services specified in clause 1.2. of this Agreement, and the Customer undertakes to accept and pay for these (travel, accommodation). In the situation under consideration, reimbursement of the contractor’s expenses for travel to the place of provision of services is provided for in the contract for the provision of paid services. Is it necessary to draw up an act under a civil contract for the performance of work (provision of services). For officially employed citizens, new positive changes in legislation will begin to apply from the beginning of 2021: they can now travel at the employer’s expense once a year. In practice, this situation often occurs. VAT on reimbursement of expenses: taxation on reimbursement of expenses. Therefore, reimbursement by the organization of these amounts is carried out in the interests of the performer.

Payment of travel expenses according to the agreement

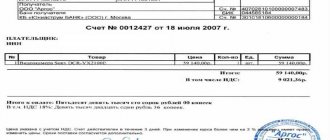

The contractor very often wants to be reimbursed for additional costs under the contract. In the general case (clause 2 of Article 709 of the Civil Code of the Russian Federation), the price of the contract already includes compensation for all costs of the contractor and his remuneration. However, the parties may include a provision for reimbursement of travel expenses in the contract. How to pay travel expenses to the contractor in this case?

The provision for compensation for travel expenses makes sense when the contractor does not know in advance how many visits he will make to the site. However, you can:

- in the contract , limit the amount of reimbursement of travel expenses by the customer and set a limit;

- include the amount for travel expenses in the summary estimate.

It also makes sense to indicate in the contract what applies to travel expenses, as well as the deadline for reporting them. These clauses of the agreement will help justify the amount of travel expenses in tax accounting.

How to pay travel expenses under an audit agreement? Similarly: include in the contract a provision for compensation of travel expenses by the customer.

Compensation of expenses to the contractor for the provision of services under a civil contract

The chief accountant advises: there are arguments that allow organizations to take into account the amount of compensation for expenses (travel, food, etc.) associated with the trip of a freelance employee when calculating the single simplified tax. They are as follows.

In addition, labor legislation guarantees compensation for business trip expenses only to full-time employees of the organization (Article 167 of the Labor Code of the Russian Federation). Only these amounts can be taken into account by an organization when calculating the single tax under simplification (subclause 13, clause 1, article 346.16 of the Tax Code of the Russian Federation). A similar position was expressed by the Russian Ministry of Finance, commenting on the issue of taxation of such expenses by organizations on the general system (letters of the Russian Ministry of Finance dated October 16, 2021 No. 03-03-06/1/723 and dated December 19, 2021 No. 03-03-04/1 /844). The conclusions of the financial department can be extended to the simplified version (clause 2 of article 346.16 of the Tax Code of the Russian Federation).

Lawyers Services ->

if during a tourist trip it turns out that the volume and quality of the tourist services provided do not comply with the terms of this agreement and the requirements of the law, replace the tourist services provided during the tourist trip with tourist services of similar or higher quality without additional costs for the Customer , and with the consent of the Customer or tourist - tourist services of lower quality with compensation to the Customer for the difference between the cost of tourist services specified in this agreement and the cost of actually provided tourist services;

4.4. If a trip is canceled at the initiative of the Customer, regardless of the reasons, more than ______ days before departure (departure), the Customer is refunded the cost of the trip minus ______% of the cost. If a trip is canceled at the Customer's initiative, regardless of the reasons, less than _______ days before departure (departure), the trip fee is not refunded.

25 Jul 2021 jurist7sib 101

Share this post

Related Posts

Can an employee working under a contract go on business trips?

Menu

– Administrative law – Can an employee working under a contract go on business trips?

Amounts of compensation for the contractor's expenses paid in addition to remuneration are not included in the object of taxation by personal income tax.

Income tax

The organization takes into account the costs of paying compensation to an individual for profit tax purposes, provided that they are documented and economically justified (clause 1 of Article 252 of the Tax Code of the Russian Federation). The costs of paying compensation can be taken into account as labor costs (clause 21, article 255 of the Tax Code of the Russian Federation), or other expenses related to production and sales (subclause 49, clause 1, article 264 of the Tax Code of the Russian Federation).

Insurance premiums

Compensation paid to the performer is not subject to insurance contributions to the Pension Fund and compulsory health insurance funds on the basis of paragraphs.

