What about materials?

In the process of working towards making a profit, business entities are often faced with the need to purchase related materials.

This type of property is of low value and is rarely purchased for the purpose of further resale. Inventory inventories (MPI) are used for production or management needs. The procedure for accounting and movement of materials must be reflected in the accounting policy of the enterprise, which each business entity has the right to form independently, without violating the requirements of current legislation. The rules for using information on materials are regulated by PBU 5/01 “Accounting for inventories”, approved by order of the Ministry of Finance of the Russian Federation dated 06/09/2001 No. 44n.

Important! From 01/01/2021 PBU 5/01 loses force, and the accounting rules are regulated by the new FSBU 5/2019 “Inventories”. Some accounting rules have been changed significantly. A ready-made solution from ConsultantPlus will help you rebuild your materials accounting. Get trial access to K+ for free and proceed to the material.

Also, on the basis of PBU 6/01 “Accounting for fixed assets”, approved by order of the Ministry of Finance of the Russian Federation dated March 30, 2001 No. 26n, equipment whose cost does not exceed 40 thousand rubles is included in the inventory.

Read about the nuances of accounting for assets whose value is below 100,000 rubles here.

Documenting

Document the release (transfer) of materials into operation (production) with the following documents:

- limit intake card (form No. M-8) is used for the systematic use of materials, when standards and plans for their consumption have been approved;

- an invoice for the release of materials to the third party (Form No. M-15) is used in cases where materials are transferred to a geographically remote unit;

- the demand invoice (Form No. M-11) or warehouse registration card (Form No. M-17) is used in other cases.

Such rules are established by paragraphs 100, 109 and 126 of the Methodological Instructions, approved by Order of the Ministry of Finance of Russia dated December 28, 2001 No. 119n.

Advice : standard forms of documents that are in albums of unified forms and approved by resolutions of the State Statistics Committee of Russia are not necessary to use. Therefore, organizations have the right to develop a single act for the write-off of materials. It can indicate only mandatory details and those that are important for the organization based on the specifics of the activity.

Use the same documents to write off property worth up to 40,000 rubles. (another limit established in the accounting policy), which in other respects corresponds to fixed assets. This is explained by the fact that in accounting its value is written off similarly to materials (paragraph 4, paragraph 5 of PBU 6/01, letter of the Ministry of Finance of Russia dated May 30, 2006 No. 03-03-04/4/98).

What types of materials are there?

In accounting, materials, according to the Chart of Accounts (approved by order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n), are accounted for on account 10 “Materials”.

Materials have a diverse grouping according to purpose and nature of use. Depending on these conditions, the organization’s materials are grouped into the following subaccounts.

| Subaccount designation | Subaccount name | What is taken into account |

| 10.1 | "Raw materials" | Inventories included in manufactured products that are involved in the manufacturing and processing process |

| 10.2 | "Components, purchased semi-finished products" | Materials purchased for further packaging of manufactured products |

| 10.3 | "Fuel" | Movement of fuel, including gasoline and diesel, as well as lubricants necessary during the operation of vehicles |

| 10.4 | "Container and packaging materials" | Availability and movement of all types of containers (except for those used as household equipment), as well as materials and parts intended for the manufacture of containers and their repair |

| 10.5 | "Spare parts" | Movement of materials used as spare parts for vehicles and other equipment |

| 10.6 | "Other materials" | Production waste, irreparable defects, material assets received from the disposal of fixed assets that cannot be used as materials, fuel or spare parts in a given organization (scrap metal, waste materials), worn tires, etc. |

| 10.7 | “Materials transferred for processing to third parties” | Materials transferred for processing to other companies |

| 10.8 | "Construction Materials" | Used by real estate developers. The invoice takes into account the materials needed for construction and installation work |

| 10.9 | "Inventory" | Inventory and other household supplies |

| 10.10 | "Special equipment and clothing in the warehouse" | Special equipment, uniforms, special uniforms in warehouse |

| 10.11 | “Special equipment and clothing in use” | Special equipment, uniforms, special uniforms handed over to employees for use |

Returning balances to the warehouse

If materials decommissioned for use (production) were not completely consumed, they must be returned to the warehouse. Issue such a return with an invoice (form No. M-11 or No. M-15) or a limit-withdrawal card (form No. M-8). This is stated in paragraph 112 of the Methodological Instructions, approved by order of the Ministry of Finance of Russia dated December 28, 2001 No. 119n.

