The statement of financial results and their use is an accounting document that presents the results of an enterprise's operations for a certain period.

Analysis of the report should begin by converting it into a form more convenient for Research:

First, if the study interval is less than a year, it is necessary to make an appropriate recalculation, since the income statement for one year is carried out on an accrual basis. Recalculation is carried out from reports on an accrual basis into reports for the period.

Secondly, the accepted form of the report on financial results and their use does not allow one to get an idea of the amount of fixed and variable costs. Without identifying these cost components, the profitability analysis and, in particular, the break-even analysis are impoverished. Therefore, in order to construct a full-fledged profit and loss statement, it is advisable to divide the costs of sold products into variable and constant parts, using for this purpose the data of the corresponding working accounting forms (magazine order No. 10, form 5z). A version of such a report is presented in Table 9.5.

Table 9.5

GAINS AND LOSSES REPORT

| Name of items | Quarters | ||

| I . 2004 | II . 2004 | III .2004 | |

| Variable costs | |||

| Marginal profit | |||

| Fixed costs | |||

| Profit from core activities | |||

| Other operating income | |||

| Balance sheet profit | |||

| Income tax | |||

| Net profit (profit after tax) | |||

Brief characteristics of the main items of the income statement:

Revenues from sales

— this is the cost of products sold or services provided (excluding value added tax, excise taxes, etc. taxes and obligatory payments) for the reporting period.

For trading and supply and distribution enterprises, this line shows the total amount of receipts for goods sold. In reporting forms used before January 1, 1996, this line was called “trade turnover.”

Variable costs

— costs, the change of which is associated with a change in the volume of products produced. In practice, variable costs include all costs directly related to the production process (direct costs), with the exception of depreciation, rent and that part of the wages of key production personnel that does not depend on changes in production volume (salaries, downtime payments, etc.).

Fixed costs

— costs that do not change when production volumes change. As a rule, these are costs associated with servicing the production process (administration, management, sales costs), called indirect or overhead costs, plus the “fixed” part of direct costs.

Marginal profit

represents the difference between sales revenue and variable costs of its production.

Profit from core activities

represents the difference between sales revenue and costs of products sold (the sum of variable and fixed costs).

The economic meaning of profit from core activities is to assess the efficiency of the purely production activities of the enterprise.

Balance sheet profit

(

BP

) represents the mass of profit before taxation. Therefore, this line is sometimes referred to as “Profit before tax.” Balance sheet profit is formed from profit (losses) from core activities, income (expenses) from participation in other organizations, as well as other operating and other non-operating income (expenses).

Net profit

(

NP

), equal to book profit minus income tax, is a key concept in financial management. It is this indicator that gives the best idea of the efficiency of the enterprise. Net profit is the main source of increasing the company's equity capital.

Analysis of the dynamics of changes in the structure of the profit and loss statement for the period under study, carried out on the basis of Table 6, is the next step in updating the report.

First, the part of the report relating to the main activity is analyzed, and then the “contribution” of other aspects of the enterprise’s activities to the balance sheet profit is assessed.

Table 9.6

STRUCTURE OF THE PROFIT AND LOSS STATEMENT

| Name of items | Quarters | ||

| I . 2004 | II . 2004 | III .2004 | |

| Sales revenue (excluding VAT) | |||

| Variable costs | |||

| Marginal profit | |||

| Fixed costs | |||

| Total costs of products sold | |||

| Balance sheet profit | |||

| Profit from core activities | |||

| Income from the Central Bank and from equity participation | |||

| Other operating income | |||

| Other non-operating income | |||

| Income tax on balance sheet profit | |||

| Net profit (profit after tax) | |||

The more the marginal profit covers fixed costs, the higher the profitability of the enterprise. You can study the break-even point in more detail in the article “Break-even point. Graphs and example of model calculation in Excel. Advantages and disadvantages". Fixed costs in the balance sheet of an enterprise Since the concepts of fixed and variable costs of an enterprise relate to management accounting, there are no lines in the balance sheet with such names. In accounting (and tax accounting) the concepts of indirect and direct costs are used. In general, fixed costs include balance sheet lines:

- Cost of goods sold – 2120;

- Selling expenses – 2210;

- Managerial (general business) – 2220.