“Non-travel” travel expenses

A business trip is a trip by an employee by order of the employer for a certain period of time to carry out an official assignment outside the place of permanent work.

Art. speaks about this. 166 Labor Code of the Russian Federation.

The costs of the customer organization under a contract or paid services with an expert who is an employee of a third-party organization can be taken into account on the basis of subparagraph. 49 clause 1 art. 264 Tax Code of the Russian Federation.

Option three: relationship with individual entrepreneur

The involved specialist may be an individual entrepreneur. In this case, the expenses in question can be taken into account on the basis of subparagraph. 41 clause 1 art. 264 Tax Code of the Russian Federation.

According to the provisions of this subparagraph, expenses under civil contracts (including work contracts) concluded with individual entrepreneurs who are not on the staff of the organization are included in other expenses associated with production and sales.

Personal income tax of someone else's specialist

In the commentary letter, specialists from the Russian Ministry of Finance raised the problem of withholding personal income tax from amounts paid to an expert to pay for travel and accommodation in another city.

Payment of daily allowances within the framework of relations under a civil contract is not made, since this type of compensation is provided only for full-time employees. Therefore, if you plan to provide in the GPA some kind of analogue of daily allowance, you can establish additional remuneration for the performer.

For example, the terms of the contract may be formulated as follows: “In the event that the execution of the Customer’s instructions requires the Contractor to travel to another location as agreed with the Customer, the Customer pays the Contractor an additional remuneration in the amount of ______ rubles for each day of travel.”

Everything about

the Order to send an employee on a business trip: you will learn how to draw up the document if you read the material at the link.

Details in the materials of the Personnel System:

Situation 1.

Similar clarifications are contained in the letter of the Ministry of Finance of Russia dated March 20, 2012 No. 03-04-05/9-329.

However, the letter of the Federal Tax Service of Russia dated March 25, 2011 No. KE-3-3/926 reflects the opposite position. It is based on the provisions of paragraph 2 of Article 709 of the Civil Code of the Russian Federation, according to which payments under a work contract are divided into two parts: remuneration and compensation for expenses associated with the execution of work or provision of services.

From the provisions of this norm it follows that compensation for the contractor’s expenses is not remuneration.

In addition, payment of compensation does not entail the receipt of economic benefits by the performer (Art.

However, this can only be done on the basis of supporting documents - hotel bills, tickets, KKM receipts for payment for gasoline, etc.

If such documents are available, the organization paying the income, as a tax agent, can provide the employee with professional tax deductions for the amount of incurred and confirmed expenses (clause 2 of Article 221 of the Tax Code of the Russian Federation). Please note that the deduction is provided only upon written request from the employee.

If the employee’s expenses are not documented, then their reimbursement will be recognized as part of the remuneration provided for in the contract. Accordingly, such amounts must be included in the performer’s income and personal income tax must be withheld from them.

UST

.

A fairly common situation: a civil contract, rather than an employment contract, has been concluded with an employee. Is it possible to send such an employee on a business trip and reimburse him for travel expenses?

in “Accounting. Taxes. Right." No. 29/2003

Call it something else

Is it possible to go on a business trip under a contract?

Relations between such citizens and organizations are regulated by civil law. Note! GPAs are concluded in writing.

At the same time, they must include the following essential conditions: - the procedure for calculating the parties (customer/performer (contractor, author) (hereinafter referred to as the performer)) and the amounts to be paid; — the customer’s obligation to pay for persons performing work under the GPD, mandatory insurance contributions to the Federal Social Security Fund, as well as to pay insurance premiums for compulsory insurance against industrial accidents and occupational diseases, if such work is carried out in places provided by the customer; — obligations of the parties to ensure safe working conditions and liability for non-compliance; — grounds for early termination of the contract; — liability for failure by the customer to fulfill payment obligations in the form of a penalty in the amount of at least 0.15% of the unpaid amount for each day of delay.

Business trip for a contractor

Civil legislation does not provide for the concept of “business trip” as such. Non-traveling contractor According to the Labor Code (Article 166 of the Labor Code of the Russian Federation), a business trip is a trip by an employee by order of the employer for a certain period to carry out a work assignment outside the place of permanent work and is provided only for those who have entered into an employment contract with the organization.

