Punishment for non-payment of taxes

So, paying taxes is one of the main responsibilities of taxpayers (subclause 1, clause 1, article 23 of the Tax Code of the Russian Federation):

- Legal entities.

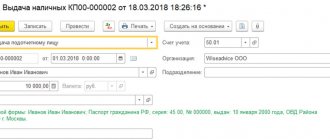

The amount to be paid to the budget is determined by the organization independently, depending on the taxation system applied. It is reflected in tax reporting submitted to the Federal Tax Service at the end of the reporting (tax) period.

- IP.

Entrepreneurs themselves calculate only those taxes that they pay in connection with their business activities. The only exception is PSN. In this mode, the tax (patent cost) payable is calculated by the tax authority. As for property taxes of individual entrepreneurs (on land, transport, property), the Federal Tax Service Inspectorate is responsible for their calculation.

- Self-employed (NPP payers).

The tax payable by self-employed citizens is calculated independently by the Federal Tax Service on the basis of data on the income received, reflected in the “My Tax” application. The amount to be paid is reflected in the application.

- Individuals.

In most cases, the Federal Tax Service calculates all taxes for individuals independently (property tax, land tax, transport tax). The exception is personal income tax. A citizen who has received taxable income from the sale of property (apartment, land, car) is obliged to declare it and pay income tax on it to the budget.

As punishment for non-payment of taxes, the Federal Tax Service has the right to:

- write off the amount of debt from the current account of an organization or individual entrepreneur (Article 46 of the Tax Code of the Russian Federation);

- block the taxpayer's current account (Article 76 of the Tax Code of the Russian Federation);

- seize the organization’s property (Article 77 of the Tax Code of the Russian Federation);

- go to court to collect the debt (clause 2 of article 45 of the Tax Code of the Russian Federation).

In addition to these sanctions, penalties and fines may be assessed on the amount of debt.

Certificate of debt from the Federal Tax Service

A certificate about the status of settlements with the budget will be required if an organization (IP) needs to find out the exact amount of debt for a specific tax.

The certificate of fulfillment of the obligation does not contain exact data on the amount of debt and the types of taxes for which this debt arose. It only reflects information about whether the taxpayer has fulfilled his obligation to pay taxes (fees, insurance contributions). If an organization or individual entrepreneur has an arrears, the Federal Tax Service will generate a certificate with the entry: “It has an unfulfilled obligation to pay taxes, fees, insurance premiums, penalties, fines, interest payable in accordance with the legislation on taxes and fees.” As a rule, this document is requested by legal entities when applying for participation in a tender or to obtain a loan from a bank.

To obtain such certificates, you will need to send a corresponding request to the Federal Tax Service. This can be done in your personal account on the Federal Tax Service website, by sending a request to the Federal Tax Service Inspectorate in writing or via TKS. This document does not have a unified form, but the Federal Tax Service website contains recommended request forms. To obtain certificates, we recommend using these document forms to avoid possible disputes with tax authorities:

Request for a certificate in writing:

Request for information in writing

Request for information on TKS:

Request for information on TKS

Suspension of transactions on taxpayer accounts

Suspension of transactions on accounts is the cessation by the bank servicing the taxpayer of expenditure activities on his account in full or within a limited amount determined by the decision of the tax authority on suspension for a legal entity. Blocking occurs only for expenses . Funds continue to flow into the account.

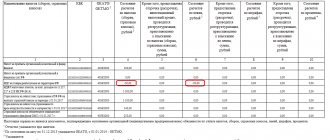

- Compensation for harm caused to life and health, and payment of alimony;

- Settlement with dismissing employees, which includes the balance of the last month’s salary, compensation, severance pay, and remuneration for authors for intellectual products;

- Fulfillment of duties regarding taxes, fees, insurance premiums, penalties and fines.

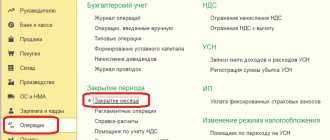

How to find out tax debt through your personal account

An organization or individual entrepreneur can obtain data on existing tax debts and fees in their personal account on the Federal Tax Service website.

To register in your personal account, an organization will need to issue an electronic signature to the director or other responsible person of the company.

Individual entrepreneurs can use the login and password from the personal account of an individual taxpayer to access their personal account. If the individual entrepreneur has not opened a personal account at all, he can do this in 3 ways:

- By contacting any Federal Tax Service with your passport and TIN. After checking the documents, the tax authority employee will issue a document with a login and temporary password, which will need to be replaced within 1 month.

- Using the State Services login and password. This method is only suitable for those individual entrepreneurs who have a confirmed account on the State Services portal. If it is not there, then it is easier to contact the Federal Tax Service for a login and password for the LKN.

- Using digital signature. This option is convenient for those individual entrepreneurs who have a qualified digital signature. If it is not there, then issuing an electronic signature only for opening a personal identification document is inappropriate.

Where to view the decision on collection by number

Situations often arise when a person is aware of the decision regarding his order, but for some reason does not receive it. The debtor is interested in the timely execution of this order (so as not to receive an additional fine) or appealing it (if there is evidence of his innocence).

Read more: Land surveying of public lands in the SNT law

The Federal Tax Service website operates a service that allows third parties to obtain information about organizations that have not submitted tax reports for more than a year; there you can also view tax debts over 1,000 rubles, aimed at collection by bailiffs. To do this, just indicate the TIN of the organization you are interested in.

