What offenses are considered under Art. 101 of the Tax Code of the Russian Federation?

Let's look at what kind of offenses can be recorded by the heads of the Federal Tax Service or their deputies in accordance with Art. 101 Tax Code of the Russian Federation.

The resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated July 30, 2013 No. 57 states that in the manner provided for by the provisions of Art. 101 of the Tax Code of the Russian Federation, offenses are considered, the composition of which is defined:

- Art. 120 of the Tax Code of the Russian Federation (gross violation of the rules for accounting for income and expenses);

- Art. 122 of the Tax Code of the Russian Federation (non-payment of a tax or fee or its incomplete transfer to the budget);

- Art. 123 of the Tax Code of the Russian Federation (failure by the agent to fulfill obligations to transfer taxes to the budget).

About what types of violations are considered to fall under Art. 123 of the Tax Code of the Russian Federation, read the material “The Ministry of Finance recalled the conditions for a fine under Art. 123 Tax Code of the Russian Federation" .

In turn, offenses, the composition of which is determined in other articles of the Tax Code of the Russian Federation, should be considered, as the Supreme Arbitration Court of the Russian Federation believes, in accordance with Art. 101.4 Tax Code of the Russian Federation.

Gross violations by a company of the procedure for accounting for income and expenses may be accompanied by a fine of 10,000 rubles if they are committed within the same tax period. If a company commits a similar violation in subsequent tax periods, the amount of sanctions is tripled. If a gross violation of the procedure for accounting for income and expenses led to a decrease in the tax base (contribution base), then the company will pay a fine in the amount of 20% of the unpaid tax (contributions), but not less than 40,000 rubles.

Gross violations in the provisions of the Tax Code of the Russian Federation mean:

- the company lacks primary documents;

- lack of invoices;

- lack of accounting or tax registers;

- incorrect or untimely reflection on synthetic, analytical accounting accounts, as well as in tax registers of business operations, assets, and financial resources.

Read more about penalties for this type of violation in the article “Fine for gross violation of the rules for accounting for income and expenses .

Let us note that from April 2021, liability for taxpayer officials has been tightened for gross violations in accounting (Article 15.11 of the Code of Administrative Offenses). Now the fine for them can be 5,000 rubles. – 10,000 rub. against 2,000 rub. — 3,000 rub. according to previous standards. In addition, the legislator expanded the list of violations that entail administrative liability.

Failure to pay a tax or fee or their incomplete transfer to the budget is accompanied by a fine of 20% of the corresponding debt of the company. If it is established that the taxpayer knowingly refused to pay taxes and fees, the fine may amount to 40% of the debt to the budget.

If the tax agent does not fulfill its obligations to withhold and transfer the required amounts to the Russian budget or does not fulfill them in full, then it will have to pay a fine in the amount of 20% of the amount of money that must be transferred to the state.

At the same time, decisions of officials from the Federal Tax Service, made based on the results of reviewing documents as part of inspections and reflecting the agency’s position on establishing facts of offenses, can be appealed. Let's consider this aspect in more detail.

What is the procedure for appealing the actions of the Federal Tax Service?

In accordance with paragraph 8 of Art. 101 of the Tax Code of the Russian Federation, tax officials must explain to the taxpayer the procedure for appealing a decision made by the Federal Tax Service based on the results of reviewing documents as part of an audit.

Current legal norms make the corresponding appeal mechanism two-stage: first, the payer must express disagreement with the decision of the Federal Tax Service by contacting a higher structure of the department, and if the reaction of the tax authorities does not suit him or the complaint remains unanswered, he can go to court (clause 2 of article 138 of the Tax Code of the Russian Federation ).

The period for consideration of a complaint by a higher body of the Federal Tax Service is 1 month. The department also has the right to extend it for another 1 month if there is a need to obtain documents from lower-level structures of the Federal Tax Service (Clause 6 of Article 140 of the Tax Code of the Russian Federation).

