Field 20

The payment order number and date are indicated. Field 32A

The upper subsection is filled in with the value date, if it differs from the date of submission of the payment order. The middle subsection indicates the payment currency code, according to the All-Russian Classifier of Currencies (hereinafter referred to as the classifier) OK 014-94, approved by Resolution of the State Standard of Russia dated December 26, 1994 No. 365 , or the Classifier of currencies under intergovernmental agreements used in the banking system of the Russian Federation, put into effect by Order of the Bank of Russia dated July 28, 1997 No. R-212 with additions. Lower subsection - the client indicates the amount in figures, the amount and name of the currency (in words)

Field 70

" Payment details ".

In this field, the following data is indicated through the separating sign “/” in accordance with the practice of international payments and the requirements of the legislation of the Russian Federation:

Number and date of the contract (contract, agreement) or other document confirming the validity of the payment in foreign currency;

Number and date of the import transaction passport (if the documents justifying the transaction require its execution in accordance with the regulatory documents of the Central Bank);

Number of the customs declaration (CD), if it is available at the time of payment, or the number of another document confirming the fact:

- importation of goods into the customs territory of the Russian Federation,

- performance of works, services, transfer of results of intellectual activity.

- name of the product, work, service, etc. in English or by clerk;

Field 71A

“Transfer costs” The Client must indicate to whose account the transfer costs will be charged.

The Regulations on the Rules for Transferring Money (Central Bank of the Russian Federation dated June 19, 2012 No. 383-P) does not contain a form of foreign currency payment order. It is not included in the All-Russian Classifier of Management Documentation (OKUD) OK 011-93 (Resolution of the State Standard of Russia dated December 30, 1993 No. 299). Therefore, each bank (commercial or state) uses its own form of payment document and the procedure for filling it out.

Preparation of payment documents in foreign currency: where to start

In order to understand the details of processing a foreign currency payment, we will consider the most general case:

- the payment is made in foreign currency to a non-resident;

- payment is made under a foreign trade contract;

- the payment leaves the Russian bank to a foreign bank

To begin correctly processing a payment in foreign currency, you first need to:

present the concluded contract to your bank and issue a transaction passport (hereinafter referred to as the Transaction Passport) in the form established by Appendix No. 4 to the instruction of the Central Bank of the Russian Federation dated June 4, 2012 No. 138-I);

More information about control of settlements with foreign counterparties and the nuances of registering a transfer agreement can be found in the article “Currency control when transferring money abroad.”

- take the payment form for the currency transfer that your bank uses. The general requirements for filling out such payments are established by instruction No. 138-I, but there is no uniform form for all - therefore the bank usually develops and approves its own;

- decide on the details of the payment: who pays the commissions and fees for the transfer - the payer, the recipient, or both (in the practice of international payments there are different options);

- how currency will be purchased to complete the transaction: the company will buy it in advance itself or instruct the bank to exchange the required amount immediately on the basis of a payment order;

- Is there a currency clause in the contract that may adjust the payment amount?

What is the difference between an account in foreign currency and an account in rubles?

Issuing an invoice in foreign currency is no fundamentally different from issuing a similar document in rubles. It should indicate all the required details:

- date of issue;

- number;

- name of the payer;

- identifiers, name and address of the company receiving the funds;

- her bank details;

- name of paid goods (services, works), units of measurement;

- unit price and cost;

- condition for including VAT in the price.

As the account currency, you must indicate the currency of the agreement: if the agreement is in euros, then the invoice is in euros. A sample of such an invoice can be downloaded from the link below.

bills in euros

It would be useful to indicate in the invoice a sample of filling out the “Purpose of payment” field in the payment order. For example: “Payment for equipment according to invoice No. 1-OB dated April 27, 2017 in accordance with equipment supply agreement No. OB-0417 (in euros), including VAT of 10,000.00 rubles.”

