Tax audit report: information, registration procedure

The procedure for drawing up a tax audit report is established by Article 100 of the Tax Code of the Russian Federation. To begin with, let us highlight the main points of the procedure for drawing up a tax audit report and delivering it to the taxpayer: a tax audit report is drawn up within two months from the day the tax inspectorate draws up a certificate of the tax audit, this is stated in paragraph 1 of Article 100 of the Tax Code of the Russian Federation. In accordance with the Order of the Federal Tax Service of Russia dated 05/08/2005. No. ММВ-7-2/ [email protected] ) the moment of completion of the tax audit is determined by the moment (date) of drawing up the certificate of the tax audit, which is drawn up precisely on the last day of the tax audit (clause 15 of Article 89 of the Tax Code of the Russian Federation).

The tax audit report consists of three main parts: introductory, descriptive and final. In accordance with paragraph 3 of Article 100 of the Tax Code of the Russian Federation, the tax audit report must contain the following mandatory details and information:

- date of signing the act;

- full and abbreviated name of the taxpayer being audited (full name of an individual registered as an individual entrepreneur);

- FULL NAME. officials of the tax authority who carried out this audit (indicating their positions, the full name of the tax office);

- date and number of the decision of the head of the tax inspectorate to conduct a tax audit (applies only to on-site tax audits);

- the date the tax authority received a declaration from the taxpayer being audited or other documents (this requirement applies only to desk tax audits);

- a list of all documents submitted during the audit by the taxpayer himself;

- the period covered by the inspection;

- type of tax being audited;

- start and end dates of the audit;

- address of the taxpayer being inspected (legal address for legal entities, registration address at the place of residence - for individuals and individual entrepreneurs);

- information about the activities carried out as part of the inspection;

- documents confirming the fact of violation of tax legislation or a note about their absence (see paragraph 3 of Article 100 of the Tax Code of the Russian Federation, Resolution of the Arbitration Court of the East Siberian District dated September 22, 2015 No. F02-5056/2015 in case No. A19-17587/ 2014, Resolution of the Arbitration Court of the Moscow Region dated July 17, 2015 No. F05-8680/2015 in case No. A41-46433/14.);

- references to the norms of articles of the Tax Code of the Russian Federation defining liability for identified violations.

The act is signed by the officials who conducted the inspection, as well as by the taxpayer himself (or his representative). The completed tax audit report then remains in storage at the tax office, and the following documents must be attached to it:

- decision of the head of the tax authority to conduct a tax audit;

- decision to make additions (changes) to the decision to conduct a tax audit (if any were made);

- if available, a decision to suspend and resume a tax audit;

- if available, a decision to extend the tax audit;

- requirement for the taxpayer to submit documents as part of the audit;

- if there is a decision to extend (or refuse to extend) the deadline for submitting documents;

- inventory act (if it was carried out);

- sections of inspection reports of branches (representative offices);

- documents (information) requested during the inspection;

- expert opinion (in case of an examination);

- protocols of interrogation of witnesses, inspection (survey) of production, warehouse and trading and other premises used by the taxpayer to generate income or related to the maintenance of taxable objects, etc., protocols drawn up during the performance of other actions to implement tax control (in the case of relevant actions), as well as decisions on the appointment of an examination and the seizure of documents and objects (if they are assigned (produced));

- certificate of inspection performed;

- documents confirming the fact of delivery or sending of a certificate of an audit, as well as a tax audit report, to the taxpayer (fee payer, tax agent) or his representative;

- copies of primary documents, tax and accounting registers confirming the presence of facts of violation of legislation on taxes and fees, certified in the prescribed manner;

- other materials relevant for confirming the facts of violations reflected in the report and for making an informed decision based on the results of the inspection.

How is an on-site tax audit report drawn up?

By virtue of paragraph 1 of Art. 100 of the Tax Code of the Russian Federation, after an on-site inspection, a report is always drawn up. Even if no violations were identified, the document must be prepared in any case.

The tax audit report is drawn up by the inspector who carried out the audit activities (his details are indicated in the decision to conduct the audit). As already mentioned, the form of the report for on-site and desk inspections is similar. In addition, the same requirements apply to the procedure for drawing up acts and their content. The composition of the information reflected in the document can be studied in the table presented above.

The document, unlike the desk inspection report, is drawn up not within 10 days, but within 2 months. The extended period is due to the fact that during an on-site audit, a larger volume of information, a longer period, and data on various types of taxes are studied.

***

Thus, the final document for any type of verification actions is the act. However, it is not issued if no violations are identified during a desk audit. Based on the results of the on-site inspection, an additional certificate is drawn up.