In accounting, register the return of materials by posting:

Debit 10 (16) Credit 20 (23, 25, 26, 29, 44, 97…)

– unused materials are credited to the warehouse.

Materials accounting

In order to control the availability and movement of inventories, a business entity can use both unified forms approved by Decree of the State Statistics Committee of the Russian Federation dated July 30, 1997 No. 71a, and those developed independently, taking into account the requirements for the mandatory details of the primary document (Article 9 of the Law “On Accounting” dated 06.12. 2011 No. 402-FZ) and enshrined in the company’s accounting policies.

Among the unified forms, the most popular are the following:

- demand-invoice;

- invoice for the release of materials to the third party;

- receipt order;

- limit fence card.

Materials are capitalized at the actual cost recorded in the documentation upon receipt. Inventory in an organization is accounted for either at its actual cost of receipt or at accounting prices, which must be enshrined in the accounting policy. When using the 2nd option, you should use account 16 “Deviation in the cost of material assets” and account 15 “Procurement and acquisition of material assets” to reflect the difference between the accounting and actual costs.

Example 1

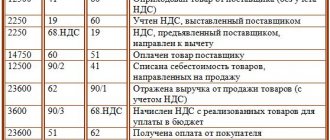

Retro LLC has enshrined in its accounting policy the need to accept materials at discount prices. A batch of raw materials (granulated sugar) was received for further use in production in the amount of 100 kg for the amount of 4,000 rubles. Accepted accounting (planned) prices for this item are 45 rubles. for 1 kg. The following postings have been made:

| Debit | Credit | Amount, rub. | Contents of operation |

| 15 | 60 | 4 000 | The receipt of raw materials (granulated sugar) from the supplier was capitalized |

| 19 | 60 | 800 | Input VAT included |

| 10.1 | 15 | 4 500 | Accepted raw materials at discount prices |

| 15 | 16 | 500 | The excess of the book value over the actual value is written off |

If the accounting price were less than the actual cost, then the last entry would have the following form:

Dt 16 Kt 15. – the difference in the excess of the cost of goods over the accounting prices is written off.

Example 2

LLC "Raduga" upon receipt of materials capitalizes them at actual cost. When purchasing office supplies (20 pencils for a total of 1,000 rubles), the following entries were made for administrative needs:

| Debit | Credit | Amount, rub. | Contents of operation |

| 10.6 | 60 | 1 000 | Stationery purchased from supplier |

| 19 | 60 | 200 | Input VAT included |

| 26 | 10.6 | 1 000 | Stationery supplies were transferred upon request-invoice for the needs of the administrative apparatus |

After receipt, the materials are written off for production or other general business needs using one of the existing methods, which also must be reflected in the accounting policy:

- By average cost - when writing off, the average price of 1 unit of homogeneous material is formed.

- At the cost of each unit - suitable for a small group of inventories in cases where it is possible to form the cost of each unit.

- Using the FIFO method - this method allows you to take into account the cost of the first received materials in expenses (clause 16 of PBU 5/01).

Find out how to write off materials according to the new FSBU 5/2019 from the Guide from ConsultantPlus by getting free trial access to the system.

Write-off at cost of each unit

This write-off method is convenient for organizations that have a small list of items. In this case, it is not too difficult to track the cost of a specific batch of inventories and determine the write-off value. If this method is used, accounting is carried out for each batch of inventories, their prices change little, and the write-off occurs at the purchase price.