In addition, you can add a “reminder” to the counterparty about the terms of the contract to the invoice. For example: “Payment of the invoice is made at the euro exchange rate established by the Bank of Russia on the day of payment.” Or: “Payment of the invoice is made at the euro exchange rate established by the Bank of Russia on the day of payment, increased by 1%.”

In this regard, there is no point in duplicating invoice amounts expressed in foreign currency in rubles. The counterparty can pay a foreign currency invoice in rubles on any of the following days after it is issued. The ruble equivalent of the presented invoice is likely to change during this time.

The payment document must be signed by an authorized person(s) of the organization. It will be stamped if available.

How to decipher KVVO

There is a table that makes it easy to decipher the first two digits of any KVVO.

Currency conversion payments made by individuals or Russian companies by bank transfer

Foreign currency conversion non-cash transfers carried out by foreign citizens or companies

Code for settlements between companies from the Russian Federation and foreign companies when conducting foreign trade activities related to the export of goods from the territory of Russia

Currency code when transferring companies from the Russian Federation to foreign companies or individuals when conducting foreign trade activities related to the import of goods into Russia

Transfers of domestic organizations for trade transactions without import of goods to Russia

Payment by foreigners to domestic companies when selling goods directly in Russia

Currency code indicated when paying residents to non-residents when conducting foreign trade activities related to the fulfillment by domestic firms of contractual obligations (work, services, transfer of information, intellectual and exclusive rights)

Payment by organizations from the Russian Federation to foreign companies when carrying out foreign trade activities related to the fulfillment by foreigners of contractual obligations (work, services, transfer of information, intellectual and exclusive rights)

Mutual settlements between residents and non-residents when transferring goods (performing work/services) by domestic firms or individual entrepreneurs

Payment by residents to non-residents when transferring goods (performing work/services) by foreign firms or citizens

Transfers from Russian companies and individual entrepreneurs to foreigners for purchased real estate

Payment by residents to foreigners within the framework of agreements on the assignment of claims (debt transfer)

Code of transfers between residents and non-residents for other foreign trade transactions

Payments for the provision of a cash loan by a Russian company to a foreigner or foreign company

Payment code for the provision of a cash loan by a foreign company from the Russian Federation

Payments when Russian companies fulfill loan obligations

Calculations when foreign companies fulfill loan obligations

Payments upon investment (capital investments)

Transfers when foreigners purchase securities from residents of the Russian Federation

Transfers when Russian companies purchase securities from non-residents

Payments upon fulfillment of obligations under securities

Mutual settlements between Russians and foreigners on derivatives transactions

Payment for transactions related to trust management of assets

Payments for brokerage operations

Payment transactions carried out by foreign companies and citizens on their accounts in Russian rubles in cash

Payments made by Russian companies in foreign currency in cash

Non-trading transactions

Settlements between a bank authorized to carry out foreign exchange transactions and a non-resident in Russian rubles, as well as between a bank and a resident in foreign currency

Settlements for other currency transactions that were not mentioned above

Let's try to decipher the operation code 10100.

From the table above we immediately see that it is associated with the export of goods. This code usually denotes an advance payment to a resident for goods exported from Russia. The numbers “100” at the end will tell us this. In a similar way, you can decipher any type of currency transaction in a payment order. But to simplify the work, the Central Bank has developed a special table that contains all the necessary values.

Currency control

All transactions with foreign currency are under special control of the state. The main regulatory legislative act of December 10, 2003 No. 173-FZ. The regulation procedure is determined by the Central Bank of the Russian Federation and the Government (Clause 1, Article 5 No. 173-FZ).

The law primarily applies to residents and non-residents. Residents include, inter alia, legal entities created in accordance with the legislation of the Russian Federation, and non-residents include legal entities created in accordance with the legislation of foreign states and located outside the territory of the Russian Federation (Article 1 No. 173-FZ).

Currency transactions between residents and non-residents are carried out through authorized banks (Clause 1.1, Article 19. No. 173-FZ).

