Home / Taxes / What is VAT and when does it increase to 20 percent? / Declaration

Back

Published: 08/09/2017

Reading time: 8 min

0

241

The correctness of VAT calculation, its amount and timely payment to the state budget are regulated by the tax authorities. Thanks to the transition to electronic reporting, monitoring the accuracy of data provided by organizations has become much easier. If inconsistencies are identified, a desk audit is carried out.

- Desk inspection: definition and subject

- How is it produced?

- What is the time frame for production?

- Deadline for making a decision on a desk audit

- If an updated declaration is submitted during the inspection

- In what cases will additional documents be required?

- At what stage is the inspection of the territory carried out?

- Tax monitoring and desk audit

Desk tax audit for VAT: definition and subject

A desk audit of a VAT return is a form of control.

With its help, representatives of the tax service identify discrepancies and errors in the reporting submitted by the payer of the relevant tax (Articles 82, 87 of the Tax Code of the Russian Federation). Such an inspection is carried out on the territory of the tax authority; in general, a visit to the office of the company being inspected is not provided (Article 88 of the Tax Code of the Russian Federation). If necessary, documents and explanations are requested via telecommunication channels (TCS). At the same time, as of January 1, 2015, tax officials have the right to inspect the taxpayer’s premises during a desk audit.

A desk tax audit for VAT is a verification of the information provided by the taxpayer in the form of a declaration. The latter is the subject of verification.

The period allotted for carrying out the necessary procedures is 2 months. But in some cases it can be extended to 3 (Article 88 of the Tax Code of the Russian Federation). The period of the desk audit for VAT begins to count from the date (day) when the declaration was received by the tax service.

In 2021, a pilot project of the Federal Tax Service was launched, within the framework of which the period of VAT registration can be reduced to 1 month. Read more here.

Letter dated 10/06/2020 No. ED-20-15/ [email protected]

In order to increase business activity and provide comfortable conditions for tax administration to conscientious taxpayers, the Federal Tax Service reports the following.

I. With regard to tax returns for value added tax (hereinafter referred to as VAT), in which the right to reimbursement of tax amounts from the budget is declared, provided for in Article 176 of the Tax Code of the Russian Federation (hereinafter referred to as the Code), a desk tax audit can be completed after one months from the date of submission of the VAT return.

For the purposes of this letter, the day of submission of the VAT tax return is understood to be the 25th day of the month following the expired tax period (the deadline provided for in paragraph 5 of Article 174 of the Code for the submission of a tax return), or the day of submission of the updated VAT tax return (but not earlier expiration of the deadline established for the submission of a VAT tax return for the corresponding tax period for which the updated tax return is submitted) (hereinafter referred to as the Submission Day).

No later than 10 calendar days from the date of submission of the VAT tax return, an assessment is carried out for compliance with the conditions:

a) an application for application of the application procedure for VAT refund has not been submitted;

the taxpayer, in accordance with the data of the software “VAT Control”, belongs to a low, medium or uncertain (for individual entrepreneurs) level of risk;

VAT reimbursement from the budget of the Russian Federation was declared in the period preceding the tax period for which the VAT tax return was submitted and according to the decision on reimbursement (in whole or in part), confirmation of the amount of VAT to be reimbursed amounted to more than 70% of the tax amount claimed for reimbursement;

more than 80% of VAT deductions from the total amount of deductions declared by the taxpayer in the audited VAT tax return falls on counterparties of low, medium or uncertain (individual entrepreneurs) risk levels, and at least 50% of the amount of VAT tax deductions falls on counterparties specified in the tax return for the previous tax period;

b) the amount of taxes paid for the three years preceding the tax period for which the VAT return was submitted exceeds the amount of tax claimed for reimbursement from the budget under such a return [1];

II. After one month from the date of submission of the tax return, taxpayers meeting the above conditions are assessed for simultaneous compliance with the following conditions:

the absence of errors in the tax return and (or) contradictions between the information contained in the submitted documents, or inconsistency of the information provided by the taxpayer with the information contained in the documents available to the tax authority and received by it during tax control, leading to a change in tax obligations;

absence of contradictions between the information on transactions contained in the VAT tax return and inconsistencies between the information on transactions contained in the VAT tax return submitted by the taxpayer and the information on these transactions contained in the VAT tax return submitted to the tax authority by another taxpayer (hereinafter referred to as — Discrepancies), or the discrepancies do not indicate an understatement of the amount of tax payable to the budget of the Russian Federation or an overstatement of the amount of tax declared for reimbursement from the budget of the Russian Federation;

absence of signs of violations of the legislation of the Russian Federation on taxes and fees, leading to an overstatement of the amount of tax declared for reimbursement from the budget or to an understatement of the amount of tax payable to the budget of the Russian Federation.

