Type of currency transaction in a payment order

Which business transactions fall under the definition of “currency” are defined in paragraph 9 of Art.

1 of the Federal Law “On Currency Regulation and Currency Control” dated December 10, 2003 No. 173-FZ. Read more about currency transactions in the article “Currency transactions: concept, types, classifications.”

Among foreign exchange transactions there are also those that are associated with the transfer of rubles. It is for them that the transaction type code is provided for filling in the payment order. All types of such operations are described and systematized in Appendix No. 2 to Instruction No. 138-I of the Bank of Russia dated 06/04/2012. Each type is assigned a specific code consisting of numbers.

Ruble payment orders and passing exchange control

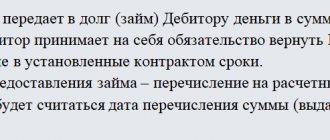

The Sberbank business online system is intended not only for sending ordinary payment orders to the bank, it is a fairly powerful tool for carrying out foreign exchange transactions. Of course, when processing payment orders, the Central Bank of the Russian Federation imposes more stringent requirements. When carrying out a currency transaction related to the debiting of funds from a ruble current account opened with an authorized bank, the settlement document for the currency transaction must contain the code of the type of currency transaction before the text part in the “payment purpose” detail (link from Appendix 2 to the instructions of the Bank of Russia dated 4 June 2012 No. 138 I).

This code must correspond to the purpose of the payment, as well as the information contained in the documents submitted by the resident related to the specified currency transaction. According to the rules, information about the code of the type of currency transaction must be enclosed in curly brackets and have the following form: {VO”code of the type of currency transaction”}

If a transaction passport was issued under a contract or loan agreement, you must provide the bank with a certificate of currency transactions

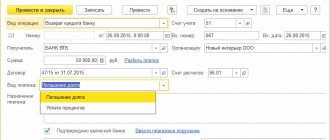

To indicate the transaction type code in the payment purpose, enter its value in the “ currency transaction type code ” field or select from the list “Directory Types of Currency Transactions according to 138-I”.

Attention: if the resident does not have documents confirming the import (export) of goods into (from the territory) of the Russian Federation, provision of services, performance of work, transfer of information and results of intellectual activity, the field is filled in based on the advance payment (codes of types of currency transactions: 10100 , 11100, 20100, 21100, 22100, 23100)

A window with a list of codes will open in front of you. Be careful before choosing one or another type of currency transaction. If you know exactly which one is right for you, select it from the list by clicking on the line, then click “OK”.

Next, so that the code appears in the right place, click on the “ Add line ”

Now in the “Payment purpose” field, information about the code of the type of currency transaction should automatically appear before the text part of the details...

It must be remembered that along with the foreign currency payment, it is necessary to submit a number of documents to the bank that are indicated in the transaction settlement document. To send scanned documents online, click on the “ Add ” button in the “ Attachments ” section and attach the necessary copies of documents (this could be a contract, transaction passport, additional agreements, customs certificates, customs declaration, etc.).

Attention: if foreign exchange transactions are carried out in the currency of the Russian Federation under a contract using a transaction passport, the resident submits a certificate of foreign exchange transactions to the bank. Also, if a transaction passport is issued, the resident, AT THE SAME TIME with the payment document, submits to the bank the documents specified in this certificate.

What is a currency transaction type code?

The code for the type of currency transaction in the payment order is indicated before the text part in the “Purpose of payment” detail. There is even a special format for this important prop:

{VO<code of the type of currency transactions>}

It is indicated without indentation or spaces inside curly braces. Its place is before the text part of the payment purpose. The VO designation is large Latin letters that do not change, followed by the digital code itself. In a payment order it always has five characters. Each KVVO is conventionally divided into two parts:

- the first two digits indicate the group into which similar transfers are combined;

- the last three digits indicate a number that specifies the transfer being made in accordance with currency legislation.

What is a currency transaction type code?

KVBO is a five-number value indicating the type of transaction. The code is selected depending on the purpose of the payment and the content of the documents accompanying the transaction. If the payment order and code do not match, the payment is rejected. The list of QVBOs is contained in Central Bank Instruction No. 181-I dated August 16, 2021.

Where should I put the code? If this is an order for a transaction in rubles, you need to put it before the text about the purpose of payment. In other banking documents, KVVO is indicated in a line specially designated for this. The code is both alphabetic and numeric values. There is no need to put spaces or other symbols between letters and numbers.

KVVO consists of two parts. The first indicates the class of the transaction, the second – its essence. Let's look at an example. Operation code – 10100. Its components:

- 10 – indicates the export of products from the territory of Russia.

- 100 – indicates that the buyer made an advance payment.

The very presence of this code means that this is a transaction with a foreign counterparty. Sometimes an accountant encounters problems when choosing a KVBO. There are a lot of codes in the Central Bank instructions. It is not always easy to decide which one is suitable for a particular operation. If an accountant is afraid of making a mistake, he can ask a representative of the servicing bank for advice.

How to decipher KVVO

There is a table that makes it easy to decipher the first two digits of any KVVO.

| 01 | Currency conversion payments made by individuals or Russian companies by bank transfer |

| 02 | Foreign currency conversion non-cash transfers carried out by foreign citizens or companies |

| 10 | Code for settlements between companies from the Russian Federation and foreign companies when conducting foreign trade activities related to the export of goods from the territory of Russia |

| 11 | Currency code when transferring companies from the Russian Federation to foreign companies or individuals when conducting foreign trade activities related to the import of goods into Russia |

| 12 | Transfers of domestic organizations for trade transactions without import of goods to Russia |

| 13 | Payment by foreigners to domestic companies when selling goods directly in Russia |

| 20 | Currency code indicated when paying residents to non-residents when conducting foreign trade activities related to the fulfillment by domestic firms of contractual obligations (work, services, transfer of information, intellectual and exclusive rights) |

| 21 | Payment by organizations from the Russian Federation to foreign companies when carrying out foreign trade activities related to the fulfillment by foreigners of contractual obligations (work, services, transfer of information, intellectual and exclusive rights) |

| 22 | Mutual settlements between residents and non-residents when transferring goods (performing work/services) by domestic firms or individual entrepreneurs |

