Methods of collecting taxes, fees, penalties

If a taxpayer does not fulfill his tax obligations voluntarily, tax authorities have the right to force him to pay the budget. To do this, they begin the collection procedure. The following ways to replenish the treasury are provided to them:

- at the expense of money in taxpayer accounts in banks and electronic DS (Article 46 of the Tax Code of the Russian Federation);

- at the expense of his property (Article 47 of the Tax Code of the Russian Federation).

A transition from one stage to another is possible only when the previous method did not work (with minor exceptions). Next, we will look at how the very first and most common stage of recovery in practice takes place - at the expense of funds. We will talk about collecting taxes from business entities. The forced collection of taxes from ordinary “physicists” is prescribed separately in the Tax Code of the Russian Federation and has its own rules (Article 48 of the Tax Code of the Russian Federation).

Request for payment of tax

If a taxpayer is found to have a tax arrears, the inspectorate sends him a request to pay the debt. The procedure for filing and serving a demand is described in Art. 69 Tax Code of the Russian Federation. And its form was approved by order of the Federal Tax Service dated February 13, 2017 No. ММВ-7-8/ [email protected]

The taxpayer must pay the request within 8 business days after receiving it, unless a longer period is specified in the request itself. If the debt is not repaid within the prescribed period, the Federal Tax Service begins the collection procedure.

IMPORTANT! If the demand was not made, the tax authorities do not have the right to write off taxes for collection.

Decision to collect tax

To collect tax debts, the inspectorate makes a decision on collection. She must do this within two months after the expiration of the deadline for voluntary payment of the claim by the taxpayer. If he is late, he will be able to collect the debt only through the court. The Federal Tax Service has 6 months to go to court after the deadline for fulfilling the requirement has expired.

IMPORTANT! A decision on collection made outside the specified two-month period is invalid and cannot be enforced. Check that controllers are meeting deadlines. If the deadline is violated, you can appeal the decision to a higher tax authority and to court.

The Federal Tax Service must deliver or send the decision on collection to the taxpayer within 6 working days from the date of its issuance. Simultaneously with the decision to collect tax debt, tax authorities may decide to suspend transactions on the account, and if there is no money in the accounts, then seize the taxpayer’s property.

Summary

- Payment of debt under IP No. 23042/17/50034-IP dated 05/05/2017 Collection of taxes and fees,

- Interdistrict Inspectorate MNS

- Types of taxes and fees

- Debt on taxes and fees

- Collection of taxes and penalties

- Inspection of the Minister of Defense

1. Payment of debt under IP No. 23042/17/50034-IP dated 05/05/2017 Collection of taxes and fees,

1.1. Dear Nikolay! Your question is not correct: what taxes, for what periods?7 Qualified legal assistance in tax, family, housing law, as well as other legal assistance for everyone! Tel. 8243217855

2.1. By filing a complaint against the said decision to the court or to higher management.

3. Records on the collection of taxes and fees appeared on the FSSP website. Where do these debts come from? I.P. It never happened. Thank you in advance.

3.1. You can familiarize yourself with the materials of enforcement proceedings from the bailiff on the basis of Art. 50 Federal Law of the Russian Federation “On Enforcement Proceedings”.

5. Due to the fault of the management company, the apartment was flooded. We won the case and an amount of compensation was awarded. The writ of execution has been handed over to the bailiffs, but the management company still has several debts: 1) Collection of taxes and fees, including penalties; 2) A fine as a type of punishment in cases of accidental arrest, imposed by the court (except for cases under FSSP protocols); 3) Fine of the EMERCOM OF RUSSIA DEPARTMENT OF SUPERVISION ACTIVITIES. Tell me in what order my debt will be collected forcibly.

5.1. Good afternoon, Civil Code of the Russian Federation Article 855. Sequence of debiting funds from an account

1. If there are funds on the account, the amount of which is sufficient to satisfy all the requirements presented to the account, these funds are written off from the account in the order in which the client’s orders and other documents for write-off are received (calendar priority), unless otherwise provided by law. 2. If there are insufficient funds in the account to satisfy all the requirements presented to it, funds are written off in the following order: first of all, according to executive documents providing for the transfer or issuance of funds from the account to satisfy claims for compensation for harm caused to life or health, as well as claims for alimony; secondly, according to executive documents providing for the transfer or issuance of funds for settlements for the payment of severance pay and wages with persons working or who worked under an employment agreement (contract), for the payment of remuneration to the authors of the results of intellectual activity; thirdly, according to payment documents providing for the transfer or issuance of funds for settlements of wages with persons working under an employment agreement (contract), instructions from tax authorities to write off and transfer debts for the payment of taxes and fees to the budgets of the budget system of the Russian Federation, and also instructions from the bodies monitoring the payment of insurance premiums to write off and transfer the amounts of insurance contributions to the budgets of state extra-budgetary funds; fourthly, according to executive documents providing for the satisfaction of other monetary claims; fifthly according to other payment documents in calendar order. Debiting funds from the account for claims related to one queue is carried out in the calendar order of receipt of documents.

