Procedure and features of the dismissal procedure

In the labor legislation of the Russian Federation, there is a procedure for dismissing an employee due to the presence of physical limitations. The main basis is a medical report. This is where the process of severing labor relations begins. Such a document must be issued by a clinical expert or medical-social commission, which indicates the reason for the disability: the name of the disease, injury or mutilation.

Only a clinical expert or medical-social commission can accurately show how possible it is for the employee to continue to fulfill his duties.

This document is the basis for issuing a disability rehabilitation card. It is the MSEC that makes a decision on the extent to which the employee’s further work is possible, in particular, the disability group is established.

Disability has three degrees:

- Third disability group (working).

- Second disability group (total disability).

- The first group (loss of ability to work and need for care).

As for the procedure for dismissal due to health conditions, the Labor Code of the Russian Federation states that it can only be carried out if, for medical reasons, this work activity is contraindicated due to the probable danger to the health of the employee and surrounding people.

The procedure for terminating an employment contract for medical reasons is based on the following reasons:

- Employee refusal to change position.

- The company does not have a suitable vacancy that matches the physical condition of the employee.

- Determination of total disability by the relevant medical commission.

An exception (the case when it is impossible to fire) is when the employee is on sick leave. However, the employment relationship can also be terminated in this case if the enterprise is subject to liquidation.

This is interesting! Find out about the peculiarities of dismissing pregnant women from our article - “Is a pregnant employee an untouchable figure or an employee with whom you can negotiate?”

In what cases does this happen on the basis of the Labor Code of the Russian Federation?

Termination of employment due to ill health is provided for by law. Let us examine in more detail the norms of the current Labor Code that establish this procedure.

- Termination of a contract due to recognition of a person as unfit to continue working. This basis is established by clause 5 of Art. 83 Labor Code of the Russian Federation. Thus, according to this norm, termination of relations with an employee occurs due to circumstances that do not directly depend on the actual expression of the will and desire of the parties. The basis for the application of clause 5 of Art. 83 of the Labor Code of the Russian Federation is the conclusion of the medical commission that the citizen is not at all capable of continuing to work. The employer terminates the employment contract immediately upon receipt of the relevant application accompanied by the conclusion of the medical commission.

- The employee’s refusal to provide him with another position. In some cases, the deterioration of health is not so fatal, and the citizen can perform his work duties in a more gentle manner. For example, this happens when a group III disability is established.

In this case, the law obliges the employer to offer its employee another position where working conditions are easier. If an employee refuses to transfer, then the organization’s management has the right to dismiss him on the basis of clause 8 of Art. 77 Labor Code of the Russian Federation.

In addition, termination of the contract on this basis occurs if the employer does not have an appropriate position in the staffing table to which an employee experiencing health problems can be transferred.

Important! Dismissal on the basis of clause 8 of Art. 77 of the Labor Code of the Russian Federation is possible only if the employee has an appropriate medical certificate.

It should be noted that termination of employment on the above grounds is impossible during the period when the employee is on sick leave.

Rules for registration and sample documents

In order to strictly follow the letter of the law, to terminate employment obligations, the employee must provide the following documents:

- A health document issued by a health care institution.

- Written refusal of an employee to be transferred to another workplace.

- A document confirming the absence or presence of a vacancy suitable for transfer.

- Employee resignation letter.

- Original employee notice of dismissal with the obligatory signature of the employee.

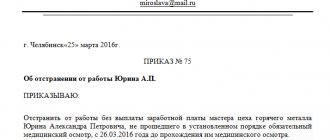

Sample notice of dismissal due to health reasons - An order from the enterprise regarding dismissal indicating the reason related to the employee’s health.

Typical order form for a private or public enterprise

In this case, the corresponding entry is entered into the work book, where the reason for dismissal is “health status”.

In order to prevent problematic issues that may arise due to an employee’s reluctance to admit to health problems, the administration of the enterprise must ensure that employees undergo regular medical examinations.

Dismissal at the initiative of the employer

The management of the organization does not have the right to allow a person to work if he has a certificate of professional incompetence in his hands. However, it will not be possible to completely dismiss such an employee. That is, responding to a medical certificate of limited ability to work by terminating the contract is not considered fair.