In accordance with the provisions of paragraph 4 of Art. 198 of the Arbitration Procedure Code of the Russian Federation, applications to arbitration must be submitted no later than 3 months after violations of a citizen’s rights are identified. The following actions of tax authorities are recognized as such:

- the higher structure of the Federal Tax Service made a decision on the complaint that did not suit the applicant, and notified him of this decision;

- The deadline for consideration of the complaint by the department has expired.

An alternative to going to court after a higher structure of the Federal Tax Service has made a decision on a complaint may be to subsequently forward the complaint to the central office of the Federal Tax Service in Moscow. This also needs to be done within 3 months from the moment of familiarization with the decision of the territorial structure of the department, which is superior to the Federal Tax Service Inspectorate that conducted the inspection (clause 2 of Article 139 of the Tax Code of the Russian Federation).

A complaint to the structure of the Federal Tax Service, to which the inspectorate of the Federal Tax Service is subordinate, must be submitted in writing signed by the person directly filing it or his representative. You can also submit it in electronic form via telecommunication channels or through the taxpayer’s personal account (clause 1 of Article 139.2 of the Tax Code of the Russian Federation).

The structure of the complaint must include:

- Full name of the applicant, company address;

- information about the appealed decision of the Federal Tax Service;

- the name of the Federal Tax Service whose actions are being appealed;

- the grounds on which the applicant is appealing the decision of the Federal Tax Service;

- applicant's requirements;

- applicant's contact details;

- documents that support the applicant’s arguments;

- if necessary, documents confirming the authority of the person representing the interests of the applicant and signing the complaint;

- method of obtaining a decision on the complaint (on paper, in electronic form or through the taxpayer’s personal account).

It may be noted that the costs associated with a possible contact with lawyers in order to more competently draw up a complaint to the Federal Tax Service can be included in expenses when calculating income tax (letter of the Ministry of Finance of the Russian Federation dated December 7, 2012 No. 03-03-06/1/644 ).

Read about the latest innovations in the appeal procedure in the material “Innovations in appealing the actions of tax authorities have begun to take effect .

Written objections to the on-site tax audit report

Within two months from the date of drawing up the certificate based on the results of the on-site audit, the tax authority draws up a tax audit report.

An objection to the on-site inspection report may be submitted to the tax authority by any organization in the following cases:

- Disagreement with the conclusions, facts, proposals set out in the act on the basis of clause 6 of Art. 100 Tax Code of the Russian Federation.

- Disagreement with the conclusions, proposals and facts set out in the act of discovery of facts (clause 5 of Article 101.4 of the Tax Code of the Russian Federation).

- Disagreement with the conclusions, proposals and facts set out in the addendum to the act.

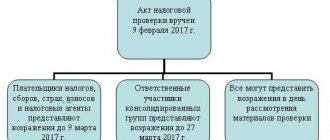

Objections to the inspection report must be submitted within no more than 1 month from the date of receipt of the report by the tax inspector. Objections may be accompanied by documentary evidence of the information referred to by the organization.

Objections to additions to the act are submitted within 15 days to the tax inspector.

The Tax Code of the Russian Federation establishes that objections must be submitted in writing, indicating the disputed tax act. The act must contain refutations of tax claims with mandatory motivation.

PROMOTION : we will make an objection to you within 24 hours or return your money, watch the VIDEO for more details

An objection can be made in different ways:

- on paper by mail;

- in electronic form through government services or another document flow operator;

- in person or through a representative of the tax office

Objections are considered during the procedure for reviewing the results of a tax audit. Before starting to consider the merits of the inspection materials, the head of the inspection:

Announces who is reviewing the case and what materials are being reviewed

Establishes the fact of attendance. In case of failure to appear, the person is notified of the date and place of consideration of the tax audit materials. If the person is notified, is absent, his presence is mandatory, the consideration is postponed. If notified is absent, but his presence is not mandatory, then the consideration takes place in his absence. If the person is not notified, the consideration is postponed.