5.2. There may be nuances here. If enforcement proceedings in relation to the criminal code are carried out in one department of the FSSP and at the same time combined into a consolidated one, then the order will be as per the law, your turn is last, 4. If administrative fines are carried out by a specialized department of the FSSP or within one department by a special bailiff, then penalties will proceed as if in parallel, regardless of the queue. In this case, the execution time depends on the efficiency of the bailiff and the solvency of the management company.

6. A notification has arrived about the receipt of a letter marked judicial from Moscow DTI.

“Other lawsuits are claims (statements) from tax authorities for the collection of taxes and fees from individuals. persons The case was considered (an order was issued) 06/02/2017 Result of the consideration Court order. Claimant of the Federal Tax Service of Russia No. 2″

What threatens me in this case?

7. I accidentally discovered on the State Services portal a court order dated January 21, 2019, to collect from me “. taxes and fees including penalties. » in the amount of 3003.83 rubles. The order was issued by the court of the region where I have not lived for 18 years! An attempt to figure out through telephone conversations what the fine was for did not bring a positive result. Please explain the legality of the court's decision and what should be my actions. Best regards, A.I. Rozsokha.

7.1. Good afternoon You can file an objection to the court regarding the execution of the court order. The judge cancels the court order if the debtor raises objections regarding its execution within the prescribed period. In the ruling on the cancellation of the court order, the judge explains to the claimant that the stated claim can be presented by him in the manner of claim proceedings. Copies of the court ruling to cancel the court order are sent to the parties no later than three days after the day it was issued (Article 129 of the Code of Civil Procedure of the Russian Federation).

7.2. Get a copy of the order and appeal it within 10 days, simply writing that you do not agree with it. After cancellation, submit the court ruling to the bailiffs.

8. Good night, I went to government services and saw for the position at the bailiff that it was 25748/19/23021-IP dated 04/22/2019 Collection of taxes and fees, including penalties No. 2 A-257/2019 dated 03/19/2019

8.1. Hello! Go to the FSSP website, enter your region and enforcement proceedings number and get all the information.

Taxes are an integral part of life in any country, including Russia. They are necessary to improve the economy and public benefits of the state to improve the comfort and standard of living of citizens in general.

The tax system is a combination of all fees, charges, and payments that are levied on taxpayers. The rules by which this procedure takes place are pre-established by the Tax Code of the Russian Federation.

The decision has been made - get your money ready

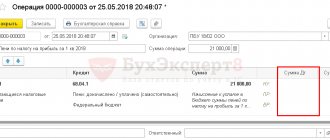

After making a decision on collection, the inspectorate issues an order to write off and transfer the debt to the budget and sends it to the bank. Orders can be issued to several accounts, but within the limits of the amount of the arrears collected (clause 54 of the Resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated July 30, 2013 No. 57).

Collections are made sequentially: from ruble accounts, from foreign currency accounts, from accounts in precious metals, through electronic funds. Each subsequent type of account is connected if there are insufficient funds on the previous one. It is prohibited to collect taxes from special election accounts and special referendum fund accounts.

The Tax Code of the Russian Federation does not establish the deadline within which the instruction must be sent. But the Presidium of the Supreme Arbitration Court of the Russian Federation explained that the tax authorities must meet both the decision and the order within the two-month period allotted for making a decision (resolution No. 13114/13 dated 04.02.2014). So here too you need to keep an eye on the deadlines. The bank must write off the money within the following terms:

- from ruble accounts - no later than the next business day after receiving the order;

- from currency and precious metals accounts - no later than two business days.

If there is not enough money, the order will go to the card index, and the bank will write off the money as it is credited to the account, observing the sequence established by civil legislation (clause 2 of Article 855 of the Civil Code of the Russian Federation). The write-off will continue until the order is fully executed or until it is suspended or withdrawn by the tax authorities.

