Conditions affecting loan accounting

A loan is a transfer of funds (or other means of payment) on debt that occurs between individuals or legal entities, as well as between a legal entity and an individual.

A credit institution never participates in this procedure, since operations with its participation, despite the same nature of the relationship, have different names: loan and deposit (for an individual) or deposit (for a legal entity). Accounting entries arise only for legal entities that can both borrow funds from legal entities or individuals and give them to the same entities, but the nature of the accounting entries does not depend on with whom exactly (a legal entity or individual) the borrowing agreement was concluded. At the same time, there are points that affect the correspondence of accounts used in these records.

For the organization giving the loan, it matters:

- Whether the loan is interest-bearing or interest-free;

- what types of activities (usual or other) does this process include for her?

It is important for the recipient of funds:

- for how long they were taken: less or more than a year;

- whether borrowed funds are invested in the creation of an investment asset.

Each of these conditions will affect the selection of account correspondence in the record of transactions performed in connection with the loan.

You will find a selection of forms for drawing up a loan agreement in various situations in ConsultantPlus. If you do not already have access to this legal system, a full access trial is available for free.

Documents “Write-off from current account” and “Cash withdrawal”

Repayment of loans or borrowings, as well as payment of accrued interest, is registered using the documents Write-off from current account and Cash withdrawal using the following types of transactions:

- Repayment of a loan to a counterparty - to reflect operations to repay a loan to a legal entity or individual;

- Loan repayment to the bank - to reflect operations to repay a loan to a bank or credit institution.

Accounting accounts are determined automatically depending on the currency of the account, the duration of the agreement, the type of transaction and the type of payment. The Payment type field is displayed in the document form only for credit or loan repayment transactions.

The program provides the following types of payment (Fig. 3):

- Amortization;

- Payment of interest.

Rice. 3. Selecting the type of payment in the document “Write-off from the current account”

The issue of a loan to a counterparty is registered using the transaction type Issue of a loan to a counterparty. When you select this type of transaction, accounting account 58.03 is filled in automatically.

Interest on a loan issued - postings

Funds issued as a loan, subject to the accrual of interest on them by the transferring party, are always taken into account as part of financial investments, i.e. in account 58. The issue is recorded by posting Dt 58 Kt 51 (50, 52).

IMPORTANT! An interest-free loan will not be shown on account 58, since it does not correspond to the very idea of financial investments (to generate income). Its amount should be shown on account 76 (Dt 76 Kt 51 (50, 52)).

At the same time, in transactions for calculating interest on a loan issued, another account will be used - 76. Its use will lead to the appearance of a transaction - interest accrued on a loan issued - with correspondence Dt 76 Kt 91 (90). The choice of account in the credit part of this record will determine which types of activities for the lender include issuing a loan: other (in which case account 91 will be used) or ordinary (in this case account 90 will be used).

Interest calculations by organizations are carried out monthly on the last date of this period (clauses 12, 16 of PBU 9/99, approved by order of the Ministry of Finance of Russia dated 05/06/1999 No. 32n).

Neither the loan amount itself nor the interest on it are subject to VAT (subclause 15, clause 3, article 149 of the Tax Code of the Russian Federation), i.e., there will be no postings regarding this tax on the debit of account 91 (90). If the lender has any costs associated with issuing a loan (for example, a fee to the bank for funds transfer services), then during the period of their implementation they will be debited to account 91 (90).

The receipt of interest payments will be expressed by posting Dt 51 (50, 52) Kt 76.

Calculation of interest and material benefits on loans

Currently, accounting for credits and loans in 1C is partially implemented, so various programs are offered for accounting for credits and loans. But it is useful for any accountant to be able to calculate any indicators manually. Today we will learn how to calculate the amounts of interest, material benefits, as well as the amount of personal income tax on material benefits manually using formulas.

For the indicators described above, the following formulas are used for calculation:

- Amount of interest = Amount of Debt x Interest x Number of days in a month/Number of days in a year;

- Amount of material benefit = Amount of Debt x (2/3 of the refinancing rate - interest) x Number of days in a month/Number of days in a year.

Let's do the calculation for our example:

- Interest amount = 500,000 x 4% x 20/365 = 1095.39 rubles;

- Amount of material benefit = 500,000 x (2/3 x 7.25% - 4%) x 20/365 = 219.18 rubles.

To deduct a loan and interest on it from an employee’s salary in 1C, the “Payroll” document is used. We find it in the menu “Salaries and Personnel” – “Salary” – “All Accruals”. We get into the list of accruals, and using the “Create” button, create a new “Salary accrual”.

Fig. 10 Calculation of interest and material benefits on loans

In the “Payroll” document, fill in the details. First, we indicate the employee from whose salary the deduction will be made. Secondly, using the “Hold” button, we fill out two deductions - the monthly payment and interest.

Fig. 11 Calculation of interest and material benefits on loans

Deductions in our document are shown in summary; for details, you need to click on the amount of deductions.

