Accounting for the consumption (issue) of materials into production. Accounting entries

The release of materials into production means their release from the organization's warehouse (shops) directly for the manufacture of products (performance of work, provision of services), as well as the consumption of materials for the management needs of the organization.

The release of materials to the warehouses of departments (shops) of the organization and to construction sites is considered as internal movement.

As materials are released from the warehouses of departments (shops) to workplaces, they are written off from the material asset accounts and credited to the corresponding production cost accounts. The cost of materials released for management needs is charged to the appropriate accounts for accounting for these expenses.

The primary accounting documents for the release (consumption) of materials from the organization's warehouses to the organization's divisions (shops) are a limit-fetch card (standard interindustry form N M-8), a demand invoice (standard interindustry form N M-11), an invoice (standard interindustry form form N M-15).

Valid options

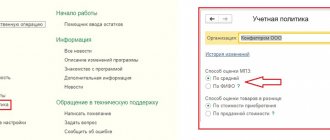

To begin with, let us recall what an accountant who forms the accounting policy of an organization can choose from. In case of single production, WIP assessment is prescribed to be carried out based on actual costs, but in mass or serial production, you can choose from four methods:

- at actual production cost;

- according to standard (planned) production costs;

- by direct cost items;

- at the cost of raw materials, materials and semi-finished products.

Finished products must be reflected in the balance sheet in one of the following ways:

- at actual production cost;

- at standard (planned) production costs.

Moreover, the standard cost, in turn, can be determined in one of two ways:

- by the amount of standard costs associated with the use of fixed assets, raw materials, materials, fuel, energy, labor resources, and other costs for production in the production process;

- for direct cost items.

If, according to the accounting policy, products are valued at actual production costs, in current accounting there is a need to use accounting prices, which can be used as standard cost, contractual (sale) price of products, and other types of prices. And at the end of the month, any deviations that arise (calculation differences) will be identified and written off.

List of accounts involved in accounting entries:

|

|

Below are accounting entries reflecting the consumption of materials for production and administrative needs.

| Account Dt | Kt account | Wiring Description | Transaction amount | A document base |

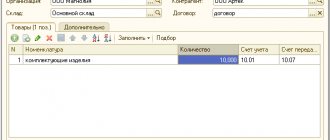

| 20 | 10 | Materials were released into main production. The consumption of materials in the main production is taken into account | Cost of materials | Limit-fence card (TMF No. M-8) Demand-invoice (TMF No. M-11) Invoice (TMF No. M-15) |

| 23 | 10 | Materials were released to auxiliary production. Material consumption taken into account | Cost of materials | Limit-fence card (TMF No. M-8) Demand-invoice (TMF No. M-11) Invoice (TMF No. M-15) |

| 25 | 10 | Materials were released for general production needs. Material consumption taken into account | Cost of materials | Limit-fence card (TMF No. M-8) Demand-invoice (TMF No. M-11) Invoice (TMF No. M-15) |

| 26 | 10 | Materials were released for general business needs. Material consumption taken into account | Cost of materials | Limit-fence card (TMF No. M-8) Demand-invoice (TMF No. M-11) Invoice (TMF No. M-15) |

| 10 | 10 | Materials were released to warehouses (storerooms) of departments (shops) | Cost of materials | Internal movement invoice |

Valuation of work in progress at actual production cost

And finally, the most complex, but also the most complete and accurate method of assessing work in progress is based on actual production costs, which takes into account not only direct, but also indirect (general production) costs.

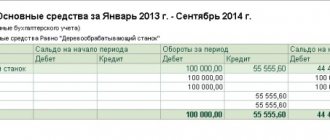

Example 5. Using the data from example 1, assume that the enterprise decided to evaluate work in progress at actual production costs.

At the end of the month, the accountant summed up all the expenses incurred for the month, reflected on account 20 (including those written off from other accounts, including account 25), and received the total amount of actual production costs for the month - 561,000 rubles.

This means that the actual production cost of each unit of production - both completed and unfinished - amounted to: 561,000 rubles. / 10,000 units = 56.10 rub.

And the “incomplete” will be valued at: 56.10 rubles. x 200 units = 11,220 rub.

And the cost of manufactured products will be determined in the amount of: 561,000 - 11,220 = 549,780 rubles.

Ideally, the degree of product readiness should also be taken into account here, if such can be determined (then general production costs when assessing work in progress are “tied” to direct labor costs).

Let us pay special attention to the fact that the regulations refer to the assessment of work in progress exclusively at production costs. However, the understanding of this term may vary.

In foreign practice, production costs clearly do not include general (administrative) and commercial expenses - they are attributed directly to the reduction of the financial result (which is equivalent to entries from the credit of accounts 26 and 44 directly to the debit of account 90 “Sales”).

In Russia, another option is acceptable and is often used - when general business expenses are not considered as semi-fixed, but are also included in the cost of production, in other words, account 26 is closed as a debit to account 20 (as well as accounts 23, 29 when selling products, work, services, auxiliary and servicing industries and outsourced farms). With this option, “production cost” is considered to be the total amount of costs collected on account 20, including general business expenses. And what is considered “production cost” according to Western ideology, in this case is called “shop cost”.

