When to pay in 2021: deadlines

The trading fee must be determined and paid every quarter. There are no reporting periods for the trade fee, just as there are no reporting forms (Article 414 of the Tax Code of the Russian Federation). Pay the calculated amount of the trading fee to the budget no later than the 25th day of the month following the taxable period (quarter). In 2021 these are the following dates:

| Trade tax payment deadlines in 2021 | |

| For the fourth quarter of 2021 | No later than 01/25/2021 |

| For the first quarter of 2021 | No later than 04/26/2021 |

| For the second quarter of 2021 | No later than 07/26/2021 |

| For the third quarter of 2021 | No later than October 25, 2021 |

KEEP IN MIND

Federal Law No. 172-FZ dated 06/08/2021 exempted those affected by coronavirus from paying the trade tax for the 2nd quarter of 2021. Read more about this in the article “To whom and what taxes will be written off: list.”

Key points about paying fees

Since July 1, 2015, a type of taxation has been applied on the territory of the Russian Federation, such as a trade tax, which refers to the local type of taxation (Article 15 of the Tax Code of the Russian Federation).

It is installed in absolutely any city by decision of the municipal authorities (Article 410 of the Tax Code of the Russian Federation). Since 2021, it has been established in Moscow, as evidenced by Law No. 62 dated December 17, 2014. Legislative bodies of local authorities of federal cities determine the rates and norms of trade fees, and also establish benefits and procedures.

Payment order in 2021: KBK

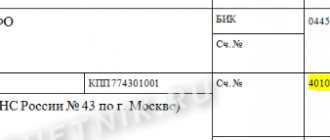

Transfer the amount of the trade tax in 2021 according to the details of the tax inspectorates in which the organization is registered as a payer of the trade tax (clause 7 of Article 416 of the Tax Code of the Russian Federation).

Make a payment for the payment of the trade tax in 2021 in accordance with the Regulation of the Bank of Russia dated June 19, 2012 No. 383-P and appendices 1 and to the order of the Ministry of Finance of Russia dated November 12, 2013 No. 107n.

If you pay a trade fee for a property, then in the payment slip indicate the details of the Federal Tax Service at the place of registration as a payer of the trade fee, and the OKTMO code - at the place of trading activity. If you pay the fee at the location of the organization (residence of the individual entrepreneur), then indicate the details of the tax office with which you are registered as a payer of the trade fee. And the code according to OKTMO is at the place of trading activity, which is indicated in the notice of registration as a payer of the trade tax.

In field 104 of the payment, indicate the KBK, which in 2021 is valid for the purpose of paying the trade fee. You may also be required to pay penalties and interest associated with the payment of the trade fee. Special budget classification codes have been approved for them. At the same time, we note that compared to 2021, the BCC for 2021 has not changed and no new codes have been approved. Here is a table with current codes for paying the trade tax in 2021.

| Purpose | Trade fee amount | Penalty | Fine |

| Trade tax paid in the territories of federal cities (Moscow) | 182 1 0500 110 | 182 1 0500 110 | 182 1 0500 110 |

Read also

23.04.2020

Legal basis of trade tax

The trade fee was introduced by law dated November 29, 2014 No. 382-FZ “On Amendments to the Tax Code of the Russian Federation” and has been applied since July 1, 2015.

It falls under the category of local level taxes. Therefore, its main provisions (circle of payers, list of taxable objects, upper limits of rates, tax period, calculation procedure and payment deadline) are described in Chapter. 33 of the Tax Code, and the right to establish specific rules of application is vested in those subjects of the Russian Federation that decide to introduce this tax. The introduction of a trade tax in the region is carried out on the basis of a local legislative act, in which it is permissible to prescribe a regional procedure:

- classification as taxpayers and dividing them into groups;

- dividing objects into categories;

- establishing specific features for taxation of certain types of activities;

- establishing territorial features of taxation;

- application of rates that the Tax Code of the Russian Federation allows to be set equal to zero;

- collecting and submitting to the Federal Tax Service that information about taxable objects, which the inspectorate will then use to control the data submitted by taxpayers.

From 07/01/2015, the trade tax began to be applied in the only subject of the Russian Federation - Moscow - in accordance with the law of December 17, 2014 No. 62 “On the trade tax”. In other constituent entities of the Russian Federation, this fee has not been introduced as of the end of 2021.

In comparison with the text of the Tax Code, Moscow City Law No. 62 dated December 17, 2014 provides for a number of benefits both by type of activity and by the range of taxpayers. The changes made to the original text of this document by the Law “On Amendments to the Laws of Moscow” dated June 24, 2015 No. 29 expanded the original list of benefits.

The trading fee is a quarterly payment that must be paid no later than the 25th day of the month following the end of the quarter (clause 2 of Article 417 of the Tax Code of the Russian Federation), based on an independently made calculation.

To a taxpayer who has not registered due to the obligation to pay this fee, as well as who has provided false information about the object of taxation, the Federal Tax Service Inspectorate, no later than 30 days from the date of discovery of such a fact, will send a request for payment of the fee, in which the corresponding amount will be calculated according to the Federal Tax Service Inspectorate. If the tax payment deadline is missed, you will have to pay a penalty. And a taxpayer who has not registered will be subject to a fine under clause 2 of Art. 116 of the Tax Code of the Russian Federation.