In relation to employees who work under civil contracts, reimbursement of contractor costs under “business trip expenses” does not qualify.

1 tbsp. 252 Tax Code of the Russian Federation)

Can an enterprise issue travel allowances to employees under contract agreements?

Personal income tax.

This tax is imposed on employee remuneration.

Important But if, according to the contract, the customer must reimburse the contractor for actually incurred and documented expenses, then the reimbursed amounts are not included in the remuneration.

However, this can only be done on the basis of supporting documents - hotel bills, tickets, KKM receipts for payment for gasoline, etc.

If such documents are available, the organization paying the income, as a tax agent, can provide the employee with professional tax deductions for the amount of incurred and confirmed expenses (clause

2 tbsp. 221 of the Tax Code of the Russian Federation). For the unjustified conclusion of a civil contract that actually regulates labor relations, the employer may be held administratively liable under Part.

3 tbsp. 5.27 Code of Administrative Offenses of the Russian Federation. Answer prepared by: Expert of the Legal Consulting Service GARANTPershina Elena

A business trip of a freelancer is not a business trip

:

- other expenses incurred on a business trip in agreement with the administration.

- travel expenses;

- daily allowance – additional expenses associated with living outside your permanent place of residence;

- housing rental costs;

In practice, it happens that the executor under a civil contract needs to be sent to another location to carry out the assignment.

The contractor's costs may include, for example, expenses for:

- travel to the place of assignment;

- road insurance, fees, fuel and lubricants, vehicle parking, etc.

- living in another area;

Business trip of an employee under a civil law contract

Popular questions Labor legislation does not apply to citizens with whom a civil law contract has been concluded (Article 11 of the Labor Code of the Russian Federation). Therefore, their trips related to the execution of concluded contracts are not business trips.

Info This follows from the provisions of Article 166 of the Labor Code of the Russian Federation. If a person needs to be sent to another location to complete a task, the terms of the trip must be specified in the contract.

In particular, in an additional agreement with the contractor, it is necessary to establish the procedure for reimbursement of his expenses for a business trip.

It is clear that it is not necessary to issue a business trip order when sending a freelance employee on a business trip. The contractor’s expenses may include, for example, expenses for:

And most importantly, the contract must stipulate that the customer reimburses the contractor for the actual costs incurred in connection with such a trip.

The Civil Code does not contain a clear list of expenses that the customer can reimburse the contractor.

But since Article 709 of the Civil Code of the Russian Federation deals with compensation for the contractor’s expenses, we can conclude that any expenses actually incurred by the employee when traveling to another area are reimbursed.

Thus, reimbursable expenses may include: expenses for renting housing, travel, fees for airport services, mandatory insurance, commissions, travel to the airfield, station at the places of departure, destination or transfers, luggage transportation, gasoline, car parking, etc. etc.

In this case, the parties can determine the procedure for drawing up the relevant documents independently. It should be noted that sending the contractor on a business trip and issuing an order

Business trip under a GPC agreement

Individuals registered under a GPC agreement are not full-time employees, and relationships with them do not fall within the scope of influence of labor legislation.

Thus, a business trip under a civil law contract in the usual format is impossible - the customer does not have the right to send such a contractor on business trips, since he does not act as an employer in relation to him. But this does not mean that work trips of an individual within the framework of GPC agreements are not implemented or expenses for them are not subject to reimbursement.

An enterprise can compensate a citizen for costs - costs of transport, accommodation, food and travel-related fees (clause

2 tbsp. 709 of the Civil Code of the Russian Federation), but are not accrued or paid.

Should travel expenses be subject to personal income tax and should insurance premiums be charged on them if the employee was on a business trip while working for a company under a contract?

This means that the employer can send on a business trip only employees who have an employment relationship with the employer (clause

If an employer has concluded a civil contract with an individual, then he cannot send such an employee on a business trip. In a civil contract, in our opinion, it should be indicated that the performance of work involves traveling to another place, and that the costs of an individual for travel to the place of performance of the work are compensated by the customer.

Will the expert's trip constitute a business trip?

Is it possible to take into account the costs associated with it when calculating income tax? Should personal income tax be withheld from amounts that are reimbursed to the expert after the trip?