As part of control, residents are required to provide authorized banks with the information specified in clause 1.1. Art. 19. No. 173-FZ, including:

- the expected timing of receiving foreign currency or Russian currency from non-residents for the fulfillment of obligations under contracts;

- expected terms of fulfillment by non-residents of obligations under agreements.

Documentation of control requirements is carried out on the basis of Instruction of the Central Bank of the Russian Federation dated June 4, 2012 No. 138-I. It contains the procedure for residents to provide control documents, the forms of these documents, as well as information for filling them out, in particular, the code of the type of currency transaction in the payment order

.

Features of drawing up a foreign currency payment order

The emergence of “bank clients” has replaced paper forms in the banking sector. Although paper forms are still used, for example, to print and create a backup copy.

The payment order form and the procedure for filling it out are necessary for such an area as foreign exchange transactions. Payment in foreign currency must meet the requirements:

- Russian legislation on currency regulation and control;

- international standards ISO (International Organization for Standardization);

- standards of the SWIFT (Society for World Wide Interbank Financial Telecommunications) system.

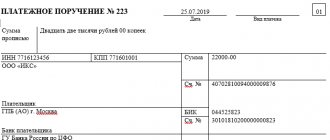

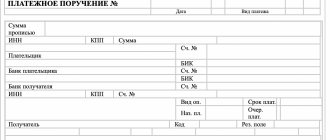

Sample of filling out a collection order

- First, write the document number and indicate the date it was completed.

- Next, indicate the type of payment and amount (necessarily in words and numbers).

- Then information about the payer is entered into the form: in the required cells put

- TIN and checkpoint numbers,

- full name of the company,

- information about the payer's bank (indicating its BIC).

- Next, in a similar manner, information about the payee and the credit institution in which he is serviced is entered into the collection order form.

- On the right side of the document, the current accounts of all organizations specified in the document are entered, and below:

- type of payment,

- purpose of payment

- and its order (if necessary).

- Then an agreement is entered into the document, according to which it became possible to use this document in settlements between enterprises (number and date of its preparation).

- Finally, the document must be signed by a responsible bank employee.

About the possibility of transferring money to Kazakhstan through Sberbank Online

Through Sberbank Online you can send funds to Kazakhstan if the recipient is a Sber client. Then all you need to do is log into your personal account and transfer money from a Sberbank card to a card in Kazakhstan.

As for other banks in Kazakhstan, alas, Sberbank does not allow you to send money online to other countries; it makes transfers within the Russian Federation. To make an international transfer through Sber, you need to personally visit the bank with the necessary documents, select the appropriate transaction method and pay for the transfer at the cash desk.

Field 77B Information for Regulatory Authorities

The field is required to be filled in only when transferring funds in Ukrainian hryvnia (UAH).

The information required by the regulatory authorities of the countries of the paying client or the beneficiary client is indicated (3 lines of 35 characters each, separated by slashes '/', format 3*35x). Information in the field can be specified using code words (see field 77B code word reference) enclosed in slashes '/'.

When transferring in Ukrainian hryvnia (UHR):

The NBU reporting code is indicated using the code word /1PB/ in the following form: /1PB/4!n.3!n.3!n, where 4!n is the transaction code according to the NBU classifier; 3! n – code of the country of registration of the payer according to the NBU classifier; 3!n – code of the country of registration of the beneficiary according to the NBU classifier.

- The ISO codes of the countries of registration are indicated: payer - using the code word /ORDERRES/;

- beneficiary - using the code word /BENEFRES/.

Field 50a Paying client

Filling out is required.

The details of the client making the funds transfer are indicated.

The following must be indicated on separate lines:

- Account number from which funds are debited during the transfer.

- Client data (4 lines, format 4*35x): Client name: full or short, as provided for in the client’s constituent documents.

- TIN (taxpayer identification number) for resident legal entities or TIN/KIO (foreign organization code) for non-resident legal entities.

- Address.

- City, country.

