Which regions are participating?

- Since 2011: Karachay-Cherkess Republic and Nizhny Novgorod region.

- Since 2012: Astrakhan, Novgorod, Novosibirsk, Tambov, Kurgan regions, Khabarovsk Territory.

- Since 2015: Republic of Crimea, Sevastopol, Republic of Tatarstan, Belgorod, Rostov, Samara regions.

- From 2021: Republic of Mordovia, Bryansk, Kaliningrad, Kaluga, Lipetsk and Ulyanovsk regions.

- From 2021: Republic of Adygea, Altai, Buryatia, Kalmykia, Altai and Primorsky Territories, Amur, Vologda, Omsk, Oryol, Magadan, Tomsk and Jewish Autonomous Regions.

- From 2021: Kabardino-Balkarian Republic, Republic of Karelia, North Ossetia, Tyva, Kostroma, Kursk regions.

- From January 1, 2021: Republic of Ingushetia, Mari El, Khakassia, Chechen, Chuvash Republics, Kamchatka Territory, Vladimir, Pskov, Smolensk regions, Nenets and Chukotka Autonomous Okrugs.

How to set up direct FSS payments?

First, let's figure out what the “FSS Pilot Project” is and what is it used for? In essence, this is an experimental innovation that involves the payment of social benefits without the participation of the employer.

If your organization is a participant in the pilot project, then to start working with this function it must be activated in the organization's accounting policy. To do this, let's go to:

- section: “Settings – Organizations – Accounting policies” (Fig. 6);

- in the subsection “Benefits at the expense of the Social Insurance Fund”, put a tick, confirming that your organization is registered in the region;

- We indicate the date from which payments will be valid.

Fig.6. Setting up Social Insurance Fund Payments in the organization’s accounting policy in “1C:ZKGU 3.1”

After completing this setup, when generating a sick leave certificate, you will see that the line where the benefit was previously calculated at the expense of the Social Insurance Fund is empty (Fig. 7).

Fig.7. Certificate of incapacity for work in “1C: Salaries and personnel of a government institution 3.1”

In addition, another tab “FSS Pilot Project” has appeared. In it, you can create an employee’s application for payment of benefits and give it for signature (Fig. 8).

Fig.8. Processing “Application for payment of benefits” in “1C:ZKGU 3.1”

Then go to your “workplace” for FSS payments. This section allows you not only to record data on sick leave and applications, but also to track the status of sent registers, as well as enter information about reimbursed funds into the information database.

To do this, open the section: “The main thing is Benefits from the Social Insurance Fund.” Next you will see 3 columns:

- sick leave;

- employee statements;

- registers of applications (Fig. 9).

Rice. 9. Workplace “Benefits at the expense of the Social Insurance Fund” in “1C:ZKGU 3.1”

You have already done the first and second points. All that remains is to create a register of applications and send it directly, if you have 1C-Reporting connected, or upload it and send it through other programs.

It is worth noting that not all benefits will be paid from the Social Insurance Fund. The exceptions are:

- funeral benefit;

- allowance for caring for disabled children.

The benefits listed above will be paid at the expense of the employer, so you will need to enter data in your “workplace” on the “Reimbursement of organization expenses” tab (Fig. 10)

Fig. 10. Tab “Reimbursement of expenses of the organization” in “1C:WKGU 3.1”

Benefit payment procedure

In general, the direct payment system looks like this:

- An employee experiences an insured event and sends an application to the employer for payment of a certain benefit.

- The employee also provides the documents necessary to assign benefits, and the employer sends this package to the Social Insurance Fund.

- With the direct payment system, the employer pays only 3 days of sick leave, and the remaining payments are made by the territorial branch of the Fund.

How does the electronic sick leave system work?

When registering an ELN, the employee must sign a written agreement at a medical institution, which, in turn, must be connected to the exchange of information with the Social Insurance Fund in order to be able to generate certificates of incapacity for work.