- Verifies the credentials of persons

- Makes a decision on adjournment if necessary

In what cases does the Federal Tax Service have the right not to satisfy a taxpayer’s complaint?

It will be useful to consider the norms of the Tax Code of the Russian Federation, according to which the Federal Tax Service acquires the right to refuse to satisfy a payer’s complaint. First of all, we note that this action is among 5 possible ones that tax authorities have the right to carry out. Apart from the refusal to satisfy the complaint, these include:

- cancellation of the act of a lower tax authority;

- reversal of the decision of a lower tax authority (in whole or in part);

- cancellation of the decision of the lower structure of the Federal Tax Service and adoption of a new one

- recognizing the actions (inaction) of tax officials as illegal and making a decision on the merits.

Provisions of paragraph 1 of Art. 139.3 of the Tax Code of the Russian Federation includes the grounds on which the Federal Tax Service has the right to refuse a payer’s complaint. A similar scenario is possible if:

- the procedure for filing a complaint is not followed or it does not indicate acts of the tax authority of a non-regulatory nature, actions or inactions of its officials that led to a violation of rights;

- the deadline for filing a complaint has been missed, there is no request for its restoration, or the payer has been denied this right;

- the applicant, before the Federal Tax Service made a decision on the complaint, sent the department a recall of the document - in whole or in part;

- this is not the first time a complaint has been filed with the Federal Tax Service, but on the same grounds as the previous one;

- Before making a decision on the complaint, the tax authority reported that the violation of the taxpayer’s rights had been eliminated.

At the same time, the taxpayer can try to challenge the refusal to satisfy the complaint, as well as file the complaint again, if the reason for the refusal was not a withdrawal of the complaint or a repetition.

The date of presentation of the decision on an on-site inspection to the taxpayer does not affect its duration

Good afternoon A pressing question, we recently received answers to it from the Ministry of Finance and the Federal Tax Service, perhaps this was the letter of the Ministry of Finance dated February 17, 2016 No. 03-02-07/1/8635). In accordance with paragraph. 2 p. 4, pp. 3 clause 10 art. 89 of the Tax Code of the Russian Federation, when conducting an on-site (repeated on-site) tax audit, a period not exceeding three calendar years preceding the year in which the decision to conduct an on-site (repeated on-site) tax audit was made.

The gap in the Code in the time limits for familiarization (delivery) with the decision to conduct an audit allows the tax authorities at the beginning of the year to extend the inspection period by a year, dating the decision to last year. Appeals to the Federal Tax Service and the Ministry of Finance showed that they do not have an answer to this question; they simply indicate the absence of established deadlines for familiarization (delivery) in the Code. To achieve success in court, in my opinion, is likely to be by using the spirit and essence of Art. 3 Tax Code of the Russian Federation. After all, the absence of established deadlines in relation to a significant tax action is not acceptable or should be interpreted in favor of the taxpayer. Meanwhile, Mr. organs are deceitful. In clauses 12, 13 of the Appendix to the order of the Federal Tax Service of Russia dated 04/15/2015 N ММВ-7-2/ [email protected] (ORDER OF SENDING DOCUMENTS USED BY TAX AUTHORITIES IN THE EXERCISE OF THEIR POWERS..), it is stated that:

"12. The document is generated on paper, signed and registered with the tax authority. No later than the next business day after registration, the Document is generated in electronic form, signed by the EPC, which allows identifying the relevant tax authority (the owner of the qualified certificate) (hereinafter referred to as the EPC of the tax authority) and sent via telecommunication channels to the taxpayer (taxpayer’s representative). In this case, the tax authority records the date of its sending to the taxpayer (taxpayer’s representative). 13. The tax authority, within the next working day after the day of sending the Document in electronic form via telecommunication channels, must receive confirmation of the date of sending from the electronic document management operator.”