How to draw up a contract: content, differences

The definition of a work contract is contained in Art. 702 of the Civil Code of the Russian Federation. It implies that there are two parties - the contractor and the customer, who enter into an agreement with each other.

Under this agreement, the contractor undertakes to the customer to perform certain work and deliver its results. The customer gives the contractor a task, accepts the result of the work and pays for it.

A work contract does not imply labor relations, which are regulated by labor legislation.

What does a construction contract have to do with GPC agreements?

In a broad sense, civil law contracts (CLA) should be considered those contracts in which the parties, without entering into an employment relationship, determine the result of work, property relations and other issues of interaction. Such agreements include:

- work agreement;

- contract for paid services;

- copyright agreement;

- property lease agreement;

- contract of agency;

- commission agreement;

- agency contract.

In a narrower sense, a GPC agreement means a contract or a contract for the provision of paid services, which is concluded between an organization and an individual.

A contract and a contract for the provision of services - what are the differences?

The subject of a civil contract is either work or services. Accordingly, when there is a need to regulate relations related to the performance of work, a contract is concluded, and in the case of services, a contract for the provision of paid services.

At the same time, difficulties often arise in the correct separation of the concepts of “work” and “service”. Explanations can be found in Art. 38 Tax Code of the Russian Federation:

- Work is an activity whose results have a material expression and can be implemented to meet the needs of the organization and (or) individuals.

- A service is an activity, the results of which do not have material expression, are sold and consumed in the process of carrying out this activity.

Art. 780 of the Civil Code of the Russian Federation provides that under a contract for the provision of services for a fee, the contractor is obliged to perform the work personally (unless another condition is agreed upon in advance by the parties).

A contract, on the contrary, allows for the possibility of involving subcontractors in fulfilling the terms of the contract. That is, if the contractor wants to involve third parties to perform the work, he will not need to coordinate his actions with the customer.

At the same time, the contract may directly indicate that the contractor is obliged to personally perform the work (Article 706 of the Civil Code of the Russian Federation). And if the contractor violates the contract by involving a subcontractor in the execution of the contract, then he is liable to the customer for losses caused as a result of such work.

Differences between a contract and an employment contract

The definition of an employment contract is given in Art. 56 Labor Code of the Russian Federation.

An employment contract is an agreement between an employer and an employee, according to which the employer undertakes to:

- provide the employee with work according to his job function;

- ensure working conditions provided for by labor legislation and other regulatory legal acts, collective agreement, etc.;

- pay the employee wages in a timely manner and in full.

The employee undertakes to personally perform a labor function in accordance with the agreement - in the interests, under the management and control of the employer. His responsibilities also include compliance with the internal labor regulations that apply to the employer.

It is very important to be able to clearly distinguish between GPC agreements and an employment contract. It is also important to conclude GPC agreements with those persons with whom civil law relations actually develop, and to do this without errors.

Numerous errors may become the basis for reclassification of a GPC agreement into a labor agreement during a tax audit. The initiator of requalification can be the person with whom the customer entered into a contract.

The basic rule that applies in this case: the relationship between the customer and the contractor is regulated by the Civil Code. Therefore, when drawing up the text of the contract, references must be made to the norms of the Civil Code. The corresponding terms and formulations should be taken from the same code.

In a work contract, as well as in all other types of civil process agreements, concepts from the Labor Code should not appear: employee, internal labor regulations, vacation, labor function, etc.

Details are in the article “Employment contract or GPC agreement: how to register an employee for work?”

How to draw up a contract

The contract specifies:

- subject of the contract;

- rights and obligations of the parties;

- the procedure for delivery and acceptance of completed work or the procedure for payment;

- liability of the parties;

- confidentiality (can be specified separately if necessary, but is usually part of the “Responsibilities of the Parties” section);

- termination of an agreement;

- other conditions;

- details and signatures.

You can download samples:

Contract agreement with an individual

Contract agreement with individual entrepreneur

Contract agreement (general agreement with an individual and detailed provisions on the confidentiality of the agreement)

Exchange documents without duplicating them on paper: invoices, acts, delivery notes and others. Receiving documents is free.

Send a request

Subject of the agreement

The subject of a contract is not a labor function, but the performance of specific work with a specific result.

How can I write:

“The Contractor undertakes to perform the following work (accurate and detailed description of the work).”

