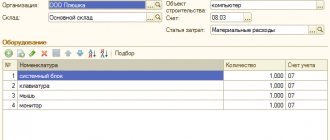

It is not always possible to put purchased equipment into operation immediately. As a rule, it needs installation. Such equipment is recorded on account 07. Separately, it is necessary to take into account equipment that cannot be put into operation immediately after receipt. Such fixed assets also require modification and installation, and equipping with auxiliary parts. Both units of equipment and complexes are considered similar operating systems. Let's consider all the nuances of accounting for objects that need installation.

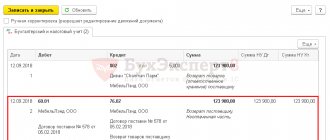

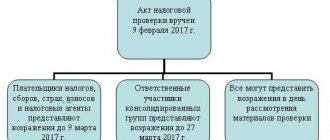

Question: How to reflect in the accounting of a Russian organization the acquisition and import into the territory of the Russian Federation of equipment that requires installation for the purpose of use in production, as well as the installation of this equipment, if the equipment was purchased from a Kazakh seller, is imported from the territory of the Republic of Kazakhstan, the installation of the equipment is carried out a Kazakh contractor on the territory of the Russian Federation? The contractual cost of the equipment is 2,000,000 rubles, the cost of installation work is 200,000 rubles. (excluding VAT). Settlements with the seller and contractor are made after receipt of the equipment and completion of installation work, respectively. The Kazakh contractor is not registered with the tax authorities of the Russian Federation as a VAT payer and does not have a representative office in the Russian Federation. View answer

What is meant by equipment that needs to be installed?

What is meant by equipment that needs installation in accounting? This is a complex of depreciable objects that are prepared before they are put into use. The assets under consideration differ in the following characteristics:

- Long-term operation.

- Relatively high cost.

- An object can reduce or increase the material benefits that a firm receives.

- The facility cannot be operated without initial installation; it requires preparation of the foundation and installation of supports.

- Requires assembly of basic elements.

- The equipment needs settings and software installation.

The list of equipment under consideration includes production facilities and laboratory equipment.

Question: How to record the acquisition of production equipment that requires installation and its installation by auxiliary production? Equipment requiring installation (machine) was purchased under a sales contract at a price of RUB 960,000. (including VAT RUB 160,000). The cost of installing equipment is 50,000 rubles. The equipment is intended for use in production for a period exceeding 12 months. View answer

What exactly is the equipment that needs installation? The necessary list is contained in the Instructions for the chart of accounts, approved by Order of the Ministry of Finance No. 94n dated October 31, 2000. In particular, this is the following technique:

- Objects of industrial importance installed in constructed/reconstructed buildings.

- Objects put into use after their elements are assembled and attached to the foundation/floors. This category includes control and measuring equipment.

Question: How to record the purchase of production equipment that requires installation and its installation by a contractor? Equipment requiring installation (machine) was purchased under a sales contract at a price of RUB 960,000. (including VAT RUB 160,000). The contractual cost of installation of purchased equipment intended for use in production for a period exceeding 12 months is 60,000 rubles. (including VAT 10,000 rub.). Installation was performed by a third party (not the equipment supplier). For the purposes of tax accounting of income and expenses, the accrual method is used. View answer

What does not apply to equipment that needs installation

The equipment to be installed does not include the following objects:

- TS.

- Agricultural equipment.

- Construction equipment.

- Tools for production employees.

- Household type equipment.

- Autonomous machines.

That is, the listed objects are taken into account in the standard order. They do not fit on account 07 since they do not need to be installed first. Such objects are placed on account 08. They are recorded as they arrive at the warehouse.

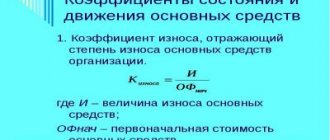

Purchased used equipment

The company purchases not new, but used equipment. In this situation you should be very careful. After all, tax accounting for such property has its own characteristics...

Determining the useful life The general rules for accounting for fixed assets as depreciable property are as follows.

Assets must have a useful life of more than 12 months and an initial cost of more than RUB 20,000. When determining the useful life, one should be guided by the Classification of fixed assets, approved by Decree of the Government of the Russian Federation of January 1, 2002 No. 1. These rules are set out in Articles 256, 257 and 258 of the Tax Code of the Russian Federation. If a company buys used equipment, it also applies these rules. However, the useful life, which is established in the Classification, can be reduced by the number of years (months) of operation of this property by the previous owners (clause 12 of Article 259 of the Tax Code of the Russian Federation).