This article will focus mainly on conducting an assignment agreement in the 1C 8.3 configuration: “Enterprise Accounting 3.0”. This is due to the fact that in other configurations, in addition to accounting ledgers (entries that can be entered manually), there are management ledgers. These registers are formed by documents that do not exist in a standard form for carrying out operations under an assignment agreement.

Basic concepts and participants in the assignment agreement:

- Assignment agreement – assignment of the debtor’s claims (receivables);

- The assignor is the primary creditor;

- The assignee is the new creditor.

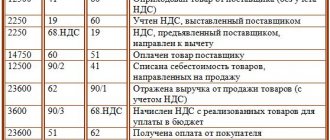

Let's look at the entries that an accountant must generate to reflect the transaction.

Manual reflection of transactions for registration of an assignment agreement in 1C 8.3 Accounting

Manual entries in this configuration are entered using the “Operations entered manually” documents, which are located in the “Operations” menu:

Get 267 video lessons on 1C for free:

The assignment of the debtor's claims in 1C is reflected by the following entries:

- First posting:

- Dt: 76.09 “Settlements with debtors - creditors.” Analytics is carried out for the counterparty, or more precisely for the “Assignee”.

- Kt: Credit 91.01 “Other income”.

- The transaction amount is the debt of the new creditor (assignee) under the assignment agreement.

- Second wiring:

- Dt: 91.02 “Other expenses”.

- Kt: 62.01 “Settlements with customers.”

- The amount of receivables as they are held by the assignor.

What entries need to be made under the assignment agreement with the assignee?:

- First posting:

- Dt: 58.05 “Providing financial investments.”

- Kt: 76.09 “Settlements with debtors - creditors”, analytics also for the counterparty.

- The transaction amount is the costs actually allocated to the acquisition of remote control.

In the accounting of the assignee, repayment of debt by the debtor occurs as follows:

- Dt: 76 “Settlements with debtors - creditors”, subaccount - “Settlements with the debtor”.

- Kt: 91.01 “Other income”.

- The amount of debt to be collected from the debtor;

- Dt: 91.02 “Other expenses”

- Loan 58.05 “Providing financial investments.”

- The amount is the actual costs received.

- Debit 51 “Current account”.

- Loan 76.09 “Settlements with debtors - creditors”, subaccount - counterparty.

- Amount – actual funds received.

Assignment of a monetary claim (assignment) under a loan agreement (assignor’s position)

Tax legislation does not clearly define what relates to the exercise of property rights. Article 39 of the Tax Code of the Russian Federation defines only the sale of goods, works, and services. However, property rights do not fall under this concept (Article 38 of the Tax Code of the Russian Federation). However, the Civil Code of the Russian Federation defines property rights as an object of civil circulation (Articles 128 and 129 of the Civil Code of the Russian Federation). That is, citizens and organizations can alienate, exchange, acquire it. BASIC: income tax Features in accounting for transactions on the assignment of the right of claim and when calculating income tax are determined by the financial result the organization (assignor) receives when realizing the right of claim: profit or loss, as well as the method of determining income and expenses that is used organization.

Accounting for an assignment agreement using a debt adjustment

As I already said, by entering only transactions manually, in most other configurations it is impossible to fully reflect the assignment agreement.

This is interesting: Mandatory audit of non-profit organizations 2021

Most often, accountants use the “Debt Adjustment” document. It allows you to generate the necessary transactions and at the same time correctly reflect the amounts in the reporting, for example, in the profit declaration.

Here is an example of such an operation:

- Buying debt. Executed by the document “Dog Adjustment” - operation: carrying out mutual settlements:

- Dt: 58.05 - Debtor.

- K: 91.01.

- Amount: 16,000 rub.

- Selling debt. Document “Sales of services”:

- Dt: 79.09 - Creditor Kt. 91.01 = 22,000 rub.

- Dt: 91.02, Kt. = ((22,000-16,000)/118*18 rub.