| 23 | Payment by residents to non-residents when transferring goods (performing work/services) by foreign firms or citizens |

| 30 | Transfers from Russian companies and individual entrepreneurs to foreigners for purchased real estate |

| 32 | Payment by residents to foreigners within the framework of agreements on the assignment of claims (debt transfer) |

| 35 | Code of transfers between residents and non-residents for other foreign trade transactions |

| 40 | Payments for the provision of a cash loan by a Russian company to a foreigner or foreign company |

| 41 | Payment code for the provision of a cash loan by a foreign company from the Russian Federation |

| 42 | Payments when Russian companies fulfill loan obligations |

| 43 | Calculations when foreign companies fulfill loan obligations |

| 50 | Payments upon investment (capital investments) |

| 51 | Transfers when foreigners purchase securities from residents of the Russian Federation |

| 52 | Transfers when Russian companies purchase securities from non-residents |

| 55 | Payments upon fulfillment of obligations under securities |

| 56 | Mutual settlements between Russians and foreigners on derivatives transactions |

| 57 | Payment for transactions related to trust management of assets |

| 58 | Payments for brokerage operations |

| 60 | Payment transactions carried out by foreign companies and citizens on their accounts in Russian rubles in cash |

| 61 | Payments made by Russian companies in foreign currency in cash |

| 70 | Non-trading transactions |

| 80 | Settlements between a bank authorized to carry out foreign exchange transactions and a non-resident in Russian rubles, as well as between a bank and a resident in foreign currency |

| 99 | Settlements for other currency transactions that were not mentioned above |

Let's try to decipher the operation code 10100.

From the table above we immediately see that it is associated with the export of goods. This code usually denotes an advance payment to a resident for goods exported from Russia. The numbers “100” at the end will tell us this. In a similar way, you can decipher any type of currency transaction in a payment order. But to simplify the work, the Central Bank has developed a special table that contains all the necessary values.

Code groups

The KVVO group is the first 2 digits that reveal the class of the operation. Let's look at these groups and their meaning:

- 01 and 02 – non-cash conversion payments.

- 10 and 11 – payment for export or import of products.

- 12 and 13 – payment for products without import and export.

- 20 and 21 – payment for services, work, rights to intellectual activity.

- 22 and 23 – payment under mixed type agreements.

- 30 – payments for real estate.

- 32 – payment under an agreement for assignment of claims.

- 35 – other payments.

- 40 and 41 – issuance of loans.

- 42 and 43 – payment of loans and interest on them.

- 57 – payment under trust agreements.

- 58 – payment under brokerage service agreements.

- 70 – transactions not related to trade (for example, transfer of salary or pension).

- 90 – other operations.

The next three numbers reveal the contents of the operation. Example: code 70 affects a non-trading transaction. The last numbers indicate which transfer was made. For example, this could be the payment of travel allowances.

What does the number 40820810 mean in the account number?

Read more about the current account number and its decoding in our other materials here.

Now we will look at the specific combination indicated.

All bank account numbers consist of 20 characters. Initial numbers such as “405”, “406” and “407” indicate, respectively, state property, as well as federal and non-state property.

The first five characters talk about the types of the company itself and its activities:

- 40807 – non-resident legal entity;

- 40805 – individual entrepreneur and legal entity (account “I”);

- 40820 – non-resident individual.

After the first five, the next three numbers symbolize the currency. Previously, for the ruble it was 810, now it is 643.

Thus, 40820810 is a ruble account of an individual who is not a resident of the Russian Federation

.

KVBO for operations

Here are the codes that usually accompany operations:

- 10100. Prepayment for the export of a batch of products from the territory of Russia.

- 10200. Deferred payment for a shipment transported out of the country.

- 11100. Advance payment to a foreigner for products imported into the country.

- 11200. Settlements with a resident if he is given a deferred payment for a consignment imported into the country.

- 12060. Payment for goods sold by a non-resident. It is assumed that the products were sold abroad, without import into the Russian Federation.

- 13010. Payment from a foreigner to a resident for goods sold in Russia.

- 20100. Prepayment of services or goods in favor of a resident.

- 20210. Payment between a non-resident and a resident for services or work.

- 20400. Payments under agreements on assignments, guarantees to the resident.

- 20500. Payments under guarantee agreements to a non-resident.

- 21100. Advance payment for services or work in favor of a foreigner.

- 35030. Payment to the resident for other actions.

- 35040. Payment in favor of a foreigner for other actions.

- 41030. Lending to a resident by a non-resident.

- 42015. Payment of the principal debt to a non-resident, if the resident has corresponding obligations.

- 61100. Movement of currency from one account to another.

- 61135. Transfer of currency from a resident’s account to an account in another bank.

- 70060. The resident transfers remuneration to the foreigner for work.

- 99090. Other actions and translations not listed above.

Other operations

KVBO is also needed when working with foreign currency:

- 01010 – sale of currency for rubles.

- 01030 – purchase of currency for rubles.

Features of the currency transaction code “Salary to non-residents”

If a resident pays a salary to an employee who is listed in the bank as a non-resident (has a different citizenship), then when issuing a payment order, the KVVO must be indicated. If this is not done, the bank will not accept the payment order for execution, since it violates currency legislation.

When transferring a salary to such a foreign citizen, you should indicate the code 70060. At the same time, it is important not to forget to simultaneously issue a payment order for the payment of personal income tax and insurance contributions, so as not to violate tax laws.

Currency transaction code 10100

Currency transaction code 10100 is used in settlement transactions of non-residents for prepayment to a resident for goods exported from Russia.

Currency transaction code 10200

The currency transaction type code 10200 denotes payments made by a non-resident to a resident in the event of a deferred payment for products exported from the Russian Federation.

Currency transaction type code 20100

20100 - currency transaction code indicating an advance payment by a non-resident for services/works provided by a resident, etc.

Currency transaction code 20210

The currency transaction type code 20210 in the payment document indicates that the non-resident is paying for work/services performed by the resident, etc.

Currency transaction code 21100: decryption

The currency transaction type code 21100 in the settlement document (certificate) indicates an advance payment by a resident in favor of a non-resident performer of work (services).