Thus, depending on the chosen approach and the option for writing off general business (administrative) expenses, the accounting policy should further clarify the concept of production cost and the composition of its costs (costing items), on the basis of which finished products and work in progress are assessed.

Accounting for other disposals (write-offs, gratuitous transfers) of materials. Accounting entries

Write-off of materials can be carried out in the following cases:

- that have become unusable after expiration of the storage period;

- obsolete;

- when identifying shortages, thefts or damage, including due to accidents, fires, and natural disasters.

The preparation of the necessary information for making a decision on the write-off of materials is carried out by the Commission with the participation of financially responsible persons. Based on the results of the inspection, the Commission draws up an Act on the write-off of materials for each division of the organization, for financially responsible persons.

The write-off of materials transferred under a gift agreement or free of charge is carried out on the basis of primary documents for the release of materials (waybills, applications for the release of materials to third parties, etc.). Article 146 “Object of taxation” of the Tax Code of the Russian Federation states that the transfer of ownership of assets free of charge is recognized as a sale, that is, subject to VAT.

Below are accounting entries reflecting the write-off and gratuitous transfer of materials

| Account Dt | Kt account | Wiring Description | Transaction amount | A document base |

| Accounting for shortages (damage) of materials in the presence of culprits | ||||

| 94 | 10 | The write-off of the book value of materials is reflected based on the write-off report drawn up by the commission | Actual cost of written-off materials | Material write-off act |

| 20 | 94 | The write-off of shortages (losses from spoilage) of materials is reflected within the approved norms of natural loss due to the expenses of the main production | Natural loss rate | Accounting certificate-calculation Act of write-off of materials |

| 23 | 94 | The write-off of shortages (losses from spoilage) of materials is reflected within the approved norms of natural loss due to the costs of auxiliary production | Natural loss rate | Accounting certificate-calculation Act of write-off of materials |

| 25 | 94 | The write-off of shortages (losses from spoilage) of materials is reflected within the approved norms of natural loss at the expense of overhead costs | Natural loss rate | Accounting certificate-calculation Act of write-off of materials |

| 26 | 94 | The write-off of shortages (losses from spoilage) of materials is reflected within the approved norms of natural loss at the expense of general business expenses | Natural loss rate | Accounting certificate-calculation Act of write-off of materials |

| 29 | 94 | The write-off of shortages (losses from spoilage) of materials is reflected within the approved norms of natural loss due to the costs of service industries | Natural loss rate | Accounting certificate-calculation Act of write-off of materials |

| 73.2 | 94 | The write-off of shortages (losses from spoilage) of materials to the perpetrators in excess of the norms of natural loss is reflected | The amount of excess of the norm of natural loss | Accounting certificate-calculation Act of write-off of materials |

| 91.2 | 68.2 | VAT, previously claimed for deduction, was restored for shortages (losses) of materials in excess of the norms of natural loss | VAT amount | Accounting certificate-calculationInvoice |

| 50.01 | 73.2 | Repayment by the guilty person of the debt for cash shortages is reflected | Shortfall amount | Receipt cash order. Form No. KO-1 |

| 70 | 73.2 | Repayment by the guilty person of the debt for shortfalls at the expense of wages is reflected | Shortfall amount | Accounting certificate-calculation |

| Features of accounting for shortages (damage) of materials in the absence of perpetrators. In this situation, the amount exceeding the natural loss rate is written off not to account 73, but to account 91 | ||||

| 91.2 | 94 | Reflects the write-off of shortages (losses from spoilage) of materials in excess of the norms of natural loss in the absence of guilty persons or shortages, the recovery of which was refused by the court | The amount of excess of the norm of natural loss | Accounting certificate-calculation Act of write-off of materials |

| Accounting for material loss due to natural disasters | ||||

| 99 | 10 | Recorded write-off of materials lost as a result of natural disasters | Cost of lost materials | Material write-off act |

| 99 | 68.2 | VAT, previously claimed for deduction, was restored on lost materials | VAT amount | Accounting certificate-calculationInvoice |

| Accounting for free transfer of materials | ||||

| 91.2 | 10 | Disposal of materials reflected | Actual cost of materials | Invoice (TMF No. M-15) Invoice |

| 91.2 | 68.2 | VAT is charged to the budget on the cost of materials donated free of charge | VAT amount | Invoice (TMF No. M-15) Invoice Sales book |

Accounting for fuel and lubricants

Accounting for fuel and lubricant consumption by trade and public catering enterprises

Talalaeva Yu.N.

Published in the issue: Accounting and taxes in trade and public catering No. 1 / 2004

Specifics of the activities trade enterprises

and

public catering

is such that it involves the use of vehicles.

Transport is used for the transportation of purchased and sold goods, raw materials, delivery of lunches, as well as for management needs. Accordingly, for accountants

,

the problem of documenting, accounting and monitoring

the consumption of fuel

and

lubricants .

These and other issues are covered in this article.

Documentation of fuel and lubricant consumption