The balance sheet is one of the main and most important purely accounting documents, which is essentially a report on the movement of financial resources in the accounts of the enterprise, as well as balances on them at the beginning and end of a certain period. It is the basis for drawing up a balance sheet and is a form that contains data on the debit and credit of each subaccount, their intermediate and final indicators. Experts consider it as the last link in the chain of preparation for tax and financial reporting.

It is worth noting that not all enterprises use balance sheets in their activities, but if this document is included in the company’s document flow, then it must be approved in its accounting policy.

- Form and sample

- Free download

- Online viewing

- Expert tested

FILES

Basic rules for drawing up a balance sheet

Today, there is no standardized, obligatory sample of this document, so it can be drawn up in free form or using special templates. Sometimes companies develop their own statement forms (based on their own needs) and subsequently print them in a printing house.

At first glance, the balance sheet may seem like a simple set of numbers divided into different columns. However, in fact, it is a clearly structured summary table into which information is entered on various transfers, economic and financial operations of the enterprise, including such as writing off production costs, calculating taxes, calculating depreciation, generating reports, etc. .

The document always indicates

- name of the enterprise or organization,

- whose accounting department generates the document,

- account numbers (sometimes with their decoding),

- specific amounts.

An important condition: if compiled correctly, the final numbers in all columns of the statement must match.

The balance sheet belongs to the category of regular documents and is compiled, as a rule, once a month in a single copy.

It is not necessary to sign the document, but if necessary, it must be certified by the employee who was involved in its preparation or verification (for example, the chief accountant). Likewise, there is no need to put a stamp on the document.

Balance sheets, like any other accounting documents, must be kept for at least five years.

What helps calculate the turnover sheet

How to work with turnover? In the column “Balance at the beginning of the month” you must enter the balance that has been transferred to the account since the last month. Depending on the type of balance, it is indicated in the “debit” or “credit” column. In the columns “Account turnover” the total amount of movement of funds on the corresponding account is given, which is given in the left column “turnovers”. The following is the “Balance at the end of the month.”

This indicator is determined by the formula

| Account balance at the beginning | + / — | Account turnover | = | Account balance at end |

Sample of filling out the balance sheet

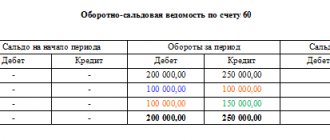

First of all, the statement must indicate the name of the enterprise for which it is being made. Next, enter the name of the document and the specific account for which it is drawn up. In this example, this is an account under code 60, which stands for “Settlements with contractors and suppliers.”

The algorithm for making entries in this sample balance sheet is not very complicated and is made in a certain order, based on the sequence of financial and economic actions performed.

EXAMPLE. Let's assume that the company transferred an advance payment in the amount of 100 thousand rubles to the counterparty. This operation was reflected in the document as an increase in receivable assets in the subaccount (line 60.1). Next, the counterparty provided the company with inventory in the amount of 150 thousand rubles. This operation is entered into the table as an increase in credit liability in subaccount 60.2. Then the enterprise pays the counterparty a partial cost of the goods and this is reflected in the statement as a decrease in liabilities by 100 thousand rubles in subaccounts 60.2 (in debit) and as a decrease in assets in subaccounts 60.1 (in credit). Thus, as a result, the enterprise owes the counterparty 50 thousand rubles during the period of drawing up the document, which is reflected in subaccounts 60.2 (on credit). Line 60 indicates the final total amounts.

Areas of use

Let's look at a few examples of using OSV data:

- The head of the company instructs the accountant to promptly provide information on revenue for the quarter. It is enough for a specialist to create a consolidated SALT and look at the credit turnover on account 90.01. The information will contain the volume of sales for the requested period, excluding VAT.

- The company applied to a credit institution to obtain a loan. To assess the profitability and solvency of the company, the bank requested SALT for the last reporting period. The solvency analysis service will be able to obtain information on existing loans and borrowings (credit 66 and 67 accounts), determine the presence of accounts payable from the borrower, and estimate the profit of the enterprise (account 99).