Currency transaction code 21200: decryption

The currency transaction type code 21200 represents a payment by a resident for services performed by a non-resident.

Currency transaction codes

Often, oil and gas companies enter into transactions in foreign currencies. This guide will help you understand the codes for types of currency transactions. The currency transaction type code is a five-digit number that encrypts the essence of the banking transaction being carried out. These codes (or KVBO ) are entered in special certificates and payment orders in the column of the payment document where the purpose of the payment is stated. Before the five-digit number indicating the required operation code, two Latin letters must be written without a space - V and O. The entire alphanumeric code must be enclosed in curly braces. The record should look like this: {VOххххх}, where xxxxx is the code required for the currency transaction .

A detailed directory-classifier of codes for currency transactions carried out on the territory of the Russian Federation - all codes and their descriptions:

01

Conversion transactions of residents in non-cash form

01010

Sale by a resident of foreign currency for the currency of the Russian Federation, except for the mandatory sale of part of the foreign currency proceeds

01020

Mandatory sale of foreign currency for the currency of the Russian Federation

01030

Purchase by a resident of foreign currency for the currency of the Russian Federation

01040

Purchase (sale) by a resident of one foreign currency for another foreign currency

02

Conversion transactions of non-residents in non-cash form

02010

Sale by a non-resident of foreign currency for the currency of the Russian Federation

02020

Purchase by a non-resident of foreign currency for the currency of the Russian Federation

10

Settlements and transfers between residents and non-residents for goods exported from the customs territory of the Russian Federation, including aircraft, sea vessels, inland navigation vessels and space objects that are objects of foreign trade activities

10010

Provision by a non-resident to a resident of a commercial loan in the form of an advance payment for the export of goods specified in sections XVI, XVII, XIX of the Commodity Nomenclature of Foreign Economic Activity (advance payment)

10020

Providing a commercial loan by a non-resident to a resident in the form of an advance payment when exporting goods under an agreement for construction and contract work (advance payment)

10030

Providing a commercial loan by a non-resident to a resident in the form of an advance payment when exporting goods, with the exception of payments with codes 10010 and 10020 (advance payment)

10040

Payments and transfers by a non-resident when a resident grants a non-resident a deferred payment for a period of up to three years when exporting goods specified in sections XVI, XVII, XIX of the Commodity Nomenclature of Foreign Economic Activity (payments after the export of goods from the customs territory of the Russian Federation)

10050

Payments and transfers by a non-resident when a resident grants a non-resident a deferred payment for a period of more than three years when exporting goods specified in sections XVI, XVII, XIX of the Commodity Nomenclature of Foreign Economic Activity (payments after the export of goods from the customs territory of the Russian Federation)

10060

Payments and transfers by a non-resident when a resident grants a non-resident a deferred payment for a period of up to five years when exporting goods under an agreement for construction and contract work (payments after the export of goods from the customs territory of the Russian Federation)

10070

Payments and transfers by a non-resident when a resident grants a non-resident a deferred payment for a period of more than five years when exporting goods under an agreement for construction and contract work (payments after the export of goods from the customs territory of the Russian Federation)

10080

Settlements and transfers by a non-resident when a resident grants a non-resident a deferred payment for up to 180 days when exporting goods, with the exception of payments with codes 10040 and 10060 (payments after the export of goods from the customs territory of the Russian Federation)

10090

Settlements and transfers of a non-resident when a resident grants a non-resident a deferred payment for a period of more than 180 days when exporting goods, with the exception of payments with codes 10040 - 10070 (payments after the export of goods from the customs territory of the Russian Federation)

11

Settlements and transfers between residents and non-residents for goods transported into the customs territory of the Russian Federation, including aircraft, sea vessels, inland navigation vessels and space objects that are objects of foreign trade activities

11010

Payments and transfers by a resident when a non-resident grants a resident a deferred payment when importing goods specified in sections XVI, XVII, XIX of the Commodity Nomenclature for Foreign Economic Activity (payments after the import of goods into the customs territory of the Russian Federation)

11010

(payments after import of goods into the customs territory of the Russian Federation)

11020

Settlements and transfers by a resident when a non-resident grants a resident a deferred payment when importing goods, with the exception of payments with a code

11030

Provision by a resident to a non-resident of a commercial loan for a period of up to three years in the form of an advance payment for the import of goods specified in sections XVI, XVII, XIX of the Commodity Nomenclature of Foreign Economic Activity of Goods (advance payment)

11040

Provision by a resident to a non-resident of a commercial loan for a period of over three years in the form of an advance payment for the import of goods specified in sections XVI, XVII, XIX of the Commodity Nomenclature of Foreign Economic Activity (advance payment)

11050

Provision by a resident to a non-resident of a commercial loan for a period of up to 180 euros in the form of an advance payment when importing goods, with the exception of payments with code 11030 (advance payment)

11060

Provision by a resident to a non-resident of a commercial loan for a period of over 180 days in the form of an advance payment when importing goods, with the exception of payments with codes 11030 and 11040 (advance payment)

12

Settlements and transfers between residents and non-residents for goods without their import into the customs territory of the Russian Federation

12010

Payments and transfers by a non-resident for marine fishery products produced and sold by a resident to a non-resident outside the customs territory of the Russian Federation

12020

Payments and transfers by a resident for marine fishery products purchased by a resident from a non-resident outside the customs territory of the Russian Federation

12030

Payments and transfers by a non-resident for air, sea, river vessels sold by a resident to a non-resident outside the customs territory of the Russian Federation

12040

Payments and transfers by a resident for air, sea, and river vessels purchased by a resident from a non-resident outside the customs territory of the Russian Federation

12050

Payments and transfers by a non-resident for goods sold by a resident to a non-resident outside the customs territory of the Russian Federation without their import into the customs territory of the Russian Federation, with the exception of payments with codes 12010 and 12030

12060

Payments and transfers by a resident for goods purchased by a resident from a non-resident outside the customs territory of the Russian Federation without their import into the customs territory of the Russian Federation, with the exception of payments with codes 12020 and 12040

13

Settlements and transfers between residents and non-residents for goods on the territory of the Russian Federation

13010

Payments and transfers by a non-resident for goods sold by a resident to a non-resident on the territory of the Russian Federation

