In the economic activities of almost any company, there are operations of issuing funds/DS to an employee from the enterprise’s cash desk, for which the employee is then obliged to either report or return the received funds to the cash desk.

In this article we will look at several examples of operations related to the accounting of funds issued on account, the issuance of money by the cash register, as well as the return by an employee of previously received and unused funds. Let us separately dwell on the features of accounting for such operations and extreme situations encountered in practice.

In accordance with the current law, the recipient of DS issued on account can be either an employee of the enterprise, i.e. an individual with whom an employment contract has been concluded, or a person with whom a civil law agreement has been concluded, for example, a contractor carrying out work under such an agreement.

As a system for modeling the operation that allowed us to generate a report on advances, we will use the 1C: Enterprise Accounting 3.0 configuration.

Issuance of funds on account

The procedure for issuing DS for reporting is regulated by the Regulations on the procedure for conducting cash transactions dated 10/12/2011 No. 373-P.

The basis for extradition is the application of the accountable person. The application must have the manager’s handwritten signature indicating the amount and period for which cash is issued, his signature and date.

In 1C 3.0, the issuance of a DS/report to an employee is carried out:

- By means of a “Cash expenditure order” with the type of business operation “Issue to an accountable person”;

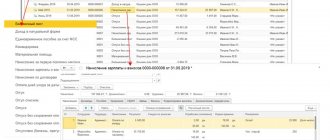

Fig.1 Issuance of money/report using a cash receipt order - The document “Payment order” with the type of operation “Transfer to an accountable person”;

Issuance of money against the document Payment order - “Issuance of monetary documents” to an accountable person. For example, a fuel card, travel pass, etc. can serve as a monetary document. Despite the fact that a monetary document is a material object, such documents are recorded in total terms.

In all documents issuing DS for reporting with the corresponding types of transactions, there is a mandatory “Recipient” field, in which you must select from the “Individuals” directory the employee to whom the funds are issued (transferred).

Regardless of the method of issuing funds for reporting - in cash from the cash register or by bank transfer to an employee's account (to a card), the essence of the business transaction does not change. In 1C Accounting, accounting for DS issued for reporting is kept on account 71: DS account 71 (for debit) corresponds with account 50 or 51 (for credit), depending on how the money was issued.

How to prepare an advance report

Since DS are issued on the basis of an employee’s application, we can conclude that the organization has the right not to accept an advance report from an employee who has not previously been given funds on account (or was issued, but for other purposes). In this case, information about the costs incurred by the employee is not reflected in the system.

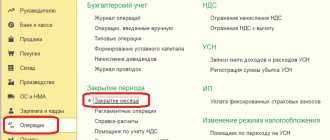

You can create a new document “Advance report” from the “Bank and cash desk” subsystem, then the “Advance reports” command.

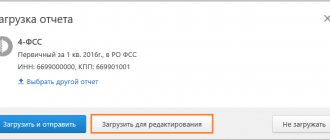

The header of the document must indicate to whom and from which company the funds for which the employee is reporting were issued.

Fig. 3 Preparation of an employee’s advance report

The document also contains a number of optional fields used to print advance reports by the employee (printed form AO-1) or, if the advance report contains goods purchased by the employee, to print a receipt order (printed form M-4).

If you need to change or supplement printed forms, contact our specialists; we will provide 1C modification services as soon as possible.

Using an expense report, you can reflect a whole range of employee expenses:

- Acquisition of inventory items (tabular section “Goods”). In this part, the functionality of the Advance Report duplicates the capabilities of the “Receipt of Goods and Services” document;

- Register the receipt of returnable packaging (tab “Returnable packaging”);

- Reflect the payment of DS to the supplier against future receipts or for previously delivered goods/rendered). The key difference between this operation and the operation of reflecting the purchase of goods and materials is that when displaying the operation on the “Goods” tab, the accountant must indicate specific values purchased by the employee by selecting them from the “Nomenclature” directory, whereas when reflecting the expenditure of funds on the “Payment” tab It is enough to indicate the amount and recipient of the funds. You can also indicate in free form the details of the incoming document and the content of the transaction. This data will be used when filling out the printed form of the Advance Report (AO-1).

- Reflect other expenses (tab “Other”). On the tab, you can reflect other expenses by specifying expense accounts manually.

The “Advances” tab stands out, where it is necessary to list the documents with which funds were issued to the employee for reporting.

According to current legislation, an employee who has received funds on account is required to report on the use of these funds no later than 3 business days from the end of the period for issuing these funds. If the deadline for the issuance of funds is not clearly defined (it can be indicated either in an order for the organization (common to all employees) or specified by the manager in an application for the issuance of funds), then three days are counted from the moment the funds are issued.

The amount of money issued and the amount spent by the accountable person may not match:

- In case of overexpenditure (if the overexpenditure is reflected in the Advance Report document, then the company has recognized the fact of overexpenditure), a credit balance is formed on account 71 for the amount of the overexpenditure, which can be closed by issuing funds to the employee.

- If the employee has a balance of funds, he can formalize their use with a new advance report or return the balance of unspent funds.

If working with expense reports raises any questions for you, please contact our 1C:Enterprise program support specialists. We will be happy to help you!

