Reason for making a payment

When they talk about a payment order by decision of the tax authority, they mean the following situation:

- The payer (company/individual entrepreneur) is required by law to independently calculate the tax to be transferred to the treasury and draw up the appropriate payment document.

- The deadline established by law for voluntary repayment of the current tax debt has passed.

- The tax inspectorate received a request to make a tax payment within the deadline specified in it.

It should be noted that to fill out a payment order, by decision of the tax authority, use the same form as for voluntary repayment of current mandatory payments. It is enshrined in the regulation of the Central Bank of Russia dated June 19, 2012 No. 383-P. This form has index 0401060.

The procedure for switching from cash to non-cash payments

Now there are several options that allow you to receive your salary through an ATM. If the company has a current account, then all that remains is to conclude an agreement with the bank to receive cards for each employee:

- It is necessary to provide a list of all employees, as well as some personal data (photocopies of passports).

- Applications with consent to transfer payments must be attached.

- The issuance schedule is determined and information about the person who will be responsible for the transfer process will provide information if questions arise.

In the future, all that remains is to draw up a payment order on time, which must indicate the total amount. A register is included with it. It indicates the bank details, last names, first names and patronymics of each employee, as well as their salary.

This document is signed by the responsible employee. A stamp is required. Today, an electronic signature is often used to speed up the process.

In the case where the company does not yet have its own current account, the bank has the right to ask to prepare some documents, including constituent documents. The commission for opening cards will be slightly higher; the manager of the enterprise must pay it. After receiving the cards, they are distributed under a personal signature.

When an employee already has his own account, he will pay additional expenses himself. The register and payment order will be sent to his bank twice a month. Only then does the transfer take place, and the second copy of the documents with seals and signatures will be returned to the company.

The legislation does not prohibit transferring wages to the non-cash account of another person . Only this should be discussed in advance and formalized in the employment contract before signing it. The application indicates passport details and bank details, and stipulates the period during which the money will be transferred. Most likely, the bank will charge an additional amount for the transfer to another person’s card.

How to correctly draw up a notice of changes in the terms of an employment contract - read here.

Why and how to issue an order to withhold funds from wages - see this article.

Nuances

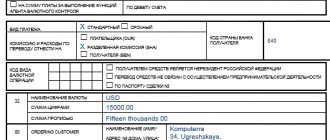

The procedure for filling out a payment order at the request of the Federal Tax Service in 2021 has its own characteristics. This applies to fields that must be traditionally filled out. The main nuances are discussed below in the table.

| Filling out a payment based on the request from the Federal Tax Service | |

| Field | What to indicate |

| 106 “Basis of payment” | The value should be “TR”. That is, the debt is repaid on the basis of a request received from the tax authority. |

| 107 “Tax period indicator” | The payment deadline established in the request for payment of taxes, fees, and contributions received from the Federal Tax Service is given. The format for filling out this field should be strictly as follows: “DD.MM.YYYY” For example, if we are talking about a late advance tax payment for the 2nd quarter of 2017, then field 107 should be like this: KV.02.2017 |

| 108 “Document number” | Number of the request for payment of tax, insurance premium, fee (without intermediate signs). In other cases, this field is not filled in at all. |

| 109 “Document date” | The date of the tax authority's request for payment of tax, insurance premium, or fee is transferred to this field. It is located next to the request number. In other cases, when voluntarily deducting current payments, indicate the date of signing the tax reporting (declaration). |

In field 106 “Base of payment”, enter exactly “ZD” if you voluntarily pay off debts for expired tax periods, but there have been no demands from the Federal Tax Service for payment of tax (fee, insurance contribution).

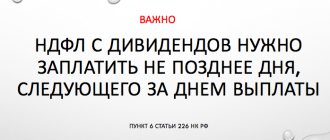

Payment order for salary to card

The transfer is executed by payment order, the details of filling which are discussed in our publication. It is important to take into account the fact that the payment day is usually considered the day the funds are credited to the card, and this day should not be later than the deadlines established by tax legislation. In order to prevent delays in salary payments, it is necessary to take into account the time period that the bank allocates for crediting money to accounts.

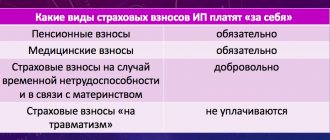

A payment order for the transfer of salaries to staff is a document whose execution is not difficult, but it is worth taking into account the nuances of filling out the details. To ensure normal payment processing, they are filled out in accordance with the following requirements:

- in the “Payment recipient” field indicate the bank institution that has the company’s salary project under the concluded agreement and the account number to which the transfer is made;

- in the “Payment amount” column, the transfer amount is recorded, which is similar to the calculated amount to be issued in person in the company’s accounting records - an advance payment or final payment for the month;

- in the “Purpose of payment” field they must reflect for what period the transfer is being made. For example, when transferring an advance, it is formulated as follows: “Payment of wages for the 1st half of the month according to register No. _ dated _._.2018.” A mandatory attachment to the payment order for the transfer of salary amounts is a register indicating the payments due to each employee of the company.