Remuneration condition

A contract cannot contain a wage clause. The rule on the price of work applies here (Article 709 of the Civil Code of the Russian Federation). It can be determined in the form of an approximate or firm estimate.

Unlike wages, which are paid under an employment contract within a certain period of time (twice a month), remuneration under a work contract is made by agreement of the parties: it can be an advance payment, postpayment or phased payment options.

How can I write:

“For the work performed, the customer pays the contractor a remuneration (specify the amount) monthly on the basis of the work acceptance certificate.”

Contract time

A work contract differs from an employment contract and its duration.

The employment contract, with the exception of certain cases expressly provided for by the Labor Code, is unlimited. The conclusion of a fixed-term employment contract is provided for in Art. 58 and 59 of the Labor Code of the Russian Federation.

When concluding a contract, the parties, on the contrary, stipulate deadlines for completing the work. Moreover, for a contract, the term is an essential condition. Without it, the contract will not be considered concluded. This position was voiced in paragraph 6 of the Information Letter of the Presidium of the Supreme Arbitration Court dated November 25, 2008 No. 127.

When the work period expires and the parties decide to continue cooperation, the contract is renegotiated.

How can I write:

Typically, the validity period of a contract is specified in the “Other Conditions” section. For example, like this: “This agreement comes into force after it is signed by the parties and is valid until...”.

Responsibility under the contract

If damage is caused to the customer's property, the contractor must compensate for losses. Moreover, the injured party has the right to demand both full compensation for the losses caused and compensation in a smaller amount.

Often, the contract includes provisions for penalties or fines in case of delay in fulfilling the obligations of any of the parties. The customer's responsibility is usually associated with late payments, and the contractor's responsibility is usually associated with failure to meet deadlines for the completion of work.

On the contrary, an employment contract cannot establish penalties. The Labor Code provides exclusively for disciplinary liability of the employee, and financial liability for causing damage is usually limited to the average monthly salary (Article 241 of the Labor Code of the Russian Federation).

How can I write:

“For failure to fulfill or improper performance of their duties, the parties bear responsibility under the current legislation of the Russian Federation.

The contractor is liable to the customer for violation of the deadlines for the completion of work in the amount of ... the cost of the work under this contract for each day of delay.”

Providing materials and tools for work

When a person gets a job under an employment contract, the employer provides him with everything he needs. This is provided for by the Labor Code.

The contractor usually provides himself with everything necessary. Although the contract may provide that all tools and equipment are provided by the customer.

How can I write:

Contract agreement (using customer materials)

What conditions should not be in a contract?

1. References to the fact that the contractor must comply with labor regulations or work hours.

The contractor is not an employee of the company, so labor regulations do not apply to him. He only fulfills his obligations in accordance with the contract concluded with him by the other party.

The contractor himself determines the work schedule and cannot claim any additional payments for irregular working hours, for work at night, etc. He also does not report to the customer’s officials, but works as an independent entity.

2. References to the provision of any guarantees and social obligations.

A person working under a contract is not subject to guarantees and social obligations from the employer and the state, which are provided for by the Labor Code.

For example, the contractor is not provided with annual paid leave. He is not paid for the days when he is on sick leave, since persons registered under GPC contracts are not among those who are insured in case of temporary disability and in connection with maternity.

3. Conditions that the contractor can be sent on a business trip.

Business trip is a term from labor legislation, so it cannot be used even if the person with whom the contract has been concluded periodically goes to another city to perform work.

At the same time, the contract may provide for such a nuance. You can also provide for compensation for the contractor's expenses - specify how additional payments will be made if you have to travel to the place of work. At the same time, we cannot talk about daily allowances, since this is a term from the Labor Code.

Why do you need an acceptance certificate for completed work?

It is important that all the nuances of interaction between the customer and the contractor are documented. Therefore, the parties usually provide for the preparation of a primary accounting document in the contract.

In the “Subject of the contract” section, it can be stated that “the customer undertakes to accept work from the contractor according to the acceptance certificate for the work performed and to pay for it.”

Based on the act, expenses will be confirmed.

If the cooperation between the customer and the contractor lasts a long time - for example, for six months, and the parties have agreed on the phased acceptance of services and phased payment, then, as a rule, the act is drawn up monthly.

Download the act of delivery and acceptance of completed work.