In this case, the Document means all documents provided for by the legislation on taxes and fees of the Russian Federation and used by tax authorities in the exercise of their powers, including decisions to conduct an on-site tax audit (see clause 1 of the Procedure).

Is an analogy of the law possible here, and the procedure registered in the Ministry of Justice of Russia on August 12, 2015 N 38482, or the law, based on Art. 3 of the Tax Code of the Russian Federation? A good question, the answer to which will most likely have to be obtained in court, if you do not initiate amendments to Article 89 of the Tax Code of the Russian Federation, as a way to eliminate a gap in the legislation recognized as such by state bodies.

Can a taxpayer refuse to participate in the review of documents?

One of the pressing issues in the area of interaction between taxpayers and the Federal Tax Service under consideration is whether the former can refuse to participate in the study of documents as part of tax audits. In accordance with paragraph 2 of Art. 101 of the Tax Code of the Russian Federation, the absence of representatives of the inspected organization when considering the inspection materials cannot be an obstacle to carrying out the relevant event, but only if the head of the Federal Tax Service does not consider that their participation is mandatory. Thus, the representative has the right not to interact with the Federal Tax Service during the study of documents, but department officials may consider that this procedure cannot be carried out without his participation.

At the same time, the Federal Tax Service has at its disposal a very effective countermeasure in case the payer’s participation in the review of documents is highly desirable, but he avoids interacting with the tax authorities. The Ministry of Finance, in paragraph 4 of letter No. AS-4-2/9355 dated May 23, 2013, recommends that territorial tax authorities provide taxpayers with notifications of the date, time, and place of consideration of inspection documents simultaneously with the acts that correspond to these inspections. If the payer does not accept this notification, the inspector may, in accordance with the recommendation of the Federal Tax Service, draw up a protocol on the administrative violation provided for in Art. 19.1.4 Code of Administrative Offenses of the Russian Federation. That is, the taxpayer in this case may be held liable for obstructing the activities of the tax authority. As a result, the company's official and the organization itself may be fined.

Entry into force of the decision

The decision made will enter into legal force after a month from the date of its delivery (Clause 9 of Article 101 of the Tax Code of the Russian Federation).

The organization has the right to appeal the decision of the Federal Tax Service by filing an appeal. There are three options for the development of events.

- The higher tax authority does not cancel the decision of the Federal Tax Service. In this case, it comes into force from the date of adoption of the corresponding decision by a higher tax authority.

- The higher tax authority cancels the decision and issues a new one. Then it comes into force from the date of its adoption.

- The appeal remains without consideration. In this situation, the decision of the Federal Tax Service will come into force from the day the higher tax authority makes a decision to reject the complaint, but not earlier than the expiration of the deadline for filing it (Article 101.2 of the Tax Code of the Russian Federation).

After the decision comes into force, within 20 working days the company will be sent a requirement to pay additional tax (penalties, fines) (Clause 2 of Article 70 of the Tax Code of the Russian Federation).

What violations of the Federal Tax Service when checking and processing decisions are significant?

In accordance with paragraph 14 of Art. 101 of the Tax Code of the Russian Federation, a taxpayer has the right to count on the cancellation by a higher body of the Federal Tax Service of a decision made by the head or deputy of the Federal Tax Service if the relevant structure violates the essential conditions of the procedure for studying documents as part of an audit. What could they be?

It happens that tax authorities neglect the obligation to serve the audited company with a desk audit report, which can also result in decisions recognizing the company as a violator of tax laws, as well as to provide the necessary evidence base reflecting the fact that the said report was sent. The Federal Antimonopoly Service of the West Siberian District, in its resolution dated July 17, 2014 No. A45-20696/2013, comes to the conclusion that this is unacceptable.