Form and requirements for drawing up a tax audit report, the procedure for delivering it to the taxpayer

Today, in the work of tax services, a standard form of a tax audit report is routinely used, which is approved by Order of the Federal Tax Service of Russia dated May 8, 2015 No. ММВ-7-2/ [email protected] This order also contains requirements for drawing up a tax audit report. Thus, a tax audit report must be drawn up in Russian and on paper, or in electronic form. If there is a need to use abbreviations and abbreviations in the text of the act, the first time the corresponding phrase is used, it should be given in full, indicating in brackets its abbreviation, which is used in this form throughout the entire text of the document.

The tax audit report should not contain corrections or blots; this is allowed only with the corresponding changing marks of the official, certified by his signature. In addition, all facts of violations reflected in the report must contain detailed information about:

- types and methods of violation, as well as the tax period;

- monetary discrepancy between the data declared by the taxpayer in the declaration and the actual identified data;

- links to primary accounting documentation;

- qualification of the identified violation with reference to articles of the Tax Code of the Russian Federation;

- details of the expert opinion, protocol of interrogation of witnesses or other protocols drawn up during the production of specific production actions of tax control.

The Tax Code of the Russian Federation regulates the taxpayer’s right to receive a copy of the tax audit report (see paragraph 9, paragraph 1, article 21, paragraph 9, paragraph 1, article 32 of the Tax Code of the Russian Federation, Letter of the Federal Tax Service of Russia dated August 27, 2007 No. 06 -1-02/558). Paragraph 5 of the Requirements for the execution of a tax audit report, approved by Order of the Federal Tax Service of Russia dated May 8, 2015 No. ММВ-7-2 / [email protected] states that the on-site tax audit report is drawn up by the inspector in two copies, one for the tax inspectorate, the second - for the taxpayer. This means, by and large, a tax audit report can be served both in the form of a copy and in the original, which is confirmed by already established judicial practice (see Resolution of the Federal Arbitration Court of the Central District dated April 28, 2014 in case No. A35-4665/2013, Federal Arbitration Court Court of the Far Eastern District dated December 23, 2013 No. F03-6129/2013 in case No. A51-16532/2013).

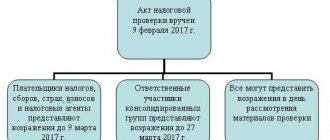

The deadline for delivering the tax audit report to the taxpayer is set within five days from the date of its preparation (clause 5 of Article 100 of the Tax Code of the Russian Federation). There is a very important point here! The tax inspectorate does not have the right to independently choose the method of delivering the tax audit report to the taxpayer! In paragraph 5 of Article 100 of the Tax Code of the Russian Federation it is clearly stated that the tax audit report is handed over to the taxpayer being inspected or his official representative against receipt or must be transferred in another way confirming the date of its receipt by the audited person, for example, the act can be sent by registered mail with notification of delivery. However, the courts believe that this method of delivering a tax audit report to a taxpayer can only be used in cases where the taxpayer avoids receiving a tax audit report, and the tax audit report must contain a note about this (see Resolution of the Arbitration Court of the Moscow District dated January 20 .2014 No. F05-16692/2013 in case No. A41-11771/10).

Experienced inspectors, in the event that a taxpayer avoids receiving his copy of a tax audit report, make a corresponding entry about this on the last page of the report, which he must certify with his signature (see clause 1.13 of the Requirements for drawing up a tax audit report, approved by the Order of the Federal Tax Service of Russia dated May 08, 2015 No. ММВ-7-2/ [email protected] ). And then he sends the tax audit report by registered mail with notification. Sometimes, cunning inspectors, in order to protect themselves, before making a note in the tax audit report about the taxpayer’s evasion in receiving it and sending the report by mail, first call the taxpayer to the tax office for the purpose of personally delivering the report by sending him a corresponding notification, the form of which is approved by the Order of the Federal Tax Service Russia dated May 31, 2007 No. MM-3-06/ [email protected] (see Appendix No. 7). The inspector sends such a notification to the taxpayer by registered mail with notification, as a rule, to his legal address.

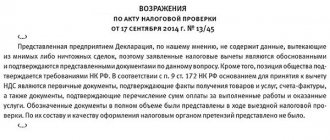

Objections to the tax audit report

Clause 6 of Article 100 of the Tax Code of the Russian Federation establishes the right of the taxpayer to submit to the tax authority, within thirty days, written objections to the tax audit report, both in general and on its individual provisions, if he does not agree with the facts reflected by the tax authorities in the tax report verification. The taxpayer may attach certified copies of documents confirming the validity of his objections to his written objections. The ten-day period established by paragraph 1 of Article 101 of the Tax Code of the Russian Federation for making a decision based on the results of the audit is calculated after the expiration of one month established by paragraph 6 of Article 100 of the Tax Code of the Russian Federation.