13020

Payments and transfers by a resident for goods purchased by a resident from a non-resident on the territory of the Russian Federation

20

Settlements and transfers of non-residents in favor of residents in foreign trade transactions related to the performance of work, provision of services, transfer of information and results of intellectual activity, including exclusive rights to them

20010

Provision by a non-resident of a commercial loan to a resident in the form of an advance payment for construction and contract work carried out by a resident outside the territory of the Russian Federation (advance payment)

20020

Providing a commercial loan by a non-resident to a resident in the form of an advance payment for work performed by a resident, services provided, transmitted information and results of intellectual activity, including exclusive rights to them, with the exception of payments with code 20010 (advance payment)

20030

Payments and transfers by a non-resident when a resident grants a non-resident a deferred payment for a period of up to five years for construction and contract work carried out by a resident outside the territory of the Russian Federation (payments after the provision of services)

20040

Payments and transfers by a non-resident when a resident grants a non-resident a deferred payment for a period of more than five years for construction and contract work carried out by a resident outside the territory of the Russian Federation (payments after the provision of services)

20050

Settlements and transfers of a non-resident when a resident grants a non-resident a deferred payment for a period of up to 180 days for work performed by a resident, services provided, information transferred and results of intellectual activity, including exclusive rights to them (payments after completion of work, provision of services, transfer of information and results intellectual activity, including exclusive rights to them)

20060

Settlements and transfers of a non-resident when a resident grants a non-resident a deferred payment for a period of over 180 days for work performed by a resident, services rendered, information transferred and results of intellectual activity, including exclusive rights to them (payments after completion of work, provision of services, transfer of information and results intellectual activity, including exclusive rights to them)

20070

Payments and transfers by a non-resident in payment for services provided by a resident to a non-resident for the extraction and sale of marine fishery products outside the customs territory of the Russian Federation

21

Settlements and transfers from residents in favor of non-residents for foreign trade transactions related to the performance of work, provision of services, transfer of information and results of intellectual activity, including exclusive rights to them

21010

Payments and transfers by a resident when a non-resident grants a deferred payment for work performed by a non-resident, services provided, information transferred and results of intellectual activity, including exclusive rights to them (payments after completion of work, provision of services, transfer of information and results of intellectual activity, including exclusive rights to them), with the exception of payments with code 21040

21020

Provision by a resident to a non-resident of a commercial loan for a period of up to 180 days in the form of an advance payment for work performed by a non-resident, services provided, transmitted information and results of intellectual activity, including exclusive rights to them (advance payment)

21030

Provision by a resident to a non-resident of a commercial loan for a period of over 180 days in the form of an advance payment for work performed by a non-resident, services provided, information transferred and results of intellectual activity, including exclusive rights to them (advance payment)

21040

Payments and transfers by a resident in payment for services rendered by a non-resident to a resident for the production and sale of marine fishing products (payments after the provision of services) outside the customs territory of the Russian Federation

30

Settlements and transfers between residents and non-residents for real estate transactions, with the exception of payments for aircraft, sea vessels, inland navigation vessels and space objects that are objects of foreign trade activities

30010

Payments and transfers by a non-resident for real estate sold by a resident to a non-resident outside the territory of the Russian Federation

30020

Payments and transfers by a resident for real estate acquired by a resident from a non-resident outside the territory of the Russian Federation

30030

Payments and transfers by a non-resident for real estate sold by a resident to a non-resident on the territory of the Russian Federation

30040

Payments and transfers by a resident for real estate acquired by a resident from a non-resident on the territory of the Russian Federation

35

Settlements and transfers between residents and non-residents for other transactions related to foreign trade activities and not directly specified in groups 10 - 30 of this List

35010

Settlements and transfers between residents and non-residents related to the return of erroneously credited amounts and amounts under unfulfilled contracts

35020

Settlements and transfers between residents and non-residents for other transactions related to foreign trade activities and not directly specified in groups 10 - 30 of this List, with the exception of payments with code 35010

40

Calculations and transfers related to the provision of credits and loans by residents to non-residents

40010

Payments and transfers by a resident in favor of a non-resident for the provision of loans and borrowings for a period of more than three years

40020

Payments and transfers by a resident in favor of a non-resident for the provision of loans and borrowings, with the exception of payments 40010

41

Calculations and transfers related to the provision of credits and loans by non-residents to residents

41010

Calculations and transfers of a non-resident in favor of a resident for the provision of loans and borrowings for a period of more than three years

41020

Payments and transfers by a non-resident in favor of a resident for the provision of loans and borrowings, with the exception of payments with code 41010

42

Settlements and transfers between residents and non-residents related to the fulfillment by residents of obligations under attracted loans and borrowings

42010

Calculations and transfers by a resident in favor of a non-resident for the repayment of loans, borrowings (principal debt)

42020

Calculations and transfers by a resident in favor of a non-resident to repay overdue debt on credits and loans (principal debt)

42030

Calculations and transfers of a resident in favor of a non-resident for the payment of interest payments

42040

Settlements and transfers by a resident in favor of a non-resident for the payment of overdue interest payments

42050

Other settlements and transfers between residents and non-residents related to the resident’s fulfillment of obligations under attracted loans and borrowings

43

Settlements and transfers between residents and non-residents related to the fulfillment by non-residents of obligations under borrowed loans

43010

Calculations and transfers by a non-resident in favor of a resident to repay loans (principal debt)

43020

Calculations and transfers by a non-resident in favor of a resident to repay overdue loans (principal debt)

43030

Calculations and transfers of a non-resident in favor of a resident for the payment of interest payments

43040

Calculations and transfers by a non-resident in favor of a resident for the payment of overdue interest payments

43050

Other settlements and transfers between residents and non-residents related to the non-resident’s fulfillment of obligations under borrowed loans

50

Settlements and transfers related to investments in the form of capital investments

50010

Payments and transfers by a resident for shares, deposits, shares acquired from a non-resident in the property (authorized or share capital, mutual fund of a cooperative) of a created resident legal entity, when the resident makes contributions under a simple partnership agreement with a non-resident