The figure below shows the balance sheet of Surgutneftekhim OJSC; as we see, fixed costs change every year.

Fixed costs. formula. definition. example calculation in excel

How are average variable costs calculated? To calculate average variable costs (AVC), the formula is used: AVR = PrZ / Q, where: PrZ - variable costs; Q is the quantity of finished products in natural units. To learn how finished products are reflected in the balance sheet, read our article “How are finished products reflected in the balance sheet?”

Examples of variable costs According to financial reporting standards accepted in the international environment, variable costs in production are divided into indirect and direct. Indirect production costs include expenses that demonstrate a direct dependence on changes in the volume of economic activity, but due to a number of technological production nuances they cannot be directly attributed to the products produced by the enterprise.

Systematization of accounting

09.09.2021 Contents Briefly:

- Purpose of the article: reflection of information about reserves.

- Line number in the balance sheet: 1210.

- Account number according to the chart of accounts: Debit balance - 10, 11, 15, 16, 20, 21, 23, 28, 29, 43, 41, 44, 45, 97, Credit balance - 14, 42.

Inventories refer to the tangible property of enterprises with the help of which final production products are manufactured. Inventories on the balance sheet consist of several categories:

- materials, raw materials;

- goods for sale.

- unfinished production;

- finished products;

- Future expenses;

Raw materials and materials that were not given for the manufacture of products, in line 1210 of the balance sheet, information is collected on the balances of debit and credit accounts: The specifics of raw materials can be very diverse depending on what the enterprise does.

Variable costs

Attention

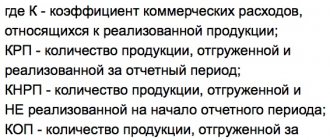

Material costs: profitability formula Since MH directly affects the cost of production, and therefore the profitability of the organization, it is necessary to carry out analysis for them, as well as calculate coefficients.

As a rule, this is done not by accountants, but by economists. They usually calculate how much profit can be made per ruble of material costs. The formula they use for this includes the following data:

- PMZ - profit per 1 ruble of the MS of a specific product;

- P - profit from the sale of these products;

- MH - for sold products.

The formula looks like this: PMZ = P / MZ. The obtained result makes it possible to calculate the profitability of production, that is, find out how much you can earn from each ruble spent or, conversely, lose (which is extremely undesirable).

Direct and indirect

Variable costs fall into two broad categories, which include:

- Direct. They are directly attributed to the cost of production, for which information from primary accounting is taken into account.

- Indirect. They depend on changes in the number of goods produced, but due to the technical characteristics of the production process it is impossible or impractical to directly attribute them to the goods created.

Features of direct and indirect costs are given in Art. 318 NK. Direct costs include the costs of purchasing raw materials and materials, paying employees and depreciation of fixed assets used for production.

Attention! Companies can classify as direct costs other expenses that in one way or another relate to the production process.

Direct costs have to be taken into account when calculating the tax base for income tax. This process is carried out over time when selling products or providing services. Indirect taxes are written off to cost.

For example, a company specializes in providing transport services. Driver salaries and car depreciation fees are considered direct expenses. If a company is engaged in the production of products, but at the same time independently transports goods to customers, then the maintenance of cars and the salaries of drivers are considered indirect costs.

Where are variable and fixed costs shown on the balance sheet?

Info

The most famous and widespread is the algebraic method, according to which the following formula can be used to determine the value of VC: Algebraic analysis assumes that the subject of the study has such information as the volume of production in physical terms (X) and the size of the corresponding costs (Z), at least two product points. The marginal method is also often used, based on determining the amount of marginal income, which is the difference between the organization’s profit and total variable costs.

Breaking point: how to minimize variable costs? A popular strategy for minimizing variable costs is to determine the “breaking point” - the volume of production at which variable costs stop increasing proportionally and reduce the growth rate: There may be several reasons for this effect.

What do variable costs include (formula)?

In some organizations, the balance of account 44 may be reflected in the line “Other inventories and costs” (p. 217); -The balance of goods at the end of the period is the line “Finished goods and goods for resale” of the balance sheet (p. 214). In the case of trading companies, it usually reflects only goods for resale; -Write-off of goods for the period is reflected in the line “Cost of goods sold” (p.

