Name of the payee what to write

To make a transfer from your Alfa-Bank account in favor of a client of another bank, you must indicate:

- name of the recipient of funds

- beneficiary account number

- Recipient's TIN

- BIC of the recipient's bank

- purpose of transfer

- account for debiting funds

- transfer amount in rubles

Let's look at the rules for filling out some parameters in more detail.

- In the “Name of Recipient” field, you must enter the name of the legal entity or the full name (full name) of the individual - the recipient of the payment. For example, LLC “Name of Organization” or “Ivanov Ivan Ivanovich”;

- In the “BIC of the beneficiary's bank” field, you must indicate the BIC (Bank Identification Code) of the payee's bank.

Moscow Budget classification code: 182 1 0800 110 OKATO code: 45286555000 Payer (full name): Petrov Ivan Fedorovich Payer address: 105425, Moscow st. Znamenskaya, house 24, bldg. 2., apt. 33 INN of the payer: 771908377721 Personal account number of the payer: 40101810800000010245 Payment by due date Amount of tax (fee) Penalty Fine Total payable TPL 3500 rub. 00 kop.

To another bank

Important

As you enter the code, a list will appear on the screen from which you can quickly select the desired bank by clicking on it with the mouse: the bank name, city and correspondent account will be filled in automatically;

- In the “Recipient INN” field, you must indicate the TIN (Taxpayer Identification Number) of the payment recipient. This field is required for legal entities.

For individuals, if the recipient has not been assigned a TIN, the field can be filled in with zeros;

- In the “Transfer number” field, the serial number of the transfer will be automatically entered by default. You can leave the default value in this field or enter your own numbering of transfers;

- In the “Purpose of payment” field, indicate the purpose of the payment as agreed with the recipient.

State duty on cases considered in courts of general jurisdiction, justices of the peace (with the exception of state duty on cases considered by the Supreme Court of the Russian Federation) 182 1 0800 110 State duty on cases considered by the Supreme Court of the Russian Federation 182 1 0800 110 State duty for state registration legal entity, individuals as individual entrepreneurs, changes made to the constituent documents of a legal entity, for state registration of liquidation of a legal entity and other legally significant actions 182 1 0800 110 State duty for the right to use the names “Russia”, “Russian Federation” and formed based on them, words and phrases in the names of legal entities.

Payee's name

For transfers in favor of legal entities, the name of goods, works, services, numbers and dates of documents: contracts, invoices, etc. may be indicated (for example: “Payment of invoice No. 85 dated March 25, 2011”). For transfers in favor of individuals, you must indicate the reason for the transfer (for example: “Financial assistance”, “Gift”, “Repayment of debt”, etc.). In addition, the Internet bank supports transfers in rubles using details from a resident (individual).

person) to a non-resident - a client of another bank. Always check the name and bank details of the recipient before sending the transfer. If you specify one of these parameters incorrectly, your money will be temporarily blocked, but as soon as the payment is verified and rejected, it will again be available for use for any purpose.

Purpose of payment: what to write? rules for filling out payment documents

Attention

We recommend that you read Problems of division and development of the Arctic shelf 'Document' Initially, the development of the Arctic went through a romantic period - the development of something new, the heroism of national victories in this field. Then - the scientific stage (research... completely Lyazh tour Novokuznetsk, st.

Rokossovsky, 3 'Document' "Great Peterhof Road - the road of emperors and presidents" to the imperial residence of Peterhof. Visit to the Great Peterhof Palace. Truancy...in full Recommend to the Mayor of Moscow to introduce the specified draft law 'Law' Currently, in Moscow, taking into account contaminated soils and sludge from treatment facilities, more than 18 million tons of industrial waste and consumed...in full Musical repertoire (1) 'Lesson' by F. Chopin. "Polonaise". 11 What the musical genre is about (continuation of the topic). F. Chopin. "Waltz". 1 Game library. P.I. Tchaikovsky.