- The next transaction is for 16,000 rubles. It can also be done through an “adjustment” (operation – debt write-off):

- Dt. 91.02

- Kt. 58.05 - Debtor

- Amount: 16,000 rub.

How can the assignor formalize and record the assignment of the right of claim?

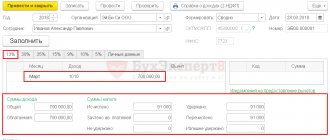

A positive permanent difference in income (in accounting the income is greater than in tax accounting) will lead to the accrual of a permanent tax asset (PTA) in the program, which will reduce the current income tax. PNA = PR * ST np = 200,000 rub. * 20% = 40,000 rub. The posting of the routine operation Calculation of income tax is shown in Fig.

9: Now let’s see how the operations we performed in the program were reflected in the income tax return. The proceeds from the assignment of the right to claim the debt after the payment date in the amount of 520,000 rubles fell into Line 013 of Appendix 1 to sheet 02. The expenses for the assignment of the right to claim (written off receivables) in the amount of 590,000 rubles fell into Line 059 of Appendix 2 to sheet 02. The amount of recovery of the reserve for doubtful debts (300,000 rubles) is reflected in Line 100 of Appendix 1 to sheet 02.

Postings under the assignment agreement in 1C 8.3

We propose to analyze in detail how, based on the 1C 8.3 Enterprise Accounting 3.0 program, the assignment agreement is reflected. This is determined by the fact that other configurations have, in addition to accounting registers (entries generated manually), also management registers. The creation of register data occurs using documents that are not available in a standard form for registering transactions under an assignment agreement. Let's define the concepts:

An assignment agreement is an agreement for the assignment of rights of claim of the debtor (receivables) to a third party (individual or legal) without the consent of the debtor.

The assignor is the creditor who transfers the rights.

Assignee is a creditor who accepts rights based on an agreement.

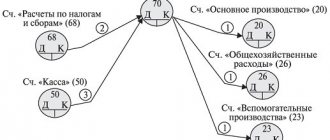

Reflection of transactions in the 1C 8.3 Accounting program is completed manually using the document “Operations entered manually.” Located on the Operations menu tab.

Upon assignment of debt in the 1C program, accounting entries must be generated:

Dt 76.09 (Settlements with debtors/creditors) – Kt 91.01 (Other income). In this case, accounting will be kept for the assignee, and the reflected transaction amount will determine the debt of the assignee, the creditor who accepted the rights of assignment on the basis of the assignment agreement.

Dt 91.02 (Other expenses) – Kt 62.01 (Settlements with the buyer). Here the transaction amount will reflect the value recorded by the assignor.

In turn, the assignee under the assignment agreement registers transactions Dt 58.05 (Provision of financial investments) – Kt 76.09 (Settlements with debtors/creditors). The transaction amount will reflect the actual costs of acquiring the receivables.

The repayment of debt by the debtor according to the accounting records of the assignee is recorded by the following entries:

Dt 76 (Settlements with debtors/creditors) – Kt 91.01 (Other income). For debit, you must indicate the subaccount “Settlements with the debtor”. The transaction amount will reflect the value that must be collected from the debtor.

Dt 91.02 (Other expenses) – Kt 58.05 (Provision of financial investments). The amount in this case will reflect the actual value of the funds received.

This is interesting: Changes in the law on mandatory audit 2021

As mentioned above, in some 1C programs with a different configuration it is impossible to fully reflect the assignment agreement using manually entered transactions. On the basis of which accountants use the “Debt Adjustment” document. This document makes it possible to generate the necessary entries and correctly reflect the amounts in the accounting reports (for example, a profit declaration). Below is an example of registering this operation:

Dt 58.05 – Kt 91.01. The debit account must go through the debtor. Reflection of the purchase of debt under the document “Adjustment of debt” indicating the type of operation “Carrying out mutual settlements”.