This is also important to know:

Dismissal of a pensioner

Thus, the employer is obliged to make efforts to adapt the person to the changed conditions of his life. First of all, this involves selecting and offering suitable vacancies. Could some of them be lower paid? Of course, yes, and those that do not require such high qualifications are also allowed. The obligation to offer options will be considered fulfilled if the employee agrees to any of them, or formalizes a refusal in writing.

Required documents for dismissal

The law establishes that in order to be dismissed for health reasons, you must have certain documents. These include:

- medical report;

- notifying the employee in writing that the company does not have a suitable position;

- employee refusal, indicating reluctance to transfer to another job within the company;

- notice of termination of the contract with a receipt stamp;

- resignation letter from work (if there is an initiative of the employee);

- an order to terminate the employment agreement specifying a clear basis. It is drawn up on a special T-8 form. It must indicate the number and date of the conclusion of the medical institution, as well as information about the employee’s refusal to accept other vacancies.

All information about dismissal must be entered into the work book in accordance with standard rules. Thus, it will not be possible not to write down the grounds for termination of the contract (due to health conditions or a medical report).

List and calculation of payments upon dismissal for health reasons

The employer is obliged to make a full settlement with the employee.

If the dismissal of an employee is carried out solely at his request, he receives only compensation for unused vacation, i.e. on a general basis.

As a result of dismissal carried out under Art. 83 of the Labor Code of the Russian Federation, part 1, clause 5, or according to Article 77 of the Labor Code of the Russian Federation, part 1, clause 8, a disabled person is paid a two-week severance pay.

Example of calculating severance pay

First you need to calculate the average daily earnings: all payments issued in hand over the last year must be added up, the resulting amount divided by 365. Now this number is multiplied by 14 days. If an employee agrees to transfer to another position and it is less paid, he is paid the previous salary in the next month.

Let's say our employee quits due to health reasons, and he managed to work 11 days this month, plus he also has unused 28 days of vacation. The total salary for the past year, taking into account allowances and bonuses, is 540,000 rubles, and the number of working days is 245.

- 540,000 rubles / 245 days = 2,204 rubles per day worked.

- 11 days worked + 14 days (average earnings for the next two weeks) + 28 days (unused vacation) = 53 days.

- 53 days * 2204 rubles = 116,812 - final payment amount.

The deadline for completing the calculation is no later than the day of payment of wages for this month.

Do you want to know what the consequences of illegally dismissing employees will be for an employer? Read our article “Unlawful dismissal: what is considered such and what does it mean for the employer?”

Step-by-step steps to reduce for medical reasons

Termination of relations with an employee on grounds related to medical contraindications for performing a particular job must be properly formalized.

It is necessary to follow this procedure, since violations during dismissal can lead to adverse consequences for the organization, expressed in bringing it to administrative responsibility and recognizing the employment relationship as valid. An employee who did not take into account certain nuances when dismissing may lose the compensation payments due to him.

Collection of documents for dismissal

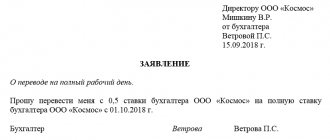

An employee who plans to resign due to illness is required to provide the organization’s personnel service with the following documents:

- Letter of resignation. Compiled in free form. However, it is necessary to indicate that the dismissal is due to health problems.

- Medical report. As a rule, it is the ITU conclusion on recognizing a citizen as disabled. However, other documents may be submitted confirming the presence of contraindications to a particular activity.

Assignment of payments and compensations

Upon dismissal, an employee is entitled to the following payments:

- Last month's salary. Proportional to time worked.

- Compensation for unused vacation. Paid in cases where the employee did not use his main or additional leave in the current year.

- Severance pay. Severance pay is a special payment paid when there is a reason for it. Thus, those dismissed for health reasons are entitled to benefits, the amount of which is the average two-week salary of the employee.

The calculation of such a benefit is quite simple.

