When a person is registered for a job, an employment contract is concluded with him. The employer is obliged to submit the organization’s reports to regulatory authorities, including the Social Insurance Fund, within the time limits established by law, if the staff exceeds 50 people.

Legal entities can perform this procedure in the following ways:

- Submission of reports personally to the inspector.

- Sending documents by mail.

- Transfer of data in electronic form.

The most effective way is the electronic form of reporting, which is produced 4 times a year. The reporting reception gateway is a tool for transmitting electronic documents from legal entities in the established format based on the current regulations of the law.

This method allows you to eliminate the time required for people submitting reports to be in queues and protect information when transmitting it on the Internet.

Basic principle of data transfer

According to Order No. 19, the payer can provide information electronically to the Social Insurance Fund in two main ways:

- Through the Internet. To do this, you need to prepare a report, certify it with a qualified electronic signature of the CEP, go to the website, and then send the finished document to the reporting gateway to the FSS. This is the simplest option, which does not require you to personally go to the organization’s office.

- Transferring data using media - flash drives, floppy disks, disks, etc. In this case, you also need to prepare an electronic file, certify it with the help of CEP and take it to the social insurance fund yourself.

The first option takes much less time and causes a minimum of difficulties, however, there are also a certain number of difficulties. The FSS reception gateway is used by hundreds of users every day, and heavy loads lead to an inevitable slowdown in its operation. Sudden technical problems may prevent the timely sending of data, so it is better not to leave this procedure until the last minute.

In addition, reporting is not checked instantly - it takes up to 24 hours. If any errors are found during the check, the calculation will be considered incomplete and will have to be redone, and this will also take time. If you leave reporting until the last minute, the task may remain undone, which will lead to negative consequences for the organization.

Reporting to the FSS can be submitted via the Internet (through the FSS reception gateway located at the address). In this case, the payer of contributions needs to go to the Fund’s website, attach a calculation file and send it to the gateway. All these actions are quite simple and intuitive.

Checking and sending

To check and send the file you must:

- Select button "Send". The button is highlighted when the cursor is placed on the line with the report:

- Next you need to check the electronic signature certificate. If you need another certificate, click on the link "Select certificate":

- Then you should select "Check report". A window with the test results will appear:

- if there are no errors, you must click “Proceed to Send” and send the calculation to the Fund branch:

- If the system detects errors, click “Edit report” , correct the data and save.

Possible errors when sending data

The main groups of errors are errors with the preparation of an electronic file and its certification with an electronic signature and errors with making calculations. In the first case, the organization will be refused to accept the report, and it will have to be redone, eliminating the shortcomings. This takes time and then the report will have to be resubmitted. If the FSS gateway for submitting reports fails at this very moment, there is a high risk of delaying the submission and receiving penalties.

The order details errors that must be avoided when filling out an electronic document:

- The document bears the signature of an unauthorized person.

- The certificate has expired. It expires after a year and must be reapplied.

- The report file is in the wrong format. This question needs to be clarified in advance.

If the organization makes errors in the calculations, the report will be considered submitted on time, but after a certain time the payer will receive a receipt indicating the inaccuracies. The FSS gateway for sending registers, checking and monitoring allows you to send reports in advance in order to promptly eliminate possible errors and avoid them in the future. After the correction, it is necessary to send a second electronic report to the FSS, but the date of acceptance remains the date of sending the first version.

Taking into account possible technical problems and problems with obtaining an electronic signature, it is recommended to take care in advance of preparing the document in electronic form and sending it. Renewing an electronic signature and solving other problems takes a lot of time, so it is better to prevent fines and other sanctions from regulatory authorities in advance. The ability to submit a report electronically has significantly speeded up and simplified the process of interaction with the social insurance fund.

How to create a calculation

To form 4-FSS you need:

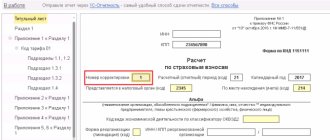

- From the main window of the service, open the “FSS” and click “Create new” :

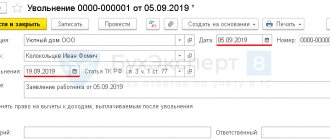

- In the form that appears, you should select an organization, a period (1 quarter, half a year, 9 months or a year), indicate whether the report is being sent for the first time or is being adjusted:

- If the previous 4-FSS was filled out in the service, then the amounts from it will be transferred to the generated calculation. The values “At the beginning of the reporting period” will be shown taking into account the transferred data. To prevent amounts from the previous period from being transferred, click on the “Do not transfer” .

- After clicking “Create report”, a window for entering information will appear.

- The form contains sections to fill out, marked in the image below. The rules for filling out form 4-FSS are described in detail in a separate article.