The tax audit report, as well as the decision of the head of the Federal Tax Service or his deputy, must contain, first of all, a systematic presentation of facts indicating a violation by the taxpayer of legislation in the field of taxes and fees (Resolution of the Federal Antimonopoly Service of the East Siberian District dated March 20, 2013 No. A78-4025/2012) . If tax authorities generate documents that do not meet the specified criterion, this may be qualified as a significant violation of the procedure for considering audit materials.

The tax audit report, as well as the decision of the head of the Federal Tax Service or his deputy, must necessarily contain references to the provisions of regulatory legal acts that the audited company violated, as well as links to documents evidencing these violations (Resolution of the Federal Antimonopoly Service of the Moscow District dated January 14, 2014 No. F05- 16619/2013). First of all, these are primary documents. If these, as well as references to legal acts, are not indicated in the inspection report, this action of the Federal Tax Service may be qualified as a significant violation of the procedure for reviewing documents.

Is the absence of signatures of all inspectors in the inspection report a significant basis for canceling the decision of the tax authority? ConsultantPlus experts have collected court decisions on this topic into a single review. Learn the material by getting trial access to the system for free.

At the same time, the tax authorities’ violation of the deadline for making a decision on an audit is not significant and cannot be a basis for canceling the decision. See here .

What is considered the moment of completion of a tax audit: analysis of law enforcement practice

Last month, the AC of the Central District supported (case No. A54-3819/2016) in resolving a tax dispute about the legality of filing an updated declaration in the period between the signing of the inspection report and the inspection’s decision. Essentially, the dispute consists in deciding what should be recognized as the end of the inspection - the date of drawing up the act or the date of the decision.

According to the Inspectorate, filing an updated declaration after drawing up an inspection report, i.e. after its completion, excludes the possibility of terminating all actions on a previously submitted declaration. Meanwhile, the court gave the concept “end of inspection” a different meaning. The arbitrators indicated that the end of an audit does not mean the literal end of those actions that the tax authority performs before drawing up an audit report, but the complete completion of all audit actions ending with a decision, since it does not make sense to continue all actions in relation to the tax return that was clarified by the taxpayer.

Thus, the court indicated that the date of completion of a tax audit is recognized as the date of the decision, and not the drawing up of the act. In accordance with the position of the arbitrators, the submission of an updated calculation before the end of the tax audit entailed the termination of the audit of the previously submitted declaration and the beginning of a new one. In this regard, the Inspectorate’s additional charges were declared unlawful.

The presentation of similar claims by the tax service is a rather large-scale problem, which is confirmed by the presence of: (1) extensive judicial practice, incl. at the level of the Supreme Arbitration Court of the Russian Federation (Definitions of the Supreme Arbitration Court of the Russian Federation dated March 23, 2011 No. VAS-247/11, dated October 29, 2010 No. VAS-11884/10) and the Supreme Arbitration Court of the Russian Federation (see the link to the case number below in the text), and (2) positions financial department.

In their majority, the judges come to the conclusion that there is no point in making a decision on checking a declaration that has been clarified by the taxpayer (resolutions of the Federal Antimonopoly Service of the Moscow District dated February 26, 2013 in case No. A40-115185/11-107-479, dated November 29, 2011 in the case No. A41-31236/10).

The Supreme Court of the Russian Federation, in its Ruling No. 310-KG16-5041 dated September 13, 2016, in case No. A09-6785/2013, confirmed that the data from updated declarations are taken into account when making a decision on an inspection if the declarations are submitted after the act of this inspection has been drawn up.

There is a position of the Federal Tax Service of Russia, according to which, when submitting an updated declaration after drawing up a desk tax audit report, clause 9.1 of Art. 88 of the Tax Code of the Russian Federation does not apply (letter of the Federal Tax Service of Russia dated November 20, 2015 No. ED-4-15/20327), as well as judicial arbitration practice is not in favor of the taxpayer (resolution of the Arbitration Court of the Ural District dated April 4, 2013 No. F09-2044/13). At the same time, there is also an opinion of the Federal Tax Service of Russia, according to which the tax authority can begin a new desk tax audit on the basis of an updated tax return after the delivery (sending) of the tax audit report, but before making a decision on its results (letter of the Federal Tax Service of Russia dated November 21. 2012 No. AS-4-2/ [email protected] ).