021) in the income statement. Perhaps, it’s worth warning right away that it is not possible to accurately separate the costs of transporting goods from business expenses, having only annual or quarterly financial statements on hand. And I had to verify this from my own experience. The fact is that the error in the calculations turns out to be too significant.

Ways to reduce costs

Many companies are faced with such situations when the product has been produced, payments with suppliers have been completed, but funds from buyers have not yet arrived - then the company is forced to resort to the use of borrowed funds. To avoid this, it is recommended to constantly look for opportunities to reduce costs. Cost minimization usually consists of three main stages:

- Distribution of costs into specific categories.

- Highlighting costs that can be adjusted.

- Financial planning and cost reduction.

Assuming that the first step is completed and the costs are categorized, you can immediately proceed to the next step.

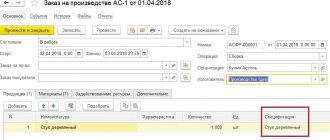

Preparation of contract

- Costs aimed at purchasing raw materials and equipment. In this case, you can resort to an attempt to revise the terms of contracts with suppliers, search for new contractors, produce previously purchased components in-house, and introduce new technological developments.

- Rent. It is always possible to find an opportunity to renegotiate a lease agreement between two legal entities. This could be sublease, preferential payment terms, or a change in location (for example, moving to another building).

- Equipment service. If possible, the repair work can be postponed for now or you can find another contractor with more favorable conditions. It may be worth carrying out the repairs yourself, without the help of third parties.

- Fare. You can reduce transportation costs by reducing official transport, outsourcing some operations, and inviting an experienced cost optimization consultant.

Variable costs balance

However, not only production costs, but also costs not related to the production process can be called variables. An example of the latter are warehouse, packaging, and transportation costs. Conventionally, we can say that variable costs characterize the value of the product produced, while constant costs characterize the price of the company. What refers to variable costs Variable costs include costs for:

- purchase of raw materials and supplies;

- for components and spare parts for production equipment;

- related to the sale of finished products (for transportation, storage, etc.)

Results

Due to the fact that variable costs change in direct proportion to production volume, and the same costs per unit of finished product usually remain unchanged, when analyzing this type of cost, the value per unit of product is initially taken into account.

In connection with this property, variable costs are the basis for solving many production problems related to planning. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Variable costs balance

- Fixed costs. Definition

- Formula for calculating fixed costs/expenses

- Two methods for calculating costs in an enterprise

- Fixed costs and the break-even point of the enterprise

- Fixed costs in the balance sheet of the enterprise

Let's talk about the enterprise's fixed costs: what economic meaning does this indicator have, how to use and analyze it. Fixed costs. Definition Fixed costs

Fixed cost, FC, TFC or total fixed cost) is a class of enterprise costs that are not related (do not depend) on the volume of production and sales. At each moment of time they are constant, regardless of the nature of the activity.

Fixed costs, together with variables, which are the opposite of constant, constitute the total costs of the enterprise.

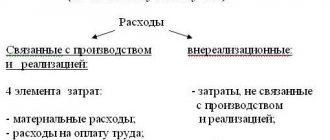

What are the costs of the enterprise?

Costs (expenses) incurred by a legal entity for the purposes of management accounting are divided into 2 large groups:

- Constants that ensure the operation of the entire enterprise as a whole, but are not directly related to the main production process. They do not depend on production volumes and occur even if production is temporarily not functioning. These include, for example, the costs of maintaining the management apparatus, taxes, rent, organizing sales, advertising, information and consulting services, communication services, and personnel training.

- Variables that make up the actual cost of production (direct costs of production). Their volume directly depends on the volume of production and changes with it.

The classification of costs as fixed or variable costs of an enterprise is quite conditional. They are determined by many factors and in reality reveal more complex dependencies, including on production volumes.

The determination of their sizes, and, consequently, the reliability of economic calculations and the reliability of the conclusions that are drawn on their basis depend on the correctness of dividing costs into these 2 groups.