- The financial director needs to draw up the actual budget and indicate the amount of VAT payable, but the declaration has not yet been generated. It is the SALT that will allow you to calculate in a few minutes preliminary data on the VAT debt to the budget at the end of the period. To do this, it is enough to use the formula VAT = 90.03 + Dt 76 (AB) – Kt 76 (VA) – Kt 19. Account 90.03 displays VAT on the sales amount, debit 76 (AB) - advances issued, Kt 76 (VA) - advances from buyers, Kt.19 – the amount of tax to be deducted.

The balance sheet is an indispensable source of analytical information that allows you to quickly assess aspects of business activity, make adjustments to accounting data, and increase profitability. The form provides simplicity for periodic reporting, thereby making it possible to economically distribute labor resources.

The skills of reading OSV in reports generated in 1C can be found below.

Analytical and synthetic accounting: filling out the “chessboard”

Some accountants prefer the so-called checkerboard sheet to the turnover sheet. This is a type of OSV, which differs in the form of filling. All credit accounts are drawn vertically, and debit accounts horizontally. Transaction amounts are indicated at the intersection of rows and columns.

The goal of "chess" is the same as that of a regular OSV. This structure allows you to analyze the income and expense parts of the balance sheet and determine the tax base for any period of time. An example of determining the corresponding account for any of the transactions is given below.

The chess sheet allows you to present information about account balances in a visual form

Sometimes drawing up a balance sheet is preceded by filling out an account card (the so-called drawing of airplanes). For each account, debits and credits are calculated. It looks like the wings of an airplane: debit on the left, credit on the right. In theory, such a drawing makes it easier to fill out the OSV and find errors. In practice, you do not need to fill out account cards to perform the transaction. Experienced accountants always skip the “airplane” stage.

Why do we need regulation of the document flow of an enterprise?

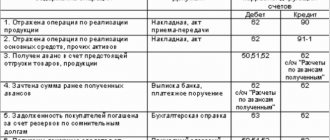

The economic life of a company consists of a sequence of actions that are recorded in a journal (book). The form of the journal is established by the enterprise independently (Part 5, Article 10 of the Federal Law of December 6, 2011 N 402-FZ). Each transaction is recorded by accounting entries using the chart of accounts (Order of the Ministry of Finance N94n dated October 31, 2000).

Entries are reflected in two accounts. The number on the left is a debit (D), and the number on the right is a credit (K). The “primary” items are entered into the journal: invoices, forms of completed work, receipts, invoices, and so on. The enterprise establishes the principles and procedure for recording transactions in its accounting policy (Parts 5, 6, Article 10 of Federal Law N 402-F3 06.11.2011).

Indicators

“Turnover” allows you to conduct a detailed analysis of the information collected on accounting accounts in the shortest possible time.

In the Balance Sheet, the accountant, in particular, reflected: – on line 1230 “Accounts receivable” – 200,000 rubles. – supplier’s receivables minus VAT accepted for deduction; – on line 1520 “Accounts payable” – 100,000 rubles. – the buyer’s accounts payable minus VAT payable to the budget.

The balances on the debit of account 76 subaccount “Calculations for VAT from advances received” and the credit of account 76 subaccount “Calculations for VAT from advances issued” are not reflected in the balance sheet.

Moreover, even if you did not exercise the right to deduct VAT from the advance paid to the supplier (for example, all the necessary conditions for deducting VAT from the advance were not met), the supplier’s receivables will still be reflected in the Balance Sheet minus VAT.

That is, what matters here is the fact that the organization has the right to deduct tax.

Control of cash flow at the enterprise (accounts 51 and 50)

The availability and flow of funds is an assessment of the operation of the enterprise as a whole. To break down cash receipts and expenses incurred, the company uses the following accounts:

- 51 – bank transactions.

- 50 – cash transactions.

The formation of balance sheets for them will allow you to track expenses, check the effectiveness of activities for making further management decisions.

51 counts

An organization's current account is the main instrument of its activities. Everyday necessary actions are carried out through it:

- settlements with buyers and suppliers;

- transfer of wages;

- paying taxes and much more.

Every day, banks provide statements of balances to their customers. It is necessary that the information provided coincides with the assessment of the current account status reflected in the organization.

Attention! Account 51 is active, that is, only a debit balance can be displayed at the beginning and end of periods.

For reliable reporting and accounting at the enterprise, a balance sheet is generated daily after receiving the statement.

For Dt, various cash receipts are indicated, for example, from customers, for Kt - expenses incurred for the selected period. Checking the end of the period consists of reconciling the balances with the bank statement.