Tax arrears - procedural procedure for extrajudicial collection

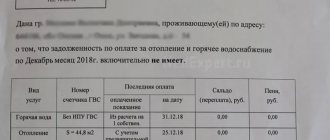

The procedural procedure for collecting tax arrears out of court is as follows. First of all, the tax office with which the taxpayer is registered, no later than three months from the date of discovery of the arrears, sends a demand for tax payment. The deadline for submitting a request is 10 days from the date of entry into force of the relevant decision. The tax payment request contains the following information:

- about the amount of tax debt, the amount of penalties accrued at the time the request was sent;

— on the deadline for paying taxes established by the Tax Code of the Russian Federation;

— about the deadline for fulfilling the requirement;

— on measures to collect tax and ensure the fulfillment of the obligation to pay tax, which can be applied in the event of failure to comply with the requirement by the taxpayer.

The tax payment requirement must be fulfilled by the taxpayer within 10 calendar days from the date of its receipt. If a legal entity does not pay the tax within the period established in the requirement, then the head of the tax authority (or his deputy), no later than two months after its expiration, must make a decision to collect the tax. The tax authorities send the decision to collect a tax (or fee) to the taxpayer no later than 6 days after its adoption. Within 1 month from the date of the decision, the tax authority sends it to the bank in which the taxpayer’s accounts are opened, as well as an order to write off from these accounts and transfer tax amounts to the budget. An order from the tax authority is an order from the tax inspectorate sent to the bank to write off and transfer to the appropriate budgets the necessary funds from the taxpayer’s account, which indicates the accounts of the taxpayer organization from which the tax must be transferred and the amount to be transferred. Tax collection can be made from ruble accounts, and if there are insufficient funds, from foreign currency accounts.

Important! Tax collection from foreign currency accounts is made in an amount equivalent to the amount of payment in rubles at the exchange rate of the Central Bank of the Russian Federation established on the day of sale of the currency.

When collecting funds held in foreign currency accounts, the tax authority, along with the order to transfer the tax, sends a second order to the bank to sell the currency held in the taxpayer’s account no later than the next day. The bank must fulfill the order of the tax authority no later than one day following the day it was received, provided that the tax is collected from ruble accounts. When collecting from foreign currency accounts - no later than two business days. Of course, these deadlines are observed when this does not violate the order of priority of payments established by the civil legislation of the Russian Federation. The order of the tax authority is subject to unconditional execution by the credit organization in the order established by the civil legislation of the Russian Federation. From the content of paragraph 2 of Article 855 of the Civil Code of the Russian Federation, it follows that the order in which funds are written off to pay taxes depends on whether they are written off voluntarily or compulsorily. Thus, payments to the budget made on behalf of the tax authorities (compulsorily) are subject to execution by the bank in the third place, payments for tax obligations made on the basis of payment orders of the taxpayer (voluntarily) - in the fifth place. This conclusion is set out in the Ruling of the Supreme Court of the Russian Federation dated March 21, 2016 No. 307-GK16-960, and is supported by the regulatory authorities - Letter of the Federal Tax Service of Russia dated July 11, 2021 No. GD-4-8/12408, Letter of the Ministry of Finance of Russia dated May 17, 2021 No. 03-02-07/2/28207.

If on the day the bank receives the tax authority’s order the required amount of money is not available, the bank executes the tax authority’s order as funds arrive:

- no later than one business day following the day of each such receipt to ruble accounts;

- no later than two business days following the day of each such receipt to foreign currency accounts.

The decision to suspend transactions on a taxpayer’s accounts opened with a bank is made by the head of the tax authority (or his deputy), and then sent to the bank at the place where the taxpayer’s accounts (settlement, currency, etc.) were opened. Execution of the tax authority's decision to collect arrears can be ensured by suspending transactions on the taxpayer organization's bank accounts. And if the tax authority’s order is issued to one account, operations on the remaining accounts are suspended. This is the meaning of the collection order. If there are not enough funds in the accounts of the debtor organization, or the tax authority does not have information about such accounts, then the collection of arrears on taxes , as well as penalties and fines, is carried out at the expense of other property of the arrears taxpayer. Collection is carried out within the limits of the amounts specified in the request for tax payment, taking into account the amounts that have already been collected by the tax authority from the accounts of the taxpayer organization. The head of the tax authority (or his deputy) makes a decision to collect tax at the expense of the taxpayer’s property. Such a decision is made in the form of a resolution. The decision to collect tax at the expense of the property of the taxpayer organization can be made within one year after the expiration of the deadline for fulfilling the requirement to pay the tax.