50020

Payments and transfers by a resident for shares, deposits, shares acquired from a non-resident in the property (authorized or share capital, mutual fund of a cooperative) of a created legal entity - a non-resident, when the resident makes contributions under a simple partnership agreement with a non-resident

50030

Calculations and transfers by a resident in payment for shares, deposits, shares in the property (authorized or share capital, mutual fund of a cooperative) of a non-resident legal entity being created, when a resident makes contributions under a simple partnership agreement with a non-resident

50040

Payments and transfers by a non-resident for shares, deposits, shares purchased from a resident in the property (authorized or share capital, mutual fund of a cooperative) of an established legal entity - a resident, when the non-resident makes contributions under a simple partnership agreement with a resident

50050

Calculations and transfers by a non-resident for shares, deposits, shares purchased from a resident in the property (authorized or share capital, mutual fund of a cooperative) of a created legal entity - a non-resident, when the non-resident makes contributions under a simple partnership agreement with a resident

50060

Calculations and transfers by a non-resident in payment for shares, deposits, shares in the property (authorized or share capital, mutual fund of a cooperative) of a resident legal entity being created, when a non-resident makes contributions under a simple partnership agreement with a resident

50070

Settlements and transfers by a resident in favor of a non-resident during the liquidation of a resident legal entity

50080

Settlements and transfers of a non-resident in favor of a resident during the liquidation of a non-resident legal entity

50090

Payment of dividends (income) from investments in the form of capital investments

51

Settlements and transfers related to the acquisition by non-residents of domestic securities (rights certified by domestic securities) from residents

51010

Payments and transfers by a non-resident in favor of a resident for purchased bonds issued on behalf of the Russian Federation

51020

Payments and transfers by a non-resident in favor of a resident for acquired shares, with the exception of the initial placement (issue) of shares

51030

Payments and transfers by a non-resident in favor of a resident during the initial placement (issue) of shares

51040

Calculations and transfers by a non-resident in favor of a resident for purchased shares of mutual investment funds

51050

Settlements and transfers by a non-resident in favor of a resident when a resident issues bonds, redemption and payments for which are expected in the first three years from the date of issue

51060

Settlements and transfers by a non-resident in favor of a resident when a resident issues bonds, redemption and payments for which are not expected in the first three years from the date of issue

51070

Settlements and transfers by a non-resident in favor of a resident for purchased bonds of residents, redemption and payments for which are expected in the first three years from the date of issue

51080

Payments and transfers by a non-resident in favor of a resident for purchased bonds of residents, redemption and payments for which are not expected in the first three years from the date of issue

51090

Settlements and transfers by a non-resident in favor of a resident for purchased bonds of non-residents, redemption and payments for which are expected in the first three years from the date of issue

51100

Payments and transfers by a non-resident in favor of a resident for purchased bonds of non-residents, redemption and payments for which are not expected in the first three years from the date of issue

51110

Payments and transfers by a non-resident in favor of a resident for purchased other domestic issue-grade securities

51120

Settlements and transfers by a non-resident in favor of a resident for purchased bills of exchange

51130

Settlements and transfers by a non-resident in favor of a resident for purchased non-issue domestic securities, with the exception of bills of exchange

51140

Settlements and transfers by a non-resident in favor of a resident upon payment of a penalty (fine, penalty) for transactions with domestic securities

51150

Settlements and transfers of a non-resident in favor of a broker to a special brokerage account

51160

Calculations and transfers by a non-resident in favor of a resident when paying interest (coupon) income, dividends on domestic securities, income on investment shares of mutual funds

51170

Settlements and transfers by a non-resident in favor of third parties when paying commissions and reimbursement of expenses when purchasing domestic securities using a special bank account, with the exception of payment of expenses of an authorized bank for performing transactions on a special bank account

52

Calculations and transfers related to the alienation by a non-resident in favor of a resident of domestic securities (rights certified by domestic securities)

52010

Payments and transfers by a resident in favor of a non-resident for alienable bonds issued on behalf of the Russian Federation

52020

Payments and transfers by a resident in favor of a non-resident for alienated shares of residents

52030

Payments and transfers by a resident in favor of a non-resident for alienated shares of non-residents, with the exception of the initial placement (issue) of shares issued by a non-resident

52040

Payments and transfers by a resident in favor of a non-resident during the initial placement (issue) of shares, the issuer of which is a non-resident - account holder B1

52050

Settlements and transfers by a resident in favor of a non-resident when a non-resident issues bonds, redemption and payments for which are expected in the first three years from the date of issue

52060

Settlements and transfers by a resident in favor of a non-resident when a non-resident issues bonds, redemption and payments for which are not expected in the first three years from the date of issue

52070

Payments and transfers by a resident in favor of a non-resident for alienated shares of mutual investment funds

52080

Settlements and transfers by a resident in favor of a non-resident for alienated bonds of residents, redemption and payments for which are expected in the first three years from the date of issue

52090

Settlements and transfers by a resident in favor of a non-resident for alienated bonds of residents, redemption and payments for which are not expected in the first three years from the date of issue

52100

Settlements and transfers by a resident in favor of a non-resident for alienated bonds of non-residents, redemption and payments for which are expected in the first three years from the date of issue

52110

Settlements and transfers by a resident in favor of a non-resident for alienated bonds of non-residents, redemption and payments for which are not expected in the first three years from the date of issue

52120

Calculations and transfers of a resident in favor of a non-resident upon alienation of other issue-grade domestic securities

52130

Settlements and transfers by a resident in favor of a non-resident, account holder B1, from the issuance of bills of exchange to a resident by a non-resident, account holder B1

52140

Settlements and transfers by a resident in favor of a non-resident upon alienation of bills of exchange, with the exception of bills of exchange issued to a resident by a non-resident, the owner of account B1

52150

Settlements and transfers by a resident in favor of a non-resident upon alienation of non-issue domestic securities, with the exception of bills of exchange

52160

Settlements and transfers by a resident in favor of a non-resident upon payment of a penalty (fine, penalty) for transactions with domestic securities

52170

Settlements and transfers by a resident in favor of a non-resident when paying interest (coupon) income, dividends on domestic securities, income on investment shares of mutual funds

52180

Settlements and transfers of a resident in favor of a non-resident received from special brokerage accounts