This example indicates that during the analyzed period of time the organization received good revenue from paying customers, and this made it possible to cover existing expenses and increase cash reserves.

Advice! Many businesses have multiple checking accounts. It is better to create a statement for each individual bank for prompt reconciliation of balances.

50 count

Many organizations make payments through the cash register. Its presence is necessary, for example, in public places (shops, restaurants). Various business transactions are carried out through the cash register. However, the law establishes the obligation to have a limit on the cash balance and the amount in excess of the limit is transferred to the bank. Therefore, at present, the main use of the cash register is receiving payments and issuing salaries.

Accounting for the movement of money at the cash desk is recorded on account 50. All reflection of receipts and expenditures occurs in the same way as accounting 51. In turn, the analysis of turnover through the balance sheet of account 50 serves as a check on account 51 in order to avoid distortion of information about the financial condition. In addition, the balance of money in the cash register allows you to check compliance with limits. The final balance of 50 together with 51 is a reflection of the company’s work in the market.

Storing the turnover sheet

Accounting statements, calculations, declarations, account cards, balance sheets and other registers are usually stored in paper form. But they can also be stored in electronic format. To do this, certify the documents with an electronic signature. If it is not there, you will have to print the papers. But in any case, you have the right to store those registers that are not listed in your accounting policy exclusively on your computer. Keep primary documents such as invoices or receipts for at least five years. Accounting registers, including balance sheets, too.

www.buhsoft.ru

Central moments

Features of compilation

To create a turnover sheet, you can use a blank Word form. To do this, you will need to download it for free on the Internet.

There are several types of statements:

- according to analytical account;

- according to synthetic account;

- chess.

The statement can be drawn up only after the account entries have been made.

When the data preparation is completed, you can proceed to filling out the table.

It consists of 2 columns:

- Account number;

- account name;

- balance at the beginning of the month;

- turnover for this month;

- balance at the end of this month.

The last three columns are divided into 2 more columns - debit and credit. In the first column you must enter the account numbers that are used, and in the second - their names. Then the data is entered into the third column. Below you need to immediately calculate the amount of entered data.

The last 2 columns are filled in the same way. The result needs to be verified. To do this, you need to add up the data from all columns. If the document was drawn up correctly, the debit and credit results in each column will match in pairs.

Balance sheet for OJSC

Requirements for chess content

The chess sheet is a type of synthetic sheet. However, unlike the last paper, the “checkerboard” data is entered using the transaction journal, and not according to accounting accounts. To compose a chess OCB in 2021, you need to follow certain rules.

The document differs from the classic one in appearance. It consists of horizontal columns in which loan account numbers are entered. There are also vertical columns intended for placing a debit account.

To fill out the document, you must carefully list the account numbers. It is important not to skip data. Next, at the intersection of the columns, you need to post the amounts that correspond to the subaccount numbers. If problems arise with the manipulation, you can use a ready-made example.

The number of horizontal and vertical columns is not limited. It must correspond to the total number of accounts. When the sheet is completed, you need to calculate the results horizontally and vertically. In this case, the final numbers must coincide.

If the results differ horizontally and vertically, an error was made when filling out the document. The completed table will have to be checked completely. Only then will it be possible to generate a balance sheet.

An electronic signature is a special scheme designed to display the authenticity of electronic messages or documents.

You can find step-by-step instructions for liquidating an LLC with a zero balance in this article.

Types and method

To know how to read and fill out balance sheets, you need to understand their types.

Highlight:

| According to synthetic accounts |

|

| According to analytical account | Data is entered into the document according to account nomenclature, quantitative indicators and categories. The statement reflects the ongoing movement within the account. There is no equality of turns. The account itself can be either credit or debit. |

| Chess | The document is an advanced synthetic statement. It is filled in based on the transaction log. The document is considered completed correctly if equality of indicators is maintained. |

Varieties of documents can be compiled over a year or a shorter period.

Where can I download it?

The form and sample filling can be downloaded on the Internet. Guided by the ready-made material, the accountant will simplify the procedure for preparing the document and minimize the likelihood of making mistakes. The paper form can be downloaded in World or Excel. However, experts recommend filling out the paper in the 1C 8.3 program. Using specialized software will speed up data entry and calculation.

Rules for filling out the balance sheet