- “Title page” – contains information about the organization’s details;

- “Table 1” - it includes payments, taxable and non-taxable, from the beginning of the year and by month of the quarter, as well as the amount of the tariff;

- “Table 1.1” - indicates payments to employees temporarily assigned to work under a contract with another organization or with an individual entrepreneur;

- “Table 2” – indicates debts at the beginning and end of the period, the amount of accrued and paid contributions, the amount of expenses;

- “Table 3” – to be filled in if insurance expenses were incurred;

- “Table 4” – indicates the number of victims in the event of insured events;

- “Table 5” – the results of a special labor assessment and medical examinations are filled in;

- “Section SKE/IF” – is filled out if different types of economic activities are carried out and/or there is partial budget funding.

You can go to the desired section by clicking on the link with its name on the left side of the page. The entered information is saved automatically when moving to a new table. The data is saved by the system to the user's computer, so when working on another PC, the entered data will not be available.

When all the information has been entered into the form, you must click “Save and Close” . The created calculation will be displayed in the list of reports:

If you need to change the data, click on the line with the report.

- When the cursor is placed over the line with the report, the following buttons will appear:

to check the calculation before sending or cancel sending; for generating 4-FSS in PDF format and printing it; to delete a calculation.

In 2021, the FSS gateway for reporting on the main type of activity should work normally

The FSS has implemented the ability to confirm the main type of economic activity through the Fund’s gateway. This was reported on the official website of the department.

FSS experts remind that in order to confirm the main type of economic activity for compulsory social insurance against accidents at work and occupational diseases, each employer must submit the following documents no later than April 15, 2020:

- application for confirmation of the main type of economic activity;

- certificate confirming the main type of economic activity;

- a copy of the explanatory note to the balance sheet for the previous year (except for policyholders - small businesses).

These documents are submitted to the territorial body of the Social Insurance Fund at the place of registration on paper or in the form of an electronic document.

The FSS also notes that now electronic documents can be sent in three different ways:

- using the Public Services Portal;

- using the policyholder's Personal Account;

- through the FSS Gateway.

The agency clarifies that employers can submit the necessary documents to confirm the main type of economic activity after submitting the balance sheet for 2021 to the Federal Tax Service, but no later than April 15, 2020.

Read also

29.02.2020

How to check an electronic sick leave on the FSS website for an employer

To check the sick leave on the FSS website (and at the same time add the necessary information to it for subsequent sending to the department), the employer needs:

- First obtain an electronic signature for document flow with the Social Insurance Fund and create an enterprise account on the State Services website. The signature is issued at an accredited certification center for the head of the organization. Creating a profile.

- Receive from the employee a unique electronic sick leave number, which is communicated to him by the medical organization after his appointment with the doctor.

- Log in to the “Policyholder's Account” on the page https://cabinets.fss.ru.

- Select the “Electronic sheets” tab, then “Request a sheet”.

- Enter the number of the certificate of incapacity for work and SNILS number of the employee.

- If necessary, select a certificate certifying the organization’s rights to make a request to the Social Insurance Fund.

- Wait for the found sheet to appear in the “List of Sheets”.

- If necessary, select the “To be completed by the employer” option.

- Fill in the appropriate area of the sick note and click “Save”.

After these steps, the completed sick leave will be sent to the Social Insurance Fund for processing of compensation for disability benefits.

From 01/01/2021, all regions joined direct payments to the Social Insurance Fund. Read about the new operating procedure in the article

To make it easier to search for sick leave, an employer can use the filters provided in the web interface.

For example, sick leave can be found:

- by patient's full name;

- SNILS;

- sick leave number;

- document status;

- date of registration.

If necessary, you can generate a sick leave file in XML format in order to subsequently process it in a cryptographic program if it is used by the employer for electronic document management with government agencies.

A representative of the medical institution that issued the certificate of incapacity for work may also need to check the sick leave certificate online.

Document statuses

You can track the fate of the submitted settlement by status. All possible options are in the following table.

Table. Statuses of reports submitted to the FSS

| Status | What does it mean |

| Report uploaded | The reporting file is transferred to the operator’s server through which the sending is carried out |

| Special operator confirmation received | The operator has received the file and is awaiting transfer to the regional office of the FSS |

| Sent | The file has been sent to the Foundation and is awaiting verification |

| Send error | The file has not been transferred to the FSS. If the problem persists after resending, you should contact technical support. |

| Decryption error | The file was not decrypted or the signature was not verified. It is necessary to check the electronic signature certificate, correct violations and resend the calculation. If the problem repeats, you need to contact technical support. |

| Accepted | The calculation has been verified and accepted by the Foundation |

| Not accepted | During the inspection, violations were identified and a protocol was sent to the policyholder. The calculation should be corrected and then resubmitted. |

| FSS found errors | The Foundation detected violations specified in the control protocol. The report was not submitted, it needs to be corrected and sent again |

Delivery Status

To control file delivery, you need to:

- Go to the main page of the service and select the “FSS” , then click “All reports” .

- In the list of reports that appears, select the desired line.

- The page that opens will display file status information, as well as buttons for saving and printing documents.