Important! A resolution to collect a tax, signed by the head (or his deputy) and certified by the official seal of the tax authority, must receive the sanction of the prosecutor.

After this, within three days the decision is sent to the bailiff service for execution. In the case where the tax authority has seized the property of a taxpayer organization, a copy of the protocol of seizure of property and a copy of the inventory report are transferred to the bailiff service (see Article 77 of the Tax Code of the Russian Federation).

By order of the Federal Tax Service of Russia and the Ministry of Justice of the Russian Federation dated July 25, 2000. No. VG-3-10/265/215 approved the procedure for interaction between tax authorities and bailiff services of justice authorities of constituent entities of the Russian Federation on the enforcement of decisions of tax authorities and other executive documents.

Order No. VG-3-10/265/215 establishes a list of documents that the tax inspectorate sends to the bailiff simultaneously with the resolution, namely information about the organization’s property (including accounts receivable), the implementation of which, in the opinion of the tax authority, will give greatest effect. In addition, the bailiff is provided with information:

— about persons responsible for the financial and economic activities of the organization;

— actual addresses, telephone numbers of the parent organization and its structural divisions;

— information about cash registers and their installation locations.

When carrying out actions to collect tax at the expense of other property of the taxpayer, bailiffs are required to act in accordance with the Federal Law of October 2, 2007. No. 229-FZ “On enforcement proceedings”. Like any other executive document, the tax authority’s resolution must be executed by the bailiff within two months from the date of its receipt by the territorial bailiff service. The algorithm for fulfilling the requirements of the tax authority’s resolution to collect tax at the expense of other property of the taxpayer is carried out in accordance with the general procedure established by 229-FZ. Having accepted the tax authority's resolution for execution, the bailiff, within three days from the date of its receipt, issues a resolution to initiate enforcement proceedings. This resolution establishes a five-day period for voluntary repayment of debt. If the debtor does not fulfill the requirements voluntarily, the debt is collected forcibly, and if necessary, the bailiff has the right to order an assessment of the debtor’s property and sell it. Funds received from the sale of the debtor's property are used to pay off tax debts, as well as the costs of paying a single enforcement fee, which is equal to 7% of the amount collected, as well as the costs of carrying out enforcement actions, fines imposed on the debtor for failure to comply with a writ of execution on a voluntary basis . If the debtor and his property are absent from the location indicated in the tax authority's executive document, the bailiff issues a resolution to search for the debtor and his property. When collecting tax at the expense of the taxpayer's property, which is not cash, the obligation to pay it is considered fulfilled from the moment of sale of this property and repayment of the taxpayer's debt from the proceeds.

Limitation period for collecting tax sanctions

Collection of tax sanctions (fines) and penalties is carried out according to the same rules that we discussed above, and within the same time frame:

- 8 working days to pay the claim;

- 2 months for the tax authorities to make a decision on collection and send a collection order to the bank (or 6 months to go to court if they are late with the decision);

- 1-2 business days for the bank to execute the order.

Upon expiration of the established deadlines, controllers lose the right to collect taxes.

Find out how the statute of limitations for imposing a fine is calculated here.

Court order as a tool for collecting tax debts: nuances

A court order certifying the right of the Federal Tax Service to collect from the debtor taxes not paid to the budget is generally issued by a magistrate based on an application from the Tax Service.

This application is sent by the tax authorities to the court, provided that by that time the department’s specialists have made other attempts to interact with the taxpayer on debt issues. For example, in the event that a citizen or organization that has not paid the tax has not transferred it (supplemented by the fines and penalties provided for by law) upon receipt of notifications or demands for payment of this tax from the Federal Tax Service.

The Federal Tax Service has the right to send a statement of claim to the magistrate court within 6 months from the date of failure by a citizen or organization to fulfill its obligations to pay taxes to the budget. In principle, it is possible to extend this period if the Federal Tax Service argues for missing it with a good reason. But, one way or another, the statute of limitations for tax debts established by the legislation of the Russian Federation is 3 years.

Results

Tax authorities have a way of influencing those who do not pay taxes voluntarily - forced collection. But the Tax Code of the Russian Federation not only grants them such a right, but also requires them to comply with a certain procedure and deadlines. Monitor their actions, because if they deviate from the rules, the penalty can be challenged.

Sources:

- Tax Code of the Russian Federation;

- Civil Code of the Russian Federation;

- Order of the Federal Tax Service of Russia dated February 13, 2017 No. ММВ-7-8/ [email protected] ;

- Resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated July 30, 2013 No. 57;

- Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated 02/04/2014 No. 13114/13.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.