Type of transfer (for what)? Reply from 2 replies[guru]Hi! Here is a selection of topics with answers to your question: What is the Name of the payee? What should I write there? What name of payment should be indicated in the payment order. If I transfer the amount of goods and materials to the accountable person on the card? tags: Cards Payment order: how to correctly write “payment in form KS-2 or KS-3” in the name of the payment? Wrote KS-2.

What is the name of the payee? What should I write there? tags: Sberbank online payments. Purpose of payment, please tell me the purchase and sale agreement with installment payment for a car or motorcycle vehicle. What should I do if I indicated the wrong name of the recipient (another company altogether) on the payment order, and all other details are the same? What are PAYMENT DETAILS? You must indicate them in your refund application.

Purpose of payment: what to write

State duty for carrying out actions related to licensing and certification in cases where such certification is provided for by the legislation of the Russian Federation.

182 1 0800 110 State duty for state registration of commercial concession (subconcession) agreements, changes made to such agreements, other state fees for state registration, as well as for the performance of other legally significant actions.

In the “OKATO Code” field, the value of the OKATO code of the municipality is indicated in accordance with the All-Russian Classifier of Objects of Administrative-Territorial Division, on the territory of which funds from paying taxes (fees) are mobilized into the budget system of the Russian Federation.

Source: https://kodeks-alania.ru/naimenovanie-poluchatelya-platezha-chto-pisat/

Alfa Bank

constitutional (statutory) subjects of the Russian Federation

182 1 0800 110 State duty on cases being considered

In the field - “Name of payment” - indicate the type of legally significant action for which an individual applies and for which the state duty is paid, as well as the name of the state body.182 1 0800 110 State fee for cases heard in courts

Supreme Court of the Russian Federation)

182 1 0800 110 State fee for state registration

Details are the most important thing in any banking transaction! :

What is it? Of course, we will be talking about bank details, and not about theater props. Although these words have in common not only the spelling, but also partly the meaning. Indeed, in various dictionaries the meaning of the word “details” is a combination of something, something necessary, obligatory.

Bank details. What are they for?

Everyone in their career or in some life situations has had to deal with this concept. Details are bank account details that are necessary in order to make a payment.

Even without conducting any business activity or making bank transfers or non-cash payments, each person indicates them, for example, when paying utilities or some kind of state duty.

Of course, you don’t always have to do this manually; most often, a bank or some organization gives you forms with the data already entered into them. There are often situations when you may be asked to provide your details for transferring, for example, social benefits to you.

For legal entities

Among the data of any organization or individual entrepreneur, bank details are one of the required items.

After all, a legal entity is required to have a bank account, which must be registered with the tax office, and the details of this account, and if there is more than one, then the main account available, are necessarily indicated in many documents.

For example, they must appear in any contracts, as well as invoices issued by the organization, invoices, invoices and other documents. Without them, these organizations are considered incomplete, and the document may be deprived of legal force.

Composition of bank details

The following data is required; it is with them that the fields in the payment order or receipt drawn up when making payments are filled in:

It is worth noting that when making a payment to the state budget, the correspondent account number will not be among the details.

Instead, the name of the bank indicates the branch number of the Moscow State Technical University of the Bank of Russia - this is where tax and other similar payments are distributed.

Be careful with the name of the payment recipient! Often there, among other details, the personal account number necessary for the correct direction of funds is indicated.

How to find out bank details

The last three of the listed items (name, correspondent account, BIC) are bank details. They are the same for all recipients within the same institution. In addition, there are special electronic databases used by employees of accounting departments of enterprises, as well as banks and other institutions, which are constantly updated and contain the necessary details for payment through all well-known banks.

They can be found out by contacting bank employees, as well as by visiting the website of the desired institution. The remaining details are individual information for each recipient.

In order to find out your bank details, namely the current account number, you need to refer to the documentation drawn up when concluding an agreement on opening a bank account, as well as to bank employees who, having verified your identity, will provide you with the necessary information.