Variable expenses balance

However, fixed and variable costs include costs related to production and sales. When production activities cease, part of the expenses disappears and becomes zero.

Let's look at what variable costs include. An example of costs will also be given in the article. Cost composition Variable costs include:

- Commercial expenses (percentages from sales to sales managers and other remunerations, as well as% paid to outsourcing companies).

- Cost of goods produced.

- Salary of working personnel (part of the salary, which depends on the standards met).

- The cost of fuel, raw materials, materials, electricity and other resources involved in production activities.

Variable costs also include some taxes: VAT, excise taxes, deductions under the simplified tax system, unified tax on premiums.

Purpose of calculation

Behind each coefficient, indicator or concept it is necessary to see their economic meaning. If we talk about the goals of the enterprise, then, in general, there are two of them: reducing costs or increasing income. When these concepts are generalized, the profitability of the company arises. The higher this indicator is, the more stable the financial position of the company will be, the more opportunities will appear to attract additional borrowed funds, expand technical and production capacities. In this case, the enterprise can increase its own value on the market and increase its investment attractiveness. The division of enterprise expenses is used in management accounting. Company managers need to know what variable costs include. There is no line showing this group of expenses in the financial statements. Determining the value of these costs in the overall structure allows us to analyze the company's activities. Management, knowing that variable costs include, by balancing expenses and income, has the opportunity to consider different management strategies for increasing the profitability of the company.

Variable costs balance line

- for basic piecework wages for workers;

- for electricity and fuel, which are consumed during production.

Examples of direct variable costs Direct variable costs include:

- sales costs, including the amount of commissions to sales agents;

- components, materials;

- energy costs for the production cycle;

- transport costs;

- costs for technological needs.

Total variable costs Total variable costs include costs that change in parallel with changes in production volumes within the limits of the potential capacity of production facilities.

Conditional variables

These include costs associated not only with the production of goods, but also with their sale. Their size changes during the economic activity of the enterprise, so it is important to correctly analyze not only their quantity, but also their quality and structure.

They may change as the activity of the company changes. Such costs include paying salaries to specialists working on a piece-rate system, as well as transferring interest to sellers.

Variable costs in the balance sheet of an enterprise

The main reason for creating such a financial unit was the increase in the scale of the business and, as a consequence, the need to monitor its financial condition. One of the primary tasks of financiers was the calculation and analysis of indicators such as marginal income, break-even point, as well as determining achievable business growth rates*.

Interestingly, the company did not maintain any management accounting. Therefore, we had to use only financial statements data.

In particular, limit yourself to the balance sheet and profit and loss account. Due to a lack of information, the company encountered a number of problems related to the calculation of the previously mentioned indicators.

As it turned out, due to the peculiarities of accounting, it is impossible to clearly distinguish between the company’s fixed and variable expenses. Now about everything in order and in detail - how the company solved the listed problems.

Variable costs on the balance sheet

In the long term, any costs become variable, often due to the impact of external economic factors. Two methods for calculating costs in an enterprise When producing products, all costs can be divided into two groups according to two methods:

- fixed and variable costs;

- indirect and direct costs.

It should be remembered that the costs of the enterprise are the same, only they can be analyzed using different methods.

In practice, fixed costs strongly overlap with such concepts as indirect costs or overhead costs. As a rule, the first method of cost analysis is used in management accounting, and the second in accounting. Fixed costs and the enterprise break-even point Variable costs are part of the break-even point model.

The variety of ways to make a profit for enterprises in any industry of production and sale of services, on the one hand, creates unlimited opportunities for the development of a particular business, on the other hand, each type of activity has a certain threshold of efficiency, determined by break-even.

In turn, the amount of revenue that guarantees profit directly depends on the total costs of production and sales of products.

General, average (unit) costs

The total costs for a period, consisting of fixed and variable costs, are called total costs. Accordingly, the total costs of each of the groups that form this sum are called total fixed and total variable costs.

For each of these amounts, you can determine the average (or unit) costs, which are calculated as the quotient of dividing the total amount of the corresponding costs by the number of products produced during the period under consideration. Average (or unit) costs represent the costs per unit of production.