53

Calculations and transfers related to the acquisition by residents from non-residents of external securities (rights certified by external securities)

53010

Payments and transfers by a resident in favor of a non-resident for purchased shares, the issuer of which is a resident

53020

Payments and transfers by a resident in favor of a non-resident for acquired shares, the issuer of which is a non-resident, with the exception of the initial placement (issue) of shares by a non-resident

53030

Payments and transfers by a resident in favor of a non-resident during the initial placement (issue) of shares by a non-resident

53040

Settlements and transfers by a resident in favor of a non-resident for purchased bonds of residents, redemption and payments for which are expected in the first three years from the date of issue

53050

Settlements and transfers by a resident in favor of a non-resident for purchased bonds of residents, redemption and payments for which are not expected in the first three years from the date of issue

53060

Settlements and transfers by a resident in favor of a non-resident for purchased other mission foreign securities, the issuer of which is a resident

53070

Settlements and transfers by a resident in favor of a non-resident for purchased bonds of non-residents, redemption and payments for which are expected in the first three years from the date of issue

53080

Settlements and transfers by a resident in favor of a non-resident for purchased bonds of non-residents, redemption and payments for which are not expected in the first three years from the date of issue

53090

Payments and transfers by a resident in favor of a non-resident for purchased other issue-grade foreign securities, the issuer of which is a non-resident

53100

Settlements and transfers by a resident in favor of a non-resident for purchased bills of exchange

53110

Settlements and transfers by a resident in favor of a non-resident for purchased non-issue foreign securities, with the exception of bills of exchange

53120

Settlements and transfers by a resident in favor of a non-resident upon payment of a penalty (fine, penalty) for transactions with foreign securities

53130

Calculations and transfers by a resident in favor of a non-resident when paying interest (coupon) income, dividends on foreign securities

53140

Settlements and transfers by a resident in favor of third parties when paying commissions and reimbursement of expenses when purchasing external securities using a special bank account, with the exception of payment of expenses of an authorized bank for performing transactions on a special bank account

54

Calculations and transfers related to the alienation by a resident in favor of a non-resident of external securities (rights certified by external securities)

54010

Payments and transfers by a non-resident in favor of a resident for alienated shares, the issuer of which is a non-resident

54020

Payments and transfers by a non-resident in favor of a resident for alienated shares, the issuers of which are residents, with the exception of the initial placement (issue) of shares

54030

Payments and transfers by a non-resident in favor of a resident during the initial placement (issue) of shares

54040

Settlements and transfers by a non-resident in favor of a resident when a resident issues bonds, redemption and payments for which are expected in the first three years from the date of issue

54050

Settlements and transfers by a non-resident in favor of a resident when a resident issues bonds, redemption and payments for which are not expected in the first three years from the date of issue

54060

Settlements and transfers by a non-resident in favor of a resident for alienated bonds of residents, redemption and payments for which are expected in the first three years from the date of issue

54070

Settlements and transfers by a non-resident in favor of a resident for alienated bonds of residents, redemption and payments for which are not expected in the first three years from the date of issue

54080

Payments and transfers by a non-resident in favor of a resident for alienated other issue-grade foreign securities, the issuer of which is a resident

54090

Payments and transfers by a non-resident in favor of a resident for alienated bonds of non-residents, redemption and payments for which are expected in the first three years from the date of issue

54100

Payments and transfers by a non-resident in favor of a resident for alienated bonds of non-residents, redemption and payments for which are not expected in the first three years from the date of issue

54110

Settlements and transfers by a non-resident in favor of a resident for alienated other mission foreign securities, the issuer of which is a non-resident

54120

Settlements and transfers by a non-resident in favor of a resident - account holder P1, from the issuance of bills of exchange to a non-resident by a resident, account holder P1

54130

Calculations and transfers of a non-resident in favor of a resident upon alienation of non-issue foreign securities, with the exception of bills of exchange issued to a non-resident by a resident, the owner of account P1

54140

Settlements and transfers by a non-resident in favor of a resident upon payment of a penalty (fine, penalty) for transactions with foreign securities

54150

Calculations and transfers by a non-resident in favor of a resident when paying interest (coupon) income, dividends on foreign securities

55

Calculations and transfers related to the fulfillment by residents and non-residents of obligations under foreign and domestic securities

55010

Settlements and transfers by a resident in favor of a non-resident when fulfilling obligations on government securities

55020

Settlements and transfers by a resident in favor of a non-resident when the resident fulfills obligations under bonds, redemption and payments for which are carried out in the first three years from the date of issue

55030

Settlements and transfers by a resident in favor of a non-resident when the resident fulfills obligations under bonds, redemption and payments for which are made after three years from the date of issue

55040

Settlements and transfers by a resident in favor of a non-resident when the resident fulfills obligations under other issue-grade securities

55050

Settlements and transfers by a resident in favor of a non-resident when the resident fulfills obligations under bills issued by the resident

55060

Settlements and transfers by a resident in favor of a non-resident when the resident fulfills obligations under other non-issued securities issued by the resident, with the exception of bills of exchange

55070

Calculations and transfers by a non-resident in favor of a resident when the non-resident fulfills obligations under bonds, redemption and payments for which are carried out in the first three years from the date of issue

55080

Calculations and transfers by a non-resident in favor of a resident when the non-resident fulfills obligations under bonds, redemption and payments for which are made after three years from the date of issue

55090

Calculations and transfers by a non-resident in favor of a resident when the non-resident fulfills obligations under other issue-grade securities

55100

Calculations and transfers by a non-resident in favor of a resident when the non-resident fulfills obligations under bills issued by the non-resident

55110

Calculations and transfers by a non-resident in favor of a resident when the non-resident fulfills obligations under other non-equity securities issued by the non-resident, with the exception of bills of exchange

60

Transfers to non-resident accounts

60010

Transfers from a non-resident’s bank account in the currency of the Russian Federation to a special non-resident bank account in the currency of the Russian Federation

60020

Transfers from a special bank account of a non-resident in the currency of the Russian Federation to a bank account of a non-resident in the currency of the Russian Federation

60030

Transfers from a special bank account of a non-resident in the currency of the Russian Federation to a special bank account of a non-resident in the currency of the Russian Federation