The operating algorithm of the FSS ELN is as follows:

- the doctor fills out the ENL, sends it to the FSS and gives the visitor the sheet number;

- the employee transfers the personal identification number to the accounting department of his company;

- an accountant in the 1C program sends a request to the Social Insurance Fund using the sick leave number;

- In response to the request, the FSS sends an electronic sick leave;

- the 1C program automatically downloads data from the electronic tax record and calculates the amount of the benefit;

- the employer pays the employee sick leave.

It is also worth mentioning separately the deadlines for paying sick leave. As soon as an employee has submitted the slip number to the company’s accounting department, it is required by law to calculate it no later than 10 calendar days. The amount of sick leave is subject to reimbursement with the withholding of income tax.

The payment, as already mentioned, is paid directly by the Social Insurance Fund if the company participates in the social insurance pilot project, which we will discuss in the article.

Step-by-step instruction

Deadlines for submitting documents

Do I need to send a package of papers to the Social Insurance Fund in order to receive benefits not only from the employer for 3 days, but also the rest of the amount for sick leave? Yes, and the employer is required to submit documents for payment of benefits to the territorial body of the Social Insurance Fund . To do this, you must submit to your employer a certificate of incapacity for work and an application for benefits within 6 months. The organization prepares a certificate calculating benefits for the Social Insurance Fund and, together with a sick leave certificate and an application, submits it to the Fund within 5 days.

Who fills out the form and how?

The first part of the sick leave form is filled out by the doctor. The information in the second part is entered by the employer. According to Order of the Ministry of Health and Social Development dated June 29, 2011 No. 624n, when filling out the following basic rules should be followed:

- Do not use a ballpoint pen.

- If you need to make corrections, you should cross out the erroneous information and indicate the correct information on the back of the form.

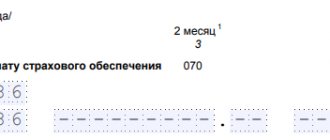

Since the Social Insurance Fund calculates the amount of compensation, the fields “At the expense of the Social Insurance Fund of the Russian Federation” and “Total accrued” must be filled in by a Fund employee.

The photo shows a sample of filling out a sick leave certificate by an employer under the Social Insurance Fund pilot project

Filling out an application

The application form for payment of benefits is established by Order of the Federal Social Insurance Fund of the Russian Federation dated November 24, 2017 N 578. This application must be filled out by the employee, but as a rule, the employer does this independently in order to reduce the number of errors. The employee only has to check whether the bank details are correct and sign.

Minimum and maximum period

After you have provided your employer with your sick leave, he has 10 days to accrue sick leave for the first 3 days. And he is obliged to make the payment on the next day of salary transfer.

After receiving a certificate of incapacity for work from you, the employer is obliged to submit a package of documents to the Social Insurance Fund within 5 days. Over the next 10 days, the Social Insurance Fund is obliged to check all the information and pay you benefits.

Thus, the maximum period during which an employee will receive payment of disability benefits is 15 days from the moment he provides sick leave to the employer. The minimum payment period is not established by law.

How is personal income tax collected?

The employer withholds tax from the amount of compensation he makes. That is, during the first three days of illness. Personal income tax on the remaining amount is withheld by the Fund, because it is the Fund that pays this part of the benefit.

How to check traffic on a website?

An employee can find out the status of his sick leave on the Social Insurance Fund website. The Fund launched the “Insured Person’s Account” service, where the employee logs in through his account on the State Services Portal.

The account must be verified. When an employee logs into his account on the FSS website, he will be able to track his benefits.

Can they refuse and why?

The Social Insurance Fund may refuse to pay benefits in the following cases:

- The documents necessary for calculating compensation were not provided . In this case, the FSS sends the employer a notice of the need to transfer data within 5 working days from the date of receipt of the letter.

- The deadline for applying for benefits has been missed . If you do not have documents confirming that this deadline was missed for a good reason, the Fund will not transfer the money to you. To avoid these situations, the employer should submit a full package of documents on time, and the employee should not delay in applying for payment.