Dt 91.02 – Kt 58.05. The debtor must be indicated on the credit account. The posting is generated based on the “Debt Adjustment” document with the selected type of operation “Debt Write-off”. The amount reflects the balance of the debt.

Assignment agreement: postings and accounting features

The procedure is carried out on the basis of a notification that was sent to the debtor about the change of creditor.

The rights of claim are transferred under an assignment agreement.

On the date on which the notification was received, it is necessary to make entries D 60 K 60.

The debtor's consent, in this case, is not required. is concluded with the consent of the debtor in the following cases:

- The obligations relate to compensation for physical or moral harm.

- Assignments occur in relation to a debt whose creditor matters to the debtor;

Notifying the debtor that, according to the assignment agreement, the creditor is changing is mandatory in the cases described above.

However, in some situations, it becomes necessary. This occurs if, under the original loan agreement, the assignment procedure can only be carried out with the consent of the debtor. Cession factors are also important.

Adjusting debt in 1C 8.3 - step-by-step instructions

Very often, accountants in their work are faced with accounts payable and receivable. They can be both from the organization and from the counterparty. There can be many reasons for their occurrence. This includes incorrect data entry into the program, repayment of debt with another equivalent, etc. Debt, as a rule, is revealed in reconciliation reports.

There are two ways to make mutual settlements and adjustments to debt in 1C 8.3: partial repayment of the debt and full repayment (the debt will be fully repaid). Let's look at the step-by-step instructions.

Reflection of the assignment of claims in 1C

Hello dear accountants! Help to correctly reflect in the 1C Agreement the assignment (according to the agreements for the assignment of the right of claim), on three sides as “Assignor”, “Assignee” - this is WE and “Debtor” - the assignor cedes, and the assignee acquires the right of claim against the Debtor in the amount of 12,970,443 rubles. how to reflect everything “Assignee” in 1C I have never encountered this ((( 1C: Enterprise 8.2 (8.2.16.368) Enterprise Accounting, edition 2.0 (2.0.45.5)

Hello! It's been a while since we've seen a cession in practice. Let's talk.

Are you interested in how the assignee is reflected in the accounting? Are you paying off debt? Did you already have any settlements with the company that plays the role of “assignor” in the chain before signing the assignment agreement? Was your debt to the assignor legal entity listed on any account? Explain, please.

I will give an excerpt from the comments from the BSS Chief Accountant.

Quote (Alena Svetlaya): Hello! It's been a while since we've seen a cession in practice. Let's talk.

Are you interested in how the assignee is reflected in the accounting? Are you paying off debt? Did you already have any settlements with the company that plays the role of “assignor” in the chain before signing the assignment agreement? Was your debt to the assignor legal entity listed on any account? Explain, please.

I will give an excerpt from the comments from the BSS Chief Accountant.

Yes, the Assignee is an individual entrepreneur, and the Assignor is the director of an LLC. They simply redo everything for the individual entrepreneur; he is an investor in the construction of a non-residential building. Previously, the Assignor paid. Now the Assignor assigns the right to the debt to I don’t understand why there is account 50 (51) is this a debt? I’m really confused and how can I reflect in this posting with analytics the Assignee = Dt 58 /who is here?/ Kt 76 /here it looks like the Debtor/ the amount is 12,970,443 and what about the Assignor?

Debt adjustment

Select the “Debt Adjustment” item in the 1C 8.3 “Purchases” or “Sales” menu.

Create a new document from the list form that opens and fill out the header. The most important field is “Type of operation”. Depending on it, the composition of the fields changes. Let's look at these types in more detail:

- Settlement of advances. This type is selected if it is necessary to take into account advances in mutual settlements.

- Debt offset. Selected if it is necessary to change mutual settlements against the debt of the counterparty to us, or a third party.

- Transfer of debt. This type is necessary for transferring debts, advances between counterparties or contracts.

- Debt write-off. This implies complete write-off of the debt.

- Other adjustments.