You can calculate similar indicators broken down by product type. This will make it possible to set an appropriate price for it, and if it turns out to be significantly higher than the market price, then make a decision to discontinue production or ways to reduce costs (production or management).

What it is?

For the purposes of analyzing the break-even of activities, the total expenses of an enterprise are usually divided into two main categories:

- — costs, the amount of which directly depends on the volume of production and sale of services (depending on the chosen direction of the company’s operation), i.e., in fact, they are directly proportional to any fluctuations in the volume of core activities;

- fixed costs are costs the amount of which does not change in the medium term (a year or more) and does not depend on the volume of the company’s core activities, i.e. they will exist even if the activity is suspended or terminated.

Having considered fixed costs using the example of an enterprise, it is easier to understand their essence and interdependence with the volume of core activities.

So, they include the following expense items:

- depreciation charges on the company's fixed assets;

- rent, tax payments to the budget, contributions to extra-budgetary funds;

- bank expenses for servicing current accounts, loans of the organization;

- wage fund for administrative and managerial personnel;

- other general business expenses necessary to ensure the normal functioning of the enterprise.

Thus, the essence of fixed costs of any organization comes down to their functional necessity for the implementation of activities. They can and most often change over time, but the reason for this is external factors (changes in the tax burden, adjustments to the terms of service at the bank, renegotiation of contracts with service organizations, changes in utility tariffs, etc.).

Internal factors influencing changes in fixed costs are a significant change in corporate policy, the personnel remuneration system, a significant change in the volume or direction of the company’s activities (not just a change in volume, but a radical transition to a new level).

Under the influence of all these factors, fixed costs change; they are usually characterized by sharp fluctuations in expenditure amounts.

For the purposes of accounting and analysis, enterprise expenses are usually divided into constant and variable, using the following methods:

- Based on experience and knowledge, through a management decision, a certain category is assigned to expenses. This method is good when the company is just starting its activities and there are simply no other ways to attribute costs. It is characterized by a high level of subjectivity and requires revision in the long term.

- Based on the data of the analytical work carried out to search, evaluate and differentiate all expenses by category based on their behavior under the influence of the factor of changes in the volume of core activities. It is the most acceptable, since this method is more objective.

To see which expenses should be assigned to which group, watch the following video:

Production and sales volume

To better understand what variable costs include, you should consider their division depending on certain characteristics. Based on production and sales volumes, the following are distinguished:

- Proportional expenses. The calculation uses an elasticity coefficient of 1. The increase in variable costs is directly proportional to the increase in production volume. For example, the latter increased by 30%, respectively, expenses will increase by the same amount.

- Progressive costs. The coefficient here is > 1. Variable costs are highly sensitive to changes in the volume of product output. If it increases, the costs will be relatively higher. For example, volume increased by 30% and costs by 50%.

- Degressive expenses. The coefficient for them is < 1. If production volume increases, costs decrease. This phenomenon is referred to as the “economy of scale” or “mass production effect.” For example, output increased by 30%, but expenses increased by only 15%.

How to calculate them?

Fixed costs are calculated using the formula:

POSTz = Z salary + Z rent + Z banking services + Depreciation + Taxes + General household services

, Where:

- FOSTz – fixed expenses;

- W salary – costs for salaries of administrative and managerial personnel;

- Rent – rental expenses;

- 3 banking services – banking services;

- General expenses - other general expenses.

To find the average fixed cost per unit of output, you must use the following formula:

SrPOSTz = POSTz / Q,

Where:

- Q – volume of products (its quantity).

The analysis of these indicators must be carried out in dynamics, assessing the retrospective values at different periods of time, including with a joint analysis of other economic indicators. This will allow you to see the interconnection of processes characteristic of the enterprise, which means you can get a cost management tool in the future.

Concept and structure of fixed costs

They cannot be reduced in a short period of time. If output volumes decrease or increase, these costs will not change.

Fixed production costs usually include the following:

- rent for premises, shops, warehouses;

- utility fees;

- administration salary;

- costs of fuel and energy resources, which are consumed not by production equipment, but by lighting, heating, transport, etc.;

- advertising expenses;

- payment of interest on bank loans;

- purchase of stationery, paper;

- costs of drinking water, tea, coffee for employees of the organization.