When conducting a desk tax audit, the assessment of the feasibility of carrying out tax control measures in relation to counterparties of low and medium levels of tax risk, for which the taxpayer has claimed VAT tax deductions, is determined taking into account the information (information) available to the tax authority.

Taking into account the above, the Federal Tax Service of Russia instructs:

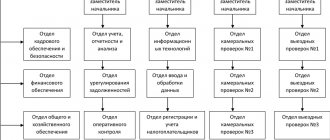

1. Interregional inspection of the Federal Tax Service of Russia for desk control:

1.1. Weekly, no later than the third working day, create a list of taxpayers who meet the conditions specified in subparagraph “a” of paragraph I of this instruction, and within two working days following the day the list is formed, bring it to the departments of the Federal Tax Service of Russia in the constituent entities of the Russian Federation ( hereinafter referred to as the Directorate), interregional inspectorates of the Federal Tax Service of Russia for the largest taxpayers (hereinafter referred to as the MI of the Federal Tax Service of Russia for CN) at the place of registration specified in the list of taxpayers;[2]

1.2. Upon readiness to use the software for automated generation specified in clause 1.1. list, bring to the Directorates, MI of the Federal Tax Service of Russia for Tax Code instructions for workplaces on the use of appropriate software in VAT administration.

2. The departments, MI of the Federal Tax Service of Russia for Tax Code no later than 1 business day from the date of receipt of the lists of taxpayers specified in paragraph I of this instruction, create a final list of taxpayers that meet the conditions specified in subparagraph “b” of paragraph I of this instruction and bring it to territorial tax authorities subordinate to the interdistrict inspectorates of the Federal Tax Service for the largest taxpayers within the same period.

3. Departments to ensure the implementation of the provisions of the order of the Federal Tax Service of Russia dated September 29, 2020 No. ED-8-15/27dsp@ within a time period sufficient to make decisions on the reimbursement of the amount of value added tax declared for reimbursement from the budget of the Russian Federation, taking into account the application of the procedure brought by this order.

4. The departments, MI of the Federal Tax Service of Russia for Taxpayers ensure the completion of desk tax audits after one month from the date of submission of VAT tax returns (updated VAT tax returns), in relation to taxpayers, while simultaneously complying with the conditions specified in paragraphs I and II of this instruction.

5. If, after a decision is made to reimburse the amount of value added tax claimed for reimbursement from the budget of the Russian Federation, circumstances are established that indicate:

about the presence of signs of a decrease in the tax base and (or) the amount of tax payable by the taxpayer as a result of distortion of information about the facts of economic life (the totality of such facts),

on identifying objects of taxation that are subject to reflection in tax and (or) accounting or tax reporting of the taxpayer (clause 1 of Article 54.1 of the Code),

on non-compliance with at least one of the two conditions defined in paragraph 2 of Article 54.1 of the Code within the framework of transactions (operations) concluded by the taxpayer,

about the presence of other signs of violation of the legislation on taxes and fees, indicating an overstatement of the amount of tax declared for reimbursement from the budget of the Russian Federation to the tax authorities in accordance with the provisions of the Recommendations of the Federal Tax Service of Russia on planning and preparation of on-site tax audits dated 02/12/2018 No. ED-5- 2/307dsp@, immediately organize activities to conduct a pre-audit analysis with a view to sending its results to the Department to consider the inclusion of the taxpayer in the Plan for conducting on-site tax audits.

6. The departments, MI of the Federal Tax Service of Russia for Tax Code, the Interregional Inspectorate of the Federal Tax Service of Russia for desk control shall ensure the application of this instruction in relation to VAT tax returns submitted after October 1, 2020 for tax periods starting from the 3rd quarter of 2021.