All of the above also applies to transferring money to a bank card. In addition to the card number, there is also the account number to which it is linked. In some cases, a card number alone may not be enough to send or receive money and full bank details may be required.

Source: https://www.syl.ru/article/186408/new_rekvizityi—eto-samoe-vajnoe-pri-lyuboy-bankovskoy-operatsii

Details for transfer to Alfa-Bank

The second part of the details will be different for each shipment.

These details are relevant for ruble accounts. If you need to send a transfer in foreign currency, then other data will be needed. They can be viewed on the official website alfabank.ru/retail/accounts. You just need to click on the name of the currency - and the details will appear on the computer screen. The third part of the details is the personal data of the individual. This is his TIN (only for individual entrepreneurs and legal entities) and account number (do not confuse with a correspondent account!). What happens if Alpha Bank doesn’t pay the loan? If there is no Alfa-Click or for some reason you cannot use it, or if the sender of the funds absolutely needs an official document with all the seals and signatures of authorized employees (for example, for tax or accounting at the place of work), then you can visit a bank branch.

So, the data of the head branch and individual divisions of Alfa-Bank are in the public domain. To find out, just visit the official website of the institution and find the necessary information on the Details page.

It will also be necessary to indicate the last name, first name and country of the payment recipient. This is especially important if he comes to withdraw money from the bank with a passport. Incorrect information will serve as grounds for refusal of payment.

Payee account: what is it and how to find out its number

To use a bank card every day, you do not need to know your account details.

The details on the surface of the plastic (16-digit and CVC2/CVV2 numbers) are enough to replenish it, make purchases and make online payments.

In some cases, you may need a PIN code, for example, if you need to cash out at ATMs or when paying with certain terminals.

It is necessary to know the recipient's account (RA) when transferring funds between legal entities and individuals, repaying a loan, or transferring money from a foreign bank. Also, to perform these operations, you may need the correspondent account number of the recipient's bank.

What is a payee account?

SP is a bank account consisting of 20 digits. The card acts as a kind of access to it, protecting it from hacking and other unauthorized actions.

After the expiration date of the plastic, if it is lost or replaced with a new one, the personal account does not change. This means that it remains unchanged until the client himself wants to close it or open another one.

It is important not to confuse the SP number with the card number.

There are three ways to find out the details :

- online;

- by calling;

- by contacting a banking institution.

✅ RECOMMENDED: What is the difference between a current and personal account

Contact a banking institution

To use the first two methods, you need to know all the verification information that the bank will request. However, it happens that the client does not remember it or did not indicate it at all.

The surest and fastest way to obtain data in this case is to visit the nearest bank branch.

By providing documents identifying the owner, he will receive all the necessary information.

Bank staff can provide information printed on paper. Such a printout is required if another bank requests data for a funds transfer.

Via online service

The second way to find out the details is to use online banking (for example, the Sberbank-online service), if this function was enabled during registration.

If it turns out that the user does not have access to information online, he can make a request to the nearest bank branch and connect to this service. Its annual cost is determined by the bank.

Call the bank

Find out the details by phone call. To do this, you need to call the code word specified during registration.

If the recipient names the correct word, then he is provided with all the data by phone or by mail.

To receive and send money you need to know the SP. You can find out by contacting or calling the bank, as well as using the online service.

Source: https://rubliplus.com/banki/chto-takoe-schet-poluchatelya-platezha-i-kak-ego-uznat.html

What are the card details?

On the map itself, the following data immediately catches your eye:

- First and last name of the card holder;

- Expiration date of plastic;

- Six-digit card number. It is important not to confuse the card number with the account number, because... these are fundamentally different things;

- On the reverse side, in addition, there is a CVV code consisting of three digits.

So all this information is the card details. In addition to them, the details include the account number (we will look at where to get the card details later). The thing is that every debit card is linked to a bank account - debit - from which funds are debited.

Transfers from an account are more secure and they provide more freedom: for example, when sending money from account to account, the limit on the transferred amount is much higher than for similar “card” transfers.