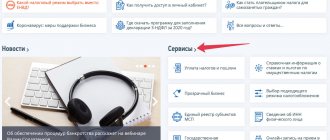

How to find out debt through State Services

This method is only relevant for individual entrepreneurs. Organizations will not be able to find out about their debt to the budget through State Services.

To receive information, an individual entrepreneur will need to log in to the system using the individual’s login and password. That is, in order to find out his debt, an individual entrepreneur must have a confirmed account with State Services.

Why can individual entrepreneurs find out about their debt through State Services, but organizations cannot? The whole point is that an individual entrepreneur is responsible for his obligations with all his property and his debts are transferred from him as an individual entrepreneur to him as an individual. Organizations, in exceptional cases, are liable for their obligations with personal property (subsidiary liability).

We will look at more details about how an individual can find out about his tax debt on the State Services portal below.

Debt verification service on the website of the Federal Tax Service of the Russian Federation

In total, the Federal Tax Service website has several services for checking whether an organization or individual entrepreneur has debt. The most popular of them:

- “Information about legal entities that have tax arrears and/or have not submitted tax reports for more than a year.”

This service is intended more for checking counterparties than for obtaining information about the presence of debt in “your” organization. With its help, any interested party can find out whether his counterparty is a tax debtor. If the organization has a debt to the budget of more than 1,000 rubles. and/or does not submit reports for more than a year, information about this is entered into the Federal Tax Service database and becomes publicly available. But information can be obtained using this service only for legal entities. Individual entrepreneurs, self-employed people and individuals are not reflected in it.

- "Transparent business".

Another service from the Federal Tax Service. Just like the previous resource, this service provides information about legal entities according to several parameters:

- “Mass” director - whether the head of the organization (IP) is a director in several legal entities.

- “Mass” founder - whether the head (participant) of an organization (IP) is a founder in several companies at once.

- Disqualification of a director - whether the head of the organization (IP) is included in the register of disqualified persons.

- “Mass” legal address - whether the organization uses a mass registration address, that is, one for which several legal entities are registered.

- Data on filing documents for state registration - whether the organization or individual entrepreneur has submitted documents to make changes to the Unified State Register of Legal Entities (USRIP) in the near future.

How to find out the tax debt of an individual

A citizen can independently find out about the presence of a tax debt in several ways:

- In your personal account on the Federal Tax Service website

This method is suitable for those who have access to LKN. Using the LKN, you can find out the exact amount of the debt and the type of tax for which it was formed. In LKN, you can immediately pay the debt in several ways: by generating a receipt or paying online through the website of the selected bank.

- On a personal visit to the Federal Tax Service.

To obtain information, an employee of the Federal Tax Service will need to present a passport and Taxpayer Identification Number (TIN). You can make an appointment with the inspectorate online on the Federal Tax Service website.

- Through the State Services portal.

To obtain information about tax debt, you need to fill out an application in which you will need to indicate your TIN. But if you have a confirmed account containing information about the TIN, you do not need to do this: the system will automatically generate data on the presence or absence of debt. You can also pay existing arrears online at State Services.

- At the MFC during a personal visit.

To find out your tax debt, you can contact any (MFC). To do this, you will need to fill out an application for recognition of confidential tax information (all or part for a certain period) as publicly available.

- On the SSP website.

If you have any unresolved questions, you can find answers to them in ConsultantPlus.

Full and free access to the system for 2 days.

Actions in the presence of restrictions

If the account is blocked, debit transactions are not possible. Finding out about account blocking on the tax website is the first step to solving the problem. Next, you need to figure out what caused such actions by the tax authorities, especially if the Federal Tax Service did not send an official document indicating the grounds and amounts. After all, there is always the possibility of a system failure.

Read more: Contract for safekeeping of funds

You can check online at any time whether your current account is blocked by the tax office. Since this service allows you to find out the decision numbers, finding out the details on them will not be difficult.

If the tax authorities made a mistake, the department will have to compensate the victim for losses. It pays interest in the amount of the refinancing rate for each day of inactivity.

If the sanction was imposed lawfully, the money will have to be paid. You can do this voluntarily, or you can wait for the first receipts - the funds will be debited automatically.

Let's sum it up

- Timely payment of taxes is one of the main responsibilities of organizations, individual entrepreneurs and individuals.

- Organizations and individual entrepreneurs can find out about their debt by requesting a certificate about the status of settlements with the budget or about the fulfillment of the obligation to make payments.

- You can also obtain data on existing tax arrears in your personal account on the Federal Tax Service website, in the “Tax Debt” service on the State Services portal and by personally contacting the Federal Tax Service Inspectorate and the MFC (relevant only for citizens).

- You can also find out about debt to the budget on the FSSP website, but only if enforcement proceedings have already been initiated in relation to this debt.

If you find an error, please select a piece of text and press Ctrl+Enter.

Blocking of a current account by the tax office or bank

Most financial transactions of legal entities and individual entrepreneurs pass through current accounts. This is a tool through which non-cash payments are made, salaries are issued to employees, and more. But situations often arise when a current account is blocked. We’ll talk today about what to do in this case.

Negative consequences certainly arise and they are serious. Sometimes blocking a current account practically paralyzes the company’s activities. You cannot conduct settlements with counterparties, there is a risk of accidentally “losing” money, and problems may arise when opening an account with another banking organization.

Read more: How to calculate vacation pay after leaving maternity leave