Advance report in 1C 8.3: sample filling

Now you know how to make an Advance report in 1C 8.3. Let's move on to filling it out.

Advance report

A document with this type of operation consists of many tabs, which allows us to reflect a variety of operations. Let's go through each tab.

Advances are all previously issued accountable amounts (including monetary documents) for which the accountable person is accountable.

Read more about the issuance of funds to the account using an example in our course Module 5. Cash desk Topic 5.4: Issuing money from the cash register to the account

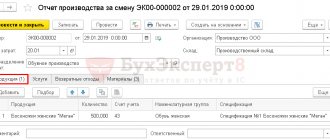

Goods – inventory items purchased by the accountable. No documents were submitted to our Organization for these positions, for example, TORG-12.

- Document (expense) – a document confirming the cost of purchased goods and materials;

- Supplier – seller of goods and materials, must be filled in when providing an invoice;

- SF – checkbox is checked only if SF was additionally provided.

Payment – filled in only if the accountant paid for the goods (services) recorded in the document Receipt (act, invoice) . This is useful to do if you need the purchase to be included in the Reconciliation Report with the counterparty.

Other – expenses that do not have a material form and therefore are not included in the Products . For example, the services for which the accountable is accountable.

- Supplier – service provider, the field must be filled in when submitting an invoice or BSO;

- SF – checkbox is checked only if SF was also provided. If you received BSO instead of SF, check the SF and BSO checkboxes at the same time.

The total line reflects the financial result of the operation. Depending on the presence of a balance or overexpenditure, the accountant's further actions depend.

When integrating the program with Smartway , this type of document can also be used. In this case, documents downloaded from this service will appear on the additional Tickets .

Advance report on business trip

in the Advance report for business trips , because... it does not imply payment or acquisition of goods and materials. As the name suggests, this document reflects only travel expenses. Now let's see how to fill out the header and tabular part of our document.

- Period – time spent on a business trip;

- Daily allowance – the amount of daily allowance allocated to an accountant is calculated automatically depending on the Period . If necessary, you can change the daily rate by clicking on the link with the amount. Cost analytics is filled out in the same form.

Attention! This document reflects only per diem costs for accounting and tax accounting. To take into account daily allowances for the purpose of accounting for personal income tax and insurance contributions, you must enter additional documents in the Salary . You can learn in detail about how to take into account excess daily allowances and daily allowances within the norms in our course Module 9. Personnel and Salary Topic 9.8. Payroll for August.

- Advance – the amount of advance given to an accountable person for a business trip. You need to select payment documents using the link. Accountable amounts not included in this list are reflected as Previous advance payment (balance) in the Totals line .

The tabular section reflects travel expenses, except for tickets downloaded through Smartway . They are accounted for in account 76.41 “Purchase of tickets for business trips”, separately from accountable amounts. Tickets purchased by the Organization are reflected using the Tickets , which is available only when integrating integration with Smartway .

To avoid problems with VAT deduction, it is not recommended to include expenses in the document that are not confirmed by the BSO, because Invoice document (strict reporting form) will be automatically created .

Why you cannot accept VAT for deduction on a check, see the video lesson Accepting VAT as deduction on a check in Module 8 Topic 8.1: Advance report for the purchase of materials for cash.

If expenses with allocated VAT are present, but there is no invoice, then you must use the universal transaction type Advance report . It is also suitable when working with Smartway . Documents downloaded from this service will appear on the additional Tickets .

Return of unused funds to the company's cash desk

The return of the DS is carried out through the “Cash receipt order/Return from an accountable person”, or by transfer to the organization’s current account.

The peculiarities of the operation of returning unspent DS by the accountant to the organization’s current account (by bank transfer) include the fact that this operation is not regulated by current legislation, therefore it is advisable to exclude it from the fact of economic activity. As a last resort, you can try to determine the procedure for such payments in local acts, for example, issue an order on the procedure for the issuance and return of unspent funds by accountable persons by bank transfer.

Results

By purchasing the 1C:Accounting program, you receive functionality sufficient for regular business activities for issuing and returning DS from the enterprise’s cash desk. Filling out an expense report in 1C Enterprise Accounting 3.0 is not difficult, but the process itself will require certain methodological knowledge.

Advance reports are drawn up as a separate document, which can be used to document both the receipt of goods or payment to a supplier for goods and services, as well as specific transactions, for example, payment of taxes or travel expenses.

Advance report: postings in 1C 8.3

Now let's move on to the final part of the design of our document. So, what kind of postings will the document generate when posted?

Let's look at the transactions for each tab of the document Advance report :

- Advances – postings are not generated, the data is needed only for information and a printed form.

- Products : Dt accounting account for inventory items Kt 71.01;

- Dt 19.03 Kt 71.01 – if the column is filled in VAT;

- Dt cost account Kt 71.01;

In the Advance report for a business trip, transactions are generated only for cost accounts for expenses that are reflected in the Per diem and in the tabular part of the document.

The cost of business trip tickets downloaded from Smartway is reflected on the Tickets of the advance report or it can be seen via the Tickets in the advance travel report. The posting will be Dt cost account Kt 76.14.

Now you know how the Advance report differs from the Advance report for a business trip and you will never get confused when preparing accountable amounts.