Travel log: is it necessary to keep it?

Most organizations use vehicles.

But the operation of transport is associated with significant costs, and it is important to control them. The main document confirming the expenses and movement of the car is the waybill. This is a primary document that reflects detailed information about the route, cargo, passengers, driver and vehicle. They should be kept in a special journal. IMPORTANT!

A waybill register (JU) must be kept by all organizations that own vehicles (clause 17 of Order of the Ministry of Transport dated September 18, 2008 No. 152).

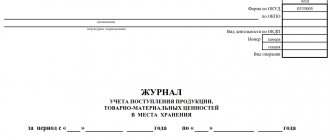

The Accounting Law No. 402 of December 6, 2011 abolished the mandatory use of the unified document form - OKUD code 0345008. Form No. 8 was approved by Resolution of the State Statistics Committee of the Russian Federation of November 28, 1997 No. 78.

However, the institution has the right to maintain accounting records using this optional form No. 8, or it needs to approve its own version in the accounting policy, which takes into account the specifics of the organization’s activities.

In Order No. 52n on the approval of forms of primary documents and accounting registers used by public sector organizations, the form of the document is not specified.

Fulfilling the requirements of Law No. 402-FZ on the forms of accounting for business transactions and the conditions of Order of the Ministry of Transport No. 152, determine the form and procedure for filling out the accounting policy.

Requirements for filling out the journal

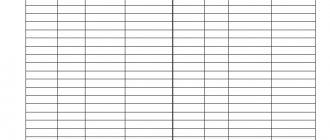

Form No. 8 is a journal whose title page states the name of the company, its status and period of coverage. The journal itself is a table in which information about all waybills issued by the company is entered. Even if any of them is incorrectly filled out and damaged, it is attached to the journal with the mark “Spoiled,” and its number must be entered in general chronological order in the journal.

Like many registration books, the journal has continuous numbering of sheets, is stitched, certified by the signature of the head and the seal of the organization (if there is one). Responsibility for filling out the document and the accuracy of the information in it rests with the employee assigned to perform this work by order of management or in accordance with job responsibilities. Travel log, form 8, can be downloaded below. It looks like this:

Accounting procedure

The form of the travel document, like the ZHU, can be developed and approved independently or used as approved by Resolution No. 78. The document will be invalid if at least one of the required details is missing. They are defined by 402-FZ and Order No. 152:

- Document's name.

- Document number in chronological order.

- Validity.

- Information about the organization that owns the vehicle, including OGRN.

- Vehicle type and model.

- State registration plate of a car.

- Odometer readings before leaving and upon returning to the garage (parking lot).

- Date and time of departure and return to the garage (parking lot).

- Signature and full name the responsible employee who indicated the odometer readings, date and time.

- FULL NAME. driver.

- Date and time of pre-trip and post-trip medical examinations (examinations) of the driver.

- Stamp, signature and full name. the health worker who performed the medical examination.

- A note about the inspection of the technical condition of the car before leaving, indicating the date and time (minutes and hours).

- Signature and full name person responsible for checking the technical condition of the vehicle (mechanic, inspector, foreman).

It is conducted according to a simple algorithm: all issued vouchers are indicated in the log, without exception. For accounting purposes, continuous numbering is used in compliance with chronological order.

The accounting policy is compiled for a month, and each time on a new page, unless other periods are established in the organization’s accounting policies.

For more information on how to correctly compose a travel voucher, read the article “Rules for preparing and maintaining travel vouchers in 2021.”

Is a journal necessary and is it compulsory to keep one?

Any organizations and individual entrepreneurs whose field of activity is related to the provision of transport and transportation services are required to keep a journal of waybills. The instruction is based on the norms of Federal Law No. 259-FZ dated November 18, 2007 and Order of the Ministry of Transport dated September 18, 2008 No. 152.

As for enterprises that are not directly related to the provision of transport and transportation services, but use vehicles in the course of their activities, the presence of a waybill log is not mandatory for them, but can be used to systematize and simplify the recording of data used in their work.

The waybill accounting journal, form 8, was approved by Goskomstat Resolution No. 78 in 1997, but on January 1, 2013, Federal Law No. 402-FZ came into force, abolishing the existing unified form 8. From this date, transport enterprises that previously kept a waybill accounting journal sheets according to Form 8, were given the opportunity to develop their own, the most optimal version of the accounting sheet, provided that the main sections of the unified Form 8 will be duplicated.

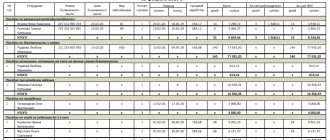

Travel log, sample filling

Let's look at how to fill out the ZHU in a budgetary institution, using an example. GBOU DOD SDYUSSHOR "ALLUR" operates a Renault Logan passenger car. In January 2021, the driver was issued 3 permits.

Step 1. Fill out the title page, OKPO code and name of the organization, indicate the period for which we are filling out the ZhU.

Step 2. Fill out the tabular part. We write down the voucher number and date of issue. We indicate your full name. (completely) the driver and his personnel number. We put the garage number of the car. In the note we indicate the destination and other information.

Step 3. We ask the driver, dispatcher and accountant to sign the registration form. We reflect the rest of the vouchers in the same way.