The identified problem requires additional attention of the RF Armed Forces due to the controversial position of both the courts and the financial department. It is obvious that the lack of a unified position on this issue can lead to:

- on the one hand, to the issuance of several decisions to prosecute for non-payment of tax based on the results of the same tax period, which will violate the legal rights and interests of taxpayers;

- on the other hand (if the clarification is an agreement with the claims presented), to the need to complete the implementation of the verification materials, because the application of penalties based on the results of a desk audit of such an updated declaration seems controversial.

Authors: Denis Savin and Elena Konstandina

In what time frame must documents be provided at the request of the Federal Tax Service?

In accordance with paragraph 1 of Art. 93 of the Tax Code of the Russian Federation, as well as clause 6 of Art. 101 of the Tax Code of the Russian Federation, Federal Tax Service inspectors have the right to request various documents from the company being inspected during the inspection. It will be useful to consider the time frame within which they should be provided.

For any types of audits, including additional ones, the taxpayer must send the required documents to the Federal Tax Service within 10 days from the receipt of the relevant request (clause 3 of Article 93 of the Tax Code of the Russian Federation).

The Federal Tax Service can deliver this request in person (clause 1 of Article 93 of the Tax Code of the Russian Federation), send it through a personal account, via telecommunication channels, or by regular mail (clause 4 of Article 31 of the Tax Code of the Russian Federation). If the request is sent by mail, then the date of its receipt is the 6th working day from the date of sending. If the request is sent through the taxpayer’s personal account, then it is considered received the very next day after sending (paragraph 3, paragraph 4, article 31 of the Tax Code of the Russian Federation).

It can be noted that even if the taxpayer received the request by mail before the expiration of 6 days from the date of sending, then he, one way or another, has the right to count the deadline for providing documents after 6 days (letter of the Ministry of Finance of the Russian Federation dated May 6, 2011 No. 03-02-07 /1-159 ).

If the payer does not provide additional documents for verification, the Federal Tax Service will impose a fine on him in the amount of 200 rubles for each source not provided (clause 1 of Article 126 of the Tax Code of the Russian Federation).

In turn, payers are required to provide the necessary documents upon request if they are at the disposal of the company (letter of the Federal Tax Service of the Russian Federation dated February 20, 2015 No. AS-3-2/636).

What is stated in the document

The decision to prosecute shall indicate (clause 8 of Article 101 of the Tax Code of the Russian Federation):

- circumstances of the tax offense committed;

- the company's arguments in its defense;

- the results of testing these arguments;

- a decision to bring the company to tax liability, indicating the relevant articles of the Tax Code of the Russian Federation;

- measures of responsibility that will be taken against the taxpayer;

- the amount of the identified arrears, penalties and fines;

- the period during which you can appeal the decision, as well as the procedure for appealing;

- name and address of the authority to which the decision can be appealed.

The decision to refuse to prosecute shall indicate the circumstances that served as the basis for the refusal. Also, such a decision may indicate the amount of arrears identified during the inspection and the amount of penalties (clause 8 of Article 101 of the Tax Code of the Russian Federation).

Assess the financial condition of your company using Kontur.Expert

Send a request

How should the Federal Tax Service notify the payer about the consideration of documents?

So, the Tax Code of the Russian Federation regulates in some detail how the Federal Tax Service should send requests to payers to provide additional documents. However, this legal regulation does not regulate in detail how the Federal Tax Service should notify the taxpayer about the time and place of studying documents as part of the audit - that is, fulfill the obligation provided for in paragraph 2 of Art. 101 Tax Code of the Russian Federation.