If registration as a fee payer was incorrect, the situation can be corrected. Read about this in the material “What to do if you made a mistake when registering for a trading fee?” .

ConsultantPlus experts explained how to correctly calculate the amount of trade fee payable. To do everything correctly, get trial access to the system and go to the Ready solution. It's free.

Trade fee calculation

The fee is calculated and paid for each retail facility of the organization. In this case, payment can be of two types:

- Voluntary, paid on the basis of one’s own calculations, upon self-registration;

- Compulsory, paid on the basis of tax calculations, if the organization is registered without appropriate notification, but according to information provided by the Department of Economic Policy.

The procedure for calculating the fee amount is the same in both cases (Read also the article ⇒ How to calculate the trading fee).

In order to calculate the trading fee, you will need the following indicators:

- Kind of activity;

- Characteristics of the retail facility and its location;

- Collection rate.

Let's look at the calculation of the trading fee using an example:

Continent LLC is engaged in retail trade in Moscow. March 10, 2021 Continent LLC submits a notification to the tax authority against the payer of the fee. Notification is given for objects:

- Store in the Central District, sales area 200 sq.m., open 24 hours a day;

- Store in the Southern District, sales area 35 sq.m., opening hours from 8 to 21 hours.

Trade tax payers

Almost all organizations whose activities are related to trade, both retail and wholesale, can pay a trade tax. The following taxpayers are exceptions:

- Working on PSN (on patent);

- Applying unified agricultural tax.

Thus, the following organizations and entrepreneurs are recognized as payers of the trade tax:

- Which carry out trade through objects of a stationary retail chain without trading floors (with the exception of gas stations) and with trading floors;

- Carrying out trade through objects of a non-stationary trading network;

- They sell goods from a warehouse.

Important! A company that owns a retail facility that is not used in trading activities does not have to pay a sales tax on it.

Payment of trade tax to the budget

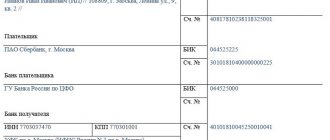

After paying the trade tax to the budget, based on the bank statement, you need to create a document Write-off from the current account transaction type Payment of tax. A document can be created based on a Payment Order using the link Enter document debited from current account . PDF

The basic data will be transferred from the Payment order . It can also be downloaded from the Client-Bank program or directly from the bank if the 1C: DirectBank service is connected.

It is necessary to pay attention to filling out the fields in the document:

- from - date of payment of the fee, according to the bank statement;

- According to document No. from - the number and date of the payment order.

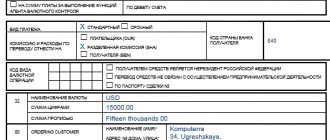

- Tax - Trade fee , selected from the Taxes and Fees directory, affects the automatic completion of the Debit Account .

- Type of liability - Tax .

- Reflection in accounting : Debit account - 68.13 “Trading fee”;

- Types of payments to the budget - Tax (contributions): accrued / paid .

Postings according to the document

The document generates the posting:

- Dt 68.13 Kt - the debt to the budget for the trade fee decreased by the amount of the payment.

Registration (deregistration) as a trade tax payer

^To the top of the page

Registration and deregistration of an organization or individual entrepreneur as a tax payer with the tax authority are carried out on the basis of a notification of registration as a trade tax payer (clause 1 of Article 416 of the Tax Code of the Russian Federation).

Registration is carried out on the basis of a notification within 5 days after its receipt by the tax authority. Within 5 days from the date of registration, the payer of the fee is sent a corresponding certificate (clause 3 of Article 416 of the Tax Code of the Russian Federation).

In case of termination of business activity using an object of trade, the payer of the fee submits a corresponding notification to the tax authority no later than 5 days from the date of termination of the business activity in respect of which the fee was established.

If the deadline for submitting a notice of termination of use of an object of trade (notice of termination of an activity for which a fee has been established) is violated, the date of termination of use of the object of trade (the date of deregistration of an organization or individual entrepreneur as a payer of the fee) is the date of submission to the tax office. relevant notification authority.

Features of filling out a payment order for trade fees

The obligation to pay the fee arises if the objects of trade (movable/immovable property) were used during the taxation period - a quarter.

When filling out a payment order for a trade fee, you first need to calculate its amount. To do this, you need to know the rates that are set by local authorities based on the categories of payers, their activities and the characteristics of the objects used for trade.

OKTMO codes in payment cards are filled in depending on the territory of trading operations. If organizations or individual entrepreneurs operate through several stationary trade facilities that have different OKTMO codes, it is necessary to draw up payment orders for the trade fee for each municipality in whose territory trade is carried out.

When using movable objects, the payment order indicates the OKTMO code corresponding to the data from the notice of registration of the trade tax payer.

More information about drawing up a payment order can be found in the article “The Federal Tax Service told how to fill out a payment order for a trade fee”