After filling out the magazine for a month (or another period established by the organization), it must be numbered and stitched, stamped, indicate the number of sheets on the back of the magazine, the date of the firmware and certified by the manager.

Method of administration

Filling out the journal for issuing waybills can be organized exclusively in paper form. There is no possibility of entering the necessary information electronically (only if each of the drivers, dispatchers and accountants of the organization has their own electronic signature).

From the very beginning of maintenance, the document is printed and, if necessary, supplied with additional sheets. At the end of the maintenance period, it is stitched, certified by the signature of the head of the organization and stored for another 5 years.

Ideally, it should be in constant use by the employee who is responsible for issuing and receiving waybills from drivers.

Storage periods and responsibility

Current legislation does not establish precise storage limits for this case. Keep the filed and numbered document in the organization for at least 5 years, as it contains information about the primary document (waybills). Determine by a separate order the person responsible for maintaining and storing the property. Under the signature, familiarize him with the procedure for maintaining the document.

If the organization does not keep a log of the issuance of waybills, the sample is not approved, then the tax authorities can fine you under clause 1 of Art. 126 of the Tax Code of the Russian Federation. That is, at the request of the tax inspectorate, the institution must provide the required documentation within the prescribed period. If this is not done, the Federal Tax Service will issue a fine of 200 rubles for each document.

general information

Individual entrepreneurs and organizations that provide transport services or use transport in their work must register the waybills issued to drivers in a special journal. This is stated in paragraph 1 of Art. 1 and paragraph 1 of Art. 6 Federal Law of November 8, 2007 No. 259-FZ, as well as in paragraph 17 of the Order of the Ministry of Transport of September 18, 2008 No. 152.

Other companies and individual entrepreneurs can decide on their own whether to keep such a journal or not.

The purpose of the document is to monitor the timely issuance and delivery of waybills, write-off of fuel and lubricants, data on which were indicated in the waybills handed over to drivers.

For reference! The waybill gives the driver the right to drive a vehicle and records information about the route and fuel consumption. It is issued for a flight or shift (from March 1, 2021). It is prohibited to “open” the document for a month.

A travel log of waybills is kept for a period of no more than 1 year. If necessary, this time can be reduced to 1 month. Data is entered on all waybills, without exception, in chronological order.

Keeping the journal falls on the shoulders of the employee, whom the head of the company has appointed for this purpose by appropriate order. It could also be an employee whose job description or employment contract specifies these responsibilities.

After the journal is completely filled out, it is stitched and signed by the head of the company or an authorized employee. The document must be stored in the organization for at least 5 years.

What kind of document is this

The waybill must contain the following information:

- driver’s personal data;

- vehicle registration number;

- personal data of the car owner or the organization that owns the vehicle;

- fuel costs (speedometer readings);

- starting and ending points of routes;

- their total length and mileage.

In the event of accidents on the roads or other offenses committed by the driver, he is also obliged to provide the traffic police officer, in addition to other documents, with his waybill for entering information about the offense into it.

The registration of the sheet must occur regardless of whether the vehicle is the property of the organization, or whether the car belongs to the driver, but is used by him for official purposes.

When transporting bulk cargo that requires a license, it is necessary to fill out the “license card” column, as well as indicate the bill of lading numbers in accordance with the cargo being transported, especially if it is of material value. At the end of the work shift, the completed waybill is handed over to the dispatcher, who is obliged to make an entry in the log while saving the completed “ticket” form.

As required by the internal regulations of the organization, the journal must be submitted to an accountant for verification. For this purpose, the accounting journal has a dedicated column for marking the submission of documentation to the accounting department.

If there is no person responsible for maintaining the log, it is possible to conclude an agreement with third-party organizations that provide technical maintenance of vehicles before leaving the line or provide parking services for vehicles. The agreement specifies relevant information about the cooperation of the parties to prevent controversial situations regarding reporting issues.

You can see how sheets are accounted for in the 1C program in the following video:

When the order on bonuses for employees is issued and what it contains - see here. If you are interested in how to calculate the profitability of an enterprise using an example, read this material.

New details of the waybill - information about transportation

Let us remind you that currently the waybill must contain the following mandatory details:

1) name and number of the waybill;

2) information about the validity period of the waybill;

3) information about the owner (owner) of the vehicle;

4) information about the vehicle;

5) information about the driver.

According to the commented order, from January 1, another mandatory detail will appear on the waybill - “information about transportation.” In this field you will need to indicate information about the types of messages and types of transportation. (Types of messages and types of transportation of passengers and baggage are listed in Articles 4 and 5 of the Federal Law of 08.11.07 No. 259-FZ).

Fill out and print the waybill with all the necessary details

Is it possible to conduct electronically?

There are no restrictions regarding the maintenance of a logbook of waybills in electronic form in any legal act of the current legislation; therefore, it is allowed to create an accounting sheet in electronic format.

Note! You can use any most convenient management option, be it regular Excel or 1C.

For organizations with an extensive fleet of vehicles and a significant staff of drivers, maintaining an electronic version is more preferable than manual registration, due to the significant labor intensity of the process. At the same time, it is desirable that it be possible to print the magazine on paper if necessary.