Example

At Parma LLC, at the beginning of the period, there were 100 kg of paint left in the warehouse for 3,000 rubles. at actual cost. Then, within a month, two more batches of paint were purchased:

- 150 kg in fact. cost 3,200 rubles, transportation and procurement costs - 1,000 rubles.

- 200 kg, cost 5,200 rubles, TZR amounted to 1,000 rubles.

Inventory and equipment are included in the actual cost. For convenience, all calculations are taken without VAT.

Let's calculate the actual cost of paint:

- At the beginning of the month - 3,000/100 = 30 rubles/kg;

- 1st batch - (3,200 +1,000) /150 = 28 rubles/kg;

- 2nd batch - (5,200 + 1,000)/200 = 31 rubles/kg.

During the period spent:

- 90 kg of paint from the remainder;

- 100 kg from the first batch;

- 110 kg from the second batch.

The cost of paint written off for production will be:

- 90*30 + 100*28 + 110*31 = 8,910 rub.

Materials released from warehouse to production: wiring:

| Dt | CT | Operation description | Amount, rub. | Document |

| 20 | 10 | Write-off of materials reflected | 8 910 | M-11 |

Postings for receipt and disposal of materials

There are several ways for materials to enter an organization: acquisition for a fee, acceptance as a contribution from the founders, production of materials, free receipt, etc.

Depending on the method of receipt, the following postings for materials appear in accounting.

| Debit | Credit | Contents of operation |

| 10 | 60, 76 | Receipt of the invoice from the supplier; Wholesale supply of goods is carried out under a sales contract |

| 10 | 71 | Acquisition of inventories by an accountable person |

| 10 | 75 | Founder's contribution; the estimated value of the property must be agreed upon with the person contributing the property |

| 10 | 91 | Reflected gratuitous receipt; In this case, the market value of the material is taken as the amount. A similar posting is made when taking into account materials received during the dismantling of fixed assets |

If upon receipt the cost of the material includes VAT, then its amount is reflected in a separate line.

Example 3

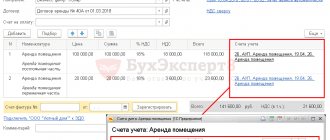

Motiv LLC purchased a batch of paper (100 packs) for office needs using an invoice for a total amount of 18,000 rubles, including VAT 20% of 3,000 rubles. The organization made the following entries:

| Debit | Credit | Amount, rub. | Contents of operation |

| 10.6 | 60 | 15 000 | A batch of paper has arrived |

| 19.3 | 60 | 3 000 | The amount of input VAT is reflected |

| 68.2 | 19.3 | 3 000 | VAT amount accepted for refund |

| 60 | 51 | 18 800 | Payment was made to the supplier through a bank account |

For more information on the formation of VAT when purchasing inventories, see the material “How is VAT recorded on purchased assets?” .

If an organization applies a taxation regime that excludes the use of VAT (STS, UTII), then the entire cost of materials should be credited to account 10. In this case, VAT does not apply to refundable taxes, but is taken into account when determining the cost price.

The release of inventories to third parties can be carried out for the following number of reasons:

| Debit | Credit | Contents of operation |

| 20, 23, 25, 26, 29, 44 | 10 | Issue from a warehouse for production or general business needs of the organization; transfer is carried out using limit-fence cards or requirements-invoices |

| 94 | 10 | The gratuitous write-off of materials as a result of damage or theft is reflected. As a rule, a lack of food supplies is identified as a result of an inventory; an act of write-off of materials is drawn up |

| 99 | 10 | The materials were lost due to a natural disaster; the transaction is reflected using a write-off statement |

| 91 | 10 | Reflection of the transfer (sale) of materials to the third party; actual cost is used |

Materials and wiring were released from the warehouse to production

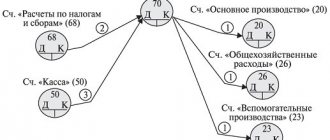

In this case, values can be transferred both to third parties, for example, through sale, and to other separate divisions of the enterprise located outside its borders. Read about it here. Accounting account 10 is used for accounting. By debit account

10 reflects the receipt of material assets at the warehouse, and for the loan - their write-off: release to production, to other departments, to third-party organizations. Depending on the direction of movement of materials. 10 corresponds with the relevant accounts.