60040

Transfers from a special bank account of a non-resident in the currency of the Russian Federation when depositing the reservation amount

60050

Transfers from a non-resident’s bank account in the currency of the Russian Federation when depositing the reservation amount

60060

Refund of reservation amounts

60070

Transfers from a non-resident bank account to a non-resident bank account

61

Transfers from one resident account to another resident account

61010

Transfers from a resident’s current foreign currency account to a resident’s special bank account in foreign currency

61020

Transfers from a resident’s special bank account in foreign currency to the resident’s current foreign currency account

61030

Transfers from a resident broker's account in foreign currency to a special resident bank account in foreign currency

61040

Transfers from a special bank account of a resident in foreign currency to the account of a resident broker in foreign currency

61050

Transfers from a special bank account of a resident in foreign currency to a special bank account of a resident in foreign currency

61060

Transfers from a resident’s transit foreign currency account to a resident’s special bank account in foreign currency

61070

Transfers from a resident’s transit currency account to pay for transportation, insurance and freight forwarding

61080

Transfers from a resident’s transit currency account for payment of export customs duties, as well as customs duties

61090

Transfers from a resident’s transit currency account for the payment of commissions to credit institutions, as well as payment for performing the functions of currency control agents

61100

Transfers from a resident's transit currency account to a resident's current currency account

61110

Transfers from the transit currency account of a resident intermediary to the transit currency account of a resident principal, principal or principal

61120

Transfers from the current foreign currency account of the resident principal, principal or principal to the transit foreign currency account of the resident intermediary

61130

Transfers from a resident’s current foreign exchange account to a current foreign currency account of the same resident

61140

Transfers from the account of a resident individual opened with a non-resident bank to the foreign currency account of the same resident individual in an authorized bank

61150

Transfers from the foreign currency account of a resident individual in an authorized bank to the account of the same resident individual opened in a non-resident bank

70

Non-trading operations

70010

Payment by non-residents of taxes, duties and other fees to residents

70020

Refund by residents of taxes, duties and other fees to non-residents

70030

Payment by non-residents to residents of amounts of alimony, pensions, inheritance, benefits, grants, gifts and donations

70040

Payment by residents to non-residents of amounts of alimony, pensions, inheritance, special benefits, grants, gifts and donations

70050

Payment by non-residents of wages and other types of remuneration, royalties and other remunerations under civil contracts to residents

70060

Payment by residents of wages and other types of remuneration, royalties and other remunerations under civil contracts to non-residents

70070

Other payments by non-residents in favor of residents for non-trade transactions

70080

Other payments by residents to non-residents for non-trade transactions

99

Settlements and transfers for other currency transactions not expressly listed in groups 40 - 55 of this List

99010

Calculations and transfers related to the return of erroneously credited or written amounts

99020

Settlements and transfers in favor of authorized banks for transactions on the account

99030

Calculations and transfers from a resident’s current foreign currency account to the account of a resident’s representative office outside the territory of the Russian Federation

99040

Calculations and transfers from the account of a resident’s representative office outside the territory of the Russian Federation to the resident’s current currency account

99050

Withdrawal of cash currency of the Russian Federation from an account by a non-resident, with the exception of a non-resident individual

99060

Crediting cash currency of the Russian Federation to the account of a non-resident, with the exception of a non-resident individual

99070

Withdrawal of cash foreign currency from an account by a resident - legal entity or individual entrepreneur

99080

Crediting foreign currency cash to an account by a resident - legal entity or individual entrepreneur

99090

Settlements and transfers for transactions not specified in groups 01 - 70, as well as with the exception of payments with codes 99010 - 99080

Sample of filling out a payment order for a non-resident (in Russian rubles)

The payment order is filled out for the transfer of Russian rubles, so its usual filling procedure is maintained in accordance with the documents and details of the counterparty, except for the currency transaction code, which must be indicated in the final field of the payment order. To do this, before the text in the “Purpose of payment” field, write VO in capital Latin letters, and then the five-digit transaction code from the table below. The code must be enclosed in curly braces.

Let’s assume that the Russian organization VESNA LLC needs to pay wages to its employee who works remotely from Kazakhstan and is not a resident of the Russian Federation. In this case, fill out the payment form as usual, and in the appropriate field write:

{VO70060} Salary of Abdurakhmanov Ilyas Karimovich for November 2021.

The given example of filling out a foreign currency payment order shows how to specify the code.

Transaction code when transferring salary to a non-resident

The transfer of wages to a non-resident is recognized as a foreign exchange transaction. All codes for such operations can be found in Bank of Russia Instruction No. 181-I dated August 16, 2017 (Appendix No. 1).

Code for the type of currency transaction “salary to non-residents”: 70060.

This code is used as follows:

- it is entered in the payment order field “Purpose of payment”;

- the code must be indicated before the text;

- numbers are placed in curly brackets - {70060};

- In addition to the code numbers, there should be no more characters in brackets. Even the presence of a space will be considered an error.

An example of how the currency transaction code “salary to a non-resident” is reflected in a payment order:

{70060} Salary for July 2021.

This code will be used only if the employer transfers wages to a non-resident by non-cash method. It is not used when making payments through the cash register.

Read also: Fixed advance payments in the 2-NDFL certificate

Possible errors when making payments to a counterparty

The value of the list of the most common errors makes it easier to check and identify shortcomings in specific payment orders. These mistakes are very often made:

- Incorrect TIN. If in all other respects the order is completed correctly, then the regulatory authorities do not have the right to demand clarification of the details.

- The basis for payment is incorrectly specified. This is also a minor error. The funds will be sent to the recipient. In this case, it makes sense to contact the recipient. His response clarifying the basis for the payment is attached to the order. This must be done, as otherwise there may be confusion. It can lead to difficulties in the work of accountants and tax representatives.

- Allocation of VAT if the order concerns counterparties under a special tax regime. For example, the counterparty may use the simplified tax system. In this case, he does not need to pay VAT. Accordingly, there is no need to highlight VAT in the payment order. If this is done, you need to send a clarifying letter to your bank. The latter sends a notification to the bank servicing the counterparty. The error must be corrected. Otherwise, the counterparty will have to pay tax at an increased rate.