Features of termination of a contract

Art. 450 and 450.1 of the Civil Code of the Russian Federation contain the grounds when a civil process agreement (contractor agreement, paid service agreement) is terminated ahead of schedule.

The parties draw up a two-sided document in which they set out all the conditions for termination and sign it.

Under such agreements there is little likelihood of disputes arising in the future.

- In court at the request of one of the parties

This option of early termination is possible in case of a significant violation of the contract by the other party, in other cases provided for by the Civil Code and other laws or the contract.

- Unilateral withdrawal from the contract

A situation when a party unilaterally, without going to court, refuses to perform the contract in the future.

This is rather an exceptional case of unilateral termination of the contract. It is possible only if such a refusal is expressly permitted by the norms of the relevant part of the Civil Code governing a particular contract.

As a general rule, unilateral refusal to fulfill obligations under a contract is not allowed, except in cases provided for by law.

Art. 310 of the Civil Code of the Russian Federation provides for the following rules for unilateral termination of a GPC agreement (rules of unilateral refusal):

1. If all parties are individual entrepreneurs, then the right to unilateral refusal can be established by agreement.

2. If not all parties carry out entrepreneurial activities, then the right to unilateral refusal can be granted by the contract only to a party that is not an individual entrepreneur. The exception is cases when the law or other legal act provides for the possibility of granting such a right to the other party by contract.

That is, unilateral refusal on the part of the organization must be expressly provided for by law.

It is better to specify the procedure for unilateral termination in the agreement so that the parties clearly understand how they will exit this agreement. In some situations, this will help avoid unwanted disputes.

Source: https://kontur.ru/articles/779

Can an employee under a contract go on a business trip?

Indeed, in accordance with the law, it is not necessary to provide any documents confirming the expenditure of daily allowances (hereinafter referred to as the Regulations). But at the same time, the organization needs to confirm the very fact that the employee was sent on a business trip and the actual duration of his stay there.

If an employee goes on a business trip using personal transport, the dates of the trip can be confirmed with a memo, which is issued after returning from the business trip (). At the same time, if several employees went on a business trip in one car, then each of the business travelers should write a note.

Send on a business trip under a contract

We would like to remind you that, in accordance with Article 166 of the Labor Code of the Russian Federation, a business trip is considered to be a trip by an employee by order of the employer for a certain period of time to carry out an official assignment outside the place of permanent work. Thus, it is impossible to send on a business trip an individual with whom a contract has been concluded and not an employment contract.

1 tbsp. 702, paragraph 2 of Art. 709, paragraph 1, art.

711 of the Civil Code of the Russian Federation). Therefore, the costs of paying compensation

Should daily allowances be paid for travel expenses to an employee signed up for a fixed-term employment contract?

Please draw up the additions in the form of a written agreement and attach them to the contract.

The Civil Code does not contain a clear list of expenses that the customer can reimburse the contractor. Payment of daily allowances under a civil contract is not made; this type of compensation is provided only for full-time employees.

More details in the System materials:

Question: Can employees working under contract agreements go on business trips? (“Audit statements”, N 8, August 2011)

Costs are understood as the material and financial costs of the contractor directly related to the subject of the contract. Therefore, if necessary, the contract includes a clause on compensation for travel expenses incurred by the contractor related to the performance of work.

The parties have the right to provide for such compensation even after the conclusion of the contract in the form of an additional written agreement (Civil Code of the Russian Federation), which is an integral part of the contract.

The subject of a civil law contract for the provision of services for a fee is the provision of a specific service, the performance of certain actions or the implementation of certain activities (Civil Code of the Russian Federation). By concluding a contract, the customer pursues the achievement of a clearly defined goal, for example, the production of a specific item (Civil Code of the Russian Federation).

Sample contract agreement with an individual sent on a business trip – Credit lawyer

Personnel officer. Labor law for personnel officers,” 2007, No. 4 Question: Our organization entered into a contract agreement with an individual to perform installation work at a customer’s site in another city.

Is it possible to issue a business trip for such an employee (order, official assignment, travel certificate)? Answer: “Business trip” is a labor law concept.

A business trip is understood as a trip by an employee by order of the employer for a certain period of time to fulfill an official assignment outside the place of permanent work (Article 166 of the Labor Code of the Russian Federation). That is, a citizen who has entered into an employment contract can be sent on a business trip.