Therefore, some transfers require an account number. It is not indicated on the card - the card number is written on the front side, not the account number.

Bank account details - how to find them out

What information is included in bank account details?

How to find out bank account details

How to find out account details using the Internet

How to find out someone else's account details

What information is included in bank account details?

There are different types of accounts opened by a banking organization for clients (see Chapter 2 of Bank of Russia Instruction No. 153-I dated May 30, 2014). At the same time, the composition of the details of any account (including card account) usually includes:

- The name of the recipient's bank (i.e. the actual bank in which the account is opened).

- TIN, KPP and BIC of the recipient's bank (and not the account owner himself).

- Correspondent account of the recipient's bank.

- Recipient's name: last name, first name, patronymic of the account owner - an individual or name if the account owner is an organization. If the account is opened for an individual entrepreneur or other individual engaged in private practice in accordance with the procedure established by law, the full name of such person and his form/type of activity (for example, individual entrepreneur, notary, etc.) are indicated.

- Name of the account (for example, current account, current account, trust account, etc.).

- The actual account number.

How to find out bank account details

You can obtain account details in the following ways:

- Inquire at a bank branch. In this case, the individual must have an identification document and a card (if we are talking about a card account). The representative of the legal entity also presents an identification document and a document confirming his authority (power of attorney, order, etc.). On this issue, we also recommend that you read our article Power of attorney to a bank from a legal entity - sample.

- Look in the application form for opening an account or the bank account agreement. Account details (including card details) are issued by the credit institution immediately after opening such an account, drawn up on a separate form or included in the bank account agreement.

- Call the hotline at the call center of the servicing bank. It must be borne in mind that in order to identify the account owner, call center employees may require certain personal data (for example, passport data), a code word specified in the account opening application form, or the answer to a secret question, also recorded in advance in questionnaire.

- Use a self-service terminal or ATM. This method is suitable for plastic card holders (including corporate ones). A plastic card is inserted into an ATM or terminal, then the corresponding tab is selected in the menu (usually called “My payments”, “My account”, etc.), which contains the “Account details” tab.

How to find out account details using the Internet

You can also find out the details using special banking resources on the Internet or the account user’s personal account. Thus, for these purposes you can use:

- Internet bank. Usually, to manage the account of both an individual and a legal entity, an Internet bank connection is made. In this case, by opening a special tab (most often it is called “Accounts and Cards”, “My Account”, etc.), you can view the account details, including saving them on electronic media for future use. An alternative option is to create any payment order, which will automatically include the sender’s details.

- The official website of the bank without logging into the account holder’s personal account. This option is relevant in the case when the account owner has information about his account number, but, for example, does not remember the general details of the servicing bank (correct name, BIC, correspondent account, etc.).

- Email. Some banks may send the account owner his details in response to a request sent to the address of a special service in the bank in the prescribed form.

How to find out someone else's account details

Often in practice there is a need to find out the details of someone else's account (for example, a debtor, a counterparty, etc.). To obtain this data, if it is not possible to establish it using existing documents (agreement with a counterparty, company card, etc.), you can resort to the following methods:

- searching for information about the details of the entity on its official website on the Internet (usually only possible in relation to business entities that post bank details on their pages on the Internet);

- requesting information from the Federal Tax Service of the Russian Federation (see paragraph 8 of Article 69 of the Law “On Enforcement Proceedings” dated October 2, 2007 No. 229-FZ);

- requesting information from banks or other credit institutions.

Source: https://rusjurist.ru/bank/bankovskie_scheta/kak_uznat_rekvizity_bankovskogo_scheta/

Details for transfer to an account in Alfa-Bank

Ruble . For ruble transfers, use the name, BIC and TIN of the bank indicated above. Address of the Central branch: Moscow, Kalanchevskaya street, building 27. It is also necessary to enter data about the recipient: last name, first name, patronymic, twenty-digit account number. If the recipient has a TIN, indicate it.