When transferring in Belarusian rubles (BYR):

- The account number and name of the payer are indicated.

- If there is no invoice, the payer's address must be indicated.

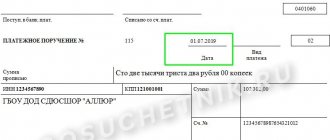

Sample currency payment order

For those who will have to fill out an instruction for a currency transaction not in the client bank, but manually, we suggest that you familiarize yourself with a sample of filling out such a document.

At the same time, we remind you that in the form that a particular bank will actually offer to fill out, the location of some columns may be changed, and additional columns or sections may be introduced for information that this bank considered necessary.

For example, in the proposed sample there is no separate table “Information for currency control,” which can often be found in forms issued by banks. In essence, such tables combine and duplicate in Russian the information that is already in the completed mandatory columns of the payment order. Filling them out, as a rule, does not cause any difficulties.

To correctly fill out a payment form in foreign currency, you need to:

- declare the transaction against payment to the bank and issue a PS;

- determine the details of a specific payment;

- fill out the transaction order according to the bank form - either in the client bank or manually according to the sample.

All actions involving the transfer of foreign currency funds outside the Russian Federation must be checked for compliance with the currency legislation of the Russian Federation.

The code is incorrectly selected and filled in - what to do?

If, when drawing up a payment order, the code for the type of currency transaction was incorrectly specified, the bank will return such a document. And he will be right, since he must control the submitted documents (Chapter 18 of instructions No. 138-I). In this case, the organization has only one option - to redo the payment card.

But there are a number of cases when you don’t have to draw up settlement documents at all. And if they are compiled, then you don’t have to write the code. And this should not be a reason for returning the document from the bank. Such situations are described in paragraph 3.3 and paragraph 3.4 of Chapter. 3 instructions No. 138-I.

Another option when an organization can be sure that the bank will accept its documents is to include clauses in the agreement with the bank stating that the bank will draw up payment orders for foreign exchange transactions on the basis of the documents that the organization provides.

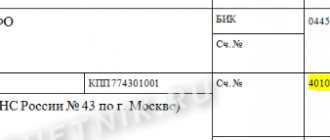

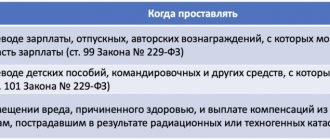

Transfers to budgets and extra-budgetary funds

The payment order can be used to pay taxes and contributions to the Pension Fund, Social Insurance Fund. In this case, fill out form fields 101 – 110.

| Field | Data |

| Contribution payer status (there are 26 different statuses, which can be found in Appendix 5 to Order of the Ministry of Finance No. 107n) | |

| OKTMO code, indicated instead of OKATO since 2015 (when paying taxes, a code similar to that indicated in the declaration is indicated) | |

| The Federal Tax Service assigns a unique code (UIN) to payers who have been fined or who have arrears. Otherwise, the number “0” is entered. | |

| Payment type - a field that is no longer filled in in 2015 | |

| The basis may be as follows: repayment of tax credits (TI); repayment of debts within the framework of a bankruptcy case (RK); repayment of mortgage by the founder of a legal entity within the framework of a bankruptcy case (TB); repayment of current debts (CL); payment of taxes (TS); payment of contributions (VZ), etc. | |

| Tax period (indicator for periodic payments, where the first two digits are letters indicating the frequency, the next 2 digits are the month number or quarter, the last 4 digits are the year) |

Figure 4. Convenient table for indicating the tax period code

In fields 108 and 109 you should indicate the number of the document that is the basis for making the payment and its date, respectively. This data will be indicated on the Federal Tax Service’s request for tax payment, decision on restructuring, etc. You will also need to put your signature in the required field (“Signatures”), and the bank employee will have to put a stamp on the document (in the “M.P.” field). This completes the filling out of the document. As you can see, it's easier than it seems!

Peter Stolypin, 2015-06-18

Paying wages to a foreigner: in cash or by card?

