Movable and immovable property

To contents

Material assets can belong to an individual, organization, state or municipal institutions that have ownership rights or can be transferred for a time to management. All property is divided into movable and immovable.

In the original interpretation of the letter of the law, everything that could not be moved or transported in any way was considered immovable, and all other values were classified as movable. But such a simple division was not always satisfactory, so amendments and additional definitions were formulated.

The concept of movable and immovable property

To contents

Anything that fits the definition of real estate must be registered. Details of the transfer of ownership, coordinates of objects are entered into the state register, and owners are required to pay tax.

Real estate is subsoil, land plots, and buildings located on them, including unfinished ones. The rule excludes forested areas; in this case, rights are regulated by the Forestry and Land Code, as well as by regional ministries. The forest area is always owned by the state and can be leased for indefinite use with various encumbrances. So, if the intended use has changed, or significant changes have occurred on the site itself, including fires, floods, the ownership will be revised.

Important! Unauthorized buildings cannot be considered real estate. Also, by the decision of the Supreme Court, all construction projects that can be dismantled are excluded. These included seasonal and utility blocks, greenhouses, and toilets.

All premises that have coordinates and boundaries established in accordance with the registration procedure in the cadastral register are real estate; the right may extend to parking spaces belonging to the adjacent territory.

Inland ships and aircraft fall into the same category. Acquisitive prescription for any property that is defined as immovable is 15 years.

Movable property is all other material assets: cash, stocks and bonds, resources, vehicles. It is not subject to mandatory registration, except in cases specified by law. For example, the car still needs to be registered. The period of limitation for acquisition of movable property is 5 years .

Differences between movable and immovable property

Real estate has the following general characteristics:

- Exact location, this also applies to airplanes, helicopters and ships;

- Cannot be moved or transported;

- Subject to mandatory registration;

- A change of ownership is registered;

- Taxed;

- Acquisitive prescription is 15 years.

What is movable property?:

- Anything that is not considered real estate;

- Can be physically moved;

- Not always certain: for example, a safe, a future harvest;

- Registration is not required except as provided by law;

- Legal entities and institutions are required to keep accounting records of fixed assets: computer equipment, production equipment, furniture, transport, various assets;

- Transfer of ownership is not subject to accounting, except for motor vehicles;

- Acquisitive prescription is 5 years.

Examples

Real estate:

- Land;

- Bosom;

- Private houses;

- buildings;

- Building;

- Unfinished construction projects;

- Premises and parts of buildings, with precise boundaries entered in the register;

- Aircraft and water vessels.

Movable:

- Cash and non-cash funds;

- Securities;

- Precious stones, metals and alloys;

- Intellectual property;

- Art objects;

- Material results of labor;

- Transport, except airplanes, helicopters, water vessels;

- Animals.

Improvements in the rented premises

Many tenants, at their own expense, improve the premises they rent from the landlord. In some cases, such improvements are included in the tenant’s property tax base, in other cases they are not. It all depends on whether the improvements are separable or inseparable.

If the improvements are separable, they can be moved or disassembled without causing damage to the building. In such a situation, improvements are recognized as movable fixed assets and are not subject to property tax. This was emphasized by the Russian Ministry of Finance in letter dated 04/11/13 No. 03-05-05-01/11960.

Inseparable improvements are capital investments in the leased premises. The money spent on such investments is included in the initial cost of the premises. This follows from the provisions of PBU 6/01 “Accounting for fixed assets”. This means that inseparable improvements are inextricably linked with the building, and they should be classified as immovable objects. As a result, the tenant is required to pay property taxes on such properties throughout the lease term.

True, taxpayers do not always agree with this approach. You can hear the opinion that inseparable improvements, along with separable ones, are excluded from the taxable base. As confirmation, the following argument is given - the tenant is not the owner of the improvements. For this reason, he is deprived of the opportunity to register with the Federal Tax Service at the location of the leased property and submit a property tax return.

Methods for assessing property value

To contents

Every property is unique, so valuation uses several methods that can most accurately determine the value. Such a procedure can be carried out during the liquidation or bankruptcy of an organization, the division of common property between family members, and the calculation of tax on inheritance received.

Market or comparative approach

Value is determined based on recent equivalent transactions and industry ratios. Thus, the cost of a car can be the average for the region, and the cost of a real estate object can be the average for the area in which it is located.

Income approach

The calculation is based on an analysis of income generation opportunities. In this case, profit is capitalized; it is not distributed among holders of shares or other rights, but is spent on reproduction and increasing fixed capital. Then they resort to discounting cash flows, which means that the value of the object will increase by the amount of payments received. This method is used when investing.

Cost-effective approach

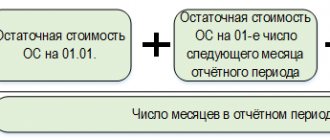

Most often used for real estate valuation. The amount of necessary investments is calculated, depending on the wear and tear of the object; it cannot exceed the cost of replacing the object with a new one. For example, no buyer would agree to buy a house that needs to be renovated if the same funds could be used to build a similar one.

Leased items and objects intended for rent

Exemption from property tax provided for in subparagraph 8 of paragraph 4 of Article 374 of the Tax Code of the Russian Federation applies to movable objects leased. Either the lessor or the lessee has the right to take advantage of the benefit, depending on whose balance sheet the fixed asset is recorded on.

Let us remind you that the question of who will put the leased asset on their balance sheet is decided by the lessor and the lessee. This is stated in paragraph 1 of Article 31 of the Federal Law of October 29, 1998 No. 164-FZ “On financial lease (leasing).” And if the movable asset ends up on the lessor’s balance sheet, then he will not have to pay property tax.