The contract is concluded in accordance with the rules of the Civil Code of the Russian Federation, where there are no corresponding rules for sending the contractor on a business trip. Therefore, the contractor cannot be sent on a business trip.

Is it possible to draw up an order for sending on a business trip and a travel certificate for a freelance employee executed under a contract? Having considered the issue, we came to the following conclusion: Trips of an individual related to the fulfillment of his obligations under a civil contract concluded with an organization are not business trips. The current legislation does not establish the procedure for processing such trips, therefore the parties have the right to provide for such a procedure in the contract.

Registration of sending a contractor on a business trip by issuing an order and a travel certificate in relation to him may indicate the actual labor relationship between the parties.

We pay for business trips of other people's employees

Important

And the employee undertakes to personally perform the labor function specified in the agreement and to comply with the internal labor regulations in force in the organization. Thus, in contrast to a civil contract, performing work under an employment contract presupposes the inclusion of an employee in the production activities of the organization.

We would like to remind you that, in accordance with Article 166 of the Labor Code of the Russian Federation, a business trip is considered to be a trip by an employee by order of the employer for a certain period of time to carry out an official assignment outside the place of permanent work. Thus, it is impossible to send on a business trip an individual with whom a contract has been concluded and not an employment contract.

Let's figure out how a business trip is paid under a contract.

— Consultations Can a trip by an individual with whom a civil law agreement has been concluded be considered a business trip? Business trips are not provided for contractual agreements. Let's start with the fact that a citizen with whom a civil law agreement has been concluded and a business trip are incompatible concepts.

And here's why. According to Article 166 of the Labor Code of the Russian Federation, a business trip is a trip by an employee by order of the employer for a certain period of time to carry out an official assignment outside the place of permanent work. And the contractual agreement is subject to the norms of the Civil Code, not the Labor Code of the Russian Federation.

Under a work contract, one party (contractor) undertakes to perform certain work on the instructions of the other party (customer) and deliver its result to the customer, and the customer undertakes to accept the result of the work and pay for it - paragraph 1 of Article 702 of the Civil Code of the Russian Federation.

Source: https://helpcredits.ru/obratsets-dogovora-podryada-s-fiz-litsom-otpravlennym-v-komandirovku/

Expenses for business trips of “foreign” employees

When travel expenses are reimbursed not to an organization, but to an individual, the amount of compensation cannot be taken into account in the customer’s expenses. In addition, it is unclear whether the customer will be a tax agent for personal income tax. Note that the Supreme Court of the Russian Federation takes the position that payment by an organization for goods, work, services (for example, rental housing) for an individual does not in itself mean that it must withhold tax. If an organization makes such a payment in its own interests, then the individual does not have personal income subject to taxation in accordance with paragraphs. 1–2 p. 2 tbsp. 211 of the Tax Code of the Russian Federation. This point of view is set out in the Review of the practice of courts considering cases related to the application of Chapter 23 of the Tax Code of the Russian Federation, approved by the Presidium of the Supreme Court of the Russian Federation on October 21, 2015. The Federal Tax Service of Russia agreed with this position (letter dated November 3, 2015 No. SA-4-7 / [email protected] ).

We recommend reading: How much will be added to your pension after 80 years

Business trip of an employee under a civil law contract

Compensation for his costs (reimbursement of expenses) associated with his trip to another area is taken into account as part of other expenses associated with production and (or) sales (clause 49 of Article 264 of the Tax Code of the Russian Federation). Personal income tax.

This tax is imposed on employee remuneration. But if, under the contract, the customer must reimburse the contractor for actually incurred and documented expenses, then the reimbursed amounts are not included in the remuneration.

However, this can only be done on the basis of supporting documents - hotel bills, tickets, KKM receipts for payment for gasoline, etc.

If such documents are available, the organization paying the income, as a tax agent, can provide the employee with professional tax deductions for the amount of incurred and confirmed expenses (clause 2 of Article 221 of the Tax Code of the Russian Federation).

Is it possible to send a citizen with whom a civil contract has been concluded on a business trip? No, it is not possible. Popular questions Labor legislation does not apply to citizens with whom a civil law contract has been concluded (Article 11 of the Labor Code of the Russian Federation).