If you believe that the Social Insurance Fund illegally refused to pay you benefits, you need to go to court.

Positive and negative sides

The Social Insurance Fund project has certain advantages for both the employer and the employee. First of all, the responsibility for calculating the insurance payment lies with the Social Insurance Fund. The employer can transmit information about the insured person to the Social Insurance Fund in electronic form , which is more convenient.

Employees receive protection: they are spared from delayed payment of benefits or complete non-payment, as well as from controversial situations with the employer. However, the employer must now be more responsible about the deadlines for submitting the package of documents, as well as the correctness of filling out sick leave.

Introduction of the FSS pilot project in Moscow

In 2021, a new mechanism for assigning and paying benefits will affect Moscow and the Moscow region. In the article by Oksana Smolanova, read about the main changes provided for by the new procedure for paying FSS benefits.

On November 25, 2021, the Government of the Russian Federation submitted to the State Duma of the Russian Federation a draft[1] of amendments to some laws on compulsory social insurance. Amendments to direct payments will come into force in 2022 (Part 2, Article 6[2] of the draft). But starting from January 1, 2021, the current rules on the assignment and payment of benefits on an offset basis will not be applied (Part 4, Article 6[3] of the draft).

The main changes provided for by the project:

- the rights and obligations of all parties to social insurance are clarified;

- the procedure for interaction between interested parties is determined;

- the mechanism for assigning and paying benefits in electronic exchange is fixed, as well as the generation of a certificate of incapacity for work in electronic form;

- a requirement is introduced according to which, if the deadlines for payment of benefits are violated, the Social Insurance Fund is obliged to pay a penalty in the amount of 0.5 percent of the unpaid amount for each day of delay;

- a mechanism is provided for reimbursement of excessively incurred expenses of the Social Insurance Fund;

- the procedure for conducting checks and the reliability of documents submitted by the policyholder for the appointment and payment of benefits is established;

- liability is introduced for violating the requirements of the legislation on compulsory social insurance.

Currently, a pilot project “Direct Payments” is already being implemented in a number of constituent entities of the Russian Federation, which provides for the payment by employers of insurance contributions to the Social Insurance Fund of the Russian Federation in full, as well as the appointment and payment of insurance coverage for compulsory social insurance, including benefits for sick leave, by territorial bodies FSS RF. From January 1, 2021, Moscow and the Moscow region will join the FSS pilot project “Direct Payments”.

We will tell you about the main changes provided for by the new procedure for the payment of Social Security benefits.

Rights and obligations of subjects of compulsory social insurance

The provisions of the bill expand the powers of the FSS. In particular, in accordance with paragraph 3 of Article 3[4] of the draft, the insurer has the right:

— request from policyholders information and documents necessary for the assignment and payment of insurance coverage, documents confirming the information provided by the policyholder for the assignment and payment of insurance coverage to the insured persons, as well as information and documents related to the costs of paying social benefits for funerals;

— carry out checks of the completeness and reliability of the information provided by the insured, necessary for the appointment and payment of benefits, as well as information and documents necessary to reimburse the insured’s expenses for the payment of social benefits for burial, demand and receive from the insured documents and explanations on issues arising during the checks ;

— carry out checks of the completeness and accuracy of the information and documents provided by the insured person;

— request and receive from medical organizations engaged in the examination of temporary disability, information and documents necessary to verify the occurrence of an insured event, as well as to verify compliance with the conditions and procedure for generating certificates of incapacity for work;

— request and receive from the tax authorities information on insurance premiums accrued and paid by policyholders;

— check compliance with the conditions and procedure for generating certificates of incapacity for work;

— bring claims against medical organizations for reimbursement of insurance costs for certificates of incapacity for work unreasonably generated in violation of the established conditions and procedures;

— represent the interests of the insured persons before the policyholders;

— based on the results of the control measures taken, make a decision to refuse to assign and pay insurance coverage (reimbursement of the insured’s expenses) or to cancel the decision to assign and pay insurance coverage in cases where facts of unreliability or concealment of information are revealed;