To transfer funds to the account of a recipient - a legal entity (OJSC, CJSC, LLC and others) serviced by Alfa-Bank, indicate the same TIN and BIC of the bank as for individuals. What happens if the Alpha Bank loan is overdue? Request a complete list of addressee details:

- Full name of the credit institution: JSC Alfa-Bank.

- Correspondent account 3010-1810-2000-0000-0593.

- BIC (Bank Identification Code) - 044-525-593.

Contents [Hide] Details vary depending on the selected currency. Be careful when filling out documents, choose the correct details, otherwise the transfer operation may be cancelled. Regardless of the region of residence, general details apply to all individuals in Russia:

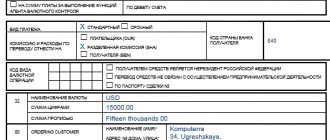

Payment order details

A payment order is a document that is filled out and submitted to the bank by its client in order to initiate the transfer of funds from his account to the account of another person in the same or any other bank. Payment order details contain a comprehensive amount of information about the payer, recipient, their banks and the purpose of the payment.

In this case, the payer’s order must be formalized accordingly. Currently, all of its fields are regulated by separate instructions of the Central Bank of the Russian Federation and official letters of the Ministry of Finance, and the nature of their location on a sheet of paper must comply with the rules for designing the form 0401060.

From a legal point of view, settlements using payment orders are regulated by Article 863 of the Civil Code of the Russian Federation.

General principles

In order to fulfill the client’s order, the executing bank must know about:

- Who will be the recipient of the money;

- What amount should be transferred from account to account;

- What is the purpose of the payment?

Despite the fact that the executing bank is aware of its own details and the payer’s data, they are still indicated in separate fields of the order. The document itself receives a specific number and the date of payment is fixed.

This is important due to the fact that, according to the law, if the payer and recipient’s bank are located within the territory of one subject of the country, then the payment should take no more than two banking days, and if in different ones, then no more than five. This requirement becomes especially relevant for non-cash payments, which provide for the payer’s responsibility for each day of delay.

The payer can be a legal entity or an individual. In the latter case, its main payment details differ only in that instead of the company name, the last name, first name and patronymic will be indicated, and the checkpoint field is not filled in at all.

Main fields of a payment order

Let's look at the main fields that the form contains. At the top of it there is a column “Type of payment”. It contains data about how the transaction was carried out. If BESP is used for this purpose, then a corresponding mark is made above the line. For example, “electronic”. When using other methods, now almost completely outdated, such as postal or telegraphic transfer, nothing is usually specified.

Below is a spacious field for indicating the amount in words. It is required to be filled out, regardless of the method of generating the document - manually or electronically. In the latter case, if some special software is used, then the numbers are converted into words programmatically. It is important that the words “rubles” and “kopecks” are written in full, without abbreviations.

This is followed by the most important columns that the payment order contains - details of the payer and recipient:

- Names of organizations for legal entities or first and last names for individuals;

- Individual taxpayer number (TIN), which can be checked with the tax service if it is unknown;

- Registration reason code (RPC) is a combination of numbers indicating the registration characteristics of a legal entity;

- Name of the payer's bank.

It is typical that for both the payer and the recipient, bank details, which are expressed in numbers, must be indicated on the right side. This is the BIC and account numbers - settlement and correspondent. The settlement account is opened for the bank client, and the correspondent account is assigned by the Central Bank to the bank itself serving the recipient.

Also to the right of the data about the recipient and his bank are the following fields:

- Type of payment - code 01 is always indicated, which means transferring money from account to account;

- Payment term - usually the field is left blank and is filled in only if it is established by the bank’s rules;

- Payment purpose is a destination code, which also depends on the bank’s rules;

- order of payment - indicated by a number, in accordance with the law;

- Code - was not filled in until March 31, 2021, now the value of the unique payment identifier (UPI) code is entered in the field;

- Reserve field - remains empty unless any other rules are established by the bank.

All this data relates to the recipient, and the fields are filled in if his bank communicated them and its rules to the payer.