7. Directorates, MI of the Federal Tax Service of Russia on CN shall submit information to the Interregional Inspectorate of the Federal Tax Service of Russia for desk control no later than December 10, March 10, June 10, August 10 in the form according to the appendix to this instruction.

8. The departments, MI of the Federal Tax Service of Russia for Tax Code shall bring this instruction to the lower tax authorities.

Appendix: electronically.

D.V.Egorov

[]The total amount of taxes paid for the purposes of applying this letter is calculated in accordance with the letter of the Federal Tax Service of Russia dated July 23, 2010 No. AS-37-2/7390, taking into account not 3 calendar years, but 36 months preceding the reporting period.

[]The clause is valid until the introduction of automated display of the taxpayer’s VAT return in the operational window of the software “VAT Control”

Appendix to the Letter xls (370 kb)

Download

Deadline for desk audit for VAT and filing a VAT return

The deadline for filing a VAT return is the 25th day of the month following the tax period that has expired (clause 5 of Article 174 of the Tax Code of the Russian Federation).

At the same time, the period for a desk audit of the VAT return is 2 months from the date of submission of the tax return (clause 2 of Article 88 of the Tax Code of the Russian Federation), and within the framework of the pilot project, 1 month. Previously, this period was 3 months, but was reduced by the Law “On Amendments...” dated August 3, 2018 No. 302-FZ.

How to determine the start and end date of a desk audit? The answer to this question is in ConsultantPlus. If you don't already have access, get a free trial online.

Tax officers are required to complete desk audits after 2 months from the date of submission of the VAT return, while simultaneously meeting the following conditions:

- there are no contradictions in the declaration, and the information contained in it corresponds to information about transactions submitted by other taxpayers (or the unresolved discrepancies do not indicate an understatement of the amount of tax payable to the budget);

- there are no signs of violations of tax legislation leading to an underestimation of the tax payable (or an overestimation of the tax claimed for reimbursement), and there is no information indicating that the taxpayer has received an unjustified tax benefit.

If the taxpayer does not meet the above criteria and the tax authorities identify contradictions, then the period of the desk audit can be extended to 3 months.

The publication will introduce you to the features of a desk audit for reimbursement.

Deadline for making a decision on a desk audit

In cases where no violations are found, the inspection is terminated. At the same time, the legislation does not provide for the obligation of the tax inspector to notify the audited company.

If violations are discovered, the tax inspector:

- Draws up a report (no later than ten days after the end of the inspection);

- Hands it over to the taxpayer (no later than five days after preparation).

The taxpayer has the right to submit objections within a calendar month from the date of receipt of the act. The decision on the audit is made within ten days after the expiration of this month, regardless of the presence of objections from the taxpayer or their absence.

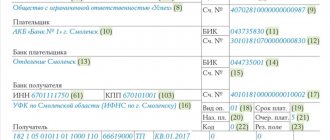

VAT declaration form

Order of the Federal Tax Service of Russia dated October 29, 2014 No. ММВ-7-3/ [email protected] approved:

- declaration form;

- the procedure for filling it out;

- format for reporting to tax authorities.

You can find out more about the composition of the declaration, download its form and sample from the materials in the section “What is the procedure for filling out a VAT declaration (example, instructions and rules)”.

If a company charges VAT and then claims the tax as a deduction, it will have to provide the relevant data on the invoices that formed the basis for the calculations. For this purpose, the declaration provides sections for reflecting data from the purchase book, sales book, and invoice journal.

Find out who is now required to fill out the invoice journal here.

Currently, tax inspectors have the opportunity to compare the data reflected in the sales book and purchase book of the selling company and the buying company. This makes it possible to identify, during a desk audit of VAT, unscrupulous persons who do not pay taxes to the budget, but claim to receive a VAT deduction.

How is the verification carried out?

Inspectors control:

- whether the fee payable has been calculated correctly;

- whether the tax base is underestimated;

- whether there is an overestimation of deductions;

- legitimacy of the use of deductions.

The taxpayer has the right to refund VAT from the budget upon completion of audit activities.

The audit is carried out on the territory of the Federal Tax Service without calling a legal entity. faces. The timing of a desk audit for VAT is regulated by Law No. 302-FZ. Inspectors check the submitted report. Tax officials notify the company if discrepancies are identified.