— other powers;

The new obligations of employers are, in particular, the following (clause 2 of article 2[5], clause 2 of article 3[6] of the draft):

— timely submit in the prescribed manner to the territorial body of the Social Insurance Fund the information and documents necessary for the assignment and payment of insurance coverage to the insured, as well as an application and documents for making a decision on financial support for the insurer’s expenses for preventive measures to reduce industrial injuries and occupational diseases of workers and sanatoriums -resort treatment for workers engaged in work with harmful and (or) hazardous production factors (clause 4 of article 1[7] of the draft);

— to reimburse the insurer for the amount of excess expenses incurred by him for the payment of insurance coverage, if this overpayment occurred due to the fact that the employer submitted false or incomplete information (clause 2 of article 3[8] of the draft).

In accordance with paragraph 14 of Article 3[9] of the draft, the insured person must provide the employer with information, including during employment, that is necessary for the payment of insurance coverage. In addition, it is necessary to inform in a timely manner if the information changes. It will be possible to send information both on paper and electronically in a form approved by the Federal Social Insurance Fund of the Russian Federation.

Procedure for assigning and paying benefits

The main feature of the new system of insurance payments for compulsory social insurance is that the Social Insurance Fund assigns and pays benefits to the insured person directly, bypassing the employer. The employer will only have the function of collecting and submitting to the fund the necessary documents for paying benefits to the employee. The specific list of them and the procedure for receiving them by the insurer will be established by the government.

Information about the insured person received by the policyholder is transferred by him to the territorial body of the insurer at the place of his registration no later than three working days from the date of receipt (clause 15, clause 14, article 3[10] of the draft). However, the employer will still have to pay the employee for the first three days in case of illness.

The rules for assigning, calculating and paying benefits by the insurer will be established in a separate article (clause 16, clause 14, article 3[11] of the draft).

The draft assumes that mainly only electronic certificates of incapacity for work will be issued (Article 5[12] of the draft). Paper sick leave forms will only be issued in certain cases.

Therefore, for employers who have not yet switched to electronic sick leave, it is recommended to do so in advance. The transition to electronic sick leave will reduce the time of medical workers and insurers for processing sick leave, help avoid errors in filling out forms and significantly reduce cases of insurance fraud.

Payment of benefits will be carried out by the Social Insurance Fund through the federal postal service, credit or other organization specified in the information about the insured person (clause 14, article 3[13] of the draft).

Information on the assignment and payment of benefits by the Social Insurance Fund of the Russian Federation will have to be posted in the Unified State Social Security Information System in accordance with Federal Law[14] dated July 17, 1999 No. 178-FZ “On State Social Assistance.”

The draft provides for liability for violations of the legislation of the Russian Federation on compulsory social insurance in case of temporary disability and in connection with maternity.

For example, if you refuse to submit documents, the policyholder faces a fine of 200 rubles for each document (Clause 18, Article 3[15] of the draft). In case of submission of incomplete or distorted information or documents, the fine will be 20% of the amount of excess expenses incurred for the payment of insurance coverage, but not more than 5,000 rubles and not less than 1,000 rubles (clause 14 of article 1[16], clause 18 Article 3[17] of the draft). If the policyholder violates the deadline for submitting information - 5,000 rubles.

In addition, the FSS will recover any excess expenses incurred from the policyholder or insured person. For this purpose, a procedure for issuing demands and penalties will be provided.

***

To summarize, we note that the new mechanism for assigning and paying benefits certainly has a number of advantages, namely:

- increasing the social security of citizens (timely and full provision of citizens with insurance payments);

- payment of benefits will not be tied to whether the organization transfers insurance premiums;

- reducing costs for policyholders to process and calculate benefits;

- simplification of document flow between subjects of compulsory social insurance;

- automation of functions related to the calculation and payment of benefits;

- exclusion of violations in the assignment of benefits (for example, payments will not be delayed due to a lack of financial resources from the employer);

- simplification of the procedure for filling out Form 4-FSS and calculating insurance premiums; there is no need to reflect data on benefits in reporting.