The Supreme Arbitration Court of the Russian Federation, in Resolution No. 57 dated July 30, 2013, indicates that tax authorities can provide notification of the consideration of documents as part of an audit in any way. The arbitration believes that the Tax Code of the Russian Federation does not have provisions regulating the specific method of communication between the Federal Tax Service and the companies being inspected in this case.

It is important that one or another notification method allows identifying the sender and recipient of information about the consideration of documents. Also, the Federal Tax Service must have evidence of the transfer of relevant information (resolutions of the Presidium of the Supreme Arbitration Court of the Russian Federation dated February 25, 2010 No. 14458/09, dated February 12, 2008 No. 12566/07).

What consequences are provided by law if the taxpayer is not given an on-site inspection report? The answer to this question is in ConsultantPlus. If you don't have access to the system, get a free trial online.

For more information about providing documents to the Federal Tax Service, read the article “How to submit documents at the request of the tax inspectorate .

Is it possible to send clarification during the inspection?

As we noted above, among the offenses that can be recorded under Art. Tax Code 101 - non-payment of taxes, fees or incomplete transfer to the budget (Article 122 of the Tax Code of the Russian Federation). The amount of these obligations is fixed mainly based on the information in the tax return provided by the company to the Federal Tax Service.

It may happen that the accounting department of the audited organization discovers that the already submitted declaration contains errors, as a result of which discrepancies arise between the actual tax obligations and the declared ones not in favor of the taxpayer. The Federal Tax Service, having discovered them during an inspection, can record an offense. Many companies, upon detection of relevant errors, immediately send an updated declaration to the Federal Tax Service. But is it possible to do this directly during the inspection?

Taxpayers are required to send clarifications to the tax authorities if errors in the previous declaration led to a reduction in tax (clause 1 of Article 81 of the Tax Code of the Russian Federation). In turn, the norms of the Tax Code of the Russian Federation do not establish circumstances and criteria limiting the sending of updated declarations to the Federal Tax Service.

Thus, it is quite acceptable to send clarifications to tax authorities during audits. However, will this help to avoid a decent fine upon discovery of arrears by the Federal Tax Service - 20% of the unpaid tax (clause 1, Article 122 of the Tax Code of the Russian Federation), and if inspectors consider the incorrect calculation of tax by the company to be intentional - then 40% (clause 3, Article 122 Tax Code of the Russian Federation)?

Unfortunately, the clarification does not guarantee that the Federal Tax Service will refuse to issue a fine. But you can avoid it if:

- submit the clarification before the deadline for transferring the tax to the budget;

- submit the clarification before being informed that the Federal Tax Service has discovered an error in the main declaration, or that the tax authorities will initiate an on-site audit for the corresponding period, provided that by the time the clarification is submitted the company will have paid the tax and penalties;

- During the on-site inspection, the Federal Tax Service did not reveal any errors in the declaration.

Another option to avoid a fine is to pay taxes and penalties, submit an amendment and send a request to the Federal Tax Service not to charge a fine, based on the provisions of sub-clause. 3 p. 1 art. 112 of the Tax Code of the Russian Federation. That is, by referring to circumstances that could mitigate liability for the identified tax offense.

Providing clarification, paying taxes and penalties, at a minimum, will convince the Federal Tax Service that the payer understated the amount of tax in the main declaration unintentionally, and the likelihood of the department imposing a fine of 40% will be significantly reduced.

To learn how the fine for tax failure to be paid on time will be calculated when several clarifications are submitted for the same period, read the material “How will the fine for non-payment be calculated if several clarifications are submitted in one period?” .

What are the legal grounds for the Federal Tax Service to take interim measures?

In accordance with paragraph 10 of Art. 101 of the Tax Code of the Russian Federation, the Federal Tax Service may apply interim measures against the inspected organization aimed at preserving the assets of the payer, through which its obligations to the budget that arose as a result of the inspection can be repaid. It will be useful to consider what are the legal reasons for taking these measures by the Federal Tax Service and in what cases the tax authorities do not have the right to implement them.