The benefit also includes movable property intended to be provided for temporary use for a fee. This property is classified as fixed assets and is reflected in accounting as profitable investments in tangible assets (clause 5 of PBU 6/01). And since this is a fixed asset, then all the rules provided for OS are valid for it, including tax exemption.

Reclaiming property from someone else's illegal possession

To contents

Vindication or vindication claim appeared in antiquity; the concept is literally translated from the Latin “vimdecire” as I declare, I demand. In accordance with Art. 301 of the Civil Code of the Russian Federation, the applicant can only be the legal owner. Art. 302 and 303 of the Civil Code of the Russian Federation divide the types of such ownership into bona fide, when the owner did not know that he was violating someone’s rights, and dishonest.

Art. 302 provides for cases of loss of material assets by the owner, or the person to whom they were transferred, loss due to theft, or in another way against the will of the legal owner. The court also establishes compensation for the amount of income that the owner was unable to receive, or the illegal owner received by exploiting the object of dispute. A vindication claim involves the recovery of movable property from the debtor .

However, if the property was divided incorrectly during the divorce of spouses or the liquidation of an organization, then you should first challenge the legality of the transfer of ownership. Recognition of the right to movable property is often difficult, especially if it has not been registered; such cases in most cases remain unresolved.

Pledge

To contents

Banks offer loans secured by movable property . Thus, the acquired property will be considered a guarantee of payment, or the already acquired property ensures the receipt of funds. Registration of a pledge of movable property takes place on the website www.reestr-zalogov.ru after which it is not subject to sale to third parties.

Seized property

Foreclosure of pledged property may be carried out pre-trial. In this case, the pledgee is notified by the notary. Sale is possible ten days from the date of delivery of the notice, unless other conditions have been stipulated between the pledgor and the pledgee. The deadline for fulfilling an obligation secured by a pledge of movable property may occur earlier, however, with a greater risk of loss in price due to the urgency of the sale.

Brief description of categories of movable property

To contents

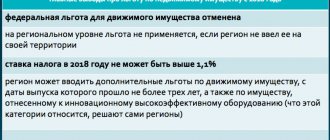

The status of property is assigned in accordance with Article 130 of the Civil Code, but often even specialists are confused whether taxes need to be paid. Art. 374 of the Tax Code determines the objects of taxation. What property should an accountant take on the balance sheet?

Water supply, sewerage, electrical network and cable communication lines

Communications are part of the buildings in which they are laid, and therefore are not subject to accounting. But, all elements of the communication infrastructure are excluded from this rule: cable channels, transitions, all structures and structures included in the system.

Alarm systems, air conditioners, advertising structures, ATMs and payment terminals

Air conditioning and fire protection systems are taxed if installed during construction and are considered integral. Self-contained mobile items are not taxed.

Vehicles

Motor transport, as already mentioned, is considered an exception in the movable category; the owner pays transport tax. However, a vehicle accepted onto the balance sheet as a fixed asset is not additionally subject to property tax assessment.

Improvements in the rented premises

If the tenant has made major permanent changes to the premises, they are recognized as immovable, and tax is charged on them for the entire duration of the lease agreement. Taxpayers object, pointing out that they do not own the premises, but the Ministry of Finance confirms that the tax on movable property is paid as on all fixed assets.

Leased items and objects intended for rent

A fixed asset leased is not subject to taxation, no matter whether it is on the balance sheet of which organization it is located: the owner or the lessee. The benefit is provided for all fixed assets leased.

Property received during reorganization or as a contribution to the authorized capital

All fixed assets transferred by the predecessor organization, as well as the authorized capital, are exempt from taxation.

Used objects

There are no exceptions for used property; it is listed on the balance sheet like any other. The fixed asset is removed from the seller's register and credited to the buyer; no benefits are provided. The sale of movable property by a legal entity is accompanied by the conclusion of a purchase and sale agreement.

Upgraded property

If the property was placed on the balance sheet before January 1, 2013, then during reconstruction and additional equipment only its value will change. Fixed assets purchased after this date are exempt from tax.

Particularly valuable movable property

Such material assets are available only in budgetary or autonomous institutions; they are acquired through subsidies or deductions from the city and regional budgets. Without OCDI, the organization's target activities are impossible. The list of particularly valuable movable property of a budgetary institution varies depending on the activity. So, in an emergency room this will be transport, equipment for resuscitation, and in other organizations - computer equipment, household equipment.

Water supply, sewerage, electrical network and cable communication lines

Perhaps the most controversial objects are communication networks laid in buildings. At first glance, it may seem that they belong to movable property, and, as a result, fall under the benefit. Indeed, sewerage, as well as water and electricity networks, although located in the room, are only part of it. In addition, state registration of communication networks is not required.

However, such objects are real estate. The fact is that, according to the definition given in Federal Law No. 384-FZ dated December 30, 2009*, a building is a single volumetric system, which, among other things, includes engineering support systems. It turns out that the water, gas and electricity supply networks, sewerage, heating batteries and elevators are functionally connected to the building, and their movement would cause disproportionate damage to it.

But cable communication lines are classified as movable objects. This conclusion follows from paragraph 5 of the Decree of the Government of the Russian Federation dated February 11, 2005 No. 68 “On the peculiarities of state registration of ownership and other proprietary rights to line-cable communication structures.” It states that engineering infrastructure facilities created or adapted for the placement of communication cables are subject to state registration. These are cable ducts, above-ground and underground structures, as well as cable crossings.

As for the cable lines themselves, they do not need to be registered. Therefore, they are movable objects and the benefit applies to them. This is stated in the letter of the Ministry of Finance of Russia dated March 27, 2013 No. 03-05-05-01/9648 (see “Organizations have the right not to pay property tax in relation to cable communication lines registered on January 1, 2013”).