Salaries must be paid no later than the 15th day after the end of the period for which they were accrued. That is, the deadline for the advance payment is the 30th day of the current month, and for salaries - the 15th day of the next month (Part 6 of Article 136 of the Labor Code of the Russian Federation). This fully applies to wages transferred to the card. Transfer salaries to employees' bank accounts at least every six months (Part 6 of Art.

Foreign citizens and stateless persons who work for an employer and do not have a residence permit in the Russian Federation are recognized as non-residents for the purposes of currency legislation (clause

Important For example, you can transfer the advance to cards, and the final salary amount from the cash register. Or, a third of your earnings can be paid in cash, and the rest by bank transfer. Often, by concluding an agreement with the servicing bank, the employer acts within the framework of special salary projects.

In addition, a draft is being prepared to punish persons who interfere with freedom of choice. It is planned that the State Duma will consider it this fall.

We transfer to non-salary cards, and therefore I’m afraid there won’t be enough space to assign the payment) There is the card number and full name of the employee and also a comment about the advance. what to do?

Salary according to the employment contract, according to Art. 136 of the Labor Code of the Russian Federation, must be paid at least once every half month.

The form for filling out the payment order form is approved by the regulations of the Bank of Russia. It contains detailed information on how to correctly enter data into each column of the document.

Payment orders for transferring wages to a card can be submitted to the bank either “on paper” or electronically.

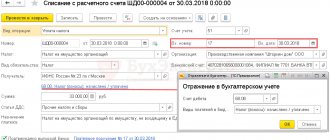

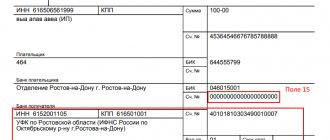

Sample of filling out a payment order for a non-resident (in Russian rubles)

The payment order is filled out for the transfer of Russian rubles, so its usual filling procedure is maintained in accordance with the documents and details of the counterparty, except for the currency transaction code, which must be indicated in the final field of the payment order. To do this, before the text in the “Purpose of payment” field, write VO in capital Latin letters, and then the five-digit transaction code from the table below. The code must be enclosed in curly braces.

Let’s assume that the Russian organization VESNA LLC needs to pay wages to its employee who works remotely from Kazakhstan and is not a resident of the Russian Federation. In this case, fill out the payment form as usual, and in the appropriate field write:

Salary of Abdurakhmanov Ilyas Karimovich for November 2019.

The given example of filling out a foreign currency payment order shows how to specify the code.

What is a currency transaction type code?

The code for the type of currency transaction in the payment order is indicated before the text part in the “Purpose of payment” detail. There is even a special format for this important prop:

It is indicated without indentation or spaces inside curly braces. Its place is before the text part of the payment purpose. The VO designation is large Latin letters that do not change, followed by the digital code itself. In a payment order it always has five characters. Each KVVO is conventionally divided into two parts:

- the first two digits indicate the group into which similar transfers are combined;

- the last three digits indicate a number that specifies the transfer being made in accordance with currency legislation.

Procedure for issuing a payment order

The content of the payment order and the settlement documents submitted along with it, as well as their form, must strictly comply with the requirements provided for by law and established banking rules.

If the payment order does not meet the requirements, the bank can clarify the contents of the order and make a request to the payer immediately upon receipt of the order.

If a response is not received on time, the bank has the right to leave the order without execution and return it to the payer. .

The payment order is issued on a standard form containing all the necessary details for making a payment, and is submitted to the bank, as a rule, in four copies, each of which has a specific purpose:

The 1st copy is used in the payer’s bank to debit funds from the payer’s account and remains in the documents for the bank;

The 4th copy is returned to the payer with the bank’s stamp as a receipt for acceptance of the payment order for execution;

The 2nd and 3rd copies of the payment order are sent to the payee's bank. In this case, the 2nd copy serves as the basis for crediting funds to the recipient’s account and remains in the documents for this bank, and the 3rd copy is attached to the recipient’s account statement as a basis for confirming the bank transaction. .

