What it is?

In 1999, the Federal State Statistics Service, by Resolution No. 20, approved a package of primary documents necessary for carrying out accounting activities at an enterprise. One of these documents is an invoice in form MX-18 for the transfer of finished products to storage places.

All enterprises that carry out production activities are required to maintain a document flow that will provide the accounting service with all the necessary information.

Form MX-18 records the movement of products by production departments to warehouses. That is, this form is an internal document of the organization.

General information about the MX-11 form

This form was approved on August 9, 1999 by Post. Goskomstat of Russia No. 66. It is included in the Album of unified “primary” forms for accounting for products and inventory items in storage areas. Since the beginning of 2013, the use of such forms in companies has become only advisory in nature. Enterprises can develop their own forms using the MX-11 as a basis. But the form has all the necessary fields and tables to fill out, so it is convenient to use even today. The use of unified forms or those developed by the company independently must be enshrined in the accounting policies by order of management.

A special commission is responsible for filling out the form. It is also formed by order of management for any period (year, half-year, quarter), and consists of at least three people. Usually this is a warehouse manager, an accountant, department heads, etc.

The purpose of the document is to reflect the difference in information on the receipt and consumption of goods from a separate batch. Required as a reason for writing off or taking into account identified shortages or surpluses of goods, respectively.

What is it used for?

Form MX-18 is usually used in production , since trade organizations, as well as those working in the service sector, do not need such a document - the invoice is used to move manufactured products.

A manufacturing enterprise is required to confirm all its business transactions with primary accounting records, and the goods it produces go through many stages before ending up in the warehouse.

At the moment when the products are produced and can be moved within the enterprise, for example, to other divisions, or to warehouses for further sale, the document in question is drawn up.

What other documents are there:

- All documents from the “Accounting” section

- Categories of all standard samples and document forms

What else to download on the topic “Accounting”:

- Information on the number and level of professional education of employees of agricultural organizations. Form N 2-K

- Information on the amount of payments and other remunerations accrued by payers of insurance premiums - policyholders in favor of an individual. Form N SZV-6-3 (filling sample)

- Information on bidding and other methods of placing orders for the supply of goods, performance of work, provision of services for state and municipal needs (form N 1-bidding). Form N 1-T (quarterly (cumulative)

- Sample case cover design

- Sample of the regulation

- Important nuances when buying a company

- The process of transferring an apartment to another person

- US Visa Process

- Car selling process

- Garage construction process (from a bureaucratic point of view)

- Construction of a private house in the city

Tags: Form, accountant, order, expense, Form

In what form is it compiled?

The MX-18 form is unified, that is, standard and complies with all legal requirements. The form has OKUD code 0335018 .

However, since 2013, unified forms are not mandatory; each enterprise has the right to independently choose the form of the invoice, but it must meet all the necessary requirements.

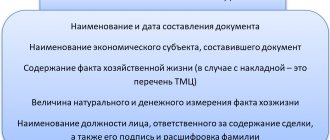

The document used to transfer finished products must contain the following columns:

- Date and document number.

- Sender - the department that transfers the products.

- Recipient - the department receiving the products.

- Corresponding account.

- A tabular section with the name, quantity and other characteristics of the transferred products.

- Signatures of the transmitting and receiving parties.

Features of filling out the form, general information

In 2013, the unified forms of primary accounting documents were abolished, so today employees of enterprises and organizations can make a choice either in favor of freely compiling a statement, or in favor of the previously mandatory unified form in the MB-7 form. It must be said that the second option is still in demand, since the form contains all the necessary data and frees company employees from unnecessary work on developing and approving the document template. In any case, regardless of which method of accounting for workwear is chosen, information about this must be included in the company’s accounting policy.

The statement can be maintained in a “live” form or electronically (with monthly printing) - at the end of the accounting period.

The document is filled out regularly and signed by the recipient of the workwear, as well as by responsible employees (materially responsible person - warehouse employee and head of a structural unit).

However, it is not necessary to certify it with the organization’s seal.

The statement, as a rule, consists of many sheets. To properly maintain a document, they must be numbered and fastened together using a thick, harsh thread. On the last page you need to put the stamp of the company and the signature of the person responsible for maintaining the document.