The Tax Code of the Russian Federation does not contain provisions regulating in detail the criteria for initiating interim measures, which the Federal Tax Service must adhere to. In paragraph 10 of Art. 101 of the Tax Code of the Russian Federation only states that tax authorities must have sufficient grounds to believe that refusal to take interim measures may adversely affect the execution of the decision of the Federal Tax Service, which requires the company to pay arrears, penalties and fines. What could those “sufficient reasons” be?

Judicial practice shows that such a basis may be, in particular, the actions of the inspected company, expressed in the transfer of fixed assets in favor of the founders, in terms of timing coinciding with the inspection (Resolution of the Federal Antimonopoly Service of the West Siberian District dated January 27, 2012 No. A27-5430/2011) . Tax authorities, having recorded this circumstance, have the right to consider that the company, by reducing assets, seeks to avoid subsequent payment of arrears, and the court may agree with this argument of the Federal Tax Service.

Another possible sufficient reason is the initiation by the company of a liquidation procedure, accompanied by a decrease in the amounts available in current accounts (Resolution of the Federal Antimonopoly Service of the North Caucasus District dated January 21, 2013 No. A53-9359/2012). This reason can be assessed as especially compelling if the liquidated company, in addition to cash in its current account, does not have a significant amount of other property through which the debt to the budget can be repaid.

The active sale of property by a company directly upon receipt of an inspection report from the Federal Tax Service is another possible reason for tax authorities to find sufficient grounds for taking interim measures (Resolution of the Federal Antimonopoly Service of the East Siberian District dated September 4, 2012 No. A10-3116/2011).

Another possible basis for discovering sufficient grounds for the Federal Tax Service to take interim measures against the taxpayer is the implementation by the audited company of settlements with shell companies (Resolution of the Federal Antimonopoly Service of the West Siberian District dated April 10, 2015 No. A70-6490/2014).

One way or another, in most cases, the taxpayer has the right to challenge the decision of the Federal Tax Service to take interim measures in court, since the Tax Code of the Russian Federation does not define in detail the criteria for detecting sufficient grounds for issuing it.

At the same time, the payer also has the opportunity to give the tax authorities a counter-response in the form of their own “interim measures.” Let us consider their essence in more detail.

Interim measures in favor of the taxpayer: what is their essence?

The term “interim measures” in Russian legislation can be interpreted in different ways. Thus, in the Tax Code of the Russian Federation, these are understood as actions of the Federal Tax Service aimed at preserving the taxpayer’s property, against which arrears can be repaid. However, there are also interim measures provided for by the arbitration procedural legislation. In accordance with paragraph 1. Art. 90 of the Arbitration Procedure Code of the Russian Federation, these should be understood as measures that are aimed at ensuring the property interests of the subject.

The main interim measures (in the meaning given in the Arbitration Procedure Code of the Russian Federation) in this case may be:

- prohibition of the Federal Tax Service from performing actions with property and bank accounts that are actually the subject of a dispute (subclause 2, clause 1, article 91 of the Arbitration Procedure Code of the Russian Federation);

- suspension of the decision of the Federal Tax Service on the adoption of interim measures in the meaning given in the Tax Code of the Russian Federation (clause 3 of Article 199 of the Arbitration Procedure Code of the Russian Federation).

As we noted above, recourse to arbitration is possible only after the taxpayer has carried out the necessary interactions with the Federal Tax Service in a pre-trial manner. But, if a company legally initiated a claim in arbitration, the subject of which is the adoption of interim measures (in the meaning given in the Arbitration Procedure Code of the Russian Federation), then the Federal Tax Service, while the case is being considered in court, cannot apply its own interim measures in the meaning given in the Tax Code RF (clause 77 of the resolution of the Supreme Arbitration Court of the Russian Federation dated July 30, 2013 No. 57).

Sources:

- Tax Code of the Russian Federation

- Arbitration Procedural Code of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.