There are three stages of action:

- Submitting reports to the Federal Tax Service.

- Desk check. Federal Tax Service employees check the ratio of indicators within the report. They are compared with the values of reporting submitted for previous periods to identify deviations.

- Recording the results of the audit.

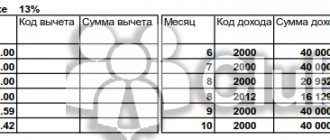

We list the points that Federal Tax Service employees pay attention to during the audit. The VAT report contains figures for invoices “incoming” from partners and issued to customers by the company.

Inspectors compare the deductions submitted by the organization with the supplier’s VAT. Tax officials consider the time period for which the report was sent.

At the Federal Tax Service, the report is loaded into the software. It is used to compare the numbers reflected in the invoices of customers and contractors to detect:

- Differences in VAT figures between the contractor and the customer for completed transactions.

- Deductions not reflected from counterparties.

With the help of the inspection program, they are fighting against “gray” organizations.

When discrepancies are detected, the Federal Tax Service's program itself, without the participation of an inspectorate employee, generates a request for clarification of the data.

Attached is a list of documentation where inaccuracies were identified, with the code designation:

- “I” – the partner’s report does not contain information about the declared transaction;

- “II” – discrepancy in information in the books of sales and purchases;

- “III” – discrepancies were identified in information about incoming and outgoing invoices;

- “IV” – when erroneous data is identified.

Now about the extension of the desk audit on VAT. If inspectors during an inspection catch a company in violation, the inspection period is increased to 3 months. Conclusions about increasing the deadlines are accepted by the inspection management.

Responsibility for violating the declaration submission form

Most VAT payers are required to file their returns electronically. If, instead of an electronic declaration, a paper declaration is submitted, the organization will face a fine.

In paragraph 5 of Art. 174 of the Tax Code of the Russian Federation states that a VAT return submitted on paper is not submitted. As a result, the consequences have become more serious: the fine has increased, and administrative liability is possible.

For more information about liability, see our material “What is the liability for a late declaration?” .

In addition, your organization’s account may be blocked (Clause 3, Article 76 of the Tax Code of the Russian Federation).

For more information about suspending account transactions, see our material “Late with your declaration? Get ready to block your account .

Receipt of electronic documents from the tax office must be confirmed

In clause 5.1 of Art. 23 of the Tax Code of the Russian Federation states that each taxpayer sending an electronic declaration to the tax service is obliged to ensure that the inspection receives from the inspectorate in electronic form via TKS the documents sent by the tax office during the control. What might your tax office require? This means:

- notice of summoning the taxpayer (Article 31 of the Tax Code of the Russian Federation);

- requirement to provide explanations (Article 88 of the Tax Code of the Russian Federation)/documents in relation to the submitted reports (Articles 93 and 93.1 of the Tax Code of the Russian Federation).

The list may be supplemented by other documents necessary for conducting a desk audit.

When a notice or demand is received, the taxpayer must send a receipt to the tax office confirming receipt. The legislation allows no more than 6 days for this from the date when the tax authorities requested documentation or clarifications on reporting.

See “Formalized response to the tax office’s demand for VAT – nuances.”

NOTE! Failure to fulfill the obligation to transfer the said receipt will have serious consequences (Article 76 of the Tax Code of the Russian Federation). Thus, the tax service has the right to freeze all transactions on the accounts of the offending company - from banking transactions to money transfers via electronic channels.

Cancellation of such a decision is possible on the basis of Art. 76 Tax Code of the Russian Federation. Frozen accounts are unblocked provided that the taxpayer:

- handed over a receipt confirming the receipt of documents that were sent by the tax office;

- provided the documents/explanations originally requested by the tax authority.

Then the cancellation of the order to block the account must occur no later than one day following the earliest of the specified dates.

When can tax authorities request documents?

Tax authorities have the right to demand, during a desk audit, that the taxpayer submit invoices, primary and other documents related to the transactions reflected in the submitted declaration (Article 88 of the Tax Code of the Russian Federation). The following are cases when this right is subject to exercise:

- If the data provided by two different taxpayers for the same transaction do not correspond to each other.

- If the information specified in the declaration does not correspond to the data from the invoice journal.