Sample payment slip for transferring salary to a card:

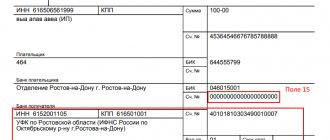

Payment Identifier (UPI)

Also, special attention should be paid to field 22 - “Unique payment identifier” (UPI). This consists of 20 or 25 characters. As a general rule, the UIP should be reflected in the payment only if it is set by the recipient of the funds. In addition, the latter must communicate its value to the payer (clause 1.1 of the instruction of the Central Bank of the Russian Federation dated July 15, 2013 No. 3025-U).

When transferring amounts of current taxes, fees, and insurance premiums calculated by the payer independently, additional identification of such payments is not required. In this case, the identifiers are KBK, INN, KPP and other details of payment orders. In field 22 “Code” it is enough to indicate “0”. In this case, the bank:

- cannot refuse to execute such an order;

- does not have the right to require filling out the “Code” field if the payer’s TIN is indicated (letter of the Federal Tax Service dated 04/08/2016 No. ZN-4-1/6133).

At the same time, filling out a payment order at the request of the Federal Tax Service for 2021 obliges to transfer to the payment the UIP value, which must be indicated in the submitted request.

Otherwise, filling out the fields of a payment order at the request of the Federal Tax Service does not have any fundamental features.

What is the order of payment in a payment order and its importance

In order for the transfer of funds to take place, the organization must send a special instruction to the bank to transfer from its account to the account of the recipient of the funds. If there are funds in the account, the bank must fulfill them within the established time frame.

The client can immediately send several payment orders to the credit institution. In addition, other entities, for example, regulatory authorities or bailiffs, also have the right to send collection orders to the bank, with or without the client’s knowledge, to debit funds from the entity’s account.

Therefore, it is important for the bank to know in what order to execute these documents. This problem can be solved by the order of payment in the payment order, which is indicated by the client in accordance with current legislation.

The order of payment is the sequence of execution by a credit institution of documents received for execution to debit funds from the account of the client it serves.

The norms of legislative acts have approved a directory of priority codes, which a business entity must indicate in payment orders. This is enshrined in the Civil Code of the Russian Federation. It is these numbers that an organization or individual entrepreneur should use to avoid double interpretation. After all, the most important orders must be executed first, such as when paying taxes as required, alimony, etc.

In this case, it matters whether there are enough funds in the account of the business entity. If yes, then the debit will be made as orders are received by the bank - that is, the time the payment is received.

However, if there is not enough money in the account, then the order of payment is important information for the bank and the client himself. First of all, you need to write off funds with the lowest value of such a code.

Attention! The order of payment is reflected in the payment order in field 21. If the code is incorrectly reflected here, the bank may not execute the document, but will return it for clarification.

Fine

When you need to issue a payment order for a fine according to the decision of the Federal Tax Service in 2018, you should remember that in the KBK the numbers from 14 to 17 will be 3000. In addition:

- field 105 – OKTMO of the municipality, where funds from paying fines are accumulated;

- field 106 – “TR”;

- field 107 (“Tax period”) – “0”;

- field 108 – requirement number (the “No” sign does not need to be inserted);

- field 109 – date of the document from field 108 in the format “DD.MM.YYYY”;

- after 110 – do not fill in;

- field 22 (“Code”) – UIN (if it is not in the request, then “0”);

- field 101 – “01” for legal entities and “09” for “individual entrepreneurs”;

- “Payment order” – 5.

Basically, these are all the features of paying a fine to the Federal Tax Service by payment order in 2021.

Read also

16.05.2017

Order of payment in a payment order in 2018, table of values

Let's take a closer look at all the values of the ciphers that determine the order of payment, indicated in field 21 in the payment order in 2018, sample.

| Priority code meaning | Types of payments | Examples of reasons for payment |

| First "1" |

| Resolutions of the bailiff service. They can issue collection orders and payment requests. A notarized agreement on the payment of alimony. |

| Second "2" |

| Orders from magistrates received by the bank regarding the collection of (write-off without acceptance) Court orders received by the client to fulfill the requirements |

| Third "3" |

| Calculation documents for calculating wages. Collection orders are payment requests received from the Federal Tax Service, Social Insurance Fund, Pension Fund and other government agencies. |

| Fourth "4" |

| Court orders from judges and court decisions for the fulfillment of obligations for utility bills, etc. Priority of payment 4 which means, first of all, the execution of rulings, decisions, court orders as a result of violations by the company of obligations in the implementation of its activities. |

| Fifth "5" |

| Invoices and agreements (contracts) of company partners for work performed, services received, material assets received. Declarations, calculations for advance payments, etc. Application from an employee of an enterprise for payment of alimony. |