So, it is necessary to calculate the total amount of money received by the employee over the last year, then divide by the number of days in the year when the employee performed his job duties, and then multiply the resulting number by 14.

Example:

Citizen Ivanova earned 350 thousand rubles over the past year, and actually worked 241 days.

We determine the average earnings per day:

350000/241 = 1452,28.

Accordingly, Ivanova’s average daily earnings were 1,452 rubles 28 kopecks.

Then:

Reference! 1452,28×14 = 20331,92.

Thus, the severance pay for employee Ivanova will be 20,331 rubles 92 kopecks .

Preparation of personnel documentation

In order to properly terminate an employment contract on the grounds discussed in the article, the employer must have and prepare the following documents:

- Medical report. Provided by employee.

- Notification of the presence or absence of a vacancy for transfer. In the event that the employee’s health condition allows him to work in easier conditions.

- Written refusal of the transfer by the employee. To be completed and certified by the employee personally.

- Notice of dismissal. The employee's signature is required.

- An order of dismissal indicating the legal grounds for termination of the agreement. An employee’s signature is required indicating familiarization with the document. Based on the order, a corresponding entry is made in the work book.

HR records management

The basis for filling out the work book of a dismissed employee due to loss of ability to work is the corresponding instructions. The entry in the document must correspond to the contents of the order and the employment agreement. The reason for dismissal is filled in the column “Information on hiring, transfer” with reference to a medical report and an article of the Labor Code of the Russian Federation. The date and order number are indicated in the “Name” column. The record is certified by the seal of the enterprise, as required by the Rules approved by the Government of the Russian Federation.

An example of filling out a work book in case of transfer of an employee to another position

Why should the manager and personnel officer of an enterprise be as prudent and scrupulous as possible regarding labor legislation? Because any step that is not verified with the law can lead to a conflict situation, and the dismissed employee can make legal claims. Particularly difficult is the moment when dismissal occurs due to limitations in work capacity. In this case, the employer must offer the employee another job (light work). If he refuses this position, he must do so in writing.

Each step must be supported by appropriate documentation, otherwise both parties may suffer. For example, if you make an unforgivable mistake in recording a work record (incorrectly indicate a link to an article of the Labor Code of the Russian Federation, which will lead to data inconsistency), and the person may face a lot of problems in the future. On the other hand, such a mistake can turn into a huge problem for the company if, after litigation, it has to pay a fine for violating labor laws.

It is worth noting that there is often confusion in the concepts of health status and professional incompetence. Professional unsuitability is a discrepancy between the professional qualities of an employee and the position held. Therefore, in the case of dismissal for health reasons, this formulation is unacceptable.

Additional payments depending on position

The employee's category may affect the list of payments upon dismissal.

Payments for a military serviceman under a contract

A person leaving the army must receive:

- monetary allowance;

- one-time benefit up to 20 salaries in case of disability;

- compensation for unused vacation days;

- money accumulated in the account for NIS participants;

- insurance in the amount of 500 thousand to 1.5 million rubles, depending on the disability group;

- a one-time benefit in the amount of 1-2 million rubles, if the disability arose in connection with service;

- monthly monetary compensation for military injury depending on the disability group.

A military man can also receive a bonus for conscientious service, the amount of which depends on his average monthly income.

Features of dismissal due to disability

Unconditional dismissal can be made only in case of complete loss of ability to work, when neither party can object to such a decision. In other cases, the administration must require from the employee a document indicating the degree of disability received due to illness.

If this is, for example, the third group of disability, such a case provides for the restoration of health. Each individual situation is considered individually. It may well be that even with a disability, an employee can perform his or her duties. Within the framework of Russian labor legislation, this means that the employer does not have the right to fire him. Dismissal of a disabled person at the initiative of the employer is unacceptable; it is considered a violation of the law, for which he can be held accountable.

An employer can fire an employee with a disability only in certain cases, for example, if the employee himself wants to leave

If an employee with a disability has contraindications to this type of activity, it is advisable to transfer him to another, more suitable position, if such a vacancy exists. If an employee submits a written refusal, only then can he be dismissed in accordance with clause 8 of Part 1 of Art. 77 Labor Code of the Russian Federation.