An example of writing off accounts payable in 1C 8.3

Let's move on to filling out the main part of the document. This can be done automatically using the button of the same name, but keep in mind that there are two of them on the form. In this case, there is no difference, just as with the selected type of operation “Debt transfer”. In other cases, the “Fill” button, which is located at the top of the form, will fill in both accounts payable and accounts receivable.

This is interesting: Request the LLC charter for the tax year 2021

Manual input is also available here. It is convenient in cases where adjustments are made based on one or two documents.

Next, fill out the “Write-off account” tab. In our example, we specified the account as 91.01. In the case where the debt is not with us, but with the counterparty to us, it is necessary to indicate account 91.02.

Postings upon assignment

Accounting in this context for all participants in the assignment, including the debtor, has a number of specific features.

The first creditor, who becomes the assignor, has two options - assignment of rights to claim the debt before the payment deadline and after.

In the first case, the basis of calculations is the estimated loss, it is the difference between income from the moment of the assignment to the date of repayment of debts in accordance with Tax Code Article 279, paragraph 1. Another version of the situation entails losses in the form of a negative difference between sales income and the resulting amount of the cost of goods, works or services sold.

The debtor's accounting process is as follows:

- Acquisition of requirements – Dt 58 Kt 76;

- Payment of demand in favor of the assignor – Dt 76 Kt 51;

- Receipt of funds – Dt 51 Kt 76;

- Income from paying off debts Dt 76 Kt 91/1;

- Write-off of settled claims Dt 91/2 Kt 58.

The party of the first creditor, who is the assignor after signing the contractual obligations, reflects the assignment agreement in the accounting registers in a slightly different way.

For example, on May 10, enterprise A sells goods for 165,200 rubles, VAT is 25,200 rubles, cost is 120,000 rubles. On May 14, A enters into an assignment with LLC B for 160,000 rubles. , which was credited to the account on May 15.

The following wiring needs to be done:

- Sales revenue Dt 62 Kt 90/1 – 165,200 rubles;

- VAT calculation Dt 90/3 Kt 68 – RUB 25,200;

- Write-off of cost price Dt 90/2 Kt 41 – 120,000 rubles;

- Agreement for assignment of rights of claim Dt 76 Kt 91/1 – RUB 160,000.

- Write-off of the value of realized debt. debt Dt 91/2 Kt 62 – 165,200 rubles;

- Transfer of money from the assignee Dt 51 Kt 76 – RUB 160,000.

Manual reflection of transactions for registration of an assignment agreement in 1C

To perform manual entries, you must use the “Operations” menu - the “Operations entered manually” subsection.

To carry out the assignment, you need to generate a couple of transactions:

Debit 76.09 “Settlements with debtors - creditors” - Credit 91.01 “Other income”. The amount reflected in the posting corresponds to the amount of debt of the new creditor.

Debit 91.01. “Other income” - Loan 62.01 “Settlements with customers.” The amount indicated is equal to the value of the assignor.

Postings to be completed under the assignment agreement with the assignee

Debit 58.05 “Providing financial payments” Credit 76.09 “Settlements with debtors - creditors”. The amount of funds is equal to the amount of costs incurred in the process of acquiring receivables.

According to the assignee's accounting, a posting is made Debit 76 Credit 91.01 “Other income”. The indicated amount is equal to the amount of the debt being collected.

Debit 91.02 Credit 58.05 “Provision of financial investments” for the amount of costs received.

Debit 51 Credit 76.09 for the amount of funds actually received.

Assignment agreement: accounting for the assignor

What kind of entries are made under the assignment agreement for the assignor?

The assignment of the right of claim under the assignment agreement is reflected in the accounting records of the assignor as the sale of other assets through account 91.

Here is the accounting entry for the assignment agreement with the assignor:

Accordingly, when assigning the right of claim, the accounting entry for payment under the assignment agreement will be as follows:

Debit of accounts 51, etc. – Credit of account 76

Thus, the entries made by the assignor when selling a debt are similar to entries when selling other property (except for finished products and goods).