- Incorrect designation of payment purposes. For example, the funds were actually transferred as an advance for the service. However, the order specifies a loan as the purpose. In this case, you also need to notify the bank about the error. If this is not done, the company will not receive a deduction for the advance payment.

- Incorrect information about the counterparty. The counterparty's details may be changed. However, the company does not always send out notifications about this. That is, the payment is sent using the old details. In this case, the transferred funds will be kept in the banking institution until the information is clarified. On the sixth day, the funds are returned to their sender. When making such an error, the company has two courses of action: submitting updated information to the bank or receiving funds back on the sixth day and then re-issuing the order.

Errors that can be fixed

Let's look at correctable errors and the procedure for eliminating them:

- The purpose of the funds is incorrectly indicated. You need to perform a tax reconciliation with the Federal Tax Service, and then fill out a reconciliation report. It is signed by an accountant, as well as a representative of the Federal Tax Service.

- Inflated payment amount. There are several ways to proceed. First: redirection of funds. The overpaid money will be used to pay the next payments. Second: processing a refund of payment to the company’s bank account.

The listed errors are considered insignificant. They are relatively easy to fix.

Errors that cannot be corrected

Let's consider significant errors that cannot be corrected:

- Indication of the wrong BCC. For example, the code numbers are indicated incorrectly or the old KBK is taken. In this case, the payment is considered unclassified. The tax will be considered unpaid. That is, the payer will have to pay penalties and fines for late payment. To correct the situation, you need to send an application to the Federal Tax Service. It specifies a request to offset the transferred funds. A copy of the incorrect order and a bank statement are attached to the application.

- Underpayment. The tax is also not considered paid. To correct the situation, you need to add the missing amount to the budget.

- Indication of the BCC, which relates to another tax. In this case, you can act in several ways. This is, firstly, a return of funds to the payer’s bank account. Secondly, this is a repeated payment of the payment. What will happen to the old payment? It is credited under another tax, to which the KBK applies. An overpayment is created for this tax, which will be offset against the next payment.

- Invalid recipient account. This is the most difficult mistake. The money will have to be sent again. A penalty will be charged for late payments.

- The name of the banking institution is incorrect. Also an irreversible error.

- Indication of a non-existent BCC. A refund is being issued. The payment is sent again.

There is a big difference between a significant and an insignificant error. In case of correctable errors, the payer only needs to send a clarification. In this case, the payment will be considered paid. Errors that cannot be corrected mean that taxes or payments to counterparties are not considered paid. That is, fines and penalties will be imposed on the payer.

Errors when sending payments to the budget

A payment order for payments to the budget has many fields, which is prone to errors. However, among these fields there are those that control structures pay little attention to. Specifically, these are the following lines:

- Taxable period.

- Tax payer status.

- Order number and date.

- Reason for payment and its type.

If errors are made in these lines, it is not necessary to correct them. The line “priority of payment” is also unimportant. An exception is that orders are sent by companies whose activities involve financial difficulties: restrictions on expense transactions, insufficient funds in a bank account. If these circumstances are present, the “priority” line is checked first.

The code is incorrectly selected and filled in - what to do?

If, when drawing up a payment order, the code for the type of currency transaction was incorrectly specified, the bank will return such a document. And he will be right, since he must control the submitted documents (Chapter 18 of instructions No. 138-I). In this case, the organization has only one option - to redo the payment card.

But there are a number of cases when you don’t have to draw up settlement documents at all. And if they are compiled, then you don’t have to write the code. And this should not be a reason for returning the document from the bank. Such situations are described in paragraph 3.3 and paragraph 3.4 of Chapter. 3 instructions No. 138-I.

Another option when an organization can be sure that the bank will accept its documents is to include clauses in the agreement with the bank stating that the bank will draw up payment orders for foreign exchange transactions on the basis of the documents that the organization provides.

Currency current account LLC

To make payments with foreign companies (suppliers, buyers or intermediaries), a foreign currency account is required.

Its main difference from a settlement account is that funds are stored in foreign currency. It can be dollar, euro, yuan and other currencies.

As a rule, organizations open it in the bank where the settlement bank is opened. To do this, you only need a written application from the bank client. But, if it is opened in another financial institution, it is necessary to submit a package of documents, which is determined by the internal rules of such institution. In both cases, you can open a foreign currency account only in a bank that has a license to carry out the relevant actions.

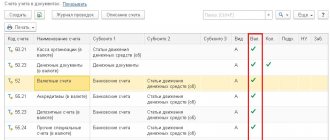

Accounting for monetary transactions on foreign currency accounts is carried out using account 52 of accounting, and it is divided into subaccounts:

- 1 - foreign exchange within the country;

- 2 - foreign exchange on the territory of a foreign country.

The foreign exchange account is divided into two: transit and current. This is necessary to exercise control by government agencies. So, first, funds in foreign currency arrive at the transit one. Then the owner is given 15 days to provide all necessary reporting documentation for the transaction. While they are there, the owner has no right to use them. After verification, financial resources are credited to the current account, and only then the organization can use them. If any inaccuracies or errors are identified in the submitted documents, a fine will be imposed on the organization.

Consequences of mistakes made

Payment orders must be drawn up carefully. Even if the error does not lead to the loss of funds, it will still take a lot of time to correct it. Let's look at the consequences of the error:

- Not paid taxes on time. Consequences: accrual of penalties, fines, risk of repaying the full amount of tax.

- The tax is considered unpaid. Consequences: penalties, fines.

- The payment went to another fund. There is no offsetting of amounts between different funds. Therefore, you will have to pay the tax in full again.

The error will have to be corrected. And this entails separation from employees’ activities, the need to draw up additional documents, and legal proceedings.

Features of filling out an application for clarification of tax payment

If the accountant made a minor mistake, the details need to be clarified. To do this, a statement is drawn up containing the information:

- Full name of the head of the Federal Tax Service.

- Company details: name, INN, KPP, OGRN, address.

- Date of.

- Title of the application.

- Request to clarify the payment with reference to regulations (clauses 7-8 of Article 45 of the Tax Code of the Russian Federation).

- Information about the payment (amount, specification of the error committed, corrected version).

- List of attached documents.