Technical errors First on the list is the incorrect attribution of a deduction to one or another

Submission of reports to the tax office in 2021 for individual entrepreneurs using the simplified tax system. All owners of individual entrepreneurs according to

Grounds for processing a payment When they talk about a payment order by decision of the tax authority, they mean

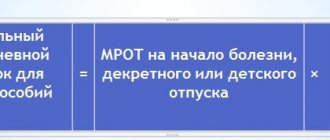

From July 1, 2021, the minimum wage increased to 7,500 rubles. (See “Increasing the minimum wage in

Does an employer have the right to require a medical examination on a day that is a day off for an employee? Legally

In the previous publication about the self-employed, we found out who they are, what they can do, and how

Description of types of activities that give the right to benefits Reduced tariffs when calculating insurance premiums

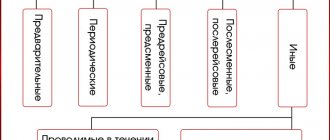

New rules for tax audits from August 2021 The Federal Tax Service will stop applying the rules of the Plenum from 2021

The deadline for submitting annual accounting (financial) statements for 2021 is approaching. In what cases does

Changed criteria for classifying assets as fixed assets The new standard established the basic rules for accounting for fixed assets