- If inconsistencies are identified in the submitted declaration.

IMPORTANT! The intention to request documentation from the taxpayer must be based on compelling reasons. That is, the “irregularities” in the reporting identified by the fiscal service should indicate the taxpayer’s desire to underestimate the amount of tax payable and an attempt to overstate the amount of compensation from the budget.

To learn about what points may influence the occurrence of questions during an audit, read the material “VAT Declaration: The Most Common Errors and How to Correct Them .

Tax authorities accept any explanations regarding VAT only in electronic form. Find out about it here.

Conducting a desk audit: what is required for this

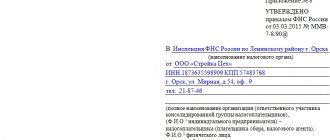

According to the order of the Federal Tax Service of the Russian Federation “On approval of the VAT tax return form...” dated October 29, 2014 No. ММВ-7-3 / [email protected] , a standard declaration form was developed, as well as rules that must be followed when filling out and submitting it. It is this form, submitted by the taxpayer to the Federal Tax Service, that is the start for the audit.

As for documents, here the enterprise may be required to provide any papers that directly or indirectly relate to the operations and data specified in the submitted declaration. A request from the tax office may be received in the following cases:

- data differs for different taxpayers for the same transaction;

- the information in the declaration does not match the information in the invoices;

- two years after the due date, the amendment is submitted, and the tax amount in it is less;

- the declaration is submitted by a foreign company that provides services in electronic form to individuals;

- other inconsistencies were identified.

The reasons for requesting the relevant documents must be compelling. This may be the conclusion of the tax authorities that the company wanted to pay less tax than it should by law. Or it has been established that they are deliberately trying to inflate the amount of compensation from the state budget. The tax office may not request documents if they have already been received during earlier inspections.

Desk inspection of VAT: territory - for inspection!

Representatives of the tax service, during a desk audit, have the right to inspect the territory of the organization, the premises it occupies, as well as other property (Article 92 of the Tax Code of the Russian Federation).

See also our material “Inspection: rules for conducting and reporting results” .

That is, a desk audit of VAT is work carried out by fiscal officials not only within the office, but also on the territory of the taxpayer.

When is an inspection allowed? Inspection is possible in the following cases (clause 1 of article 92, clauses 8 and 8.1 of article 88 of the Tax Code of the Russian Federation):

- submission of a declaration in which the amount of VAT is claimed for reimbursement;

ConsultantPlus experts explained how a desk audit of a declaration is carried out in the event of a VAT refund. Get trial access to the system and move on to the Ready-made solution.

- identification of contradictions and inconsistencies that give reason to believe that a business entity is trying to underestimate the amount of tax payable or overstate the amount of tax to be reimbursed.

The resolution of the controlling person conducting the inspection is a sufficient basis for inspecting the territories, premises and other property of a legal entity. At the same time, it must have the following characteristics:

- firstly, have motivation;

- secondly, to be approved by the head of the tax authority or his deputy.

A resolution that fully complies with these requirements is the basis for the fiscal service to have access to the territory/premises of the company being inspected. In addition, representatives of the tax service are required to have official identification.

Tax collection deadlines

According to paragraph 1 of Article 46 of the Tax Code of the Russian Federation, if the payer has not timely paid the tax debt, which is determined on the basis of available reporting (can be adjusted based on the results of audits), his obligation is compulsorily fulfilled by foreclosure on his funds in bank accounts.

The statute of limitations for collection is determined by paragraph 3 of Article 46 of the Tax Code of the Russian Federation, according to which the tax authority has 2 months, which are calculated from the end of the period for fulfilling the requirement to pay taxes, to make a decision on forced collection. After acceptance, it is sent to the taxpayer, as well as to the banks where the debtor has accounts.

Missing the two-month deadline entails the invalidity of the decision and the further impossibility of collecting funds in an administrative manner, which does not deprive the tax inspectorate of the right to go to court to collect the same payments (i.e., already in court). The tax authority, in accordance with paragraph 3 of Article 46 of the Tax Code of the Russian Federation, has 6 months to go to court, which are also calculated from the date of expiration of the period specified in the requirement to pay taxes. Missing this deadline without the possibility of restoration leads to the impossibility of forced collection.