So, there are the following reasons for dismissing disabled or incapacitated employees:

- If the state of health is such that a person cannot fully or partially perform his job duties, or working conditions directly harm his health and aggravate his physical condition.

- Lack of vacancies with appropriate working conditions for a disabled person.

- A written refusal of an employee with a disability or an incapacitated employee from a position offered by management or the human resources department.

- The employee expressed a desire to resign or change his current place of work of his own free will.

In relation to a disabled person, the wording can be used by mutual consent of the parties, which is used in cases of dismissal of ordinary employees.

○ Nuances of dismissal of different categories of citizens.

✔ Military personnel.

The decision as to whether or not a serviceman is fit for service is made on the basis of the conclusion of the Military Military Commission .

Each military employee under a contract has the right, in accordance with clause b clause 6 of Article 51 of the Federal Law “On Military Duty to Military Service,” to resign for health reasons, as well as to take another position corresponding to his health.

To do this, the Military Military Commission must recognize him as partially fit for service. To dismiss under this clause, the consent of the serviceman will be required.

The grounds for unconditional dismissal from military service for health reasons will be:

- Declaring a serviceman unfit for service.

- Recognition is limited to the fitness of a serviceman performing his duties under a contract in a position for which the rank of sergeant major is provided, serving on conscription.

- Upon dismissal, a serviceman has the right to government payments and compensation.

[]

✔ Pregnant.

The legislator prohibits firing a pregnant woman at the request of an employer!

So if the contract has expired, the employer, in accordance with Art. 261 of the Labor Code of the Russian Federation must extend it until the end of pregnancy; for this you will need your written consent and a certificate indicating that you are pregnant.

Be prepared for the fact that the employer may require this document from you once every 3 months. Upon expiration of the contract, you have the right to be fired.

Let us repeat, the exception may be the liquidation of an enterprise. Do not forget that employment relations can be terminated at the request of the employee on the basis of Art. 80 of the Labor Code of the Russian Federation or by agreement of the parties.

There are often cases when a woman, having written a letter of resignation, finds out about her pregnancy. In such a situation, you have the right to withdraw it within 2 weeks from the date of submission of the application.

However, if another employee was transferred to your place due to health reasons, then you cannot demand reinstatement. Therefore, before applying for dismissal, take into account all the nuances and legal consequences of your actions.

[]

✔ Single mother with many children.

According to Art. 261 of the Labor Code of the Russian Federation, an employer, at his own request, cannot fire a mother for health reasons, who has a child under 14 years of age or a disabled minor, or if she is the only breadwinner in a large family.

If you belong to this category of workers, then you are not threatened with dismissal due to the fact that you do not correspond to the position you occupy, or there is a reduction in staff or a change of ownership in your organization.

The reason for the calculation may be clause 8, part 1, art. 77 Labor Code of the Russian Federation. This happens based on the results of the medical examination, if there is no desire to move to another vacancy that is more suitable for the employee’s health condition.

They are also fired if the employee is recognized by the expert commission as completely incapacitated.

[]

✔ Pensioner.

The legislation equates pensioners with other categories of employees, therefore their dismissal for health reasons occurs on a general basis.

Consequently, the employer will have to part with you if the medical commission finds you unfit to work.

Also, if you are recognized as having limited ability to work, the employer will be obliged to offer you another position that you can occupy in accordance with your health.

[]

✔ Compensation and payments.

If you refuse to transfer to another position under clause 8, part 1 of art. 77 of the Labor Code of the Russian Federation, you are disabled (clause 5 of Article 83 of the Labor Code of the Russian Federation), then the organization in accordance with Art. 178 of the Labor Code of the Russian Federation pays benefits. Its volume will be an average two-week earnings.

Military personnel are entitled to the following payments:

- Monetary allowance until the day of exclusion from the list of personnel.

- If you quit after serving for less than 20 years, then your severance pay will be 2 salaries; if you served for more than 20 years, then it will be 7 salaries.

- Financial assistance, which amounts to one salary if you filled a military position.