Fig. 12 Calculation of interest and material benefits on loans

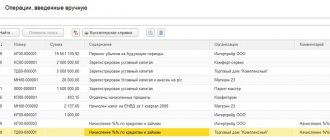

The “Payroll” document does not create entries for withholding the monthly payment and interest on the loan, therefore, to reflect these amounts in accounting, you must use the “Manually entered transaction” document. We find it in the menu “Operations” – “Accounting” – “Operations entered manually”. We go to the list and create a new operation using the “Create” button.

Fig. 13 Calculation of interest and material benefits on loans

Fill out the entries:

- Dt 70 - Kt 73.01 - reflects deductions from the employee’s salary to pay off debt and interest;

- Dt 73.01 – Kt 91.01 – other non-operating income is reflected in the amount of interest on the loan.

Fig. 14 Calculation of interest and material benefits on loans

Interest accrued on the loan received - postings

The recipient of the borrowed funds will have their receipt recorded either in account 66 (if the loan is short-term - up to a year) or in account 67 (if the funds are taken for a period exceeding 12 months). The wiring will be as follows: Dt 51 (50, 52) Kt 66 (67).

The accrued interest will be credited to these same accounts, separating them in the accounting analytics from the amount of the principal debt. That is, in the entry for calculating interest on a loan received in the credit part there will be an account 66 or 67. The choice of the account that falls into its debit part will determine the fact of use or non-use of the funds received when creating an investment asset (clause 7 of PBU 15/2008, approved by order of the Ministry of Finance of Russia dated October 6, 2008 No. 107n).

Interest amounts on a loan that is not related to the creation of an asset regarded as an investment (it has a long period of creation and high cost) should always be taken into account in other expenses - Dt 91 Kt 66 (67), accruing the corresponding amounts monthly (clause 6 of PBU 15/2008).

If borrowed funds are involved in expensive long-term investments, then the interest on them will form the cost of property (fixed assets or intangible assets) created with the participation of the corresponding investments: Dt 08 Kt 66 (67). During a long (more than 3 months) break that arose in the process of making investments, and upon completion of investments in the object, the continuing accrual of interest on the loan should be included in other expenses (clauses 11, 13 of PBU 15/2008).

The tax nuances of accounting for interest on loan agreements in various situations are discussed in detail in the Transaction Guide from ConsultantPlus. Get trial access to the system for free and learn how, when taxing, you need to take into account interest on loans related and not related to the acquisition of depreciable property, spent on paying dividends, etc.

Legal entities using simplified accounting methods have the right not to separate expenses associated with the creation of investment assets from other expenses.

Payment of interest will be reflected by posting Dt 66 (67) Kt 51 (50, 52). If their recipient is an individual, then his income should be subject to personal income tax (Dt 66 (67) Kt 68).

Results

The entry for accrual of interest on a loan occurs both for legal entities giving the loan (to a legal entity or individual) and for those receiving borrowed funds (from a legal entity or individual). The first accounts for the issued debt itself in account 58 (Dt 58 Kt 51 (50, 52)), and the interest on it in account 76, accruing them monthly in correspondence with the financial results account (Dt 76 Kt 91 (90)). The second, depending on the period for which the funds are borrowed, the amount of debt is attributed to account 66 or 67 (Dt 51 Kt 66 (67)) and interest is accrued there. If borrowed funds are not involved in the creation of an investment asset, then they are accrued by posting Dt 91 Kt 66 (67). Participation in the creation of an asset regarded as an investment requires taking into account interest on the loan in the cost of this asset (Dt 08 Kt 66 (67)).

Sources:

- Order of the Ministry of Finance of Russia dated May 6, 1999 N 32n

- Tax Code of the Russian Federation

- Order of the Ministry of Finance of Russia dated October 6, 2008 N 107n

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Documents “Receipt to current account” and “Receipt of cash”

Receipt of credits or loans is reflected in the documents Receipt to current account (Fig. 1) or Receipt of cash using the following types of transactions:

- Receiving a loan from a counterparty - to reflect transactions to obtain a loan from a legal entity or individual;

- Obtaining a loan from a bank - to reflect transactions to obtain a loan from a bank or credit institution.

Rice. 1. Selecting the type of transaction with credits and loans in the document “Receipt to the current account”

Accounting accounts are determined automatically depending on the account currency, the duration of the agreement and the type of transaction. The validity period of the contract (the date of the contract and the expiration date of the contract) can be specified in the directory element Contracts (Fig. 2). If the duration of the contract is less than a year, then it is considered short-term. If the start and end dates of the contract are not specified, when accounting in the program, the contract is considered long-term by default. To reflect transactions on loans and borrowings, the Other agreement type is used.

Rice. 2. Indication of the duration of the contract

The return from a counterparty of a previously issued loan is reflected using the transaction type Repayment of loan by counterparty. When you select this type of transaction, accounting account 58.03 “Loans provided” is also filled in automatically.