In the event that there are insufficient funds in the organization’s accounts, the penalty, in accordance with paragraph 1 of Article 47 of the Tax Code of the Russian Federation, is applied to other property of the payer. In this case, a similar administrative or judicial procedure applies - with the only difference that the tax authorities are given 12 months to make a decision, and 2 years to go to court, which are calculated from the end of the period specified in the request for payment of taxes.

This is important to know: Voluntary execution before filing a claim in court

Limitation period for collecting taxes from citizens

According to paragraph 2 of Article 48 of the Tax Code of the Russian Federation, unpaid taxes are collected from citizens only in court. Moreover, in order to go to court, it is necessary that the total amount of debt exceeds 3 thousand rubles. The tax office has 6 months to submit an application.

If the amount of debt is less than 3 thousand rubles, then paragraph 2 of Article 48 defines the following period for foreclosure:

- when the total amount of debt within 3 years reaches more than 3 thousand rubles. the period for going to court is limited to 6 months from the date of accumulation of 3 thousand rubles;

- If within 3 years the amount of debt has not exceeded 3 thousand rubles, then 6 months for going to court will begin to count after 3 years from the date of the first non-payment.

Practitioners need to remember that the tax on real estate and vehicles, due to the requirements of paragraph 2 of Article 52 of the Tax Code of the Russian Federation, is calculated only for the last 3 tax periods. The tax office does not have the right to calculate tax and send notification of its payment for earlier periods.

Tax monitoring and desk audit of VAT: points of contact

Starting in 2015, some taxpayers may be interested in a new form of tax control - tax monitoring.

To whom tax monitoring is available, see the material “From 01/01/2015, large taxpayers will be able to be “monitored”” .

The subject of tax monitoring is the correctness of tax calculations, as well as compliance with the deadlines for their payment to the budget, in particular this applies to VAT verification (Article 105.26 of the Tax Code of the Russian Federation).

Tax officials do not have the right to conduct desk (by the way, on-site, too) audits within the time period that falls under monitoring.

True, the legislator has provided several exceptions to this rule. For example, if during the period subject to monitoring, representatives of the tax inspectorate reveal that the amount of tax that should go to the budget does not correspond to what the company indicated in its declaration, an audit will be carried out.

Please note that tax monitoring can be carried out exclusively voluntarily. The obligatory basis for it is the decision made upon consideration of the application submitted by the organization initiating its implementation. Moreover, this is not the only thing required. The application must be supplemented with certain documents and a number of data must be provided about the organization.

The order of the Federal Tax Service dated April 21, 2017 No. ММВ-7-15/ [email protected] approved new forms of documents used when conducting tax monitoring. Find out about them by following the link .

Results

A desk audit of the VAT return is carried out by the tax office. If necessary, inspectors may request documents or come to the taxpayer to inspect premises and territories.

The period for a desk audit of a VAT return is generally 2 months. This period can be extended up to 3 months if tax authorities find errors or discrepancies.

Sources:

- Tax Code of the Russian Federation

- Order of the Federal Tax Service of Russia dated October 29, 2014 No. ММВ-7-3/ [email protected]

- Order of the Federal Tax Service dated April 21, 2017 No. ММВ-7-15/ [email protected]

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

When can a requirement from the Federal Tax Service be ignored?

Not all requests from tax officials require documents to be submitted as part of a desk audit; inspectors are often disingenuous or try to exceed their authority. Let's consider situations when you may not comply with a requirement received from the Federal Tax Service. Thus, there will be no penalty in the form of a fine under Article 126 of the Tax Code for failure to provide documents upon request if the request:

- the inspector sent it to you after the end of the period established for conducting a desk inspection;

- sent by ordinary mail and not by registered mail, as a result of which the inspection does not confirm that it was delivered to the addressee;

- contains unclear wording that does not make it possible to clearly establish which documents should be submitted to the inspection upon request;

- was sent to the company again or documents were requested that were previously provided to the inspection as part of other control activities.

In the listed cases, do not ignore the requirement; you still need to respond to it. To do this, fill out the notification on the form approved by Federal Tax Service Order No. ММВ-7-2/204 dated April 24, 2021, and send it to the tax office within the general deadlines.