What is a payment order?

A payment order is a document that contains the payer’s information for the bank engaged in servicing him about the payments necessary to make from his current account to the accounts of counterparties or to government agencies for a certain amount.

There are two types:

- in electronic;

- in writing.

If the organization does not have remote access to Internet banking, then this order can be downloaded from the link and filled out by hand or on a computer.

Permitted activities

The full list of permitted activities is contained in Art. 346.43 Tax Code. For 2021, there are 63 species on the list. Local authorities have the right to supplement the list (only from the category of providing services to the population), but cannot exclude any items.

The list includes such activities as: repair, knitting and tailoring of any clothes, hairdressing salons, cosmetology services, dry cleaning, production of metal haberdashery, furniture repair, some motor transport services, photo studios, installation and welding work, etc. These are various household or personal services, retail trade (hall area up to 50 m2), various small types of production, catering.

When purchasing a patent, an entrepreneur already determines the type of activity. To make a choice, you can use the calculator on the Federal Tax Service website.

For the calculation you will need the following data:

- work period;

- region, municipality;

- Kind of activity;

- For some types, the number of employees or units of transport and the area of the hall may be required.

An entrepreneur will be able to preliminarily assess whether it is beneficial for him to apply this tax regime. To pay for a patent, an individual entrepreneur can also use the services of the website (make a receipt, calculate the actual cost of the patent).

According to paragraph 2 of Art. 411 of the Tax Code, there is still no need to pay a trade fee for individual entrepreneurs applying the patent. Regimes such as Unified Agricultural Tax and PSN are completely exempt from the Customs Union.

Obligations of the bank and the payer

When making a payment from a current account in a banking organization, when using a payment order, obligations arise for both the payer and the financial organization. There is a certain procedure for filling out the details; the payer is absolutely obliged to follow them when making non-cash payments. If he intentionally or carelessly violates this rule, the payment order may not be executed. This norm is regulated by Article 864 of the Civil Code of the Russian Federation.

By accepting this document for execution, the bank undertakes to transfer the specified amount of payment from the payer's account to the recipient's account using the specified details. This obligation is regulated by the Civil Code in Article 863 paragraph 1.

Patent payment

There is no state fee for issuing a patent. But to obtain a patent, you must first pay personal income tax in the form of a fixed advance payment.

According to paragraph 2 of Article 227.1 of the Tax Code, the amount of a fixed advance payment is 1,200 rubles per month. But this amount is not final, since it is subject to indexation by coefficients:

- deflator set for the corresponding calendar year;

- regional, which is also set for the calendar year by each region.

Therefore, information about the final payment amount must be obtained from the migration department when applying for a patent.

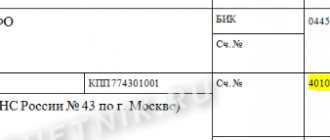

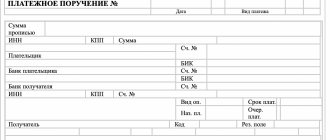

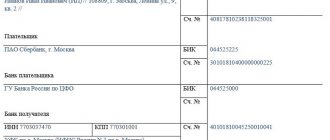

Sample payment order fields in 2021

In electronic form, a payment order can usually be found in two formats: Word and Excel. We also suggest using the online service to automatically fill out all the columns of the payment order.

Payment order, download in Word format : form and sample

Payment order, download in Excel format: form and sample

Receipt for payment of a patent to a foreign citizen

If it is not possible to generate a receipt online, then payment can be made in the MMC departments. You need to contact the employees in zone “P (obtaining a patent) and follow the instructions of the employees.

There is also another option. You can print the receipt, fill it out and pay at the bank. But you need to keep in mind that the receipt form is approved by Letter of the Ministry of Taxes of Russia N FS-8-10/1199, Sberbank of Russia N 04-5198 dated September 10, 2001. Here is a sample of it:

payment document (form N PD (tax), payment form for a patent of a foreign citizen)

This form contains a barcode, in addition, the dimensions must correspond exactly to the specified parameters. Failure to comply with these parameters may make it impossible for bank employees to accept it (for technical reasons). In this case, the payer must be asked to fill out another form in Form N PD-4sb (tax).