The statement is compiled in two identical copies, one of which remains with the storekeeper, the second is transferred to the specialists of the accounting department.

Compilation and design

Responsible person

It is necessary to draw up a document in form MX-18 to the person responsible for the transfer of products in the transferring unit, that is, the financially responsible person.

How many copies do you need?

The invoice for the transfer of finished products must be drawn up in two copies:

- one copy remains in the department from which the products will be transferred, after which the accounting department will write off;

- the second is transferred to the department receiving the products, where the receipt is posted.

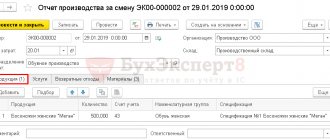

Filling

The header states:

- Full name of the enterprise.

- Information about the organization.

- OKPO.

- OKDP.

- Number and date.

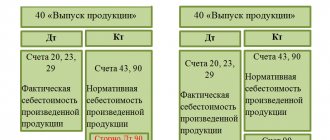

The following is a tabular section containing information such as:

- Name of the transmitting unit with OKDP code.

- Name of the receiving unit with OKDP code.

- Accounting entries: subaccount and analytics code.

- Product characteristics:

- Product name.

- Product characteristics.

- The units in which products are measured, as well as the OKEI code.

- Type of packaging.

- Number of products.

- Weight of transferred products.

- Registration prices for products - both per unit of goods and the total amount.

- Quantity and cost of products in words.

- All necessary signatures.

Particular attention should be paid to the header of the document, the name and quantity of products, as well as the signatures of the responsible persons.

If the document is not filled out completely, you may encounter problems during fiscal audits.

Signing the document

The invoice in the MX-18 form must be signed on both sides : by the financially responsible person of the department transferring the product, and by the financially responsible person of the department receiving the product.

Otherwise, if a controversial situation arises, there will be no person who can be held responsible for what happened.

Some organizations also have a person assigned supervisory responsibilities for such transactions. In such cases, this employee also leaves his signature on the document.

The signature is made in the form: indication of position, signature and transcript of the signature. Please note that an invoice without all the required signatures is considered invalid .

Placing stamps

Since 2015, affixing stamps on the primary document has been an optional feature. And if with an external transfer/sale it is better to play it safe and affix stamps, then there is no need to do this in internal documents, such as MX-18.

Fill out the form

The MX-11 form has a front and back side.

Facial

First comes the part containing information about the organization and general information about the product:

- name of the company or enterprise, department or other structural unit;

- OKPO number;

- activity code;

- warehouse number;

- type of operation;

- act number and date of its formation;

- batch number (it is indicated in the log of received inventory items) and the date of the last issue of inventory items;

- information about which goods, on which securities, from which supplier and when they were released (the relevant data is entered in the empty lines);

- sales period from the date of delivery to the warehouse.

Then the tabular part begins, where you need to enter data such as:

- name of the product, its code, discount price;

- information about the product upon receipt: quantity, weight, amount;

- information about the product at its final consumption: quantity, weight, amount;

- deviations: surpluses or shortages, how many there are in total, how many are within the limits of natural loss norms, how many are above the norms;

- cost difference.

If there are many items, then the table can be continued on several sheets. At the end of the table, each page summarizes the page total.

Reverse side

On the reverse side, the table continues, at the end of it the total for the entire document is summed up in the column “Total for the act.”

Then you need to write an explanation of the reasons for the surplus or shortage. Warehouse employees who are MOLs put their signatures. Next, the accountant and all members of the commission sign. Positions and transcripts of signatures are also indicated.

Then the head of the company makes his decision on writing off or accounting for shortages and surpluses, respectively, and puts a date and signature.

At the end of the document, the accountant signs and states the date of receipt of the act.

How long to store?

MX-18 is primary accounting documentation , according to this, like all other primary documents, it should be stored for at least five years.

There are different types of invoices for accounting; we suggest you learn about goods invoices, demand invoices, transport, consignment notes, expenditure and receipts, expenditure and receipts, returns and for the release of goods.

Form MX-18 is the easiest and most accurate way to reflect the movement of finished products within the organization. Filling it out is not difficult, however, it, like filling out any primary documentation, should be treated responsibly in order to avoid further problems.

If you find an error, please select a piece of text and press Ctrl+Enter.