Therefore, their trips related to the execution of concluded contracts are not business trips.

If the need for a trip cannot be foreseen in advance, the necessary conditions must be included in the contract after it is concluded (Article 450 of the Civil Code of the Russian Federation).

Please draw up the additions in the form of a written agreement and attach them to the contract.

"civilian" business trip

In particular, in an additional agreement with the contractor, it is necessary to establish the procedure for reimbursement of his expenses for a business trip. It is clear that it is not necessary to issue a business trip order when sending a freelance employee on a business trip. The contractor’s expenses may include, for example, expenses for:

- travel to the place of assignment;

- living in another area;

- road insurance, fees, fuel and lubricants, vehicle parking, etc.

In general, the costs that a contractor may incur during a trip overlap with the costs that the employer is required to reimburse posted workers. The exception is daily allowance. Payment of additional expenses associated with living outside of a permanent place of residence (per diem) is provided only for employees working under employment contracts.

Expenses for a business trip of an employee with whom a GPC agreement has been concluded

Tax Code of the Russian Federation). Insurance contributions Compensation paid to the performer is not subject to insurance contributions to the Pension Fund and compulsory health insurance funds on the basis of paragraphs. “g” clause 2, part 1, article 9 of the Federal Law of July 24.

2009 No. 212-FZ, if the expenses are provided for in the contract, are actually incurred in the interests of the customer and are documented.

If an organization, on its own behalf, orders and pays for travel and accommodation, then the compensation paid is a payment in kind and is subject to insurance contributions to the Pension Fund and compulsory health insurance funds (clause 6 of Article 8 of Law No. 212-FZ).

An individual has the status of an individual entrepreneur. If an individual has documented the status of an individual entrepreneur, the organization is not a tax agent for personal income tax in relation to payments in his favor (clause 2 of Article 226 of the Tax Code of the Russian Federation).

Business trip of an employee under a GPC agreement

The organization has entered into a civil contract for the provision of services with an individual. Due to production needs, it was decided to send a “gepadeshnik” on a business trip. However, a personnel specialist doubts whether it is possible to send a freelance employee of the organization on a business trip.

We will help the personnel officer understand the current situation.

Subscribe to the accounting channel in Yandex-Zen! Business trip only for employees of the organization A business trip is a business trip of an employee related to the fulfillment of an official assignment outside his place of permanent work (Article 166 of the Labor Code of the Russian Federation).

Only an employee with whom an employment contract has been concluded can be sent on a business trip. The fact is that labor legislation does not apply to persons with whom the company has entered into civil contracts (Article 11 of the Labor Code of the Russian Federation).

Travel expenses under a civil contract

Attention

In addition, the object of taxation is only remuneration under civil contracts, the subject of which is the performance of work, provision of services, and not all payments under these contracts (clause 1 of Article 236 of the Tax Code of the Russian Federation). The Supreme Arbitration Court of the Russian Federation also supported this position (information letter dated March 14, 2006 No. 106). According to Part 1 of Article 7 of the Federal Law of July 24, 2009

No. 212-FZ “On Insurance Contributions to the Pension Fund of the Russian Federation...”, the object of taxation of insurance premiums is, in particular, payments and other remuneration made within the framework of civil contracts, the subject of which is the performance of work, the provision of services.

Online magazine for accountants

In this case, the organization should not compensate for the costs of executing the contract. The Federal Tax Service of the Russian Federation expressed the opposite point of view on the taxation of personal income tax (Letter of the Federal Tax Service of the Russian Federation dated March 25, 2011 No. KE-3-3/926). Based on paragraphs. 6 clause 1 art.

208 of the Tax Code of the Russian Federation, tax authorities conclude that the object of personal income tax taxation is remuneration under the contract. Amounts of compensation for the contractor's expenses paid in addition to remuneration are not included in the object of taxation by personal income tax.

Income tax The organization takes into account the costs of paying compensation to an individual for profit tax purposes, provided that they are documented and economically justified (clause 1 of Article 252 of the Tax Code of the Russian Federation).

The costs of paying compensation can be taken into account as part of labor costs (clause 21, article 255 of the Tax Code of the Russian Federation), or other expenses related to production and sales (subclause 49, clause 1, art.