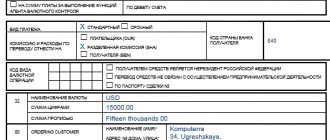

How to fill out a payment order point by point

The details of the future payment in this document are filled in in strictly designated places. A large amount of information in this document is provided in coded form. The encoding is universal for all participants in the process of non-cash financial transfer:

- banking organization;

- recipient;

- payer.

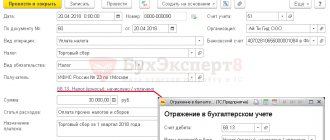

This versatility allows you to introduce automation when recording financial transactions for electronic document management. This instruction is relevant for the current version of the payment order, developed by the Bank of Russia in 2012. The settlement document is filled out on the OKUD form 0401060, the new form is approved by Appendix No. 2 of Regulation No. 383-P. and filled in as follows:

Field 3. Document number. According to the internal document flow in the organization, an ordinal value is assigned. When an individual applies, the number can be assigned by the banking organization independently. The number of characters should not exceed six.

Field 4. The date of sending the payment is indicated in the format DD.MM.YYYY. If you fill out a payment order electronically, the sending time is formatted automatically.

Field 5. Type of payment. Fill in how payment will be made (by mail, electronically, telegraph). It must be left blank when choosing another payment method. When using a client bank, a coded value developed by the bank is entered into the field. .

Field 6. Amount in words. The first letter must be capitalized. Everything is written without abbreviations, at the end the phrase “rubles” is written. Then the number of kopecks is indicated using numbers, after which “kopeck” is written. If the number of kopecks is zero, they can be omitted.

Field 7. Amount in numbers. Rubles are separated from kopecks by a comma. If there are no kopecks, the “=” sign is used. The presence of other characters will make the payment order unusable.

Field 8. Payer. The short name of the legal entity is indicated. persons of the organization, individuals indicate the full last name, first name and patronymic. The type of activity, address, and legal status are indicated in brackets. The person's name and organization name are separated from the location by a "//" (maximum 160 characters).

Field 9. Payer's current account, consisting of 20 digits.

Field 10. Name of the payer's bank, either in full or abbreviated with its location.

Field 11. BIC. Identification code of the payer's bank. It is taken in accordance with the “Handbook of the BIK of the Russian Federation”.

Field 12. Correspondent account, except for those cases when the payer is served by the Bank of Russia or its territorial divisions.

Field 13-17. Above, by analogy, we fill in information about the recipient, bank and account.

Field 18. The number 01 is entered - the type of operation indicating the payment order.

Field 19-20. Leave blank. Only if there were no special instructions from the bank.

Field 21. Payment queue, enter a number from 1 to 6. For example: 3 - contributions, taxes, wages, 6 - payment for purchases (Article 855 of the Civil Code of the Russian Federation).

Field 22. UIN (unique accrual identifier). It consists of 40 characters for legal entities, 25 for individuals. If it is missing, then 0 is written.

Field 23. This is a reserve field and must not be filled in.

Field 24. Purpose of payment. The name of the service or product purchased for which payment is made is indicated here. To be on the safe side, you can specify VAT.

Field 43. Client's stamp, if the payment form is filled out in printed form.

Field 44. Signature. It must correspond to the sample provided when opening an account with a financial institution.

Field 45 is intended for bank marks such as stamps and signatures.

Field 60. Payer’s INN, consisting of 12 characters for legal entities and 10 for individuals.

Field 61. Recipient's TIN.

Field 62. Date of receipt of the payment by the banking organization. This is done by a financial institution.

Field 71. Date of debiting money from the account, filled in by the bank.

Important! Paragraphs 101-110 are filled out only if the payments are intended for customs authorities or the tax service.

Field 101. The payer status is indicated using a special code designation in the range of numbers from 01 to 26 (Order of the Ministry of Finance of Russia dated November 12, 2013 No. 107n).

Payers of insurance premiums are recommended to use the following codes to fill out a payment order:

- code "01" - legal. persons making payments to individuals. persons;

- codes “09”, “10”, “11”, “12” - individual entrepreneur;

- code "13" - physical. faces.