- Award for impeccable performance of official duties.

[]

What documents are needed to obtain?

Since payments in this case are a legal consequence of termination of the employment contract, an employee whose health condition does not allow him to continue working should contact the employer with the following documents:

- ITU conclusion , which must indicate that the employee is recognized as disabled and cannot continue to work in full or in his previously held position, as well as an individual rehabilitation program for a disabled person;

- a certificate issued by the medical institution where the employee was treated , containing information about the person’s complete or partial loss of professional and (or) general ability to work.

If we are talking about the inability to perform the duties of the position that the employee previously held, the employer is obliged to offer him another job that he can perform taking into account his state of health. Dismissal in this case is a consequence of the employee’s refusal to transfer to a new job or the employer’s lack of suitable vacancies.

What does the law say?

Labor legislation guarantees all citizens of our country to occupy positions in accordance with their state of health. Simply put, an employee must not only meet professional hiring criteria, but also have sufficient health to perform work duties. The employer is responsible for caring for the employee's condition.

Disability

Turning to the legislation, you can see that Art. 81 of the Labor Code of the Russian Federation prohibits dismissing an employee during his temporary disability (illness). The exception is cases when during this period the liquidation of a legal entity or the closure of an individual entrepreneur occurs.

At the same time, in Art. 83 of the Labor Code of the Russian Federation talks about the legality of dismissing an employee for health reasons. For example, if a person experiences serious problems with his body and is unable to perform his usual work for a long period, he is fired. Moreover, it will happen for reasons beyond the control of the parties.

In accordance with the provisions of Art. 178 of the Labor Code of the Russian Federation, the dismissal of an employee is accompanied by the payment of monetary compensation - severance pay. The amount of allowance is wages for 14 days worked. All payments are made no later than the employee's payment month.

From the point of view of legality, dismissal for health reasons is reflected in the articles of the Labor Code of the Russian Federation. The procedure requires mandatory payments from the employer. In case of violations of the procedure for issuing cash benefits, the victim has the right to file a complaint with the Labor Inspectorate.

What are the dimensions?

A specific payment provided specifically in the event of a deterioration in the employee’s health that does not allow him to continue working is severance pay.

Its size is fixed in Art. 178 of the Labor Code of the Russian Federation (Part 3) and is the average salary of a person for 2 weeks . It is important to keep in mind that we are talking about the number of working days per 2 weeks. Thus, with a five-day working week, average earnings are multiplied by 10 days, and with a six-day week - by 12 days.

The employer has the right to establish a larger severance pay (Part 4 of Article 178 of the Labor Code of the Russian Federation).

Liability for violation of the law upon dismissal

Violation of the law when dismissing an employee for health reasons falls into the category of violation of labor legislation and entails administrative sanctions (Article 5.27 of the Code of Administrative Offenses of the Russian Federation):

| Violator category | Administrative punishment |

| Executive | Warning or fine 1000-5000 rubles. |

| Entity | Fine 30,000-50,000 rubles |

| In case of repeated violation | |

| Executive | Fine 10,000-20,000 rubles or disqualification for 1-3 years |

| Entity | Fine 50,000-70,000 rubles |

When is it paid?

The employer is obliged to offer the subordinate to transfer to another position with more lenient conditions. This transfer may be temporary until the victim feels better. If the employee refuses to transfer or the employer does not have a place:

- the transfer period is within four months - management removes the employee from activities and retains his place (without payment of salary); after four months, the citizen goes through the commission again, if everything is in order, he has the right to return to the organization at his workplace;

- the transfer period exceeds four months - the employment contract is terminated, two weeks' average earnings are paid as compensation for the loss of a source of income.

According to the Labor Code of the Russian Federation, payment of benefits upon dismissal of disability benefits is carried out if the employee refuses the transfer or the employer does not have a suitable job for him. Under such circumstances, termination of the employment contract is inevitable, but the employee is guaranteed financial support for a specified period.

Deadlines

As in any other cases, it is necessary to pay the employee in full on the last day of work (Article 140 of the Labor Code of the Russian Federation).