If the taxpayer has not filed written objections to the tax audit report, he is not deprived of the right to give explanations when considering the tax audit materials (see paragraph 4 of Article 101 of the Tax Code of the Russian Federation). Moreover, this rule is applicable to the execution of not only an on-site tax audit, but also a desk audit. If the taxpayer did not submit his objections to the tax audit report within the period established by law, but personally participated in the consideration of the audit materials, he will be able to obtain the cancellation of the final decision of the tax authority only by proving that he did not have the opportunity to properly prepare for the consideration of the audit materials and accordingly provide reasoned explanations.

Appealing the results of a tax audit

The final stage of processing the results of a tax audit is the review of its materials, which is carried out by the head of the tax office that audited the taxpayer.

For its part, the tax authority is obliged to notify the taxpayer of the date, time and place of consideration of the tax audit materials. The taxpayer's notice must be reasonable and take into account the time required for the taxpayer to appear, again reasonable. The head of the tax inspectorate is obliged to establish whether an offense was committed by the taxpayer being inspected, whether the violations identified during the inspection constitute a tax offense within the meaning of the Tax Code of the Russian Federation, and whether the tax authority has grounds for bringing the inspected person to tax liability. Also, if there are grounds for holding the taxpayer accountable, the head of the tax inspectorate must establish the fact that the involved taxpayer has circumstances mitigating or aggravating his responsibility for the violation identified during the audit.

The result of consideration of the tax audit materials is the decision of the head of the tax authority, which determines:

- holding the taxpayer accountable for committing a tax offense, indicating the relevant articles of the Tax Code of the Russian Federation, the amount of the identified arrears, and the amount of penalties and fines payable;

- refusal to hold the taxpayer accountable for committing a tax offense. In this case, the decision indicates the amount of arrears and the amount of penalties.

The decision made by the tax authority comes into force after 10 (ten) days from the date of delivery to the taxpayer. Afterwards, the tax authority is obliged to explain to the taxpayer about the possibility of voluntarily paying the amount of tax sanctions (Article 104 of the Tax Code of the Russian Federation). At the same time, the head of the tax authority, if there are grounds, has the right to take interim measures against the guilty taxpayer for the purpose of proper execution of the decision (see paragraph 10 of Article 101 of the Tax Code of the Russian Federation). Such interim measures, in particular, include a ban on the alienation of the taxpayer’s property without the consent of the tax authority (real estate, vehicles, securities, etc.).

Currently, appeals against inspection decisions are carried out first by filing a complaint with a higher tax authority, then with a judicial authority. In judicial practice, there are examples when the court sides with the taxpayer (see Resolution of the Federal Antimonopoly Service of the Ural District dated February 24, 2014 No. F09-8/14). At the same time, we should not forget that the tax authority also has the right and grounds to go to court. For example, in accordance with Article 104 of the Tax Code of the Russian Federation, if a taxpayer refuses to voluntarily pay the amount of tax penalties or has missed the deadline for their payment, as indicated in the request of the tax authority, the latter has the right to go to court with demands for the collection of tax sanctions, but the statute of limitations for this action is 6 months from the date of discovery of the tax offense (Article 115 of the Tax Code of the Russian Federation). In addition to the above, a statement of claim for the collection of tax sanctions is filed in court taking into account the status of the taxpayer:

- arbitration court (when a claim is brought against a legal entity or individual entrepreneur);

- court of general jurisdiction (when a claim is brought against an individual).

Regarding the collection of penalties from a taxpayer, their forced collection from legal entities occurs in an indisputable manner, and in court - only from individual taxpayers, this is indicated in paragraph 6 of Article 75 of the Tax Code of the Russian Federation.

In conclusion, we note that in any case, the result of consideration of the tax audit materials will be the final decision of the head of the inspection, and such a decision will already be final and binding. And as we noted earlier, the taxpayer can influence the decision of the tax authority, and one of these ways may be the fact of not delivering the tax audit report to the taxpayer before considering the tax audit materials. Also, if the taxpayer proves in court that he was not properly notified by the tax inspectorate of the date and time of consideration of the audit materials, the court will side with the taxpayer and cancel the final decision on the audit. Therefore, taxpayers, know your rights and defend them, because the legal rights of taxpayers should not be violated.

Attached documents

We continue to consider the procedure for processing the results of a tax audit (desk and field). The above-mentioned act must be accompanied by documents documenting facts of violation of Russian legislation in the field of taxes and fees that were discovered during the audit.

But at the same time, documents that were received from the person or organization being inspected are not attached to the act. In addition, the following cannot be used as attached evidence:

- Documentation containing data that the tax service does not have the right to disclose.

- Papers containing tax, banking or other secrets of third parties protected by Russian laws.

- Personal information of individuals.

All other documentation that does not fall under these prohibitions is attached to the act in the form of extracts.