Individual entrepreneurs must indicate whether they pay contributions for themselves or for their employee.

Field 102-103. The payer's checkpoint (9 digits), if there is one, and the recipient's checkpoint cannot begin with two zeros.

Field 104. Budget classification code (BCC).

Important! Since 2021, changes have occurred, and now the recipient of contributions is not the Pension Fund, as before, but the Federal Tax Service, with the exception of cases of contributions to the Social Insurance Fund for injuries. Starting in December, new BCCs must be indicated. You can find out the details of your Federal Tax Service here.

Field 105. OKTMO code.

Field 106. Payment basis, consisting of two special characters. Below are the main codes for filling out field 106 in the 2021 payment order.

| Situation | Code |

| Tax payments (insurance contributions) of the current year | TP |

| Voluntary repayment of debts for expired tax periods in the absence of a requirement from the tax inspectorate to pay taxes (fees, insurance contributions) | ZD |

| Repayment of debt at the request of the tax inspectorate for payment of taxes (fees, insurance contributions) | TR |

| Repayment of debt according to the inspection report | AP |

| Repayment of debt under a writ of execution | AR |

Field 107. Shows the frequency of tax payments: per month, per quarter, per year.

Field 108. Payment basis number. Enter the number of the document on the basis of which the payment is made. If the values of TP or ZD are indicated in the previous paragraph, then “0-zero” must be entered here.

Field 109. Document date. If the value 0 is specified in paragraph 108, then 0 is also entered here.

Field 110. Remains empty after changes in legislation came into force in 2015.

Important! From 2021, any corrections to the payment order are not allowed.

Receipt for payment of the patent

Interest in how to pay for a patent through Sberbank online arises among all foreigners who have crossed the Russian border without a visa and intend to get a job legally. Especially for this category of citizens, the current legislation provides for the issuance of a work permit. It is issued for 12 months and a mandatory condition for its validity is timely payment. You can make payments monthly or quarterly, and there are different ways to do this, including using your personal account on the website of the country's main bank. Step-by-step instructions on how to pay for a patent through the Sberbank online application will help you transfer money quickly and easily, avoiding errors and additional difficulties.

InfoMoney from paying for patents goes to the regional budget, which bears the main burden of financing social expenditures in the region, and therefore is almost always in deficit. In addition, an increase in patent fees in a region with high unemployment makes it less attractive for a migrant to work in the region, stimulating the attraction of local labor resources. When will the patent fee for 2021 be known ? In the last days of November. The size of the monthly fee for a patent depends on two coefficients: the deflator coefficient and the regional coefficient, reflecting the characteristics of the regional labor market. The deflator coefficient for the next year is set by the Ministry of Economic Development of the Russian Federation several months before the end of the year. It is the same for the entire country. After its announcement, regional coefficients are established in each region.

Attention: From January 1, 2015, all migrants wishing to obtain a work permit in Russia are required to pass a comprehensive test in the Russian language, fundamentals of law and Russian history and receive a certificate confirming passing the exam. The cost of passing the exams is 4.9 thousand rubles if a visitor is applying for a work permit, and 5.3 thousand. How to pay for a patent In fact, this statement is erroneous and payment should be made based on the date of issue of the patent. Thus, in the specified formula there is only one variable - the regional coefficient, and therefore the amount of payment for a patent depends on the Russian region in which it is issued. How to pay In order not to lose the right to carry out labor activities on the territory of Russia, foreign citizens must comply with the deadlines and procedure for making payments to pay for the patent.

Nuances

In most cases, four instructions are drawn up:

- the first is needed to write off money at the payer’s bank and remains there, ending up in daily documents;

- the second is stored in the recipient’s bank and is needed for crediting to the second party’s account;

- the third is used as confirmation of the bank transaction and is attached to the account statement of the second party;

- the fourth is given to the payer with a seal imprint as confirmation of payment.

Attention! The banking organization accepts “payments” even if the balance in the payer’s current account is less than the amount specified in the order. The payment order is executed only in the opposite case.

When the payer contacts a banking organization for information about the execution of orders, they are provided to him on the next business day.