Economic entities that were among the first to take part in the Direct Payments pilot project have already appreciated the benefits of the new order and have received generally positive results from the introduction of the new payment mechanism.

[1] Draft Federal Law No. 1062568-7 “On Amendments to Certain Legislative Acts of the Russian Federation on Compulsory Social Insurance” (as amended by the State Duma of the Federal Assembly of the Russian Federation, text as of November 25, 2020) {ConsultantPlus}.

[2] Art. 6 of the draft Federal Law No. 1062568-7 “On amendments to certain legislative acts of the Russian Federation on issues of compulsory social insurance” (as amended by the State Duma of the Federal Assembly of the Russian Federation, text as of November 25, 2020) {ConsultantPlus}.

[3] Art. 6 of the draft Federal Law No. 1062568-7 “On amendments to certain legislative acts of the Russian Federation on issues of compulsory social insurance” (as amended by the State Duma of the Federal Assembly of the Russian Federation, text as of November 25, 2020) {ConsultantPlus}.

[4] Art. 3 of the draft Federal Law No. 1062568-7 “On amendments to certain legislative acts of the Russian Federation on issues of compulsory social insurance” (as amended by the State Duma of the Federal Assembly of the Russian Federation, text as of November 25, 2020) {ConsultantPlus}.

[5] Art. 2 of the draft Federal Law No. 1062568-7 “On amendments to certain legislative acts of the Russian Federation on issues of compulsory social insurance” (as amended by the State Duma of the Federal Assembly of the Russian Federation, text as of November 25, 2020) {ConsultantPlus}.

[6] Art. 3 of the draft Federal Law No. 1062568-7 “On amendments to certain legislative acts of the Russian Federation on issues of compulsory social insurance” (as amended by the State Duma of the Federal Assembly of the Russian Federation, text as of November 25, 2020) {ConsultantPlus}.

[7] Art. 1 of the draft Federal Law No. 1062568-7 “On amendments to certain legislative acts of the Russian Federation on issues of compulsory social insurance” (as amended by the State Duma of the Federal Assembly of the Russian Federation, text as of November 25, 2020) {ConsultantPlus}.

[8] Art. 3 of the draft Federal Law No. 1062568-7 “On amendments to certain legislative acts of the Russian Federation on issues of compulsory social insurance” (as amended by the State Duma of the Federal Assembly of the Russian Federation, text as of November 25, 2020) {ConsultantPlus}.

[9] Art. 3 of the draft Federal Law No. 1062568-7 “On amendments to certain legislative acts of the Russian Federation on issues of compulsory social insurance” (as amended by the State Duma of the Federal Assembly of the Russian Federation, text as of November 25, 2020) {ConsultantPlus}.

[10] Art. 3 of the draft Federal Law No. 1062568-7 “On amendments to certain legislative acts of the Russian Federation on issues of compulsory social insurance” (as amended by the State Duma of the Federal Assembly of the Russian Federation, text as of November 25, 2020) {ConsultantPlus}.

[11] Art. 3 of the draft Federal Law No. 1062568-7 “On amendments to certain legislative acts of the Russian Federation on issues of compulsory social insurance” (as amended by the State Duma of the Federal Assembly of the Russian Federation, text as of November 25, 2020) {ConsultantPlus}.

[12] Art. 5 of the draft Federal Law No. 1062568-7 “On amendments to certain legislative acts of the Russian Federation on issues of compulsory social insurance” (as amended by the State Duma of the Federal Assembly of the Russian Federation, text as of November 25, 2020) {ConsultantPlus}.

[13] Art. 3 of the draft Federal Law No. 1062568-7 “On amendments to certain legislative acts of the Russian Federation on issues of compulsory social insurance” (as amended by the State Duma of the Federal Assembly of the Russian Federation, text as of November 25, 2020) {ConsultantPlus}.