The posting for writing off materials for main production has the form: D20 K10. When releasing materials for the needs of auxiliary production, the wiring has the form D23 K10.

If material assets are sold for general business or general production needs, then the wiring looks like this: D25 (26) K10.

/ accounting, postings

for sales of materials: The >

Write-off and capitalization of material in 1C: The > In which subaccount to record stationery. 1 Postings for returnable packaging Examples of typical accounting entries for deposit packaging.

Materials were released to the main wiring production workshop

Accounting for materials After materials are accepted for accounting at the warehouse, they can be moved both within the organization and outside it. We will discuss the features of accounting for the release of material assets from the warehouse in the article below. Internal movements are documented with the document requirement-invoice for the release of materials in the M-11 form.

Important

At the same time, they are released from the warehouse, where they are stored from the moment of receipt, and transferred to other units located within the territory of the organization.

Results

Any movement of inventories must be documented in primary documents and recorded in accounting entries.

The primary report can be compiled using standardized forms or on forms developed by the business entity independently. Postings are compiled in accordance with the Chart of Accounts. The cost of materials and the rules for their acceptance for accounting, as well as movement or disposal before 01/01/2021 are determined in accordance with PBU 5/01, and from 01/01/2021 the new FSBU 5/2019 “Inventories”. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Methods for assessing raw materials and materials in accounting upon disposal

Materials received by the enterprise are acquired for some purpose: either for use in the production process directly, or for organizing the management process. Therefore, there comes a time when materials are deregistered. Upon disposal, their value must be assessed.

Let's say an employee came to the warehouse for a certain name of material, and a release was made according to the request-invoice. At what cost should the accountant write off this item of inventory in accounting? After all, in a warehouse it may turn out that units of the same material have different actual costs due to inflation, for different suppliers.

The legislation suggests making a choice in favor of one of three methods for assessing raw materials and supplies upon their disposal:

- At the cost of each unit;

- At average cost;

- At the cost of the first materials purchased (FIFO method):

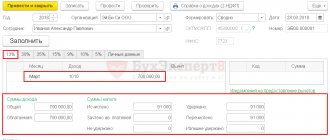

Each method has its own calculation algorithm. This calculation algorithm for each method is included in the 1C accounting programs. Each method is based on its own version of the assumption.

Disposal accounting method at average cost

Is the most traditional. In this case, it is assumed that all units are completely equivalent at any given time. The weighted average method is used to determine the cost per unit when issued. As soon as the next batch of materials arrives, the 1C program again recalculates and the average cost is specified. Thus, the write-off of a unit of materials from accounting, which will take place immediately after the next receipt, will be at the new price.

FIFO method

It is based on the assumption that the storekeeper will always release materials from the batch that was received earlier in order to avoid expiration.

Method for estimating disposals at the cost of each unit

It assumes that the storekeeper will release that specific unit of material that arrived on a specific day. But this is not rational, unless precious stones and precious metals with original characteristics are stored in a warehouse. As a rule, this method is used by micro-enterprises with minor purchases of materials.

The chosen method must be reflected in the Accounting Policy for accounting purposes.

Methods for assessing the disposal of low-value fixed assets

If a fixed asset costs no more than 40,000 rubles, then in accounting, despite its name, it is taken into account as part of inventories. And if so, then low-value assets should be subject to the same accounting rules as inventory items. This means that the method of calculating a unit of retiring low-value fixed asset must also be fixed in the accounting policy.