The payment order is accepted by the bank for execution regardless of whether there are enough funds in the payer's account to pay it. In the absence or insufficiency of funds in the payer’s account, if the bank account agreement does not define the terms of payment for settlement documents in excess of funds not available in the account, payment orders are placed in a card index in off-balance sheet account No. 90902 “Settlement documents not paid on time.” On the front side in the upper right corner of all copies of the payment order, a mark in any form is placed on placement in the card index indicating the date. In this case, payment for payment orders will be made as funds are received in the order of priority established by law.

Partial payment of payment orders placed in the card index is also possible. It is carried out on the basis of a payment order of form 0401066. When issuing a payment order for partial payment, the bank’s stamp, date, and signature of the bank’s responsible executive are affixed to all copies in the “bank marks” field.

When paying a payment order, the following accounting entries are made.

At the payer's bank:

D-t – payer’s current account;

K-t sch. 30102 (correspondent account of the payer’s bank in the RCC).

At the payee's bank:

Dt sch. 30102 (correspondent account of the payee's bank in the RCC);

K-t – current account of the payee. .

The document flow scheme for settlements by payment orders is simple. That is why this form was primarily subject to innovation, in particular automation. Along with translation by mail and telegraph, electronic translation is becoming increasingly common.

The advantages of settlements using payment orders: familiarity, relatively simple and fast document flow, acceleration of cash flow, the ability of the payer to pre-check the quality of the goods or services being paid, as well as the ability of the payer to independently plan the sequence of payments on the account. The possibility of using a form of settlement for non-commodity payments makes settlements by payment orders the most promising form.

Disadvantages: when making payments by payment orders, the parties do not have a full guarantee of the fulfillment of obligations by counterparties; prepayment does not guarantee the payer receipt of the goods (it is dangerous for the supplier, since it may not be made by an unscrupulous payer.

Field 56a Intermediary bank

The field is optional, but if field 57a contains the correspondent account number of the beneficiary's bank, field 56a must be filled in. The details of the bank in which the beneficiary's bank (field 57a) has a correspondent account are indicated.

The field is filled in one of three options:

- If you have a SWIFT code: SWIFT code and the corresponding name of the bank;

- City, country.

- national clearing code (see the reference book Structure of National Clearing Codes) and the corresponding name of the intermediary bank (full);

- name of the intermediary bank (full);

Currency payment order form

Important! The codes located on the left (for example 33B, 52a, etc.) correspond to a specific field of the SWIFT format in the international ISO system. According to SWIFT standards, such payments do not allow the use of characters like: №, %, #, $, &, “ “, =, @, \, { }, , ;, *,!, _,

The correctness of the details is important for both the payer and the bank for the purposes of:

- reducing the risk of erroneous execution of orders for payment in foreign currency;

- acceleration of currency control procedures and greater efficiency of payment;

- reducing translation costs by reducing the number of investigations into unaccepted or erroneously accepted payments;

- fulfillment of obligations to the counterparty without additional costs, including due to failure to meet payment deadlines.

Additional nuances

Typically, the payment form must be drawn up in 4 copies:

- The 1st is used when writing off at the payer’s bank and ends up in bank daily documents;

- The 2nd is used to credit funds to the recipient’s account in his bank, stored in the documents of the day of the recipient’s bank;

- 3rd confirms the bank transaction, attached to the recipient's account statement (at his bank);

- The 4th with the bank’s stamp is returned to the payer as confirmation of acceptance of the payment for execution.

NOTE! The bank will accept the payment, even if there is not enough money on the payer’s account. But the order will be executed only if there are enough funds for this.

If the payer contacts the bank for information about how his payment order is being executed, he should receive an answer on the next business day.

The currency transaction code in the payment order

is filled in when carrying out certain transactions with currency. In this article, we will look at how to fill out this detail and learn about the regulatory documents governing this situation.