[14] Federal Law of July 17, 1999 No. 178-FZ (as amended on April 24, 2020) “On State Social Assistance” {ConsultantPlus}.

[15] Art. 3 of the draft Federal Law No. 1062568-7 “On amendments to certain legislative acts of the Russian Federation on issues of compulsory social insurance” (as amended by the State Duma of the Federal Assembly of the Russian Federation, text as of November 25, 2020) {ConsultantPlus}.

[16] Art. 1 of the draft Federal Law No. 1062568-7 “On amendments to certain legislative acts of the Russian Federation on issues of compulsory social insurance” (as amended by the State Duma of the Federal Assembly of the Russian Federation, text as of November 25, 2020) {ConsultantPlus}.

[17] Art. 3 of the draft Federal Law No. 1062568-7 “On amendments to certain legislative acts of the Russian Federation on issues of compulsory social insurance” (as amended by the State Duma of the Federal Assembly of the Russian Federation, text as of November 25, 2020) {ConsultantPlus}.

Possible questions and difficulties

- Can a company refuse to participate in a pilot project? No, if the company is located in a region that participates in the Direct Payments project.

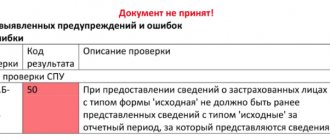

- Is it possible to submit a single register to the Social Insurance Fund for several sick leaves at the same time? Yes, the employer has the right to submit one register for several certificates of incapacity for work. The form of the register and the rules for filling it out were approved by Order of the Federal Social Insurance Fund of the Russian Federation dated November 24, 2017 No. 579.

- If the package of documents to the FSS turns out to be incomplete or with shortcomings, does the FSS notify? What is the deadline for providing the missing documents? In this case, the Social Insurance Fund sends a notification to the organization. After receiving the notice, the employer must provide the fund with the missing documents. 6 days after sending the notice, it is considered received.

- What to do if all the documents were submitted to the Social Insurance Fund in a timely manner, but the employee does not receive payments? In this case, it is necessary to check whether the information in the documents submitted to the Fund is correct. Particular attention should be paid to the employee’s full name and bank details. If all data is entered correctly, the benefit status can be checked in your personal account on the Social Insurance Fund website or directly at the territorial office of the Social Insurance Fund.

In modern economic realities, the old “credit” system of social payments is catastrophically outdated. The Social Insurance Fund project is designed to simplify work with insurance payments and optimize document flow , as well as protect citizens from non-compliance with the law by the employer.

There are no obvious disadvantages to the project yet. Nothing will change for insured persons, but for organizations the procedure for calculating and paying out funds is greatly simplified.

What documents are needed for a pilot project?

In case of illness or leave due to employment and labor regulations, request the following package of documents from the employee:

- sick leave: paper or electronic bulletin number;

- certificates of the amount of earnings received from other policyholders for the 2 years preceding the year of the insured event;

- application for payment of benefits (according to the form from Appendix No. 1 of the Order of the Social Insurance Fund of November 24, 2017 No. 578).

The application is filled out by the employee in block letters and with a black pen. The document can be filled out on a computer and printed. An application from the employee is taken in any case.

Application form to the Social Insurance Fund from an employee (pilot project)

Sample application to the Social Insurance Fund from an employee (pilot project)

In certain insurance cases, the following additional documents may be required:

| Benefit, payment | Documentation |

| One-time benefit when registering in the early stages of pregnancy | Certificate from the medical institution that registered the employee |

| One-time benefit for the birth of a child |

If the parents are divorced, a certificate of divorce and a certificate of cohabitation with the child must be submitted |

| Monthly allowance for child care up to 1.5 years |

|

| Accident or injury at work |

|

| To reimburse benefits | |

| Payment for additional days to care for a disabled child | A copy of the order granting additional days off |

| Funeral benefit | Death certificate |

When filling out a sick leave form, do not fill in the following cells:

- “at the expense of the Social Insurance Fund”;

- “Total accrued.”

Sample of filling out a sick leave certificate by an employer (pilot project)