Article 140 of the Labor Code of the Russian Federation. Payment terms upon dismissal

Upon termination of the employment contract, payment of all amounts due to the employee from the employer is made on the day the employee is dismissed. If the employee did not work on the day of dismissal, then the corresponding amounts must be paid no later than the next day after the dismissed employee submits a request for payment.

In the event of a dispute about the amount of amounts due to the employee upon dismissal, the employer is obliged to pay the amount not disputed by him within the period specified in this article.

There are several options for calculation and its design:

- in cash on the payday established by the company, in which case the employee must sign the payroll;

- in cash on a day other than the date of payment of wages, in this case an expense cash order is issued;

- in non-cash form with the execution of an expense payment order.

If an employee was absent from the workplace on the day of dismissal, payments must be made when he contacts the company (on the day of application or the next day).

Exit compensation amount

The provision for the payment of severance pay is contained in Article 178 of the Labor Code. The categories of citizens who are eligible for it are indicated there.

Namely:

- Citizens recognized as completely incapable of working in accordance with a medical report.

- Employees who refuse to be transferred to another job if the transfer is necessary in accordance with a medical report.

- People for whom the company cannot offer suitable work.

This accrual must correspond to the employee’s average earnings for a period of two weeks.

In addition, the law does not prohibit making other payments. They can be included in a collective or employment agreement. If there is such a provision in the document, then the disabled person will be credited with the appropriate amounts.

If the employment contract is terminated due to:

- with the liquidation of the organization;

- staff reduction;

then the dismissed employee is paid severance pay in the amount of average monthly earnings, and he also retains his average monthly earnings for the period of employment, but not more than two months from the date of dismissal. For the third month, this benefit can be extended by decision of the employment service. The employee must contact this service to register as unemployed within two weeks after dismissal and not be employed within three months of payment of such benefits.

In addition, a disabled disabled employee may receive unemployment benefits.

Also, upon dismissal, the employee receives wages for days worked and compensation for unused vacation.

Calculation method

A citizen can independently estimate how much money he is entitled to as a mandatory payment. To do this, you need to calculate your average daily earnings.

- All amounts received over the last 12 months (up to the day of dismissal) are taken (OA), with the exception of:

- business trips;

- payment of official sick leave;

- material assistance.

- The exact number of days worked (DC) is calculated.

- The indicators are divided: OD / CD = SD. The result is the average daily income.

- The benefit amount is equal to: SD x 14 days.

Vacation and related payments are not included in the calculation.

Calculation example

Let’s say a citizen has been assigned disability group 2. There was no place at the enterprise suitable for health reasons. The administration had to fire him as not meeting the conditions. The date of receipt of the group certificate is 02/24/2017.

- Income is taken into account for the period: from 02/24/2016 to 02/23/1017. It is equal to: 259.2 thousand rubles.

- In total, during this time the citizen worked 216 days.

- Average daily earnings: 259.2 thousand rubles. / 216 days = 1.2 thousand rubles.

- Allowance: 1.2 thousand rubles. x 14 days = 16.8 thousand rubles.

Subtleties of taxation and other deductions

Article 217 of the Tax Code states that this type of payment is not subject to taxation. However, if an employee upon dismissal due to a reduction in staff is paid severance pay in increased amounts, then the amount of severance pay that exceeds the amount established by the Labor Code is subject to personal income tax.

Insurance premiums are also not supposed to be taken from severance compensation.

Alimony is withheld in accordance with the writ of execution from all income of the citizen. Severance compensation for disability is not exempt from this type of payment.

general information

If an employee has expressed a desire to abandon his work duties due to permanent disability or has been declared unfit during a medical examination, then he has the right not to work for two weeks. The basis should be both a statement of resignation at his own request and a medical certificate signed by a medical commission that declared him incapable of work.

Termination of an employment contract is also possible at the initiative of the employer. In this case, there are only three legal grounds:

- the employee is declared completely incapacitated;

- the employee is unable to perform his job duties and follow instructions;

- continued work may cause harm to the employee or his colleagues.

Each of these grounds must be documented, otherwise the dismissal will be considered illegal.